🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Pulmonary Arterial Hypertension Market

Global Pulmonary Arterial Hypertension Market (By Drug Class (Endothelin Receptor Antagonists (ERAs), PDE-5 Inhibitors, Prostacyclin and Prostacyclin Analogs, SGC Stimulators), By Type (Branded, Generics), By Route of Administration (Oral, Intravenous/ subcutaneous, Inhalational), By Region and Companies)

Sep 2024

Healthcare

Pages: 138

ID: IMR1217

Pulmonary Arterial Hypertension Market Overview

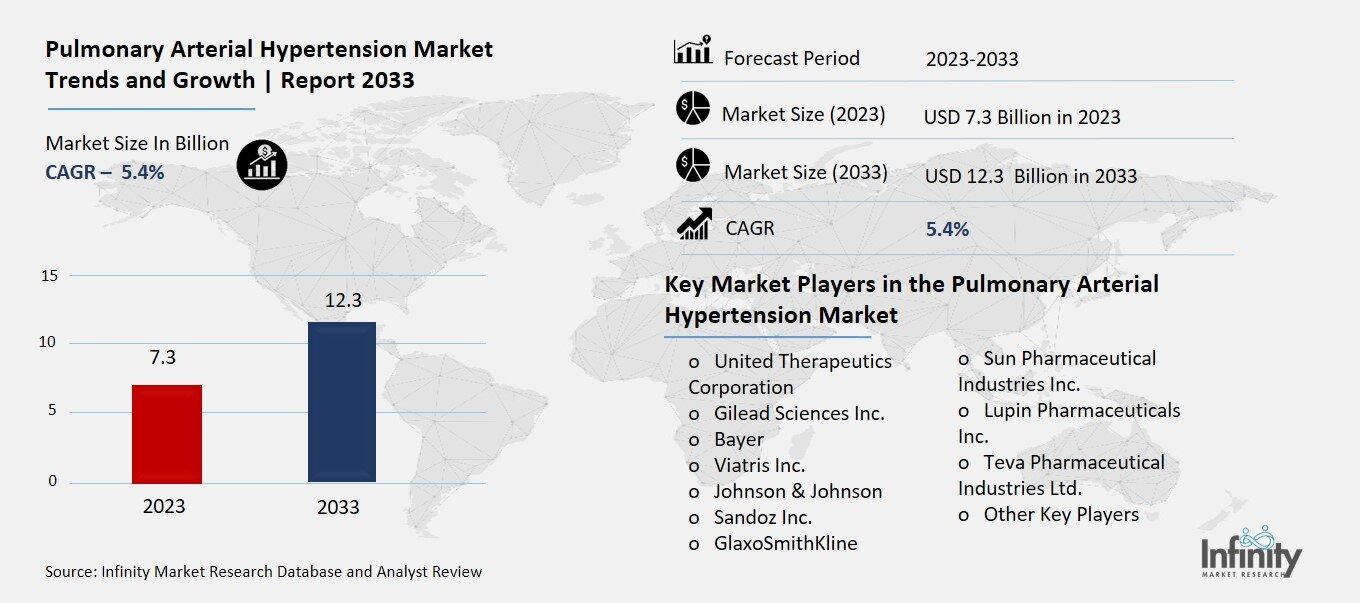

Global Pulmonary Arterial Hypertension Market size is expected to be worth around USD 12.3 Billion by 2033 from USD 7.3 Billion in 2023, growing at a CAGR of 5.4% during the forecast period from 2023 to 2033.

The Pulmonary Arterial Hypertension (PAH) market focuses on treatments and therapies for a rare but serious condition where the blood pressure in the arteries of the lungs is much higher than normal. This condition makes it hard for the heart to pump blood through the lungs, causing shortness of breath, chest pain, and fatigue. Over time, it can lead to heart failure if not properly treated. The market includes medications, medical devices, and therapies designed to manage the symptoms, improve quality of life, and slow the disease's progression.

This market is growing due to the increasing number of people diagnosed with PAH and advancements in treatment options. Drug therapies, like endothelin receptor antagonists, PDE-5 inhibitors, and prostacyclin analogs, play a big role in managing the condition. The market also includes research into new treatments and technologies that can help patients live longer and healthier lives despite the disease.

