🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Real Estate Market

Real Estate Market (By Property (Residential, Commercial, Industrial, Land, Others), By Business (Sales, Rental, Lease), By Property Type (Fully Furnished, Semi Furnished, Unfurnished), By Region and Companies)

Jun 2024

Consumer and Retails

Pages: 180

ID: IMR1105

Real Estate Market Overview

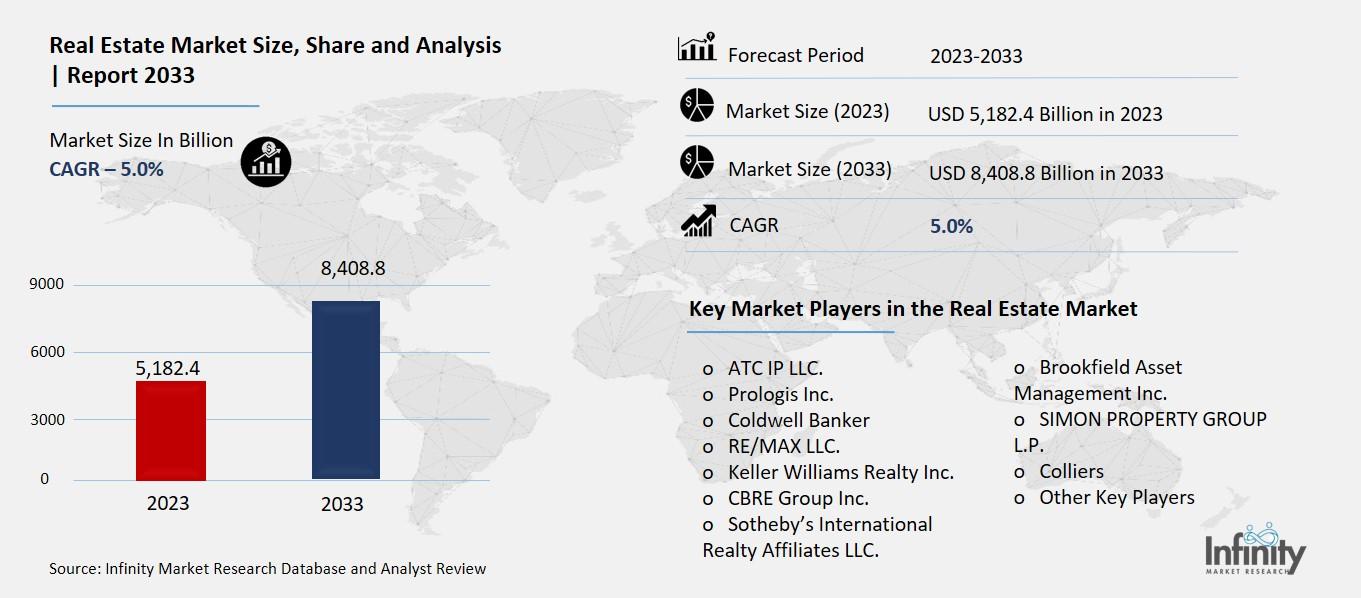

Global Real Estate Market size is expected to be worth around USD 8,408.8 Billion by 2033 from USD 5,182.4 Billion in 2023, growing at a CAGR of 5.0% during the forecast period from 2023 to 2033.

The real estate market is where people buy, sell, and rent properties like houses, apartments, and commercial buildings. It works like any other market: people who want to sell or rent their property list it, and those looking to buy or rent check out these listings. Prices in the real estate market can go up or down depending on factors like location, the economy, interest rates, and the demand for properties.

When the real estate market is doing well, you might see more people buying homes, which can drive up prices because there’s more competition. On the other hand, if the market is slow, prices might drop, making it easier for buyers to find good deals. Whether you’re buying your first home, selling a property, or investing in real estate, understanding the market can help you make better decisions and get the most out of your money.

Drivers for the Real Estate Market

Interest Rates Impact

One of the biggest drivers for the real estate market is interest rates. When interest rates are low, borrowing money becomes cheaper, making it easier for people to buy homes and for investors to finance new projects. This tends to boost demand for real estate. On the flip side, when interest rates rise, borrowing costs increase, which can slow down the market. As of 2024, the uncertainty around interest rates is a significant factor, with many market participants closely watching for any changes that could affect their plans.

