🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Microcrystalline Cellulose Market

Microcrystalline Cellulose Market Global Industry Analysis and Forecast (2024-2033) by Source (Wood-based and Non-wood-based), Form (Powder and Liquid), Application (Pharmaceutical, Paints & Coatings, Food & Beverages, Personal Care & Cosmetics, and Other Applications) and Region

Apr 2025

Chemicals and Materials

Pages: 138

ID: IMR1924

Microcrystalline Cellulose Market Synopsis

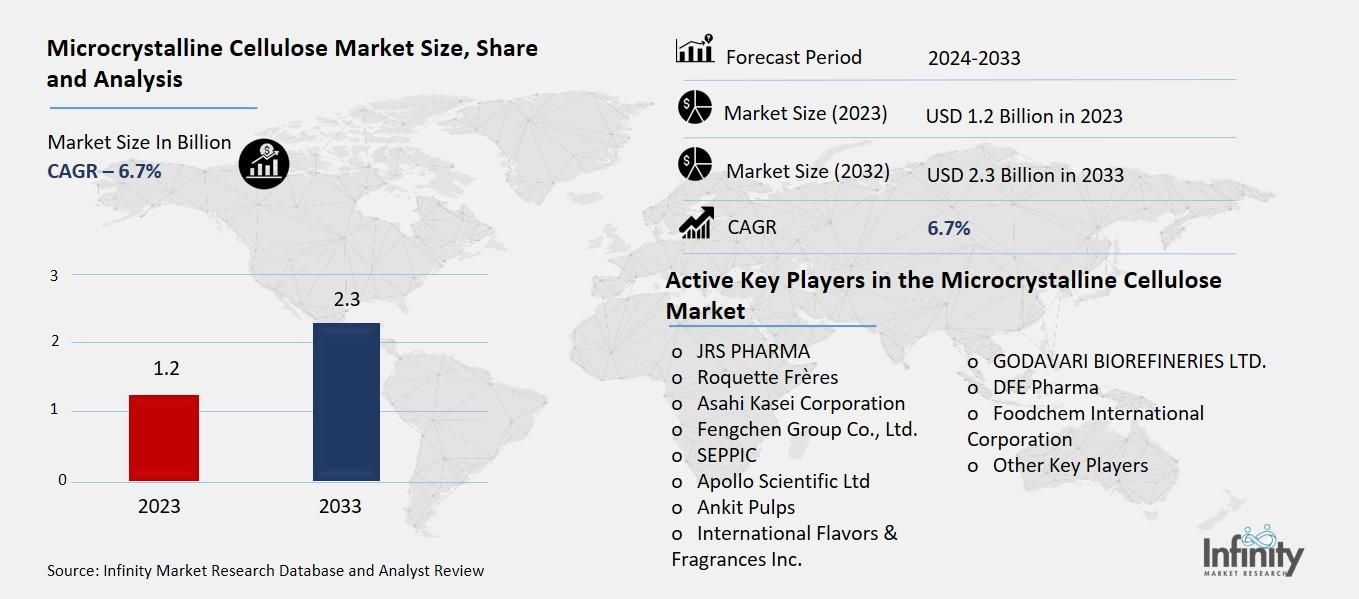

The global Microcrystalline Cellulose Market was valued at USD 1.2 billion in 2023 and is expected to grow from USD 1.3 billion in 2024 to USD 2.3 billion by 2033, reflecting a CAGR of 6.7% over the forecast period.

Microcrystalline cellulose (MCC) demonstrates stable market growth because pharmaceuticals together with food & beverages and cosmetics industries actively use it for multiple applications. MCC functions as an important pharmaceutical component because it serves as both tablet filler and disintegrate and binder material within the pharmaceutical sector. The food industry uses MCC as a stabilizer alongside its functions as a fat replacer and bulking agent particularly for processed low-calorie foods. The functional and processed food market expansion while consumers become more health-conscious leads to increasing MCC usage. MCC finds increased application in the personal care and cosmetics industry because of its capacity to absorb and improve texturizing characteristics. MCC gains popularity in the market because its natural origin derives from wood pulp or cotton while consumers increasingly choose plant-based clean-label ingredients.

Microcrystalline Cellulose Market Driver Analysis

Increasing Demand for Processed Foods

The food sector heavily depends on Microcrystalline cellulose (MCC) when developing low-calorie ready-to-eat meal products. MCC functions as a helpful ingredient in food products since it replaces fat while maintaining texture and mouthfeel properties for recipes that focus on diet and health. The product duplicates fat characteristics to provide manufacturers options for reducing calorie counts without altering product taste. Food processors use MCC as a stabilizer to achieve improved structure when processing ingredients since it prevents separation and creates even distribution. MCC serves as a useful food ingredient because its bulk properties help enhances product volume together with texture while avoiding caloric addition in applications such as baked goods and dairy replacements and portion-controlled meals. The diverse capabilities of MCC have established its role as a preferred component in producing nutritious and convenient food products for consumers.

