🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Mercury Market

Mercury Market (By Product Type (Metal, Alloy, Compounds, Other Product Type), By Application (Chemical manufacturing, Artisanal Gold Mining, Batteries Measurement, Control Devices, Electrical and lighting, Healthcare, Pharmaceuticals, Other Applications), By Region and Companies)

Jul 2024

Chemicals and Materials

Pages: 132

ID: IMR1148

Mercury Market Overview

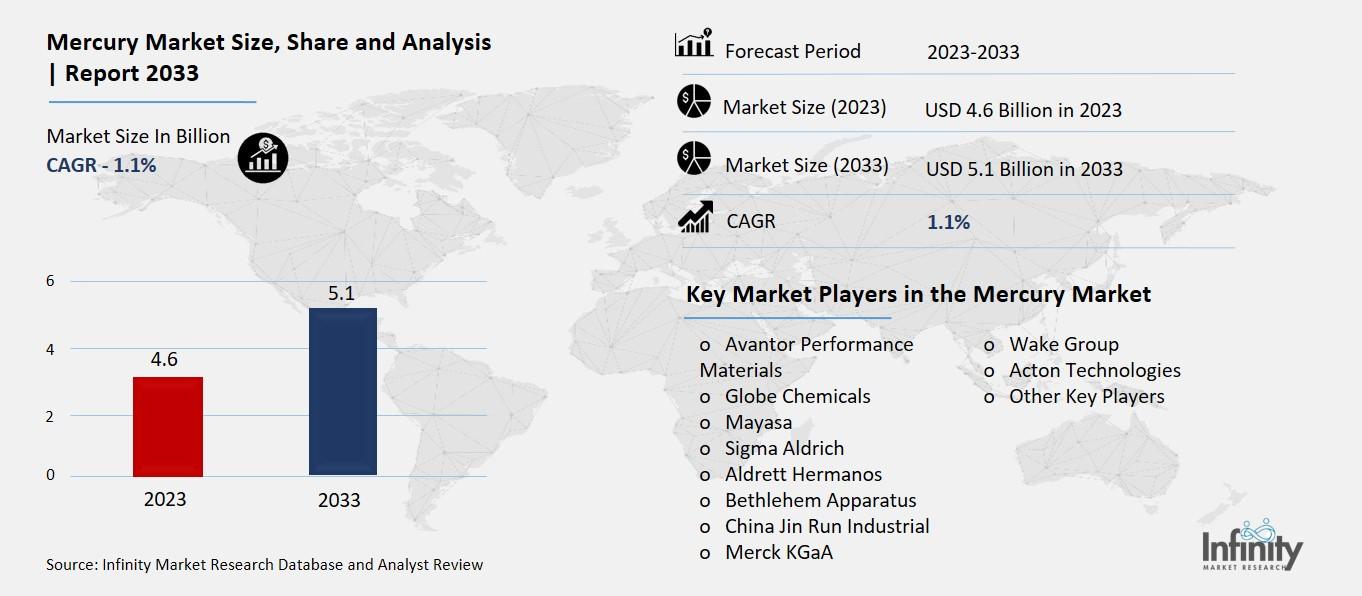

Global Mercury Market size is expected to be worth around USD 5.1 Billion by 2033 from USD 4.6 Billion in 2023, growing at a CAGR of 1.1% during the forecast period from 2023 to 2033.

The Mercury market refers to the buying and selling of mercury, a metallic element that is liquid at room temperature and known for its unique properties. Mercury is used in various industries and processes, including electronics, medical equipment, and chemical production.

It is also used in small-scale gold mining and dental amalgams. The market for mercury involves transactions where buyers and sellers trade this element based on its supply, demand, and price fluctuations. Regulations around the world aim to control the use and trade of mercury due to its toxic effects on humans and the environment.

In recent years, there has been increasing global concern about the environmental and health impacts of mercury. This has led to stricter regulations and efforts to reduce mercury emissions and use. The mercury market is influenced by these regulations, as well as by technological advancements that seek to minimize mercury's harmful effects while still utilizing its unique properties in various industrial applications. As the world moves towards more sustainable practices, the mercury market continues to evolve with a focus on safer handling, disposal, and alternative materials in industries where mercury has traditionally been used.

