🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Power SCADA Market

Power SCADA Market (By Component (Remote Terminal Unit, Programmable Logic Controller, Human Machine Interface, Communication System Protection Relays, Other Components), By Architecture (Hardware, Services, Software, Other Architecture), By End-User (Oil & Gas, Chemicals, Wastewater Treatment, Metal & Mining, Transportation, Other End-User), By Region and Companies)

Aug 2024

Energy and Power

Pages: 138

ID: IMR1191

Power SCADA Market Overview

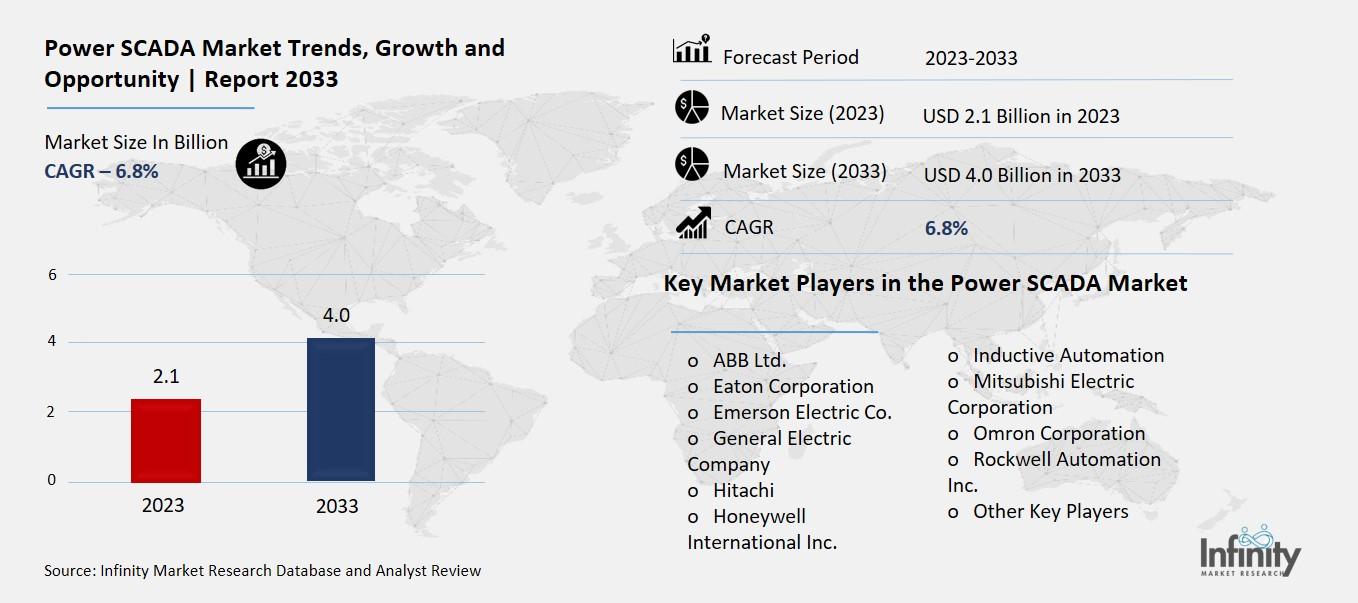

Global Power SCADA Market size is expected to be worth around USD 4.0 Billion by 2033 from USD 2.1 Billion in 2023, growing at a CAGR of 6.8% during the forecast period from 2023 to 2033.

The Power SCADA Market refers to the market for systems and software that help manage and control electrical power grids and systems. SCADA stands for Supervisory Control and Data Acquisition, which is a fancy way of saying it’s a technology used to monitor and control industrial processes. In this case, it's all about managing the flow and distribution of electricity. These systems are essential for utility companies and large industries to ensure the power grid is running smoothly, efficiently, and safely.

