🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Power Purchase Agreement Market

Global Power Purchase Agreement Market (By Type (Physical Delivery PPA, Virtual PPA, Portfolio PPA, Block Delivery PPA, and Others), By Location (On-site and Off-site), By Category (Corporate, Government, and Others), By Deal Type (Wholesale, Retail, and Others), By Capacity (Up to 20 MW, 20-50 MW, 50-100 MW, and Above 100 MW), By Application (Solar, Wind, Geothermal, Hydropower, Carbon Capture and Storage, Other Applications), By End-Use (Residential, Commercial, Industrial), By Region and Companies)

May 2024

Energy and Power

Pages: 160

ID: IMR1043

Power Purchase Agreement Market Overview

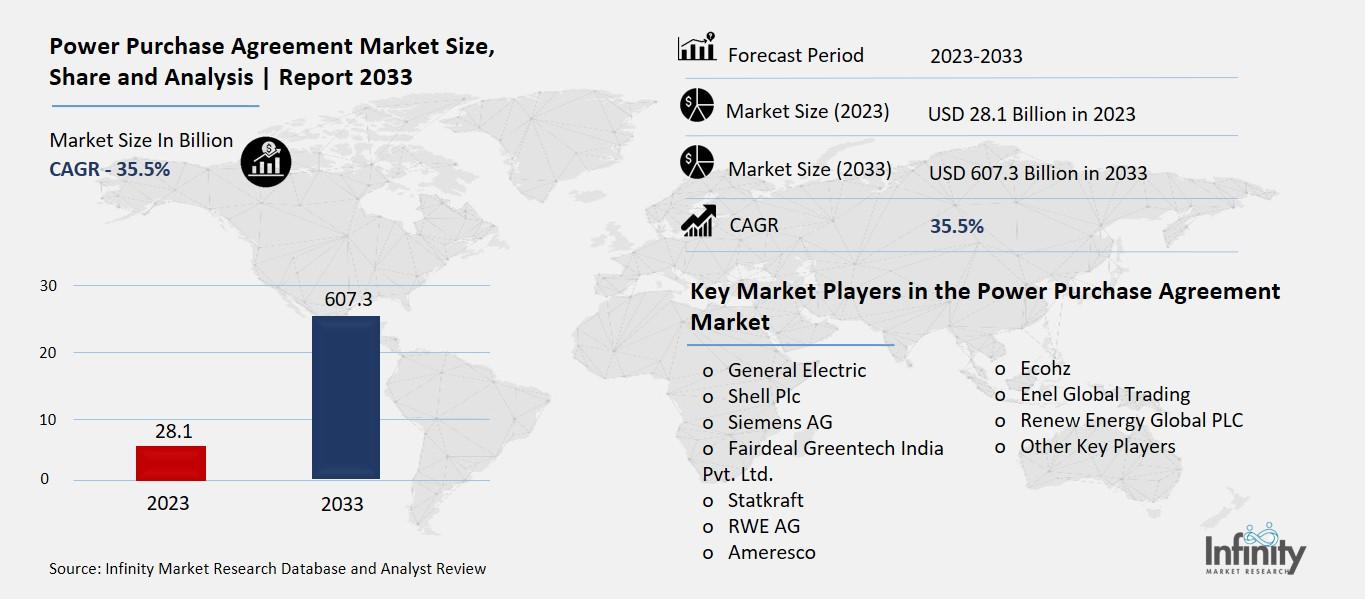

Global Power Purchase Agreement Market size is expected to be worth around USD 607.3 Billion by 2033 from USD 28.1 Billion in 2023, growing at a CAGR of 35.5% during the forecast period from 2023 to 2033.

The "Power Purchase Agreement (PPA) Market" refers to the business sector involving contracts between electricity producers and consumers. In a PPA, a power generator (such as a solar farm, wind farm, or conventional power plant) agrees to sell electricity to a buyer (which could be a utility company, corporation, government entity, or other organization) at an agreed-upon price over a specified period. PPAs typically outline the terms and conditions of the electricity sale, including pricing, quantity, duration, and other relevant details.

