🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Polypropylene Market

Polypropylene Market Global Industry Analysis and Forecast (2024-2033) by Type (Homopolymer and Copolymer), Application (Blow Molding, Injection Molding, Extrusion Molding, and Other Applications), End-Use Industry (Automotive, Medical, Packaging, Building & Construction, Electrical & Electronics, and Other End-Use Industries) and Region

May 2025

Chemicals and Materials

Pages: 138

ID: IMR1943

Polypropylene Market Synopsis

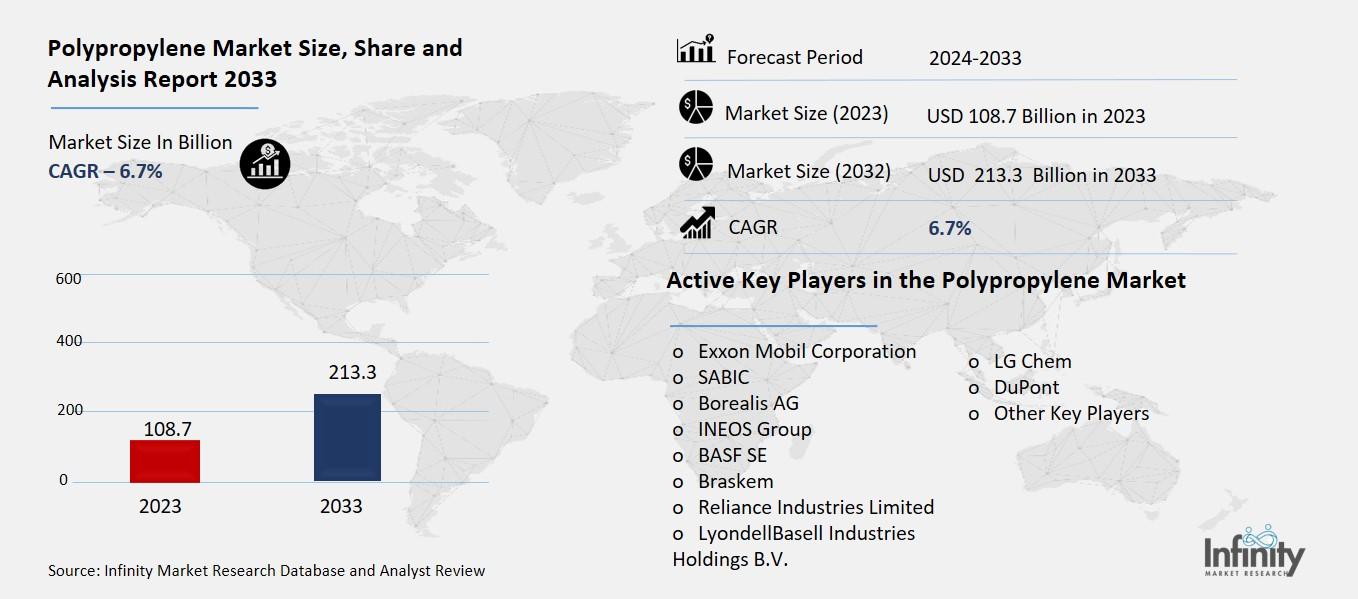

The Global Polypropylene Market was valued at USD 108.7 billion in 2023 and is expected to grow from USD 116.1 billion in 2024 to USD 213.3 billion by 2033, reflecting a CAGR of 6.7% over the forecast period.

The global plastics industry includes polypropylene as its major segment because this substance serves many applications through its advantageous material attributes. As a thermoplastic polymer with high durability and chemical resistance and versatile applications polypropylene provides optimal solutions for packaging and automotive components and textile materials and medical devices among others. The market grows steadily through emerging economy demand together with rising automotive and packaging lightweight material usage paired with continuous developments in polymeric processing methods. The plastic industry encounters difficulties because of plastic waste environmental issues and unpredictable raw material costs together with sustainability standards established by governmental regulations.

