🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Perfluorosulfonic Acid Proton Exchange Membranes Market

Perfluorosulfonic Acid Proton Exchange Membranes Market Global Industry Analysis and Forecast (2024-2032) By Thickness (Less than 50 μm, 50–100 μm, above 100 μm), By Application (Fuel Cells, Water Electrolysis, Others), By End-Use Industry (Automotive, Energy, Chemicals, Others) and Region

Jan 2025

Chemicals and Materials

Pages: 138

ID: IMR1461

Perfluorosulfonic Acid Proton Exchange Membranes Market Synopsis

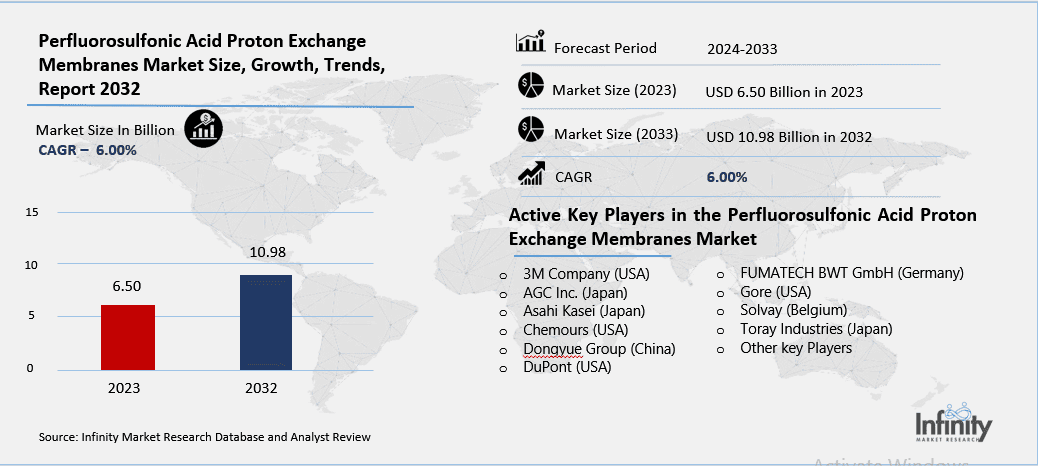

Perfluorosulfonic Acid Proton Exchange Membranes Market Size Was Valued at USD 6.50 Billion in 2023, and is Projected to Reach USD 10.98 Billion by 2032, Growing at a CAGR of 6.00 % From 2024-2032.

Perfluorosulfonic Acid Proton Exchange Membranes (PFSA PEM) is a class of materials with anions that act as active phases and are involved in the conduction of ions in electrochemical structures such as fuel cells and water electrolyzers. These membranes exhibit high proton conductivity, chemical stability and suitable stability under severe operating conditions, which when incorporated in energy applications makes them efficient and long lasting.

The increase use of clean energy technologies is expected to boost the demand for PFSA PEM market. Various governments around the globe are turning their attention to the encouragement of renewable energy technologies and hydrogen power systems as a means of combating greenhouse gases. Due to this there has been a growing demand on fuel cells and electrolyzers in which PFSA PEMs are used. In addition to this, the automotive manufacturers are fitting the hydrogen fuel cell systems in automobiles and this added energy is also driving market development.

One of the other driving factors do to the current developments is the increase of the hydrogen infrastructure investment. Currently, companies in the United States, Germany, and Japan are putting a lot of capital in hydrogen production, storage, and refueling. These developments are are opening up new opportunities for PFSA PEM deployment since they are critical elements of hydrogen-based energy technologies. Also, the new developments membrane technologies that increase their parsimony and decrease production costs open new opportunities of their application in different industries.

Perfluorosulfonic Acid Proton Exchange Membranes Market Outlook, 2023 and 2032: Future Outlook

Perfluorosulfonic Acid Proton Exchange Membranes Market Trend Analysis

Activity of governments, research institutions

As the trend of the membranous electrolytes degree in the PFSA PEM system increases, there is growth of the thin and more durable membranes occurrence. Fuel cell and electrolyze manufacturers are paying attention to improved mechanical properties of membranes and desire reduced thickness. This is because automotive and portable power application demands more of compact and lightweight energy system.

