🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Poly (L-Lactic) Acid Market

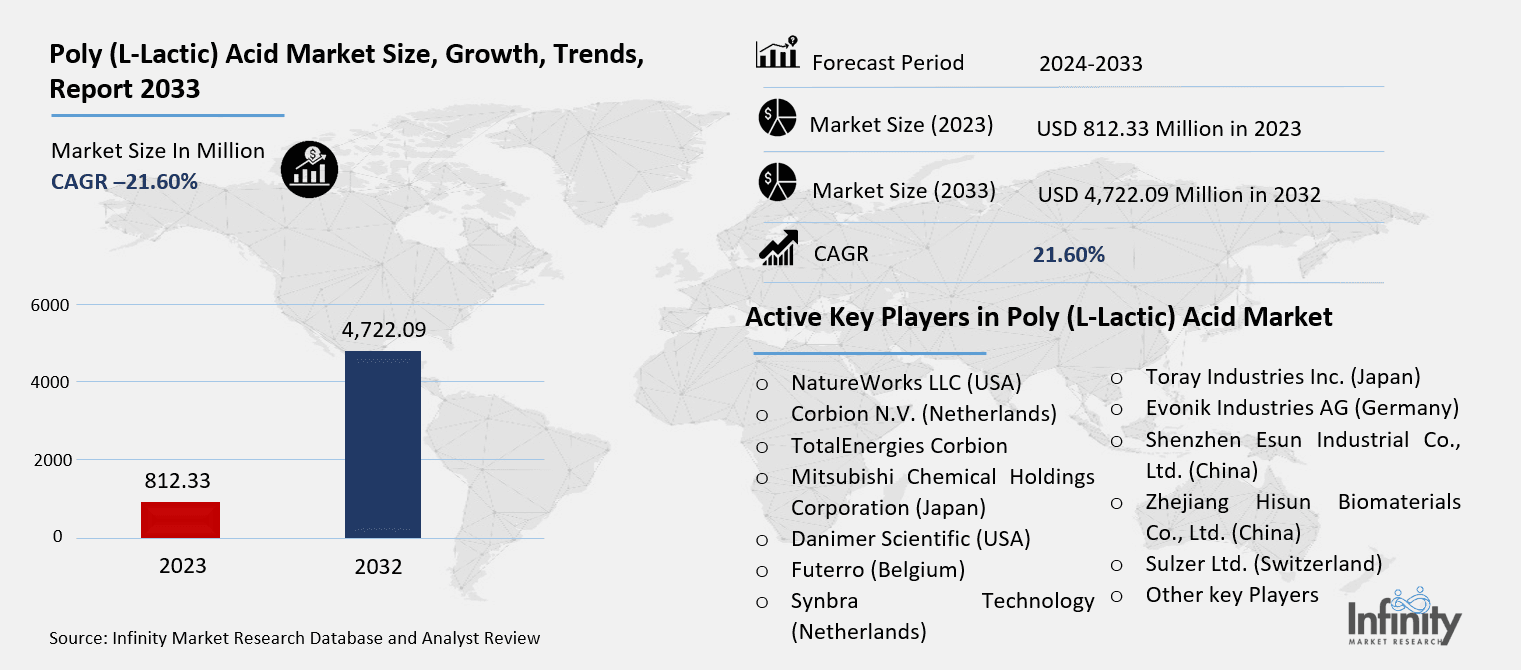

Poly (L-Lactic) Acid Market Global Industry Analysis and Forecast (2024-2032) By Raw Material(Corn, Sugarcane, Cassava, Others),By Application(Packaging, Biomedical, Textiles, Agriculture, Consumer Goods, Others),By End-Use Industry(Healthcare, Food & Beverage, Textile, Agriculture, Electronics, Others) and Region

Feb 2025

Chemicals and Materials

Pages: 138

ID: IMR1814

Poly (L-Lactic) Acid Market Synopsis

Poly (L-Lactic) Acid Market Size Was Valued at USD 812.33 Million in 2023, and is Projected to Reach USD 4,722.09 Million by 2032, Growing at a CAGR of 21.60% From 2024-2032.