Drivers for the Pulmonary Arterial Hypertension Market

Increasing Disease Awareness

One of the key drivers for the pulmonary arterial hypertension (PAH) market is the growing awareness about the disease. As more healthcare professionals and the general public become knowledgeable about PAH, early detection and diagnosis are improving. This allows patients to receive timely treatment, leading to better outcomes. Awareness campaigns and education initiatives empower individuals to recognize symptoms and seek medical help sooner, leading to increased demand for PAH treatments. This growing awareness also fuels advocacy efforts, pushing for better access to therapies and expanding the market.

Advancements in Drug Development

The development of new drugs and therapies is another significant factor driving the PAH market. Pharmaceutical companies are heavily investing in research and development, leading to new product launches and approvals. For instance, recent approvals for advanced therapies have strengthened the treatment options available, boosting market growth. Innovative drugs, such as soluble guanylate cyclase (SGC) stimulators, are making a notable impact, offering improved outcomes for PAH patients. As these advancements continue, the availability and effectiveness of treatments are expected to grow.

Strong Pipeline and Product Launches

The PAH market is also driven by a robust pipeline of drugs and new product launches. Several major pharmaceutical companies are focusing on bringing novel treatments to the market, which is helping to meet the growing demand. With increasing approvals for both branded and generic drugs, the market is seeing expanded treatment options. For instance, recent FDA approvals of new formulations and generics are expected to drive growth as they become more accessible and affordable.

Government and Organizational Support

Support from governments and healthcare organizations plays a crucial role in the growth of the PAH market. Various initiatives and programs aimed at improving cardiovascular health are indirectly benefiting PAH treatment. For example, initiatives by the Centers for Disease Control and Prevention (CDC) and the World Health Organization (WHO) emphasize better heart health and disease prevention, which aligns with improving PAH management. Such support helps in the promotion of early diagnosis and better access to treatment options.

Technological Advancements in Diagnostics

Advances in diagnostic technologies are also driving the PAH market. The development of reliable biomarkers and advanced imaging techniques has made early detection more efficient. Early diagnosis is vital in managing PAH effectively, and these technological innovations are making it possible to identify the disease at its initial stages. As diagnostic methods continue to evolve, the market is likely to benefit from better patient outcomes and an increased number of diagnosed cases, further driving the demand for treatment options.

Restraints for the Pulmonary Arterial Hypertension Market

High Treatment Costs and Limited Access

One of the main restraints in the pulmonary arterial hypertension (PAH) market is the high cost of treatment, which limits access to effective therapies. PAH medications, such as endothelin receptor antagonists and phosphodiesterase inhibitors, are often very expensive, putting them out of reach for many patients, especially in low-income and middle-income regions. This limits the market’s growth, as only a fraction of those who need treatment can afford it. Even in developed countries, high drug prices and limited insurance coverage create barriers to accessing proper treatment, which impacts the overall market expansion.

Lack of Awareness and Misdiagnosis

Another significant challenge is the lack of awareness and frequent misdiagnosis of PAH. The symptoms of PAH are often nonspecific and overlap with other cardiovascular or respiratory conditions, leading to late diagnosis or incorrect treatment. Many healthcare professionals may not have sufficient training or experience in recognizing PAH, resulting in delayed or inappropriate care. This not only hinders the patient’s quality of life but also limits the potential market size, as fewer patients receive timely and accurate diagnoses that lead to the correct treatments.

Side Effects and Drug Tolerability

The side effects associated with PAH treatments also pose a significant barrier. While available drugs can improve symptoms and slow disease progression, they often come with severe side effects that can affect a patient’s willingness to continue treatment. Common side effects like nausea, headaches, and liver damage can lead to non-compliance, reducing the effectiveness of treatment plans. These adverse reactions can make it difficult for patients to adhere to long-term therapies, limiting the market growth as treatment discontinuation rates remain high.

Complex Regulatory Requirements

Strict regulatory guidelines and lengthy approval processes also act as a restraint in the PAH market. Developing new PAH drugs requires extensive clinical trials and a high level of regulatory scrutiny to ensure patient safety and efficacy. These rigorous requirements slow down the introduction of new treatments into the market and can deter smaller companies from investing in drug development. Moreover, regulatory differences between regions add to the complexity, making it challenging for companies to launch their products globally.

