🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Plastic Packaging Market

Plastic Packaging Market (By Material (Polyethylene (PE), Polyethylene Terephthalate (PET), Polypropylene (PP), Polystyrene (PS), Expanded Polystyrene (EPS), Polyvinyl Chloride (PVC), Bio-based plastics), By Product (Rigid, Bottles & Jars, Cans, Trays & Containers, Caps & Closures, Flexible, Wraps & Films, Bags, Pouches), By Technology (Injection Molding, Extrusion, Blow Molding, Thermoforming), By Application (Food & Beverages, Industrial Packaging, Pharmaceuticals, Personal & Household Care), By Region and Companies)

Jul 2024

Packaging and Transports

Pages: 160

ID: IMR1124

Plastic Packaging Market Overview

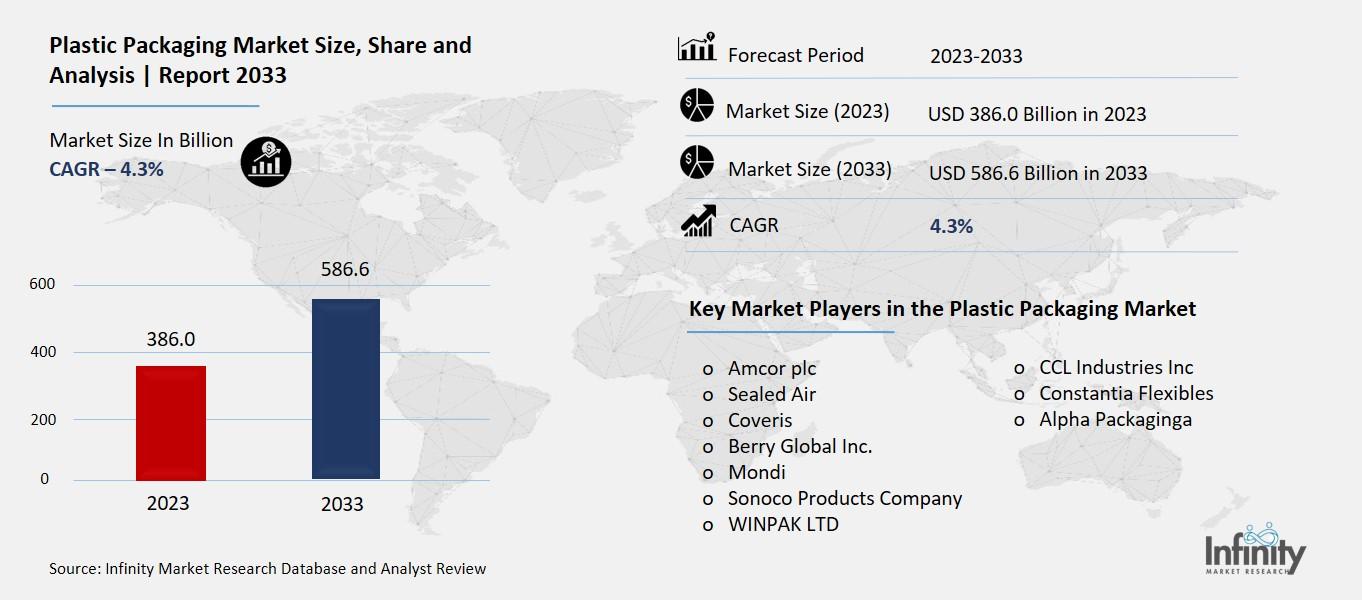

Global Plastic Packaging Market size is expected to be worth around USD 586.6 Billion by 2033 from USD 386.0 Billion in 2023, growing at a CAGR of 4.3% during the forecast period from 2023 to 2033.

The Plastic Packaging Market refers to the industry that creates containers, bags, bottles, and other packaging materials using plastic. These materials are widely used for storing and transporting goods like food, beverages, cosmetics, and household products. Plastic packaging is chosen for its durability, flexibility, and ability to protect items from moisture and damage during handling and shipping. It plays a crucial role in preserving the freshness and quality of products on store shelves and in homes.

In recent years, concerns have arisen about the environmental impact of plastic packaging due to its persistence in the environment and potential harm to wildlife. Efforts are underway to develop more sustainable alternatives and to recycle more plastic to reduce waste. Despite these challenges, plastic packaging remains popular due to its affordability and versatility, continuing to be a significant part of the global packaging industry.

