🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Para Amino Phenol (PAP) in Pharmaceutical Intermediates Market

Para Amino Phenol (PAP) in Pharmaceutical Intermediates Market Global Industry Analysis and Forecast (2024-2032) By Application (Pharmaceuticals, Cosmetics and Personal Care, Others) By Form (Powder, Liquid) By End-Use Industry (Pharmaceutical Industry, Chemicals Industry, Others) and Region

Jan 2025

Healthcare

Pages: 1378

ID: IMR1620

Para Amino Phenol (PAP) in Pharmaceutical Intermediates Market Synopsis

Para Amino Phenol (PAP) in Pharmaceutical Intermediates Market acquired the significant revenue of XX Billion in 2023 and expected to be worth around USD XX Billion by 2032 with the CAGR of XX% during the forecast period of 2024 to 2032.

Para Amino Phenol (PAP) refers to an organic compound which is widely used as a processing intermediate for the synthesis of various pharmaceuticals with a major raw material input into manufacturing of acetaminophen (paracetamol) that is a pain killer and fever reductor. This is because through the help of PAP, the formulation of active ingredients in the pharmaceutical industry can be developed hence making it an important element of the structure. It is used in other chemical processes such as dyes manufacturing and its use pharmaceutical industry is increasing due to increase in using of analgesics and antipyretics in the market.

The Para Amino Phenol (PAP) market for pharmaceutical intermediates can be regarded as the pharmaceutical market on its own legs especially due to its primary importance to the preparation of acetaminophen (paracetamol) which is one of the most extensively used analgesic and antipyretic across the globe. PAP plays a critical role as a feedstock in the synthesis of acetaminophen – a component for commonly used non-prescription analgesic and antipyretic drugs. Due to the increased prevalence of pain and fever, particularly with the increase in the global population, especially aging population, health consciousness, and access to healthcare the demand for PAP is set to rise. The fact that the pharmaceutical industries have shifted its production line to generics such as acetaminophen, also pushes the need for PAP as a pharmaceutical intermediary.

The demand for PAP is further driven by the synthesis of other pharmaceutical active ingredients (APIs) as evidenced by its significance in the pharmaceutical value chain. This will certainly be the trend in the future since pharmaceutical firms will continue to search for techniques that will help them cut costs on operations, manufacturing and delivery of services and products. In addition, the incidence of chronic diseases, especially arthritic and other painful diseases, increases, which requires the development and use of effective and cost-efficient analgesics. Historical tendencies, technological progress, as well as growing interest in new substances contributing to drug formulations, play an important role for the market’s growth. Since more pharmaceutical manufacturers require intermediates to meet production demands and, especially in new markets, the tendency for the overall market, including PAP, will increase.

