🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Pet Supplements Market

Pet Supplements Market by Form (Chewable, Powders, Tablets/ Pills, Other Forms), By Pet Type (Dogs, Cats, Freshwater Fish, Other Pet Types), By Application (Multivitamins, Skin & Coat, Prebiotics & Probiotics, Hip & Joint, Digestive Health, Calming, Other Applications), By Distribution Channel (Offline, Online), By Region and Companies)

Jun 2024

Consumer and Retails

Pages: 133

ID: IMR1108

Pet Supplements Market Overview

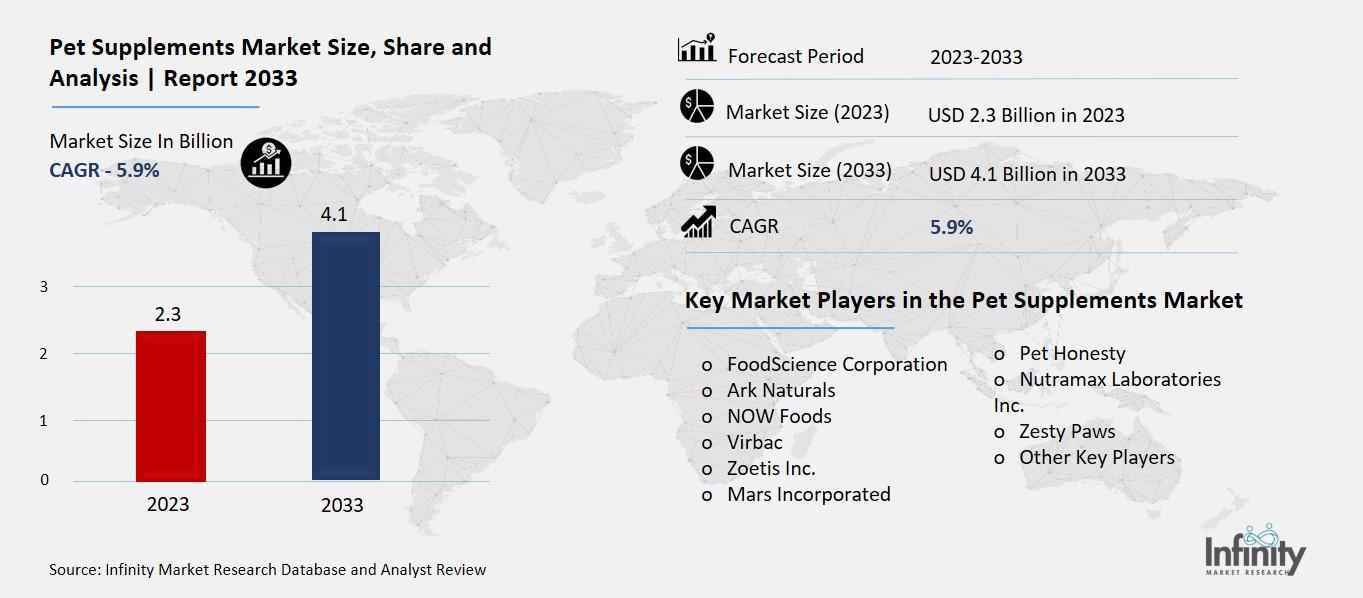

Global Pet Supplements Market size is expected to be worth around USD 4.1 Billion by 2033 from USD 2.3 Billion in 2023, growing at a CAGR of 5.9% during the forecast period from 2023 to 2033.

The pet supplements market is a growing industry focused on products designed to improve the health and well-being of pets, such as dogs, cats, birds, and fish. These supplements include vitamins, minerals, and other nutritional products that help pets stay healthy. The market is expanding for several reasons.

First, more people are owning pets and treating them like family members, which leads to higher spending on their pets' health. Second, pet owners are becoming more aware of their pets' health needs and the benefits of supplements. Additionally, pets are living longer, much like humans, and often require extra health support as they age. Many pet owners also use supplements as a preventive measure to avoid future health problems.