Urbanization and Population Growth

Urbanization and population growth are powerful forces driving the real estate market. As more people move to cities in search of better job opportunities and living standards, the demand for housing and commercial spaces increases. In regions like Asia Pacific, rapid urbanization has led to the development of new urban centers and significant real estate investments. This trend is particularly strong in emerging economies such as China and India, where new urban infrastructure and housing projects are continuously being developed to accommodate the growing population .

Technological Advancements

Technology is transforming the real estate market in many ways. Online platforms and apps have made it easier to buy, sell, and rent properties, providing convenience and greater accessibility. These digital tools allow for virtual tours, real-time updates, and seamless communication between buyers, sellers, and agents. This shift to online transactions has expanded the reach of the real estate market, enabling people to explore properties from anywhere in the world. Additionally, technology is helping real estate firms streamline their operations and improve efficiency through automation and data analytics.

Economic Stability

Economic stability plays a crucial role in the health of the real estate market. A strong economy usually means higher employment rates, better wages, and more disposable income, all of which contribute to higher demand for real estate. In regions like North America, the robust economy and dynamic urbanization trends drive significant real estate activity. Major cities like New York and Los Angeles attract both domestic and international investors, bolstering the market. Conversely, economic downturns or uncertainties, such as geopolitical tensions or financial market instability, can negatively impact the market by reducing investor confidence and consumer spending.

Government Policies and Incentives

Government policies and incentives can significantly influence the real estate market. Policies aimed at encouraging homeownership, such as tax benefits and subsidies, can boost demand. Similarly, initiatives to develop affordable housing or improve urban infrastructure can attract investment and drive market growth. In many regions, governments are also promoting sustainable and smart city developments, which not only enhance livability but also attract global investors looking for environmentally friendly projects.

Foreign Investment

Foreign investment is another critical driver of the real estate market. International investors often seek opportunities in markets that offer higher returns and portfolio diversification. This influx of capital can lead to the development of large-scale real estate projects, including commercial hubs and mixed-use complexes. For instance, in the Asia Pacific region, foreign direct investment has been a key factor in the rapid growth of the real estate market, with many global investors drawn to the region's vibrant economies and growth potential (IMARC).

Restraints for the Real Estate Market

High Interest Rates

One major restraint for the real estate market is high interest rates. When interest rates are elevated, borrowing money to buy property becomes more expensive. This increase in the cost of borrowing can lead to a decrease in the number of people who can afford to buy homes, thereby reducing demand. High mortgage rates particularly affect first-time buyers, who might be priced out of the market. As borrowing costs rise, both residential and commercial property markets experience a slowdown in sales and new constructions.

Economic Uncertainty

Economic uncertainty is another significant factor restraining the real estate market. When the economy is unstable, people are less likely to make large investments like purchasing property. Concerns about job security, inflation, and future economic conditions can lead to a more cautious approach among potential buyers and investors. This hesitancy can result in lower demand for both residential and commercial properties, impacting overall market growth.

Regulatory and Policy Changes

Changes in government regulations and policies can also act as restraints. For example, new laws related to zoning, land use, or environmental standards can increase the cost and complexity of real estate development. Additionally, policies aimed at cooling down overheated housing markets, such as higher taxes on property transactions or stricter lending criteria, can deter both buyers and developers. These regulatory changes can create uncertainty and slow down market activity as stakeholders adjust to new rules.

Construction and Material Costs

Rising construction and material costs are another challenge for the real estate market. The cost of raw materials like steel, cement, and lumber has been increasing, which directly impacts the cost of building new homes and commercial properties. These higher costs can make new developments less financially viable, leading to a slowdown in construction projects. Additionally, supply chain disruptions can exacerbate these issues, causing delays and further increasing costs.

Supply and Demand Imbalance

An imbalance between supply and demand also restrains the market. In some areas, there is an oversupply of properties, particularly in certain segments like luxury apartments or commercial spaces. This oversupply can lead to lower rental yields and property values, making investments less attractive. Conversely, in markets with high demand but limited supply, affordability becomes a major issue, preventing many potential buyers from entering the market.

