🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

MMA (Methyl Methacrylate) Market

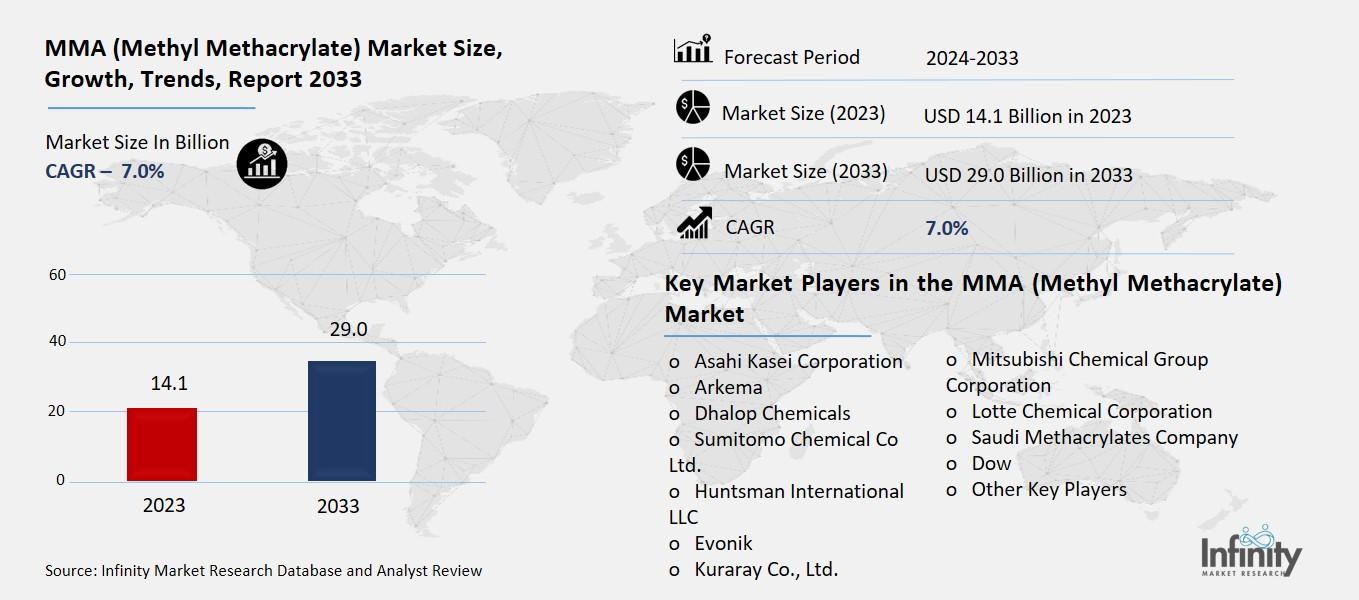

Global MMA (Methyl Methacrylate) Market (By Application, Chemical Intermediates, Surface Coatings, and Emulsion Polymer; By End-Use, Buildings & Construction, Paints & Coatings, Electronics, Automotive, and Other End-Uses; By Region and Companies), 2024-2033

Dec 2024

Chemicals and Materials

Pages: 138

ID: IMR1341

MMA (Methyl Methacrylate) Market Overview

Global MMA (Methyl Methacrylate) Market acquired the significant revenue of 14.1 Billion in 2023 and expected to be worth around USD 29.0 Billion by 2033 with the CAGR of 7.0% during the forecast period of 2024 to 2033. The silicon-manganese alloy market is more or less an important segment of the global market for alloy and related products required for consumption in the construction and production of steel and other metal products. The main product of used silicon and manganese is the silicon-manganese alloy that contains additional amounts of iron; it is used in the production of steel to strengthen its characteristics, to protect from oxidation processes and corrosive environments. Such teams as China and India moving toward higher rates of urbanization and industrialization have increased the rate of steel consumption hence the need for silicon manganese alloys.

Further, the alloy is applied in making other alloys and aluminum and castings, which is an added advantage to market growth. Growing requirements of high-performance steel and the necessity to improve the ecological parameters of steel production, including the partial replacement of ferroalloys by materials that are more favorable to the environment, also contribute to market dynamics.

Drivers for the MMA (Methyl Methacrylate) Market

Growing Industrialization in Emerging Economies

The maturity of industries in the Asian Pacific region especially in China, India and South East Asia has greatly boosted the demand of silicon manganese alloy. These areas are witnessing very rapid growth of urbanization and infrastructure development thereby creating high demand for steel and other metals. Steel as a raw material for construction, manufacturing and transportation industries would not afford to depend on silicon manganese alloys and others.

For instance, growth of automobile, construction tractors and infrastructure related industries in growing economy has created a need for higher strength and wear resistant material which has helped increased consumption of silicon manganese alloys. Also, using silicon-manganese, these countries enhance the production processes with a view of facilitating resistance of steel to oxidation, corrosion and wear more so, to meet the emerging markets of quality metals.

