🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Orthopedic Surgical Planning Software Market

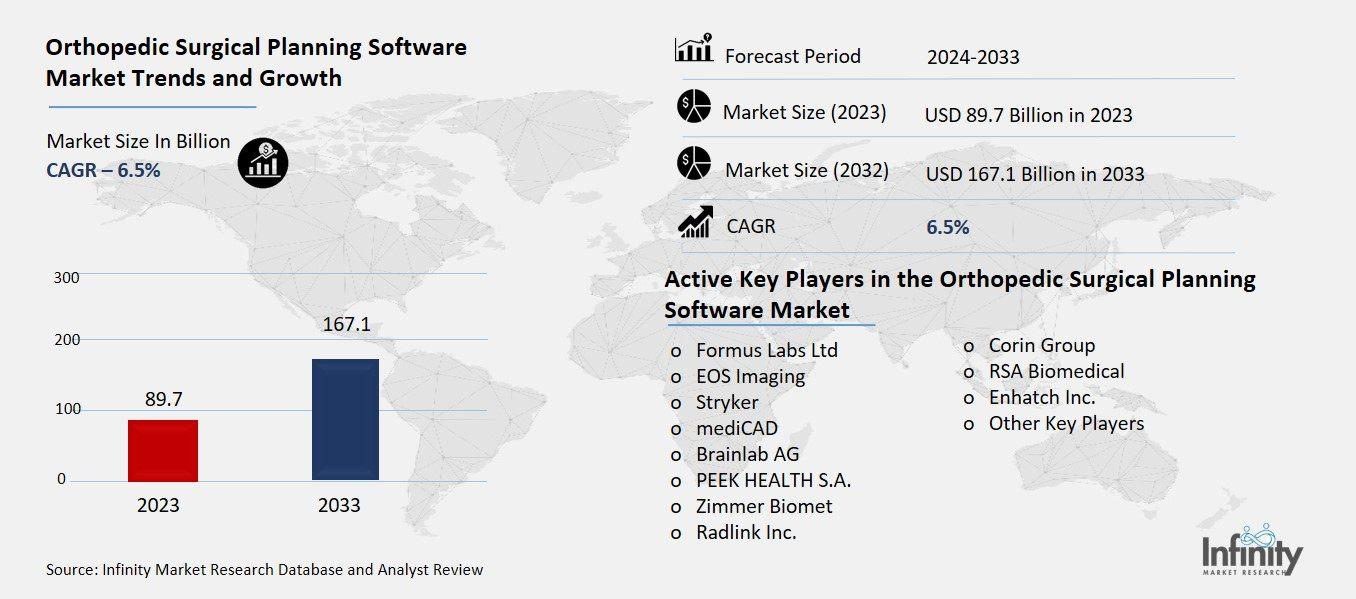

Orthopedic Surgical Planning Software Market Global Industry Analysis and Forecast (2024-2033) by Type (Pre-Operative and Post-Operative), Application (Neurosurgery, Dental & Orthodontics, Orthopedic Surgery, and Other Applications), End-User (Hospitals, Rehabilitation Centers, and Orthopedic Clinics) and Region

May 2025

Healthcare

Pages: 138

ID: IMR2043

Orthopedic Surgical Planning Software Market Synopsis

The Global Orthopedic Surgical Planning Software Market was valued at USD 89.7 billion in 2023 and is expected to grow from USD 95.4 billion in 2024 to USD 167.1 billion by 2033, reflecting a CAGR of 6.5% over the forecast period.

The orthopedic surgical planning software market is the worldwide sector dedicated to supporting surgeons when preparing for orthopedic surgeries including joint replacements, spinal surgeries and treating bone fractures. With the help of these programs, surgeons can clearly see and plan the patient’s internal structures, pick out the required implants and predict how the operation will work. The orthopedic market is boosted by more surgical procedures, the increased popularity of less invasive techniques and updated imaging tools. Using AI and machine learning helps improve predictability and lets surgeons plan for the best way to carry out each operation. Among the main users are hospitals, specialty clinics and ambulatory surgical centers.