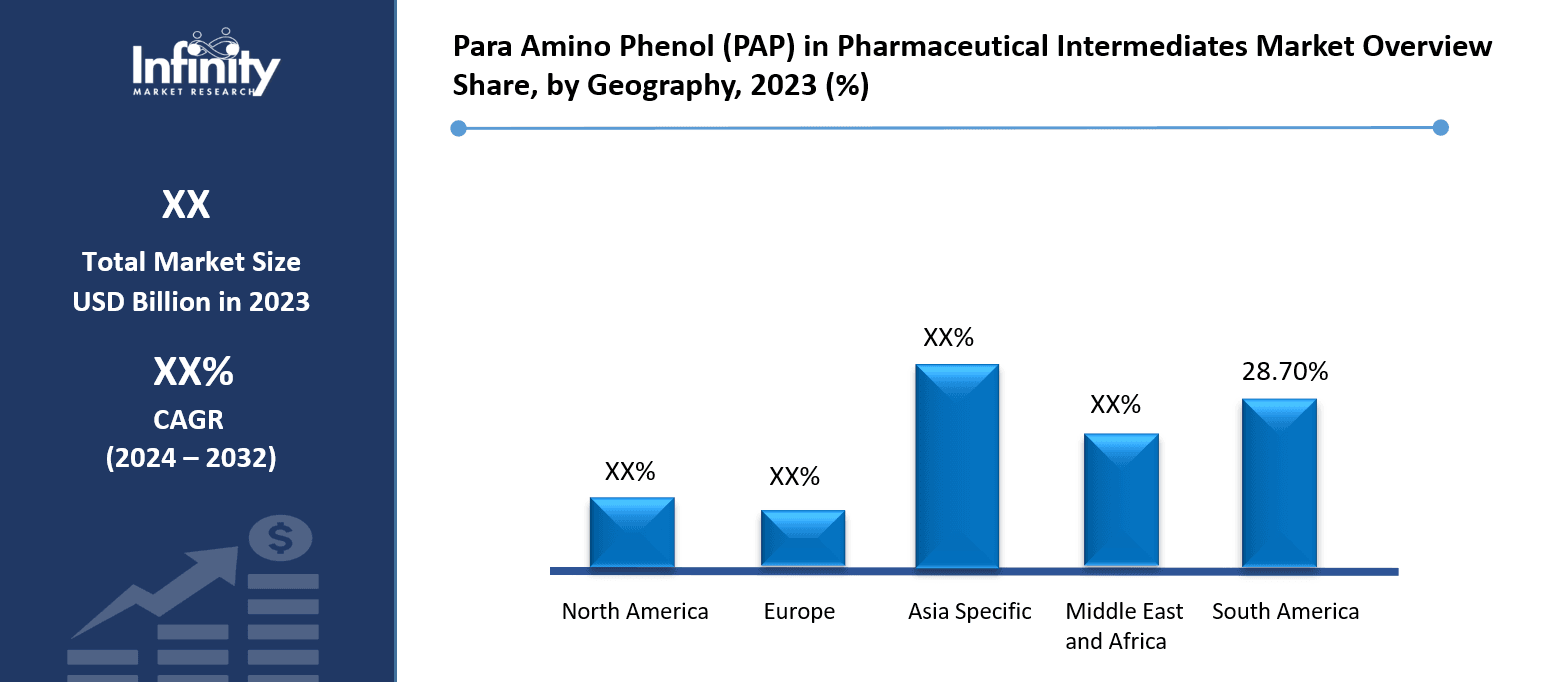

Based on region, the Asia-Pacific market is likely to dominate the production and consumption charts, the market is mainly in China and India. These countries mention not only offer large scale production facilities for API but also are important sources of PAP and other pharma chemical raw material at relatively cheaper prices. The region is also experiencing a fast growth of the health care system, such that it becomes a good ground for investment in the manufacturing of drugs. Furthermore, there is a growing population in these countries, higher healthcare cost and a growing market for generic drugs and PAP. North American and European demand for PAP is robust, yet this market is different in that its legislative regulations and product standards mean that only PAP with near-pharmaceutical standards of purity will be admitted to pharmaceutical preparations. These reasons coupled with a higher rate of pharmaceutical research, development and innovation in these regions add favour to the need for the production of reliable and quality PAP such as intermediates.

In global perspective, the applications of PAP in pharmaceutical intermediates is likely to expand its growth steadily in economical market. This market can continue to grow based on pressing factors such as growth in the technology aspect of the manufacturing process thereby boosting yields and minimizing costs and pressure from rising regulatory guidelines in the firms dealing with drugs. As over and over again such authorities increase the standard for the products or services they allow into the market, the players in the pharmaceutical industries will focus on sourcing of PAP with high purity from authentic vendors. In addition to this, given a shift in consumer focus towards understanding the need to take pain relief drugs as well as an increasing culture of self-drugging, the need for PAP will also increase. Technological advancements in chemical synthesis methodologies, improvements in overall manufacturing processes in addition to increasing trend towards self medication through over the counter drugs shall further define the role of PAP as the backbone of the global pharmaceutical distribution network. The further development of this market will also likely involve the continuing geographical diversification specifically towards the development countries where these products will remain in demand while reflecting standards for PAP set within the global pharmaceutical market.

