🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Ortho-dichlorobenzene Market

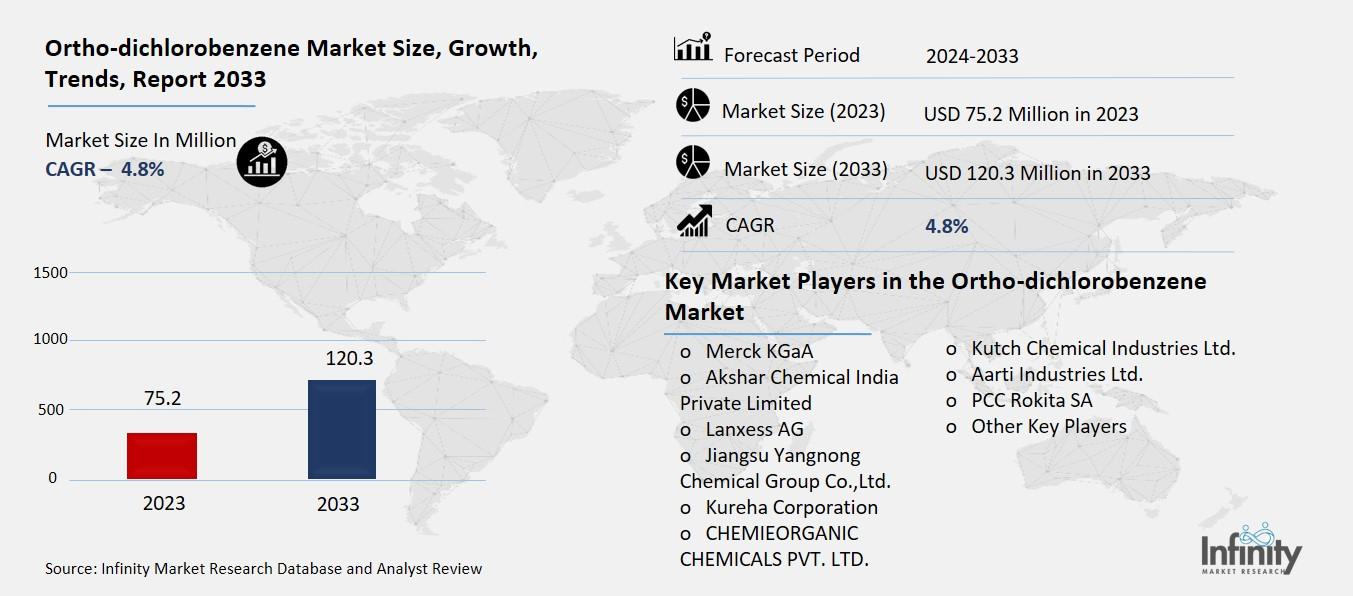

Global Ortho-dichlorobenzene Market (By Type, Type I, Type II, Type III, and Type IV; By Application, Pharmaceutical Intermediate, Pesticide Industry, TDI Solvent, Dye Intermediate, and Other Applications; By Region and Companies), 2024-2033

Dec 2024

Chemicals and Materials

Pages: 138

ID: IMR1363

Ortho-dichlorobenzene Market Overview

Global Ortho-dichlorobenzene Market acquired the significant revenue of 75.2 Million in 2023 and expected to be worth around USD 120.3 Million by 2033 with the CAGR of 4.8% during the forecast period of 2024 to 2033. The ortho-dichlorobenzene is a halogenated aromatic compound mainly employed as the raw material for the preparation of herbicides, insecticides, and dyestuffs as well as other applications in the agrochemical, polymer, and pharmaceutical industries. Market growth is well associated to growing demands for agricultural chemicals particularly in the Asia-Pacific, where agriculture production is highly increasing.

Also, it is used as a solvent for engineering plastics and resins and as a corrosion inhibitor for concrete reinforcement bars, thereby broadening the circle of its application. However, due to risks associated with the compound to the environment and the human health, the market has experienced limitations from regulation restrictions and this made the manufacturers to seek green chemistry solutions.

Drivers for the Ortho-dichlorobenzene Market

Increasing Demand in Agrochemicals

Ortho-dichlorobenzene (o-DCB) is a valued intermediate for the synthesis of herbicides and insecticides which are key components for any modern farming system. Due to the mentioned chemical properties, it is well suited for producing active substances that shield crops from pests and weeds. With regards to agricultural output, specialty chemicals have grown importance in due to increasing food demand globally and especially in Asia-Pacific regions which is densely populated.

Manufactured herbicides and insecticides that contain o-DCB are useful in enhancing agricultural productivity of crops and quality thus enhancing the food security agenda in the globe. This is because there is a growing demand for the superior quality advanced agrochemicals for the protection of crops, powered by the escalating investments in agriculture as well as improvements in materials protection for field crops.

