🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Petroleum (PET) Coke Market

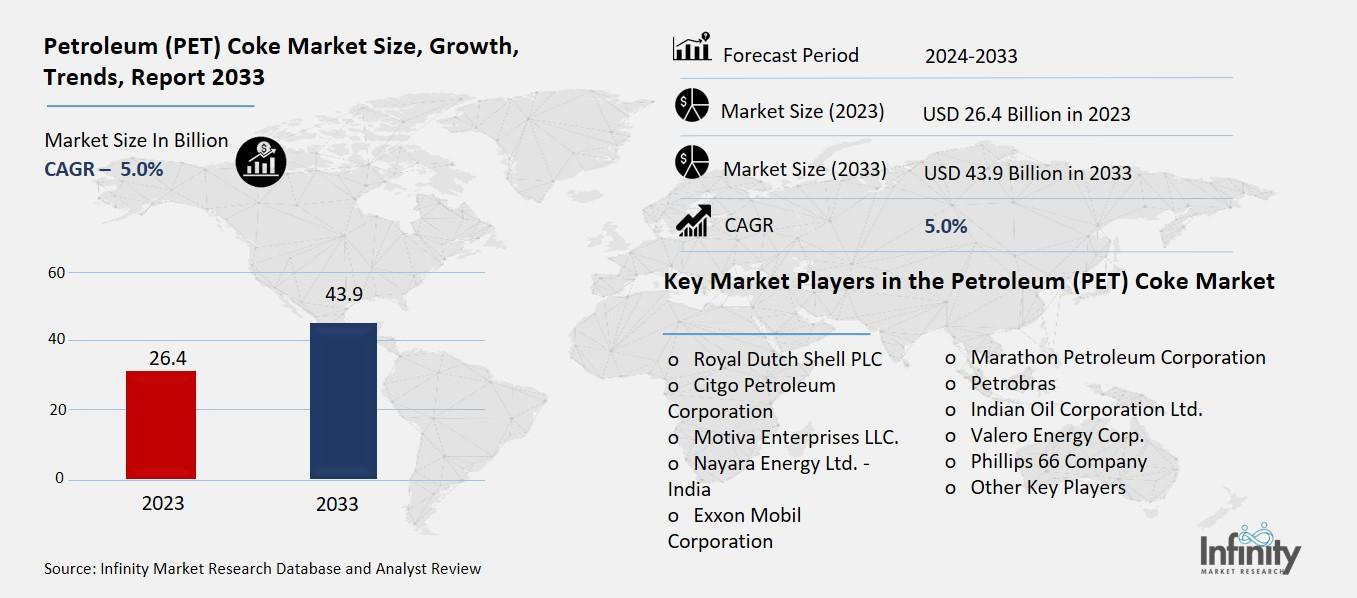

Global Petroleum (PET) Coke Market (By Type, Fuel Grade Coke and Calcined Coke; By Application, Aluminum, Power, Cement, Iron and Steel, and Other Applications; By Region and Companies), 2024-2033

Dec 2024

Chemicals and Materials

Pages: 138

ID: IMR1348

Petroleum (PET) Coke Market Overview

Global Petroleum (PET) Coke Market acquired the significant revenue of 26.4 Billion in 2023 and expected to be worth around USD 43.9 Billion by 2033 with the CAGR of 5.0% during the forecast period of 2024 to 2033. The petroleum (PET) coke market is an essential component of the global energy and materials market given the diversified uses of PET coke in power generation, cement production, and in industries. PET coke, a byproduct of crude oil refining, comes in two primary types: fuel-grade and calcined. Fuel-grade PET coke is mainly employed as a low-cost high carbon fuel for power plants and cement kilns on the other hand; calcined PET coke is used as a material by aluminum, steel and titanium industries.

Crude oil prices, environment standards and regulatory changes with regard to carbon emission and the increasing trend in end use segments affect the market. Further, the rise in demand for cleaner fuels and the ongoing research studies on instances and applications of PET coke gasification and exploitation are the factors that are influencing the market.

