🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Palladium Acetate Market

Palladium Acetate Market Global Industry Analysis and Forecast (2024-2032) By Purity Level( High Purity (≥99%), Low Purity (<99%)),By Application( Catalysis, Organic Synthesis, Pharmaceuticals, Electronics, Others),By End-Use Industry(Chemical Industry, Pharmaceutical Industry, Electronics Industry, Automotive Industry, Others),By Form( Powder, Crystal) and Region

Mar 2025

Chemicals and Materials

Pages: 138

ID: IMR1862

Palladium Acetate Market Synopsis

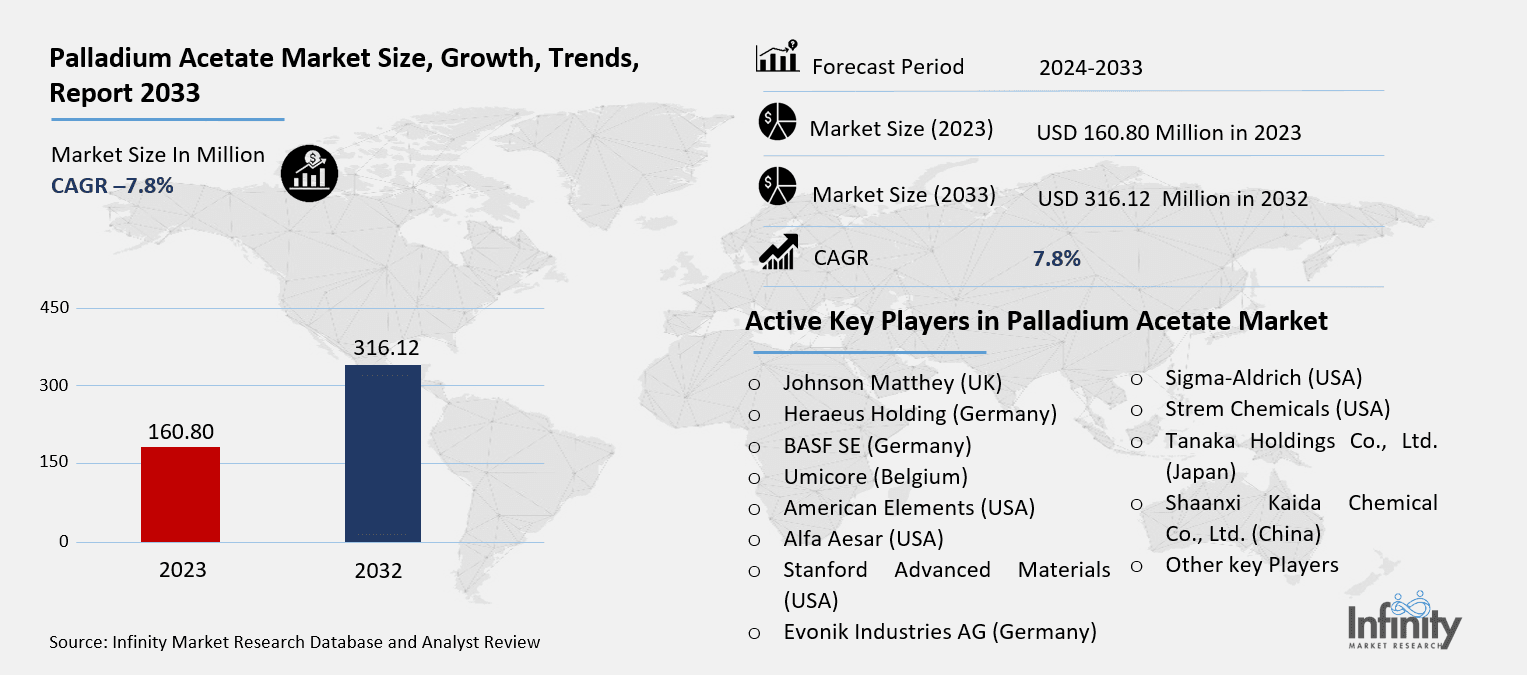

Palladium Acetate Market Size Was Valued at USD 160.80 Million in 2023, and is Projected to Reach USD 316.12 Million by 2032, Growing at a CAGR of 7.8% From 2024-2032.

Often employed as a precursor for palladium catalysts, palladium acetate is a palladium-based chemical compound having the formula Pd(O₂CCH₃)₂. Because of its solubility in organic solvents and its capacity to enable cross-coupling reactions—including Suzuki and Heck reactions—it is quite valuable in organic synthesis, catalysis, and many industrial uses. Driven mostly by the chemical, electronics, and pharmaceutical sectors, it is a necessary component in high-performance uses.