The PPA market encompasses various stakeholders, including power producers, electricity buyers, project developers, financiers, and regulators. It plays a crucial role in facilitating the development of renewable energy projects by providing revenue certainty for project developers and helping electricity buyers meet their sustainability goals or secure stable energy prices.

PPAs are essential for renewable energy deployment because they often provide a long-term revenue stream for renewable energy projects, making them financially viable. Additionally, PPAs can enable electricity buyers to access renewable energy without needing to invest in or operate their own renewable energy facilities. This arrangement allows buyers to benefit from renewable energy's environmental advantages and potentially lower energy costs.

Drivers for the Power Purchase Agreement Market

Government Policies and Renewable Energy Targets

A significant driver for the Power Purchase Agreement (PPA) market is the supportive policies and renewable energy targets established by governments worldwide. Many countries have implemented renewable energy policies, incentives, and mandates to promote the adoption of clean energy sources and reduce greenhouse gas emissions. For instance, Renewable Portfolio Standards (RPS) require utilities to procure a certain percentage of their electricity from renewable sources, driving demand for renewable energy projects and PPAs.

Moreover, Feed-In Tariffs (FITs), tax credits, grants, and other financial incentives encourage investment in renewable energy generation and facilitate the signing of PPAs between renewable energy developers and electricity buyers. Market data shows that countries with ambitious renewable energy targets, such as the European Union, China, and the United States, have experienced significant growth in the PPA market as developers seek to capitalize on supportive policies and meet renewable energy goals.

Cost Competitiveness of Renewable Energy Technologies

The declining cost of renewable energy technologies, particularly solar and wind power, is another key driver for the PPA market. Advances in technology, economies of scale, and improved project efficiency have led to substantial reductions in the cost of generating electricity from renewable sources. Market research indicates that the Levelized Cost of Electricity (LCOE) from solar and wind projects has become increasingly competitive with conventional fossil fuel generation in many regions.

As a result, renewable energy projects can offer attractive PPA rates to electricity buyers, making them economically viable alternatives to traditional power plants. The cost competitiveness of renewable energy technologies enhances the appeal of PPAs for both project developers and electricity buyers, driving investment in renewable energy projects and expanding the PPA market globally.

Corporate Sustainability Goals and Demand for Renewable Energy

The growing focus on corporate sustainability and environmental responsibility is driving demand for renewable energy PPAs among commercial and industrial electricity consumers. Many corporations, including tech companies, retailers, and manufacturers, have set ambitious sustainability goals to reduce their carbon footprint and transition to renewable energy sources.

Market data reveals a significant increase in corporate renewable energy procurement through PPAs, with companies entering into long-term agreements to purchase electricity from solar and wind projects. By signing PPAs, corporations can demonstrate their commitment to sustainability, mitigate climate risks, and secure a stable and cost-effective energy supply. This trend is fueling the growth of the PPA market, with developers and electricity buyers collaborating to meet corporate sustainability targets and drive the transition to a low-carbon economy.

Energy Market Dynamics and Price Volatility

Energy market dynamics and price volatility play a significant role in driving the adoption of PPAs as a risk management tool for electricity buyers. Market data shows that traditional wholesale electricity markets can experience price fluctuations due to factors such as fuel costs, demand-supply imbalances, and regulatory changes. PPAs offer a hedge against price volatility by providing electricity buyers with long-term price certainty and protection against future energy price spikes.

Additionally, PPAs can offer fixed or indexed pricing structures, allowing buyers to choose the most suitable option based on their risk appetite and market outlook. This flexibility in pricing arrangements enhances the attractiveness of PPAs as a financial instrument for managing energy costs and mitigating market risks, driving their adoption in competitive energy markets worldwide.

Restraints for the Power Purchase Agreement Market

Policy and Regulatory Uncertainty

One of the primary restraints for the Power Purchase Agreement (PPA) market is policy and regulatory uncertainty, which can create challenges for renewable energy developers and electricity buyers. Market data reveals that changes in government policies, incentives, and regulations can impact the attractiveness and feasibility of renewable energy projects and PPAs. For example, alterations to renewable energy targets, subsidy programs, or tax policies can affect project economics and investor confidence, leading to project delays or cancellations.