Restraints for the MMA (Methyl Methacrylate) Market

Competition from Alternative Alloys

The availability and use of alternative alloys, such as ferrochrome and ferrosilicon, pose a significant challenge to the demand for silicon-manganese alloys. These alternatives are often considered more cost-effective or efficient in certain applications, making them attractive options for manufacturers. Ferrochrome, for example, is primarily used in the production of stainless steel and offers high corrosion resistance, which makes it a preferred choice in industries where such properties are critical. Similarly, ferrosilicon, which is produced by combining iron with silicon, is often used in steelmaking and in the production of cast iron, offering better performance in some contexts and being potentially cheaper to produce compared to silicon-manganese alloys. As industries look to optimize their production costs, the ability of these alternative alloys to deliver comparable or superior properties at lower costs can limit the adoption of silicon-manganese alloys.

Opportunity in the MMA (Methyl Methacrylate) Market

Increasing Demand for High-Performance Alloys

The shift towards advanced materials in the automotive and aerospace industries presents significant opportunities for the silicon-manganese alloy market, as these sectors increasingly demand high-performance, durable materials. In the automotive industry, there is a growing emphasis on lightweight, fuel-efficient, and high-strength materials to improve vehicle performance and meet regulatory standards for emissions and safety. Silicon-manganese alloys, known for their excellent strength-to-weight ratio and resistance to wear and corrosion, are ideal for these applications. They are used in the production of high-strength steels that can withstand harsh conditions, enhancing the durability and safety of automotive components such as structural parts, engine blocks, and chassis.

Trends for the MMA (Methyl Methacrylate) Market

Focus on Low-Carbon Steel Production

As the steel industry transitions to low-carbon technologies in response to environmental concerns and stringent regulations on carbon emissions, the demand for alloys like silicon-manganese is steadily rising. Traditional steel production methods, which rely heavily on coke and other carbon-intensive materials, are being gradually replaced by more sustainable technologies, such as electric arc furnaces (EAF) and hydrogen-based reduction processes. These low-carbon methods focus on reducing the carbon footprint of steel production while maintaining or improving the quality and performance of the steel.

Silicon-manganese alloys play a critical role in this transition as they are integral to modern steelmaking processes. The combination of silicon and manganese helps improve the strength, durability, and corrosion resistance of steel, allowing manufacturers to meet the high standards required by industries like automotive, construction, and infrastructure.

Segments Covered in the Report

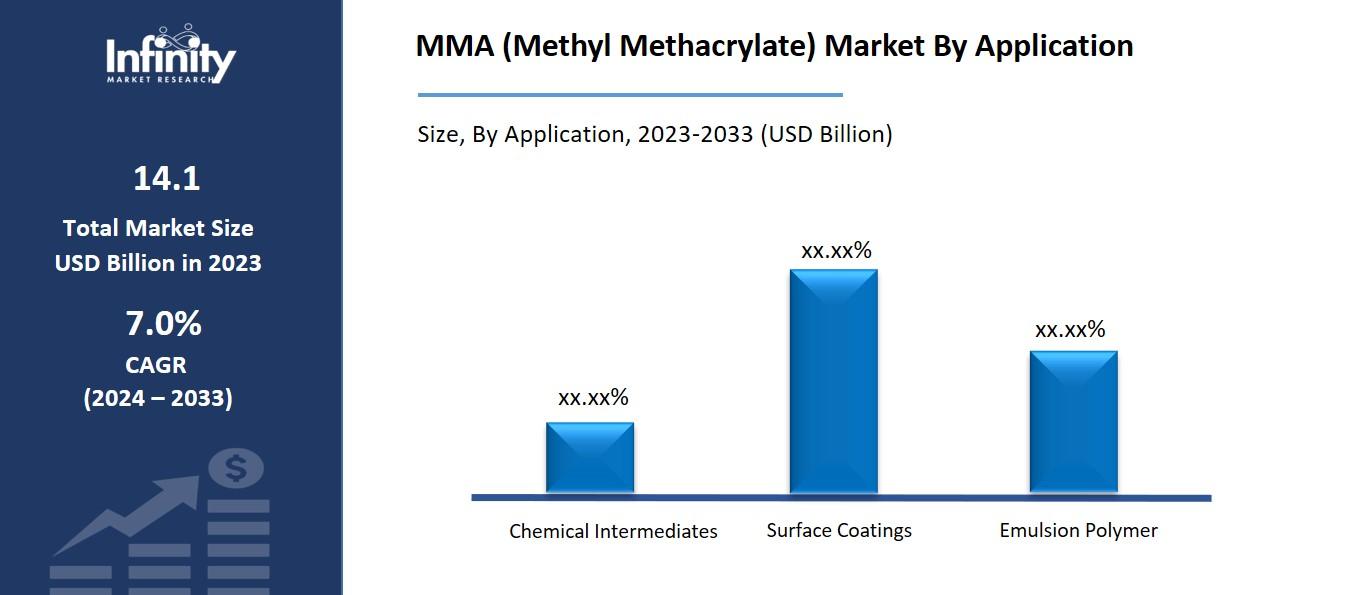

By Application

o Chemical Intermediates

o Surface Coatings

o Emulsion Polymer

By End-Use

o Buildings & Construction

o Paints & Coatings

o Electronics

o Automotive

o Other End-Uses

Segment Analysis

By Application Analysis

On the basis of application, the market is divided into chemical intermediates, surface coatings, and emulsion polymer. Among these, chemical intermediates segment acquired the significant share in the market owing to the critical role that silicon-manganese plays in the production of various chemicals used across industries. Silicon-manganese alloys are essential in the production of chemicals like silicones, which are widely used in products ranging from sealants and adhesives to lubricants and personal care items. The alloy acts as a key feedstock in the manufacturing of silicon-based chemicals, which are highly valued for their heat resistance, electrical properties, and durability.