There are different types of pet supplements available. Vitamins and minerals ensure that pets get all the essential nutrients they need. Joint health supplements, like glucosamine, are popular for helping with joint problems, especially in older pets. There are also supplements for skin and coat health, keeping pets' skin healthy and their coats shiny. Digestive health supplements, such as probiotics, support a healthy digestive system. Lastly, there are general wellness supplements that boost overall health and immunity. The market is also seeing some interesting trends. Natural and organic supplements are becoming more popular as pet owners look for high-quality, safe products.

There is also a rise in the use of supplements for specific health issues, such as anxiety, obesity, and dental health. With more people working from home and spending time with their pets, there is an increased focus on maintaining their pets' health. The pet supplements market is expected to continue growing as more pet owners seek ways to ensure their pets live longer, healthier lives.

Drivers for the Pet Supplements Market

Growing Pet Ownership

One of the main drivers for the pet supplements market is the increase in pet ownership. As of 2023, about 66% of American households, or around 86.9 million families, have pets. This rise in pet ownership naturally leads to a higher demand for products that ensure pets' health and wellness, including supplements. As more people adopt pets, the market for pet-related products continues to expand rapidly.

Veterinary Recommendations

Veterinarians significantly influence the pet supplements market. As awareness of preventive healthcare for pets grows, more veterinarians recommend supplements to address various health issues in pets, such as joint pain, digestive problems, and skin conditions. Pet owners trust their vets and are likely to follow their advice, leading to increased sales of supplements. This trend underscores the importance of professional endorsements in boosting market growth.

Humanization of Pets

Pets are increasingly seen as family members, and this shift is driving the pet supplements market. Owners are willing to spend more on their pets’ health and well-being, similar to how they would for their human family members. This humanization trend means that pet owners are more inclined to buy supplements that enhance their pets' quality of life. This has led to a variety of products tailored to different pet needs, from multivitamins to specialized joint and skin supplements.

Aging Pet Population

The growing population of aging pets is another crucial factor driving the market. Older pets often require additional nutritional support to maintain their health and mobility. Supplements targeting senior pets, such as those for joint health and cognitive function, are in high demand. As pets live longer, thanks to better healthcare and nutrition, the need for supplements that cater to their changing health needs increases.

Rising Awareness of Preventive Care

Awareness of the benefits of preventive healthcare is rising among pet owners. They are increasingly proactive about maintaining their pets' health, leading to higher demand for supplements that support overall wellness and address specific health issues. Products for skin and coat care, digestive health, and immune support are becoming more popular as owners seek to prevent health problems before they arise.

Market Trends and Future Prospects

The pet supplements market is expected to continue growing, driven by trends like personalized nutrition and innovative delivery formats. E-commerce is becoming a dominant distribution channel, making it easier for pet owners to purchase a wide range of supplements online. Moreover, the market is seeing an increase in premium products and transparency in sourcing and manufacturing, which appeals to health-conscious consumers. These trends indicate a robust future for the pet supplements market, with significant opportunities for growth and innovation.

Restraints for the Pet Supplements Market

Regulatory Challenges

One of the primary restraints in the pet supplements market is the complex and varying regulatory landscape across different regions. Regulatory authorities like the FDA in the U.S. have stringent guidelines for pet supplements to ensure their safety and efficacy. These regulations often require extensive testing and documentation, which can be costly and time-consuming for manufacturers. Additionally, different countries have their own set of rules and standards, making it difficult for companies to navigate and comply with all requirements simultaneously. This regulatory burden can hinder the entry of new products into the market and slow down the overall growth of the industry.