Microcrystalline Cellulose Market Restraint Analysis

Fluctuating Raw Material Prices

The low solubility rate of microcrystalline cellulose in water makes it difficult to incorporate in particular liquid-based formulations. The inability of MCC to dissolve completely within water makes it inappropriate for clear or homogenous liquid systems as it fails to meet effectiveness standards. Its capability to dissolve in water is limited which affects its potential use in beverages and syrups along with some liquid pharmaceutical products based on dissolution requirements for consistency and dispersion or bioavailability needs. The requirement of fully dissolvable ingredients prompts manufacturers to look for different cellulose alternatives or modified forms that increase both formulation cost and complexity.

Microcrystalline Cellulose Market Opportunity Analysis

Rising Demand for Clean-Label Products

The natural origin of microcrystalline cellulose (MCC) produced from wood pulp or cotton sources responds to consumers who want visible ingredients in their daily products. People interested in the ingredients of their food supplements and personal care items now choose products containing natural ingredients that require minimal processing. Manufacturers can meet consumer preferences for clean labelling through MCC because it is a natural plant-derived ingredient which functions as multiple additives while avoiding synthetic ingredients. The natural derivation of MCC aligns with sustainability criteria as well as health-based market preferences so manufacturers select it for creating products that demonstrate both health awareness and sustainable origins.

Microcrystalline Cellulose Market Trend Analysis

Shift Toward Plant-Based Ingredients

Microcrystalline cellulose (MCC) finds high value in vegan and plant-based product lines because it originates naturally from plants. The increasing demand among customers for vegan and plant-based products leads to rising market requirements for ingredients with matching values. MCC functions perfectly within the current market trend because it serves as a non-animal-based product suitable for vegan food items and plant-based cosmetics. MCC obtaining from wood pulp or cotton is its typical origin. MCC serves as a binder and stability agent and texture modifier in vegan and plant-based product lines because its natural properties maintain the consistency of these production methods. MCC provides manufacturers with a versatile component to develop plant-based and vegan products because it allows clean manufacturing of sustainable ethical product choices.

Microcrystalline Cellulose Market Segment Analysis

The Microcrystalline Cellulose Market is segmented on the basis of Source, Form, and Application.

By Source

o Wood-based

o Non-wood-based

By Form

o Powder

o Liquid

By Application

o Pharmaceutical

o Paints & Coatings

o Food & Beverages

o Personal Care & Cosmetics

o Other Applications

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Source, Wood-based Segment is Expected to Dominate the Market During the Forecast Period

The sources discussed in this research study, the wood-based segment is expected to account for the largest market share of microcrystalline cellulose market in the forecast period. The extraction of softwood tree-derived wood pulp exists as an inexpensive abundant material compared to cotton and other cellulose sources for MCC production. The growing MCC market demand triggers the selection of wood pulp as the main source since it provides the optimal conditions for production in pharmaceuticals food & beverages and personal care applications. Due to its high cellulose content wood pulp produces MCC with perfect functions and high levels of purity. Additionally, the global push for sustainability and the renewable nature of wood pulp support its continued dominance. Consumer interest and industry demand for sustainable components support the usage of renewable wood-based MCC as a production material.

By Form, the Powder Segment is Expected to Held the Largest Share

The powder segment of the microcrystalline cellulose (MCC) market is expected to hold the largest share during the forecast period due to its versatility, ease of use, and wide range of applications. The excellent compressibility together with flow ability characteristics and drug-controlled release properties strengthen both tablets and capsules while enhancing their performance and stability. MCC attains popularity because it maintains inert properties which protect the active substances present in pharmaceutical drugs. The global rising requirement for generic over-the-counter drugs together with expanding global healthcare needs drives the necessity for dependable drug formulation excipients specifically Microcrystalline Cellulose. MCC gains preference in pharmaceutical applications through its origin from plant materials due to growing industrial interest in clean-label natural pharmaceutical ingredients.

By Application, the Pharmaceutical Segment is Expected to Held the Largest Share

The pharmaceutical segment is expected to hold the largest share of the microcrystalline cellulose (MCC) market during the forecast period due to MCC's critical role in the formulation of solid dosage forms, particularly tablets. MCC functions as an essential pharmaceutical ingredient for production of tablets because the industry uses this material for binding and filling purposes and to enhance tablet disintegration. The pharmaceutical properties of excellent compressibility and flow ability together with its capacity to control drug release improve the performance and stability of tablets and capsules. The pharmaceutical industry uses MCC because it remains inactive which allows it to preserve the effectiveness of active drug ingredients. The pharmaceutical industry requires dependable excipients including MCC because global health demands and the rising market for generic medicines and over-the-counter drugs continue to increase.