In simple terms, imagine a giant network that delivers electricity to your home and businesses. The Power SCADA systems are like the brain and nervous system of this network. They help keep an eye on everything, from the power plants generating electricity to the lines carrying it to your house. If something goes wrong, like a power outage or a technical issue, the SCADA system can quickly detect it and help fix the problem. This market includes the companies that make these systems, the software developers who create the programs, and the service providers who maintain and update them.

Drivers for the Power SCADA Market

Increasing Demand for Electricity

One of the main drivers for the Power SCADA market is the growing demand for electricity worldwide. As populations increase and economies expand, especially in developing regions, the need for reliable and efficient power distribution systems is more critical than ever. Power SCADA systems play a vital role in monitoring and managing electrical grids, ensuring that power distribution is optimized and disruptions are minimized.

Integration of Renewable Energy Sources

The shift towards renewable energy sources is another significant driver. With the global push for sustainable and clean energy, there is an increasing reliance on renewable energy sources like wind, solar, and hydroelectric power. Power SCADA systems are essential for integrating these renewable sources into existing power grids, managing the variable nature of renewable energy, and ensuring a stable power supply.

Technological Advancements and Industry 4.0

Advancements in technology, particularly the adoption of Industry 4.0 principles, have greatly influenced the Power SCADA market. The automation of industrial processes requires sophisticated control and monitoring systems, which SCADA provides. These systems help reduce human errors, improve efficiency, and ensure continuous operation of power plants and other industrial facilities.

Government Initiatives and Investments

Government initiatives and investments in modernizing aging power infrastructure have also fueled the growth of the Power SCADA market. Many governments are investing in upgrading their power grids to handle increased loads and improve reliability. This modernization includes the implementation of advanced SCADA systems to enhance the efficiency and reliability of power distribution networks.

Increasing Adoption in Emerging Markets

Emerging markets, particularly in Asia-Pacific, are seeing rapid industrialization and urbanization, leading to a significant increase in the demand for Power SCADA systems. Countries like China and India are investing heavily in power infrastructure to support their growing economies. The adoption of Power SCADA systems in these regions is driven by the need to manage complex power networks efficiently and reliably.

Enhanced Security and Cybersecurity Measures

With the increasing digitalization of power systems, there is a heightened need for robust security measures to protect against cyber threats. Power SCADA systems are being enhanced with advanced cybersecurity features to safeguard critical infrastructure from cyber-attacks. This focus on security is a crucial driver for the adoption of modern SCADA systems, ensuring the safe and reliable operation of power grids.

Restraints for the Power SCADA Market

Complex Integration Processes

Integrating SCADA systems with existing infrastructure can be a complex and time-consuming process. Many power utilities have legacy systems that are not easily compatible with modern SCADA technology. The need for custom solutions and extensive modifications can prolong implementation timelines and increase costs. This complexity often requires specialized knowledge and expertise, further adding to the financial and operational burden on organizations.

High Initial Costs

The Power SCADA market faces significant challenges due to the high initial costs associated with implementing these systems. Installing a SCADA system involves substantial investments in hardware, software, and skilled labor. The initial expenses can be a deterrent for many organizations, particularly smaller utilities, and companies in emerging markets. These high upfront costs can make it difficult for some organizations to justify the expenditure, especially when the return on investment may not be immediately apparent.

Cybersecurity Concerns

With the increasing digitalization of power infrastructure, cybersecurity has become a major concern for the Power SCADA market. SCADA systems are critical for the operation of power grids, making them a prime target for cyberattacks. Ensuring the security of these systems requires continuous monitoring and updating of security protocols, which can be resource-intensive. The potential risk of cyber threats can also make organizations hesitant to adopt SCADA systems fully, fearing vulnerabilities that could lead to severe disruptions.

Maintenance and Upgrade Challenges

Once installed, SCADA systems require ongoing maintenance and regular upgrades to remain effective and secure. This continuous need for upkeep can strain the resources of power utilities, especially those with limited budgets. The maintenance process often necessitates periodic shutdowns or slowdowns in operations, which can be costly and disruptive. Keeping up with technological advancements and ensuring compatibility with new components also presents an ongoing challenge.

