🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Organic Phosphorus Insecticides Market

Global Organic Phosphorus Insecticides Market (By Type, Fungicides, Herbicides, Insecticides, and Other Types; By Ingredient, Glyphosate, Diazinon, Methamidophos, Malathion, Chloropyriphos, Dimethoate, Parathion, and Other Ingredients; By Application, Crop based and Non-crop based, By Region and Companies), 2024-2033

Sep 2024

Aggriculture

Pages: 138

ID: IMR1231

Organic Phosphorus Insecticides Market Overview

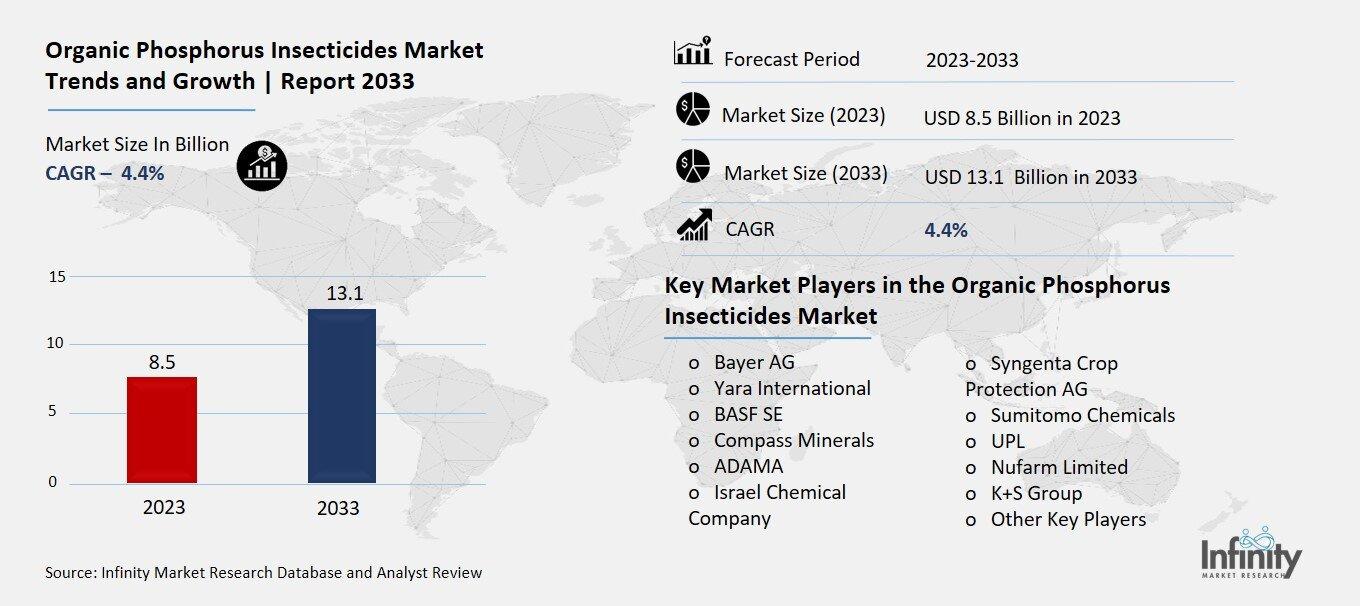

Global Organic Phosphorus Insecticides Market acquired the significant revenue of 8.5 Billion in 2023 and expected to be worth around USD 13.1 Billion by 2033 with the CAGR of 4.4% during the forecast period of 2024 to 2033. The organic phosphorus insecticides market is focuses on environmentally sustainable solutions for pest management. These insecticides are derived from natural sources or designed to meet organic farming standards and targets a wide range of agricultural and horticultural applications.

To Get An Overview , Request For Sample

Also, the market has seen significant growth owing to the rise consumer demand for organic produce. This segment includes products derived from natural organophosphates, microbial insecticides, and essential oils. Moreover, government regulations favoring organic agriculture, and advancements in biopesticide formulations, surge the demand for the market.