By End-Use Analysis

On the basis of end-use, the market is divided into buildings & construction, paints & coatings, electronics, automotive, and other end-uses. Among these, buildings & construction segment held the prominent share of the market due to the growing demand for high-strength, durable materials in infrastructure development. Silicon-manganese alloys play a crucial role in steel production, which is a fundamental material in construction projects such as buildings, bridges, roads, and other infrastructure. These alloys improve the strength, corrosion resistance, and workability of steel, making it ideal for the harsh conditions encountered in construction environments.

As urbanization and industrialization continue to accelerate, particularly in emerging markets like China, India, and Southeast Asia, the demand for steel in construction applications is expanding. The need for sustainable, long-lasting, and high-performance materials to support large-scale infrastructure projects further drives the demand for silicon-manganese alloys.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 32.3% of the market. The region is home to advanced manufacturing facilities and leading steel producers, which require high-quality alloys like silicon-manganese to enhance the performance and durability of their steel products. The automotive industry in North America, especially in the United States, is a significant consumer of high-strength steel, which relies on silicon-manganese alloys for better resistance to wear and corrosion, contributing to the demand for these alloys.

Moreover, North America is experiencing a push toward sustainable and low-carbon steel production, further driving the need for silicon-manganese alloys. With an increasing focus on reducing the environmental impact of manufacturing processes, the adoption of more efficient and eco-friendly technologies in steel production is fueling the demand for silicon-manganese as a key component in low-carbon steelmaking.

Competitive Analysis

The competitive analysis of the silicon-manganese alloy market highlights a landscape shaped by a blend of established global players and regionally strong suppliers, each vying for market share through various strategies such as cost efficiency, technological innovation, and product differentiation. Leading manufacturers, particularly from Asia-Pacific, dominate the market, driven by economies of scale, lower production costs, and proximity to raw material sources like manganese and silicon. These companies are capitalizing on the region's strong industrial growth, particularly in steel production, automotive, and infrastructure, which are key end-use sectors for silicon-manganese alloys.

Recent Developments

In January 2024, EVONIK introduced VISIOMER HEMA-P 100, a non-migratory phosphate methacrylate monomer designed to deliver long-lasting effects. This innovative product enhances flame retardancy, adhesion, and corrosion resistance, all while preserving transparency and mechanical properties.

In February 2020, Mitsubishi Chemical planned to establish a methyl methacrylate (MMA) plant on the U.S. Gulf Coast by 2024, with a production capacity ranging from 250,000 to 350,000 tons per year. The facility was set to utilize Alpha Technology, which produces MMA from a combination of methanol, carbon monoxide, and ethylene.

Key Market Players in the MMA (Methyl Methacrylate) Market

o Asahi Kasei Corporation

o Arkema

o Dhalop Chemicals

o Sumitomo Chemical Co Ltd.

o Huntsman International LLC

o Evonik

o Kuraray Co., Ltd.

o Mitsubishi Chemical Group Corporation

o Lotte Chemical Corporation

o Saudi Methacrylates Company

o Dow

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 14.1 Billion |

|

Market Size 2033 |

USD 29.0 Billion |

|

Compound Annual Growth Rate (CAGR) |

7.0% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Application, End-Use, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Asahi Kasei Corporation, Arkema, Dhalop Chemicals, Sumitomo Chemical Co Ltd., Huntsman International LLC, Evonik, Kuraray Co., Ltd., Mitsubishi Chemical Group Corporation, Lotte Chemical Corporation, Saudi Methacrylates Company, Dow, and Other Key Players. |

|

Key Market Opportunities |

|

|

Key Market Dynamics |

Growing Industrialization in Emerging Economies |

📘 Frequently Asked Questions

1. Who are the key players in the MMA (Methyl Methacrylate) Market?

Answer: Asahi Kasei Corporation, Arkema, Dhalop Chemicals, Sumitomo Chemical Co Ltd., Huntsman International LLC, Evonik, Kuraray Co., Ltd., Mitsubishi Chemical Group Corporation, Lotte Chemical Corporation, Saudi Methacrylates Company, Dow, and Other Key Players.

2. How much is the MMA (Methyl Methacrylate) Market in 2023?

Answer: The MMA (Methyl Methacrylate) Market size was valued at USD 14.1 Billion in 2023.

3. What would be the forecast period in the MMA (Methyl Methacrylate) Market?

Answer: The forecast period in the MMA (Methyl Methacrylate) Market report is 2024-2033.

4. What is the growth rate of the MMA (Methyl Methacrylate) Market?

Answer: MMA (Methyl Methacrylate) Market is growing at a CAGR of 7.0% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.