🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Polyethylene Market

Polyethylene Market (By Product (Low-density Polyethylene (LDPE), High-density Polyethylene (HDPE), Linear Low-density Polyethylene (LLDPE), Other Products), By Application (Bottles & Containers, Films & Sheets, Bags & Sacks, Pipes & Fittings, Other Applications), By End-use (Packaging, Construction, Automotive, Agriculture, Consumer Electronics, Other End-uses), By Region and Companies)

Jul 2024

Chemicals and Materials

Pages: 218

ID: IMR1168

Polyethylene Market Overview

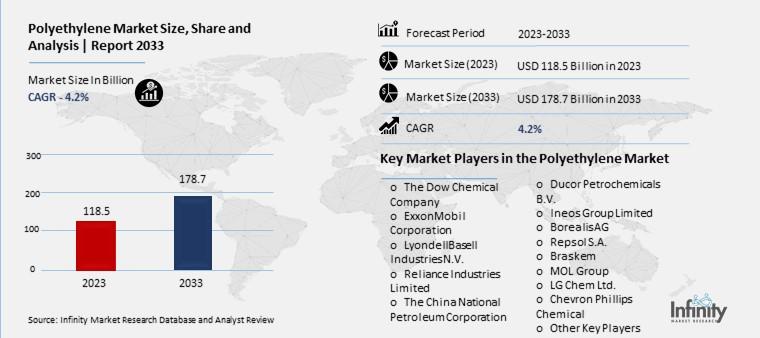

Global Polyethylene Market size is expected to be worth around USD 178.7 Billion by 2033 from USD 118.5 Billion in 2023, growing at a CAGR of 4.2% during the forecast period from 2023 to 2033.

The polyethylene market revolves around the production and distribution of polyethylene, a versatile plastic known for its durability and flexibility. This type of plastic is widely used in various industries due to its ability to withstand different temperatures and resist chemicals. It is commonly found in everyday items such as plastic bags, bottles, and packaging materials used in food, beverages, and personal care products. Its popularity stems from its ease of manufacturing, which allows for the production of items in different shapes, sizes, and colors to meet specific consumer and industrial needs.

In recent years, the polyethylene market has seen significant growth driven by the expanding global demand for packaging materials and consumer goods. Its applications extend beyond everyday products to include uses in the construction, agriculture, and healthcare sectors. As industries continue to innovate and adapt to changing consumer preferences and regulatory standards, the polyethylene market remains integral to meeting these evolving needs with its versatile and cost-effective solutions.

Drivers for the Polyethylene Market

Growing Demand for Packaging Materials

One of the primary drivers fueling the polyethylene market is the increasing global demand for packaging materials. Polyethylene, being lightweight, durable, and versatile, is extensively used in packaging applications across various industries. It is favored for its ability to protect goods from moisture, chemicals, and physical damage, making it ideal for packaging food, beverages, pharmaceuticals, and consumer products. The rise in e-commerce activities and online shopping has further boosted the demand for polyethylene packaging, as companies seek efficient and secure ways to deliver goods to consumers worldwide. This trend is expected to continue driving growth in the polyethylene market, particularly in flexible packaging solutions.

Expanding Applications in Consumer Goods

Polyethylene's wide-ranging applications in consumer goods contribute significantly to market growth. It is utilized in the production of everyday items such as plastic bags, containers, and household products due to its affordability and ease of manufacturing. In the healthcare sector, polyethylene is crucial for manufacturing medical devices, packaging pharmaceuticals, and creating sterile environments in hospitals. Its inert nature and ability to be sterilized make it a preferred material in medical applications. Moreover, the versatility of polyethylene allows for the production of toys, sports equipment, and automotive parts, catering to diverse consumer needs across different sectors.

Advancements in Plastic Recycling Technologies

Technological advancements in plastic recycling have emerged as a key driver for the polyethylene market. With increasing emphasis on sustainability and environmental conservation, there is growing investment in recycling technologies that enable the efficient recovery and reuse of polyethylene materials. Innovations in chemical recycling and mechanical recycling processes improve the quality and purity of recycled polyethylene, making it suitable for high-value applications. Governments and industries worldwide are implementing regulations and initiatives to promote the circular economy and reduce plastic waste, driving demand for recycled polyethylene and fostering market growth.

