🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Paints and Coatings Market

Paints and Coatings Market Global Industry Analysis and Forecast (2024-2033) by Product Type (Waterborne, Solvent Borne, Powder Coating, UV Coatings, and Other Product Types), Resin (Epoxy, Acrylic, Polyester, Alkyd, Polyurethane (PU), and Other Resins), Application (Architectural, Automotive OEM, Marine, Coil, General Industries, Protective Coatings, Automotive Refinish, and Industrial Wood, Packaging, and Other Applications), and Region

Apr 2025

Chemicals and Materials

Pages: 138

ID: IMR1931

Paints and Coatings Market Synopsis

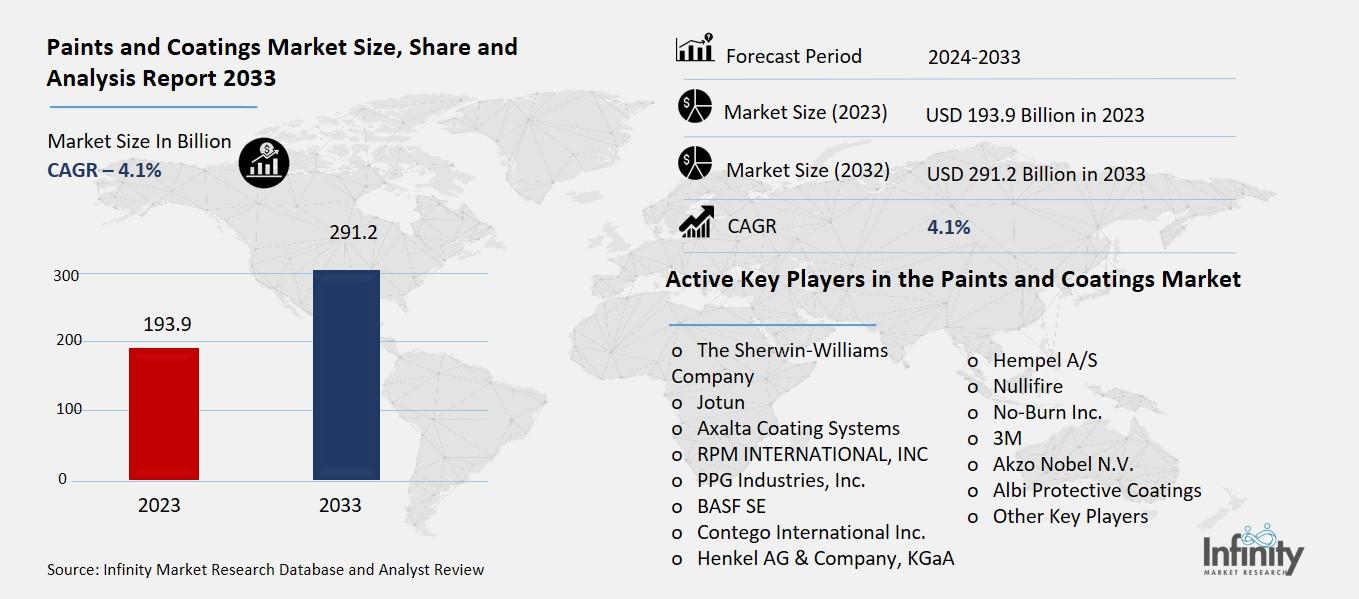

The global Paints and Coatings Market was valued at USD 193.9 billion in 2023 and is expected to grow from USD 210.9 billion in 2024 to USD 291.2 billion by 2033, reflecting a CAGR of 4.1% over the forecast period.

The paints and coatings market maintains steady growth worldwide due to rising sector demand between construction and automotive and industrial sectors. The market shows strong projections of future expansion because of quick urbanization and rising infrastructure and increasing customer interest in protective and aesthetic finishes. Asia-Pacific commands the leading position of all regional markets due to rapid economic expansion throughout the territories of China India and South Korea. The product segment is led by waterborne coatings because they have low VOC emissions alongside environmentally-friendly properties. The market benefits from technological developments that incorporate smart coatings with nanotechnology which improves both durability and sustainability while adding enhanced functionality. The rising competition in the market stems from both new companies entering the field while existing players implement diversified business approaches.

Paints and Coatings Market Driver Analysis

Expansion of Automotive and Industrial Sectors

The rising numbers of produced vehicles and expanding industrial equipment usage create extensive market demand for paints and coatings because they serve protective functions and enhance appearance. Automobile manufacturers use coatings both to create attractive finishes and to safeguard their vehicles by protecting them against corrosion together with UV rays heat and chemicals. Industrial equipment requires durable coatings since operating in harsh conditions requires protective finishes to increase equipment endurance and operational quality. Coatings require continuous innovation due to growing manufacturing demands for improvements in performance and corrosion resistance and temperature tolerance in plants and machinery and transportation equipment.