Market Saturation in Developed Regions

In developed regions such as North America and Europe, the market for SCADA systems is becoming saturated. Many utilities in these areas have already implemented SCADA solutions, leading to a slowdown in new system installations. This saturation shifts the focus toward system modifications and maintenance rather than new deployments, limiting growth opportunities. As a result, market expansion in these regions is primarily driven by the need for upgrades and enhancements rather than new installations.

Regulatory and Compliance Issues

The power industry is highly regulated, and compliance with various standards and regulations can be a hurdle for SCADA system implementation. Navigating the regulatory landscape requires significant effort and resources. Non-compliance can result in penalties and legal challenges, adding to the complexity and cost of SCADA system adoption. Ensuring that SCADA systems meet all regulatory requirements and keeping up with changing regulations can be a substantial burden for power utilities.

Opportunity in the Power SCADA Market

Integration of Renewable Energy Sources

The growing adoption of renewable energy sources like wind and solar power presents a significant opportunity for the Power SCADA market. As utilities and grid operators look to integrate these intermittent energy sources into the grid, there is a rising demand for advanced SCADA systems. These systems are essential for monitoring and managing the performance of renewable energy assets in real time, ensuring they are seamlessly integrated into the existing power infrastructure. This integration not only enhances the efficiency of power grids but also supports the global transition to more sustainable energy solutions.

Advancements in Smart Grid Technologies

The modernization of power grids, often referred to as the development of "smart grids," is another key opportunity for the Power SCADA market. Smart grid technologies, which include automated control systems and advanced communication networks, rely heavily on SCADA systems to optimize operations and improve grid reliability. Utilities are increasingly investing in these technologies to enhance the efficiency and resilience of their power networks, paving the way for significant growth in the Power SCADA market.

Increasing Demand for Microgrids

The rising interest in microgrids, which are localized power grids that can operate independently from the main grid, offers another promising opportunity for the Power SCADA market. Microgrids are particularly beneficial in remote or underserved areas, providing reliable power supply and enhancing energy security. SCADA systems are crucial for managing these decentralized power networks, allowing for efficient monitoring and control of energy distribution, which further boosts the market's growth prospects.

Industrial Automation and Urbanization

Rapid industrialization and urbanization, especially in emerging economies, are driving the demand for robust power management solutions. Power SCADA systems play a critical role in managing complex power networks in industrial and urban settings, ensuring efficient energy distribution and minimizing downtime. As more industries and urban areas seek to modernize their power infrastructure, the demand for advanced SCADA systems is expected to rise, creating substantial growth opportunities for market players.

Technological Innovations and Product Development

Continuous technological advancements and innovations in SCADA systems are opening new avenues for market expansion. Companies are investing heavily in research and development to introduce more sophisticated and user-friendly SCADA solutions. These innovations not only improve the functionality and reliability of SCADA systems but also attract new customers looking for cutting-edge power management technologies. The ongoing development of more advanced SCADA systems is set to drive market growth in the coming years.

Regional Market Expansion

Geographical expansion, particularly in regions like Asia-Pacific and Latin America, presents a significant opportunity for the Power SCADA market. These regions are experiencing rapid growth in their power infrastructure, driven by industrialization and increasing energy demands. As regional utilities and independent power producers seek to modernize their grids, the adoption of SCADA systems is expected to grow. The presence of SCADA vendors collaborating with local partners in these regions further supports market expansion, ensuring that the benefits of advanced power management technologies reach a broader audience.

Trends for the Power SCADA Market

Growing Adoption of Industry 4.0 Principles

The shift towards Industry 4.0 is significantly impacting the Power SCADA market. Industry 4.0 focuses on automation and data exchange in manufacturing technologies, which include cyber-physical systems, the Internet of Things (IoT), and cloud computing. This trend is driving the demand for Power SCADA systems because they enable real-time monitoring and control of various industrial processes, ensuring high efficiency and minimal human error. By integrating SCADA with IoT and other advanced technologies, industries can achieve better predictive maintenance, resource optimization, and operational efficiency.

