🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Remote Patient Monitoring Software And Services Market

Remote Patient Monitoring Software And Services Market (By Type (Software, Services), By Application (Cancer, Cardiovascular Disease, Diabetes, Sleep Disorder, Other Applications), By End-User (Payers, Patients, Providers), By Region and Companies)

Jun 2024

Healthcare

Pages: 160

ID: IMR1118

Remote Patient Monitoring Software And Services Market Overview

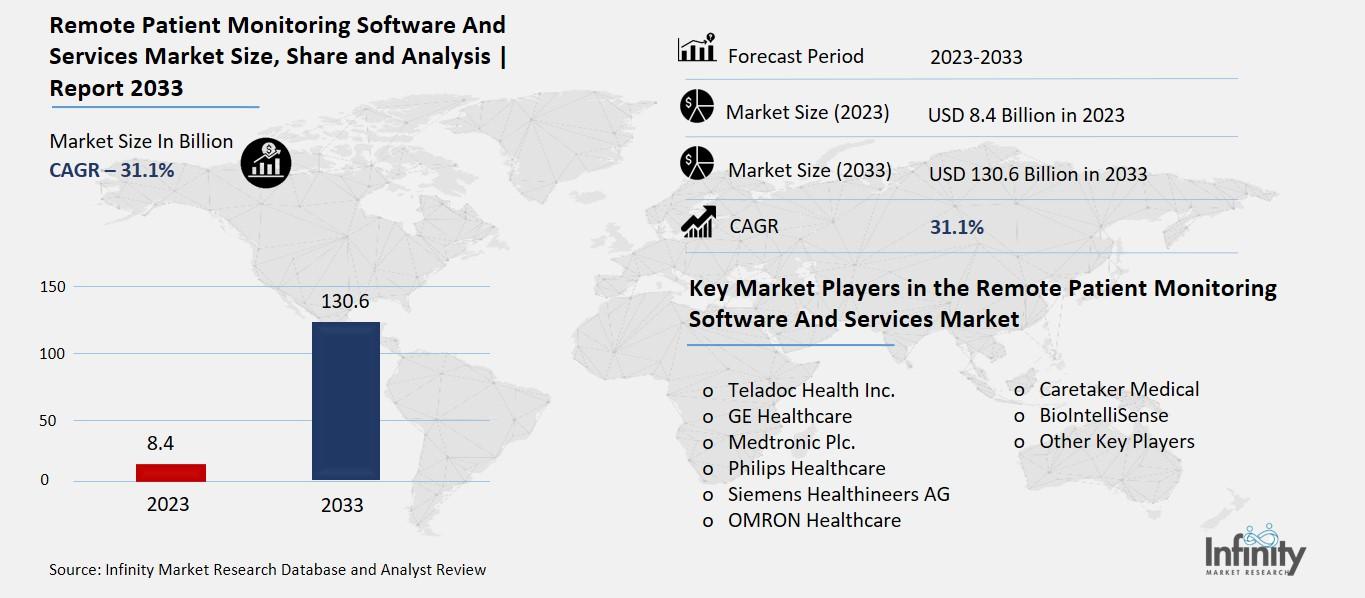

Global Remote Patient Monitoring Software And Services Market size is expected to be worth around USD 130.6 Billion by 2033 from USD 8.4 Billion in 2023, growing at a CAGR of 31.1% during the forecast period from 2023 to 2033.

Remote patient monitoring (RPM) software and services refer to the tools and systems used to keep track of a patient's health from a distance. Instead of visiting a doctor’s office or hospital, patients can use devices at home to measure things like blood pressure, heart rate, and blood sugar levels. This information is then sent electronically to healthcare providers, who can monitor the patient's condition and provide medical advice or intervention if needed. RPM helps in managing chronic diseases, improving patient outcomes, and reducing the need for hospital visits.

The RPM market includes the software that collects and analyzes health data, as well as the services provided by healthcare professionals who monitor and interpret this data. This market is growing rapidly due to the increasing number of individuals with chronic illnesses, the rising adoption of telemedicine, and advancements in technology that make remote monitoring more effective and accessible. It aims to make healthcare more convenient, especially for those who need regular monitoring but have difficulty traveling to medical facilities.

Drivers for the Remote Patient Monitoring Software And Services Market

Rising Prevalence of Chronic Diseases

One of the main drivers of the RPM market is the increasing prevalence of chronic diseases such as diabetes, hypertension, and heart disease. As the number of people living with these conditions grows, there is a greater need for continuous monitoring to manage their health effectively. RPM provides a convenient and efficient way for patients to monitor their health at home, reducing the need for frequent hospital visits and allowing for timely interventions.

