🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Operational Analytics Market

Operational Analytics Market (By Deployment Mode (On-Premise, On-Cloud), By Application (Risk Management, Fraud Detection, Supply Chain Management, Customer Management, Asset Maintenance), By Industry Vertical (IT, Finance, Marketing, Sales, Human Resources), By Region and Companies)

Jun 2024

Information and Communication Technology

Pages: 118

ID: IMR1073

Operational Analytics Market Overview

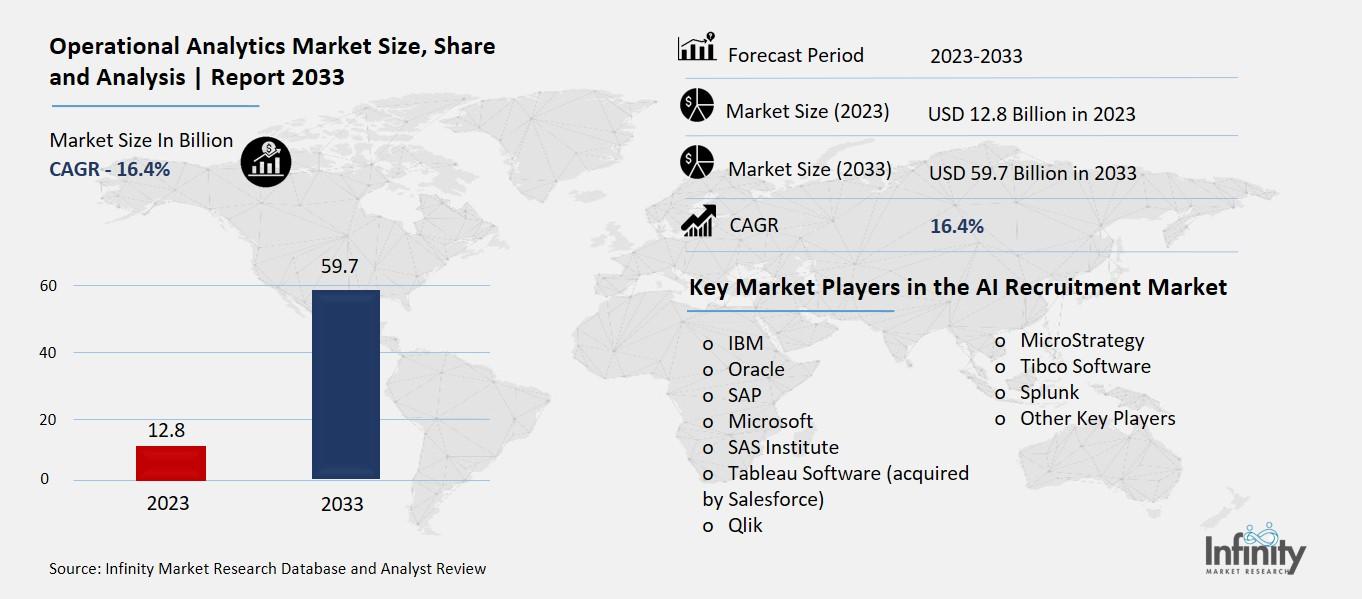

Global Operational Analytics Market size is expected to be worth around USD 59.7 Billion by 2033 from USD 12.8 Billion in 2023, growing at a CAGR of 16.4% during the forecast period from 2023 to 2033.

The Operational Analytics Market is about using data and technology to improve how businesses work every day. Companies collect lots of information from their activities, like sales, customer interactions, and production processes. Operational analytics helps them understand this data to make better decisions, fix problems faster, and run more smoothly. It’s like having a smart assistant that looks at everything happening in the business and gives advice on how to do things better.

In simple terms, imagine a store owner who wants to know why certain products sell better than others, or why some days are busier. By using operational analytics, they can see patterns and trends in their data. This helps them stock the right products, manage their staff better, and keep customers happy. Overall, it helps businesses be more efficient and make smarter choices.

Drivers for the Operational Analytics Market

Increasing Volume and Variety of Data

The rapid increase in data volume and variety is a major factor driving the growth of the operational analytics market. Businesses generate massive amounts of data from numerous sources like transactions, sensors, social media, and log files. This abundance of data requires effective analysis tools to derive meaningful insights, making operational analytics essential. As companies strive to manage and interpret this data, the demand for advanced analytics solutions continues to grow, pushing the market forward.