Para Amino Phenol (PAP) in Pharmaceutical Intermediates Market Trend Analysis

Trend

Rising Demand for PAP in Pharmaceutical Production

In particular, the Para Amino Phenol (PAP) market for pharmaceuticals intermediates is rapidly growing as a result of ever-higher demand for necessary drugs, including analgesics, antipyretics, and antibiotics, based on PAP, and, in particular, acetaminophen (paracetamol). Since the LDCs are the most significant growth area for the growth of the international insurance industry, PAP will become even more important as the molecular building block of the whole process of pharmaceutical manufacture. A similar trend is also evident in the increasing demand for OTC drugs together with an escalating consumer concern over their health. Therefore, with the synergistic importance at displaying a crucial role to such prominent pharmaceutical product synthesis of PAP is greatly beneficial for the market.

There are add-on improvements in chemical manufacturing processes that are also adding input to the overall market for PAP. Installing better procedures in production, higher productivity and efficiency or production and costs have been cut and manufactures have adopted environment friendly measures. While the pharmaceutical industry is shifting towards carrying out more research, innovating, and developing new formulations of drugs, PAP is finding more uses in formulations being used concurrently with other formulations. These factors include high demand of PAPs, enhancement of technology and increased focus on drug manufacturing is likely to perpetuate growth of PAP market in the future world.

Drivers

Rising Demand for Acetaminophen Drives PAP Market Growth

Para Amino Phenol (PAP) is an essential raw material in preparing acetaminophen which is a widely utilized drug for controlling pains and fever. It is expected that with the increase in the number of people using acetaminophen as an over the counter analgesic the PAP market will experience tremendous growth. A general increase in global health issues that include conditions that cause pain and fever has been evidenced by chronic diseases, flue outbreaks, and general health care needs hence increased acetaminophen consumption. The rising pain and fever related condition is more pronounced in up and coming markets where access to healthcare is improving the requirement for acetaminophen based formulations and thus PAP as a pharmaceutical intermediate.

This is because the pharma major sector such as the Asia Pacific pharma market has been growing and therefore facilitating the PAP market. Since health systems in these countries are rapidly developing, people’s demand for both drugs and prescription and other medications is increasing; thus, demand for pharmaceutical Intermediates such as PAP is likely to increase. The expanding manufacturing capacities of generic pharma companies besides increased healthcare access due to middle-income populations in these countries is another factor expected to boost the consequent production needs of PAP for acetaminophen and other pharmaceuticals. This trend will continue to influence the market growth of PAP in the future years.

Restraints

High Compliance Costs and Delays in Product Development

The first and major challenge associated with Para Amino Phenol (PAP) pharmaceutical intermediates is the high level of regulatory scrutiny implemented today by both the U.S. FDA and the EMA. These regulatory bodies set very high standards in order to protect the quality and efficiency of the pharmacological constituents. Providers have to follow certain rules and this sometimes requires through research, test and trial as used in the approval process. This can result in the extended development schedule and major costs for compliance. The need to test the drugs for safety and purity makes them fit for pharmaceutical use hence takes a lot of time in the development process hence new formulations and or changes in formulation may take time to get into the market.

Also, these regulatory requirements entail considerable costs which exert pressure on the manufacturers, or companies especially those from developing nations. Laying these added costs does not limit the extra costs to first production only but also quality assurance, audits and compliance checks. Consequently, manufacturers can lose competitiveness and that is particularly damaging in this market, where cost leadership and speed of product release is so important. This regulatory pressure could potentially hinder a few firms from being involved in the market or enjoy a broad product portfolio of PAPs that can dramatically slow down the development of the PAP market in pharmaceutical uses.

Opportunities

Rising Demand for Acetaminophen as a Key Opportunity

One major opportunity that can be identified in the Para Amino Phenol (PAP) market is amplified by the fact that acetaminophen is a primary over the counter pain reliever. Indeed, as with most chronic pain diseases, the prevalence of health disorders associated with aging and lifestyle factors increases across the globe, consistent pain control and management becomes a paramount issue. PAP plays a crucial role in the synthesis of acetaminophen, and, consequently, the elevated demand for affordable and accessible pain relief, guarantees that the pharma companies will continue experiencing demand for acetaminophen-based drugs. This is a clear opportunity for the manufactures to improve on its production line and increase production of PAPs in order to meet the increasing demand in the market.

