🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Ready Meals Market

Ready Meals Market (By Product (Chilled, Frozen, Shelf-stable, Canned), By Meal Type (Vegan, Vegetarian, Non-vegetarian), By End-Use (Residential, Food Services), By Distribution Channel (Convenience Stores, Supermarkets & Hypermarkets, Online, Others), By Region and Companies)

Jun 2024

Food Beverage and Nutrition

Pages: 131

ID: IMR1112

Ready Meals Market Overview

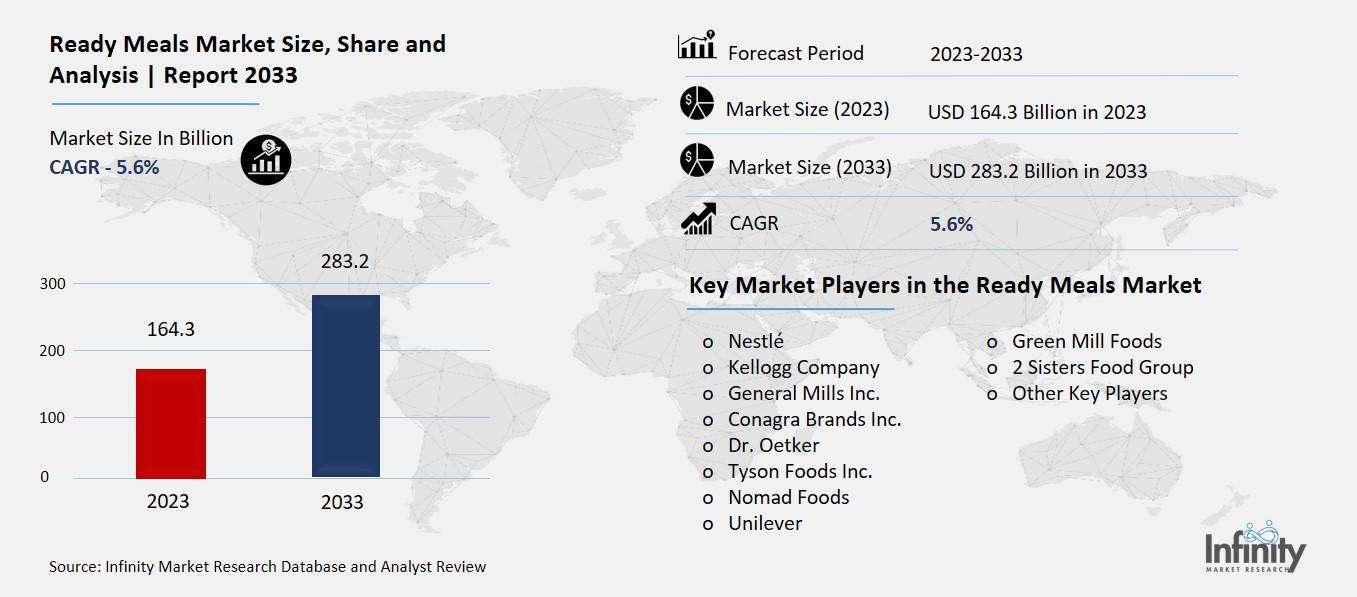

Global Ready Meals Market size is expected to be worth around USD 283.2 Billion by 2033 from USD 164.3 Billion in 2023, growing at a CAGR of 5.6% during the forecast period from 2023 to 2033.

The Ready Meals Market is the industry that makes and sells pre-cooked, packaged meals that you can quickly heat and eat. These meals are designed for convenience, so people who don’t have time to cook or prefer not to can still enjoy a hot, tasty meal. You can find ready meals in grocery stores, and they often come in varieties like frozen, chilled, or shelf-stable, which means they don't need to be refrigerated until opened.

This market is growing because more people are leading busy lives and looking for easy meal options. Ready meals save time and effort since you don’t need to prepare ingredients or spend a lot of time cooking. They are especially popular among working professionals, students, and families who need quick meal solutions. Plus, with more options available, from healthy and organic choices to gourmet and ethnic dishes, there’s something to suit every taste and dietary preference.

Drivers for the Ready Meals Market

Busy Lifestyles and Convenience Needs

One of the Ready Meals market's main drivers is modern consumers' busy lifestyles. With hectic work schedules, long commutes, and various daily responsibilities, many people find it challenging to cook meals from scratch. Ready meals offer a convenient solution by providing quick and easy meal options that require minimal preparation. This convenience factor particularly appeals to working professionals, students, and busy families who need to save time without compromising on a hot meal. According to a survey by the Food Marketing Institute, 50% of U.S. consumers purchase ready meals due to convenience.

