🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Nitrile Coated Gloves Market

Global Nitrile Coated Gloves Market (By Type, Single Use Gloves and Reusable Gloves; By Application, Electrical, Mechanical, Chemical, Surgical, and Other Applications; By Region and Companies), 2024-2033

Dec 2024

Chemicals and Materials

Pages: 138

ID: IMR1387

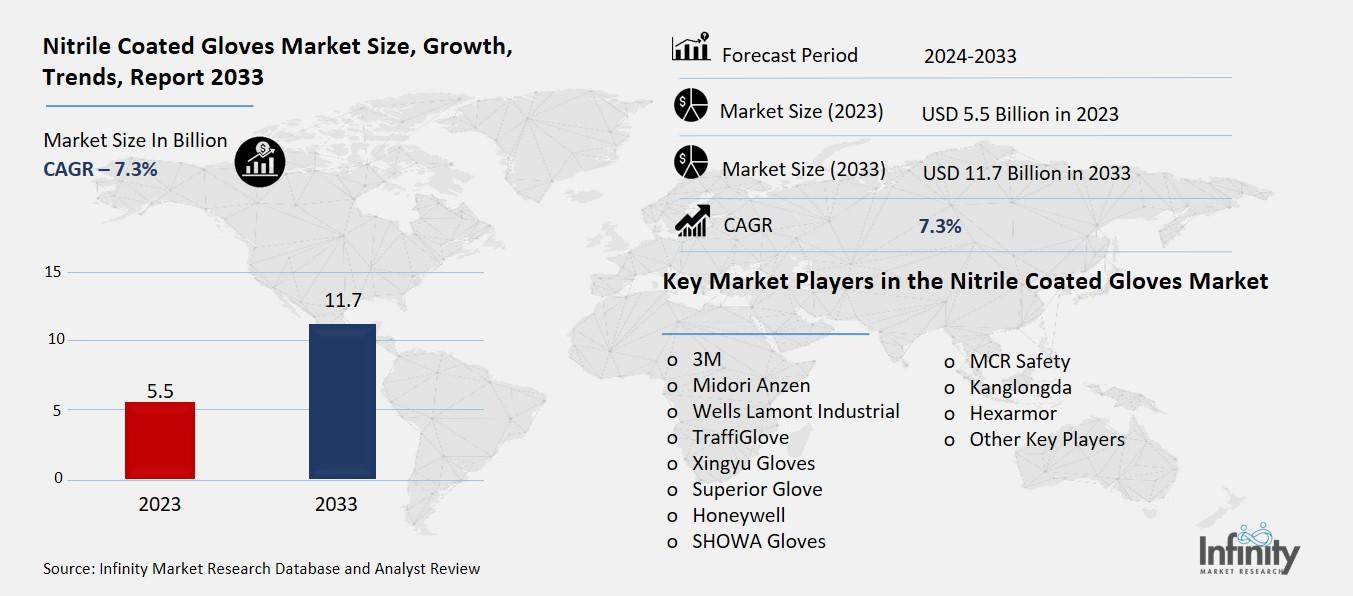

Nitrile Coated Gloves Market Overview

Global Nitrile Coated Gloves Market acquired the significant revenue of 5.5 Billion in 2023 and expected to be worth around USD 11.7 Billion by 2033 with the CAGR of 7.3% during the forecast period of 2024 to 2033. The nitrile-coated gloves market is one of the most promising segments within the global PPE market due to rising demand in industries increasingly following safety standards as well as officials and employees’ awareness within healthcare, automotive, manufacturing, construction, and other spheres. Nitrile coated gloves for their good chemical, oil and puncture resistance are especially preferred for use where the conditions are likely to be hazardous. Increased reliability and elasticity with improved grip and feel, expansion has been driven largely by industries such as health care, automotive, manufacturing and construction. This is helped by the move away from latex because of allergy complications coupled with new introductions of design variations of gloves with a view of enhancing on user-friendliness.