Drivers for the Plastic Packaging Market

Convenience and Durability

Plastic packaging offers unmatched convenience and durability, making it ideal for a wide range of applications. It is lightweight, easy to shape into different forms like bottles, containers, and bags, and is resistant to breakage during transportation and handling. This durability ensures that products remain intact from production to consumption, reducing losses due to damage.

Cost-Effectiveness

One of the primary drivers of the plastic packaging market is its cost-effectiveness compared to other materials like glass or metal. Plastic is cheaper to manufacture and lighter to transport, leading to lower production and shipping costs for companies. This affordability makes it an attractive choice for both manufacturers and consumers, contributing to its widespread adoption across various industries.

Versatility and Customizability

Plastic packaging is highly versatile and can be customized to meet specific product requirements. Manufacturers can easily modify the shape, size, and color of plastic containers to enhance product appeal and brand visibility. This flexibility allows for innovative packaging designs that attract consumers and differentiate products in competitive markets.

Barrier Properties

Plastic packaging provides excellent barrier properties that protect products from moisture, oxygen, and contaminants. This helps in extending the shelf life of perishable goods such as food and pharmaceuticals, maintaining their quality and safety over time. These barrier properties are crucial in ensuring product integrity and consumer satisfaction, driving the demand for plastic packaging solutions.

Growth in End-User Industries

The growth of key end-user industries such as food and beverage, healthcare, personal care, and household products significantly contributes to the expansion of the plastic packaging market. These industries rely heavily on efficient and protective packaging solutions to meet consumer demands for convenience, hygiene, and safety. As consumer lifestyles evolve and demand for packaged goods continues to rise globally, the need for innovative plastic packaging solutions is expected to grow further.

Technological Advancements

Advancements in plastic manufacturing technologies and materials science have spurred innovation in the packaging industry. New developments in biodegradable and recyclable plastics aim to address environmental concerns while maintaining the functional benefits of traditional plastics. These technological advancements support sustainable practices and drive market growth by offering eco-friendly alternatives to conventional plastic packaging.

Restraints for the Plastic Packaging Market

Environmental Concerns and Regulatory Pressures

One of the primary restraints for the plastic packaging market is increasing environmental awareness and stringent regulatory measures. Plastic packaging is often criticized for its environmental impact, including littering, marine pollution, and contribution to landfill waste. Governments and environmental agencies worldwide are imposing stricter regulations on plastic usage, promoting recycling initiatives, and encouraging the adoption of sustainable packaging alternatives. These regulatory pressures compel manufacturers to reconsider their packaging strategies and invest in eco-friendly solutions to mitigate environmental harm.

Shift Towards Sustainable Packaging Alternatives

The growing consumer preference for sustainable and biodegradable packaging alternatives presents a significant restraint for the plastic packaging market. Consumers are increasingly conscious of environmental issues and prefer products packaged in materials perceived as more eco-friendly, such as paper, cardboard, glass, and bio-based plastics. This shift in consumer behavior has prompted companies to explore and invest in sustainable packaging innovations that reduce dependence on traditional plastics. As a result, the demand for non-plastic packaging materials continues to rise, posing a competitive challenge to the plastic packaging industry.

Recycling and Waste Management Challenges

Effective recycling and waste management of plastic packaging pose significant challenges due to the complexity of plastic materials and the global infrastructure required for recycling. Many types of plastics are not easily recyclable or require specialized processes, limiting the scalability of recycling efforts. Inadequate recycling infrastructure in certain regions further exacerbates the challenge, leading to low recycling rates and increased plastic waste accumulation in landfills and oceans. Addressing these challenges requires substantial investment in recycling technologies, infrastructure development, and consumer education on proper recycling practices.

Public Perception and Consumer Backlash

Public perception of plastic packaging as environmentally harmful has led to consumer backlash against brands using excessive or non-recyclable plastic packaging. Social media and environmental advocacy campaigns amplify consumer concerns, influencing purchasing decisions and brand reputations. Companies are under increasing pressure to demonstrate commitment to sustainability and transparency in their packaging practices to retain consumer trust and loyalty. Negative publicity related to plastic pollution incidents further intensifies public scrutiny and regulatory scrutiny, impacting market dynamics and consumer perception of plastic packaging products.