Rising Urbanization

Rising urbanization is another key driver for the Ready Meals market. As more people move to urban areas, the demand for convenient and time-saving food options increases. Urban residents often have busier lifestyles and less time for meal preparation, making ready meals an attractive choice. The United Nations estimates that by 2050, nearly 68% of the world’s population will live in urban areas, which will likely boost the demand for ready meals further. The growth of urban populations means more consumers will be looking for quick meal solutions, driving market growth.

Increase in Single-Person Households

The increase in single-person households is also driving the demand for ready meals. Single individuals, including young professionals and elderly people, often find it more practical and economical to buy ready meals instead of cooking for one. Ready meals offer portion-controlled options that reduce food waste and provide a variety of choices without the hassle of cooking multiple dishes. According to the U.S. Census Bureau, single-person households make up about 28% of all households in the United States, and this trend is expected to continue, supporting the growth of the ready meals market.

Health and Nutrition Awareness

Growing health and nutrition awareness among consumers is driving the Ready Meals market as well. Manufacturers are responding to this trend by offering healthier ready-meal options, such as those with organic ingredients, low sodium, and reduced fat. Additionally, there is a rising demand for ready meals that cater to specific dietary needs, such as gluten-free, vegan, and keto-friendly options. This shift towards healthier and specialized ready meals is attracting health-conscious consumers who want convenient meal solutions without compromising their dietary preferences and nutritional goals.

Technological Advancements in Food Processing

Technological advancements in food processing and packaging are also contributing to the growth of the Ready Meals market. Innovations such as vacuum packaging, high-pressure processing, and microwaveable packaging have improved the quality, taste, and shelf life of ready meals. These advancements make ready meals more appealing to consumers by ensuring that the meals remain fresh and flavorful for longer periods. The improved quality of ready meals, along with enhanced convenience, encourages more consumers to purchase these products.

Expansion of Distribution Channels

The expansion of distribution channels, including online grocery platforms and home delivery services, is another important driver for the Ready Meals market. The rise of e-commerce has made it easier for consumers to access a wide variety of ready meals from the comfort of their homes. Online grocery shopping and food delivery services have become increasingly popular, especially during the COVID-19 pandemic, which accelerated the shift toward online purchasing.

Restraints for the Ready Meals Market

High Competition and Market Saturation

One significant restraint for the Ready Meals market is high competition and market saturation. The market is crowded with numerous brands and products, each vying for consumer attention. This intense competition can make it challenging for new entrants to establish themselves and for existing players to maintain their market share. Companies often need to invest heavily in marketing and promotions to differentiate their products, which can impact profit margins. Additionally, with many similar products available, consumers have plenty of choices, which can lead to price sensitivity and brand switching.

Perceptions of Unhealthiness

Perceptions of unhealthiness associated with ready meals can also act as a restraint. Many consumers still view ready meals as less healthy compared to home-cooked food, associating them with high levels of preservatives, sodium, and artificial ingredients. Despite efforts by manufacturers to offer healthier options, this perception can deter health-conscious consumers from purchasing ready meals.

Regulatory Challenges

Regulatory challenges pose another restraint for the Ready Meals market. Different countries have varying regulations and standards related to food safety, labeling, and packaging. Navigating these regulations can be complex and costly for manufacturers, especially those looking to expand into new markets. Compliance with these regulations requires significant investments in quality control, testing, and certification processes. Failure to meet regulatory standards can result in product recalls, legal issues, and damage to brand reputation, further hindering market growth.

Supply Chain Disruptions

Supply chain disruptions can also impact the Ready Meals market. The production and distribution of ready meals rely on a complex supply chain involving various raw materials, packaging materials, and logistics. Disruptions in any part of this supply chain, such as shortages of key ingredients, transportation issues, or packaging material delays, can affect the availability and cost of ready meals. The COVID-19 pandemic highlighted these vulnerabilities, causing significant supply chain disruptions and impacting the ready meals market. Ensuring a stable and resilient supply chain is crucial for maintaining market stability.

Environmental Concerns

Environmental concerns related to packaging waste are becoming increasingly prominent and can act as a restraint for the Ready Meals market. Ready meals often come in single-use plastic or other non-biodegradable packaging, contributing to environmental pollution and waste management issues. As consumers become more environmentally conscious, there is growing pressure on manufacturers to develop sustainable packaging solutions. However, transitioning to eco-friendly packaging can be costly and technologically challenging, posing a barrier for many companies. Addressing these environmental concerns is essential for long-term market sustainability.