Drivers for the Organic Phosphorus Insecticides Market

Growing Demand for Organic Produce

Increasing consumer awareness is significantly drives the demand for organic pest management solutions. Customers prefers food products free from synthetic chemicals and pesticides as they become aware about the health and environmental impacts of conventional agricultural practices. This shift is fueled by growing understanding of the potential health risks associated with synthetic pesticide residues. Organic farming has become a preferred choice for both consumers and producers. As a result, farmers are adopting organic phosphorus insecticides as a safer alternative to traditional chemical options.

Restraints for the Organic Phosphorus Insecticides Market

Limited Awareness and Knowledge

Farmers may lack awareness or knowledge regarding the effectiveness and application of organic phosphorus insecticides compared to traditional chemical options, which poses a significant barrier to the widespread adoption of these products. Many farmers, particularly those who have relied on conventional pesticides for decades, are often unfamiliar with the specific benefits and limitations of organic alternatives. Traditional chemical insecticides tend to have well-documented results in terms of pest control, and farmers may be hesitant to switch to organic products due to concerns about their reliability, ease of use, and overall efficacy in comparison.

Additionally, the application methods for organic phosphorus insecticides may differ from those of synthetic chemicals, requiring different spraying techniques, timing, or dosages to maximize effectiveness. Without proper guidance or education, farmers may misuse organic insecticides, leading to suboptimal results and reinforcing the perception that they are less effective than conventional options.

Opportunity in the Organic Phosphorus Insecticides Market

Growing Recognition of the Importance of IPM

There is a growing recognition of the importance of Integrated Pest Management (IPM) strategies, which combine organic and synthetic methods to optimize pest control and enhance crop yields. IPM is a holistic approach that seeks to minimize the environmental and health impacts of farming by using a combination of biological, cultural, mechanical, and chemical methods for managing pests. In this strategy, organic phosphorus insecticides play a key role by providing a safer, more sustainable alternative to conventional chemicals, reducing the reliance on synthetic pesticides while maintaining effective pest control.

Farmers are increasingly aware that over-reliance on synthetic insecticides can lead to pest resistance, environmental damage, and harm to beneficial insects such as pollinators. By integrating organic insecticides into their pest management plans, farmers can reduce chemical inputs, mitigate pest resistance, and promote biodiversity in their fields. IPM encourages the careful selection of pest control methods based on effectiveness, safety, and sustainability, ensuring that organic and synthetic products are used strategically rather than indiscriminately.

Trends for the Organic Phosphorus Insecticides Market

Consumer Preference for Clean Label Products

As consumers increasingly demand transparency in food production, organic insecticides are gaining popularity because they align with the clean label trend. The clean label movement reflects consumer preferences for food products that are natural, minimally processed, and free from artificial additives, synthetic chemicals, and pesticides. Shoppers today are not only concerned with the nutritional content of their food but also with how it is produced. They want assurance that the farming practices used are environmentally friendly and do not involve harmful chemicals that could impact their health or the ecosystem.

Organic insecticides, including organic phosphorus insecticides, are seen as a crucial part of this shift toward transparency and sustainability in agriculture. These products are derived from natural sources or approved for organic farming, providing a pesticide solution that fits clean label standards. Consumers trust that foods grown with organic insecticides are less likely to contain harmful pesticide residues, making them more appealing in a marketplace that values health, sustainability, and ethical production.