High Costs and Limited Affordability

The high cost of pet supplements can be a significant barrier for many pet owners, especially in developing regions. Premium supplements, often marketed for their superior quality and health benefits, come with a higher price tag that not all consumers can afford. This limits the market to a more affluent customer base, reducing the overall potential customer pool. Moreover, the perception of supplements as non-essential products during economic downturns can further decrease their demand. Pet owners may prioritize necessities over supplements when budgets are tight, impacting sales and market growth.

Limited Scientific Evidence

While many pet supplements are marketed with various health claims, there is often limited scientific evidence to back these assertions. This lack of robust clinical data can lead to skepticism among veterinarians and pet owners regarding the effectiveness and safety of these products. Without solid proof, gaining the trust of consumers and healthcare professionals becomes challenging. This skepticism can reduce the adoption rates of supplements, as pet owners may be reluctant to invest in products without guaranteed benefits.

Market Fragmentation and Competition

The pet supplements market is highly fragmented, with numerous small and large players vying for market share. This intense competition can lead to market saturation, making it difficult for new entrants to establish a foothold. Established brands with strong reputations and extensive distribution networks dominate the market, creating high entry barriers for smaller companies. Additionally, the presence of counterfeit or low-quality products can tarnish the market's reputation, further complicating efforts to build consumer trust and loyalty.

Consumer Awareness and Education

Despite growing interest in pet health, many pet owners still lack awareness and education about the benefits of pet supplements. Misconceptions about supplements, such as their necessity or potential side effects, can deter consumers from purchasing these products. Effective marketing and educational campaigns are essential to inform pet owners about how supplements can enhance their pets' health and well-being. However, creating and disseminating such information requires significant resources and strategic efforts, which can be a challenge for smaller companies.

Opportunity in the Pet Supplements Market

Rising Pet Ownership

One of the primary opportunities in the pet supplements market is the rising rate of pet ownership worldwide. With more people adopting pets, there is a corresponding increase in the demand for pet supplements to ensure their pets' health and wellness. For example, in the United States, 66% of households own a pet, driving a substantial market for pet-related products and services. As more people bring pets into their homes, the market for supplements that promote health, longevity, and quality of life for pets is expected to expand significantly.

Humanization of Pets

The trend of treating pets as family members, known as the humanization of pets, continues to grow. This shift means pet owners are more willing to invest in high-quality supplements to ensure their pets' well-being. Products that address specific health concerns, such as joint health, skin and coat care, and digestive health, are becoming increasingly popular. As pet owners seek to provide the best care for their pets, the demand for specialized and premium pet supplements is likely to rise.

Advances in Veterinary Science

Advances in veterinary science present another significant opportunity for the pet supplements market. With improved understanding and treatment of various pet health conditions, there is a growing need for supplements that can support these treatments. Veterinarians increasingly recommend supplements as part of comprehensive care plans for pets, particularly for managing chronic conditions and improving overall health. This professional endorsement plays a crucial role in boosting the market for pet supplements.

E-commerce and Online Retail

The rise of e-commerce and online retail has opened new avenues for the pet supplements market. Online platforms make it easier for pet owners to access a wide range of products, compare prices, read reviews, and make informed purchasing decisions. This convenience has led to a significant increase in online sales of pet supplements. Companies that optimize their online presence and offer user-friendly shopping experiences are well-positioned to capture a larger share of the market.

Personalized Nutrition

Personalized nutrition is becoming a key trend in the pet supplements market. Pet owners are increasingly looking for products tailored to their pet's specific needs, whether based on age, breed, size, or health condition. Companies that offer customized supplement solutions can differentiate themselves in the market and attract a loyal customer base. This trend towards personalized pet care aligns with the broader consumer movement towards individualized health and wellness products for humans.

Innovations in Product Formulations

Innovations in product formulations and delivery methods present another opportunity for growth in the pet supplements market. New formats such as soft chews, liquid supplements, and flavor-enhanced products make it easier for pet owners to administer supplements to their pets. These innovations not only improve compliance but also enhance the overall experience for pets and their owners. Companies that invest in research and development to create novel, effective, and easy-to-use supplements can gain a competitive edge in the market.