Moreover, inconsistent or ambiguous regulatory frameworks across different jurisdictions can create barriers to entry for renewable energy developers and complicate PPA negotiations between parties. The lack of long-term policy certainty and stability can deter investment in renewable energy projects and hinder the growth of the PPA market, particularly in regions with volatile political environments or regulatory landscapes.

Financing and Investment Risks

Financing and investment risks represent significant restraints for the PPA market, particularly for renewable energy projects with long development timelines and capital-intensive requirements. Market analysis indicates that securing financing for renewable energy projects can be challenging due to factors such as project bankability, creditworthiness, and perceived risks associated with emerging technologies or market uncertainties.

Additionally, fluctuations in interest rates, currency exchange rates, and commodity prices can impact project economics and investor returns, affecting the attractiveness of PPAs as revenue streams. Market data also shows that renewable energy projects may face challenges in accessing capital from traditional lenders or investors due to perceptions of higher risk or lack of familiarity with renewable energy technologies. These financing and investment risks can pose barriers to the development of renewable energy projects and limit the availability of PPAs, particularly for smaller developers or projects in emerging markets.

Grid Connection and Transmission Constraints

Grid connection and transmission constraints represent significant restraints for renewable energy projects and the PPA market, particularly in regions with limited or outdated grid infrastructure. Market data reveals that connecting renewable energy projects to the grid and transmitting electricity to end-users can be challenging due to technical, logistical, and regulatory factors. Smart grid connection delays, capacity limitations, and interconnection costs can increase project development timelines and expenses, affecting project economics and PPA negotiations.

Moreover, grid congestion or bottlenecks can restrict the flow of renewable energy from generation sites to consumption centers, limiting the availability and reliability of renewable energy supply for potential PPA buyers. Addressing grid connection and transmission constraints requires coordinated efforts from renewable energy developers, grid operators, regulators, and policymakers to invest in grid modernization, expand transmission capacity, and streamline interconnection processes.

Market and Price Risks

Market and price risks pose additional restraints for the PPA market, particularly in deregulated or competitive energy markets where electricity prices are subject to market forces and price volatility. Market data shows that fluctuations in energy prices, demand patterns, and competitive dynamics can impact the financial performance of renewable energy projects and the attractiveness of PPAs as revenue streams. Uncertainty in future energy market conditions, including changes in fuel prices, technological advancements, and regulatory reforms, can affect PPA pricing and contract terms, leading to renegotiations or contract cancellations.

Moreover, competition from other energy sources, such as natural gas or coal, can influence market prices and affect the competitiveness of renewable energy projects and PPAs. Managing market and price risks requires careful consideration of market dynamics, risk mitigation strategies, and contractual mechanisms to protect the interests of renewable energy developers and PPA buyers in a dynamic and evolving energy landscape.

Trends for the Power Purchase Agreement Market

Increasing Demand for Renewable Energy

A prominent trend in the Power Purchase Agreement (PPA) market is the increasing demand for renewable energy sources, driven by environmental concerns, policy support, and cost competitiveness. Market data reveals a growing global shift towards cleaner and more sustainable energy sources, with renewable energy accounting for a significant and expanding share of electricity generation capacity worldwide.

Governments, businesses, and consumers are increasingly prioritizing renewable energy procurement to reduce carbon emissions, mitigate climate change risks, and achieve sustainability goals. According to industry reports, the demand for renewable energy PPAs has surged in recent years, with corporations, utilities, and municipalities entering into long-term agreements to purchase electricity from solar, wind, hydro, and other renewable energy projects. This trend is expected to continue as renewable energy technologies become increasingly cost-competitive with conventional fossil fuels, supported by advances in technology, economies of scale, and policy incentives.

