🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Pallet Racking Market

Pallet Racking Market (By System (Conventional, Mobile Racking, Shuttle Racking and Hybrid/Customized Racking), By Racking System (Cantilever Racking, Selective Racking, Push Back Racking, Drive-In Racking, Pallet Flow Racking, Carton Flow Racking), By Frame Load Capacity (Up to 5 Ton, 5 - 15 Ton, Above 15 Ton), By End-Use Industry (Automotive, Food & Beverage, Retail, Manufacturing, Warehouse), By Region and Companies)

Jul 2024

Packaging and Transports

Pages: 160

ID: IMR1123

Pallet Racking Market Overview

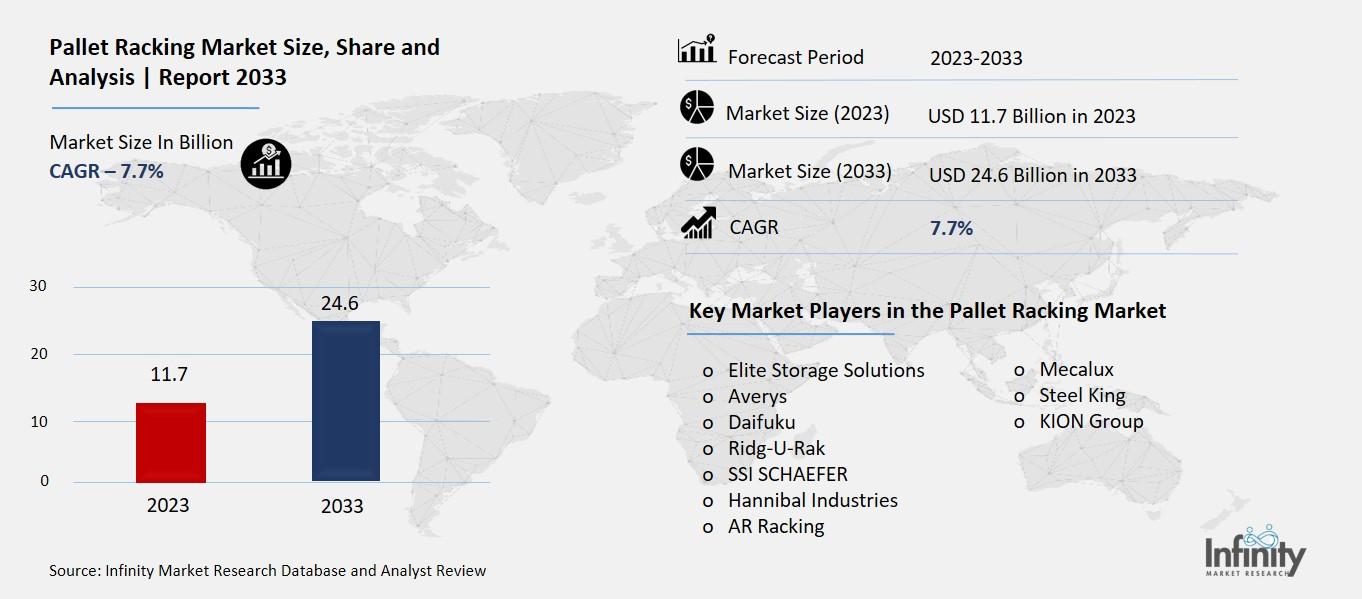

Global Pallet Racking Market size is expected to be worth around USD 24.6 Billion by 2033 from USD 11.7 Billion in 2023, growing at a CAGR of 7.7% during the forecast period from 2023 to 2033.

The pallet racking market involves the manufacturing and selling of storage systems used in warehouses and distribution centers. These systems are designed to hold pallets, which are flat structures used to stack goods stably and efficiently. Pallet racking allows for the organized and accessible storage of products, maximizing the use of space in a warehouse. It's an essential part of logistics and supply chain management, helping businesses keep their inventories well-organized and easily accessible for shipping and handling.

In simple terms, think of pallet racking as the big shelves you see in a warehouse. They are built to hold large quantities of goods stacked on pallets, making it easier for forklifts to move them around. With the growth of e-commerce and global trade, the demand for efficient storage solutions like pallet racking has increased. This market is crucial for ensuring that goods can be stored and retrieved quickly and safely, which is vital for the smooth operation of any large-scale storage facility.