Drivers for the Petroleum (PET) Coke Market

Industrialization in Emerging Economies

The rapid industrial growth in countries like China, India, and Brazil has been a significant driver of the petroleum coke market, fueled by their expanding manufacturing sectors and infrastructural development. These nations are witnessing robust urbanization, resulting in increased energy demands to support industrial operations and construction activities. In China and India, the development of large-scale projects such as industrial parks, smart cities, and transportation networks has driven the consumption of PET coke, particularly in the cement and power sectors.

Brazil, with its focus on infrastructure modernization, including roads, airports, and ports, also relies heavily on PET coke to meet the growing demand for energy and construction materials. This trend is further amplified by government policies encouraging industrial investments and public-private partnerships for infrastructure development.

Restraints for the Petroleum (PET) Coke Market

Environmental Regulations

Stringent carbon emission policies affecting fuel-grade PET coke usage and growing concerns about air pollution from PET coke combustion are significant challenges for the market. Governments worldwide are implementing stricter environmental regulations to curb greenhouse gas emissions, which directly impacts the use of fuel-grade PET coke due to its high carbon content and polluting nature. In many regions, industries that rely on PET coke for power generation and cement production face increased compliance costs, such as carbon taxes and mandatory emissions reduction technologies. These policies often discourage its usage and promote cleaner alternatives like natural gas and renewable energy.

Opportunity in the Petroleum (PET) Coke Market

Technological Advancements

The development of PET coke gasification and carbon capture technologies is transforming the utilization of petroleum coke, addressing environmental concerns while enhancing its value in industrial applications. Gasification converts PET coke into synthesis gas (syngas), a mixture of hydrogen and carbon monoxide, which serves as a versatile intermediate for producing chemicals, fertilizers, and fuels. This process not only enables the efficient use of PET coke but also facilitates the integration of carbon capture and storage (CCS) systems, significantly reducing greenhouse gas emissions.

For instance, the Air Products Slurry-feed gasification process employs a refractory-lined reactor to generate hot syngas, which can be cooled using convective or radiant syngas coolers, offering high thermal efficiency and suitability for large-scale chemical projects and integrated gasification combined cycle (IGCC) power generation.

Trends for the Petroleum (PET) Coke Market

Shift Toward Cleaner Alternatives

In response to stringent environmental regulations, companies are increasingly adopting sustainable practices to mitigate the environmental impact of petroleum coke (PET coke) usage. One such approach involves blending PET coke with biofuels to reduce emissions. This strategy aims to combine the high energy content of PET coke with the cleaner combustion properties of biofuels, thereby achieving a balance between performance and environmental compliance.

Recent research has focused on the effects of low-carbon biofuels and their blends on combustion efficiency and emissions. Studies indicate that biofuels can enhance combustion efficiency and lower greenhouse gas emissions when blended with traditional fossil fuels. For instance, a review published in Sustainability highlights that biofuels, due to their renewable nature and cleaner combustion products, have attracted significant attention as alternatives to fossil fuels

Segments Covered in the Report

By Type

o Fuel Grade Coke

o Calcined Coke

By Application

o Aluminum

o Power

o Cement

o Iron and Steel

o Other Applications

Segment Analysis

By Type Analysis

On the basis of type, the market is divided into fuel grade coke and calcined coke. Among these, fuel grade coke segment acquired the significant share in the market owing to its widespread use as an affordable and efficient energy source in industrial applications. Fuel-grade coke, characterized by its high carbon content and low production cost, is extensively utilized in power generation and cement production, especially in emerging economies with growing energy demands. Its high calorific value makes it a preferred choice for industries seeking cost-effective fuel alternatives to coal and natural gas.

Additionally, the global increase in infrastructure projects has fueled demand for cement, further driving the consumption of fuel-grade coke. Despite environmental concerns, its affordability and availability, combined with ongoing efforts to improve combustion efficiency and reduce emissions, continue to bolster its dominance in the market.

