🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Polystyrene (PS) and Expanded Polystyrene (EPS) Market

Global Polystyrene (PS) and Expanded Polystyrene (EPS) Market (By Type, Polystyrebe and Expanded Polystyrene (EPS); By Application, Packaging, Building and Construction, Electrical and Electronics, and Other Applications; By Region and Companies), 2024-2033

Dec 2024

Chemicals and Materials

Pages: 138

ID: IMR1368

Polystyrene (PS) and Expanded Polystyrene (EPS) Market Overview

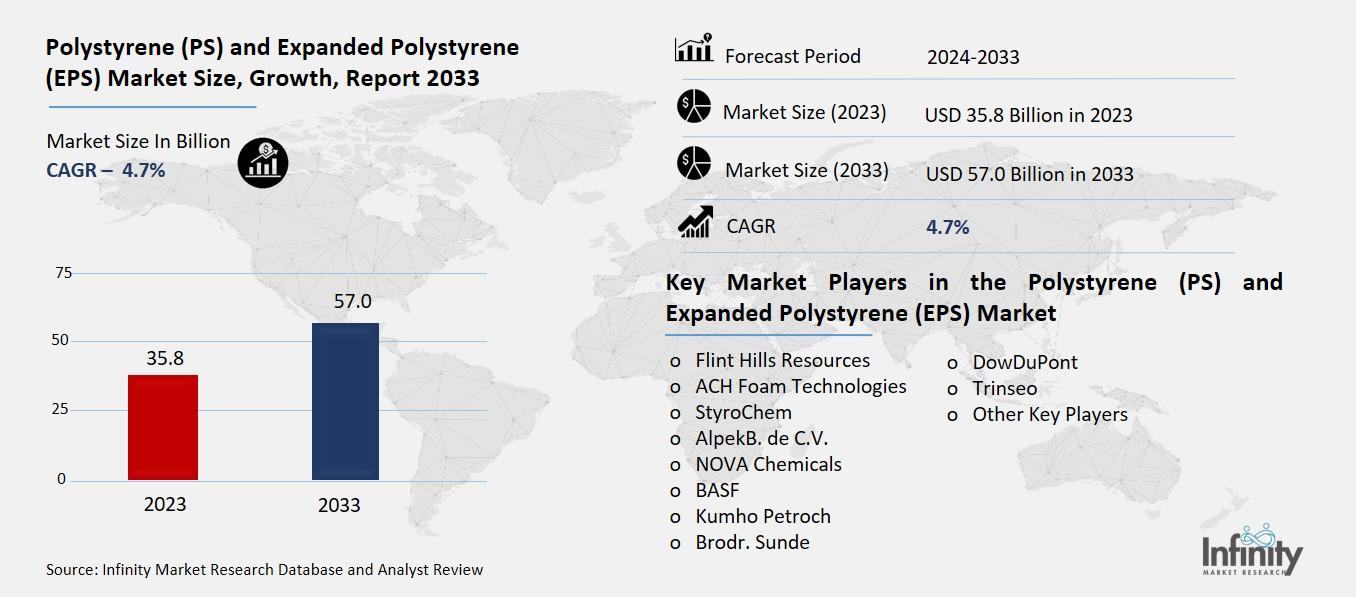

Global Polystyrene (PS) and Expanded Polystyrene (EPS) Market acquired the significant revenue of 35.8 Billion in 2023 and expected to be worth around USD 57.0 Billion by 2033 with the CAGR of 4.7% during the forecast period of 2024 to 2033. Global demand for polystyrene (PS) and expanded polystyrene (EPS) products is stimulated by high demands for these products in packaging, construction, automotive, and consumer goods industries. There is polystyrene – a versatile thermoplastic very rigid thermoplastic with outstanding clarity and easy moulding, used in food packaging, disposable cutlery, and electronics. Such as EPS for insulation, thermal insulating materials, thermal support and cushioning materials, construction structural materials such as. Opening of new markets such as e-commerce and increasing need for green packaging solutions also continues to drive the market.