Polypropylene Market Driver Analysis

Rising Demand from Packaging Industry

Food together with consumer products get packaged frequently with polypropylene due to its useful attributes and cost-effectiveness. Lightweight properties of this material lower supply costs and improve efficiency during handling operations alongside its robust resistance to moisture which protects against water degradation and extends product lifespan. The chemical resistance properties of polypropylene enable safe contact with numerous food products that do not affect their quality or safety standards. The material allows for attractive designs since it offers high transparency and flexibility when shaped. The costs related to manufacturing with polypropylene remain lower compared to alternative packaging materials thereby promoting affordability to producers. Polypropylene serves as a preferred material for containers and bottles together with films and caps in the worldwide packaging sector because of its various ideal attributes.

Polypropylene Market Restraint Analysis

Regulatory Restrictions

The growing restrictions on single-use plastics by governments creates major obstacles for polypropylene use throughout industries especially in the packaging domain. The environmental crisis and landfill and ocean plastic waste reduction have spurred numerous governments to put restrictions on single-use plastics in their territories. The regulatory actions focusing on single-use plastics directly decrease the market need for polypropylene because this material exists extensively in disposable food packaging items such as food containers and straws alongside wrappers. The industry faces two options: changing to products made from recyclable or biodegradable substances or redesigning existing products to achieve compliance levels. The regulatory pressure creates dual impacts on polypropylene production through its influence on supply chains and forces companies to develop sustainable alternatives which may modify its market expansion.

Polypropylene Market Opportunity Analysis

Emergence of Bio-Based Polypropylene

The dedication of investors to support green solutions with bio-based origins generates strong market potential for polypropylene products that benefit the environment. Industrial operations seek products which decrease their carbon footprint while offering environmental protection because of growing ecological and governmental regulations. Research into bio-based polypropylene continues to increase due to its development from renewable resources such as sugarcane or corn instead of traditional fossil fuels. Sustainable polypropylene materials duplicate conventional polypropylene performance but support environmental responsibility better. Government initiatives and growing market demand for sustainable products allow companies to engage in further investments in this domain. The combination of renewable resource-derived polypropylene development creates optimistic prospects for merging performance needs within industrial sectors with sustainable initiatives.

Polypropylene Market Trend Analysis

Innovation in Polymer Blends and Composites

The creation of advanced polypropylene composites serves as a key driver to increase the material's applications for demanding uses especially in automotive and electronic products. Polypropylene reinforcement with glass fibers or minerals or nanomaterials results in substantial improvements of its mechanical performance and thermal capabilities and impact tolerance. These composites enable the automotive sector to create light-weight durable components including bumpers dashboards and interior trims which improve both fuel efficiency and reduce environmental emissions. Defective polypropylene compositions are used to build electronic components including housings and insulation units and static-resistant structural elements which need stable dimensions. The innovative polypropylene developments enable superior performance in challenging environments thus accelerating industry movements toward fuel-efficient light-weight solutions with reduced total cost.

Polypropylene Market Segment Analysis

The Polypropylene Market is segmented on the basis of Type, Application, and End-Use Industry.