Aging Population

The global population is aging, with a growing number of elderly individuals who require regular health monitoring. Older adults are more likely to have chronic conditions and mobility issues that make frequent trips to healthcare facilities challenging. RPM enables healthcare providers to monitor elderly patients remotely, ensuring they receive the care they need while remaining in the comfort of their homes. This not only improves the quality of life for older adults but also reduces the burden on healthcare systems.

Technological Advancements

Advancements in technology are significantly driving the growth of the RPM market. Innovations in wearable devices, sensors, and mobile health applications have made it easier to collect and transmit health data. These technologies offer accurate and real-time monitoring, which is crucial for managing chronic conditions and detecting potential health issues early. The integration of artificial intelligence (AI) and machine learning (ML) further enhances the capabilities of RPM systems, enabling predictive analytics and personalized care.

Increased Adoption of Telehealth

The adoption of telehealth services has surged, particularly in the wake of the COVID-19 pandemic. Telehealth provides a platform for remote consultations, diagnostics, and monitoring, making it a perfect complement to RPM. The combination of telehealth and RPM allows for comprehensive remote care, where patients can receive medical advice, prescriptions, and monitoring without leaving their homes. This shift towards telehealth is expected to continue, driving the demand for RPM solutions.

Cost-Effectiveness

RPM is a cost-effective solution for both patients and healthcare providers. For patients, it reduces the need for frequent in-person visits, saving time and travel expenses. For healthcare providers, RPM helps in managing large patient populations efficiently, reducing hospital readmissions, and lowering operational costs. Insurance companies are also recognizing the benefits of RPM, leading to better reimbursement policies that encourage its adoption.

Government Initiatives and Support

Government initiatives and support play a crucial role in the growth of the RPM market. Many governments are promoting the use of digital health technologies to improve healthcare access and quality. Regulatory bodies are also establishing guidelines and frameworks to ensure the safe and effective use of RPM. These initiatives are creating a favorable environment for the adoption of RPM solutions, further driving market growth.

Restraints for the Remote Patient Monitoring Software And Services Market

Data Privacy and Security Concerns

One of the primary restraints for the RPM market is data privacy and security concerns. As RPM involves the collection, transmission, and storage of sensitive health information, ensuring the privacy and security of patient data is crucial. Patients and healthcare providers are increasingly concerned about data breaches, unauthorized access, and the potential misuse of health data. Strict regulations such as HIPAA in the United States and GDPR in Europe govern the protection of health information, requiring RPM providers to implement robust security measures and adhere to compliance standards. Addressing these concerns is essential to gaining patient trust and encouraging widespread adoption of RPM solutions.

Reimbursement Challenges

Another significant restraint for the RPM market is reimbursement challenges. While RPM has been shown to reduce healthcare costs by preventing hospitalizations and emergency visits, the reimbursement landscape varies across regions and healthcare systems. In some cases, reimbursement policies may not adequately cover the costs associated with RPM services, making it financially challenging for healthcare providers to adopt and sustain these technologies. Clarifying and improving reimbursement policies to reflect the value and benefits of RPM is crucial for its widespread adoption and long-term sustainability.

Integration with Existing Healthcare Systems

Integrating RPM solutions with existing healthcare systems and workflows can be a complex and challenging process. Healthcare providers often use multiple systems for electronic health records (EHR), telehealth, and other medical applications. RPM solutions need to seamlessly integrate with these systems to ensure smooth data exchange, continuity of care, and efficient workflows. However, interoperability issues, compatibility concerns, and resistance to change from healthcare professionals can hinder the integration of RPM into clinical practice.

Limited Access to Technology

Access to technology, particularly in rural and underserved areas, is a significant restraint for the RPM market. Reliable internet connectivity and access to mobile devices are essential for patients to use RPM solutions effectively. However, many rural areas lack adequate broadband infrastructure, limiting the availability of telehealth and RPM services. Additionally, elderly patients or those with limited technological literacy may face challenges in using RPM devices and applications, reducing their ability to benefit from remote monitoring.

Regulatory and Legal Challenges

Navigating regulatory and legal challenges is another restraint for the RPM market. Healthcare regulations vary across countries and regions, requiring RPM providers to comply with local laws, standards, and certifications. Obtaining regulatory approvals and ensuring compliance with data protection regulations can be time-consuming and costly. Additionally, regulatory changes and uncertainties may create barriers to market entry and expansion for RPM vendors, impacting the growth potential of the market.