Derived from renewable sources including corn, sugarcane, and cassava, Poly (L-Lactic) Acid (PLLA) is a biodegradable, bio-based thermoplastic polymer. High crystallinity polylactic acid (PLA) of this kind is fit for uses needing strength, biocompatibility, and environmental sustainability since it is PLLA's great mechanical qualities and biodegradability make it extensively employed in packaging, biomedical equipment, textiles, agriculture, and consumer goods.

Driven by increasing environmental concerns and strict laws about plastic waste, Poly (L-Lactic) Acid (PLLA) is becoming very popular as a sustainable substitute for traditional petroleum-based polymers. PLLA is synthesis mostly from lactic acid derived from fermented plant-based feedstocks including corn, sugarcane, and cassava since it is a bio-based polymer. Key forces driving the market forward include the worldwide drive toward lowering carbon footprints and the increasing acceptance of biodegradable plastics in several sectors. Given its great biocompatibility, high tensile strength, and natural degradation capacity in industrial composting circumstances, PLLA is used extensively in many different applications including packaging, biomedical implants, textiles, and consumer goods.

Regulatory support for sustainable materials, customer preference for environmentally friendly products, and ongoing material processing innovation fuel the need for PLLA most especially. PLLA is progressively taking place in food containers, films, and biodegradable bags in the packaging sector in place of traditional plastics. PLLA's non-toxic degrading characteristics make it quite valuable in the biomedical field for use in sutures, orthopedic implants, and drug delivery systems. Furthermore under investigation as a sustainable substitute for synthetic materials is PLLA fibers in the textile sector. PLLA does, however, have several drawbacks despite its many benefits including high production costs, poor thermal stability, and rivalry from other biodegradable polymers. Still, developments in polymer processing, cost-effective technologies, and a growing spectrum of uses should help to reinforce the direction of market growth in next years.

Poly (L-Lactic) Acid Market Outlook, 2023 and 2032: Future Outlook

Poly (L-Lactic) Acid Market Trend Analysis

Trend: Rising Demand for Sustainable Packaging

Demand for sustainable packaging materials, particularly Poly (L-Lactic) Acid (PLLA), is fast rising as worries about plastic pollution and laws limiting single-use plastics raise their profile. Strict rules imposed by governments all over are meant to reduce the usage of non-biodegradable plastics, so industry are moving toward environmentally friendly substitutes. Because PLLA is compostable and non-toxic, it is becoming increasingly popular as a preferred material for food packaging, throw-away tableware, and biodegradable films. Leading consumer goods firms and food brands are also using PLLA-based packaging solutions to satisfy customer tastes for ecologically friendly products and improve their sustainability aims.

Growing e-commerce has also driven demand for environmentally friendly packaging options; PLLA is one of a workable choice for flexible and protective packing. Major stores and logistics companies are investigating biodegradable materials to cut plastic waste and follow worldwide sustainability standards. Moreover, developments in barrier coatings and better mechanical qualities of PLLA packaging are increasing its relevance in several sectors, thereby guaranteeing its ongoing development in the field of sustainable packaging.

Opportunity: Expansion in the Biomedical Industry

Because of its biocompatibility, bioresorbability, and non-toxic degradation properties, the biomedical sector offers Poly (L-Lactic) Acid (PLLA) a great potential. Medical uses for PLLA have been many and include absorbable sutures, orthopedic implants, tissue engineering scaffolds, and drug delivery systems. The demand for bioresorbable polymers is projected to explode with growing healthcare improvements and the increasing frequency of chronic diseases, so enhancing the acceptance of PLLA in the biomedical field.