Another trend is the activity of governments, research institutions, and private companies in their joint effort. Although the genesis of hydrogen energy solutions is traced in government policies, public-private collaborations are driving advances in membrane technologies for the broader market adoption of hydrogen energy. This synergy is enhancing the further incorporation of PFSA PEMs into the next generation of energy fundamentals and its market scope.

Experiencing industrialization

The is particularly true in the emerging economy of the PFSA PEM market. Asian-Pacific and middle American countries are experiencing industrialization and express concern for their energy sources. This leads to the establishment of a large market for PFSA PEMs for large scale hydrogen society and energy storage applications.

Also, market growth creates a tremendous growth opportunity in the market for green hydrogen. Since energy producers and consumers as well as manufacturing industries are aspiring to attain net zero carbon emissions intensity, the market for green hydrogen produced by water electrolysis is anticipated to experience tremendous growth. Since PFSA PEMs are an integral part of electrolyzers, this growing market segment will bring benefits to their producers.

Perfluorosulfonic Acid Proton Exchange Membranes Market Segment Analysis

Perfluorosulfonic Acid Proton Exchange Membranes Market Segmented on the basis of By Thickness, By Application and By End-Use Industry.

By Thickness

o Less than 50 μm

o 50–100 μm

o above 100 μm

By Application

o Fuel Cells

o Water Electrolysis

o Others

By End Use Industry

o Automotive

o Energy

o Chemicals

o Others

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Thickness, Less than 50 μm segment is expected to dominate the market during the forecast period

The PFSA PEM market is segmented by thickness into three categories: smaller than 50μm, between 50–100μm and more than 100μm. Nanosized membranes which have thickness less than 50 μm are preferable for fuel cell applications want high proton conductivity and miniaturization such as portable fuel cell systems. The 50–100 μm segment can be considered as the most popular one, because it stabilizes the balance between the foil durability on the one hand, and the operating characteristics on the other, thus it ensures stationery types of fuel cells and water electrolyzers. As the thickness of the membrane increases, it passes 100 μm there is more mechanical strength required and the membrane is selected let for heavy-duty application.

By Application, Fuel Cells segment expected to held the largest share

On the basis of application, the market is bifurcated as fuel cells and electrolysis, and others. Fuel cells dominate with reference to the application segment, particularly in automotive, stationary power, and portable power applications. The use of water electrolysis is gradually increasing due to the development of an emphasis on green hydrogen generation. Other segment includes specialty applications like sensors and electrochemical devices which are being adopted at a fast pace thanks to the advancement in the technology.

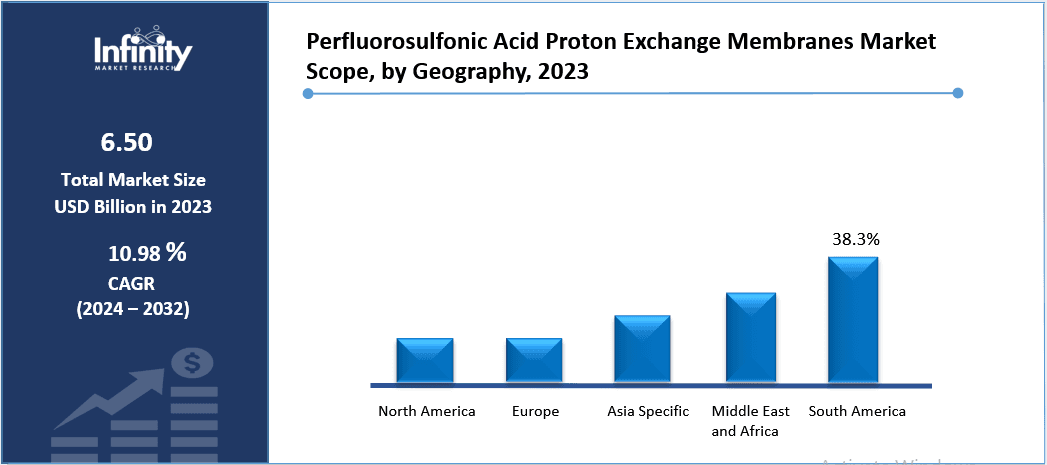

Perfluorosulfonic Acid Proton Exchange Membranes Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

Geographically, North America holds the largest share for PFSA PEM market. This can be attributed to the fact that the major manufacturers of key fuel cell and electrolyzers are located in this region and the region’s governments have been keen on promoting development of hydrogen energy. America specifically, has been the front-runner in the consumption and incorporation of hydrogen-based technologies inclusive of massive investments in infrastructure and research.