Opportunity in the Ready Meals Market

Rising Demand for Healthy and Nutritious Options

There is a significant opportunity in the Ready Meals market for products that focus on health and nutrition. As consumers become more health-conscious, they are looking for ready meals that offer balanced nutrition without sacrificing convenience. This includes meals that are low in sodium, free from preservatives, and made with organic or natural ingredients. The global health and wellness food market is projected to grow at a CAGR of 9.20% from 2021 to 2028, highlighting the potential for healthy ready-meal options. Companies that can innovate and provide nutritious, tasty, and convenient meal solutions are likely to attract a growing customer base.

Expansion into Emerging Markets

Expansion into emerging markets presents a vast opportunity for the Ready Meals market. Countries in Asia, Latin America, and Africa are experiencing rapid urbanization and an increase in disposable incomes, leading to a growing middle class with a higher demand for convenient food options. For example, the Asia-Pacific ready meals market is expected to grow at a CAGR of 8.3% from 2021 to 2026. By tailoring products to local tastes and preferences and addressing regional dietary needs, ready meal manufacturers can tap into these burgeoning markets and significantly boost their sales.

Growth of Online Grocery Shopping

The growth of online grocery shopping offers another promising opportunity for the Ready Meals market. The convenience of ordering groceries online has led to an increase in the purchase of ready meals through digital platforms. E-commerce platforms provide a wider reach and the ability to target specific customer segments through personalized marketing. During the COVID-19 pandemic, online grocery sales surged, and this trend is expected to continue as consumers appreciate the convenience of having groceries delivered to their doorstep.

Introduction of Premium and Gourmet Options

The introduction of premium and gourmet ready-meal options is another area of opportunity. Consumers are willing to pay a premium for high-quality, restaurant-style meals that offer unique flavors and ingredients. This segment can attract food enthusiasts who seek convenience without compromising on taste and culinary experience. Premium-ready meals can include international cuisines, chef-curated recipes, and locally sourced ingredients, appealing to discerning customers. The market for premium ready meals is growing as consumers look for more sophisticated and diverse meal options that can be enjoyed at home.

Sustainability and Eco-Friendly Packaging

Sustainability and eco-friendly packaging are becoming crucial factors in consumer decision-making. There is a growing opportunity for ready-meal manufacturers to develop sustainable packaging solutions that minimize environmental impact. Using recyclable, biodegradable, or compostable materials can attract environmentally conscious consumers and meet regulatory requirements aimed at reducing plastic waste. A report by Trivium Packaging in 2020 found that 74% of consumers are willing to pay more for sustainable packaging. By adopting eco-friendly practices, companies can enhance their brand image and appeal to a broader customer base.

Innovation in Product Development

Innovation in product development offers ongoing opportunities in the Ready Meals market. Continuous research and development can lead to new and exciting products that cater to evolving consumer preferences. This includes creating ready meals that cater to specific dietary needs, such as gluten-free, vegan, or keto-friendly options. Additionally, incorporating new ingredients, flavors, and cooking techniques can differentiate products in a competitive market. Companies that prioritize innovation can stay ahead of trends and capture the interest of consumers looking for variety and novelty in their meal choices.

Trends for the Ready Meals Market

Shift Towards Healthier Options

One of the prominent trends in the Ready Meals market is the shift toward healthier options. As consumers become more health-conscious, they seek ready meals that are nutritious, low in calories, and free from artificial additives. This trend is driving manufacturers to innovate and develop meals that cater to specific dietary needs, such as low-sodium, gluten-free, vegan, and organic options. Companies that offer healthier ready-meal options are likely to attract a growing customer base.

Rise of Plant-Based Meals

The rise of plant-based meals is another significant trend in the Ready Meals market. With increasing awareness of the health benefits of plant-based diets and concerns about the environmental impact of meat consumption, more consumers are opting for vegetarian and vegan-ready meals. Ready meal manufacturers are expanding their product lines to include a variety of plant-based options, catering to the growing demand for sustainable and ethical food choices.

Premium and Gourmet Ready Meals

There is a growing trend towards premium and gourmet ready meals. Consumers are willing to pay more for high-quality, restaurant-style meals that offer unique flavors and ingredients. This trend is driven by the desire for convenience without compromising on taste and culinary experience. Premium-ready meals often include international cuisines, chef-curated recipes, and locally sourced ingredients.

