🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Optoelectronics Market

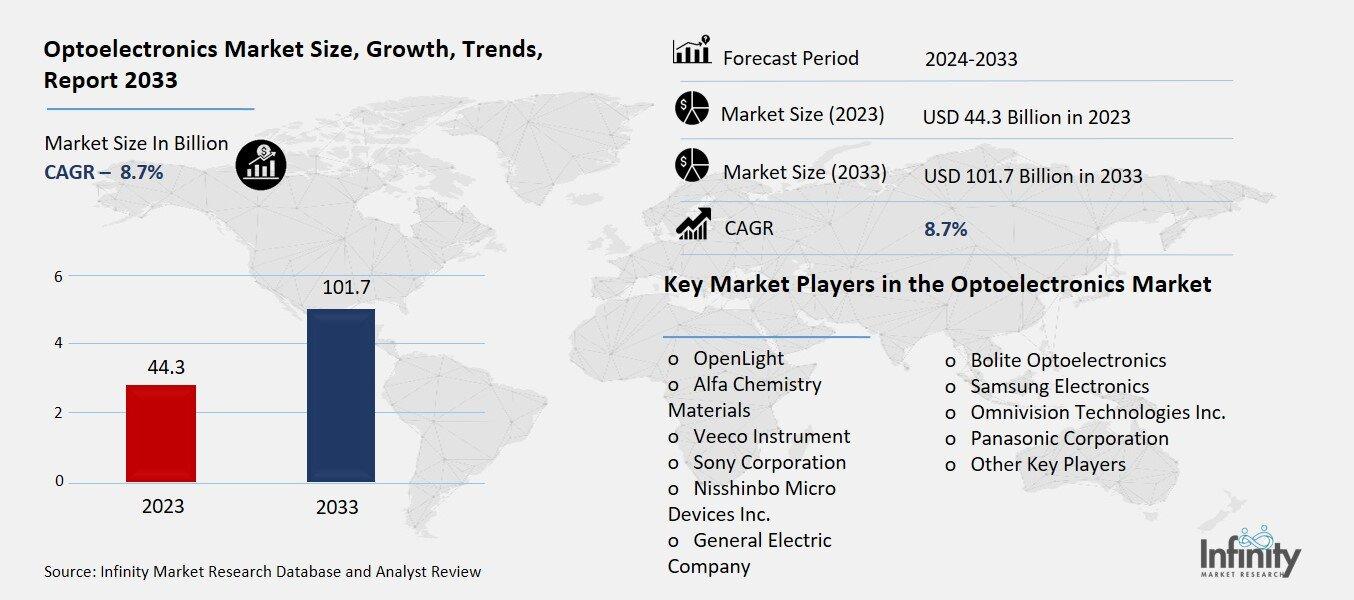

Global Optoelectronics Market (By Device, LEDs, Infrared Components, Sensors, and Other Devices; By Material, Gallium Nitride, Silicon Carbide, Gallium Arsenide, and Other Materials; By End-Use Industry, Aerospace & Defense, IT & Telecommunication, Energy & Power, Automotive, Healthcare, and Other End-Use Industries, By Region and Companies), 2024-2033

Nov 2024

Semiconductor and Electronics

Pages: 138

ID: IMR1310

Optoelectronics Market Overview

Global Optoelectronics Market acquired the significant revenue of 44.3 Billion in 2023 and expected to be worth around USD 101.7 Billion by 2033 with the CAGR of 8.7% during the forecast period of 2024 to 2033. Optoelectronics is a large market, including many related technologies and devices that deal with the way light and electronics work together. This market encompasses parts like, LEDs, Laser diode, Photodiode, Optical sensors and fiber optic parts which are used in telecommunication, automobile, health facilities, home appliances and industries in general.

The rising need for high speed data transmission, efficient and smart lighting and better diagnostic tools are some of the factors fueling the growth of this market. Furthermore, AR, and VR and the availability and spread of smart devices have increased the use of optoelectronic technologies.

Drivers for the Optoelectronics Market

Rising Demand for Energy-Efficient Lighting

The most prominent factor fueling the optoelectronics market is its transition to LED lighting among other efficiency enhancing inventions primarily caused by the global mandate for energy efficient technologies. LEDs (Light Emitting Diodes) are more energy efficient than both incandescent bulbs and fluorescent lights which makes them able to potentially reduce energy usage by both commercial, residential users and industries. This energy efficiency is further amplified by the fact that LEDs have a longer life span, hence, less frequency of replacement and therefore less costs. Besides, local and international governments and regulatory authorities are putting into place improved energy efficiency measures and promoting the use of energy-efficient lighting technologies. Consequently, the desire for LEDs and associated optoelectronic components is increasing rapidly.

Restraints for the Optoelectronics Market

Complex Manufacturing Processes

The production of optoelectronic devices involves complex and highly specialized manufacturing techniques that can pose significant challenges to scalability and cost efficiency. Unlike traditional electronic components, optoelectronic devices, such as LEDs, laser diodes, and photodetectors, require precise control over material properties, such as semiconductor characteristics, and the integration of light-sensitive components.