Drivers for the Pallet Racking Market

E-Commerce Boom

The rise of e-commerce has drastically increased the need for efficient warehouse storage solutions. With more consumers shopping online, companies require more warehouse space to store and manage products. According to CBRE, e-commerce is expected to make up a quarter of all retail sales by 2025, necessitating an additional 330 million square feet of warehouse space. This surge in demand is a major driver for the pallet racking market, as businesses need reliable storage systems to keep up with the influx of online orders.

Supply Chain and Logistics Expansion

The global supply chain and logistics industry is expanding rapidly, contributing significantly to the growth of the pallet racking market. Efficient storage solutions are critical for managing the flow of goods from manufacturers to consumers. As supply chains become more complex and globalized, the need for robust and scalable storage solutions like pallet racking systems becomes increasingly important. This trend is expected to continue as companies look to optimize their supply chain operations and enhance efficiency.

Technological Advancements

Technological advancements in material handling and storage solutions are another crucial driver. The integration of automated and robotic pallet racking systems is revolutionizing warehouse operations by improving efficiency and reducing labor costs. Technologies like IoT (Internet of Things) enable real-time monitoring and inventory management, while AI (Artificial Intelligence) helps in predictive maintenance and optimization. These innovations make pallet racking systems more attractive to businesses looking to modernize their warehouses.

Food and Beverage Industry Growth

The food and beverage industry is also contributing to the pallet-racking market's growth. This sector requires extensive warehousing solutions to store perishable and non-perishable goods efficiently. The rise of food delivery services and online grocery shopping has further amplified this need. As this industry continues to grow, the demand for specialized pallet racking systems designed to handle various types of food products is expected to increase.

Sustainable Storage Solutions

There's a growing trend towards sustainable and eco-friendly racking materials and designs. Businesses are increasingly focusing on reducing their environmental footprint, and this extends to their choice of warehouse storage solutions. Pallet racking systems made from recycled materials or those designed to be energy-efficient are gaining popularity. This shift towards sustainability is driving innovation and growth within the pallet racking market, as manufacturers develop greener options to meet market demand.

Retail Sector Expansion

The expansion of the retail sector, particularly in emerging markets, is another significant driver. As retail businesses expand their operations and open new stores, they require efficient storage solutions to manage their inventory. This is particularly important for large retailers who need to store vast amounts of products across multiple locations. Pallet racking systems provide the necessary flexibility and scalability to meet these demands, making them a preferred choice for retail businesses.

Restraints for the Pallet Racking Market

High Initial Costs

One significant restraint in the pallet racking market is the high initial costs associated with setting up these systems. Companies need to invest a substantial amount upfront to purchase and install pallet racking systems, which can be a barrier, especially for small and medium-sized enterprises (SMEs). The costs include not only the racking equipment but also the installation and potential modifications to existing warehouse layouts. This substantial investment can deter businesses from upgrading or expanding their storage capabilities, impacting market growth.

Limited Flexibility

Pallet racking systems can sometimes lack flexibility, which is another restraint in the market. Once installed, these systems are relatively rigid, and altering the layout to adapt to changing storage needs can be both time-consuming and costly. This inflexibility can be a significant drawback for businesses that require frequent changes in their storage configurations due to varying inventory sizes and types. Companies may hesitate to commit to such systems knowing the difficulty in making adjustments down the line.

Maintenance and Safety Concerns

Maintenance and safety issues also pose challenges for the pallet racking market. Regular maintenance is crucial to ensure the structural integrity and safety of these systems, but it can be both costly and labor-intensive. Additionally, improper maintenance or installation can lead to accidents and injuries, making safety a major concern. Businesses need to adhere to strict safety regulations and conduct regular inspections, which can add to operational costs and complexity.

Space Limitations

Another restraint is the space limitations within existing warehouses. Not all facilities have the adequate height or floor space required to install pallet racking systems effectively. This can limit the market potential in certain areas, particularly in older warehouses that were not designed with modern storage systems in mind. The need for specific spatial requirements means that some businesses might not be able to implement these systems without significant structural changes to their facilities.

Economic Factors

Lastly, broader economic factors can impact the pallet racking market. Economic downturns or instability can lead businesses to cut back on capital expenditures, including investments in new storage solutions. Moreover, fluctuations in raw material prices, particularly steel, can influence the cost of pallet racking systems. These economic pressures can slow down market growth as companies delay or scale back their plans to implement new storage solutions.

Opportunity in the Pallet Racking Market

Growing Demand for Pallet Racking Systems Driving Market Expansion

The pallet racking market is experiencing robust growth driven by increasing demand for efficient storage solutions across various industries. These systems are crucial for warehouses and distribution centers to maximize storage capacity and streamline operations.