Drivers for the Mercury Market

Electronics and Medical Equipment

Mercury's unique properties make it indispensable in various industries, especially electronics and medical equipment. In electronics, mercury is used in switches, relays, and fluorescent lamps due to its conductivity and reliability in controlling electrical currents. The demand for electronic devices continues to rise globally, fueled by advancements in technology and increasing consumer preferences for gadgets. Similarly, in medical equipment, mercury is utilized in thermometers, barometers, and dental amalgams. The healthcare sector's expansion, particularly in developing regions, contributes to the steady demand for mercury in medical applications.

Chemical Industry Applications

The chemical industry relies on mercury for its catalytic properties in processes such as chlorine and caustic soda production. These chemicals are essential in various manufacturing sectors, including pulp and paper, textiles, and water treatment. Mercury's role as a catalyst enhances efficiency and enables the production of essential chemicals on a large scale. As industrial activities expand globally, particularly in emerging economies, the demand for mercury in chemical manufacturing processes remains robust.

Artisanal and Small-Scale Gold Mining

Mercury is extensively used in ASGM to extract gold from ore. Despite global efforts to reduce mercury use in this sector due to environmental and health concerns, ASGM remains a significant driver of mercury demand, especially in regions where formal mining operations are limited. The informal nature of ASGM makes it challenging to regulate, but efforts are underway to promote safer mining practices and alternative technologies that reduce mercury emissions.

Energy-efficient Lighting

Mercury is a key component in fluorescent lighting, which is known for its energy efficiency compared to traditional incandescent bulbs. The push towards sustainable lighting solutions and energy-efficient technologies has bolstered the demand for mercury in fluorescent lamps. Additionally, the transition towards LED lighting, which also uses mercury in smaller quantities, continues to influence the dynamics of the mercury market as manufacturers seek to balance performance with environmental considerations.

Regulatory Impacts and Challenges

The mercury market is influenced by global regulations aimed at reducing mercury emissions and exposure. Initiatives such as the Minamata Convention on Mercury, which seeks to minimize mercury use and emissions worldwide, have prompted industries to adopt cleaner technologies and alternatives. These regulatory frameworks pose challenges to the mercury market, requiring stakeholders to innovate and invest in sustainable practices while ensuring compliance with stringent environmental standards.

Restraints for the Mercury Market

Environmental and Health Concerns

One of the primary restraints on the mercury market is the significant environmental and health risks associated with its use and disposal. Mercury is a potent neurotoxin that can bioaccumulate in the food chain, posing risks to human health and ecosystems. Efforts to mitigate these risks have led to stringent regulations and guidelines governing mercury use and emissions globally. Industries using mercury must adhere to strict environmental standards, which often involve costly compliance measures such as emission controls and waste management protocols. These regulations act as a significant deterrent for industries reliant on mercury, impacting its market dynamics.

Regulatory Restrictions and Bans

Governments worldwide are increasingly implementing bans or restrictions on mercury use in various applications to reduce environmental pollution and protect public health. The Minamata Convention on Mercury, adopted by over 128 countries, aims to phase out mercury mining and significantly reduce mercury emissions. Such regulatory measures restrict the market's growth by limiting the availability and use of mercury in industries where it was traditionally employed, such as small-scale gold mining and certain industrial processes. Compliance with these regulations requires industries to invest in alternative technologies and materials, further constraining the mercury market.

Shift Towards Alternatives

Advancements in technology have spurred the development of alternatives to mercury in various applications. For instance, LED technology has emerged as a viable alternative to mercury-containing fluorescent lamps, reducing the demand for mercury in lighting applications. Similarly, non-mercury catalysts are being increasingly adopted in chemical manufacturing processes to comply with environmental regulations and consumer preferences for sustainable products. The availability and efficacy of these alternatives pose a challenge to the traditional uses of mercury, compelling industries to transition towards safer and more sustainable options.

Decline in Artisanal and Small-Scale Gold Mining

Artisanal and small-scale gold mining, a significant consumer of mercury, is facing pressures from regulatory crackdowns and awareness campaigns highlighting the environmental and health hazards of mercury use. While ASGM remains a key driver of mercury demand in certain regions, efforts to formalize the sector and promote mercury-free mining practices are reducing its reliance on mercury. This trend limits the growth prospects of the mercury market in ASGM-dependent economies and encourages the adoption of alternative gold recovery methods.