Emphasis on Data-Driven Decision-Making

Organizations are increasingly recognizing the importance of data-driven decision-making to gain a competitive edge. Operational analytics enables companies to analyze and interpret data in real time, allowing for informed decisions, optimized processes, and enhanced operational efficiency. This focus on leveraging data to drive business strategies and outcomes is a significant driver of market growth.

Technological Advancements and AI Integration

The adoption of advanced technologies, including machine learning and artificial intelligence (AI), is transforming the operational analytics landscape. These technologies help organizations uncover valuable insights, automate processes, and make predictive and prescriptive decisions based on data. The integration of AI and machine learning in analytics tools enhances their capabilities, making them more attractive to businesses aiming to stay ahead in a competitive environment.

Impact of the COVID-19 Pandemic

The COVID-19 pandemic underscored the need for real-time data and insights, accelerating the adoption of operational analytics tools. Businesses had to adapt quickly to remote work and changing market conditions, necessitating close monitoring of key performance indicators (KPIs). This shift drove the demand for cloud-based analytics platforms, data visualization tools, and predictive analytics solutions. The pandemic highlighted the critical role of operational analytics in navigating disruptions and optimizing remote collaboration and process management.

Regional Insights and Market Dynamics

North America leads the operational analytics market due to the presence of major analytics solution providers and high technological adoption rates. The region's robust infrastructure and large customer base contribute to its dominance. Europe follows, driven by the need for streamlined processes and technological innovation. The Asia-Pacific region is expected to grow the fastest, fueled by the rise of IoT-enabled technology and rapid technology adoption in countries like China and India.

Competitive Landscape and Strategic Investments

Key players in the operational analytics market, such as IBM, Oracle, Microsoft, and SAP, are heavily investing in research and development to expand their product lines and enhance their market presence. These companies are also engaging in strategic activities like mergers, acquisitions, and collaborations to strengthen their positions. The focus on innovation and the introduction of new products and services are crucial strategies to meet the growing demand for operational analytics solutions.

Restraints for the Operational Analytics Market

Data Security and Privacy Concerns

One major restraint in the operational analytics market is the concern over data security and privacy. Companies handle vast amounts of sensitive information, and any breach could lead to significant financial and reputational damage. Strict data protection regulations, such as GDPR in Europe and CCPA in California, impose heavy penalties for non-compliance. These regulations make organizations hesitant to fully embrace operational analytics solutions, especially in industries with stringent privacy laws, such as finance and healthcare. The fear of potential data breaches and the complexity of ensuring compliance can hinder the widespread adoption of these tools.

Integration Challenges with Legacy Systems

Another significant challenge is integrating modern operational analytics platforms with existing legacy systems. Many organizations still rely on outdated infrastructure that may not be compatible with new analytics solutions. This integration process can be resource-intensive, requiring substantial time, money, and technical expertise. The difficulty in achieving seamless integration can slow down the implementation of operational analytics, particularly in sectors where legacy systems are deeply entrenched. This barrier often results in delayed or limited deployment of advanced analytics capabilities.

High Implementation Costs

The high costs associated with implementing operational analytics solutions can be a significant barrier, particularly for small and medium-sized enterprises (SMEs). These costs include purchasing software, investing in necessary hardware, and training employees to use the new systems effectively. Additionally, ongoing maintenance and updates add to the financial burden. For many organizations, especially those with limited budgets, the return on investment may not be immediately apparent, making them cautious about adopting such technologies.

Complexity of Analytical Processes

The complexity of analytical processes also poses a challenge for many organizations. Operational analytics involves sophisticated techniques, including data mining, machine learning, and real-time data processing. Companies may lack the necessary in-house expertise to manage and interpret these complex processes. This skills gap can lead to underutilization of the analytics tools, reducing their effectiveness and the overall value derived from the investment. The need for specialized knowledge and skills can thus be a deterrent for companies considering the adoption of operational analytics.

Resistance to Change

Finally, resistance to change within organizations can impede the adoption of operational analytics. Employees accustomed to traditional ways of working may be reluctant to adopt new technologies, fearing job displacement or the need for retraining. This resistance can be particularly strong in established organizations with long-standing processes and cultures. Overcoming this resistance requires effective change management strategies, clear communication of the benefits, and sufficient training to ensure a smooth transition to new analytics-driven practices.