Expansion of E-commerce Fuels Adoption of Pallet Racking Systems

With the rapid growth of e-commerce, there's a heightened need for scalable and flexible storage solutions. Pallet racking systems allow businesses to optimize space utilization and accommodate diverse product inventories, supporting the logistical challenges posed by online retail.

Technological Advancements Enhance System Efficiency and Safety

Advancements in pallet racking technology have significantly enhanced system efficiency and safety. Innovations such as automated storage and retrieval systems (AS/RS) and IoT-enabled monitoring systems improve inventory management accuracy and reduce operational risks.

Sustainability Initiatives Driving Adoption of Environmentally Friendly Racking Solutions

There's a growing preference for environmentally friendly pallet racking solutions that support sustainability goals. Manufacturers are developing racking systems using recyclable materials and energy-efficient designs, aligning with global efforts towards eco-friendly warehouse practices.

Emerging Markets Offer Lucrative Growth Opportunities for Pallet pallet-racking providers

Emerging markets, particularly in Asia-Pacific and Latin America, present lucrative opportunities for pallet-racking providers. Rapid industrialization, urbanization, and infrastructure development in these regions drive the demand for advanced storage solutions to support growing retail and manufacturing sectors.

Integration of Robotics and AI Expected to Transform Pallet Racking Operations

The integration of robotics and artificial intelligence (AI) is poised to revolutionize pallet-racking operations. Automated systems can optimize inventory placement, reduce labor costs, and enhance overall warehouse productivity, making them increasingly attractive to large-scale logistics operators.

Trends for the Pallet Racking Market

Adoption of Flexible Storage Solutions

Flexible and modular pallet racking systems are gaining popularity due to their ability to adapt to changing warehouse needs. Businesses are increasingly opting for adjustable pallet racking (APR) and selective pallet racking (SPR) systems that offer versatility in storing various product types and sizes without requiring extensive modifications.

Integration of Automation and Robotics

The trend towards automation in warehouse operations is influencing the pallet racking market significantly. Automated guided vehicles (AGVs) and robotic arms are being integrated with pallet racking systems to enhance efficiency in goods retrieval and storage. This integration reduces manual labor, minimizes operational errors, and improves overall warehouse productivity.

Focus on Safety and Compliance

There's a heightened emphasis on safety features and compliance with international standards in pallet racking design and installation. Manufacturers are developing racking systems with enhanced load-bearing capacities, robust structural integrity, and advanced safety mechanisms to prevent accidents and ensure workplace safety.

Sustainable Practices in Racking Solutions

Sustainability continues to be a key trend driving innovation in the pallet racking market. Companies are adopting sustainable practices by using eco-friendly materials, optimizing energy efficiency in warehouse operations, and designing racking systems that support recycling and waste reduction initiatives. This trend aligns with global efforts towards environmental responsibility and resource conservation.

Expansion of Online Retail and Omnichannel Distribution

The expansion of online retail and omnichannel distribution strategies is driving the demand for efficient pallet-racking solutions. Warehouses are increasingly adopting high-density storage systems like drive-in/drive-through racking and pallet flow racking to accommodate diverse product assortments and manage rapid order fulfillment requirements effectively.

Shift Towards Customization and Modular Designs

There's a growing trend towards customizable and modular pallet racking designs that can be tailored to specific warehouse layouts and operational requirements. Manufacturers are offering scalable solutions that allow businesses to expand or reconfigure storage capacities easily, supporting scalability and operational agility.