Opportunity in the Plastic Packaging Market

Demand Growth in Emerging Markets

One of the major opportunities for the plastic packaging market lies in the expanding demand from emerging economies. Rapid urbanization, rising disposable incomes, and changing lifestyles in countries across Asia-Pacific, Latin America, and Africa are driving increased consumption of packaged goods. This demographic shift towards convenience-oriented lifestyles fuels the demand for reliable and cost-effective packaging solutions, creating opportunities for market expansion in these regions. Manufacturers are increasingly focusing on catering to the unique needs and preferences of emerging markets through localized production, distribution networks, and product customization.

Technological Advancements and Material Innovations

Technological advancements and innovations in plastic materials present opportunities for enhancing the performance and sustainability of plastic packaging. Research and development efforts are focused on developing eco-friendly alternatives such as bio-based plastics, recyclable materials, and advanced barrier technologies. These innovations aim to reduce the environmental impact of plastic packaging while maintaining its functional benefits such as durability, flexibility, and product protection. Companies investing in research and partnerships with technology providers are well-positioned to capitalize on emerging trends and consumer demands for sustainable packaging solutions.

E-commerce and Online Retailing

The exponential growth of e-commerce and online retailing represents a significant opportunity for the plastic packaging market. The shift towards online shopping platforms has increased the demand for protective and visually appealing packaging solutions that ensure product integrity during shipping and handling. Plastic packaging offers lightweight, customizable, and cost-effective options that meet the stringent logistics and branding requirements of e-commerce retailers. As online shopping continues to surge globally, there is a growing need for innovative packaging designs that enhance consumer experience, minimize shipping costs, and reduce environmental footprint.

Aging Population and Healthcare Sector

The aging population and increasing healthcare expenditures present opportunities for specialized plastic packaging solutions. The healthcare sector requires packaging materials that ensure sterility, safety, and compliance with regulatory standards for pharmaceuticals, medical devices, and healthcare products. Plastic packaging offers hygienic, tamper-evident, and easy-to-use solutions that support patient compliance and product integrity. With the global healthcare industry expanding, particularly in regions with aging populations like Europe and North America, there is a growing demand for innovative packaging solutions that cater to healthcare-specific requirements.

Sustainable Packaging Initiatives

Growing consumer awareness and regulatory pressures have spurred demand for sustainable packaging solutions, presenting opportunities for the plastic packaging market to innovate and differentiate. Companies investing in sustainable packaging initiatives, such as recyclable materials, biodegradable plastics, and closed-loop recycling systems, can capitalize on shifting consumer preferences towards environmentally friendly products. Sustainable packaging not only meets regulatory requirements but also enhances brand reputation, fosters consumer loyalty, and drives market competitiveness in a progressively environmentally conscious marketplace.

Trends for the Plastic Packaging Market

Shift Towards Sustainable Packaging Solutions

A prominent trend in the plastic packaging market is the shift towards sustainable solutions. Consumers and regulatory bodies are increasingly concerned about the environmental impact of plastic packaging, leading to growing demand for recyclable, biodegradable, and compostable materials. Companies are investing in research and development to innovate sustainable packaging alternatives that reduce plastic waste and carbon footprint. This trend is driving collaboration across the industry to develop closed-loop recycling systems and adopt eco-friendly packaging practices, aligning with global sustainability goals and consumer expectations.

Focus on Lightweight and Flexible Packaging

Another trend shaping the plastic packaging market is the emphasis on lightweight and flexible packaging solutions. Advancements in polymer technology have enabled the development of thinner yet robust packaging materials that offer superior protection and reduced material usage. Lightweight packaging not only lowers transportation costs and carbon emissions but also enhances shelf appeal and convenience for consumers. This trend is particularly prevalent in the food and beverage sectors where packaging design plays a critical role in maintaining product freshness and extending shelf life.

Digital Printing and Personalization

Digital printing technologies are revolutionizing the plastic packaging industry by enabling high-quality, customizable designs at lower costs and faster production times. Brands are leveraging digital printing capabilities to create visually appealing packaging that stands out on retail shelves and resonates with target consumers. Personalized packaging allows companies to enhance brand recognition, communicate product information effectively, and engage consumers through interactive and engaging packaging experiences. This trend is driving innovation in packaging design and marketing strategies, enabling brands to differentiate themselves in competitive markets.