Paints and Coatings Market Restraint Analysis

Supply Chain Disruptions

The availability of essential materials utilized in paints and coatings manufacturing remains strongly influenced by international global issues and tensions between countries and pandemic occurrences. The COVID-19 pandemic produced several supply chain complications alongside factory stoppages together with international trade restrictions which resulted in delayed delivery and shortages of essential materials including resins and solvents and pigments. Geopolitical tensions and trade conflicts along with producing region conflicts can block vital material exports and imports thereby creating supply chain problems which simultaneously result in elevated transportation costs. Supply chain disturbances generate manufacturing period delays and elevate material prices which drives up production expenses that ultimately burdens customers with higher costs.

Paints and Coatings Market Opportunity Analysis

Development of Smart and Functional Coatings

The market requires innovative coatings with built-in self-healing and anti-microbial properties which also improve energy efficiency because industry leaders need solutions that deliver superior performance while ensuring safety combined with sustainability standards. Self-healing coatings possess an automatic damage restoration ability which both improves surface longevity and lowers maintenance expenses thus benefiting automotive applications together with aerospace technology. These coatings demonstrate growing demand for medical facilities along with food production units and public buildings through their ability to stop microbial growth on touchable surfaces. The use of heat-reflective along with insulating paints constitutes energy-efficient coatings which help buildings save energy while achieving global energy conservation and carbon reduction objectives.

Paints and Coatings Market Trend Analysis

Adoption of Nanotechnology

The paints and coatings market witnesses a revolutionary change through nano-coatings technology because nanomaterials enable superior performance in paint systems. These coatings perform better than typical alternatives because they use thin layers and nanoparticles at the nano scale. UV resistance stands out as their main benefit because these coatings guard surface aspects from sun degradation and color deterioration particularly useful for automotive industry along with construction and outdoor applications. The main advantage of nano-coatings is their ability to resist scratching because they enhance surface hardness which results in better material durability and prolonged aesthetic and functional performance. Hydrophobic surfaces produce two effects that increase durability because they push water away and also prevent both long-term surface contamination and moisture damage like corrosion and mold growth.

Paints and Coatings Market Segment Analysis

The Paints and Coatings Market is segmented on the basis of Product Type, Resin, and Application.

By Product Type

o Waterborne

o Solvent Borne

o Powder Coating

o UV Coatings

o Other Product Types

By Resin

o Epoxy

o Acrylic

o Polyester

o Alkyd

o Polyurethane (PU)

o Other Resins

By Application

o Architectural

o Automotive OEM

o Marine

o Coil

o General Industries

o Protective Coatings

o Automotive Refinish

o Industrial Wood

o Packaging

o Other Applications

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Product Type, Waterborne Segment is Expected to Dominate the Market During the Forecast Period

The product types discussed in this research study, the waterborne segment is expected to account for the largest market share of paints and coatings market in the forecast period. The usage of water as a main solvent in coatings leads to significant VOC emission reduction because VOCs represent harmful substances for human health and environmental stability. The growing global pressure on VOC emissions has led industries to transition from solvent-based to waterborne standards because of their regulatory compliance. These coatings demonstrate outstanding adhesion properties with extended durability and good color stability which makes them work well across multiple sectors like architecture and automotive together with industrial machinery and consumer items. Recent research has improved waterborne coatings by enhancing their functionality in terms of drying times alongside strengthening their resistance to weather elements, corrosion and chemical attacks.

By Resin, the Polyurethane (PU) Segment is Expected to Held the Largest Share

The polyurethane (PU) segment is likely to dominate the market on account of its exceptional durability, versatility, and performance characteristics. Polyurethane coatings find extensive usage in automotive manufacturing and furniture production alongside flooring as well as industrial equipment applications because they tolerate well to abrasions and chemical attacks alongside ultraviolet rays and climate change. Their outstanding properties for finish quality extend to exceptional adhesion and flexibility and hardness which allows their use in interior and exterior application spaces. The ability to develop polyurethane coatings which satisfy unique requirements regarding gloss, color and texture makes these coatings even more attractive.

By Application, the Architectural Segment is Expected to Held the Largest Share

During the forecast period architectural segment stands as the biggest contributor to paints and coatings markets based on application requirements. The quick rise of urban neighbourhoods throughout the world collects momentum most strongly in advancing economies which leads to greater demand for paints and coatings to build and modernize new buildings along with infrastructure expansion. Structural buildings utilize architectural coatings which serve both decorative and protectively functional roles to leave buildings looking attractive and resistant to environmental impact.