A main palladium compound utilized extensively in catalytic processes in many different sectors is palladium acetate. Especially in cross-coupling reactions that allow the creation of carbon-carbon and carbon-heteroatom bonds, it is a fundamental catalyst in organic synthesis. Its effectiveness in enabling these reactions has resulted in broad acceptance in the pharmaceutical sector for drug development, in the electronics sector for semiconductor manufacture, and in fine chemicals manufacture. Growing applications in green chemistry and sustainable industrial practices are driving expansion in the palladium acetate market.

One of the main drivers increasing market development is the increasing need for sophisticated catalytic solutions in chemical and pharmaceutical sectors. Further driving market growth are the increasing acceptance of palladium-based catalysts in the electronics industry, especially for thin-film deposition and manufacture of printed circuits boards (PCB). The market is seriously challenged, nonetheless, by the high cost and unpredictability in palladium supplies. Additionally affecting market dynamics are regulatory constraints on palladium disposal and recycling projects.

Palladium acetate is becoming more and more important as a component of low-emission manufacturing methods as sustainable chemistry and environmentally friendly catalytic processes take the stage. In order to improve its catalytic efficiency and lower dependency on costly raw ingredients, researchers are also looking at new synthesis techniques. Geographically, North America and Europe are dominant markets because of sophisticated industrial infrastructure and strict environmental rules supporting better production techniques. Rising demand for specialized chemicals and increasing industrialization help Asia-Pacific to become a fast-growing area.

Palladium Acetate Market Outlook, 2023 and 2032: Future Outlook

Palladium Acetate Market Trend Analysis

Trend: Rising Demand for Palladium Acetate in Green Catalysis

The demand for palladium acetate in environmentally friendly catalytic processes has been driven in great part by growing attention on green chemistry and sustainable manufacturing techniques. Palladium-based catalysts are being used in industry replacement of conventional hazardous catalysts, therefore improving process efficiency and lowering environmental effect. Particularly in the synthesis of fine chemicals and pharmaceuticals, palladium acetate is crucial in enabling low-emission chemical synthesis by means of extremely selective and efficient reactions.

Apart from its environmental advantages, the use of palladium acetate in green catalysis has helped manufacturers economically by lowering waste creation and energy usage. Policies and incentives launched by governments all over are meant to promote the use of environmentally friendly catalysts, hence increasing market demand. Constant research is being done to create creative palladium acetate-based catalysts with reduced palladium content and increased reusability so guaranteeing long-term sustainability and economy.

Opportunity: Expansion in the Pharmaceutical Industry

Given its crucial part in medication manufacturing, the pharmaceutical sector offers a big potential for the palladium acetate market. By allowing the effective synthesis of complicated organic compounds, Palladium-catalyzed coupling reactions—including Suzuki-Miyaura and Buchwald-Hartwig amination—have transformed pharmaceutical manufacture. The demand for creative medicinal formulations is growing, hence high-performance catalysts such as palladium acetate should also become more important.

Moreover, the development of next-generation active pharmaceutical ingredients (APIs) and the extension of biopharmaceutical research open fresh paths for palladium acetate vendors. Advanced catalyst technologies are being invested in by pharmaceutical corporations to maximize reaction efficiency and reduce byproducts creation. Since palladium-catalyzed processes are essential in generating customized medicinal molecules, the growing attention on personalized medicine and targeted therapies is also predicted to fuel market development.

Driver: Growing Demand in the Electronics Industry

Particularly because of its uses in semiconductor production and printed circuit board (PCB) construction, the fast growth of the electronics industry is a main driver of the palladium acetate market. Highly employed as a precursor in thin-film deposition techniques, palladium acetate helps to generate high-performance electronic components. The market for palladium acetate has been further stimulated by the growing need for sophisticated materials resulting from the rising acceptance of small-sized and high-speed electronic gadgets.

The need for premium semiconductors and innovative electronic materials has greatly expanded as we continue toward 5G technologies. Furthermore driving the need for palladium-based electronic components are the growth of renewable energy technologies and electric vehicles (EVs). The use of palladium acetate in next-generation microelectronics is predicted to increase as consumer electronics and industrial automation keep developing, therefore confirming its importance in the worldwide market.

Restraints: High Cost and Supply Chain Volatility

The great cost of palladium, which directly affects production expenses, is one of the main limits in the palladium acetate industry. Rare and valuable, palladium is a metal whose price is somewhat erratic worldwide. Variations in palladium prices have a major impact on the cost structure of palladium acetate manufacturing, therefore generating uncertainty for end users and manufacturers.