Opportunity in the Remote Patient Monitoring Software And Services Market

Rising Prevalence of Chronic Diseases

One of the significant opportunities for the RPM market is the rising prevalence of chronic diseases worldwide. Conditions such as diabetes, cardiovascular diseases, and chronic respiratory illnesses are becoming more common, particularly with aging populations and changing lifestyles. RPM offers a proactive approach to managing these chronic conditions by allowing healthcare providers to monitor patients remotely, detect early warning signs, and intervene promptly. This reduces hospitalizations, improves patient outcomes, and enhances quality of life, making RPM an essential tool for chronic disease management.

Aging Population and Increased Healthcare Needs

The global population is aging rapidly, leading to an increased demand for healthcare services. Older adults often have multiple chronic conditions that require ongoing monitoring and management. RPM enables elderly patients to receive continuous care from the comfort of their homes, reducing the strain on healthcare facilities and personnel. This demographic shift presents a significant opportunity for RPM providers to expand their services and cater to the healthcare needs of aging populations.

Technological Advancements and Innovation

Advancements in technology, particularly in wearable devices, sensors, and telecommunication technologies, are driving innovation in the RPM market. Wearable devices can monitor vital signs, activity levels, and medication adherence in real-time, providing healthcare providers with valuable data for decision-making. Telehealth platforms and mobile applications complement RPM by facilitating remote consultations and patient education. The integration of artificial intelligence (AI) and machine learning (ML) further enhances RPM capabilities by predicting health trends and personalizing patient care plans. These technological advancements create new opportunities for RPM vendors to develop sophisticated solutions that improve patient outcomes and streamline healthcare delivery.

Cost-Effectiveness and Healthcare Savings

RPM has been shown to reduce healthcare costs by preventing hospital admissions, emergency department visits, and complications associated with chronic diseases. By monitoring patients remotely and intervening early, healthcare providers can address health issues before they escalate, leading to significant cost savings for healthcare systems and payers. This cost-effectiveness makes RPM an attractive investment for healthcare providers and insurers looking to optimize resource allocation and improve healthcare efficiency.

Expansion of Telehealth and Remote Care Models

The COVID-19 pandemic has accelerated the adoption of telehealth and remote care models, creating a favorable environment for RPM market growth. Patients and healthcare providers have become more comfortable with remote consultations and digital health solutions, paving the way for the widespread adoption of RPM. Telehealth platforms integrate seamlessly with RPM systems, enabling comprehensive virtual care that spans from diagnosis to ongoing monitoring and management. This shift towards telehealth and remote care models expands the market reach for RPM solutions, particularly in underserved rural areas and regions with limited healthcare access.

Supportive Government Policies and Regulations

Government policies and regulations are increasingly supportive of digital health technologies, including RPM. Regulatory bodies are establishing frameworks to ensure the safety, efficacy, and privacy of RPM solutions, which builds confidence among healthcare providers and patients. Reimbursement policies are also evolving to cover RPM services, incentivizing healthcare providers to adopt these technologies. These supportive policies create a conducive environment for RPM market expansion and innovation.

Trends for the Remote Patient Monitoring Software And Services Market

Integration of Artificial Intelligence (AI) and Machine Learning (ML)

One of the most significant trends in the RPM market is the integration of AI and ML technologies. These technologies enable RPM systems to analyze large volumes of patient data, identify patterns, and predict health outcomes. AI algorithms can detect anomalies in vital signs, monitor changes in patient behavior, and alert healthcare providers to potential issues. ML models improve over time by learning from new data, allowing RPM solutions to deliver personalized insights and recommendations to both patients and healthcare professionals.

Expansion of Wearable Devices and Mobile Health Apps

There is a growing trend towards using wearable devices and mobile health applications in remote patient monitoring. Wearable devices, such as smartwatches and fitness trackers, can continuously monitor vital signs, activity levels, and sleep patterns. These devices transmit data to mobile apps, where patients can track their health metrics in real-time and share them with their healthcare providers. This trend is empowering patients to take a more active role in managing their health and enabling healthcare providers to deliver more personalized and proactive care.