Paints and Coatings Market Regional Insights

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Asia Pacific is expected to dominate the paints and coatings market over the forecast period, driven by rapid industrialization, urbanization, and infrastructure development across the region. The paint and coating markets experience substantial growth in China, India and Vietnam together with Indonesia because the sectors of manufacturing, automotive production and construction remain key purchasers across these nations. Rising middle-class populations together with higher disposable income levels among these nations generate growing demand for decorative paints specifically in residential and commercial structures. The region remains strong industrially because of positive governmental support as well as foreign investment initiatives along with expanding export market opportunities. Asia Pacific stands as a major international center for paint production and consumption because of its domestic manufacturers together with affordable labor costs and competitive raw material prices.

Recent Development

In February 2023, AkzoNobel Powder Coatings launched the Interpon Futura Collection, featuring three contemporary color palettes: Merging World, Healing Nature, and Soft Abstraction. This collection is free from solvents and volatile organic compounds, aligning with AkzoNobel's broader sustainability initiatives.

In February 2023, H.B. Fuller Company acquired Apollo, an independent U.K.-based manufacturer of liquid adhesives, coatings, and primers, catering to the roofing, industrial, and construction sectors.

Active Key Players in the Paints and Coatings Market

o The Sherwin-Williams Company

o Jotun

o Axalta Coating Systems

o RPM INTERNATIONAL, INC

o PPG Industries, Inc.

o BASF SE

o Contego International Inc.

o Henkel AG & Company, KGaA

o Hempel A/S

o Nullifire

o No-Burn Inc.

o 3M

o Akzo Nobel N.V.

o Albi Protective Coatings

o Other Key Players

Global Paints and Coatings Market Scope

|

Global Paints and Coatings Market | |||

|

Base Year: |

2024 |

Forecast Period: |

2024-2033 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 193.9 Billion |

|

Market Size in 2024: |

USD 210.9 Billion | ||

|

Forecast Period 2024-33 CAGR: |

4.1% |

Market Size in 2033: |

USD 291.2 Billion |

|

Segments Covered: |

By Product Type |

· Waterborne · Solvent Borne · Powder Coating · UV Coatings · Other Product Types | |

|

By Resin |

· Epoxy · Acrylic · Polyester · Alkyd · Polyurethane (PU) · Other Resins | ||

|

By Application |

· Architectural · Automotive OEM · Marine · Coil · General Industries · Protective Coatings · Automotive Refinish · Industrial Wood · Packaging · Other Applications | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Expansion of Automotive and Industrial Sectors | ||

|

Key Market Restraints: |

· Supply Chain Disruptions | ||

|

Key Opportunities: |

· Adoption of Nanotechnology | ||

|

Companies Covered in the report: |

· The Sherwin-Williams Company, Jotun, Axalta Coating Systems, RPM INTERNATIONAL, INC and Other Key Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Paints and Coatings Market Research report?

Answer: The forecast period in the Paints and Coatings Market Research report is 2024-2033.

2. Who are the key players in the Paints and Coatings Market?

Answer: The Sherwin-Williams Company, Jotun, Axalta Coating Systems, RPM INTERNATIONAL, INC and Other Key Players.

3. What are the segments of the Paints and Coatings Market?

Answer: The Paints and Coatings Market is segmented into Product Type, Resin, Application, and Regions. By Product Type, the market is categorized into Waterborne, Solvent Borne, Powder Coating, UV Coatings, and Other Product Types. By Resin, the market is categorized into Epoxy, Acrylic, Polyester, Alkyd, Polyurethane (PU), and Other Resins. By Application, the market is categorized into Architectural, Automotive OEM, Marine, Coil, General Industries, Protective Coatings, Automotive Refinish, and Industrial Wood, Packaging, and Other Applications. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Paints and Coatings Market?

Answer: The paints and coatings market represents the worldwide industry dedicated to manufacturing along with distributing different paint types and coating substances intended for decorative applications and defense mechanisms and performance purposes. The market utilizes these broad product lines throughout construction work and automotive operations as well as aerospace facilities and marine operations and industrial manufacturing facilities.

5. How big is the Paints and Coatings Market?

Answer: The global Paints and Coatings Market was valued at USD 193.9 billion in 2023 and is expected to grow from USD 210.9 billion in 2024 to USD 291.2 billion by 2033, reflecting a CAGR of 4.1% over the forecast period.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.