By Type

o Homopolymer

o Copolymer

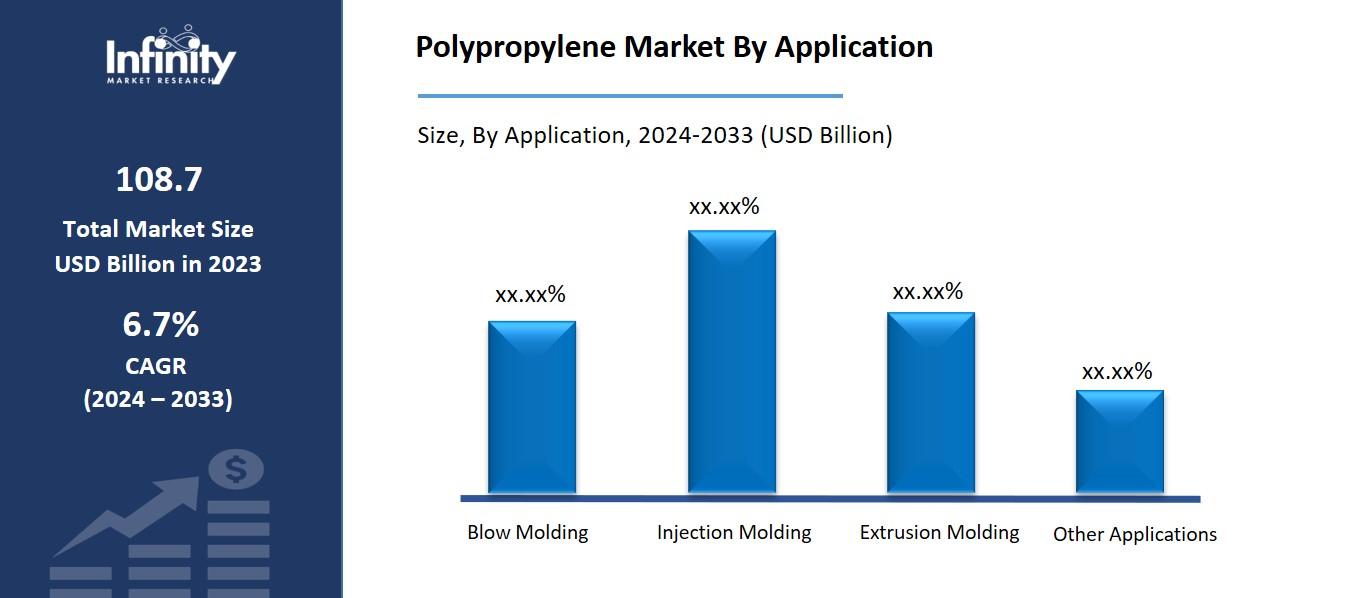

By Application

o Blow Molding

o Injection Molding

o Extrusion Molding

o Other Applications

By End-Use Industry

o Automotive

o Medical

o Packaging

o Building & Construction

o Electrical & Electronics

o Other End-Use Industries

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Type, Homopolymer Segment is Expected to Dominate the Market During the Forecast Period

The types discussed in this research study, the homopolymer segment is expected to account for the largest market share of polypropylene market in the forecast period. Polypropylene holds its leading position because of superior strength and stiffness together with enhanced clarity when compared with copolymer materials. Homopolymer polypropylene rules numerous applications that need strong tensile strength and rigidity because it appears widely in packaging components alongside automotive parts and household goods and textiles production. Industry manufacturers select this material because of its outstanding processing capabilities and budget-friendly nature to fulfill their production needs. The market demand for durable lightweight materials in industrial and consumer products drives the continued use of homopolymer polypropylene which ensures its position as the industry leader.

By Application, the Injection Molding Segment is Expected to Held the Largest Share

The forecast period shows injection molding as the leading segment in terms of polypropylene application share. The material provides excellent moldability together with low shrinkage and high impact resistance properties which make it optimal for producing complex precise components. The injection-molding process of polypropylene produces numerous products that serve multiple applications in the automotive field along with consumer goods industry and packaging sector and electronics manufacturing. The lightweight nature along with durability and cost-efficiency characteristics support polypropylene applications in various industries. The growth of this segment continues to rise due to the increasing market need for mass-produced plastic parts in automotive interiors as well as containers alongside household items.

By End-Use Industry, the Automotive Segment is Expected to Held the Largest Share

The automotive field maintains its position as the leading segment in the polypropylene market throughout the predicted period. The market expansion for lightweight durable cost-effective materials is responsible for this trend because these materials help improve both fuel efficiency as well as lower vehicle emissions. The automotive sector relies heavily on polypropylene due to its ability to resist chemical exposure as well as its high impact strength and durability for producing interior parts such as dashboards as well as door panels and trims and under-the-hood components. The adoption of electric technology and environmental standards pushes manufacturers to implement lightweight materials including polypropylene because these materials fulfill necessary performance goals. Automakers expect to expand polypropylene usage in the automotive sector because they have prioritized weight reduction without reducing safety or quality standards.