Segments Covered in the Report

By System

-

Conventional

-

Mobile Racking

-

Shuttle Racking and Hybrid/Customized Racking

By Racking System

-

Cantilever Racking

-

Selective Racking

-

Push Back Racking

-

Drive-In Racking

-

Pallet Flow Racking

-

Carton Flow Racking

By Frame Load Capacity

-

Up to 5 Ton

-

5 - 15 Ton

-

Above 15 Ton

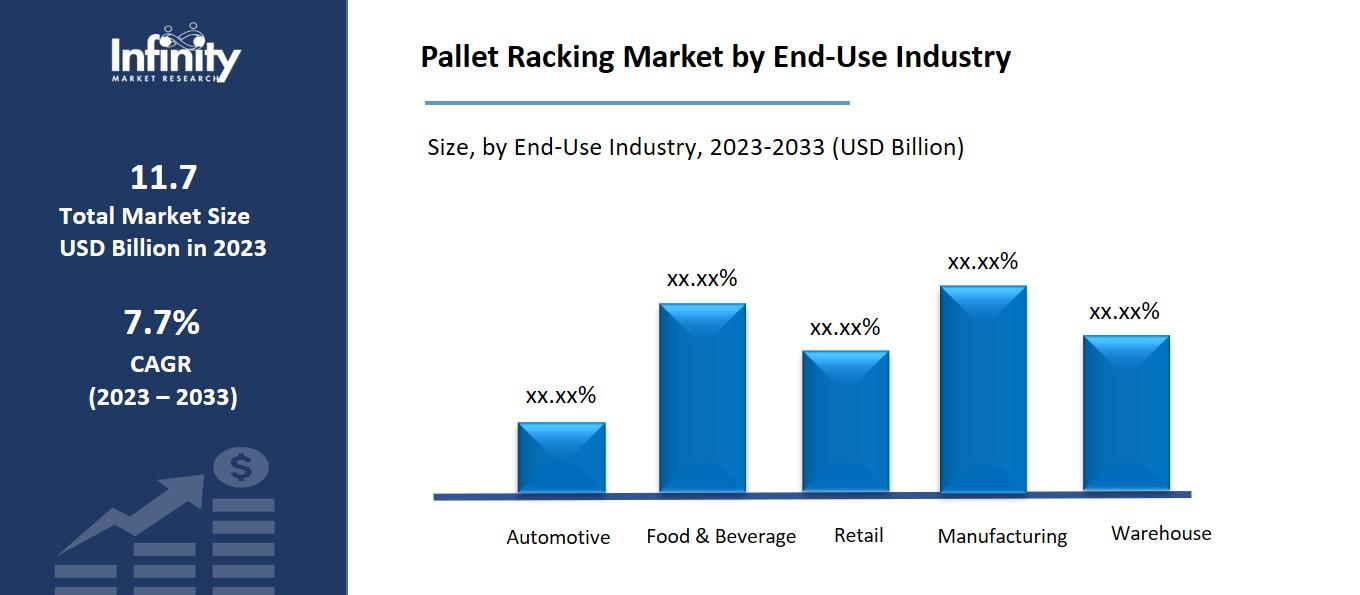

By End-Use Industry

-

Automotive

-

Food & Beverage

-

Retail

-

Manufacturing

-

Warehouse

Segment Analysis

By System Analysis

Based on the system, the pallet racking market is divided into three segments: hybrid/customized racking, shuttle racking, and traditional mobile racking. Because transportable modular storage solutions are increasingly being used in modular building systems, such as sprinkler, electrical, and HVAC systems, the market for these solutions is expected to expand.

The shuttle racks also saw notable expansion. This configuration allows you to store a lot of stuff in a short space. By swapping the drives on the racks of a radio shuttle system, the initial storage area can be utilized up to thirty percent more efficiently.

By Racking System Analysis

Pallet racking market data has been divided into five categories by rack system: carton flow racking, push-back racking, drive-in racking, cantilever racking, and selective racking. The pallet racking market revenue is expected to witness a significant rise in the selective pallet racking segment throughout the projected period. Selective pallets, the most widely used and well-liked pallet racking system, are expected to be in high demand from a variety of application industries, including retail, food & beverage, automotive, and others. However, a sizable market share was also attained by the drive-in racking system. The growing requirement for storage areas that can hold as many products as possible is expected to fuel growth in the second-largest market for drive-in warehouse racking systems.

By Frame Load Capacity Analysis

Pallet racking has been divided into three segments: up to 5 tons, 5 - 15 tons, and above 15 tons, based on frame load capacity. The pallet racking market was led by the 5 to 15-ton racks segment throughout the predicted period. The medium-sized shelf has a distinctive shape, and a sensible structure, is easy to put together and take apart, permits free adjustment of the layer height of 50 mm, doesn't require fasteners, and has a durable and robust bearing capacity.

Within the pallet racking industry, the above-15-ton sector is the second fastest-growing section. Larger hallways and industrial tracks can be constructed, and your storage capacity can be increased, with pallet racking systems that hold more than 15 tons.

By End-Use Industry Analysis

Based on the end-use industry, the pallet racking market is segmented into the following categories: automotive, food and beverage, retail, manufacturing, and warehousing. The automotive application segment is expected to grow significantly over the next several years, having produced a significant amount of revenue in 2023. Due to the increasing inclination to oversee large cars and associated stock-keeping units (SKUs) in the warehouse, this group held the majority of the pallet-racking market. Throughout the estimated time, it is expected that the food and beverage application segment will grow. Warehouse racking systems are widely used in food and beverage applications to meet storage and preservation requirements.