The emergence of Virtual Power Purchase Agreements (VPPAs)

An emerging trend in the PPA market is the rise of Virtual Power Purchase Agreements (VPPAs), which enable electricity buyers to procure renewable energy from remote projects without the physical delivery of electricity. Market data shows a growing interest in VPPAs among corporations, particularly large energy consumers with global operations seeking to meet sustainability goals across multiple jurisdictions. VPPAs typically involve agreements between corporate buyers and renewable energy developers to finance and support the construction of new renewable energy projects, with the buyer receiving Renewable Energy Certificates (RECs) or equivalent environmental attributes to offset their electricity consumption.

According to industry reports, VPPAs accounted for a significant share of corporate renewable energy procurement in recent years, with companies leveraging VPPAs to access renewable energy from diverse locations and optimize cost savings. This trend is expected to continue as VPPAs offer flexibility, scalability, and risk mitigation benefits for both buyers and developers in a rapidly evolving energy landscape.

Focus on Additionality and Environmental Impact

A notable trend shaping the PPA market is an increasing emphasis on additionality and environmental impact, driven by corporate sustainability commitments and stakeholder expectations. Additionality refers to the concept that renewable energy projects supported by PPAs should result in the addition of new renewable energy capacity to the grid beyond business-as-usual scenarios. Market data reveals a growing preference among corporate buyers for PPAs that demonstrate additionality by financing new renewable energy projects or supporting the expansion of existing ones.

Additionally, buyers are placing greater importance on environmental impact metrics, such as carbon emissions reductions, water savings, and biodiversity conservation, when evaluating PPA opportunities. According to industry studies, corporate buyers are increasingly seeking transparent and credible reporting on the environmental benefits of PPAs to align with their sustainability objectives and enhance corporate reputation. This trend is driving innovation in PPA structures and contractual terms to maximize additionality and environmental impact, fostering greater accountability and transparency in renewable energy procurement.

Integration of Energy Market Platforms and Digital Solutions

An emerging trend in the PPA market is the integration of energy market platforms and digital solutions to streamline PPA transactions, enhance market liquidity, and improve transparency. Market data shows a growing number of online platforms and digital marketplaces facilitating PPA negotiations, project matchmaking, and contract management between renewable energy developers and buyers.

These platforms leverage technology, data analytics, and artificial intelligence to connect buyers and sellers, optimize deal structuring, and provide real-time market intelligence. Additionally, digital solutions such as blockchain technology are being explored to enhance transparency, traceability, and trust in PPA transactions by securely recording and verifying renewable energy attributes and transactions. According to industry experts, the integration of energy market platforms and digital solutions is expected to accelerate the growth of the PPA market by reducing transaction costs, increasing market efficiency, and expanding access to renewable energy procurement opportunities.

Segments Covered in the Report

By Type

o Physical Delivery PPA

o Virtual PPA

o Portfolio PPA

o Block Delivery PPA

o Other Types

By Location

o On-site

o Off-site

By Category

o Corporate

o Government

o Other Category

By Deal Type

o Wholesale

o Retail

o Other Deal Type

By Capacity

o Up to 20 MW

o 20 50 MW

o 50 100 MW

o Above 100 MW

By Application

o Solar

o Wind

o Geothermal

o Hydropower

o Carbon Capture and Storage

o Other Applications

By End-Use

o Residential

o Commercial

o Industrial

Segment Analysis

By Type Analysis

Based on type, The market for power purchase agreements is divided into categories such as block delivery PPA, virtual PPA, portfolio PPA, and physical delivery PPA. With a market share of 59.2% in 2023, the virtual PPA category was the most lucrative of these in the global power purchase agreement market. PPAs, or virtual power purchase agreements, are growing in popularity because of their affordability, scalability, and flexibility.

These agreements are appropriate for enterprises with limited on-site space because they enable firms to purchase renewable energy from off-site projects without having to be physically close to the generation source. Moreover, they offer stability through long-term contracts in erratic energy markets. Large-scale renewable energy projects can be integrated into corporate energy portfolios owing to the scalability of virtual PPAs, promoting sustainability objectives and cutting carbon emissions. Because of these benefits, companies looking to reduce their energy costs and practice environmental stewardship choose virtual PPAs.