Opportunity in the Operational Analytics Market

Adoption of AI and Machine Learning

One of the biggest opportunities in the operational analytics market is the increasing adoption of artificial intelligence (AI) and machine learning (ML) technologies. These advanced tools allow companies to gain deeper insights from their operational data, automate processes, and make more accurate predictions. AI and ML can help identify patterns and anomalies in real time, enabling proactive decision-making and improving overall efficiency. As businesses continue to invest in these technologies, the demand for operational analytics solutions that integrate AI and ML is expected to grow significantly.

Growing Demand for Real-Time Analytics

Another key opportunity lies in the rising demand for real-time analytics. Organizations across various sectors are increasingly relying on real-time data to make informed decisions quickly. This is especially important in dynamic industries like finance, retail, and manufacturing, where conditions can change rapidly. Real-time analytics tools help companies monitor their operations as they happen, allowing for immediate adjustments and optimizations. This demand is driving the development and adoption of more sophisticated operational analytics platforms that offer real-time capabilities.

Expansion of Cloud-Based Solutions

The shift towards cloud-based solutions presents a significant opportunity for the operational analytics market. Cloud platforms offer flexibility, scalability, and cost-effectiveness, making them an attractive option for businesses of all sizes. Cloud-based analytics solutions enable organizations to easily integrate data from various sources, perform complex analyses, and access insights from anywhere. As more companies move their operations to the cloud, the market for cloud-based operational analytics is set to expand rapidly.

Rising Focus on Data-Driven Decision Making

The growing emphasis on data-driven decision-making is another major opportunity. Companies are increasingly recognizing the value of leveraging data to gain competitive advantages. Operational analytics provides the tools needed to analyze large volumes of data and extract actionable insights. By using data to guide their decisions, businesses can optimize their processes, reduce costs, and improve performance. This trend is expected to fuel the demand for operational analytics solutions in the coming years.

Emergence of IoT and Big Data

The proliferation of Internet of Things (IoT) devices and the explosion of big data are creating new opportunities for the operational analytics market. IoT devices generate vast amounts of data that need to be analyzed to extract useful information. Operational analytics solutions can help manage and make sense of this data, providing valuable insights into operations, maintenance needs, and potential issues. As IoT continues to grow, the need for advanced analytics tools to handle and analyze big data will increase, driving market growth.

Trends for the Operational Analytics Market

Increasing Adoption of Cloud-Based Solutions

One of the most significant trends in the operational analytics market is the growing adoption of cloud-based solutions. Companies are increasingly moving their data and analytics operations to the cloud to leverage its scalability, flexibility, and cost-efficiency. Cloud platforms enable businesses to process large volumes of data quickly and efficiently, leading to more timely and actionable insights. This shift is driven by the need for businesses to handle the ever-increasing amount of data generated from various sources, including IoT devices, social media, and enterprise systems.

Integration of AI and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are becoming integral parts of operational analytics. These technologies enhance the ability of analytics platforms to predict outcomes, identify trends, and automate decision-making processes. By incorporating AI and ML, companies can improve their operational efficiency and gain a competitive edge. For instance, predictive maintenance uses these technologies to foresee equipment failures and schedule timely maintenance, thus reducing downtime and operational costs.

Focus on Real-Time Analytics

There is a growing demand for real-time analytics in the operational analytics market. Businesses are increasingly recognizing the value of real-time data to make quick, informed decisions. Real-time analytics allows companies to monitor their operations continuously, respond swiftly to any issues, and optimize their processes on the fly. This trend is particularly evident in sectors such as manufacturing, logistics, and retail, where real-time insights can significantly enhance performance and customer satisfaction.

Expansion of IoT-Driven Analytics

The rise of the Internet of Things (IoT) is significantly impacting the operational analytics market. IoT devices generate vast amounts of data that can be analyzed to optimize operations, improve product quality, and enhance customer experiences. The integration of IoT with operational analytics enables businesses to gain deeper insights into their processes and make data-driven decisions. This trend is especially prominent in industries like manufacturing, energy, and healthcare, where IoT devices are widely used to monitor and manage operations.

Emphasis on Data Security and Privacy

As businesses collect and analyze more data, there is an increasing emphasis on data security and privacy. Ensuring that data is protected from breaches and misuse is crucial, particularly with the rising number of cyber threats. Companies are investing in advanced security measures and compliance frameworks to safeguard their data. This focus on security not only protects sensitive information but also builds trust with customers and stakeholders.