Apart from financial considerations, supply chain interruptions provide difficulties for the market. Trade policies, mining limitations, and geopolitical concerns affect the availability of palladium, hence generating price volatility and supply shortages. Dependency on a small number of important palladium-producing sites, notably Russia and South Africa, increases supply chain vulnerabilities even more. Industry participants are looking at alternative synthesis techniques and recycling projects to guarantee a consistent palladium supply and help to offset these problems.

Palladium Acetate Market Segment Analysis

Palladium Acetate Market Segmented on the basis of purity level, form, application and end user.

By Purity

o High Purity (≥99%)

o Low Purity (<99%)

By Application

o Catalysis

o Organic Synthesis

o Pharmaceuticals

o Electronics

o Others

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Purity Level, High Purity (≥99%) segment is expected to dominate the market during the forecast period

Although both low-purity (<99%) and high-purity (>99%) grades of palladium acetate have particular uses, Pharmaceuticals, electronics, and precision chemical synthesis all benefit from high-purity palladium acetate as, in these fields, few contaminants are absolutely essential to preserving product integrity. Adoption of high-purity palladium acetate has been spurred by growing demand for high-performance catalysts in advanced uses.

Mostly employed in bulk industrial operations comprising basic catalysis and broad chemical reactions, low-purity palladium acetate is Although it is more affordable, its limited relevance in highly precise industries limits its market expansion. As businesses concentrate on raising process efficiency and product quality, the taste for high-purity versions should grow.

By Application, Catalysis segment expected to held the largest share

Catalysis, organic synthesis, drugs, electronics, and other uses all benefit from palladium acetate. In catalysis, it is essential for cross-coupling reactions to enable effective chemical transformations in industrial processes. Especially in the synthesis of complicated organic compounds, the pharmaceutical industry mostly depends on palladium acetate.

Palladium acetate finds application in semiconductor production, PCB manufacture, and thin-film deposition in electronics, hence advancing microelectronics. Other uses include polymer manufacture and precision chemical synthesis, in which case it is an essential catalyst. The several uses of palladium acetate underline its value in several sectors, so guaranteeing constant market expansion.