Volatility in Supply and Prices

Mercury is primarily sourced from mercury mines, which are concentrated in a few countries. The limited geographical distribution of mercury reserves and fluctuations in production can lead to supply disruptions and price volatility in the global market. Uncertainties in supply chains and geopolitical factors affecting mercury-producing regions impact market stability and investor confidence. Moreover, the high costs associated with ensuring responsible mining practices and regulatory compliance further contribute to the economic challenges facing the mercury market.

Opportunity in the Mercury Market

Technological Innovations and Clean Technologies

Technological advancements present significant opportunities for the mercury market, particularly in the development of clean technologies and alternatives. Innovations in mercury-free catalysts, such as non-mercury catalysts in chemical processes, offer promising avenues for market expansion. These technologies not only comply with stringent environmental regulations but also cater to the growing consumer demand for sustainable and eco-friendly products. Moreover, advancements in mercury emission control technologies provide opportunities for industries to enhance operational efficiency while minimizing environmental impact, thereby driving the demand for advanced emission control systems globally.

Remediation and Recycling Technologies

The increasing focus on environmental remediation and recycling technologies presents lucrative opportunities in the mercury market. Remediation technologies aim to mitigate mercury contamination in soil, water, and air, offering solutions for environmental cleanup and restoration. Recycling technologies focus on recovering and reusing mercury from end-of-life products and industrial processes, promoting resource efficiency and reducing the demand for primary mercury sources. These technologies not only support sustainable practices but also create new revenue streams for companies involved in mercury remediation and recycling services.

Expansion in Healthcare Applications

The healthcare sector represents a growing opportunity for the mercury market, particularly in medical devices and instruments where mercury remains essential. Despite efforts to phase out mercury-containing thermometers and dental amalgams, there is ongoing demand for mercury-based medical equipment in certain specialized applications. The expanding healthcare infrastructure in emerging economies, coupled with advancements in medical technology, is expected to sustain the demand for mercury in healthcare settings. Innovations in mercury-free alternatives and safer handling practices further enhance the market's growth potential in the healthcare sector.

Urbanization and Infrastructure Development

Rapid urbanization and infrastructure development in emerging markets present opportunities for the mercury market, particularly in construction materials and infrastructure projects. Mercury-based products such as fluorescent lamps and coatings continue to be integral components in urban development, driven by the need for energy-efficient lighting and durable building materials. The ongoing investments in infrastructure projects, including transportation networks and residential complexes, support the demand for mercury-containing products in construction and building applications.

Market Expansion in Asia Pacific

Asia Pacific is emerging as a key region for the mercury market, driven by industrialization, urbanization, and increasing consumer demand. Countries like China and India are significant consumers of mercury, particularly in electronics manufacturing, chemical production, and small-scale gold mining. The region's robust economic growth and expanding industrial base present opportunities for market players to capitalize on growing mercury demand. Moreover, efforts to implement sustainable practices and comply with international environmental standards create avenues for investments in clean technologies and alternative mercury-free solutions in Asia Pacific.

Trends for the Mercury Market

Shift Towards Sustainable Practices

A significant trend in the mercury market is the global shift towards sustainable practices and eco-friendly solutions. Environmental concerns and regulatory pressures have prompted industries to reduce mercury emissions and adopt alternative technologies. There is a growing demand for mercury-free products and processes across various sectors, including electronics, healthcare, and manufacturing. This trend is driven by consumer awareness, regulatory mandates such as the Minamata Convention on Mercury, and advancements in technology that offer viable alternatives to traditional mercury-containing products. As a result, industries are investing in research and development to innovate and transition towards safer and more sustainable practices, thereby influencing the dynamics of the mercury market.

Innovation in Mercury-Free Technologies

Technological innovations play a crucial role in shaping the mercury market, particularly in the development of mercury-free alternatives and clean technologies. Industries are increasingly investing in research to explore substitutes for mercury in applications such as catalysts, lighting, and medical devices. LED lighting, for instance, has gained traction as a mercury-free alternative to fluorescent lamps, driven by its energy efficiency and environmental benefits. Similarly, advancements in chemical engineering have led to the formulation of non-mercury catalysts that offer comparable performance while minimizing environmental impact. These innovations not only support regulatory compliance but also stimulate market growth by offering sustainable solutions to traditional mercury-based processes.

Growing Awareness and Health Concerns

There is a rising awareness among consumers and stakeholders about the health risks associated with mercury exposure. Mercury is a potent neurotoxin that can adversely affect human health, leading to neurological disorders and other serious health complications. This awareness has spurred initiatives to reduce mercury use in consumer products, healthcare applications, and industrial processes. Regulatory agencies and advocacy groups are advocating for stricter controls on mercury emissions and promoting safer alternatives. The shift towards mercury-free technologies and products is driven by concerns over public health and environmental sustainability, influencing market trends and consumer preferences globally.