Rapid Urbanization and Infrastructure Development

The rapid pace of urbanization and infrastructure development globally is boosting the demand for polyethylene in construction and building materials. Polyethylene pipes and fittings are widely used in water supply, drainage systems, and gas distribution networks due to their durability, corrosion resistance, and lightweight properties. As urban populations grow, there is increasing investment in infrastructure projects, including housing, commercial buildings, and transportation networks, which require reliable and cost-effective materials like polyethylene. This trend is expected to support the expansion of the polyethylene market, particularly in emerging economies investing heavily in urban development.

Shift Towards Lightweight and Fuel-Efficient Vehicles

The automotive industry's shift towards lightweight materials to enhance fuel efficiency and reduce emissions is another significant driver for the polyethylene market. Polyethylene is used in automotive components such as bumpers, interior panels, and fuel tanks due to its lightweight nature and impact resistance. As automakers embrace electric vehicles (EVs) and hybrid technologies, there is increasing demand for polyethylene-based composites that offer superior performance characteristics while reducing vehicle weight. This trend is driven by stringent regulatory standards for vehicle emissions and fuel efficiency, prompting automotive manufacturers to adopt innovative materials like polyethylene to meet sustainability goals.

Increasing Demand in Agriculture and Horticulture

Polyethylene plays a vital role in agriculture and horticulture applications, contributing to market growth. Agricultural films made from polyethylene are used for greenhouse covering, mulching, and crop protection, enhancing crop yields and optimizing farming practices. The demand for polyethylene films in agriculture is driven by the need for efficient water management, soil protection, and climate control in various climatic conditions. Moreover, polyethylene products such as irrigation pipes and agricultural nets support sustainable farming practices by conserving water resources and protecting crops from pests and adverse weather conditions.

Restraints for the Polyethylene Market

Environmental Concerns and Plastic Waste Management

One of the primary restraints facing the polyethylene market is the growing environmental concerns associated with plastic pollution and waste management. Polyethylene, like other plastics, is non-biodegradable and can persist in the environment for hundreds of years, contributing to marine pollution and harming wildlife. Governments, environmental organizations, and consumers are increasingly advocating for sustainable practices and regulations aimed at reducing single-use plastics and promoting recycling. This regulatory scrutiny and public awareness are pressuring manufacturers to innovate and adopt eco-friendly alternatives, impacting the growth prospects of the polyethylene market.

Volatility in Raw Material Prices and Supply Chain Disruptions

The polyethylene market is susceptible to fluctuations in raw material prices, primarily derived from crude oil and natural gas. As polyethylene is derived from petrochemical feedstocks, changes in global oil prices and supply disruptions can significantly impact production costs and profit margins for manufacturers. Moreover, geopolitical tensions, natural disasters, and global economic uncertainties can disrupt supply chains, affecting the availability of raw materials and logistics operations. These factors pose challenges for market players in managing operational costs and maintaining competitive pricing amid volatile market conditions.

Regulatory Challenges and Compliance Issues

Stringent regulatory frameworks and evolving compliance requirements present another restraint for the polyethylene market. Governments worldwide are implementing regulations to address plastic pollution, promote recycling initiatives, and impose restrictions on single-use plastics. Compliance with these regulations often entails additional costs for manufacturers, including investments in recycling technologies, product redesigns, and meeting environmental standards. Furthermore, varying regulatory landscapes across different regions can create complexities in market expansion strategies and product distribution, hindering the growth potential of the polyethylene market.

Growing Preference for Sustainable Alternatives

The increasing consumer preference for sustainable and eco-friendly materials poses a significant challenge to the polyethylene market. Consumers, particularly in developed economies, are increasingly opting for biodegradable plastics, plant-based alternatives, and reusable packaging solutions to reduce their environmental footprint. This shift in consumer behavior towards sustainability is influencing purchasing decisions across various industries, including food and beverage, retail, and personal care products. Manufacturers in the polyethylene market are under pressure to innovate and offer recyclable or biodegradable polyethylene products to align with changing consumer preferences and regulatory expectations.