Growth of Predictive and Prescriptive Analytics

Predictive and prescriptive analytics are gaining traction in the operational analytics market. Predictive analytics involves using historical data to forecast future trends, while prescriptive analytics suggests actions to achieve desired outcomes. These advanced analytics techniques help businesses anticipate future scenarios and make proactive decisions. By leveraging predictive and prescriptive analytics, companies can optimize their operations, reduce risks, and improve overall performance.

Segments Covered in the Report

By Deployment Mode

o On-Premise

o On-Cloud

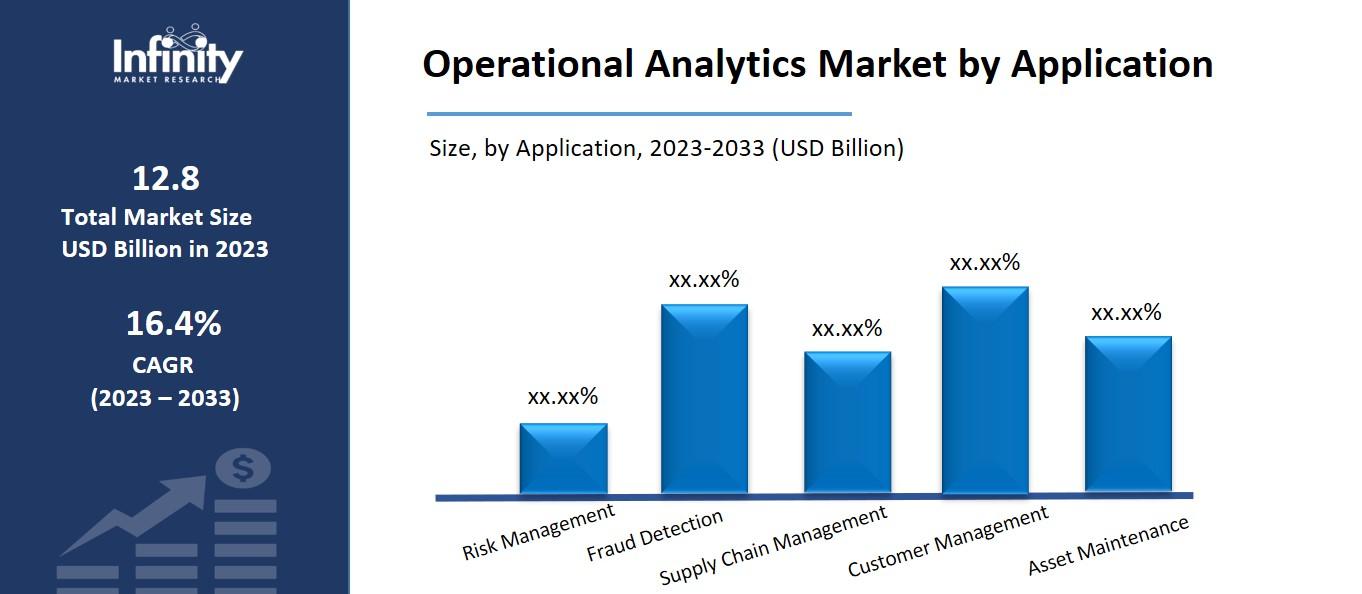

By Application

o Risk Management

o Fraud Detection

o Supply Chain Management

o Customer Management

o Asset Maintenance

By Industry Vertical

o IT

o Finance

o Marketing

o Sales

o Human Resources

Segment Analysis

By Deployment Mode Analysis

The global market segments are on-premise and on-cloud, based on deployment. As more businesses chose to employ operational analytics in this manner, the on-cloud portion of the market saw the greatest growth. On-cloud systems come with a lot of benefits.

Scalability choices are one such aspect; based on business requirements, firms can choose to scale up or reduce the use of these technologies. Their only financial obligation will be to cover the total quantity of resources spent. Businesses may decide to reduce their usage of operational analytics to save money during downtime. Moreover, cloud-based technologies enable quicker deployment times and offer greater flexibility in terms of usage.

By Application Analysis

With a market share of 21.9%, the application segment with the fastest growth rate is supply chain management. The firm analyzes its operations, sourcing, manufacturing, waste minimization, forecasting, and data synthesis using the supply chain. Artificial Intelligence (AI) is a key component of contemporary supply chain analytics, contributing to improved customer experience and higher organizational profitability. The AI supply chain analytics collaborates with a smart machine to handle problem-solving across multiple organizational departments.

Businesses have been utilizing unified advanced analytics software due to the trend of optimizing the delivery mechanism from the point of production to the end of consumption. The supply chain visibility platform business Project 44, which was founded in April 2023, announced the release of GPT, a new artificial intelligence technology that would enable the sector to harness the potential of generative AI.