Expansion of Online Sales Channels

The expansion of online sales channels is reshaping the Ready Meals market. The convenience of ordering groceries and ready meals online has led to an increase in e-commerce sales. Online grocery platforms and food delivery services have become essential channels for purchasing ready meals, especially during the COVID-19 pandemic. According to Statista, online grocery sales in the U.S. reached $95.82 billion in 2020 and are projected to continue growing. This trend provides ready meal manufacturers with opportunities to reach a wider audience and offer personalized marketing through digital platforms.

Focus on Sustainable Packaging

Sustainable packaging is becoming increasingly important in the Ready Meals market. Consumers are more environmentally conscious and prefer products with eco-friendly packaging. Manufacturers are responding by developing packaging solutions that reduce plastic waste and use recyclable, biodegradable, or compostable materials. A report by Trivium Packaging found that 74% of consumers are willing to pay more for sustainable packaging, indicating a strong demand for environmentally responsible products. Companies that prioritize sustainability can enhance their brand image and appeal to eco-conscious consumers.

Innovation in Flavors and Ingredients

Innovation in flavors and ingredients is driving growth in the Ready Meals market. Consumers are looking for variety and new taste experiences, prompting manufacturers to experiment with different cuisines, exotic ingredients, and fusion dishes. This trend is leading to the introduction of diverse ready-meal options that cater to adventurous eaters and food enthusiasts.

Segments Covered in the Report

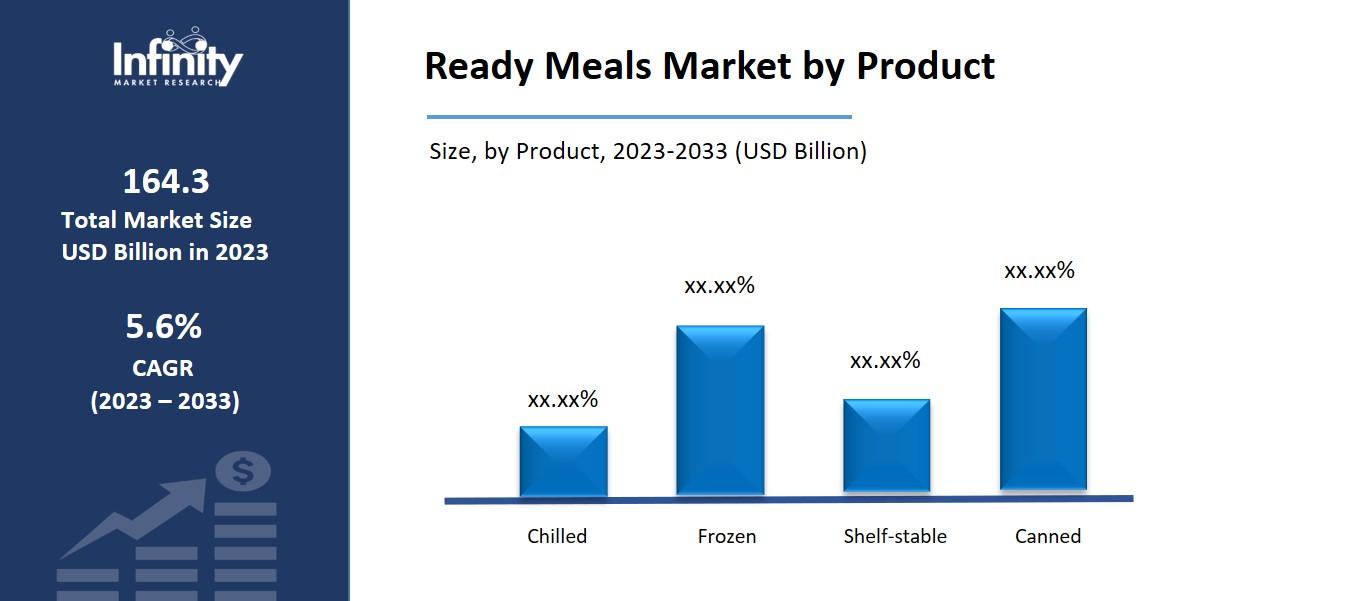

By Product

o Chilled

o Frozen

o Shelf-stable

o Canned

By Meal Type

o Vegan

o Vegetarian

o Non-vegetarian

By End-Use

o Residential

o Food Services

By Distribution Channel

o Convenience Stores

o Supermarkets & Hypermarkets

o Online

o Others

Segment Analysis

By Product

The combination of their little processing and fresh chilled ready meals held a dominant 46.2% market share in 2023. This made them appealing to consumers looking for quick-to-eat, healthy options with a shorter shelf life.