By Application Analysis

On the basis of application, the market is divided into aluminum, power, cement, iron and steel, and other applications. Among these, aluminum segment held the prominent share of the market due to the essential role of calcined petroleum coke in the aluminum smelting process. Calcined coke is a critical raw material used as an anode in the electrolytic reduction of alumina to produce aluminum, making it indispensable to the industry. The growing demand for aluminum in automotive, construction, aerospace, and packaging sectors has directly contributed to the increased consumption of calcined petroleum coke. Furthermore, the lightweight and recyclable properties of aluminum are driving its adoption as a sustainable material, further boosting the demand for high-quality calcined coke.

Regional Analysis

Asia Pacific Dominated the Market with the Highest Revenue Share

Asia Pacific held the most of the share of 32.1% of the market due to its rapid industrialization, urbanization, and expanding infrastructure projects. Countries like China, India, and Japan are key contributors, with high demand for petroleum coke in industries such as power generation, cement production, and aluminum manufacturing. In China and India, the surge in construction and industrial activities has driven significant consumption of fuel-grade coke, while Japan’s advanced manufacturing sector relies heavily on calcined coke for aluminum production.

Additionally, the region benefits from the presence of major refining capacities and the availability of low-cost raw materials, further enhancing its market position. Government initiatives promoting industrial growth and increasing investments in infrastructure development are also bolstering demand for petroleum coke, making Asia Pacific the leading region in the global market.

Competitive Analysis

The petroleum coke market is highly competitive, with key players focusing on strategic initiatives such as mergers, acquisitions, capacity expansions, and technological advancements to strengthen their market position. Major companies, including Chevron Corporation, ExxonMobil, Indian Oil Corporation, and BP, dominate the market due to their extensive refining capacities and global distribution networks. These players are investing heavily in research and development to improve the quality of calcined coke for aluminum and steel industries and to develop sustainable solutions like carbon capture technologies. Additionally, regional players in emerging economies, particularly in Asia Pacific, are intensifying competition by leveraging low production costs and proximity to high-demand markets.

Recent Developments

In July 2023, Venezuela's state-owned oil company, PDVSA, entered into two new agreements with Latif Petrol, a Turkish company, and Reussi Trading, a firm based in St. Vincent and the Grenadines, to export as much as 1.6 million metric tons of petroleum coke.

Key Market Players in the Petroleum (PET) Coke Market

o Royal Dutch Shell PLC

o Citgo Petroleum Corporation

o Motiva Enterprises LLC.

o Nayara Energy Ltd. - India

o Exxon Mobil Corporation

o Marathon Petroleum Corporation

o Petrobras

o Indian Oil Corporation Ltd.

o Valero Energy Corp.

o Phillips 66 Company

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 26.4 Billion |

|

Market Size 2033 |

USD 43.9 Billion |

|

Compound Annual Growth Rate (CAGR) |

5.0% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Royal Dutch Shell PLC, Citgo Petroleum Corporation, Motiva Enterprises LLC., Nayara Energy Ltd. – India, Exxon Mobil Corporation, Marathon Petroleum Corporation, Petrobras, Indian Oil Corporation Ltd., Valero Energy Corp., Phillips 66 Company, and Other Key Players. |

|

Key Market Opportunities |

Technological Advancements |

|

Key Market Dynamics |

Industrialization in Emerging Economies |

📘 Frequently Asked Questions

1. Who are the key players in the Petroleum (PET) Coke Market?

Answer: Royal Dutch Shell PLC, Citgo Petroleum Corporation, Motiva Enterprises LLC., Nayara Energy Ltd. – India, Exxon Mobil Corporation, Marathon Petroleum Corporation, Petrobras, Indian Oil Corporation Ltd., Valero Energy Corp., Phillips 66 Company, and Other Key Players.

2. How much is the Petroleum (PET) Coke Market in 2023?

Answer: The Petroleum (PET) Coke Market size was valued at USD 26.4 Billion in 2023.

3. What would be the forecast period in the Petroleum (PET) Coke Market?

Answer: The forecast period in the Petroleum (PET) Coke Market report is 2024-2033.

4. What is the growth rate of the Petroleum (PET) Coke Market?

Answer: Petroleum (PET) Coke Market is growing at a CAGR of 5.0% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.