Telehealth and Virtual Care Integration

The COVID-19 pandemic has accelerated the adoption of telehealth and virtual care solutions, including RPM. Telehealth platforms enable healthcare providers to conduct remote consultations, monitor patients remotely, and deliver virtual care services. RPM integrates seamlessly with telehealth, allowing for comprehensive remote patient management from diagnosis to ongoing monitoring and treatment adjustments. This integration is improving access to healthcare, particularly in rural and underserved areas, and enhancing patient convenience and satisfaction.

Focus on Chronic Disease Management

Chronic disease management is a primary focus of RPM solutions, given the rising prevalence of chronic conditions globally. RPM enables healthcare providers to monitor patients with chronic diseases, such as diabetes, hypertension, and heart disease, more effectively. By monitoring vital signs and health indicators remotely, healthcare providers can detect early signs of complications and intervene promptly, reducing hospitalizations and improving patient outcomes. This trend is driving the adoption of RPM among healthcare providers and insurers looking to manage chronic diseases more efficiently.

Remote Monitoring of Elderly and High-Risk Patients

RPM is increasingly used to monitor elderly patients and those with multiple chronic conditions who are at higher risk of health complications. Elderly patients can benefit from continuous monitoring of vital signs and daily activities, which can detect early signs of health decline or emergencies. RPM solutions provide peace of mind to patients and their caregivers while enabling healthcare providers to deliver proactive and preventive care. This trend is crucial for supporting aging populations and reducing healthcare costs associated with hospital admissions and emergency care.

Data Security and Privacy Enhancements

As RPM solutions collect and transmit sensitive health data, there is a growing emphasis on data security and privacy. Healthcare providers and technology vendors are implementing robust security measures to protect patient information from unauthorized access, data breaches, and cyber threats. Compliance with regulations such as HIPAA in the United States and GDPR in Europe is essential to ensuring patient trust and regulatory compliance. This trend is driving investments in cybersecurity and data protection technologies to safeguard patient data and maintain confidentiality.

Segments Covered in the Report

By Type

-

Software

-

Services

By Application

-

Cancer

-

Cardiovascular Disease

-

Diabetes

-

Sleep Disorder

-

Other Applications

By End-User

-

Payers

-

Patients

-

Providers

Segment Analysis

By Type Analysis

In 2023, services accounted for the most market share, with 79.1%. This rise is anticipated to be influenced by elements including increased use of remote patient monitoring services and software to lower hospital admission rates. RPM offers a range of services, like as prescription management, data-driven patient engagement solutions, and emergency response system utilization. By reducing response times and allocating hospitals appropriately, emergency response systems help patients obtain better care.

The fastest predicted CAGR, of 36.4%, is expected to occur in software between 2023 and 2033. This rise is being supported by factors like the increased global adoption of cell phones and the internet. For example, statistics from Bankmycell indicate that there were 6.05 billion cell phones in the world in 2020, and that figure rose to 6.37 billion in 2021. It is expected that this will increase RPM solutions' uptake. It is expected that recent advancements in video conferencing technologies and 4G and 5G networks will further accelerate this increase.