Restraints for the Ortho-dichlorobenzene Market

Availability of Alternatives

The increasing preference for less hazardous and eco-friendly substitutes poses a challenge to the growth of the ortho-dichlorobenzene (o-DCB) market. As awareness of environmental sustainability and human health risks rises, industries are actively seeking alternatives to traditional chemicals with high toxicity levels, such as o-DCB. Regulatory bodies across the globe are enforcing stricter environmental standards, incentivizing the adoption of greener and biodegradable substitutes. For instance, bio-based solvents and advanced formulations are gaining traction in agrochemical and polymer industries as safer alternatives. This shift in consumer and industrial preferences could lead to a decline in demand for o-DCB, urging manufacturers to innovate and transition toward environmentally sustainable practices to remain competitive.

Opportunity in the Ortho-dichlorobenzene Market

Advancements in Application Technologies

Ortho-dichlorobenzene (o-DCB) is integral to the production of various specialty chemicals and advanced materials, serving as a solvent and chemical intermediate. Its high solvency power makes it effective in dissolving complex organic compounds, facilitating reactions in the synthesis of dyes, pigments, and pharmaceuticals. In advanced material applications, o-DCB is utilized in the fabrication of high-performance polymers and resins, contributing to the development of materials with enhanced mechanical and thermal properties.

Additionally, o-DCB has been investigated as a pore modifier in proton exchange membrane fuel cells (PEMFCs), where its inclusion in catalyst inks leads to improved electrode structures and performance. These innovations underscore o-DCB's versatility and its expanding role in the advancement of specialty chemicals and materials.

Trends for the Ortho-dichlorobenzene Market

Shift Toward Eco-Friendly Alternatives

The growing demand for sustainable and biodegradable chemical solutions is reshaping the global chemical industry, including the market for ortho-dichlorobenzene (o-DCB). With increasing awareness of environmental concerns and stricter regulatory frameworks, industries are shifting focus toward eco-friendly alternatives that minimize ecological impact. Sustainable chemicals, often derived from renewable resources, and biodegradable compounds are becoming the preferred choice for applications in agriculture, pharmaceuticals, and polymers. This trend is particularly evident in regions with robust environmental policies, such as Europe and North America, where manufacturers are actively investing in green chemistry innovations. For o-DCB, this shift presents both a challenge and an opportunity driving the need for its producers to innovate and create greener formulations to align with evolving market preferences and regulatory landscapes.