Convergence with Wireless Sensor Networks

Another key trend is the integration of Power SCADA systems with Wireless Sensor Networks (WSNs). WSNs consist of distributed autonomous sensors that monitor physical or environmental conditions, such as temperature and pressure. In industries like oil & gas, these sensors help manage remote operations efficiently. Using wireless networks reduces the costs associated with traditional wired systems, making SCADA solutions more attractive. This convergence enhances data collection and monitoring capabilities, crucial for maintaining and optimizing industrial operations in challenging environments.

Expansion in Renewable Energy Integration

The growing emphasis on renewable energy sources is also shaping the Power SCADA market. With the increasing installation of solar and wind energy systems, SCADA technology is essential for integrating these intermittent energy sources into the power grid. SCADA systems help in monitoring and managing the performance of renewable energy assets, ensuring their seamless integration with existing power infrastructure. This trend is particularly prominent in regions like North America and Europe, where renewable energy adoption is accelerating.

Rise in Cybersecurity Concerns

As Power SCADA systems become more interconnected and integrated with various digital technologies, cybersecurity has become a major concern. Protecting critical infrastructure from cyber threats is paramount, and there's a growing need for robust security measures within SCADA systems. This trend is driving investments in cybersecurity solutions tailored for SCADA environments, ensuring the safe and reliable operation of power networks. Enhanced security protocols and technologies are being developed to address these concerns, making cybersecurity a pivotal aspect of SCADA implementations.

Increasing Demand in Emerging Economies

The demand for Power SCADA systems is rising rapidly in emerging economies, particularly in Asia-Pacific. Countries like China and India are experiencing rapid industrialization and urbanization, which necessitates advanced systems to manage complex power networks. The manufacturing and oil & gas sectors in these regions are investing heavily in SCADA technologies to improve operational efficiency and control. This trend is expected to drive significant market growth in Asia-Pacific over the coming years.

Impact of COVID-19 on Market Dynamics

The COVID-19 pandemic has had a notable impact on the Power SCADA market. Initially, the market experienced disruptions due to lockdowns and restrictions, affecting global supply chains and project timelines. However, the pandemic also highlighted the importance of remote monitoring and control, accelerating the adoption of SCADA systems. As industries adapt to the new normal, there's a heightened focus on digital transformation and automation, further boosting the demand for Power SCADA solutions.