Competition from Generic Drugs

The growing availability of generic drugs is another factor limiting market growth. While generic drugs help make treatment more affordable, they also reduce the revenue of companies producing branded PAH drugs. This competitive pressure forces companies to lower prices, which can impact profitability and reduce funding for further research and development. As more generic versions enter the market, especially in developed regions, the overall market value faces downward pressure.

Opportunity in the Pulmonary Arterial Hypertension Market

Growing Demand for Targeted Therapies

The increasing focus on targeted therapies is a significant opportunity in the pulmonary arterial hypertension (PAH) market. As research advances, more targeted treatments are being developed that specifically address the underlying causes of PAH. Unlike conventional therapies, these targeted drugs aim to modify the disease progression rather than just manage symptoms. The development of novel therapies like prostacyclin analogs and endothelin receptor antagonists is expected to drive market growth. With targeted approaches offering better efficacy and fewer side effects, pharmaceutical companies are investing heavily in R&D, creating a fertile ground for the introduction of more effective PAH treatments.

Expansion into Emerging Markets

Emerging markets in regions like Asia-Pacific and Latin America present untapped opportunities for the PAH market. As healthcare infrastructure improves and awareness about pulmonary arterial hypertension grows, these regions are seeing increased demand for treatment options. Countries like China, India, and Brazil have large populations with rising incidences of PAH due to the growing prevalence of lifestyle-related diseases. Additionally, the lower costs of conducting clinical trials in these regions are attracting global pharmaceutical companies. By entering these markets, companies can significantly expand their customer base and drive long-term revenue growth.

Rising Adoption of Combination Therapies

Another promising opportunity is the growing adoption of combination therapies in treating PAH. Combining multiple drugs to enhance efficacy is becoming more common, leading to better patient outcomes. These combination therapies are particularly beneficial in treating severe cases of PAH, where single-drug treatments may not be sufficient. The rise in clinical trials exploring various drug combinations is expected to bring more effective and comprehensive treatment plans to the market. As more healthcare providers and patients opt for combination therapies, this trend will likely fuel market expansion.

Advances in Diagnostics and Screening

Technological advancements in diagnostics and screening present an opportunity to improve early detection of PAH. Early and accurate diagnosis is critical for effective treatment, and new diagnostic tools are making it easier to identify the condition at earlier stages. Enhanced imaging techniques, biomarkers, and genetic testing are some innovations that hold promise in streamlining the diagnostic process. With better diagnostics, more patients can be identified early, allowing for timely intervention and increasing the demand for PAH treatments.

Government Initiatives and Increased Funding

Government initiatives and increased funding for rare diseases like PAH create a supportive environment for market growth. Governments and regulatory bodies are increasingly offering grants, tax incentives, and funding programs that encourage research into rare and life-threatening conditions. These initiatives are driving pharmaceutical companies to focus more on PAH drug development. Additionally, patient advocacy groups are raising awareness and pushing for better access to treatment, which is likely to spur further market opportunities as awareness and diagnosis rates increase.

Strategic Collaborations and Partnerships

Collaborations and partnerships between pharmaceutical companies, research institutions, and healthcare providers are becoming a crucial growth driver in the PAH market. Companies are increasingly partnering to combine their expertise in drug development, regulatory approvals, and market distribution. These collaborations help accelerate the development of new therapies and broaden market reach. Joint ventures also facilitate the sharing of resources, reducing overall costs and risks. As more stakeholders recognize the benefits of strategic alliances, the PAH market is poised to benefit from the combined efforts in advancing treatment options and expanding market penetration.

Trends for the Pulmonary Arterial Hypertension Market

Technological Advancements Driving Precision Treatment

One of the prominent trends in the Pulmonary Arterial Hypertension (PAH) market is the increasing adoption of precision medicine and advanced technologies. Innovations such as biomarkers, genetic profiling, and AI-driven diagnostics are allowing for more personalized and effective treatment options. These technologies are enabling healthcare providers to better understand the molecular basis of PAH, leading to the development of targeted therapies that improve patient outcomes. As precision medicine continues to gain traction, the PAH market is expected to see a rise in novel therapeutic approaches designed for specific patient populations.

Growing Popularity of Combination Therapies

The use of combination therapies is becoming a key trend in managing PAH. Traditional monotherapy approaches are being replaced by treatment plans that combine multiple drugs, which have been shown to enhance therapeutic efficacy and reduce disease progression. The use of combination therapies is particularly beneficial in managing complex cases, where a single treatment may not be effective enough. This trend is being supported by ongoing clinical trials exploring different drug combinations, signaling a shift in the standard of care in PAH treatment. As a result, pharmaceutical companies are focusing on developing combination drugs to meet this growing demand.