Drivers for the Nitrile Coated Gloves Market

Increasing Workplace Safety Regulation

Laws regulating occupational safety standards and required use of safety gear in various sectors including healthcare, automotive, and construction sectors are contributing strongly to analysis of nitrile coated nitrile-coated gloves. It also brings with the requirement of personal protective gear (PPC) to reduce risks in place and safeguard employees specifically at workplaces that are handled with risks like chemicals, oils, sharp points or diseases causing substances. For example, in health care, nitrile coated gloves play a very crucial role in avoiding cross contamination and avoiding bio hazards.

Likewise, automotive as well as the construction industry benefits from their capacity to resist abrasions, punctures, and harsh chemical substances sales by providing suitable gloves for operating heavy and sharp machinery, tools, and materials. These regulations contribute to decreased workplace accidents and increase in productivity making employers adopt high quality protective products including nitrile-coated gloves. This regulatory focus on safety remains to enhance market development across the world.

Restraints for the Nitrile Coated Gloves Market

Volatility in Raw Material Prices

Fluctuations in raw material costs, such as nitrile butadiene rubber (NBR), can significantly impact the manufacturing and pricing of nitrile-coated gloves. NBR, a key component in the production of these gloves, is subject to price volatility due to factors like changes in crude oil prices, supply chain disruptions, and geopolitical issues. When raw material costs rise, manufacturers face increased production expenses, which may lead to higher product prices or reduced profit margins. Conversely, price drops can benefit manufacturers but may create uncertainty in long-term planning and inventory management. This volatility poses challenges for maintaining consistent pricing, especially in competitive markets, and forces manufacturers to adopt strategies such as cost optimization, supplier diversification, or the use of alternative materials to mitigate risks.

Opportunity in the Nitrile Coated Gloves Market

Customization and Niche Applications

Tailored solutions for specific industries, such as chemical handling and food processing, are unlocking new opportunities for market expansion in the nitrile-coated gloves sector. Industries with unique safety and performance requirements demand customized gloves designed to meet their specific needs. For example, in chemical handling, gloves must provide exceptional resistance to harsh chemicals, solvents, and abrasions, ensuring worker safety in highly hazardous environments. In food processing, the emphasis is on compliance with food safety standards, featuring gloves that are non-toxic, powder-free, and resistant to oils and fats. These tailored solutions enhance industry-specific functionality, improve worker efficiency, and ensure regulatory compliance, making them increasingly attractive to businesses. As more industries recognize the value of specialized protective equipment, manufacturers can tap into these niche markets, driving growth and diversification in the nitrile-coated gloves market.

Trends for the Nitrile Coated Gloves Market

Automation in Manufacturing

Automation in glove production is transforming the nitrile-coated gloves market by enhancing manufacturing efficiency and reducing production costs. Advanced machinery and robotic systems are streamlining processes such as dipping, coating, drying, and packaging, resulting in faster production cycles and consistent product quality. Automation minimizes human errors, reduces labor costs, and enables manufacturers to meet the growing demand for nitrile-coated gloves with greater scalability. This is particularly beneficial in regions with rising labor costs or high-volume requirements.

Additionally, automated production supports innovation by allowing precise control over glove features, such as thickness, texture, and chemical resistance. As manufacturers adopt automation to stay competitive, they can achieve higher output levels while maintaining affordability, contributing to the market's sustained growth.

Segments Covered in the Report

By Type

o Single Use Gloves

o Reusable Gloves

By Application

o Electrical

o Mechanical

o Chemical

o Surgical

o Other Applications

Segment Analysis

By Type Analysis

On the basis of type, the market is divided into single use gloves and reusable gloves. Among these, single use gloves segment acquired the significant share in the market owing to their widespread use in industries such as healthcare, food processing, and pharmaceuticals, where hygiene and cross-contamination prevention are critical. Single-use gloves are disposable, ensuring a fresh pair is used for every task, making them essential for applications requiring high cleanliness standards.

Additionally, their affordability and convenience for short-term use have further bolstered their adoption in various settings. The COVID-19 pandemic significantly amplified demand for single-use nitrile gloves due to increased awareness of hygiene practices, further solidifying their market share. In contrast, reusable gloves are gaining traction in heavy-duty industrial applications but remain a smaller segment due to their niche usage and higher initial cost.