Moreover, continuous research and development projects improve the characteristics of PLLA for more general medical uses including 3D-printed biodegradable implants and controlled drug release systems. PLLA-based biomaterials also pique interest in minimally invasive operations and patient-friendly treatment choices. The integration of PLLA in innovative biomedical applications is expected to generate major market development prospects as the worldwide healthcare industry keeps changing.

Driver: Government Regulations Favoring Biodegradable Plastics

Government rules pushing the usage of biodegradable and bio-based polymers greatly influence the Poly (L-Lactic) Acid (PLLA) market. Strict rules aimed at lowering single-use plastics have been adopted by several nations, therefore pushing businesses to utilize PLLA instead. Accelerating the move toward bio-based polymers, environmental agencies and international organizations are pushing for the substitution of biodegradable materials for traditional petroleum-based plastics.

Further fueling PLLA demand are subsidies and incentives for bio-based plastic manufacture as well as prohibitions on traditional plastic bags and packaging. Manufacturers are encouraged to create and market PLLA-based goods by regulatory systems such the U.S. Biodegradable goods Institute (BPI) certification and the European Union's Single-Use Plastics Directory. These programs not only help companies using sustainable polymer technology develop their markets but also provide a competitive advantage.

Restraints: High Production Costs and Processing Challenges

Poly (L-Lactic) Acid (PLLA) is not widely used due in great part to its high production cost relative to other plastics. The very difficult fermentation and polymerization techniques needed to generate lactic acid from biomass add to the general PLLA production cost. PLLA is also less competitive in price-sensitive industries since the demand for specific processing tools and processes raises manufacturing expenses.

PLLA's poor thermal and mechanical stability presents another difficulty related to processing and application in high-temperature surroundings. PLLA has a lower melting point than petroleum-based polymers, hence its use in uses needing heat resistance is limited. While studies are still under progress to enhance PLLA's thermal characteristics by copolymerization and blending methods, these changes can raise expenses and so provide a barrier to general market acceptance.

Poly (L-Lactic) Acid Market Segment Analysis

Poly (L-Lactic) Acid Market Segmented on the basis of raw mate, application and end user.

By Raw Material

o Corn

o Sugarcane

o Cassava

o Others Corn

o Sugarcane

o Cassava

o Others

By Application

o Packaging

o Biomedical

o Textiles

o Agriculture

o Consumer Goods

o Others

By End User

o Packaging

o Biomedical

o Textiles

o Agriculture

o Consumer Goods

o Others

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Raw Material, Corn segment is expected to dominate the market during the forecast period

The availability and sustainability of raw resources including corn, sugarcane, and cassava drive mostly the Poly (L-Lactic) Acid (PLLA) market. Among these, corn is the most often utilized feedstock because of its established supply network, great starch content, and quick fermenting process. Major producers of corn-based PLLA, the United States and China gain from a lot of agricultural infrastructure. Because of its great supply of fermentable sugars, which improves cost-effectiveness, sugarcane-based PLLA is becoming popular especially in Brazil and South-east Asia. Key raw resource in tropical areas, cassava offers PLLA manufacture a substitute feedstock, therefore diversifying the market.

By Application, Packaging segment expected to held the largest share

Serving several sectors, the Poly (L-Lactic) Acid (PLLA) market finds packaging as the main application segment as demand for biodegradable materials in food and beverage packaging rises. PLLA's biocompatibility and resorbable characteristics are driving fast expansion of biomedical uses including sutures, orthopedic implants, and drug delivery systems. PLLA fibers are under study as sustainable fashion substitutes in the textiles sector. Other uses include consumer goods, where PLLA-based mulch films substitute for petroleum-based plastics in throw-away products, and agriculture, where they help environmentally responsible farming.