Regional Market Dynamics

The mercury market exhibits diverse regional dynamics influenced by economic factors, industrial activities, and regulatory frameworks. North America and Europe have stringent regulations governing mercury use and emissions, leading to a decline in demand for mercury-containing products and processes. In contrast, Asia Pacific, particularly countries like China and India, continues to be a significant consumer of mercury due to rapid industrialization and urbanization. These regions face challenges in managing mercury pollution but are also exploring opportunities to adopt cleaner technologies and sustainable practices to mitigate environmental impact.

Integration of Circular Economy Principles

The concept of the circular economy is gaining traction in the mercury market, promoting resource efficiency and waste reduction. Recycling and recovery technologies are being developed to recover mercury from end-of-life products and industrial waste streams, thereby closing the loop and minimizing the need for primary mercury extraction. This trend aligns with global efforts to achieve sustainable development goals and reduce reliance on finite resources. Industry stakeholders are increasingly embracing circular economy principles to enhance operational efficiency, reduce environmental footprint, and meet regulatory requirements, driving innovation and market transformation in the mercury sector.

Segments Covered in the Report

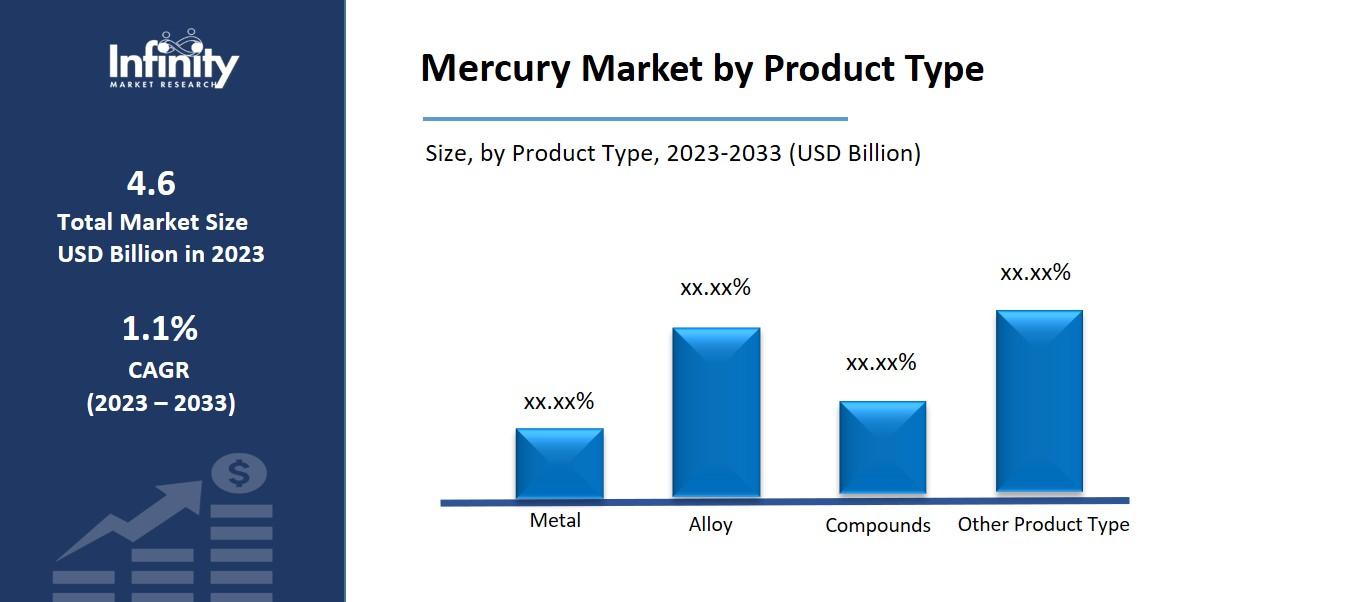

By Product Type

o Metal

o Alloy

o Compounds

o Other Product Type

By Application

o Chemical Manufacturing

o Artisanal Gold Mining

o Batteries Measurement

o Control Devices

o Electrical and Lighting

o Healthcare

o Pharmaceuticals

o Other Applications

Segment Analysis

By Product Type Analysis

Based on product category, Metal, Alloy, and Compound are included in the Mercury market segmentation. The market was led by the metal category, which generated the most income from its extensive use in a variety of industrial applications. Applications for mercury amalgams, alloys, and compounds are widespread in industries like dentistry, electronics, and auto manufacturing.