Segments Covered in the Report

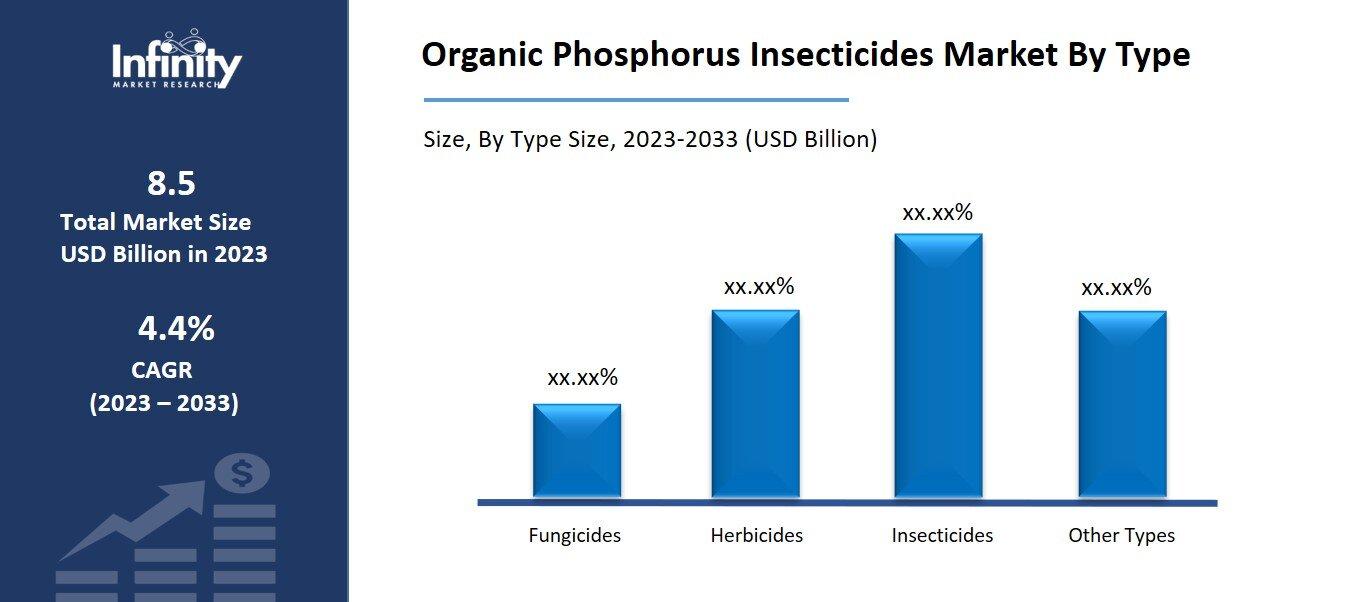

By Type

o Fungicides

o Herbicides

o Insecticides

o Other Types

By Ingredient

o Glyphosate

o Diazinon

o Methamidophos

o Malathion

o Chloropyriphos

o Dimethoate

o Parathion

o Other Applications

By Application

o Crop based

o Non-crop based

Segment Analysis

By Type Analysis

On the basis of type, the market is divided into fungicides, herbicides, insecticides, and other types. Among these, insecticides segment acquired the significant share around 42.1% in the market owing to the rising need for effective pest control in agriculture and horticulture. Insecticides play a critical role in protecting crops from harmful insects and pests, which can lead to significant yield losses if left unchecked.

To Learn More About This Report , Request For Sample

The demand for organic insecticides, particularly organic phosphorus insecticides, has surged as farmers and growers prioritize sustainable and eco-friendly solutions to manage pests. Additionally, growing concerns over the environmental impact and health risks associated with synthetic chemical insecticides have further propelled the shift toward organic options. Farmers increasingly favor organic insecticides because they minimize harm to beneficial insects like pollinators, improve soil health, and reduce chemical residue on crops, aligning with the broader trend toward organic and clean-label food production.

By Ingredient Analysis

On the basis of ingredient, the market is divided into glyphosate, diazinon, methamidophos, malathion, chlorpyriphos, dimethoate, parathion, and other ingredients. Among these, glyphosate held the prominent share of the market due to its widespread usage and effectiveness as a broad-spectrum herbicide. Its cost-effectiveness and versatility, particularly in glyphosate-resistant crop systems, contribute to its dominance in the market. However, other ingredients such as diazinon, methamidophos, malathion, chlorpyrifos, dimethoate, and parathion are also significant players, each with unique applications and market dynamics. For instance, diazinon and malathion are utilized for various pests in agricultural and residential settings, but they face increasing regulatory scrutiny due to safety and environmental concerns.