Polypropylene Market Regional Insights

Asia Pacific is Expected to Dominate the Market Over the Forecast period

The Asia Pacific region is expected to dominate the polypropylene market over the forecast period, driven by rapid industrialization, urbanization, and strong growth in key end-use industries such as packaging, automotive, construction, and electronics. The growing manufacturing sector and expanding consumer base together with increasing infrastructure expansion in China India and Southeast Asian countries results in rising polypropylene consumption levels. The region has two main advantages: multiple polymer producing facilities and low labor costs alongside governmental backing of industrial development. The combination of automotive and electronics manufacturing bases increases the market need for polypropylene components. The continued economic growth combined with population increase establishes Asia-Pacific as the main player in global polypropylene market consumption.

Recent Development

In November 2023, Borealis AG completed the acquisition of Rialti, a producer of recycled polypropylene compounds, enhancing its portfolio of PP compounds made from mechanical recyclates by an additional 50,000 tons per year.

In December 2020, LyondellBasell introduced Beon3D, an innovative range of polypropylene products designed to enable the one-step production of high-quality, complex 3D-printed objects. Developed by integrating advanced polymer technologies with additive manufacturing, Beon3D is tailored to serve key industries including transportation, industrial, building and construction, and consumer goods.

Active Key Players in the Polypropylene Market

o Exxon Mobil Corporation

o SABIC

o Borealis AG

o INEOS Group

o BASF SE

o Braskem

o Reliance Industries Limited

o LyondellBasell Industries Holdings B.V.

o LG Chem

o DuPont

o Other Key Players

Global Polypropylene Market Scope

|

Global Polypropylene Market | |||

|

Base Year: |

2024 |

Forecast Period: |

2024-2033 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 108.7 Billion |

|

Market Size in 2024: |

USD 116.1 Billion | ||

|

Forecast Period 2024-33 CAGR: |

6.7% |

Market Size in 2033: |

USD 213.3 Billion |

|

Segments Covered: |

By Type |

· Homopolymer · Copolymer | |

|

By Application |

· Blow Molding · Injection Molding · Extrusion Molding · Other Applications | ||

|

By End-Use Industry |

· Automotive · Medical · Packaging · Building & Construction · Electrical & Electronics · Other End-Use Industries | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Rising Demand from Packaging Industry | ||

|

Key Market Restraints: |

· Regulatory Restrictions | ||

|

Key Opportunities: |

· Emergence of Bio-Based Polypropylene | ||

|

Companies Covered in the report: |

· Exxon Mobil Corporation, SABIC, Borealis AG, INEOS Group and Other Key Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Polypropylene Market Research report?

Answer: The forecast period in the Polypropylene Market Research report is 2024-2033.

2. Who are the key players in the Polypropylene Market?

Answer: Exxon Mobil Corporation, SABIC, Borealis AG, INEOS Group and Other Key Players.

3. What are the segments of the Polypropylene Market?

Answer: The Polypropylene Market is segmented into Type, Application, End-Use Industry, and Regions. By Type, the market is categorized into Homopolymer and Copolymer. By Application, the market is categorized into Blow Molding, Injection Molding, Extrusion Molding, and Other Applications. By End-Use Industry, the market is categorized into Automotive, Medical, Packaging, Building & Construction, Electrical & Electronics, and Other End-Use Industries. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Polypropylene Market?

Answer: The polypropylene market describes the worldwide industry dedicated to polypropylene production combined with its distribution and polypropylene product sales as a thermoplastic polymer. The polypropylene market services diverse industries including packaging alongside automotive as well as construction and textiles with healthcare and consumer goods sectors totalling its operations. Polypropylene gains high value in these sectors due to its lightweight structure and durable properties together with chemical resistance and budget-friendly nature. The market for polypropylene shows direct correlation with economic expansion along with industrial development especially in developing economies. The market environment develops through manufacturing innovations combined with recycling technological advancements.

5. How big is the Polypropylene Market?

Answer: The Global Polypropylene Market was valued at USD 108.7 billion in 2023 and is expected to grow from USD 116.1 billion in 2024 to USD 213.3 billion by 2033, reflecting a CAGR of 6.7% over the forecast period.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.