Segments Covered in the Report

By Component

o Remote Terminal Unit

o Programmable Logic Controller

o Human Machine Interface,

o Communication System Protection Relays

o Other Components

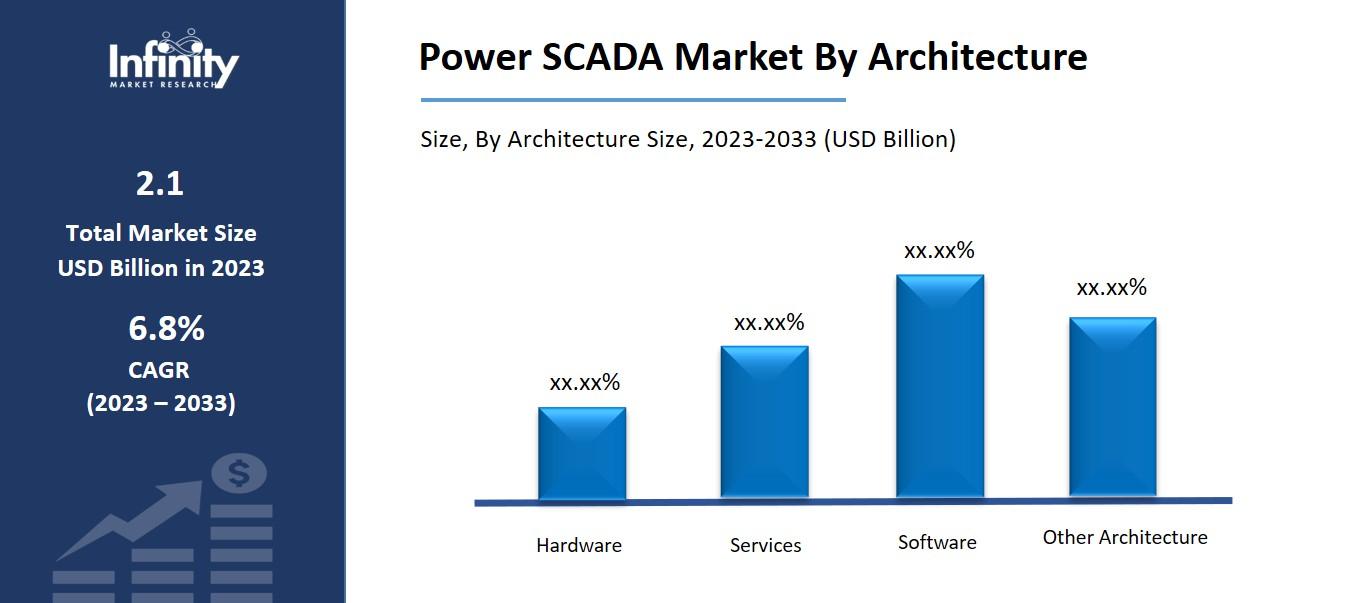

By Architecture

o Hardware

o Services

o Software

o Other Architecture

By End-User

o Oil & Gas

o Chemicals

o Wastewater Treatment

o Metal & Mining

o Transportation

o Other End-User

Segment Analysis

By Component Analysis

In 2023, With 58.9% of market revenue, the remote terminal unit (RTU) sector led the industry. For the monitoring and management of vital infrastructure elements like substations, transformers, and switchgear in power grids, RTUs are essential. They are used in many different industries, such as transportation, water management, oil and gas, and electricity generation, transmission, and distribution.

Real-time data collecting from faraway places is made easier by RTUs, which give operators vital information for making decisions and maximizing grid performance. RTUs are becoming increasingly important in the market because of their scalability and dependable communication protocols, which allow them to interface smoothly with SCADA systems. This allows for effective monitoring and control of the electrical infrastructure.

By Architecture Analysis

It is divided into software, hardware, and services based on architecture. In 2023, the hardware category accounted for a sizeable portion of the market's revenue share constituting 57.8% of market income, and this trend is anticipated to continue. The APAC region's growing need for power SCADA may be the cause of this expansion. The Mexican government incentivizes businesses to update their industrial systems and employ renewable energy.

In Mexico, integrated communication technologies such as SCADA systems for distribution automation and substation automation have been a prominent component of grid modernization projects. It is anticipated that throughout the forecast period, the hardware category will grow at the quickest rate due to the increasing demand for advanced software and the ability to handle massive volumes of data while preventing attacks.

By End-User Analysis

Oil & Gas, Water & Wastewater Treatment, Metal & Mining, Chemicals, Transportation, and Other End-use Industry are included in the Power SCADA Market segmentation based on End-use Industry. With 59.2% of market sales, the oil and gas category led the market. To begin with, oil and gas extraction, processing, refining, and distribution facilities frequently require power equipment including turbines, compressors, and motors. In addition, they keep a lot of combustible, flammable, and hazardous materials; as a result, extra process control and monitoring procedures are needed to stop fires, explosions, and other mishaps.

In this particular context, OSHA regulates all such facilities and mandates the use of centralized control rooms with dependable safety instrumented systems. In the meanwhile, SCADA systems offer the recorded audit trails, automatic safety features, and real-time visibility required to maintain compliance. Additionally, oil and gas companies benefit greatly from SCADA's enhanced monitoring and remote access due to their enormous facility footprints, intricate multi-site operations, and remote field locations. These features help them maintain optimum uptime, throughput, and efficiency while posing the fewest dangers to their workers and assets.