Impact of COVID-19 Pandemic on Market Dynamics

The global COVID-19 pandemic has disrupted supply chains, dampened consumer demand, and posed operational challenges for businesses in the polyethylene market. Lockdown measures, travel restrictions, and economic uncertainties have affected industrial activities and consumer spending patterns, impacting the overall demand for polyethylene products. Although the packaging sector witnessed increased demand for essential goods packaging during the pandemic, other segments such as automotive and construction experienced slowdowns. The pandemic-induced disruptions highlighted vulnerabilities in global supply chains and emphasized the need for resilience and adaptability in the polyethylene market.

Competitive Pressure and Market Consolidation

Intense competition among key players and market consolidation poses challenges for new entrants and smaller manufacturers in the polyethylene market. Established companies with extensive production capabilities, technological expertise, and global distribution networks have a competitive advantage in terms of economies of scale and brand recognition. Market consolidation through mergers, acquisitions, and strategic partnerships further strengthens the market position of dominant players, limiting opportunities for smaller firms to expand their market share. This competitive pressure underscores the importance of innovation, differentiation, and operational efficiency for sustained growth in the polyethylene market amidst competitive dynamics.

Opportunity in the Polyethylene Market

Rising Demand in Emerging Economies

An exciting opportunity for the polyethylene market lies in the rising demand from emerging economies. Countries in Asia-Pacific, Latin America, and Africa are experiencing rapid urbanization, industrialization, and growth in consumer spending. This demographic and economic shift is driving the demand for polyethylene products across various sectors, including packaging, construction, automotive, and consumer goods. As these regions continue to invest in infrastructure development, urban housing projects, and industrial expansion, there is a growing need for affordable and versatile materials like polyethylene to meet the evolving demands of modern lifestyles and urban landscapes.

Expansion of E-commerce and Retail Packaging

The expanding e-commerce sector presents a significant growth opportunity for the polyethylene market. With the proliferation of online shopping platforms and the shift towards digital retail channels, there is an increasing demand for efficient and sustainable packaging solutions. Polyethylene's properties, such as its lightweight, durability, and customizable designs, make it ideal for packaging goods sold online. The surge in e-commerce activities, coupled with changing consumer preferences for convenient and eco-friendly packaging, is driving innovation in polyethylene packaging solutions. Companies are focusing on developing recyclable and biodegradable polyethylene packaging options to align with environmental regulations and consumer expectations.

Technological Advancements in Material Science

Advancements in material science and polymer technology offer promising opportunities for the polyethylene market. Research and development efforts are focused on enhancing the performance characteristics of polyethylene, such as strength, flexibility, and recyclability. Innovations in polymer blends, additives, and processing techniques enable manufacturers to develop high-performance polyethylene products tailored for specific applications in the automotive, healthcare, agriculture, and industrial sectors. These technological advancements not only expand the application scope of polyethylene but also improve its environmental sustainability and cost-effectiveness, driving market growth and differentiation.

Focus on Sustainable Development Goals

The global focus on sustainable development goals (SDGs) presents an opportunity for the polyethylene market to innovate and promote sustainable practices. Governments, businesses, and consumers are increasingly prioritizing environmental stewardship, resource efficiency, and circular economy principles. Polyethylene manufacturers are investing in research and development of bio-based polyethylene, recycled plastics, and eco-friendly packaging solutions to reduce carbon footprint and support sustainable consumption patterns. The alignment of polyethylene products with SDGs, such as responsible consumption and production, climate action, and sustainable cities and communities, enhances market acceptance and competitiveness in the global marketplace.