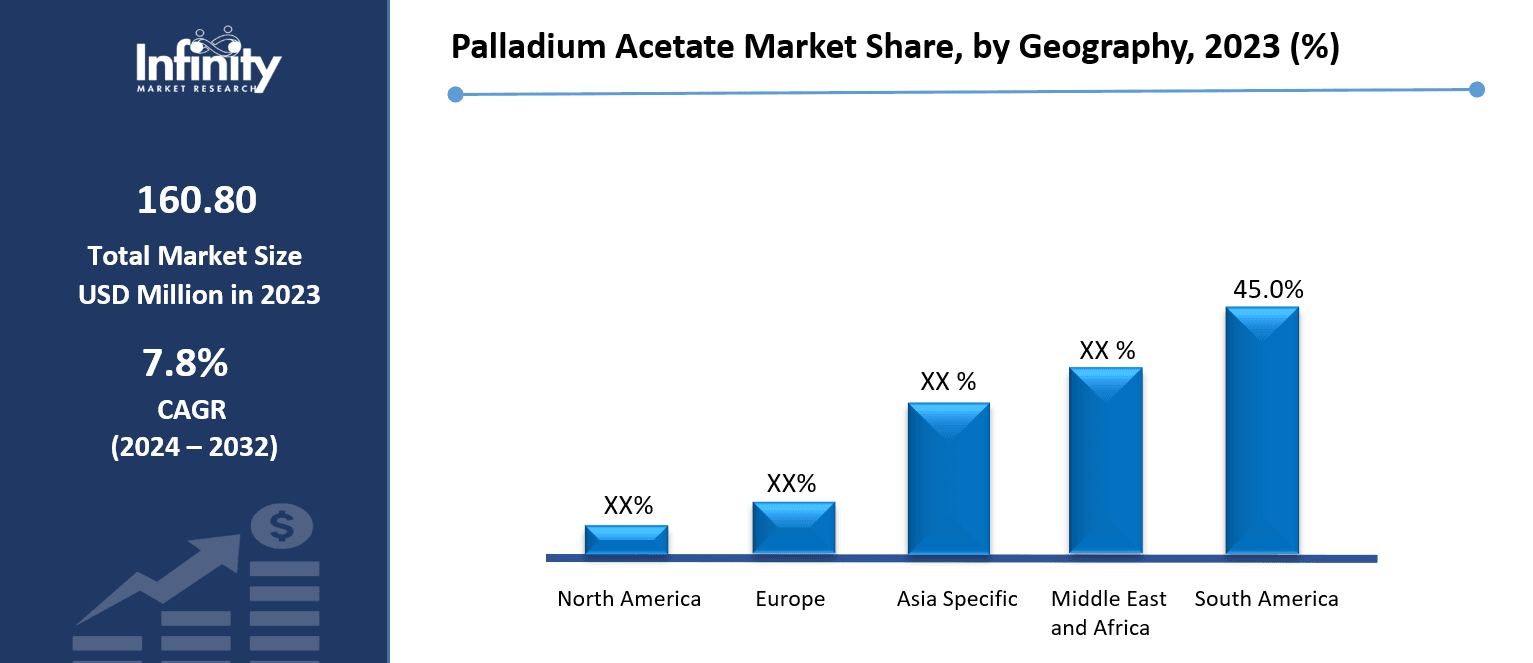

Palladium Acetate Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

Because of its great presence in electronics, pharmaceuticals, and advanced material sectors, North America rules the palladium acetate industry. Palladium-based catalysts have been widely adopted in the area thanks in part to its established research capacity and innovative focus. Driven by demand from semiconductor and pharmaceutical companies, the United States especially consumes palladium acetate heavily.

Strong environmental laws in North America also encourage the adoption of sustainable catalysts, therefore enhancing market expansion. The area's investments in green chemistry projects and next-generation materials guarantees ongoing demand for palladium acetate. North America should keep its market leadership given continuous technical developments and industrial growth.

Palladium Acetate Market Share, by Geography, 2023 (%)

Active Key Players in the Palladium Acetate Market

o Johnson Matthey (UK)

o Heraeus Holding (Germany)

o BASF SE (Germany)

o Umicore (Belgium)

o American Elements (USA)

o Alfa Aesar (USA)

o Stanford Advanced Materials (USA)

o Evonik Industries AG (Germany)

o Sigma-Aldrich (USA)

o Strem Chemicals (USA)

o Tanaka Holdings Co., Ltd. (Japan)

o Shaanxi Kaida Chemical Co., Ltd. (China)

o Other key Players

Global Palladium Acetate Market Scope

|

Global Palladium Acetate Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 160.80 Million |

|

Forecast Period 2024-32 CAGR: |

7.8% |

Market Size in 2032: |

USD 316.12 Million |

|

Segments Covered: |

By Purity Level |

· High Purity (≥99%) · Low Purity (<99%) | |

|

By Application |

· Catalysis · Organic Synthesis · Pharmaceuticals · Electronics · Others | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Growing Demand in the Electronics Industry | ||

|

Key Market Restraints: |

· High Cost and Supply Chain Volatility | ||

|

Key Opportunities: |

· Expansion in the Pharmaceutical Industry | ||

|

Companies Covered in the report: |

· Johnson Matthey (UK), Heraeus Holding (Germany), BASF SE (Germany), Umicore (Belgium), American Elements (USA), Alfa Aesar (USA), Stanford Advanced Materials (USA), Evonik Industries AG (Germany), Sigma-Aldrich (USA) and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Palladium Acetate Market research report?

Answer: The forecast period in the Palladium Acetate Market research report is 2024-2032.

2. Who are the key players in the Palladium Acetate Market?

Answer: Johnson Matthey (UK), Heraeus Holding (Germany), BASF SE (Germany), Umicore (Belgium), American Elements (USA), Alfa Aesar (USA), Stanford Advanced Materials (USA), Evonik Industries AG (Germany), Sigma-Aldrich (USA) and Other Major Players.

3. What are the segments of the Palladium Acetate Market?

Answer: The Palladium Acetate Market is segmented into Purity Level, Application, End User, Form and region. By Purity Level, the market is categorized into High Purity (≥99%), Low Purity (<99%). By Application, the market is categorized into Catalysis, Organic Synthesis, Pharmaceuticals, Electronics, Others. By End-Use Industry, the market is categorized into Chemical Industry, Pharmaceutical Industry, Electronics Industry, Automotive Industry, Others. By Form, the market is categorized into Powder, Crystal. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Palladium Acetate Market?

Answer: Often employed as a precursor for palladium catalysts, palladium acetate is a palladium-based chemical compound having the formula Pd(O₂CCH₃)₂. Because of its solubility in organic solvents and its capacity to enable cross-coupling reactions—including Suzuki and Heck reactions—it is quite valuable in organic synthesis, catalysis, and many industrial uses. Driven mostly by the chemical, electronics, and pharmaceutical sectors, it is a necessary component in high-performance uses.

5. How big is the Palladium Acetate Market?

Answer: Palladium Acetate Market Size Was Valued at USD 160.80 Million in 2023, and is Projected to Reach USD 316.12 Million by 2032, Growing at a CAGR of 7.8% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.