🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Passenger Vehicles Snow Chain Market

Global Passenger Vehicles Snow Chain Market (By Type, Metal Snow Chain and Nonmetal Snow Chain; By Application, R14-17 and R17-20; By Region and Companies), 2024-2033

Oct 2024

Automobiles

Pages: 138

ID: IMR1257

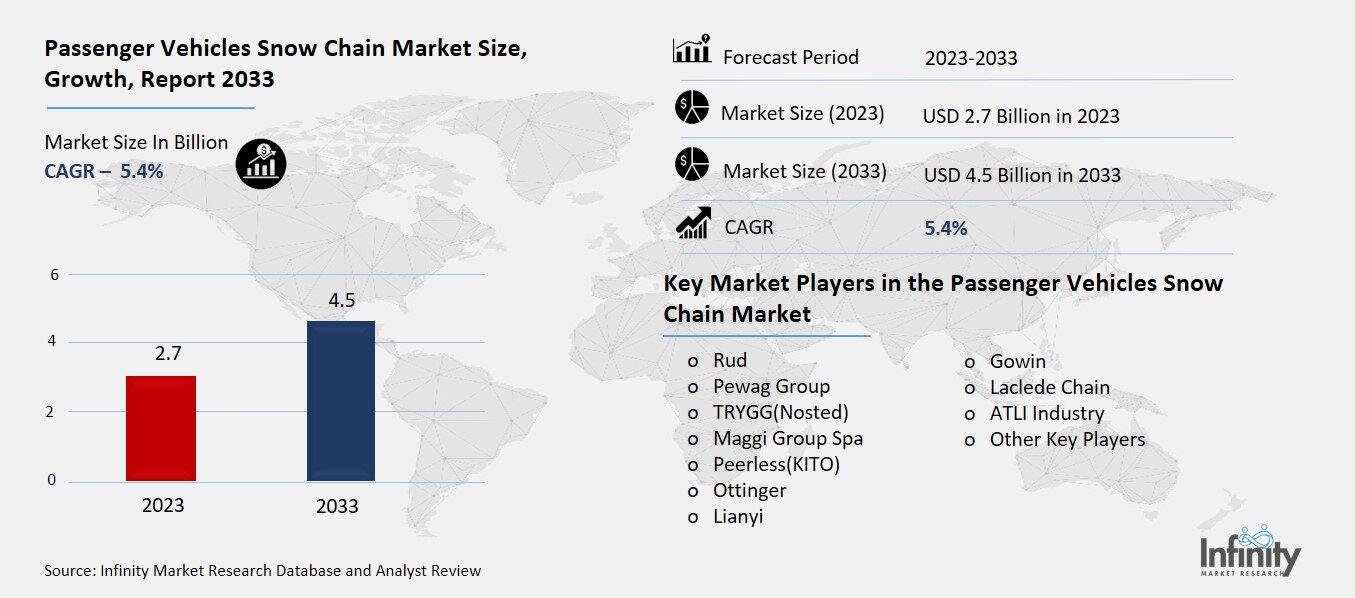

Passenger Vehicles Snow Chain Market Overview

Global Passenger Vehicles Snow Chain Market acquired the significant revenue of 2.7 Billion in 2023 and expected to be worth around USD 4.5 Billion by 2033 with the CAGR of 5.4% during the forecast period of 2024 to 2033. The passenger vehicles snow chain market is a niche but significant segment in the automotive accessories market, mostly developed in cold areas or mountainous regions. During the winter, all vehicles need snow chains to increase their grip on icy or snow roads so that they are less likely in accidents.

The growth of this market is driven by the increasing awareness about road safety, and increase in consumption of end products due to improvements and developments at a rapid pace. Due to the technological development, snow chains are currently lightweight, easy to mount and remove even-though they are durable. Favorable trends in adventure tourism and proliferation of off-road driving are also fostering the popularity.

Drivers for the Passenger Vehicles Snow Chain Market

Increase in Winter Road Safety Awareness

Increase in road accidents identified during extreme winter weather has also emerged as a key driver for the demand for snow chains in areas characterized by frequent snowfalls. Roads get slippery in snowy and icy situations, thus it poses a high risk of sliding, least vehicle control and many accidents. By offering the needed grip, snow chains enhance the mechanical stability of a car and its general maneuverability on such roads hence increasingly minimizing traffic accidents. As people become more conscious about the dangers of winter driving, more consumers aim towards using snow chains as their imperative protective gear. In addition, some insurance companies and the government tend to encourage or require drivers to install or put on the snow chains to avoid accidents during the snowy conditions most especially when the snow is persistent.

Restraints for the Passenger Vehicles Snow Chain Market

Inconvenience and Difficulty of Installation

The difficulty of installing traditional snow chains has been a notable barrier to their widespread adoption among consumers. Many snow chains require drivers to kneel on cold, wet, or icy ground, manually securing them around the tires a process that can be cumbersome, time-consuming, and physically demanding, particularly in freezing conditions. This installation challenge is especially problematic for less experienced drivers or those who may not have the strength or skill required to quickly and properly fit the chains. In addition, incorrect installation can reduce the effectiveness of the chains, potentially compromising safety and leading to vehicle damage. These drawbacks can deter consumers from using snow chains, even in regions where they are essential for safe driving.