Expansion of Healthcare and Medical Applications

The healthcare sector offers significant growth opportunities for polyethylene products, particularly in medical devices, pharmaceutical packaging, and healthcare infrastructure. Polyethylene's biocompatibility, stabilizability, and chemical resistance make it suitable for manufacturing medical implants, surgical instruments, and disposable medical supplies. The growing healthcare expenditures, aging population, and increasing prevalence of chronic diseases globally drive the demand for polyethylene-based healthcare solutions. Furthermore, advancements in polymer processing technologies enable the production of specialized polyethylene materials that meet stringent regulatory standards and healthcare industry requirements, fostering market expansion in this critical sector.

Innovation in Renewable Energy and Infrastructure

Innovation in renewable energy technologies and infrastructure development presents opportunities for the polyethylene market. Polyethylene is essential for manufacturing components used in renewable energy systems, such as solar panels, wind turbine blades, and energy storage systems. The transition towards clean energy sources and sustainable infrastructure projects requires durable, weather-resistant materials like polyethylene to support the expansion of renewable energy capacity and improve energy efficiency. As governments and private sectors invest in renewable energy initiatives and smart city projects, the demand for polyethylene products in the construction, utilities, and infrastructure sectors is expected to grow, creating new opportunities for market players.

Trends for the Polyethylene Market

Shift Towards Sustainable Packaging Solutions

A prominent trend in the polyethylene market is the shift towards sustainable packaging solutions. With increasing global awareness about environmental issues, there is a growing demand for eco-friendly packaging alternatives. Polyethylene manufacturers are focusing on developing recyclable and biodegradable materials that reduce environmental impact and meet regulatory requirements. Innovations in polymer technology and packaging design are enabling the production of lightweight yet durable polyethylene packaging solutions for various industries, including food and beverage, healthcare, and consumer goods. This trend is driven by consumer preferences for sustainable products and the implementation of stringent environmental policies worldwide.

Rise in Demand for Flexible Packaging

Flexible packaging continues to be a key trend in the polyethylene market, driven by its versatility, convenience, and cost-effectiveness. Polyethylene films and bags are widely used in flexible packaging applications due to their moisture resistance, barrier properties, and ability to preserve product freshness. The food and beverage industry, in particular, relies heavily on polyethylene flexible packaging for packaging snacks, ready-to-eat meals, beverages, and pharmaceutical products. The demand for flexible packaging is further fueled by the growth of e-commerce, increasing urbanization, and changing lifestyles that favor on-the-go consumption patterns.

Advancements in Polyethylene Recycling Technologies

Advancements in polyethylene recycling technologies are shaping the market landscape, offering new opportunities for sustainability and resource efficiency. Recycling initiatives are gaining traction globally, driven by regulatory frameworks and corporate sustainability goals. Polyethylene manufacturers are investing in recycling infrastructure and collaborating with recycling facilities to enhance the recyclability of polyethylene products. Mechanical recycling, chemical recycling, and feedstock recycling are some of the innovative approaches being explored to recover and reuse polyethylene waste effectively. These efforts aim to close the loop in the plastic lifecycle and minimize the environmental impact of polyethylene production and consumption.

Emergence of Bio-based Polyethylene

The emergence of bio-based polyethylene is a significant trend in response to the growing emphasis on reducing carbon footprint and dependence on fossil fuels. Bio-based polyethylene is derived from renewable resources such as sugarcane ethanol, offering a sustainable alternative to traditional petroleum-based polyethylene. Manufacturers are scaling up production capacities for bio-based polyethylene to meet consumer demand for environmentally friendly products. This trend aligns with global efforts to promote bioeconomy and achieve climate goals, driving innovation and market expansion in the bio-based polyethylene segment.

Increasing Adoption in Automotive and Construction Industries

Polyethylene's versatility and durability are driving its adoption in the automotive and construction industries, contributing to market growth. In automotive applications, polyethylene is used for manufacturing lightweight components, interior trim, fuel tanks, and under-the-hood parts, contributing to vehicle weight reduction and fuel efficiency. In the construction sector, polyethylene is employed in pipes, insulation materials, waterproof membranes, and roofing solutions due to its resistance to moisture, chemicals, and weathering. The demand for polyethylene in these industries is influenced by infrastructure development projects, urbanization trends, and advancements in material science that enhance performance and durability.