Increasing Focus on Oral and Inhalation Therapies

Another trend in the PAH market is the shift toward more patient-friendly treatment options, particularly oral and inhalation therapies. These methods offer easier administration compared to traditional intravenous treatments, which require hospital visits. Oral medications and inhaled therapies not only improve patient compliance but also reduce healthcare costs. As more pharmaceutical companies invest in developing these user-friendly treatment options, the market is likely to see a broader range of easily accessible therapies, catering to the growing patient preference for convenience.

Rise in Partnerships and Collaborations

Strategic partnerships and collaborations are becoming increasingly common as companies aim to expand their market presence and leverage expertise in the PAH sector. Collaborations between pharmaceutical companies, research organizations, and academic institutions are driving innovation, especially in drug development and clinical trials. These alliances are also helping companies to accelerate regulatory approvals and streamline the commercialization process. The trend of forming strategic partnerships is expected to continue, offering mutual benefits in terms of resource sharing, risk mitigation, and market expansion.

Patient-Centric Care Models

The shift toward patient-centric care models is also gaining momentum in the PAH market. This approach involves tailoring treatment plans to the unique needs and preferences of individual patients, focusing on improving quality of life alongside managing the disease. Telemedicine, remote monitoring, and personalized treatment plans are some aspects of this trend. By focusing more on patient outcomes and convenience, healthcare providers can deliver more holistic and effective care. As a result, the adoption of patient-centric models is expected to grow, influencing both treatment protocols and product development strategies in the PAH market.

Regulatory Support and Fast-Track Approvals

The regulatory landscape for PAH treatments is evolving, with more governments providing support for rare diseases. Fast-track approvals and orphan drug designations are becoming more common, helping to speed up the introduction of new therapies. Regulatory bodies like the FDA and EMA are offering incentives to companies developing PAH treatments, such as tax breaks and extended market exclusivity. This trend is encouraging more investments in the research and development of PAH drugs, leading to an expanded pipeline of innovative therapies. As regulatory frameworks continue to adapt, the market is likely to witness quicker and more widespread adoption of breakthrough treatments.

Segments Covered in the Report

By Drug Class

o Endothelin Receptor Antagonists (ERAs)

o PDE-5 Inhibitors

o Prostacyclin and Prostacyclin Analogs

o SGC Stimulators

By Type

o Branded

o Generics

By Route of Administration

o Oral

o Intravenous/ subcutaneous

o Inhalational

Segment Analysis

By Drug Class Analysis

Prostacyclin and prostacyclin analogs dominated the market, accounting for 46.8% of worldwide revenue in 2023. Prostacyclin is a powerful vasodilator and one of the most effective medications for treating PAH. It is synthesized from arachidonic acid using the Cyclooxygenase (COX) pathway and released by endothelial cells in the pulmonary artery. Prostacyclin binds to prostaglandin receptors, promoting smooth muscle relaxation and vasodilation by activating G protein and protein kinase. According to a study released by the American College of Cardiology in October 2023, selexipag, an oral prostacyclin receptor agonist, has demonstrated encouraging outcomes in the treatment of PAH. The group is now exploring prostacyclin's efficacy in the treatment of pulmonary arterial hypertension.

SGC Stimulators are expected to have the fastest CAGR during the projection period. Soluble Guanylate Cyclase (sGC) is a key enzyme in the cardiovascular system. It also serves as the receptor for nitric oxide (NO). It has emerged as a therapeutic target in cardiac illnesses such as PAH, which is associated with reduced NO production. It also causes endothelial dysfunction and insufficient activation of the NO-sGC-cGMP pathway. This inhibits vasorelaxation and smooth muscle proliferation in PAH patients.

By Type Analysis

The branded category dominated the pulmonary arterial hypertension market in 2023. The greatest share of the branded segment is attributed to an increase in product approvals, a solid pipeline, and significant investments by market competitors. In addition, the increasing number of product launches is likely to have a beneficial impact on segment growth during the projection period. For example, in June 2022, United Therapeutics Corporation got FDA approval for its Tyvaso DPI powder in the pulmonary arterial hypertension market.