Geopolitical Risks

Finally, geopolitical risks can have a significant impact on the real estate market. Political instability, trade conflicts, and international tensions can create an uncertain environment that affects investor confidence. Real estate markets thrive on stability and predictability, so any factors that introduce risk and uncertainty can dampen investment and slow market growth.

Opportunity in the Real Estate Market

Technology and Innovation

The integration of technology into the real estate market is opening up numerous opportunities. Proptech, or property technology, is transforming how properties are managed, sold, and rented. Innovations such as virtual reality (VR) and augmented reality (AR) enable potential buyers and renters to tour properties remotely, enhancing the buying experience. Additionally, data-driven property management tools optimize rent settings, maintenance schedules, and tenant satisfaction. Artificial intelligence (AI) and predictive analytics are also becoming critical, providing data-driven insights that help in making informed investment decisions.

Expansion into Secondary Markets

As remote and hybrid work models become more prevalent, people are moving away from traditional urban centers to secondary markets, offering significant opportunities for real estate investors. These markets often provide more affordable housing options and a better quality of life, attracting a growing number of buyers and renters. This trend is expected to continue as more people seek housing in less densely populated areas, driven by the desire for more space and the flexibility to work from anywhere.

Demand for Sustainable and Green Buildings

There is a growing demand for sustainable and green buildings, creating opportunities for developers and investors who focus on eco-friendly construction. Consumers and businesses are increasingly prioritizing sustainability, leading to a rise in the development of energy-efficient buildings with lower carbon footprints. This shift not only meets regulatory requirements but also appeals to environmentally conscious buyers and tenants, potentially commanding higher rents and property values.

Resilience in the Retail Sector

Despite the rise of e-commerce, the retail real estate sector is showing resilience, with strong tenant demand for physical retail spaces. Shopping centers and mixed-use developments that combine retail, residential, and office spaces are particularly attractive. Investors who can adapt to the evolving retail landscape by incorporating experiential elements and ensuring convenience for shoppers can capitalize on this trend. The continuous demand for physical retail spaces underscores the sector's long-term potential.

Opportunities in Rental Properties

The rental market is expanding, driven by the affordability challenges in the homeownership market. With high mortgage rates and property prices, more people are opting to rent. This trend provides opportunities for investors to develop and manage rental properties. Enhancing rental listings on Multiple Listing Services (MLSs) can streamline the rental process, increase exposure for landlords, and improve profitability for agents.

Investment in Urban Revitalization

Urban revitalization projects present significant opportunities for real estate development. Many cities are investing in infrastructure improvements and community development initiatives to attract residents and businesses. Real estate investors can benefit from these initiatives by investing in properties in revitalizing areas, potentially reaping substantial returns as these neighborhoods grow and develop.

Trends for the Real Estate Market

Technology's Growing Influence

Technology is playing an increasingly crucial role in real estate. Proptech, which encompasses property technology, is focusing on profitability after facing challenges due to economic shifts. Companies are enhancing their offerings and leveraging tools like AI, predictive analytics, and virtual reality to improve property management and enhance the buying experience. Smart home technology, including integrated security systems and home automation, is also becoming a standard expectation among buyers, making homes more attractive and efficient.

Sustainable and Energy-Efficient Homes

Homes designed for energy efficiency are gaining popularity as buyers become more environmentally conscious. Features like solar panels, eco-friendly heating systems, and sustainable building materials not only appeal to eco-minded buyers but also offer financial benefits through reduced energy costs and potential tax incentives. This trend aligns with a broader push toward sustainability in various industries.

Hybrid Work Models and Home Design

The shift towards remote and hybrid work models continues to influence home design preferences. Buyers are increasingly looking for homes that can accommodate work-from-home setups, with features like dedicated office spaces and strong internet connectivity. This change has also driven demand for homes in secondary markets, where housing may be more affordable and offer a better quality of life compared to traditional urban centers.

Unique Home Staging and Wellness Spaces

Home staging is evolving from neutral, impersonal setups to more unique and curated presentations that highlight a home's character. High-end properties now often feature designer furnishings and real artwork to attract buyers. Additionally, there is a growing interest in wellness spaces within homes, such as home gyms, saunas, and spa-like bathrooms. These features enhance the living experience and can be significant selling points.