Trends for the Pet Supplements Market

Growing Popularity of Natural and Organic Supplements

One major trend in the pet supplements market is the increasing demand for natural and organic products. Pet owners are becoming more aware of the benefits of natural ingredients and are seeking products that do not contain artificial additives or preservatives. This trend is driven by the humanization of pets, where owners treat their pets as family members and prioritize their health similarly to their own. Companies are responding by offering a wider range of plant-based and vegan supplements to cater to this growing segment.

Increase in Pet Ownership

The rise in pet ownership globally is a significant trend fueling the growth of the pet supplements market. More households are adopting pets, leading to a higher demand for products that enhance pet health and well-being. For instance, in the United States, 66% of households own at least one pet, which drives the market for various pet health products, including supplements.

Veterinary Recommendations Boosting Sales

Veterinary endorsements are playing a crucial role in promoting pet supplements. As preventive healthcare becomes more prominent, veterinarians recommend supplements to address specific health issues in pets. Pet owners tend to trust their veterinarians' advice, which leads to increased sales of these recommended products. This trend underscores the importance of professional guidance in the pet supplements market.

Focus on Specific Health Issues

Pet supplements are increasingly tailored to address specific health concerns. For example, there is a growing demand for supplements that support digestive health, skin and coat health, and joint health. Products targeting these issues are popular among pet owners who want to improve their pets' quality of life. Digestive health supplements, in particular, are seeing significant growth due to their benefits in alleviating common digestive issues in pets.

Rise of E-commerce

The shift towards online shopping is another trend impacting the pet supplements market. E-commerce platforms like Amazon, Chewy, and other online retailers are making it easier for pet owners to purchase supplements. This convenience, combined with the ability to access a wider variety of products and read customer reviews, is driving the growth of online sales channels. This trend is particularly strong in regions like North America and Europe.

Innovations in Product Forms

Innovation in product forms is also shaping the market. Pet supplements are now available in various forms, including chewables, liquids, gels, and powders. These different forms cater to the diverse preferences of pets and their owners, making it easier to administer supplements. For example, liquids and gels can be mixed with food, while chewables are convenient for direct feeding. These innovations enhance the appeal and usability of pet supplements.

Segments Covered in the Report

By Form

o Chewable

o Powders

o Tablets/ Pills

o Other Forms

By Pet Type

o Dogs

o Cats

o Freshwater Fish

o Other Pet Types

By Application

o Multivitamins

o Skin & Coat

o Prebiotics & Probiotics

o Hip & Joint

o Digestive Health

o Calming

o Other Applications

By Distribution Channel

o Offline

o Online

Segment Analysis

By Form

The market can be further divided into chewables, powders, tablets/pills, and various forms based on form. In terms of market share by form, chewable supplements held a 45.7% share in 2023; chewing is more natural for cats and dogs than ingesting pills or tablets!

Chewable supplements are made to accommodate pets' innate need to chew food, which simplifies supplement administration for both owners and pets. Chewable vitamins frequently include tastes and textures created especially to appeal to pets' palates.

Chewable supplements are more popular and have a dominant market share in the pet supplement industries because pet owners find it easier to ensure that their animals are getting the appropriate vitamins without experiencing resistance.