Due to their longer shelf life and ease of storage, frozen ready meals also retained a sizable portion of the market. Customers seeking easy preparation and prolonged meal preservation are drawn to these meals.

With their lengthy shelf life and low refrigeration needs, shelf-stable ready meals cemented their place in the market by satisfying consumers who value convenience and long-term storage options. Reliability and portability made canned ready meals popular with consumers looking for non-perishable meal options for emergency preparedness or eating on the go.

The market for ready meals is continuing to develop and change because of the wide variety of goods available that cater to consumers' preferences for convenience, freshness, and storage demands.

By Meal Type

With a market share of approximately 39.8% in 2023, vegan quick meals led the industry. This spike is explained by consumers' growing interest in plant-based diets for ecological and health benefits. Vegan dishes don't contain any animal products, making them appealing to people looking for sustainable and cruelty-free dietary options. To satisfy customers who are concerned about their health, they provide a range of nutrient-dense plant-based ingredients.

Vegetarian-ready meals continued to hold a sizable market share after vegan meals. These meals offer a versatile way to cut back on meat consumption because they don't include meat but can still include dairy and eggs. People who want to switch to a more plant-based diet without giving up animal products find vegetarian options appealing.

On the other hand, non-vegetarian ready meals held onto their market share since they appealed to customers who liked meat-based foods. Convenience and flavor variation are provided by the variety of meat, poultry, and seafood dishes included in these meals. Non-vegetarian options provide quick and satisfying meal solutions while catering to people from a variety of ethnic backgrounds and dietary requirements.

Every variety of prepared food caters to specific customer requirements and inclinations. While non-vegetarian meals serve customers who like meat-based foods and seek convenience without sacrificing flavor, vegan and vegetarian options appeal to people who prioritize plant-based diets for ethical, environmental, or health-related reasons.

The market for vegan and vegetarian ready meals is anticipated to continue growing as consumer awareness of sustainability and health issues rises. This growth will be fueled by increased availability and innovation in retail and food service channels.

By End-Use

At a market share of more than 64.9% in 2023, the ready meals segment was led by Food Services. This category covers a range of businesses, including cafeterias, restaurants, caterers, and other food service suppliers. Food services serve a broad spectrum of customers, such as corporate clients, event planners, and people dining out.

In the ready-meal sector, factors including hectic lives, a rise in the popularity of eating out, and the growing need for convenient meal options are what are driving the popularity of food services. Customers choose food services because they are convenient, offer a wide selection of menu items, and allow them to enjoy freshly made meals without having to prepare or cook at home.

However, Residential holds the remaining market share in the ready-to-eat food category. This category includes homes and individuals who buy prepared meals to eat at home. For a variety of reasons, including convenience, time-saving advantages, and the need for quick and simple meal options, residential consumers look for ready meals.

With ready meals, homeowners don't have to spend a lot of time preparing meals or cooking; instead, they can enjoy restaurant-caliber cuisine in the convenience of their own homes. The residential segment offers a variety of options, from classic comfort foods to gourmet cuisine, to accommodate individuals and families with a wide range of dietary restrictions and taste preferences. The residential segment of the ready meals industry remains significant despite the dominance of food services, as it provides consumers looking for quick and hassle-free meal options at home with a convenient and approachable option.

By Distribution Channel

A combination of a market share of more than 46.7% in 2023, supermarkets and hypermarkets dominated the ready-meal industry. These retail locations serve a broad range of prepared meals to satisfy a wide range of customer tastes. Customers like supermarkets and hypermarkets because of their large selection of products, easy access, and one-stop shopping experience.

A wide selection of ready-to-eat meals, from freshly made deli dishes to frozen entrees, are available for customers to peruse through aisles. Supermarkets and hypermarkets have a monopoly on the market because of their large shelf spaces and marketing campaigns.

Convenience stores offered customers quick and easy meal options, accounting for a large portion of the ready meals sector. Customers choose these establishments because they are easily accessible and have longer hours, making it convenient for them to buy prepared meals while on the go.

A variety of grab-and-go foods, such as sandwiches, salads, microwaveable entrees, and snacks, are usually available at convenience stores. Convenience stores are a desirable alternative for customers looking for quick and simple meal solutions because of their strategic placement in busy locations like gas stations, transportation hubs, and urban centers.