The generic type category is expected to have the fastest CAGR throughout the projection period. Certain factors, such as cost, patent expiration, and generic availability, are expected to drive growth in the generic market by 2033. Lupin plans to offer generic Sildenafil in the United States in September 2022 for the treatment of pulmonary arterial hypertension.

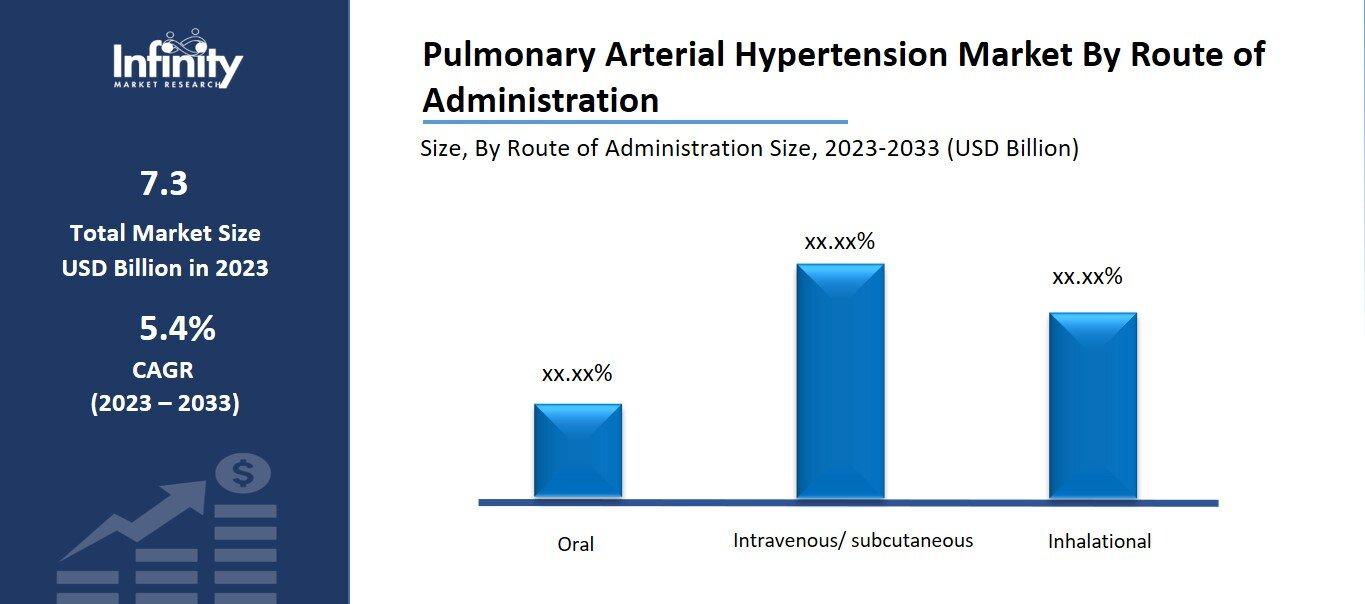

By Route of Administration Analysis

In terms of route of administration, the oral segment dominated the pulmonary arterial hypertension market in 2023. This is due to the increasing availability of oral formulations for PAH and patient preference for the oral route of administration. Letairis, Opsumit, Adcirca, and Revatio are examples of oral PAH medications. Furthermore, growing approvals for innovative oral formulations are expected to provide a good potential for segment growth during the projection period. For example, Tenax Therapeutics, Inc.'s TNX-103 IND application was approved by the FDA in November 2023. The company is looking at oral levosimendan for the treatment of pulmonary arterial hypertension.

The intravenous/subcutaneous segment is expected to grow the fastest over the projection period. Intravenous medicines provide significant improvements in the treatment of pulmonary arterial hypertension (PAH). When administered directly into the bloodstream, these medications can quickly reach therapeutic levels, offering immediate relief from symptoms. Intravenous administration enables consistent absorption and bioavailability, which is critical for addressing the complicated pathophysiology of PAH. Furthermore, this approach enables accurate dose modifications, which improves treatment outcomes.

Regional Analysis

North America dominated the market, accounting for 31.9% in 2023. The developed healthcare system in the United States permitted access to innovative treatments, contributing to the region's growth. Furthermore, the availability of reimbursement for PAH medicines fueled the expansion of the North American PAH market. Growing awareness, a high diagnosis rate, and supportive government activities drove the region's rise. Sedentary lifestyle choices such as smoking, drinking, and eating junk food are significant risk factors for the development of PAH.