Growing Investments in Research and Development

Investments in research and development (R&D) are pivotal to driving innovation and market competitiveness in the polyethylene industry. Manufacturers are focusing on developing high-performance polyethylene grades, exploring new applications, and improving production processes to meet evolving customer demands and regulatory requirements. R&D initiatives encompass polymer chemistry, material engineering, and sustainable technologies aimed at enhancing product performance, recyclability, and environmental sustainability. These investments are expected to accelerate technological advancements and foster market growth in the polyethylene sector, positioning it as a cornerstone of the global plastics industry.

Segments Covered in the Report

By Product

o Low-density Polyethylene (LDPE)

o High-density Polyethylene (HDPE)

o Linear Low-density Polyethylene (LLDPE)

o Other Products

By Application

o Bottles & Containers

o Films & Sheets

o Bags & Sacks

o Pipes & Fittings

o Other Applications

By End-use

o Packaging

o Construction

o Automotive

o Agriculture

o Consumer Electronics

o Other End-uses

Segment Analysis

By Product Analysis

With a revenue share of more than 48.9% in 2023, the high-density polyethylene (HDPE) segment held the highest revenue share. The growing need for strong, corrosion-resistant materials in infrastructure and building projects is good for the HDPE market. The demand for HDPE is driven by its appropriateness for pipelines, geo-membranes, and other construction applications. Because of their flexibility, resilience to corrosion, and longevity, HDPE pipes are frequently utilized in irrigation, drainage, and water distribution systems. The need for durable and effective solutions in agriculture and water infrastructure improves the HDPE segment's growth prospects.

Furthermore, it is anticipated that demand for HDPE will increase due to ongoing infrastructure construction and rising urbanization. The HDPE's contribution to vital industries like construction emphasizes how important it is to the market's overall stability and growth. From 2024 to 2030, the linear Low-density Polyethylene (LLDPE) category is anticipated to develop at the quickest CAGR of 5.5%. LLDPE is in high demand in the electrical and communications industries because of its use in the manufacture of cable insulation and electrical conduits. For insulating cables to be protected from sunlight, fire, inclement weather, and chemical deterioration, LLDPE's insulating qualities, resilience, and resistance to the environment are crucial.

By Application Analysis

Application-wise, the bottles & containers segment dominated the market in 2023, accounting for a sizeable 40.2% of total revenue. The desire for effective and affordable packaging solutions across a range of industries is fueling the expansion of the bottles and containers market, which is a reflection of PE's versatility in satisfying these industries' varied packaging requirements.

The category for films and sheets is anticipated to expand at the quickest rate between 2024 and 2030—a 6.0% CAGR. The expansion of this market is being driven by the current trend of smart packaging. RFID tags and QR codes are only two examples of features embedded into polyethylene films. Real-time tracking, authentication, and information sharing regarding packaged goods are made possible by these technologies. By enabling the integration of smart packaging solutions, the films & sheets market improves supply chain visibility and engages consumers with interactive packaging.

By End-use Analysis

With a sales share of more than 51.7%, the packaging sector led the end-use segment in 2023. The expansion of this market is being driven by the widespread usage of PE in the manufacturing of plastic bags, pouches, and flexible packaging films. PE packaging is essential for maintaining product freshness, increasing shelf life, and improving the overall aesthetic appeal of products on retail shelves, ranging from food and beverages to pharmaceuticals and consumer goods.

Because of the increasing focus on sustainable and energy-efficient construction methods, the construction sector is predicted to develop at the fastest compound annual growth rate (CAGR) of 5.5% from 2024 to 2030. This puts PE in a vital position to improve the performance of building structures. Furthermore, the construction industry's demand for PE-made geomembranes and geotextiles propels product acceptance.