With the ease of e-commerce, online platforms have become a rising means of distributing ready meals to a wider audience. An extensive selection of ready meals, from freshly made gourmet dishes to pantry-stable alternatives, are available from online stores.

For time-pressed customers looking for hassle-free meal alternatives, the convenience of online ordering, doorstep delivery, and subscription services is appealing. Specialty and niche ready-meal manufacturers can also directly contact consumers through online channels, tailoring their offerings to their individual dietary needs and preferences.

By providing distinctive and focused meal options, other distribution channels including vending machines, specialty shops, and meal kit services support the ready meals business. Specialty stores cater to discriminating customers looking for high-end ready-meal options by specializing in specialty markets and handcrafted goods.

Easy access to prepared meals is made possible by vending machines in busy places like offices, schools, and airports. Meal kit businesses provide customers with pre-portioned supplies and recipes to create meals at home. They offer subscription-based meal solutions. The ready-meal market is seeing innovation and competition as a result of these varied distribution channels, which meet the changing demands and tastes of consumers.

Regional Analysis

North America accounted for 40.9% of the worldwide pre-packaged meal market in 2023, with the United States being the biggest consumer. Product demand in the region is being driven by consumers' changing dietary habits as a result of increased health consciousness and worries about food safety. Furthermore, the perception of health and consumer trust are major factors in the value of pre-packaged goods that are vegan, gluten-free, and organic. The rising popularity of ready-to-eat meals can be attributed to their mobility, ease of preparation, and constant availability of new options.

As the target population in the region is expected to grow at the quickest rate between 2023 and 2033, Asia Pacific is expected to be the fastest-growing regional market. Additionally, rising consumer awareness of ready-to-eat items and expanding disposable income are driving market expansion. Furthermore, rising living standards and fast industrialization in developing nations like India would boost the market for pre-packaged foods. Europe is anticipated to have significant growth in the upcoming years as a result of the introduction of novel products.

Competitive Analysis

The existence of numerous domestic and international businesses has caused the market to become fragmented. To meet the growing global customer preference for healthier options, producers are concentrating on developing new products that cater to niche markets such as frozen, chilled, vegetarian, and vegan meals. In light of the COVID-19 pandemic, retailers have started expanding their product lines in supermarkets and hypermarkets. To increase the variety of products they offer and the number of customers they serve, they are also concentrating on tactics like collaborations, internet marketing campaigns, creativity, and new product creation.

Recent Developments

June 2023: To expand its yogurt offering, Unilever, a multinational consumer goods corporation based in Britain, announced that it had acquired Yasso, a high-end frozen Greek yogurt brand, in North America.

April 2023: Nestle, a multinational food and drink processing giant based in Switzerland, has announced that it will be forming a frozen pizza joint venture with PAI in Europe to compete in this highly competitive market.

Key Market Players in the Ready Meals Market

o Nestlé

o Kellogg Company

o General Mills Inc.

o Conagra Brands Inc.

o Dr. Oetker

o Tyson Foods Inc.

o Nomad Foods

o Unilever

o Green Mill Foods

o 2 Sisters Food Group

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 164.3 Billion |

|

Market Size 2033 |

USD 283.2 Billion |

|

Compound Annual Growth Rate (CAGR) |

5.6% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Product, Meal Type, End-User, Distribution Chanel, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Nestlé, Kellogg Company, General Mills Inc., Conagra Brands Inc., Dr. Oetker, Tyson Foods Inc., Nomad Foods, Unilever, Green Mill Foods, 2 Sisters Food Group, Other Key Players |

|

Key Market Opportunities |

Rising Demand for Healthy and Nutritious Options |

|

Key Market Dynamics |

Busy Lifestyles and Convenience Needs |

📘 Frequently Asked Questions

1. How much is the Ready Meals Market in 2023?

Answer: The Ready Meals Market size was valued at USD 164.3 Billion in 2023.

2. What would be the forecast period in the Ready Meals Market report?

Answer: The forecast period in the Ready Meals Market report is 2023-2033.

3. Who are the key players in the Ready Meals Market?

Answer: Nestlé, Kellogg Company, General Mills Inc., Conagra Brands Inc., Dr. Oetker, Tyson Foods Inc., Nomad Foods, Unilever, Green Mill Foods, 2 Sisters Food Group, Other Key Players

4. What is the growth rate of the Ready Meals Market?

Answer: Ready Meals Market is growing at a CAGR of 5.6% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.