Digital and Virtual Viewings

The pandemic accelerated the adoption of digital viewings, and this trend is continuing with advancements in virtual reality (VR) and augmented reality (AR). These technologies provide immersive experiences for potential buyers, allowing them to explore properties remotely in great detail. This trend not only caters to out-of-town buyers but also streamlines the buying process by making it more efficient and accessible.

Emphasis on the Rental Market

The rental market is becoming increasingly important as affordability challenges make homeownership difficult for many. Multiple listing services (MLS) are expanding to include rental properties, providing better visibility and accessibility for renters and agents. This shift helps streamline the rental process, reduce fraudulent listings, and increase profitability for landlords and agents.

Segments Covered in the Report

By Property

o Residential

o Commercial

o Industrial

o Land

o Others

By Business

o Sales

o Rental

o Lease

By Property Type

o Fully Furnished

o Semi Furnished

o Unfurnished

Segment Analysis

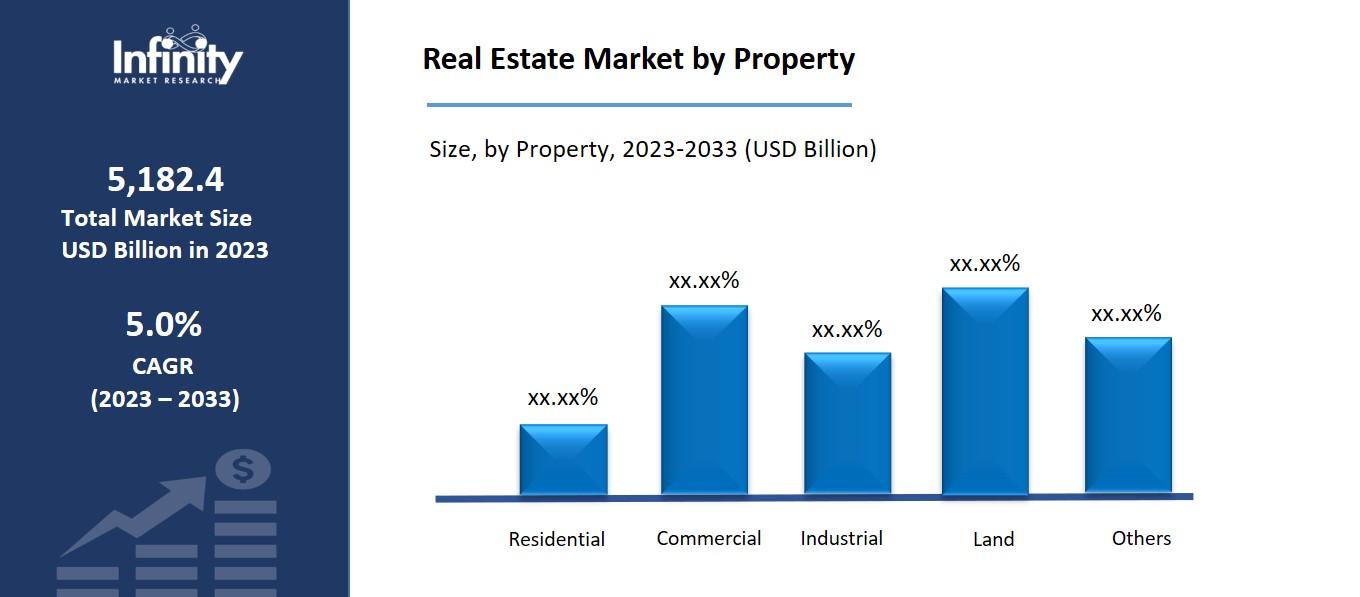

By Property Analysis

In 2023, residential real estate held a 36.3% revenue share, dominating the market. Millennials are largely responsible for the surge, as they have shown a greater inclination toward homeownership in recent years. For example, the homeownership percentage among millennials rose from 40% in 2020 to 47.9% in 2021, per Apartment List's Homeownership report.

A CAGR of 5.3% is anticipated for commercial real estate between 2023 and 2033. The market is expanding at a remarkable rate due to the expansion of the tourism industry. Furthermore, it is anticipated that the need for bathroom furniture will be driven by the expanding number of hotels and resorts. With five projects totaling 945 rooms, Citadines Apart Hotels was the most active hotel brand in Thailand in 2020, according to TOPHOTELPROJECTS GmbH.