Opportunity in the Passenger Vehicles Snow Chain Market

Increased Customization and Premium Products

The market for high-end vehicles presents a significant opportunity for manufacturers to develop customized snow chains that offer premium features and enhanced performance. Luxury and high-performance vehicles often require specialized equipment to maintain optimal safety and functionality in harsh winter conditions. Standard snow chains may not meet the specific needs of these vehicles, as factors like tire size, weight, and vehicle dynamics can differ significantly from average cars. Customized snow chains tailored to high-end vehicles can address these challenges by offering a precise fit, superior materials, and advanced design features such as automatic tensioning, improved durability, and enhanced grip on icy or snowy surfaces.

Trends for the Passenger Vehicles Snow Chain Market

Focus on Durability and Performance

Manufacturers are increasingly prioritizing durability and traction performance in snow chains, driven by consumer demand for more reliable and long-lasting products in harsh winter conditions. Traditional snow chains, often made from basic steel links, can wear down quickly when exposed to abrasive road surfaces, leading to reduced performance and frequent replacements. To address these issues, manufacturers are developing snow chains using advanced materials such as high-strength alloys, hardened steel, and composites, which offer superior durability, corrosion resistance, and the ability to withstand extreme wear.

In addition to stronger materials, innovations in design are improving the traction capabilities of snow chains. Modern designs incorporate more aggressive patterns and unique chain link geometries, which provide better grip on ice and snow. Some models now feature self-tensioning mechanisms that automatically adjust the tightness of the chains around the tire, ensuring consistent contact with the road and reducing the likelihood of slippage.

Segments Covered in the Report

By Type

o Metal Snow Chain

o Nonmetal Snow Chain

By Application

o R14-17

o R17-20

Segment Analysis

By Type Analysis

On the basis of type, the market is divided into metal snow chain and nonmetal snow chain. Among these, metal snow chain segment acquired the significant share in the market due to its superior durability, strength, and traction performance in harsh winter conditions. Metal snow chains, typically made from high-quality steel or alloy materials, are highly resistant to wear and tear, making them ideal for long-term use on icy and snow-covered roads. Their robust construction ensures better grip and stability, especially in extreme environments where heavy snowfall and ice pose serious challenges to vehicle safety.

In comparison to nonmetal snow chains, metal chains offer enhanced traction, which is particularly important for drivers who face steep inclines or severe weather conditions. This reliability in critical situations makes metal snow chains the preferred choice for many consumers, including those in regions with frequent and severe winters, as well as professional drivers and those operating larger or heavier vehicles.

By Application Analysis

On the basis of application, the market is divided into R14-17 and R17-20. Among these, R17-20 held the prominent share of the market owing to the increasing demand from larger passenger vehicles, such as SUVs, crossovers, and light trucks. These vehicles, which typically require larger tire sizes, are becoming more popular globally due to their versatility, off-road capabilities, and better performance in adverse weather conditions, including snow. The R17-20 tire size segment benefits from the growing trend of consumers preferring bigger vehicles for family use, adventure tourism, and off-road driving, all of which require effective traction in winter conditions.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of the market. The region's well-established automotive industry and the high rate of vehicle ownership contribute to the robust market for snow chains. As many drivers in North America rely on their vehicles for daily commuting and travel, the necessity of having effective traction solutions during winter is paramount. This necessity is further underscored by government regulations in certain states and provinces, which mandate the use of snow chains in specific conditions or areas, further driving sales.

Competitive Analysis

The competitive landscape of the snow chain market is characterized by a mix of established players and emerging companies, each striving to capture a share of this niche yet vital sector. Key manufacturers, including brands like Thule, Peerless, and Michelin, leverage their extensive experience and technological advancements to develop high-quality products that emphasize durability, ease of use, and performance in extreme conditions. These companies invest significantly in research and development to create innovative designs, such as automatic tensioning systems and lightweight materials, catering to the evolving needs of consumers.

Key Market Players in the Passenger Vehicles Snow Chain Market

o Rud

o Pewag Group

o TRYGG(Nosted)

o Maggi Group Spa

o Peerless(KITO)

o Ottinger

o Lianyi

o Gowin

o Laclede Chain

o ATLI Industry

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 2.7 Billion |

|

Market Size 2033 |

USD 4.5 Billion |

|

Compound Annual Growth Rate (CAGR) |

5.4% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Rud, Pewag Group, TRYGG(Nosted), Maggi Group Spa, Peerless(KITO), Ottinger, Lianyi, Gowin, Laclede Chain, ATLI Industry, and Other Key Players. |

|

Key Market Opportunities |

Increased Customization and Premium Products |

|

Key Market Dynamics |

Increase in Winter Road Safety Awareness |

📘 Frequently Asked Questions

1. Who are the key players in the Passenger Vehicles Snow Chain Market?

Answer: Rud, Pewag Group, TRYGG(Nosted), Maggi Group Spa, Peerless(KITO), Ottinger, Lianyi, Gowin, Laclede Chain, ATLI Industry, and Other Key Players.

2. How much is the Passenger Vehicles Snow Chain Market in 2023?

Answer: The Passenger Vehicles Snow Chain Market size was valued at USD 2.7 Billion in 2023.

3. What would be the forecast period in the Passenger Vehicles Snow Chain Market?

Answer: The forecast period in the Passenger Vehicles Snow Chain Market report is 2023-2033.

4. What is the growth rate of the Passenger Vehicles Snow Chain Market?

Answer: Passenger Vehicles Snow Chain Market is growing at a CAGR of 5.4% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.