Furthermore, there is an opportunity for manufacturers in the PAP market to expand their product profile, as the existing types of preparations are constantly changing, and new spheres are increasingly attractive for developing formulations. As more pressure builds for lower cost treatment solutions, the pharmaceutical manufacturers may seek to streamline the production acetaminophen, boosting demand for more efficient PAP intermediates that come at lower costs. Thus, manufacturers who managed to implement improvements in the creation of PAP, for instance, the development of new types of synthesis or post-synthesis that provide improved or more efficient reagents for the patients, will be able to take a considerable market share. This focus will easily fit into the growing trend of preparing affordable solutions to the provision of health services, especially in emerging markets where the demand for over-the-counter pain relievers is rapidly rising.

Para Amino Phenol (PAP) in Pharmaceutical Intermediates Market Segment Analysis

Para Amino Phenol (PAP) in Pharmaceutical Intermediates Market Segmented on the basis of By Application, By Form, By End-Use Industry.

By Application

o Pharmaceuticals

o Cosmetics and Personal Care

o Others

By Form

o Powder

o Liquid

By End-Use Industry

o Pharmaceutical Industry

o Chemicals Industry

o Others

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Application, Pharmaceuticals segment is expected to dominate the market during the forecast period

At the present, the use of active ingredients, excipients, and several other chemicals in the manufacture of pharmaceutical products is on the rise owing to the increasing global demand for drugs, vaccines and nutritional supplements. The aspect of global chronic diseases, as well as the constant population aging in developed countries and the constant expansion of healthcare access in emerging markets, are forcing the pharmaceutical industry to satisfy the growing healthcare needs. Therefore, manufacturers are always in the process of searching for superior supplies which they can then turn into safe, effective and stable products. Specialized chemicals are used to manufacture treatments, and therefore selection of accurate, high quality chemicals forms an integral part of developing drugs.

That is, the rules of food production also extend to the pharmaceutical industry, which is also subject to strict standards of quality of raw materials used in production, including the necessary quality of medicines. It has also become paramount to require active ingredients and excipients to meet safety and efficacy standards hence the call for certified and tested substances. It also contributes to the reduction of reach or introduction of contaminated or substandard products into the market hence consumers enjoy the quality drugs. Thus, as the producers of pharmaceuticals do attempt to come up with new beneficial products in conditions of global health care challenges, the high-quality ingredients prove to be even more of a necessity to further the market expansion and improve the general quality of the products.

By End-Use Industry, Pharmaceutical Industry segment expected to held the largest share

Pharmaceutical industry is the biggest consumer of chemicals and active ingredients, as these products are used in formulation, manufacturing, as well as production of drugs. They include counter and prescription drugs, which for safety, efficacy and stability issues depend on a wide range of chemicals. The general public has grown more conscious with their health and more people are living longer, healthcare products are on steady demand on a global scale. The pharma industry is being challenged to deliver solutions for chronic diseases, diseases associated with aging and new disease burdens. Hence, there is on-going demand for quality raw materials that conform to demanding regulatory requirements to enable the manufacturing of these critical drugs.

There is also a growing trend towards biopharmaceuticals, personalized medicine, and generics, which precisely the chemicals and technical processes used to produce. WO, especially biopharmaceuticals, need sophisticated and superior ingredients, which are increasingly biologic in nature that will develop new treatments and medicinal products. Embending personalization adocrinologies, which are produced according to the winner’s genetic profile, also contain elements of chemical technologies perffect for usage. In addition, there is a trend towards taking more generics of brand-name drugs; thus, it creates more opportunities for supply of the standardized and cheaper RMA. The appearance of these new branches of drugs proves that the chemical and pharmaceutical industry depends on new chemicals and active substances to address new problems in human healthcare.

Para Amino Phenol (PAP) in Pharmaceutical Intermediates Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

In North America, Para Amino Phenol (PAP) has a large market because many people use pills such as acetaminophen for pain relief. Consumption of PAP is strongly propelled by the fully developed pharmaceutical manufacturing industry in the region with special emphasis on the developed country in the region that is the United States. Being regionally developed with an advance healthcare structure and dedicated to research and development, North America provides the best environment for production of such a pharmaceutical intermediate as PAP. The increased sales of generic and over the counter medicines increases the demand for PAP as it is a primary component of acetaminophen which continues to be one of the most popular pain relief medication.