By Industry Vertical Analysis

The Operational Analytics Market is divided into IT, Finance, Marketing, Sales, and Human Resources segments based on Industry Vertical. In the market for operational analytics, the marketing sector is growing at a considerable rate. The growing need to measure important indicators including return on investment (ROI), market attribution, and the efficacy of advertising campaigns across different industries is what is fueling the segment's rise.

Regional Analysis

With a 36.8% market share, North America leads the operational analytics market and is expected to stay that way for the duration of the forecast. The most efficient and advanced companies when it comes to putting operational analytics systems into practice are those based in the United States, such as Splunk, Oracle, Microsoft, and SAP. Massive amounts of data are constantly produced by companies and used to enhance IT operations. Businesses in the area frequently implement new technologies early on. One gains knowledge and competence in implementing and optimizing ITOA solutions when they are prepared to take measured risks and embrace unique ideas. The variables are probably going to help the market in the area flourish.

One of the industries in the US where operational analytics adoption is having a significant influence is healthcare. Analytics are being used by healthcare businesses to improve patient outcomes, allocate resources optimally, and increase overall operational efficiency.

The market for operational analytics in Europe has the second-largest share. The Region is witnessing a rise in technological innovation as the need for enhanced operations and optimized processes keeps growing. Businesses are looking for innovative ways to reduce expenses and waste while increasing production and efficiency. Additionally, the UK market is expanding quickly, and the German market for operational analytics holds the most market share. It appears that this market is expanding at the quickest rate in the European Union.

From 2023 to 2033, the Asia-Pacific Operational Analytics Market is anticipated to develop at the fastest rate. The rapid rise in technology use and the emergence of IOT-enabled technology are the reasons for this. Furthermore, the operational analytics market in China had the biggest market share, while the market in India was expanding at the quickest rate in the Asia-Pacific area.

Competitive Analysis

Prominent industry participants are making significant R&D investments to broaden their product offerings, contributing to the further expansion of the Operational Analytics market. In addition, market participants are engaging in a range of strategic endeavors aimed at broadening their market reach. Notable events in this regard include the introduction of new products, contractual agreements, mergers and acquisitions, increased investment levels, and cooperation with other entities. In an increasingly competitive and expanding market environment, the operational analytics business needs to provide affordable products to grow and thrive.

Recent Developments

March 2023: The existent Angles Professional for Oracle product line of insightsoftware, a top software technology provider of effective reporting, analytics, and performance management solutions, has expanded. By developing a technology that is beneficial to all business departments, the company has improved its product offerings by utilizing the advantages of Logi Analytics.

April 2022: The top technology company in India, Tata Consultancy Services (TCS), recently announced the release of a brand-new risk-based monitoring tool that is undergoing clinical trials. The system's exceptional agility and intuitiveness allow for more informed decision-making and increased research efficacy.

November 2022: IBM introduced Business Analytics Enterprise, a new solution designed to combat data silos and analytical silos for improved output performance.

Key Market Players in the Operational Analytics Market

o IBM

o Oracle

o SAP

o Tableau Software (acquired by Salesforce)

o Qlik

o Splunk

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 12.8 Billion |

|

Market Size 2033 |

USD 59.7 Billion |

|

Compound Annual Growth Rate (CAGR) |

16.4% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

Deployment Mode, Application, Industry Vertical, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

IBM, Oracle, SAP, Microsoft, SAS Institute, Tableau Software (acquired by Salesforce), Qlik, MicroStrategy, Tibco Software, Splunk, Other Key Players |

|

Key Market Opportunities |

Adoption of AI and Machine Learning |

|

Key Market Dynamics |

Increasing Volume and Variety of Data |

📘 Frequently Asked Questions

1. What would be the forecast period in the Operational Analytics Market report?

Answer: The forecast period in the Operational Analytics Market report is 2024-2033.

2. How much is the Operational Analytics Market in 2023?

Answer: The Operational Analytics Market size was valued at USD 12.8 Billion in 2023.

3. Who are the key players in the Operational Analytics Market?

Answer: IBM, Oracle, SAP, Microsoft, SAS Institute, Tableau Software (acquired by Salesforce), Qlik, MicroStrategy, Tibco Software, Splunk, Other Key Players

4. What is the growth rate of the Operational Analytics Market?

Answer: Operational Analytics Market is growing at a CAGR of 16.4% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.