The physical delivery PPA category held 33.8% of the market for renewable energy in 2023. Owing to its dependability and transparency, customers can pay for electricity from renewable projects, guaranteeing a steady supply of energy. Long-term agreements also offer pricing stability in erratic energy markets. Because of their simplicity, PPAs reduce risks and simplify transaction processes, which makes them a popular option among stakeholders in the renewable energy industry.

By Location Analysis

The worldwide Power Purchase Agreement can be further divided into on-site and off-site categories based on geography. In 2023, the off-site category had a commanding 82.9% of the market. With off-site PPAs, companies and utilities have the freedom to get renewable energy from sources that offer advantageous generation conditions, typically at a reduced cost and on a big scale. Given the difficulties posed by on-site renewable energy, including limitations in terms of space, infrastructure, and requirements, this strategy is taxing.

Off-site PPAs also give businesses access to renewable energy in environmentally rich locations, which can improve their sustainability initiatives and possibly save operating expenses. The off-site segment's dominance highlights its appeal and feasibility in aiding the shift to a more robust and greener energy source.

By Category Analysis

This market is further divided into corporate, government, and other segments based on category. With a significant revenue share of 86.0%, the corporate segment led the Power Purchase Agreement Market and is expected to grow at a CAGR of 33.1% over the forecast period.

The corporate segment's dominance is explained by the increased utilization of renewable energy sources by companies looking to lower their carbon footprints and guarantee long-term energy prices. Businesses are committing to sustainability targets and using PPAs as a tactical weapon to protect themselves from fluctuating energy prices.

For instance, corporate power purchase agreements in Europe saw the signing of 30.9 GW of clean power contracts in October 2023, a significant increase year over year in multiple industries.

Technological developments in renewable energy, encouraging government policies, and a growing social movement toward environmental responsibility all contribute to this trend. These elements encourage corporate sector investment in and dedication to PPAs for renewable energy.

By Deal Type Analysis

The PPA market is segmented into wholesale, retail, and other deal types. With a 62.7% market share in 2023, the wholesale segment leads the market among them. Large energy purchasers and utilities looking to secure significant volumes of electricity at predictable rates are drawn to the scalability of wholesale PPAs. These agreements provide economies of scale by facilitating the direct purchase of renewable energy from large-scale installations.

Furthermore, by allowing energy producers to secure income streams for their projects, wholesale PPAs help to increase project viability and draw in investment. The market for renewable energy obtained through wholesale PPAs is being driven by the expanding corporate commitment to sustainability and the legislative backing for this segment's dominance.

By Capacity Analysis

This market is further classified into four segments based on capacity: Up to 20 MW, 20-50 MW, 50-100 MW, and Above 100 MW. The 50–100 MW sector was the market leader with a 49.2% market share in 2023. This capacity range is very appropriate for a wide range of applications since it achieves the ideal mix between manageability and scalability. Its size allows for the realization of economies of scale, which lowers the cost per megawatt and increases the financial viability of projects.

For instance, in February 2023, Evonik and EnBW inked a second PPA for the 15-year purchase of 50 MW of offshore wind energy from the proposed "He Dreiht" offshore wind farm. Together with the 100 MW of offshore wind energy that was already purchased from EnBW under a previous PPA, this is new.

Furthermore, installations in this capacity range are frequently easier to incorporate into current power networks, eschewing the regulatory obstacles and infrastructural difficulties that larger projects can run into.

By Application Analysis

PPA's market is further segmented according to its application in carbon capture and storage, hydropower, solar, wind, geothermal, and other energy sources. With a market share of more than 51% in 2023, the solar segment leads the market among them. Commercial and industrial enterprises seeking to protect themselves from fluctuating energy prices find solar power purchase agreements (PPAs) to be especially appealing due to their consistent and stable pricing structure.

Furthermore, a wide range of applications can now affordably utilize solar energy due to its scalability and continuously dropping installation prices. Adoption has also increased since photovoltaic (PV) cell technology has advanced and greatly increased efficiency.