Increased Focus on Food Safety and Shelf-Life Extension

Food safety and shelf-life extension remain critical priorities in the plastic packaging market. Packaging materials with advanced barrier properties and antimicrobial coatings are being developed to preserve food freshness, prevent contamination, and reduce food waste. Manufacturers are investing in active and intelligent packaging technologies that monitor and maintain product quality throughout the supply chain. This trend is driven by stringent regulatory standards, consumer demand for safer products, and industry efforts to enhance sustainability by minimizing food loss and packaging waste.

Adoption of Smart Packaging Technologies

The integration of smart packaging technologies is emerging as a significant trend in the plastic packaging market. Smart packaging solutions incorporate sensors, indicators, and tracking systems to provide real-time information about product condition, authenticity, and shelf life. These technologies enable manufacturers and retailers to optimize inventory management, enhance supply chain visibility, and ensure product integrity and safety. Smart packaging also facilitates interactive consumer experiences through augmented reality and digital content, transforming traditional packaging into a tool for customer engagement and brand storytelling.

Segments Covered in the Report

By Material

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Polystyrene (PS)

- Expanded Polystyrene (EPS)

- Polyvinyl Chloride (PVC)

- Bio-based plastics

- Others

By Product

- Rigid

- Bottles & Jars

- Cans

- Trays & Containers

- Caps & Closures

- Flexible

- Wraps & Films

- Bags

- Pouches

- Others

By Technology

- Injection Molding

- Extrusion

- Blow Molding

- Thermoforming

- Others

By Application

-

Food & Beverages

-

Industrial Packaging

-

Pharmaceuticals

-

Personal & Household Care

-

Other Applications

Segment Analysis

By Material Analysis

The polystyrene (PS), expanded polystyrene (EPS), polyvinyl chloride (PVC), bio-based plastics, polyethylene (PE), polyethylene terephthalate (PET), polypropylene (PP), and polystyrene (PS) segments make up the plastic packaging market.

In 2023, the material segment consisting of polyethylene terephthalate (PET) held a market share of over 32.8%. Its outstanding qualities—transparency, and a lightweight, and robust barrier against gases and moisture-account for this promising future. PET is widely used to package a wide range of drinks, such as juices, soft drinks, water, vegetable oils, energy drinks, and other foods and beverages. Because of its capacity to preserve product freshness and integrity, it is also utilized in the packaging of dried and fresh fruits, nuts, and snacks.

Owing to its reputation for being resistant to chemical solvents like bases and acids and for being mechanically sturdy, polypropylene accounts for a significant portion of the market. It is widely utilized in the production of various plastic packaging items used in the food beverage and dairy sectors, including bottles, caps, containers, and packaging films.

By Product Analysis

Because of its superior durability and visual appeal, the rigid segment of the plastic packaging market held the greatest revenue share of over 59.7% in 2023. In addition, elements including rigid packaging's strong barrier against light, moisture, and oxygen helped explain why the segment held a larger share in 2023. Pallets, intermediate bulk containers, and other industrial packaging products can be reused, which is expected to encourage the development of rigid plastic products.

There are two divisions within the rigid plastic-type segment: bottles and jars, cans, trays and containers, caps and closures, etc. Because they are inexpensive, convenient, and perform better than other materials, plastic bottles are widely used in beverage packaging. On the other hand, because of their lighter weight and attractive design, trays and containers are used in the food service and packaged food industries. Four sub-segments within the flexible packaging type are wraps and films, bags, pouches, and others. In comparison to more rigid items like bottles and jars, pouches use less plastic material to manufacture, which is why they are becoming increasingly popular in the market.

By Technology Analysis

Since extrusion technology is used to make most flexible packaging products, including bags, pouches, and films, it held the greatest revenue share in the technology segment in 2023-more than 40.2%. In the upcoming years, it is anticipated that the extrusion segment's demand will increase due to the expanding popularity of flexible packaging items, which are more affordable and environmentally friendly than their corresponding rigid products.

Many food and drink goods, including dairy, bread, meat, and other things, are packed in thermoformed packaging because it provides a good barrier against air pollutants, oxygen, and chemicals while extending the shelf life of the product. Additionally, thermoformed packaging is less expensive and enhances the visual attractiveness of packaged goods; these benefits have led to a greater uptake of thermoformed packaging in the food and beverage industry. Industrial containers, crates, caps, and closures are examples of products made of stiff or durable plastic packaging that are often produced using injection molding techniques.