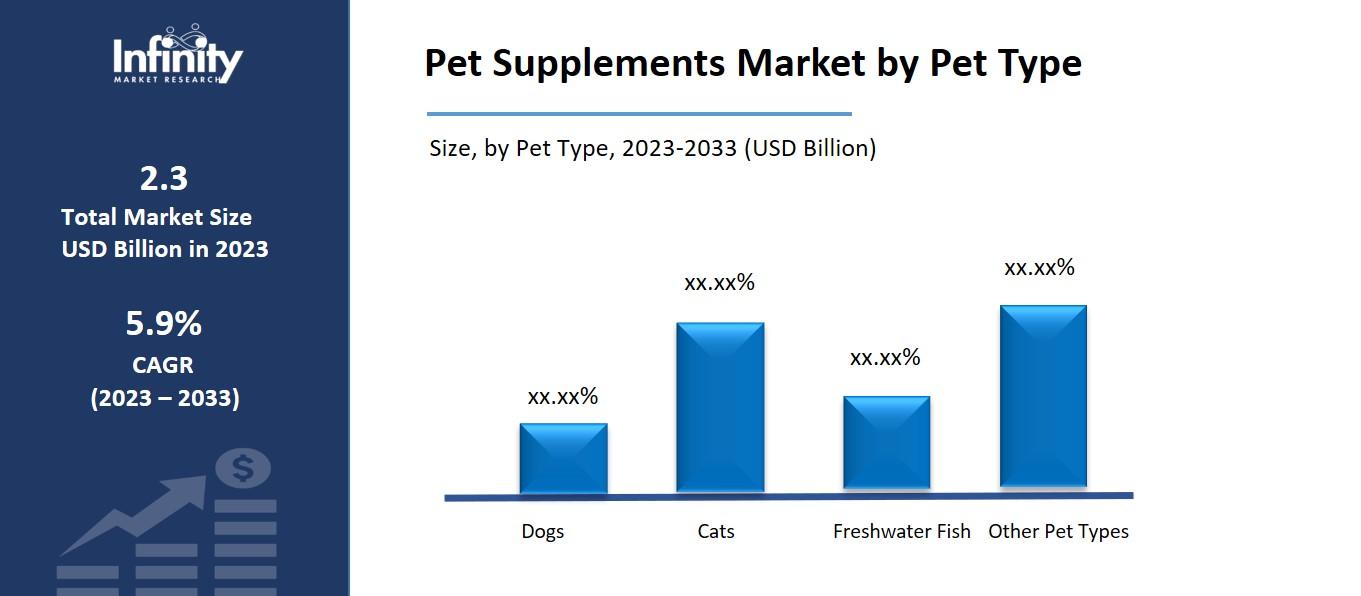

By Pet Type Analysis

Dogs, cats, freshwater fish, and other pet types comprise the segments that make up the worldwide pet supplements market; as of 2023, the dogs segment represented a 48.4% revenue share.

Due to several factors, such as the growing number of pets worldwide, pet parents' lavish spending on their dogs' health and wellness, and the many health issues that dogs frequently face that supplements can help with, dog supplements currently dominate the global pet supplements market.

Furthermore, this category has a substantial market share because there are a lot of supplements made especially for dogs that deal with digestive health, joint health, and coat care. Dogs continue to be some of the most cherished pets on the planet!

Many households in nations like the United States own dogs, according to the National Pet Owners Survey; this high adoption rate directly supports the growing market for dog items like supplements.

By Application Analysis

As the number of pets with arthritis rises, Hip & Joint Supplements for Animals have seen an exponential increase in market share. The global pet supplements market can be segmented based on application, including multivitamins, skin and coat, prebiotics and probiotics, hip and joint supplements (with a projected 19.4% market share), digestive health supplements like digestive enzymes or vitamins, and other joint health applications like MSM for joint mobility and stability.

The increasing popularity of this segment can be attributed to pet owners' rising knowledge of joint problems in larger or older breeds that are more prone to disorders like arthritis. Supplements for the hips and joints are essential for these pets' mobility and quality of life as they age.

By Distribution Channel Analysis

The offline and internet markets are divided. By 2023, the offline sector is predicted to provide the most revenue of these, with a share of 60.8%. This suggests that a sizable proportion of customers still favor offline methods despite the growing trend and ease of internet purchases.

This may be the result of several things, including the tactile nature of shopping in real places, the speed at which goods can be obtained, in-person customer support, or mistrust of online payment methods. Offline purchasing offers immediate satisfaction in contrast to online shopping, which requires waiting for delivery. Consumers can get the product right away, which is crucial in emergency scenarios like when a pet needs a certain supplement right away.