For instance, manufacturing these devices often involves processes like molecular beam epitaxy (MBE) or metal-organic chemical vapor deposition (MOCVD), which require highly controlled environments and expensive equipment. These processes are not only costly but also time-consuming, limiting the ability to scale up production rapidly to meet growing demand.

Opportunity in the Optoelectronics Market

Integration of Optoelectronics in IoT

The growing Internet of Things (IoT) ecosystem presents substantial opportunities for optoelectronic components, particularly in the areas of sensors, communication, and data processing. As the number of connected devices expands globally, the demand for more efficient, reliable, and low-power solutions has surged. Optoelectronic components, such as photodetectors, optical sensors, and light-based communication technologies, are crucial for enabling many IoT applications, from smart homes and cities to industrial automation and healthcare.

In terms of sensors, optoelectronics plays a vital role in environmental monitoring, smart agriculture, and health tracking by enabling the detection of various parameters such as temperature, humidity, light, and gas levels. These sensors often offer advantages in terms of sensitivity, speed, and precision compared to traditional electronic sensors.

Trends for the Optoelectronics Market

Hybrid and Multimodal Sensors

The integration of multiple functionalities, such as optical sensing with thermal, pressure, or motion sensing, is a rising trend in both industrial and consumer applications, driven by the need for more compact, efficient, and versatile sensing solutions. This trend leverages the unique strengths of different sensor types, combining them into a single, multifunctional device that can provide more comprehensive data and enhance system performance while reducing space and power consumption.

In industrial settings, integrated sensors enable real-time monitoring of complex systems with greater accuracy. For example, in predictive maintenance, optical sensors can detect visual changes in machinery, while thermal sensors monitor temperature variations, and pressure sensors measure stress or pressure fluctuations all within a single device. This combination of sensing capabilities allows for early detection of potential faults, minimizing downtime and improving efficiency.

Segments Covered in the Report

By Device

o LEDs

o Infrared Components

o Sensors

o Other Devices

By Material

o Gallium Nitride

o Silicon Carbide

o Gallium Arsenide

o Other Materials

By End-Use Industry

o Aerospace & Defense

o IT & Telecommunication

o Energy & Power

o Automotive

o Healthcare

o Other End-Use Industries

Segment Analysis

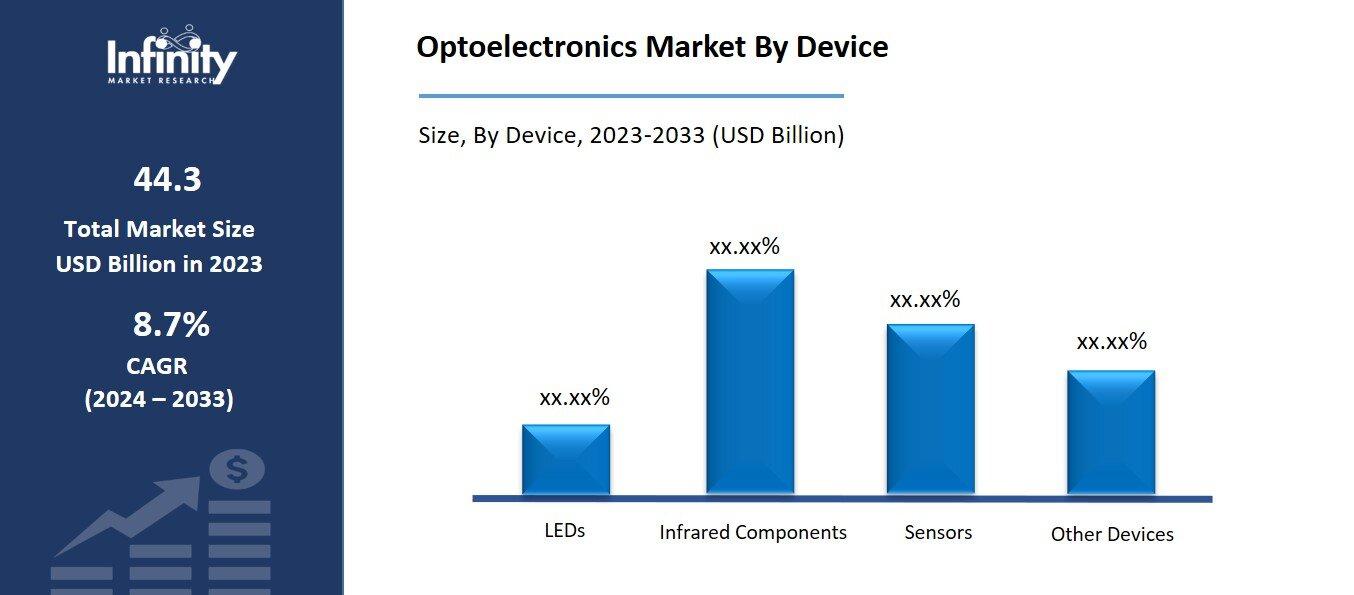

By Device Analysis

On the basis of device, the market is divided into LEDs, infrared components, sensors, and other devices. Among these, sensors segment acquired the significant share in the market owing to their widespread adoption across various industries, driven by the growing demand for automation, smart devices, and real-time monitoring solutions. Optoelectronic sensors, such as photodetectors, light sensors, and image sensors, play a crucial role in numerous applications, including industrial automation, automotive systems, healthcare, consumer electronics, and environmental monitoring.