By Application Analysis

On the basis of application, the market is divided into crop based and non-crop based. Among these, crop-based segment held a prominent share of the market due to the widespread use of organic phosphorus insecticides in agricultural production to protect crops from pests and diseases. The growing emphasis on sustainable agriculture, along with the rising global demand for organic food products, has driven the adoption of organic insecticides in crop protection. Farmers are increasingly turning to organic phosphorus insecticides to maintain crop health while reducing the environmental impact of conventional chemical pesticides.

Regional Analysis

Asia Pacific Dominated the Market with the Highest Revenue Share

Asia Pacific held the most of the share of 32.1% the market owing to the significant rise in agricultural activities, driven by a large and growing population that demands increased food production. Countries such as China, India, and Japan are at the forefront of adopting organic farming practices, propelled by government initiatives and policies promoting sustainable agriculture. These countries are increasingly focusing on minimizing chemical pesticide usage to combat environmental concerns and enhance food safety.

Furthermore, the rising awareness among farmers regarding the adverse effects of synthetic pesticides on health and the environment has led to a shift towards organic alternatives, including organic phosphorus insecticides. The region's diverse agricultural landscape, which includes various high-value crops such as fruits, vegetables, and cereals, provides a substantial market for organic pest management solutions.

Competitive Analysis

The competitive landscape of the organic phosphorus insecticides market is characterized by a diverse mix of key players, including major multinational corporations like BASF SE, Syngenta AG, and Bayer AG, alongside smaller specialized firms focused on organic solutions. These companies are actively investing in research and development to innovate and enhance their product offerings, emphasizing sustainability and eco-friendliness to meet the growing consumer demand for organic and clean-label products. Strategic partnerships with agricultural organizations and research institutions are becoming increasingly common, allowing these players to expand their market reach and educate farmers about effective organic pest management solutions.

Key Market Players in the Organic Phosphorus Insecticides Market

o Bayer AG

o Yara International

o BASF SE

o Compass Minerals

o ADAMA

o Israel Chemical Company

o Syngenta Crop Protection AG

o Sumitomo Chemicals

o UPL

o Nufarm Limited

o K+S Group

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 8.5 Billion |

|

Market Size 2033 |

USD 13.1 Billion |

|

Compound Annual Growth Rate (CAGR) |

4.4% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Ingredient, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Bayer AG, Yara International, BASF SE, Compass Minerals, ADAMA, Israel Chemical Company, Syngenta Crop Protection AG, Sumitomo Chemicals, UPL, Nufarm Limited, K+S Group, and Other Key Players |

|

Key Market Opportunities |

Growing Recognition of the Importance of IPM |

|

Key Market Dynamics |

Growing Demand for Organic Produce |

📘 Frequently Asked Questions

1. Who are the key players in the Organic Phosphorus Insecticides Market?

Answer: Bayer AG, Yara International, BASF SE, Compass Minerals, ADAMA, Israel Chemical Company, Syngenta Crop Protection AG, Sumitomo Chemicals, UPL, Nufarm Limited, K+S Group, and Other Key Players

2. How much is the Organic Phosphorus Insecticides Market in 2023?

Answer: The Organic Phosphorus Insecticides Market size was valued at USD 8.5 Billion in 2023.

3. What would be the forecast period in the Organic Phosphorus Insecticides Market?

Answer: The forecast period in the Organic Phosphorus Insecticides Market report is 2023-2033.

4. What is the growth rate of the Organic Phosphorus Insecticides Market?

Answer: Organic Phosphorus Insecticides Market is growing at a CAGR of 4.4% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.