Microcrystalline Cellulose Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

The North American market will preserve its leadership position in the microcrystalline cellulose (MCC) market through the upcoming forecast period because of its robust pharmaceutical industry base along with food processing requirements and research and development alignment. MCC serves as a main component in creating solid pharmaceutical tablets which makes North America stand as a significant market consumer of MCC because its pharmaceutical sector ranks among the largest worldwide. North American consumers show growing preference for natural sustainable ingredients which consequently drives food and cosmetics manufacturers to use MCC in their products.

The U.S. together with Canada implements strong regulatory systems regarding MCC usage which helps the ingredient find acceptance as a widespread industry solution. The regional focus on technological advancement throughout food production and pharmaceutical manufacturing operations strengthens the market demand for MCC. Suppliers identify North America as a fundamental market because this region operates with an advanced system that reliably makes MCC available through its well-developed distribution channels.

Recent Development

In September 2023, International Flavors & Fragrances, Inc. (IFF) introduced their innovative excipient, Avicel PH LN, a high-performance low-nitrile microcrystalline cellulose (MCC) designed specifically for the pharmaceutical industry.

In February 2023, Asahi Kasei Corporation successfully completed the construction of its second manufacturing plant for Ceolus Microcrystalline Cellulose at its Mizushima Works in Kurashiki, Okayama, Japan. The company invested a total of USD 87 million (¥13 billion) in the new facility, reinforcing its commitment to meeting the rapidly increasing demand for its MCC products.

Active Key Players in the Microcrystalline Cellulose Market

o JRS PHARMA

o Roquette Frères

o Asahi Kasei Corporation

o Fengchen Group Co., Ltd.

o SEPPIC

o Apollo Scientific Ltd

o Ankit Pulps

o International Flavors & Fragrances Inc.

o GODAVARI BIOREFINERIES LTD.

o DFE Pharma

o Foodchem International Corporation

o Other Key Players

Global Microcrystalline Cellulose Market Scope

|

Global Microcrystalline Cellulose Market | |||

|

Base Year: |

2024 |

Forecast Period: |

2024-2033 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.2 Billion |

|

Market Size in 2024: |

USD 1.3 Billion | ||

|

Forecast Period 2024-33 CAGR: |

6.7% |

Market Size in 2033: |

USD 2.3 Billion |

|

Segments Covered: |

By Source |

· Wood-based · Non-wood-based | |

|

By Form |

· Powder · Liquid | ||

|

By Application |

· Pharmaceutical · Paints & Coatings · Food & Beverages · Personal Care & Cosmetics · Other Applications | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Increasing Demand for Processed Foods | ||

|

Key Market Restraints: |

· Limited Solubility | ||

|

Key Opportunities: |

· Rising Demand for Clean-Label Products | ||

|

Companies Covered in the report: |

· JRS PHARMA, Roquette Frères, Asahi Kasei Corporation, Fengchen Group Co., Ltd. and Other Key Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Microcrystalline Cellulose Market Research report?

Answer: The forecast period in the Microcrystalline Cellulose Market Research report is 2024-2033.

2. Who are the key players in the Microcrystalline Cellulose Market?

Answer: JRS PHARMA, Roquette Frères, Asahi Kasei Corporation, Fengchen Group Co., Ltd. and Other Key Players.

3. What are the segments of the Microcrystalline Cellulose Market?

Answer: The Microcrystalline Cellulose Market is segmented into Source, Form, Application, and Regions. By Source, the market is categorized into Wood-based and Non-wood-based. By Form, the market is categorized into Powder and Liquid. By Application, the market is categorized into Pharmaceutical, Paints & Coatings, Food & Beverages, Personal Care & Cosmetics, and Other Applications. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Microcrystalline Cellulose Market?

Answer: The MCC market incorporates global operations that produce microcrystalline cellulose serving pharmaceuticals as binding and stabilizing ingredient and bulk volume enhancer. The pharmaceutical sector uses MCC as a tablet excipient because this substance offers enhanced compressibility properties and good disintegration performance. The same substance acts as molecular structure replacement for fat content and it acts as both an anti-caking agent and texturizer that enhances the consistency of dairy products and baked goods and processed foods. The cosmetic and personal care industries use MCC because this material performs as both a thickening and absorbent ingredient.

5. How big is the Microcrystalline Cellulose Market?

Answer: The global Microcrystalline Cellulose Market was valued at USD 1.2 billion in 2023 and is expected to grow from USD 1.3 billion in 2024 to USD 2.3 billion by 2033, reflecting a CAGR of 6.7% over the forecast period.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.