One of the main factors making solar PPAs appealing is how affordable they are. For example, the average cost of solar power purchase agreements in North America decreased by 1% in the second quarter of 2023 to USD 49.09 per megawatt-hour. Wider adoption is encouraged by this price reduction, which makes solar projects more financially viable for purchasers.

By End-Use Analysis

Based on the end-uses this market is further divided into residential, commercial, and industrial segments. In 2023, the commercial segment held a majority share of the market, leading the industry. Commercial businesses frequently require more energy than residential consumers do, which makes solid, long-term energy procurement methods necessary.

Additionally, PPAs provide businesses with the chance to set fixed energy prices, reducing the risk of fluctuations in energy market prices. Businesses need this financial stability to plan their long-term operating costs. Additionally, PPAs help businesses achieve environmental objectives by allowing them to directly procure renewable energy.

Regional Analysis

With a 41.2% market share, North America dominated the PPA market in 2023. North America is a major player in the Power Purchase Agreement (PPA) industry because of its robust regulatory backing for renewable energy programs. PPAs are becoming more appealing to producers and customers as a result of government incentives and policies, especially those implemented in the US and Canada, that promote the use of renewable energy sources.

Large-scale renewable projects have also been made possible by North America's developed and technologically advanced renewable energy sector, which has supported the PPA market even more. Driven by the growing societal need for green energy, corporations in North America are increasingly joining PPAs to ensure long-term, affordable renewable energy supply.

With a 36.1% CAGR during the anticipated time frame, Europe increased at the fastest pace in the Power Purchase Agreement (PPA) market, and in the next years, it is expected to overtake North America in terms of market share. PPAs are a desirable alternative for securing long-term energy supply because of their rapid expansion, which can be ascribed to strict environmental rules and ambitious renewable energy objectives set by the European Union.

Competitive Analysis

Key industry players, such as General Electric, Siemens AG, Shell Plc, Statkraft, and several others, are present in the global Power Purchase Agreement (PPA) market and have a significant impact on market dynamics through the variety of renewable energy solutions and services they offer.

Owing to their ability to facilitate the development, funding, and operationalization of renewable energy projects globally, these firms have a significant impact on the landscape of renewable energy. The distribution of market share among various businesses is determined by factors such as their geographic reach, technological proficiency, and ability to establish strategic alliances and contracts.

Key Market Players in the Power Purchase Agreement Market

o General Electric

o Shell Plc

o Siemens AG

o Fairdeal Greentech India Pvt. Ltd.

o RWE AG

o Ameresco

o Ecohz

o Enel Global Trading

o Other Key Players

|

Report Attribute |

Details |

|

Market Size 2023 |

USD 28.1 Billion |

|

Market Size 2033 |

USD 607.3 Billion |

|

Compound Annual Growth Rate (CAGR) |

35.5% |

|

Market Forecast Period |

2023-2033 |

|

Historical Data |

2018-2022 |

|

Region Covered |

North America, Europe, Asia-Pacific, South America, Middle East and Africa |

|

Market Scope |

Type, Location, Category, Deal Type, Capacity, Application, End-Use and Region |

|

Key Players |

General Electric, Shell Plc, Siemens AG, Fairdeal Greentech India Pvt. Ltd., Statkraft, RWE AG, Ameresco, Ecohz, Enel Global Trading, Renew Energy Global PLC, Other Key Players

|

📘 Frequently Asked Questions

1. What would be the forecast period in the Power Purchase Agreement Market Research report?

Answer: Answer: The forecast period in the Power Purchase Agreement Market Research report is 2024-2033

2. Who are the key players in the Power Purchase Agreement Market?

Answer: General Electric, Shell Plc, Siemens AG, Fairdeal Greentech India Pvt. Ltd., Statkraft, RWE AG, Ameresco, Ecohz, Enel Global Trading, Renew Energy Global PLC, Other Key Players

3. How big is the Power Purchase Agreement Market?

Answer: Global Power Purchase Agreement Market size is expected to be worth around USD 607.3 Billion by 2033 from USD 28.1 Billion in 2023, growing at a CAGR of 35.5% during the forecast period from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.