Regional Analysis

Asia Pacific accounted for approximately 43.2% of the worldwide polyethylene market in 2023, a substantial share given the region's fast development and urbanization. The packaging, automotive, construction, and consumer goods industries all of which are significant users of polyethylene—have experienced significant expansion in the region. The growing middle class and rising urbanization are the main drivers of this rise. China in particular has emerged as a major exporter of polyethylene products in the region, meeting global demand.

A lot of the Asia-Pacific region's nations, such as South Korea, Japan, and India, are developing their infrastructure quickly, which calls for a lot of building supplies, like polyethylene for pipes, cables, and insulation. Furthermore, the high population density of the region—particularly in nations like China and India—translates into a sizable market for polyethylene products.

The market for polyethylene packaging materials is being driven by consumers' increasing desire for packaged items and contemporary retail models. Due to substantial investments in petrochemical facilities, the Asia Pacific region has emerged as a center for the manufacturing of polyethylene. The market is expanding because raw resources are more readily available and production prices are cheaper. The market domination of the Asia Pacific area is a consequence of its dynamic economic environment and the crucial role that it plays in the global supply chain for polyethylene and related products.

Competitive Analysis

Solvay, Honeywell International, Inc., Lanxess AG, Arkema Group, and Stella Chemifa Corp. are some of the major companies in the worldwide polyethylenes industry. These businesses are spending money on R&D to produce cutting-edge polyethylene blends with better performance, like stronger barrier qualities without sacrificing recyclable nature. Businesses are looking into alternatives to single-use plastic packaging as a result of growing awareness of the problem of plastic pollution.

Recent Developments

In November 2023: As part of its plan to become carbon neutral by 2050, Dow stated that it would invest USD 6.5 billion in the Fort Saskatchewan Path2Zero project in Alberta, Canada. A new ethylene factory will be built as part of the project, and the capacity of polyethylene will be increased by 2 million metric tons yearly. The enhanced capacity will be implemented gradually, with the first phase expected to start in 2027. Construction is expected to start in 2024.

In October 2023: Plans were revealed by Borealis AG and TotalEnergies SE to build a USD 1.4 billion Borstar PE unit inside their joint venture, Baystar. With a capacity of 625,000 metric tons per year, this PE unit represents a major expansion, more than doubling the Baystar site's current production capabilities, which include two PE production units already in place.

Key Market Players in the Polyethylene Market

o LyondellBasell Industries N.V.

o Reliance Industries Limited

o The China National Petroleum Corporation

o Ducor Petrochemicals B.V.

o Borealis AG

o Repsol S.A.

o Braskem

o MOL Group

o LG Chem Ltd.

o Chevron Phillips Chemical

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 118.5 Billion |

|

Market Size 2033 |

USD 178.7 Billion |

|

Compound Annual Growth Rate (CAGR) |

4.2% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Product, Application, End Use, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

The Dow Chemical Comp, LyondellBasell Industries N.V., ExxonMobil Corporation, The China National Petroleum Corporation, Reliance Industries Limited, Ineos Group Limited, Ducor Petrochemicals B.V., Repsol S.A., Borealis AG, MOL Group, Braskem, Chevron Phillips Chemical, LG Chem Ltd., Other Key Players |

|

Key Market Opportunities |

Expansion of E-commerce and Retail Packaging |

|

Key Market Dynamics |

Growing Demand for Packaging Materials |

📘 Frequently Asked Questions

1. How much is the Polyethylene Market in 2023?

Answer: he Polyethylene Market size was valued at USD 118.5 Billion in 2023.

2. What would be the forecast period in the Polyethylene Market report?

Answer: The forecast period in the Polyethylene Market report is 2023-2033.

3. Who are the key players in the Polyethylene Market?

Answer: The Dow Chemical Comp, LyondellBasell Industries N.V., ExxonMobil Corporation, The China National Petroleum Corporation, Reliance Industries Limited, Ineos Group Limited, Ducor Petrochemicals B.V., Repsol S.A., Borealis AG, MOL Group, Braskem, Chevron Phillips Chemical, LG Chem Ltd., Other Key Players

4. What is the growth rate of the Polyethylene Market?

Answer: Polyethylene Market is growing at a CAGR of 4.2% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.