By Application Analysis

On the basis of application, the market is divided into electrical, mechanical, chemical, surgical, and other applications. Among these, chemical segment held the prominent share of the market due to the superior chemical resistance provided by nitrile-coated gloves, making them indispensable in industries such as chemical manufacturing, laboratories, and oil and gas. These gloves effectively protect workers from exposure to hazardous chemicals, solvents, and corrosive substances, ensuring safety in high-risk environments. The increasing emphasis on occupational safety regulations in these industries has further driven the demand for chemically resistant gloves. Additionally, their durability and ability to maintain dexterity under challenging conditions make them a preferred choice in chemical applications, significantly contributing to the segment's market share.

Regional Analysis

Asia Pacific Dominated the Market with the Highest Revenue Share

Asia Pacific held the most of the share of 32.1% of the market driven by rapid industrialization, expanding healthcare infrastructure, and increasing awareness of workplace safety. Countries like China, India, Malaysia, and Indonesia have emerged as major manufacturing hubs for nitrile gloves due to the availability of raw materials, cost-effective labor, and advanced production facilities. Malaysia, in particular, is a global leader in glove manufacturing, supplying a significant portion of the world’s nitrile gloves.

The growing adoption of personal protective equipment (PPE) in various sectors, such as healthcare, automotive, and chemical industries, further fuels market growth in the region. Additionally, government initiatives promoting industrial safety standards and the rising demand for disposable gloves in medical and food industries have strengthened the market’s dominance in Asia-Pacific. The region's robust supply chain and increasing export activities also contribute to its leading position in the global market.

Competitive Analysis

The nitrile-coated gloves market is highly competitive, with key players vying for market share through product innovation, strategic partnerships, and expansion efforts. Major companies such as Top Glove Corporation, Ansell Limited, Hartalega Holdings, Kossan Rubber Industries, and Showa Group dominate the landscape, leveraging their extensive production capacities and global distribution networks. These firms focus on developing gloves with enhanced properties, such as improved chemical resistance, comfort, and eco-friendliness, to meet evolving customer demands across industries. The competitive environment is further intensified by the entry of new manufacturers, particularly in emerging markets like Asia-Pacific, where cost advantages and rising demand fuel competition.

Recent Developments

In October 2024, Unigloves, a prominent expert in hand protection, has teamed up with KluraLabs, pioneers in antimicrobial solutions, to introduce the CrossGuard antimicrobial nitrile glove. This innovative product is the first of its kind to eradicate 99.99% of selected bacteria within just 60 seconds. The breakthrough has been validated through third-party testing and contains no active ingredients.

Key Market Players in the Nitrile Coated Gloves Market

o 3M

o Midori Anzen

o Wells Lamont Industrial

o TraffiGlove

o Xingyu Gloves

o Superior Glove

o Honeywell

o SHOWA Gloves

o MCR Safety

o Kanglongda

o Hexarmor

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 5.5 Billion |

|

Market Size 2033 |

USD 11.7 Billion |

|

Compound Annual Growth Rate (CAGR) |

7.3% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

3M, Midori Anzen, Wells Lamont Industrial, TraffiGlove, Xingyu Gloves, Superior Glove, Honeywell, SHOWA Gloves, MCR Safety, Kanglongda, Hexarmor, and Other Key Players. |

|

Key Market Opportunities |

|

|

Key Market Dynamics |

Increasing Workplace Safety Regulations: |

📘 Frequently Asked Questions

1. Who are the key players in the Nitrile Coated Gloves Market?

Answer: 3M, Midori Anzen, Wells Lamont Industrial, TraffiGlove, Xingyu Gloves, Superior Glove, Honeywell, SHOWA Gloves, MCR Safety, Kanglongda, Hexarmor, and Other Key Players.

2. How much is the Nitrile Coated Gloves Market in 2023?

Answer: The Nitrile Coated Gloves Market size was valued at USD 5.5 Billion in 2023.

3. What would be the forecast period in the Nitrile Coated Gloves Market?

Answer: The forecast period in the Nitrile Coated Gloves Market report is 2024-2033.

4. What is the growth rate of the Nitrile Coated Gloves Market?

Answer: Nitrile Coated Gloves Market is growing at a CAGR of 7.3% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.