🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Polymer Resin for Packaging and Oil Gas Market

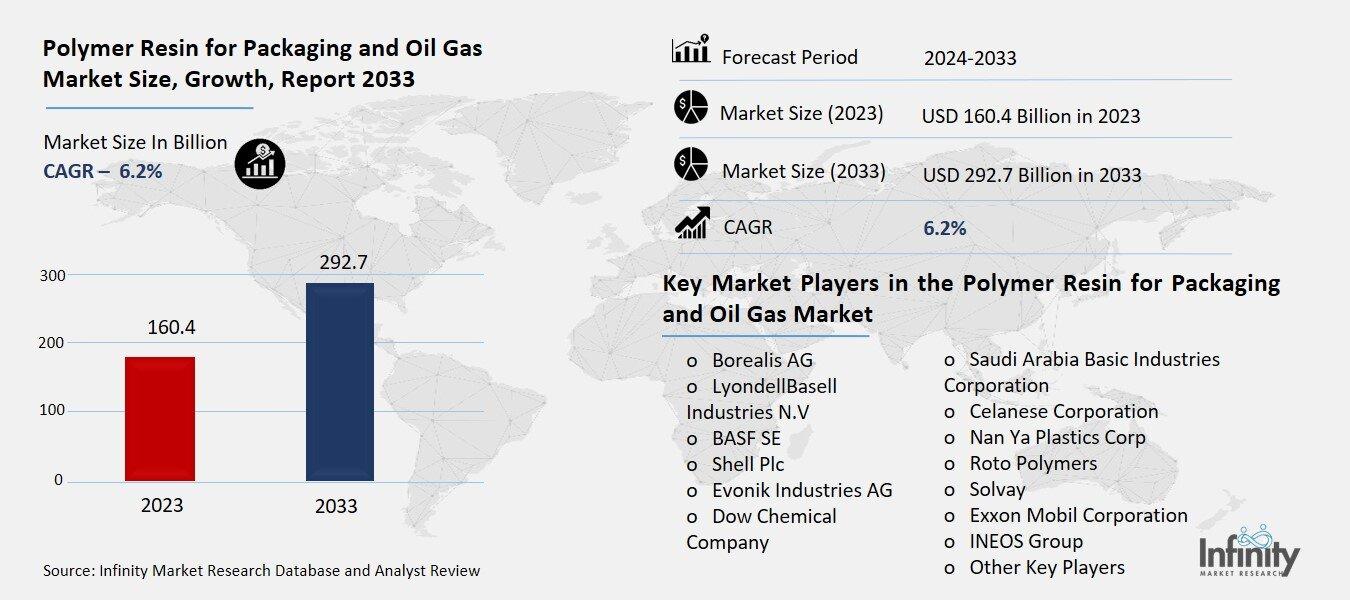

Global Polymer Resin for Packaging and Oil Gas Market (By Type, Polypropylene, Polyethylene, and Other Types; By Application, Packaging and Oil & Gas; By Region and Companies), 2024-2033

Nov 2024

Chemicals and Materials

Pages: 138

ID: IMR1298

Polymer Resin for Packaging and Oil Gas Market Overview

Global Polymer Resin for Packaging and Oil Gas Market acquired the significant revenue of 160.4 Billion in 2023 and expected to be worth around USD 292.7 Billion by 2033 with the CAGR of 6.2% during the forecast period of 2024 to 2033. The polymer resin market for packaging and the oil and gas industry is expanding due to the use of lightweight, durable, and versatile materials. In packaging, polymer resins like polyethylene, polypropylene, and polyvinyl chloride are widely used because the former material possesses attributes like high barrier characteristics and low moisture permeability; the latter material’s ability to be molded into various forms. These attributes improve shelf life of products, they are used widely in food, drugs, and other consumable products.

Similarly, in the oil and gas sector, polymer resins are used in the fabrication of pipes, tanks and protective coatings because of their chemical inertness high strength to weight ratio and ease of application. Ongoing advances in resin technology that has seen the development of Bioplastics and high performance composites are also widening the fields of uses in both sectors, evidenced by environmental concerns and regulations. Driven by changing consumer preferences and emerging economies supplemented by sustainability as one of the significant forces, the demand for recyclable and biodegradable resins will change the market outlook for investment and create opportunities for new players across the value chain.

Drivers for the Polymer Resin for Packaging and Oil Gas Market

Increased Demand for Sustainable Packaging

Rising environmental consciousness is rapidly changing people’s preferences and market norms, which in turn is promising a higher call for polymer resins that are recyclable and eco-friendly. Since the recent past, there has been a growing consciousness about the negative impacts of plastics, to the environment as well as people, thus, the demand for the products that are environmentally friendly. This is now putting pressure to the manufacturers to come up with new strategies of manufacturing as they embark on research on known polymer materials that can help reduce on environmental effects. Business have since shifted transplanting emphasis on how the product fulfills the needs and want of users while at the same time being environmentally conscious with issues such as carbon footprint and pollution.