Orthopedic Surgical Planning Software Market Driver Analysis

Increasing Number of Orthopedic Surgeries

The growth in orthopedic surgery is mainly due to an aging global population and an increase in musculoskeletal conditions. As older people age, they may get osteoarthritis, osteoporosis or degenerative disc diseases and surgery is often needed to improve movement and relieve their pain. And because joints and bones are affected by age, older people often develop more fractures and problems with degenerating hips, knees and spine. Besides this, more people living inactive lives, experiencing obesity and suffering sports injuries at every age add to the burden of musculoskeletal diseases. Thus, surgical planning software is more necessary now to raise the accuracy, results and speed of recovery for the increasing number of orthopedic surgeries.

Orthopedic Surgical Planning Software Market Restraint Analysis

High Cost of Software and Implementation

The start-up expenses and continuing fees for surgical planning software can be very high and this often makes it difficult for places with limited resources to get these systems. Many developing countries or small clinics find it tough to contribute to surgical robotics due to low surgery volumes or a budget shortage. In addition, operating the software and any updates to imaging or IT systems can mean more costs to cover. Therefore, with all the benefits of these systems, low-income regions that need them the most are unable to access them due to weak healthcare resources.

Orthopedic Surgical Planning Software Market Opportunity Analysis

Integration with AI and Machine Learning

With the help of AI, orthopedic surgeons can now use valuable insights and data to improve their planning for surgery. Based on the review of plenty of patients’ records, including visual findings, the results of surgical procedures and past studies, AI can suggest the best surgical plan for each patient. Such information allows experts to predict problems, estimate when a person will recover and choose the right implants or treatments. Moreover, AI is able to automate regular planning work, lessen the risk of errors and enhance the accuracy of simulations. It simplifies the work before an operation and supports more accurate, personal plans, helping the patient both recover and save costs.

Orthopedic Surgical Planning Software Market Trend Analysis

Collaborative Platforms and Tele-Surgical Planning

In orthopedic surgery, more cases are now being prepared using teamwork across various locations, with the help of digital tools. Through these platforms, surgeons, radiologists and several other healthcare professionals can team up in real time, not matter where they are. Since all teams have access to the same patient information, 3D images and surgical plans over the internet, they can plan together, talk about difficult issues and decide as a group. Working together during the planning stage improves surgical decisions, cuts down on errors and speeds everything up. Global healthcare, higher education and cross-country medical dialogue are made much easier when instant and easy sharing of vast knowledge is made possible by EMRs.

Orthopedic Surgical Planning Software Market Segment Analysis

The Orthopedic Surgical Planning Software Market is segmented on the basis of Type, Application, and End-User.

By Type

o Pre-Operative

o Post-Operative

By Application

o Neurosurgery

o Dental & Orthodontics

o Orthopedic Surgery

o Other Applications

By End-User

o Hospitals

o Rehabilitation Centers

o Orthopedic Clinics

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Type, Pre-Operative Segment is Expected to Dominate the Market During the Forecast Period

The types discussed in this research study, the pre-operative segment is expected to account for the largest market share of orthopedic surgical planning software market in the forecast period. The main reason for this dominance is that thorough planning ahead of surgery helps achieve success. Before surgery, surgeons can use software tools along with CT and MRI scans to assess a patient’s bones, plan the procedure and pick out the best implant and procedure method. Thanks to these, there are less surgical risks, greater accuracy and smoother surgery. Because more people are asking for individualized and gentle surgeries and because advancements in 3D imaging and AI support this, the need for detailed preparation before surgery is even greater and has become the top area in the market.

By Application, the Orthopedic Surgery Segment is Expected to Held the Largest Share

The orthopedic surgery segment is likely to dominate the market on account of the high volume of orthopedic procedures performed globally, such as joint replacements, spinal surgeries, and fracture repairs. Properly planning before surgery is needed for the right placement, alignment and successful functioning of the implants. Growing rates of musculoskeletal disorders, injuries from sports and conditions tied to getting older have created additional demand for high-tech planning methods. Therefore, surgeons in orthopedics are increasingly using specialized software solutions which help them perform more accurately, complete surgery fast and increase the chances of full patient recovery. Because of strong clinical demand, the orthopedic surgery segment leads the market.

By End-User, the Hospitals Segment is Expected to Held the Largest Share

By end-user, the hospitals segment is expected to hold the largest share of the orthopedic surgical planning software market. Orthopedic procedures are common in hospitals and help them understand why they should upgrade to cutting-edge devices for better outcomes, less time in surgery and better patient care. With more capital, multi-use imaging and different experts, hospitals can easily use complete surgical planning systems. Furthermore, hospitals are important places for emergency treatment, hip and knee surgeries and back surgeries which all gain a lot from thorough planning before the operation. As more hospitals concentrate on precision medicine and use digital health tech, the segment’s influence in the market continues to increase.