The increasing reliance on Internet of Things (IoT) devices, which require precise, real-time data for efficient operations, has further propelled the demand for optoelectronic sensors. For instance, in industrial applications, optoelectronic sensors are integral to automation processes, providing critical data for machinery monitoring, safety systems, and quality control.

By Material Analysis

On the basis of material, the market is divided into gallium nitride, silicon carbide, gallium arsenide, and other materials. Among these, gallium nitride segment held the prominent share of the market due to its superior material properties, which make it highly suitable for a wide range of optoelectronic applications. GaN is known for its high efficiency, durability, and ability to perform at higher temperatures and voltages compared to other materials like silicon. These advantages are particularly important in industries such as telecommunications, automotive, consumer electronics, and power electronics.

By End-Use Industry Analysis

On the basis of end-use industry, the market is divided into aerospace & defense, IT & telecommunication, energy & power, automotive, healthcare, and other end-use industries. Among these, IT & telecommunication held the prominent share of the market. The increasing reliance on optical communication systems, such as fiber optics, and advancements in 5G technology have significantly driven the adoption of optoelectronic components in the IT and telecommunications industry.

Optoelectronic devices like photodetectors, optical sensors, and lasers are integral to the functioning of modern communication systems, enabling faster, more reliable data transfer over long distances. The surge in demand for internet connectivity, cloud computing, and data centers has further amplified the need for high-performance optical components.

Regional Analysis

Asia-Pacific Dominated the Market with the Highest Revenue Share

Asia-Pacific held the most of the share of 28.9% of the market. The region is home to some of the world’s largest manufacturers of optoelectronic devices, particularly in countries like China, Japan, South Korea, and Taiwan. These countries have established themselves as global hubs for electronics production, with significant investments in research and development, as well as manufacturing capabilities for components like LEDs, sensors, and laser diodes.

Additionally, the increasing adoption of smart technologies, automotive advancements, and the expanding telecommunications infrastructure in the region are key factors contributing to market growth. China, as the largest consumer electronics market, plays a pivotal role in driving demand for optoelectronics, particularly in the production of smartphones, wearables, and home automation devices.

Competitive Analysis

The competitive landscape of the optoelectronics market is characterized by the presence of several prominent global players and a high level of technological innovation. Key market leaders such as OSRAM Opto Semiconductors, Nichia Corporation, Broadcom Inc., Samsung Electronics, and Texas Instruments are at the forefront, driving the development of cutting-edge optoelectronic components, including LEDs, sensors, and laser diodes. These companies invest heavily in research and development to introduce new products with enhanced performance, energy efficiency, and miniaturization to meet the growing demand across industries like telecommunications, automotive, healthcare, and consumer electronics.

Recent Developments

In June 2023, STMicroelectronics, a leading semiconductor manufacturer, has entered into an agreement with Sanan Optoelectronics to collaborate on advancing the manufacturing and development of Silicon Carbide ecosystems throughout China.

In April 2023, ROHM, a prominent semiconductor and electronic component manufacturer, developed 4-channel and 6-channel LED drivers for medium to large automotive displays. This new solution is designed to consume 20% less power compared to traditional drivers.

Key Market Players in the Optoelectronics Market

o OpenLight

o Alfa Chemistry Materials

o Veeco Instrument

o Sony Corporation

o Nisshinbo Micro Devices Inc.

o General Electric Company

o Bolite Optoelectronics

o Samsung Electronics

o Omnivision Technologies Inc.

o Panasonic Corporation

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 44.3 Billion |

|

Market Size 2033 |

USD 101.7 Billion |

|

Compound Annual Growth Rate (CAGR) |

8.7% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Device, Material, End-Use Industry, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

OpenLight, Alfa Chemistry Materials, Veeco Instrument, Sony Corporation, Nisshinbo Micro Devices Inc., General Electric Company, Bolite Optoelectronics, Samsung Electronics, Omnivision Technologies Inc., Panasonic Corporation, and Other Key Players. |

|

Key Market Opportunities |

Integration of Optoelectronics in IoT |

|

Key Market Dynamics |

Rising Demand for Energy-Efficient Lighting |

📘 Frequently Asked Questions

1. Who are the key players in the Optoelectronics Market?

Answer: OpenLight, Alfa Chemistry Materials, Veeco Instrument, Sony Corporation, Nisshinbo Micro Devices Inc., General Electric Company, Bolite Optoelectronics, Samsung Electronics, Omnivision Technologies Inc., Panasonic Corporation, and Other Key Players.

2. How much is the Optoelectronics Market in 2023?

Answer: The Optoelectronics Market size was valued at USD 44.3 Billion in 2023.

3. What would be the forecast period in the Optoelectronics Market?

Answer: The forecast period in the Optoelectronics Market report is 2024-2033.

4. What is the growth rate of the Optoelectronics Market?

Answer: Optoelectronics Market is growing at a CAGR of 8.7% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.