Regional Analysis

Throughout the study, the pallet racking market in North America is anticipated to rise at a noteworthy CAGR of 42.9%. The North American pallet racking market is also driven by several factors. The demand for warehouse and storage services in the area is significantly influenced by the existence of retail and e-commerce giants such as Amazon and Walmart. Walmart states that by 2022, 90% of Americans will be able to complete their online orders within a 10-mile radius thanks to its usage of 4,700 locations and 31 specialized e-commerce fulfillment centers.

The second-largest market share is held by the pallet racking market in Europe. It is expected that the rapid expansion of pallet racking in the European pallet racking market will significantly increase demand due to the increased demand from the retail, automotive, food & beverage, manufacturing, and packaging application segments throughout the forecast period. Growing warehouse development and a shift in German consumers' preferences away from struggling office buildings and retail centers and toward online shopping are the main factors behind the positive growth of the pallet-racking business. Furthermore, the European market with the most market share for pallet racking was Germany, while the market with the quickest rate of growth was the UK.

The pallet racking industry in the Asia Pacific is expected to grow significantly. Pallet racking demand is expected to rise in China and India because of their rapid population development, which is expected to benefit both economies' retail sectors and the demand for processed goods. India, the country with the fastest rate of economic growth, is expected to invest heavily in the e-commerce and manufacturing sectors. Furthermore, the pallet-racking market in China had the most market share, while the pallet-racking market in India had the quickest rate of growth in the Asia-Pacific area.

Competitive Analysis

To obtain a competitive advantage in the pallet racking business, major corporations are launching novel products like the automated guided vehicle (AGV). An automated guided vehicle (AGV) is a robotic, movable vehicle or equipment used to transport goods or commodities inside a facility. For example, the US-based Mitsubishi Logisnext Americas Group, a manufacturer of machinery, introduced the Jungheinrich EKX 516ka and 516a Automated HighRack Stacker to the North American market in March 2023. The fully automated, full-pallet storage and retrieval systems of the Jungheinrich EKX 516ka and 516a enable optimal productivity and efficiency.

Recent Developments

September 2022: Leading contract logistics provider GXO Logistics Inc. partnered with Bayer to establish a new warehouse. Through its shared-space distribution network GXO Direct, GXO will oversee warehouse support, which includes all shipping and receiving operations, for Bayer's Crop Science division at the company's new 350,000-square-foot facility in Kearney, Nebraska.

August 2022: Rocket Solutions is a firm that creates the newest, most innovative, standardized autonomous storage and retrieval solutions. Kardex purchased shares in Rocket Solutions. Kardex is expanding its portfolio and entering the storage and transportation of light goods materials with these strategic plans. Additionally, this acquisition helps Kardex execute IoT effectively.

Key Market Players in the Pallet Racking Market

-

Elite Storage Solutions

-

Averys

-

Daifuku

-

Ridg-U-Rak

-

SSI SCHAEFER

-

Hannibal Industries

-

AR Racking

-

Mecalux

-

Steel King

-

KION Group

|

Report Features |

Description |

|

Market Size 2023 |

USD 11.7 Billion |

|

Market Size 2033 |

USD 24.6 Billion |

|

Compound Annual Growth Rate (CAGR) |

7.7% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By System, Racking System, Frame Load Capacity, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Elite Storage Solutions, Averys, Daifuku, Ridg-U-Rak, SSI SCHAEFER, Hannibal Industries, AR Racking, Mecalux, Steel King, KION Group, Other Key Players |

|

Key Market Opportunities |

Growing Demand for Pallet Racking Systems Driving Market Expansion |

|

Key Market Dynamics |

E-Commerce Boom |

📘 Frequently Asked Questions

1. How much is the Pallet Racking Market in 2023?

Answer: The Pallet Racking Market size was valued at USD 11.7 Billion in 2023.

2. What would be the forecast period in the Pallet Racking Market report?

Answer: The forecast period in the Pallet Racking Market report is 2023-2033.

3. Who are the key players in the Pallet Racking Market?

Answer: Elite Storage Solutions, Averys, Daifuku, Ridg-U-Rak, SSI SCHAEFER, Hannibal Industries, AR Racking, Mecalux, Steel King, KION Group, Other Key Players

4. What is the growth rate of the Pallet Racking Market?

Answer: Pallet Racking Market is growing at a CAGR of 7.7% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.