The drive towards carbon neutrality across the region and decreasing dependence on fossils have also driven the use of PFSA PEMs. Furthermore, the private and federal partnerships have encouraged steady advancement and commercialization of new membrane technologies and established the North American market as the world’s leader.

Perfluorosulfonic Acid Proton Exchange Membranes Market Share, by Geography, 2023 (%)

Active Key Players in the Perfluorosulfonic Acid Proton Exchange Membranes Market

o 3M Company (USA)

o AGC Inc. (Japan)

o Asahi Kasei (Japan)

o Chemours (USA)

o Dongyue Group (China)

o DuPont (USA)

o FUMATECH BWT GmbH (Germany)

o Gore (USA)

o Solvay (Belgium)

o Toray Industries (Japan)

o Other key Players

Global Perfluorosulfonic Acid Proton Exchange Membranes Market Scope

|

Global Perfluorosulfonic Acid Proton Exchange Membranes Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.50 Billion |

|

Forecast Period 2024-32 CAGR: |

6.00 % |

Market Size in 2032: |

USD 10.98 Billion |

|

Segments Covered: |

By Thickness |

· Less than 50 μm · 50–100 μm · above 100 μm | |

|

By Application |

· Fuel Cells · Water Electrolysis · Others | ||

|

By End-Use Industry |

· Automotive · Energy · Chemicals · Others | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Rising Investments in Hydrogen Infrastructure | ||

|

Key Market Restraints: |

· Challenges in Recycling and Environmental Concerns | ||

|

Key Opportunities: |

· Green Hydrogen Revolution Creating New Prospects | ||

|

Companies Covered in the report: |

· DuPont (USA), Chemours (USA), 3M Company (USA), Solvay (Belgium), Dongyue Group (China), Asahi Kasei (Japan), FUMATECH BWT GmbH (Germany), Gore (USA), Toray Industries (Japan), AGC Inc. (Japan) and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Perfluorosulfonic Acid Proton Exchange Membranes Market research report?

Answer: The forecast period in the Perfluorosulfonic Acid Proton Exchange Membranes Market research report is 2024-2032.

2. Who are the key players in the Perfluorosulfonic Acid Proton Exchange Membranes Market?

Answer: DuPont (USA), Chemours (USA), 3M Company (USA), Solvay (Belgium), Dongyue Group (China), Asahi Kasei (Japan), FUMATECH BWT GmbH (Germany), Gore (USA), Toray Industries (Japan), AGC Inc. (Japan) and Other Major Players.

3. What are the segments of the Perfluorosulfonic Acid Proton Exchange Membranes Market?

Answer: The Perfluorosulfonic Acid Proton Exchange Membranes Market is segmented into By Thickness, By Application, By End-Use Industry and region. By Thickness, the market is categorized into Less than 50 μm, 50–100 μm, Above 100 μm. By Application, the market is categorized into Fuel Cells, Water Electrolysis, Others. By End-Use Industry, the market is categorized into Automotive, Energy, Chemicals, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Perfluorosulfonic Acid Proton Exchange Membranes Market?

Answer: Perfluorosulfonic Acid Proton Exchange Membranes (PFSA PEM) is a class of materials with anions that act as active phases and are involved in the conduction of ions in electrochemical structures such as fuel cells and water electrolyzers. These membranes exhibit high proton conductivity, chemical stability and suitable stability under severe operating conditions, which when incorporated in energy applications makes them efficient and long lasting.

5. How big is the Perfluorosulfonic Acid Proton Exchange Membranes Market?

Answer: Perfluorosulfonic Acid Proton Exchange Membranes Market Size Was Valued at USD 6.50 Billion in 2023, and is Projected to Reach USD 10.98 Billion by 2032, Growing at a CAGR of 6.00 % From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.