Regional Analysis

With the biggest revenue share of 49.2% in the pet supplement industry in 2023, North America was the dominant region. The main reasons propelling the growth of the North American market are the increasing number of pet owners, the growing worries for pets, and the growing knowledge among pet owners about various health hazards.

The National Pet Owners Survey 2019–2020 found that 67% of American homes have a pet, up from 56% in 1988. The growing trend among pet owners in North America to enhance their pets' immune systems, promote better digestion, strengthen their bones, and treat numerous skin allergies is also fueling the market for pet supplements.

The market in Asia Pacific is anticipated to grow at the quickest rate between 2023 and 2033. The growing belief among pet owners that their pets' everyday diets may not contain all the nutrients they need and that supplements might help fill in the gaps is encouraging the development of these animal health products. The number of domesticated fish, dogs, birds, and cats is also predicted to increase in the region, especially in China and Australia, which is projected to boost market growth.

Competitive Analysis

FoodScience Corporation, Ark Naturals, NOW Foods, Virbac, Zoetis Inc., Mars, Incorporated, Pet Honesty, Nutramax Laboratories, Inc., Zesty Paws, and other major businesses are among the market leaders for pet supplements.

In the rapidly growing pet supplement sector, several up-and-coming firms are competing for market supremacy. Smaller, specialty businesses are better renowned for meeting the needs and preferences of their customers. Another facet of the competitive industry is private label brands made by retailers and e-commerce sites. Although they offer more reasonably priced solutions, their product selection or recognition differs from that of well-known corporations. Innovation in pet supplements, sourcing of ingredients, and sustainability policies are some of the key competitive factors that are believed to provide a company an advantage over competitors in the market.

Recent Developments

March 2023: Mars Petcare will launch Pedigree Multivitamins, marking their entry into the dietary supplement market. Three different kinds of soft chews are part of this new product range, which is made specially to satisfy the basic requirements of pets. The Pedigree Multivitamins are designed to help pets' joints, maintain healthy digestion, and boost immunity.

October 2023: Zesty Paws debuted in Canada as a joint venture between PetSmart and Amazon. Zesty Paws began to expand internationally with this relocation.

March 2022: Two brand-new Virbac Veterinary HPM wet feeds were introduced to prevent and treat feline lower urinary tract disease (FLUTD), a condition that affects many cats.

Key Market Players in the Pet Supplements Market

o Ark Naturals

o Virbac

o Mars Incorporated

o Pet Honesty

o Nutramax Laboratories Inc.

o Zesty Paws

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 2.3 Billion |

|

Market Size 2033 |

USD 4.1 Billion |

|

Compound Annual Growth Rate (CAGR) |

5.9% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Form, By Pet Type, Application, Distribution Channel, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

FoodScience Corporation, Ark Naturals, NOW Foods, Virbac, Zoetis Inc., Mars, Incorporated, Pet Honesty, Nutramax Laboratories, Inc., Zesty Paws, |

|

Key Market Opportunities |

Rising Pet Ownership |

|

Key Market Dynamics |

Rising Awareness of Preventive Care |

📘 Frequently Asked Questions

1. How much is the Pet Supplements Market in 2023?

Answer: The Pet Supplements Market size was valued at USD 2.3 Billion in 2023.

2. What would be the forecast period in the Pet Supplements Market report?

Answer: The forecast period in the Pet Supplements Market report is 2023-2033.

3. Who are the key players in the Pet Supplements Market?

Answer: FoodScience Corporation, Ark Naturals, NOW Foods, Virbac, Zoetis Inc., Mars, Incorporated, Pet Honesty, Nutramax Laboratories, Inc., Zesty Paws.

4. What is the growth rate of the Pet Supplements Market?

Answer: Pet Supplements Market is growing at a CAGR of 5.9% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.