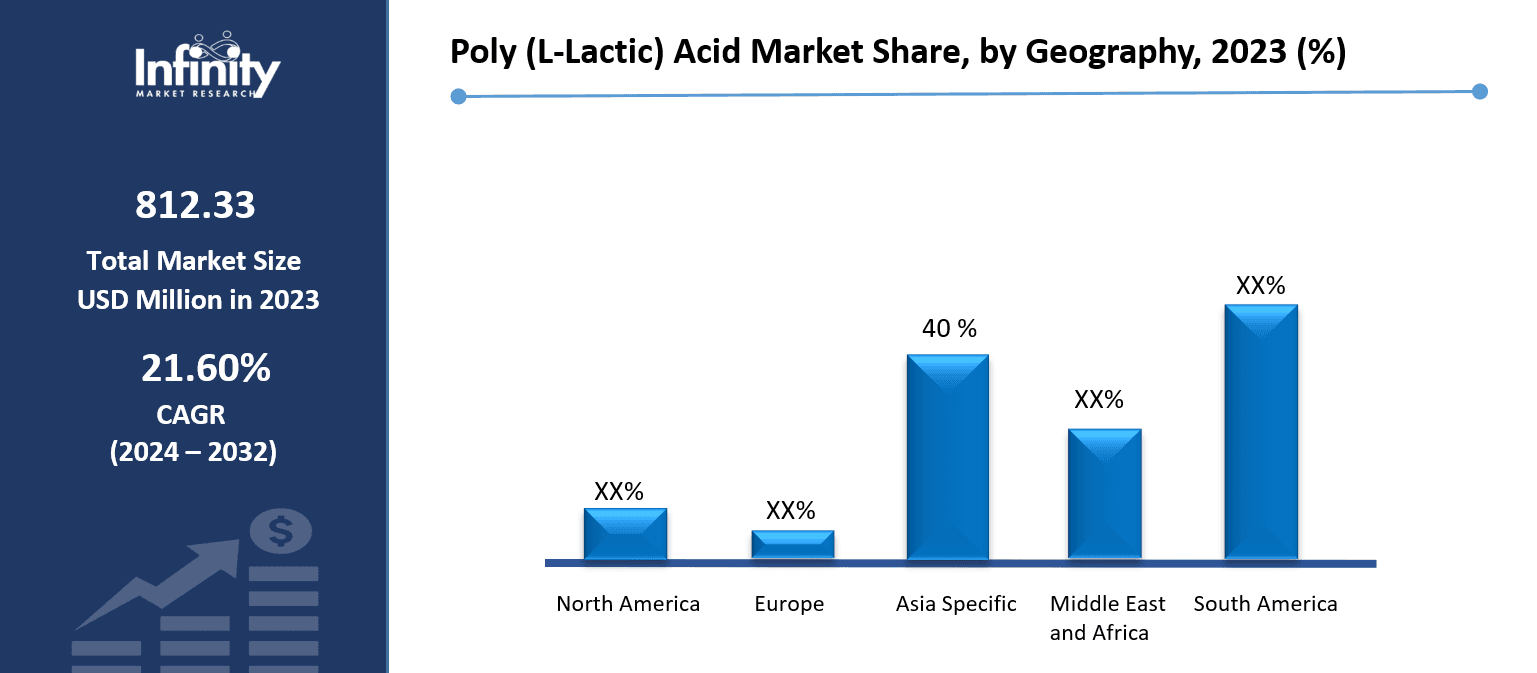

Poly (L-Lactic) Acid Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

Driven by robust regulatory systems, a well-established bio-based economy, and large expenditures in sustainable materials, North America is the dominating area in the Poly (L-Lactic) Acid (PLLA) market. Thanks to its superior biopolymer research, high-scale maize output, and government laws endorsing biodegradable polymers, the United States leads the industry. Prominent companies in the area gain from incentives for bioplastics and sustainable packaging, therefore increasing the acceptance of PLLA in many sectors.