Restraints for the Polymer Resin for Packaging and Oil Gas Market

Fluctuating Raw Material Prices

The volatility in the prices of petroleum-based raw materials significantly impacts the production costs and profit margins for manufacturers of polymer resins. These raw materials, primarily derived from crude oil, serve as the foundational inputs for a wide array of polymer products, including those used in packaging and the oil and gas industry. Fluctuations in crude oil prices can be driven by various factors, such as geopolitical tensions, changes in supply and demand dynamics, and natural disasters, which create uncertainty for manufacturers who rely heavily on these inputs.

Opportunity in the Polymer Resin for Packaging and Oil Gas Market

Integration of Smart Packaging Technologies

The incorporation of smart technologies, such as QR codes and RFID (Radio-Frequency Identification) tags, into polymer packaging is revolutionizing the way brands interact with consumers and manage their supply chains. These technologies offer a range of benefits that enhance consumer engagement and product traceability, ultimately improving the overall user experience and bolstering brand loyalty. By integrating QR codes into packaging, brands enable consumers to access detailed product information, including sourcing details, nutritional data, and usage instructions, simply by scanning the code with their smartphones. This transparency not only empowers consumers to make informed decisions but also fosters a sense of trust and connection between brands and their audiences.

Trends for the Polymer Resin for Packaging and Oil Gas Market

Shift Toward Circular Economy

A growing emphasis on circular economy principles is fundamentally transforming the way manufacturers approach the design and production of polymer products. The circular economy focuses on minimizing waste and promoting the continual use of resources, urging companies to rethink traditional linear production models that often lead to significant environmental impacts. This shift encourages manufacturers to prioritize the development of recyclable and reusable polymer products, aligning with sustainability goals and responding to increasing consumer demand for eco-friendly solutions.

As manufacturers adopt circular economy practices, they are re-evaluating product design to facilitate end-of-life recyclability and reuse. This involves selecting materials that can be easily recycled and integrating features that promote the safe disassembly of products at the end of their life cycles.

Segments Covered in the Report

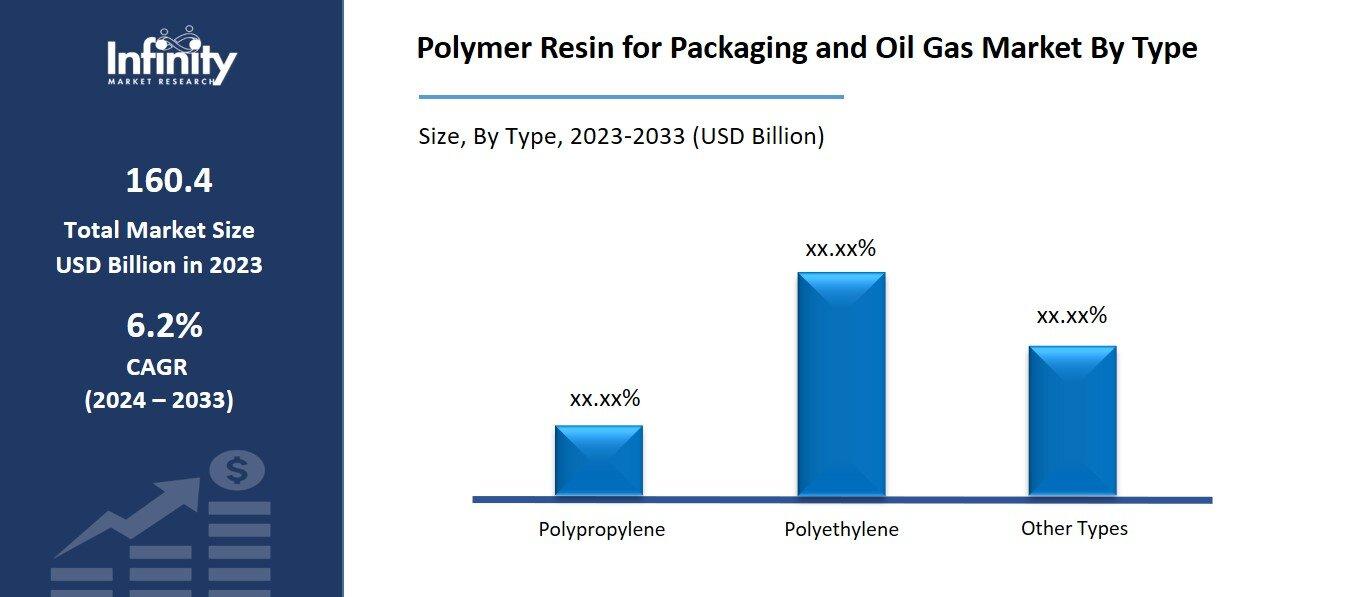

By Type

o Polypropylene

o Polyethylene

o Other Types

By Application

o Packaging

o Cups & Containers

o Bottles

o Films & Wraps

o Bags & Pouches

o Others

o Oil & Gas

o Seals

o Pipelines

o Equipment Parts

o Coatings

o Others

Segment Analysis

By Type Analysis

On the basis of type, the market is divided into polypropylene, polyethylene, and other types. Among these, buttercream frosting segment acquired the significant share around 41.1% in the market owing to its versatility and wide range of applications across various industries. Polypropylene is favored for its excellent chemical resistance, lightweight nature, and durability, making it an ideal choice for packaging solutions, automotive components, and consumer products.