Segments Covered in the Report

By Type

o Type I

o Type II

o Type III

o Type IV

By Application

o Pharmaceutical Intermediate

o Pesticide Industry

o TDI Solvent

o Dye Intermediate

o Other Applications

Segment Analysis

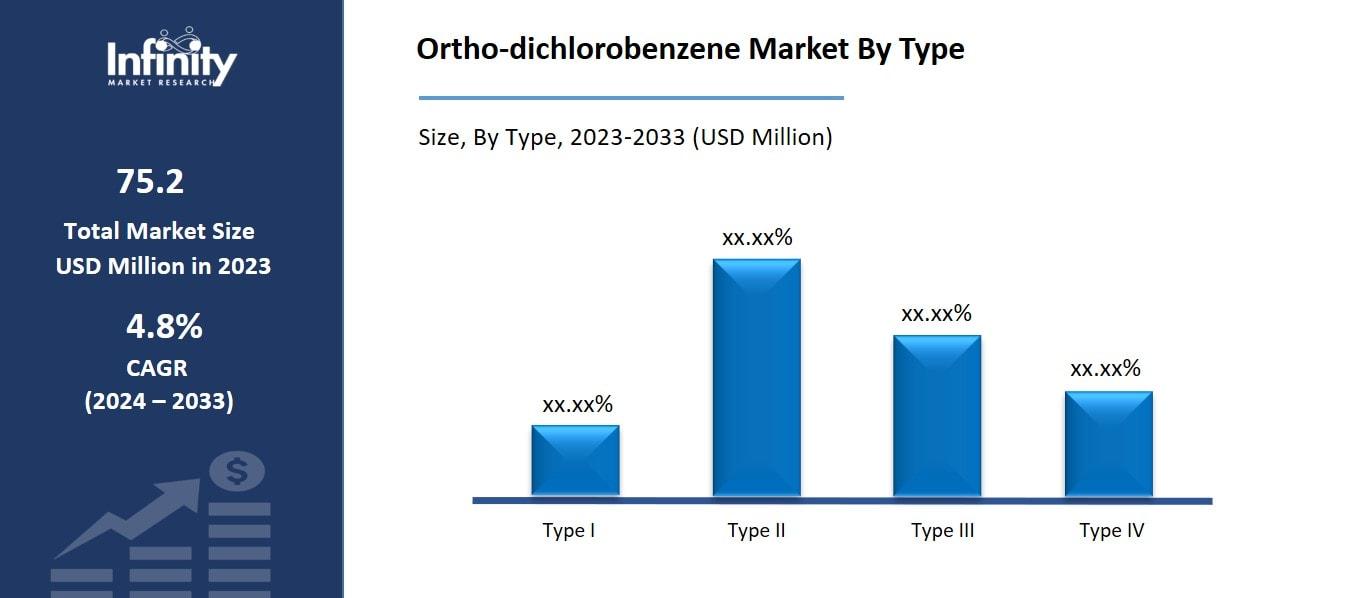

By Type Analysis

On the basis of type, the market is divided into type I, type II, type III, and type IV. Among these, type I segment acquired the significant share in the market owing to its versatile properties and wide-ranging applications. Type I o-DCB is characterized by its high purity and suitability for use as a chemical intermediate in agrochemicals, particularly in the synthesis of herbicides and insecticides. Its efficiency in facilitating chemical reactions and its compatibility with various manufacturing processes make it a preferred choice in industries such as polymers, resins, and dyes. Additionally, the robust demand for Type I o-DCB in regions with high agricultural output and growing industrialization, such as Asia-Pacific, further contributes to its dominance.

By Application Analysis

On the basis of application, the market is divided into pharmaceutical intermediate, pesticide industry, TDI solvent, dye intermediate, and other applications. Among these, TDI solvent segment held the prominent share of the market due to its critical role in polyurethane production. TDI is a key raw material used in the manufacture of flexible foams, coatings, adhesives, and elastomers, with o-DCB serving as an effective solvent during its synthesis. The rising demand for polyurethane products across industries such as automotive, construction, and furniture has directly boosted the consumption of o-DCB in this application. Additionally, the solvent's chemical stability and compatibility with TDI production processes ensure its continued relevance in industrial applications.

Regional Analysis

Asia Pacific Dominated the Market with the Highest Revenue Share

Asia Pacific held the most of the share of 31.1% of the market due to its strong industrial base and expanding agricultural sector. Countries like China, India, and Japan are major contributors, driven by the high demand for o-DCB in agrochemicals, including herbicides and insecticides, to support their large-scale farming activities. Additionally, the region's robust manufacturing industries, particularly in polymers, resins, and specialty chemicals, further bolster the market.

The rapid urbanization and industrialization in Asia-Pacific have also increased the consumption of o-DCB in applications such as engineering plastics and coatings. Moreover, favorable government policies, low labor costs, and the presence of major chemical manufacturers enhance production capacities, solidifying the region's leadership in the global market.

Competitive Analysis

The ortho-dichlorobenzene (o-DCB) market is highly competitive, with key players focusing on strategies such as product innovation, capacity expansions, and partnerships to strengthen their market position. Major manufacturers are investing in advanced production technologies to ensure consistent quality and compliance with stringent environmental regulations. The competition is intensified by the presence of both global and regional players, each vying to cater to the growing demand from industries like agrochemicals, pharmaceuticals, and polymers. Companies are also exploring sustainable production processes and eco-friendly alternatives to address the rising demand for greener solutions.

Key Market Players in the Ortho-dichlorobenzene Market

o Merck KGaA

o Akshar Chemical India Private Limited

o Lanxess AG

o Jiangsu Yangnong Chemical Group Co.,Ltd.

o Kureha Corporation

o CHEMIEORGANIC CHEMICALS PVT. LTD.

o Kutch Chemical Industries Ltd.

o Aarti Industries Ltd.

o PCC Rokita SA

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 75.2 Million |

|

Market Size 2033 |

USD 120.3 Million |

|

Compound Annual Growth Rate (CAGR) |

4.8% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Million) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Merck KGaA, Akshar Chemical India Private Limited, Lanxess AG, Jiangsu Yangnong Chemical Group Co.,Ltd., Kureha Corporation, CHEMIEORGANIC CHEMICALS PVT. LTD., Kutch Chemical Industries Ltd., Aarti Industries Ltd., PCC Rokita SA, and Other Key Players. |

|

Key Market Opportunities |

Advancements in Application Technologies |

|

Key Market Dynamics |

Increasing Demand in Agrochemicals |

📘 Frequently Asked Questions

1. Who are the key players in the Ortho-dichlorobenzene Market?

Answer: Merck KGaA, Akshar Chemical India Private Limited, Lanxess AG, Jiangsu Yangnong Chemical Group Co.,Ltd., Kureha Corporation, CHEMIEORGANIC CHEMICALS PVT. LTD., Kutch Chemical Industries Ltd., Aarti Industries Ltd., PCC Rokita SA, and Other Key Players.

2. How much is the Ortho-dichlorobenzene Market in 2023?

Answer: The Ortho-dichlorobenzene Market size was valued at USD 75.2 Million in 2023.

3. What would be the forecast period in the Ortho-dichlorobenzene Market?

Answer: The forecast period in the Ortho-dichlorobenzene Market report is 2024-2033.

4. What is the growth rate of the Ortho-dichlorobenzene Market?

Answer: Ortho-dichlorobenzene Market is growing at a CAGR of 4.8% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.