By Business Analysis

With a 53.3% revenue share in 2023, the rental type led the market. This is explained by the fact that renters are more prevalent in developed nations due to rising housing costs, which supports the segment's growth. As per a blog post by Mansion Global, over 60% of residences in Germany will be rented in 2021, making it the nation with the highest percentage of renters.

Throughout the projected period, sales type is predicted to grow at a CAGR of 6.3%. Due to the shift in consumer attitudes on property ownership brought about by the COVID-19 pandemic, demand for luxury homes, villas, and second homes has increased. For example, a blog post by Construction Week Online states that around 1,63,000 new residential units were added from India's top 7 cities between January and September 2021.

By Property Type Analysis

Fully Furnished dominated the market in 2023, accounting for more than 42.2% of the total share. This market niche serves renters and buyers looking for residences with furnishings, appliances, and other conveniences that can be occupied right away.

A sizeable portion of the properties were semi-equipped, offering a compromise between fully furnished and unfurnished options. These homes usually come with all the necessary equipment and fittings, so tenants can partially personalize their living area.

Even though they make up a decreasing percentage of the market, unfurnished properties are nonetheless significant. They provide owners or tenants with a blank canvas to furnish and decorate as they see fit, giving them flexibility and the possibility of long-term cost savings.

Regional Analysis

In 2023, Asia Pacific held a 51.3% market share, leading the industry. The region's growing rates of homeownership are mostly responsible for the growth. With an estimated 64.8% of the market, China is thought to be the dominant country in the area. It is also predicted that the growing number of travelers in developing nations like Vietnam, Thailand, Indonesia, the Philippines, and India will help the business expand in the area.

The CAGR for the Middle East and Africa is predicted to be 6.6% between 2023 and 2033. The country's growing number of residential and commercial developments is primarily responsible for the growth. In the third quarter of 2021, for example, the Middle East Construction Pipeline Trend Report states that there were 545 hotel projects totaling 168,042 rooms. In addition, Tamcoon and Durrat Marina inked a contract in July 2021 for the construction of eighteen private villas in Bahrain.

Competitive Analysis

There are both fresh entrants and a small number of established competitors in the market. Numerous major players are concentrating more of their attention on the real estate market. To preserve their market share, industry participants are broadening the range of services they provide.

Key Market Players in the Real Estate Market

o ATC IP LLC.

o Prologis Inc.

o Coldwell Banker

o RE/MAX LLC.

o Keller Williams Realty Inc.

o CBRE Group Inc.

o Sotheby’s International Realty Affiliates LLC.

o Brookfield Asset Management Inc.

o SIMON PROPERTY GROUP L.P.

o Colliers

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 5,182.4 Billion |

|

Market Size 2033 |

USD 8,408.8 Billion |

|

Compound Annual Growth Rate (CAGR) |

5.0% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

Property, Based on Business, Property Type, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

ATC IP LLC., Prologis, Inc., Coldwell Banker, RE/MAX, LLC., Keller Williams Realty, Inc., CBRE Group, Inc., Sotheby’s International Realty Affiliates LLC., Brookfield Asset Management Inc., SIMON PROPERTY GROUP, L.P., Colliers, Other Key Player |

|

Key Market Opportunities |

Demand for Sustainable and Green Buildings |

|

Key Market Dynamics |

Government Policies and Incentives |

📘 Frequently Asked Questions

1. How much is the Real Estate Market in 2023?

Answer: The Real Estate Market size was valued at USD 5,182.4 Billion in 2023.

2. What would be the forecast period in the Real Estate Market report?

Answer: The forecast period in the Real Estate Market report is 2023-2033.

3. Who are the key players in the Real Estate Market?

Answer: ATC IP LLC., Prologis, Inc., Coldwell Banker, RE/MAX, LLC., Keller Williams Realty, Inc., CBRE Group, Inc., Sotheby’s International Realty Affiliates LLC., Brookfield Asset Management Inc., SIMON PROPERTY GROUP, L.P., Colliers, Other Key Player

4. What is the growth rate of the Real Estate Market?

Answer: Real Estate Market is growing at a CAGR of 5.0% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.