However, the market has issues such as, the increase in regulations on the use of single-use plastics majorly because of the non-biodegradable nature of the material, this has led to more investment in the development of recycling methods as well as green products. The World Wide Web and new economies besides the technological progress of the manufacturing methods are forecasted to drive the market significantly.

Drivers for the Polystyrene (PS) and Expanded Polystyrene (EPS) Market

Expanding Consumer Electronics Sector

Polystyrene (PS) is in high demand for electronics uses because of it possesses properties as a material that makes it suitable for production of light and robust electronic products. The material has a good electrical resistivity that makes the product safe to use in electronic circuits, it also has strength and impact strength that gives support to delicate parts. E-mail also has low staking which is compulsory in modern lightweight portable gadgets including Smartphone, laptop, and wearable gadgets.

Furthermore, it can be easily cast, which means that client-specific and constrained shapes and forms can be designed and integrated into selection. The affordability of PS also increases its usability since it enables the organization to continue producing electronics products cheaply in a sensitive market.

Restraints for the Polystyrene (PS) and Expanded Polystyrene (EPS) Market

Volatility in Raw Material Prices

The production of polystyrene (PS) and expanded polystyrene (EPS) relies heavily on petroleum-based raw materials, primarily styrene monomer, a derivative of crude oil. This dependence makes the industry highly susceptible to fluctuations in global oil prices, which are influenced by factors such as geopolitical tensions, changes in production levels, and shifts in global demand. Price volatility in crude oil directly impacts the cost of styrene monomer, creating uncertainty in production expenses for manufacturers. These fluctuating costs can erode profit margins, especially in competitive markets where passing on increased costs to consumers is challenging. Moreover, this reliance on non-renewable resources raises concerns about long-term sustainability and pushes manufacturers to explore alternatives, such as bio-based or recycled styrene.

Opportunity in the Polystyrene (PS) and Expanded Polystyrene (EPS) Market

Recycling and Circular Economy

Advancements in polystyrene (PS) recycling technologies are playing a crucial role in mitigating environmental impacts associated with plastic waste. Traditional recycling methods often face challenges due to contamination and degradation of material quality. However, innovative approaches are emerging to address these issues effectively.

Recent developments in chemical recycling have introduced processes that depolymerize polystyrene back into its monomer form, styrene. This method allows for the production of high-quality recycled polystyrene suitable for various applications. Notably, a new polystyrene recycling process has been identified as both economical and energy-efficient, marking a significant advancement in tackling hard-to-recycle packaging materials and reducing landfill waste.

Trends for the Polystyrene (PS) and Expanded Polystyrene (EPS) Market

Shift Toward Green Building Materials

Expanded Polystyrene (EPS) has emerged as a pivotal material in energy-efficient construction, aligning with global sustainability goals aimed at reducing energy consumption and carbon emissions. EPS is widely used in building insulation due to its superior thermal resistance, lightweight nature, and durability. It helps maintain consistent indoor temperatures by minimizing heat transfer, thereby reducing the energy required for heating and cooling systems. This results in significant energy savings and a reduced carbon footprint for buildings.

Moreover, EPS is resistant to moisture and has a long lifespan, making it an ideal choice for sustainable construction practices. Its recyclability further enhances its eco-friendly profile, contributing to a circular economy. EPS is utilized in various applications such as wall insulation, roofing systems, and foundation insulation, all of which support the development of energy-efficient buildings.

Segments Covered in the Report

By Type

o Polystyrebe

o Expanded Polystyrene (EPS)

By Application

o Packaging

o Building and Construction

o Electrical and Electronics

o Other Applications

Segment Analysis

By Type Analysis

On the basis of type, the market is divided into polystyrebe and expanded polystyrene (EPS). Among these, expanded polystyrene (EPS) segment acquired the significant share in the market owing to its extensive application in the building and construction industry, where it is valued for its lightweight, thermal insulation properties, and structural strength. EPS is widely used in insulation panels, roofing, and flooring systems, contributing to energy-efficient building solutions. Additionally, the packaging sector heavily utilizes EPS for protective packaging materials, especially in the food and electronics industries, due to its cushioning properties and cost-effectiveness.