By Application Analysis

In 2023, the application category for food and beverages dominated the market with a revenue share of more than 50.8%. Throughout the projected period, the segment is anticipated to experience significant expansion. The packaging and processed food production industries have grown as a result of shifting consumer tastes and lifestyles, which is expected to drive up demand for plastic packaging. Additionally, rising alcohol and non-alcoholic beverage consumption, particularly among youth, is anticipated to fuel market expansion.

Due to its simplicity, single-serve consumer packaging has seen a tremendous increase in the last several years. The demand for packaged drinking water has increased globally due to growing consumer attention to health and well-being, increased awareness of waterborne diseases, and rising spending capacities. These factors are projected to have a favorable impact on consumers.

Growing consumer awareness of hygiene and grooming has led to tremendous growth in this market. Growing consumer interest in plant-based or clean-label cosmetics combined with increased awareness of health and wellness in emerging nations is also anticipated to be a major factor in the segment's growth over the forecast period.

Regional Analysis

The report offers market information for North America, Europe, Asia-Pacific, and the rest of the world, broken down by region. The plastic packaging market in North America increased at a 40.70% CAGR throughout the study. The food and beverage, industrial, healthcare, and personal care sectors have all seen a rise in the use of plastic packaging because of its flexible properties.

The plastic packaging market with the biggest share is found in North America. This is primarily due to advancements in food packaging technology and an increase in the availability of packaged organic food items in this area. This is the most attractive market for packaged food supplies because of individual's busy work schedules and increased preference for convenience and ready-to-eat meals. Furthermore, because packaging was seen as an essential function, the US plastic packaging market maintained the biggest market share. According to the FDA, there isn't a current packaging-related COVID-19 virus transmission in the US. On the other hand, some sources claim that viruses can live for one to three days on packing materials.

Competitive Analysis

Owing to the existence of both large international corporations and medium- and small-sized domestic players, the market is highly fragmented. The market for plastic packaging is steadily adopting sustainable packaging materials due to strict laws on excessive plastic packaging consumption and rising consumer awareness of sustainability. Prominent firms in the worldwide plastic packaging industry are mostly utilizing acquisition tactics as a means of augmenting their geographic reach and production capacities.

Recent Developments

In October 2023: Greif Inc., a US-based company that produces industrial packaging goods and services, paid USD 538 billion to acquire PACKCHEM Group SAS, a French producer of barrier and non-barrier jerrycans and small plastic containers. This acquisition allowed Greif Inc. to expand its product line horizontally.

In March 2023: SK Chemicals purchased Shuye, For USD 100 billion, a Chinese manufacturer of green materials, including its chemically recycled PET and BHET business division.

Key Market Players in the Plastic Packaging Market

-

Amcor plc

-

Sealed Air

-

Coveris

-

Berry Global Inc.

-

Mondi

-

Sonoco Products Company

-

WINPAK LTD

-

CCL Industries Inc

-

Constantia Flexibles

- Alpha Packaginga

|

Report Features |

Description |

|

Market Size 2023 |

USD 386.0 Billion |

|

Market Size 2033 |

USD 586.6 Billion |

|

Compound Annual Growth Rate (CAGR) |

4.3% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Material, Product, Technology, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Amcor plc, Sealed Air, Coveris, Berry Global Inc., Mondi, Sonoco Products Company, WINPAK LTD, CCL Industries, Inc, Constantia Flexibles, Alpha Packaging, Other Key Players |

|

Key Market Opportunities |

Demand Growth in Emerging Markets |

|

Key Market Dynamics |

Growth in End-User Industries |

📘 Frequently Asked Questions

1. How much is the Plastic Packaging Market in 2023?

Answer: The Plastic Packaging Market size was valued at USD 386.0 Billion in 2023.

2. What would be the forecast period in the Plastic Packaging Market report?

Answer: The forecast period in the Plastic Packaging Market report is 2023-2033.

3. Who are the key players in the Plastic Packaging Market?

Answer: Amcor plc, Sealed Air, Coveris, Berry Global Inc., Mondi, Sonoco Products Company, WINPAK LTD, CCL Industries, Inc, Constantia Flexibles, Alpha Packaging, Other Key Players

4. What is the growth rate of the Plastic Packaging Market?

Answer: Plastic Packaging Market is growing at a CAGR of 4.3% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.