Orthopedic Surgical Planning Software Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

North America is expected to dominate the orthopedic surgical planning software market over the forecast period due to several key factors. Advanced health systems, lots of modern tools and strong spending on research and development characterize the region. Because North America has many aging people affected by musculoskeletal conditions, it creates an increased need for orthopedic surgery planning tools. The region is further boosted by big companies, favorable policies for payment and government help in advancing digital health. As a result, orthopedic surgical planning software will continue to have the largest market share in North America during the next few years.

Recent Development

In March 2023, Zimmer Biomet Holdings, Inc. introduced the latest improvements to its ZBEdge Dynamic Intelligence platform at the American Academy of Orthopaedic Surgeons (AAOS) 2023 annual meeting. These enhancements expanded the capabilities of its pre-operative surgical planning software, contributing to an increase in the company’s sales.

In September 2022, Zimmer Biomet Holdings, Inc. announced a multi-year co-marketing partnership with Surgical Planning Associates, Inc. to promote HipInsight, its FDA-cleared mixed reality navigation system for total hip replacement. This collaboration played a key role in boosting the company’s product sales.

Active Key Players in the Orthopedic Surgical Planning Software Market

o Formus Labs Ltd

o EOS Imaging

o Stryker

o mediCAD

o Brainlab AG

o PEEK HEALTH S.A.

o Zimmer Biomet

o Radlink Inc.

o Corin Group

o RSA Biomedical

o Enhatch Inc.

o Other Key Players

Global Orthopedic Surgical Planning Software Market Scope

|

Global Orthopedic Surgical Planning Software Market | |||

|

Base Year: |

2024 |

Forecast Period: |

2024-2033 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 89.7 Billion |

|

Market Size in 2024: |

USD 95.4 Billion | ||

|

Forecast Period 2024-33 CAGR: |

6.5% |

Market Size in 2033: |

USD 167.1 Billion |

|

Segments Covered: |

By Type |

· Pre-Operative · Post-Operative | |

|

By Application |

· Neurosurgery · Dental & Orthodontics · Orthopedic Surgery · Other Applications | ||

|

By End-User |

· Hospitals · Rehabilitation Centers · Orthopedic Clinics | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Increasing Number of Orthopedic Surgeries | ||

|

Key Market Restraints: |

· High Cost of Software and Implementation | ||

|

Key Opportunities: |

· Integration with AI and Machine Learning | ||

|

Companies Covered in the report: |

· Formus Labs Ltd, EOS Imaging, Stryker, mediCAD, and Other Key Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Orthopedic Surgical Planning Software Market Research report?

Answer: The forecast period in the Orthopedic Surgical Planning Software Market Research report is 2024-2033.

2. Who are the key players in the Orthopedic Surgical Planning Software Market?

Answer: Formus Labs Ltd, EOS Imaging, Stryker, mediCAD, and Other Key Players.

3. What are the segments of the Orthopedic Surgical Planning Software Market?

Answer: The Orthopedic Surgical Planning Software Market is segmented into Type, Application, End-User, and Regions. By Type, the market is categorized into Pre-Operative and Post-Operative. By Application, the market is categorized into Neurosurgery, Dental & Orthodontics, Orthopedic Surgery, and Other Applications. By End-User, the market is categorized into Hospitals, Rehabilitation Centers, and Orthopedic Clinics. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Orthopedic Surgical Planning Software Market?

Answer: The Orthopedic Surgical Planning Software market is part of healthcare technology and is used to support orthopedic surgeons in managing how they operate. They give detailed views, analysis and simulations of procedures including joint replacements, fixing problems of the spine and treating trauma injuries. Because it works with imaging data unique to each patient, the software enables surgeons to design the placement of implants carefully. As a result, surgeries are more successful, take less time and cause fewer problems.

5. How big is the Orthopedic Surgical Planning Software Market?

Answer: The Global Orthopedic Surgical Planning Software Market was valued at USD 89.7 billion in 2023 and is expected to grow from USD 95.4 billion in 2024 to USD 167.1 billion by 2033, reflecting a CAGR of 6.5% over the forecast period.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.