Further, the advanced and strategically located pharmaceutical industries and research institutions in the United States and Canada encourage sustained improvement of PAP in drug production. From the authorities like the FDA, guidelines are set down that check on the quality of the drugs to make sure that manufacturers adhere to these standards, a factor which supports the need for procurement of high quality material such as PAP. These regulations serve not only as protection means for the public health but also as factors promoting the implementation of PAP in pharmaceutical manufacturing and providing population with necessary safe medication. As the market environment in North America remains consistently secure, this market remains an important market for PAP in the pharmaceutical industry.

Para Amino Phenol (PAP) in Pharmaceutical Intermediates Market Share, by Geography, 2023 (%)

Active Key Players in the Para Amino Phenol (PAP) in Pharmaceutical Intermediates Market

o Hunan Huateng Pharmaceutical Co., Ltd.

o Anmol Chemicals Group

o Chemfield

o Jiangsu Jiaming Chemical Co., Ltd.

o Liaoning Huaxing Chemical Industry Co., Ltd.

o Jiangsu Aolike Chemical Co., Ltd.

o U.S. Chemicals, Inc.

o Other key Players

Global Para Amino Phenol (PAP) in Pharmaceutical Intermediates Market Scope

|

Global Para Amino Phenol (PAP) in Pharmaceutical Intermediates Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD XX Billion |

|

Forecast Period 2024-32 CAGR: |

XX% |

Market Size in 2032: |

USD XX Billion |

|

|

By Application |

· Pharmaceuticals · Cosmetics and Personal Care · Others | |

|

By Form |

· Powder · Liquid | ||

|

By End-Use Industry |

· Pharmaceutical Industry · Chemicals Industry · Others | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Rising Demand for Acetaminophen Drives PAP Market Growth | ||

|

Key Market Restraints: |

· High Compliance Costs and Delays in Product Development | ||

|

Key Opportunities: |

· Rising Demand for Acetaminophen as a Key Opportunity | ||

|

Companies Covered in the report: |

· Hunan Huateng Pharmaceutical Co., Ltd., Anmol Chemicals Group, Chemfield, Jiangsu Jiaming Chemical Co., Ltd., Liaoning Huaxing Chemical Industry Co., Ltd., Jiangsu Aolike Chemical Co., Ltd., U.S. Chemicals, Inc., and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Para Amino Phenol (PAP) in Pharmaceutical Intermediates Market research report?

Answer: The forecast period in the Market research report is 2024-2032.

2. Who are the key players in the Para Amino Phenol (PAP) in Pharmaceutical Intermediates Market?

Answer: Hunan Huateng Pharmaceutical Co., Ltd., Anmol Chemicals Group, Chemfield, Jiangsu Jiaming Chemical Co., Ltd., Liaoning Huaxing Chemical Industry Co., Ltd., Jiangsu Aolike Chemical Co., Ltd., U.S. Chemicals, Inc., and Other Major Players.

3. What are the segments of the Para Amino Phenol (PAP) in Pharmaceutical Intermediates Market?

Answer: The Para Amino Phenol (PAP) in Pharmaceutical Intermediates Market is segmented into By Application, By Form, By End-Use Industry and region. By Application, the market is categorized into Pharmaceuticals, Cosmetics and Personal Care, Others. By Form, the market is categorized into Powder, Liquid. By End-Use Industry, the market is categorized into Pharmaceutical Industry, Chemicals Industry, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Para Amino Phenol (PAP) in Pharmaceutical Intermediates Market?

Answer: Para Amino Phenol (PAP) is an organic compound commonly used as a key intermediate in the synthesis of pharmaceuticals, primarily for the production of acetaminophen (paracetamol), a widely used pain reliever and fever reducer. PAP serves as a crucial building block in the pharmaceutical industry due to its ability to facilitate the creation of active ingredients that are essential in a variety of therapeutic formulations. It is also employed in other chemical processes, including dye manufacturing, and its demand in pharmaceutical applications continues to rise due to the growing consumption of analgesics and antipyretics worldwide.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.