In the packaging sector, polypropylene's ability to create moisture barriers and its resistance to fatigue make it a popular material for both flexible and rigid packaging formats. This is particularly important in food packaging, where maintaining product freshness and extending shelf life are critical.

By Application Analysis

On the basis of application, the market is divided into packaging (including cups and containers, bottles, films and wraps, bags and pouches, and others) and oil & gas (including seals, pipelines, equipment parts, coatings, and others). Among these, packaging held the prominent share of the market. The increasing demand for convenient, safe, and effective packaging solutions in the food and beverage sector significantly contributes to the growth of this segment. As consumer preferences shift towards on-the-go products and e-commerce shopping, the need for robust and versatile packaging options has escalated. Items such as cups, containers, and pouches are essential for maintaining product integrity, extending shelf life, and providing user-friendly experiences. This trend is further supported by innovations in polymer technologies that enhance the performance of packaging materials, such as improved barrier properties and the introduction of sustainable options.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 32.1% of the market. The increasing consumption of packaged goods, driven by e-commerce growth and changing consumer preferences, has further propelled the demand for polymer resins in packaging applications. The presence of key players and established supply chains in North America has facilitated the rapid introduction of innovative polymer solutions that cater to evolving market needs.

Moreover, the region’s investment in infrastructure development and the ongoing expansion of the oil and gas sector contribute to the demand for polymer resins used in pipelines, coatings, and equipment parts. The combination of these factors positions North America as a leading region in the polymer resin market, with a robust outlook for continued growth driven by technological advancements and sustainability initiatives.

Competitive Analysis

The competitive landscape of the polymer resin market is characterized by a dynamic interplay of established players and emerging companies, all striving to capture market share and meet evolving consumer demands. Key industry participants, including global giants like BASF, Dow Chemical Company, and LyondellBasell Industries, leverage their extensive research and development capabilities, vast distribution networks, and strong brand recognition to maintain competitive advantages. These companies invest significantly in innovation, focusing on developing sustainable and high-performance polymer resins that align with the growing emphasis on environmental responsibility.

Recent Developments

In May 2023, LyondellBasell and Veolia Belgium established a joint venture (JV) for Quality Circular Polymers (QCP), focusing on plastic recycling. Under the terms of the agreement, LyondellBasell will acquire Veolia Belgium's 50% stake in QCP, thereby becoming the sole owner of the company.

In November 2022, Shell Chemical Appalachia LLC, a subsidiary of Shell plc, announced the commencement of operations at Shell Polymers Monaca (SPM), a chemical project located in Pennsylvania. This facility is notable for being the first major polyethylene manufacturing complex in the Northeastern United States, with a targeted production capacity of 1.6 million tonnes per year.

Key Market Players in the Polymer Resin for Packaging and Oil Gas Market

o Borealis AG

o LyondellBasell Industries N.V

o BASF SE

o Shell Plc

o Evonik Industries AG

o Dow Chemical Company

o Saudi Arabia Basic Industries Corporation

o Celanese Corporation

o Nan Ya Plastics Corp

o Roto Polymers

o Solvay

o Exxon Mobil Corporation

o INEOS Group

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 160.4 Billion |

|

Market Size 2033 |

USD 292.7 Billion |

|

Compound Annual Growth Rate (CAGR) |

6.2% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Borealis AG, LyondellBasell Industries N.V, BASF SE, Shell Plc, Evonik Industries AG, Dow Chemical Company, Saudi Arabia Basic Industries Corporation, Celanese Corporation, Nan Ya Plastics Corp, Roto Polymers, Solvay, Exxon Mobil Corporation, INEOS Group, and Other Key Players. |

|

Key Market Opportunities |

Integration of Smart Packaging Technologies |

|

Key Market Dynamics |

Increased Demand for Sustainable Packaging |

📘 Frequently Asked Questions

1. Who are the key players in the Polymer Resin for Packaging and Oil Gas Market?

Answer: Borealis AG, LyondellBasell Industries N.V, BASF SE, Shell Plc, Evonik Industries AG, Dow Chemical Company, Saudi Arabia Basic Industries Corporation, Celanese Corporation, Nan Ya Plastics Corp, Roto Polymers, Solvay, Exxon Mobil Corporation, INEOS Group, and Other Key Players.

2. How much is the Polymer Resin for Packaging and Oil Gas Market in 2023?

Answer: The Polymer Resin for Packaging and Oil Gas Market size was valued at USD 160.4 Billion in 2023.

3. What would be the forecast period in the Polymer Resin for Packaging and Oil Gas Market?

Answer: The forecast period in the Polymer Resin for Packaging and Oil Gas Market report is 2024-2033.

4. What is the growth rate of the Polymer Resin for Packaging and Oil Gas Market?

Answer: Polymer Resin for Packaging and Oil Gas Market is growing at a CAGR of 6.2% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.