Because of its specific qualities, which include its capacity to create stable alloys with other metals, mercury is used extensively in the manufacturing of specialist metal products. These mercury-infused metal products are used by industries because of their remarkable corrosion resistance, durability, and electrical conductivity. Therefore, the prevalence of metal product categories continues to play a significant role in determining the general structure of the mercury market.

By Application Analysis

Based on application, the Mercury market is divided into three segments batteries, electrical and electronics, and measuring and controlling devices. Because the element is essential to the production of electronic components, the electrical and electronics category commands the largest share of the market.

Mercury is an essential component of relays, switches, and fluorescent lights because of its special qualities, which include its low melting point and excellent electrical conductivity. The market continues to grow steadily because of the rising demand for electronic gadgets, which includes both consumer electronics and industrial equipment.

Mercury's dependence on its unique qualities is further highlighted by the growing trend of electronics becoming smaller. There is a steady and strong demand for mercury in the electrical and electronics industry due to the widespread use of electronic devices and ongoing technological advancements. This dominance highlights how important mercury is as a building block of the modern electrical environment.

Regional Analysis

The global market for mercury was controlled by the Asia-Pacific region. Given that it produces 84.8% of the world's mercury, China is the largest producer of the metal. China and Kyrgyzstan are the two countries with the most mercury mine production worldwide. In China, vinyl chloride is produced using coal and mercury compounds as a reactant.

The market share of Mercury in Europe is the second highest owing to strict environmental restrictions and an emphasis on sustainable practices. In addition, the UK Mercury market was increasing at the quickest rate in the European Union, while the German Mercury market maintained the biggest market share.

Competitive Analysis

Prominent industry participants are making significant R&D investments to broaden their product offerings, hence contributing to the Mercury market's continued expansion. In order to increase their market share, market participants are also engaging in a variety of strategic initiatives.

Notable events in this regard include mergers and acquisitions, the introduction of new products, contractual agreements, increased investments, and cooperation with other companies. The Mercury industry needs to provide affordable products to grow and thrive in the increasingly cutthroat and dynamic market environment.

Recent Developments

Jul 2023: To safeguard the environment and the people of the European Union from hazardous mercury, the European Commission approved a proposal to amend the Mercury Regulation. The usage of dental amalgam, which now utilizes 40 tons of mercury yearly in the EU, will be completely outlawed under the change.

Feb 2023: To combat harmful cosmetic practices, the governments of Gabon, Jamaica, and Sri Lanka teamed up and started a USD 14 million project to do away with the use of mercury in skin-lightening products.

Key Market Players in the Mercury Market

o Avantor Performance Materials

o Mayasa

o Sigma Aldrich

o China Jin Run Industrial

o Merck KGaA

o Wake Group

o Other Key Players

Report Scope:

|

Report Features |

Description |

|

Market Size 2023 |

USD 4.6 Billion |

|

Market Size 2033 |

USD 5.1 Billion |

|

Compound Annual Growth Rate (CAGR) |

1.1% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Product Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Avantor Performance Materials, Globe Chemicals, Mayasa, Sigma Aldrich, Aldrett Hermanos, Bethlehem Apparatus, China Jin Run Industrial, Merck KGaA, Wake Group, Acton Technologies, Other Key Players |

|

Key Market Opportunities |

Technological Innovations and Clean Technologies |

|

Key Market Dynamics |

Electronics and Medical Equipment |

📘 Frequently Asked Questions

1. Who are the key players in the Mercury Market?

Answer: Avantor Performance Materials, Globe Chemicals, Mayasa, Sigma Aldrich, Aldrett Hermanos, Bethlehem Apparatus, China Jin Run Industrial, Merck KGaA, Wake Group, Acton Technologies, Other Key Players

2. How much is the Mercury Market in 2023?

Answer: The Mercury Market size was valued at USD 4.6 Billion in 2023.

3. What would be the forecast period in the Mercury Market?

Answer: The forecast period in the Mercury Market report is 2023-2033.

4. What is the growth rate of the Mercury Market?

Answer: Mercury Market is growing at a CAGR of 1.1% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.