Poly (L-Lactic) Acid Market Share, by Geography, 2023 (%)

Active Key Players in the Poly (L-Lactic) Acid Market

o NatureWorks LLC (USA)

o Corbion N.V. (Netherlands)

o TotalEnergies Corbion (Netherlands)

o Mitsubishi Chemical Holdings Corporation (Japan)

o Danimer Scientific (USA)

o Futerro (Belgium)

o Synbra Technology (Netherlands)

o Toray Industries Inc. (Japan)

o Evonik Industries AG (Germany)

o Shenzhen Esun Industrial Co., Ltd. (China)

o Zhejiang Hisun Biomaterials Co., Ltd. (China)

o Sulzer Ltd. (Switzerland)

o Other key Players

Key Industry Developments in the Poly (L-Lactic) Acid Market:

In May 2023, TotalEnergies Corbion collaborated with Bluepha Co. Ltd for making advanced sustainable biomaterials solutions in China. This is possible by combining polyhydroxyalkanoates (PHA) of Bluepha® with Luminy® polylactic acid technology

In May 2023, TotalEnergies Corbion announced an agreement with Xiamen Changsu Industrial Pte Ltd. For making advancements in the polylactic acid market. Both companies will operate together for market promotion, research and development, and product development of the latest applications and technologies of biaxially oriented polylactic acid (BOPLA)

In April 2023, NatureWorks LLC declared its collaboration with Jabil Inc. to provide the latest polylactic acid-based powder for particular laser sintering 3D printing platforms.

Global Poly (L-Lactic) Acid Market Scope

|

Global Poly (L-Lactic) Acid Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 812.33Million |

|

Forecast Period 2024-32 CAGR: |

21.60% |

Market Size in 2032: |

USD 4,722.09 Million |

|

Segments Covered: |

By Raw Material |

· Corn · Sugarcane · Cassava · Others | |

|

By Application |

· Packaging · Biomedical · Textiles · Agriculture · Consumer Goods · Others | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Government Regulations Favoring Biodegradable Plastics | ||

|

Key Market Restraints: |

· High Production Costs and Processing Challenges | ||

|

Key Opportunities: |

· Expansion in the Biomedical Industry | ||

|

Companies Covered in the report: |

· NatureWorks LLC (USA), Corbion N.V. (Netherlands), TotalEnergies Corbion (Netherlands), Mitsubishi Chemical Holdings Corporation (Japan), Danimer Scientific (USA), Futerro (Belgium), Synbra Technology (Netherlands) and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Poly (L-Lactic) Acid Market research report?

Answer: The forecast period in the Poly (L-Lactic) Acid Market research report is 2024-2032.

2. Who are the key players in the Poly (L-Lactic) Acid Market?

Answer: NatureWorks LLC (USA), Corbion N.V. (Netherlands), TotalEnergies Corbion (Netherlands), Mitsubishi Chemical Holdings Corporation (Japan), Danimer Scientific (USA), Futerro (Belgium), Synbra Technology (Netherlands) and Other Major Players.

3. What are the segments of the Poly (L-Lactic) Acid Market?

Answer: The Poly (L-Lactic) Acid Market is segmented into Raw Material, Application, End User and region. By Raw Material, the market is categorized into Corn, Sugarcane, Cassava, Others. By Application, the market is categorized into Packaging, Biomedical, Textiles, Agriculture, Consumer Goods, Others. By End-Use Industry, the market is categorized into Healthcare, Food & Beverage, Textile, Agriculture, Electronics, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Poly (L-Lactic) Acid Market?

Answer: Derived from renewable sources including corn, sugarcane, and cassava, Poly (L-Lactic) Acid (PLLA) is a biodegradable, bio-based thermoplastic polymer. High crystallinity polylactic acid (PLA) of this kind is fit for uses needing strength, biocompatibility, and environmental sustainability since it is PLLA's great mechanical qualities and biodegradability make it extensively employed in packaging, biomedical equipment, textiles, agriculture, and consumer goods.

5. How big is the Poly (L-Lactic) Acid Market?

Answer: Poly (L-Lactic) Acid Market Size Was Valued at USD 812.33Million in 2023, and is Projected to Reach USD 4,722.09 Million by 2032, Growing at a CAGR of 21.60% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.