Regional Analysis

It is projected that the Power SCADA market in North America will grow due to several important factors. The need for SCADA systems to efficiently integrate intermittent renewable energy sources like solar and wind power into the electrical grid is growing as their use increases. A record 31 gigawatts (GW) of solar energy capacity were installed in the US in 2023, breaking the previous record set in 2021 and up 55% from 2022. According to the Solar Energy Industries Association, the United States has 161 GW of installed solar capacity, or about 5% of the country's electricity. This means that SCADA technology is crucial.

With rooftop solar panels, energy storage systems, and electric vehicles becoming more prevalent, the Europe Power SCADA Market has the second-largest market share. Grid operators are faced with both possibilities and challenges as a result of these distributed energy resources. By the end of 2022, rooftop PV will have contributed 66% of the 209 GW of distributed energy resources built throughout the European Union. By 2020, the EU had effectively achieved its 20% renewable energy objective, and by 2022, 22.5 percent of the energy consumed in the EU came from renewable sources. The seamless integration of these dispersed energy resources into the grid is made possible by SCADA systems, which also help to enhance the coordination, optimization, and administration of these decentralized assets.

Competitive Analysis

Prominent industry participants are making significant R&D investments to broaden their product offerings, contributing to the further expansion of the Power SCADA market. To increase their market share, market players are also engaging in a range of strategic initiatives. Notable developments in this regard include the introduction of new products, contracts, mergers and acquisitions, increased investment, and cooperation with other businesses. The Power SCADA sector needs to provide affordable products to grow and thrive in an increasingly competitive and developing market environment.

Recent Developments

October 2022: The Japanese electronics company Hitachi purchased ABB's remaining 19.9% stake in Hitachi Energy. In mid-2020, Hitachi acquired 81.1% of ABB's power grids division, with its headquarters located in Switzerland, creating a joint venture (JV) between the two companies. Before the joint venture changed its name to Hitachi ABB Power Grids in October of last year to reflect the new majority ownership, it was known as that. Hitachi Energy provides a wide range of technology and services for the power sector, including transformers, SCADA, control systems, high voltage DC (HVDC) transmission infrastructure, and more.

February 2021: Honeywell and SEPCO Electric Power Construction Corporation sealed an agreement for Honeywell to provide connected control, telecommunications, and safety and security systems to a Saudi Arabian shipyard that is currently under construction.

Key Market Players in the Power SCADA Market

o ABB Ltd.

o General Electric Company

o Hitachi

o Honeywell International Inc.

o Inductive Automation

o Mitsubishi Electric Corporation

o Omron Corporation

o Rockwell Automation Inc.

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 2.1 Billion |

|

Market Size 2033 |

USD 4.0 Billion |

|

Compound Annual Growth Rate (CAGR) |

6.8% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Component, Architecture, End-user, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

ABB Ltd., Eaton Corporation, Emerson Electric Co., General Electric Company, Hitachi, Honeywell International Inc., Inductive Automation, Mitsubishi Electric Corporation, Omron Corporation, Rockwell Automation., Other Key Players |

|

Key Market Opportunities |

Integration of Renewable Energy Sources |

|

Key Market Dynamics |

Increasing Demand for Electricity |

📘 Frequently Asked Questions

1. What would be the forecast period in the Power SCADA Market?

Answer: The forecast period in the Power SCADA Market report is 2024-2033.

2. How much is the Power SCADA Market in 2023?

Answer: The Power SCADA Market size was valued at USD 2.1 Billion in 2023.

3. Who are the key players in the Power SCADA Market?

Answer: ABB Ltd., Eaton Corporation, Emerson Electric Co., General Electric Company, Hitachi, Honeywell International Inc., Inductive Automation, Mitsubishi Electric Corporation, Omron Corporation, Rockwell Automation., Other Key Players

4. What is the growth rate of the Power SCADA Market?

Answer: Power SCADA Market is growing at a CAGR of 6.8% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.