Asia Pacific is expected to experience significant expansion in the pulmonary arterial hypertension industry. Economic changes in nations like India and China are projected to boost market growth. The combination of a large population and a low per capita income has increased demand for low-cost treatment solutions. MNCs prioritize investment in developing countries such as India and China. As a result, organizations in the region are forming numerous partnerships and strategic alliances. Furthermore, rapid expansion in the Asia Pacific region, a large population, and improved healthcare systems are expected to contribute to the region's lucrative growth. The Organization for Rare Diseases India (ORDI) is a notable organization for all rare disease patients in India. The government has recommended major financial assistance of USD 0.18 million through the Rashtriya Arogaya Nidhi. This cash is meant for individuals who require one-time treatment under the Rare Diseases Policy 2020. Such initiatives launched by the Indian government are projected to play a significant influence in market growth.

Competitive Analysis

Actelion Pharmaceuticals, a Janssen Pharmaceutical Company, is a key player in the Pulmonary Arterial Hypertension (PAH) industry, focusing on the research, development, and commercialization of new PAH medicines. Strategic collaborations, clinical trials, and regulatory clearances are part of their market expansion strategy. These firms, which are focused on solving unmet medical requirements, help to develop PAH therapy by focusing on patient outcomes and market expansion.

Arena Pharmaceuticals, an emerging participant in the Pulmonary Arterial Hypertension (PAH) industry, is constantly researching novel medicines and growing its portfolio. Their efforts frequently include strategic alliances, research collaborations, and participation in clinical trials. By focusing on innovation and building a solid pipeline, these rising firms want to carve out a position in the competitive PAH market and contribute to the evolution of patient treatment options.

Recent Developments

August 2023: Keros Therapeutics hosted a presentation to reveal encouraging results from their KER-012 phase 2 clinical trial, which is investigating the drug's efficacy for the treatment of pulmonary arterial hypertension (PAH).

May 2023: Janssen Pharmaceutical Companies submitted a new medication application to the FDA seeking approval of a combination therapy of tadalafil 40mg and macitentan 10mg to treat pulmonary arterial hypertension.

Key Market Players in the Pulmonary Arterial Hypertension Market

o United Therapeutics Corporation

o Gilead Sciences Inc.

o Bayer

o Viatris Inc.

o Johnson & Johnson

o Sandoz Inc.

o GlaxoSmithKline

o Sun Pharmaceutical Industries Inc.

o Lupin Pharmaceuticals Inc.

o Teva Pharmaceutical Industries Ltd.

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 7.3 Billion |

|

Market Size 2033 |

USD 12.3 Billion |

|

Compound Annual Growth Rate (CAGR) |

5.4% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Drug Class, Type, Route Of Administration, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

United Therapeutics Corporation, Gilead Sciences Inc., Bayer, Viatris Inc., Johnson & Johnson, Sandoz Inc., GlaxoSmithKline, Sun Pharmaceutical Industries Inc., Lupin Pharmaceuticals Inc., Teva Pharmaceutical Industries Ltd., Other Key Players |

|

Key Market Opportunities |

Growing Demand for Targeted Therapies |

|

Key Market Dynamics |

Increasing Disease Awareness |

📘 Frequently Asked Questions

1. Who are the key players in the Pulmonary Arterial Hypertension Market?

Answer: United Therapeutics Corporation, Gilead Sciences Inc., Bayer, Viatris Inc., Johnson & Johnson, Sandoz Inc., GlaxoSmithKline, Sun Pharmaceutical Industries Inc., Lupin Pharmaceuticals Inc., Teva Pharmaceutical Industries Ltd., Other Key Players

2. How much is the Pulmonary Arterial Hypertension Market in 2023?

Answer: The Pulmonary Arterial Hypertension Market size was valued at USD 7.3 Billion in 2023.

3. What would be the forecast period in the Pulmonary Arterial Hypertension Market?

Answer: The forecast period in the Pulmonary Arterial Hypertension Market report is 2023-2033.

4. What is the growth rate of the Pulmonary Arterial Hypertension Market?

Answer: Pulmonary Arterial Hypertension Market is growing at a CAGR of 5.4% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.