By Application Analysis

On the basis of application, the market is divided into packaging, building and construction, electrical and electronics, and other applications. Among these, building and construction segment held the prominent share of the market due to EPS's exceptional thermal insulation properties, lightweight nature, and durability, making it ideal for energy-efficient building solutions. The material's resistance to moisture and pests further enhances its suitability for construction purposes. As global emphasis on sustainable and energy-efficient building practices intensifies, the demand for EPS in this sector continues to rise, reinforcing its leading position in the market.

Regional Analysis

Asia Pacific Dominated the Market with the Highest Revenue Share

Asia Pacific held the most of the share of 30.1% of the market due to rapid industrialization, urbanization, and population growth. Countries like China, India, and Japan drive demand with their expanding construction and packaging industries. In the construction sector, EPS is widely utilized for insulation and energy-efficient building materials, aligning with the region's growing focus on sustainable infrastructure.

Additionally, the booming e-commerce and food delivery sectors in Asia Pacific have led to increased use of polystyrene in protective and food-grade packaging. Favorable government policies, low manufacturing costs, and an abundant availability of raw materials further bolster the region’s market position. With ongoing developments in manufacturing technologies and rising investments in infrastructure, Asia Pacific is expected to maintain its leadership in the PS and EPS market.

Competitive Analysis

The competitive landscape of the global polystyrene (PS) and expanded polystyrene (EPS) market is characterized by the presence of several key players, including large multinational corporations and regional manufacturers. Major companies such as Styrolution, Trinseo, INEOS, and TotalEnergies dominate the market, leveraging their strong production capabilities, extensive distribution networks, and significant investment in research and development to maintain a competitive edge. These companies are actively engaged in product innovations, including the development of sustainable and recyclable polystyrene solutions, to address growing environmental concerns.

Recent Developments

In October 2022, TotalEnergies introduced its new RE:clic product range, featuring low-carbon polymers designed to help tackle the challenges of the circular economy.

Key Market Players in the Polystyrene (PS) and Expanded Polystyrene (EPS) Market

o Flint Hills Resources

o ACH Foam Technologies

o StyroChem

o AlpekB. de C.V.

o NOVA Chemicals

o BASF

o Kumho Petroch

o Brodr. Sunde

o DowDuPont

o Trinseo

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 35.8 Billion |

|

Market Size 2033 |

USD 57.0 Billion |

|

Compound Annual Growth Rate (CAGR) |

4.7% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Flint Hills Resources, ACH Foam Technologies, StyroChem, AlpekB. de C.V., NOVA Chemicals, BASF, Kumho Petroch, Brodr. Sunde, DowDuPont, Trinseo, and Other Key Players. |

|

Key Market Opportunities |

Recycling and Circular Economy |

|

Key Market Dynamics |

Expanding Consumer Electronics Sector |

📘 Frequently Asked Questions

1. Who are the key players in the Polystyrene (PS) and Expanded Polystyrene (EPS) Market?

Answer: Flint Hills Resources, ACH Foam Technologies, StyroChem, AlpekB. de C.V., NOVA Chemicals, BASF, Kumho Petroch, Brodr. Sunde, DowDuPont, Trinseo, and Other Key Players.

2. How much is the Polystyrene (PS) and Expanded Polystyrene (EPS) Market in 2023?

Answer: The Polystyrene (PS) and Expanded Polystyrene (EPS) Market size was valued at USD 35.8 Billion in 2023.

3. What would be the forecast period in the Polystyrene (PS) and Expanded Polystyrene (EPS) Market?

Answer: The forecast period in the Polystyrene (PS) and Expanded Polystyrene (EPS) Market report is 2024-2033.

4. What is the growth rate of the Polystyrene (PS) and Expanded Polystyrene (EPS) Market?

Answer: Polystyrene (PS) and Expanded Polystyrene (EPS) Market is growing at a CAGR of 4.7% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.