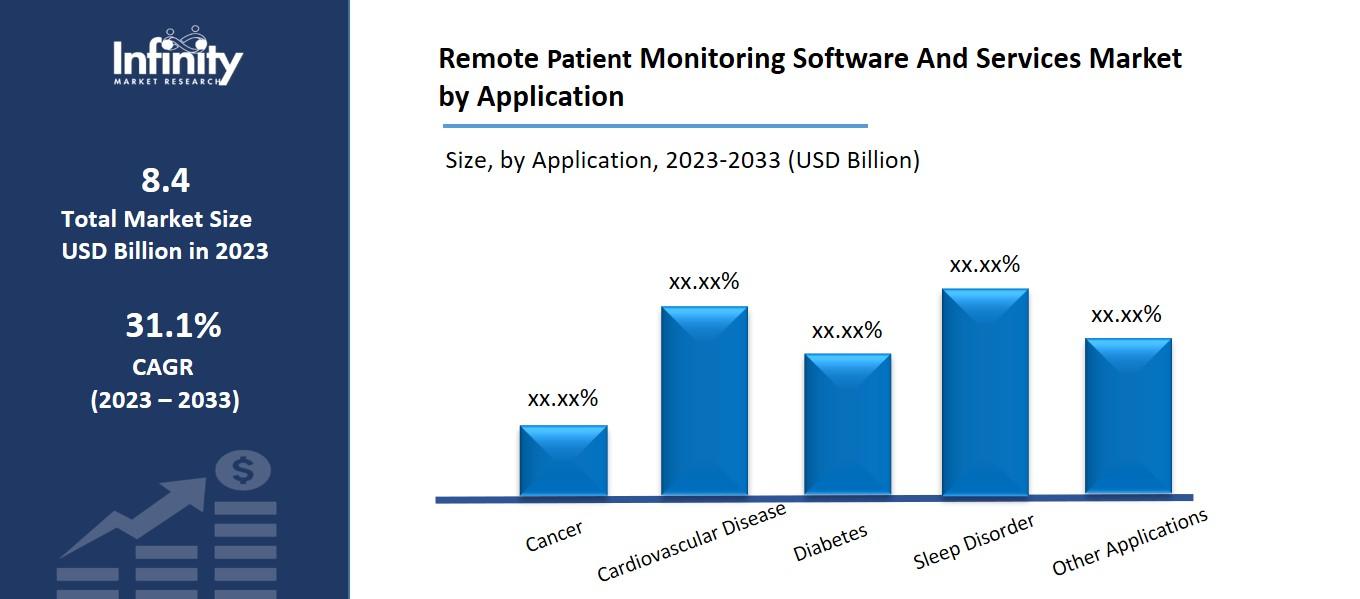

By Application Analysis

53.9% of the market was accounted for by the Others segment in 2023. It is projected that increased use of RPM software and solutions for remote monitoring of long-term ailments like Alzheimer's, rheumatoid arthritis, hypertension, and paralysis will propel their use. Some additional important variables that are expected to fuel this increase are the rising elderly population and the rising prevalence of these disorders. Patients with mobility challenges due to conditions including paralysis and arthritis are expected to increase demand for RPM services and solutions, contributing to the segment's growth.

The fastest CAGR of 37.1% is predicted for diabetes between 2023 and 2033. Diabetes needs constant blood glucose monitoring, which can be done remotely, as it is known to impair the functions of the liver, eyes, heart, and kidneys. It is expected that partnerships between public and private companies to offer diabetes remote monitoring will propel the segment's growth. For example, the University of Mississippi Medical Center and North Mississippi Primary Health Care collaborated to expand access to remote monitoring-based diabetes care management. At least 1,000 people are expected to participate in the initiative, which will be spread over eight American cities: Corinth, Ashland, Booneville, Oxford, New Albany, Ripley, Tishomingo, and Walnut.

By End-User Analysis

In terms of end users, the providers segment had the biggest share in 2023 (43.8%). Hospitals, clinics, doctors, and clinicians are examples of providers. The providers' increased use of remote patient monitoring services is one factor that is expected to fuel the market's expansion. For example, a 2021 study conducted by the American Medical Association found that 53% of doctors would be open to employing remote monitoring services to assist patients. This is expected to give the segment's growth a significant boost during the projection period.

Throughout the forecast period, the patient sector is expected to grow at the fastest rate-35.9%. Higher use of services to lower healthcare expenses and improved doctor-patient engagement are just a couple of the reasons that are expected to propel market expansion throughout the forecast period. Industry statistics state that in 2021, four out of five Americans supported the use of remote monitoring in healthcare. According to the survey, eighty-five percent of the participants who employed remote patient monitoring for medical purposes were in the 18–34 age range.

Regional Analysis

In 2023, North America held a dominant 51.7% revenue share. This expansion is expected to be driven by factors including the availability of digital infrastructure and the use of remote patient monitoring services. It is anticipated that government actions will increase North America's use of RPM solutions. In June 2021, for example, the Rural Remote Monitoring Patient Act was introduced by U.S. legislators. This measure is anticipated to launch a virtual health pilot program that assists in supplying RPM services and software in rural states across the United States. The bill will help make RPM more accessible and enable medical professionals to provide better patient care.

Between 2023 and 2033, MEA is expected to increase at a compound annual growth rate (CAGR) of 41.2% due to the increasing need to reduce healthcare expenditures and the rising prevalence of chronic illnesses including type II diabetes and hypertension. Regional market expansion is also expected to be aided by the use of RPM to lessen the strain on healthcare facilities and by rising governmental and private sector efforts to fortify the digital healthcare system. For example, a June 2022 article in Healthcare IT News states that 30% of hospital spending in the Middle East and North Africa is anticipated to go toward virtual care, artificial intelligence, and remote patient monitoring.

Competitive Analysis

The market for remote patient monitoring software and services is fragmented because many companies operate both locally and internationally. The industry is seeing fierce rivalry as a result of the entry of new firms selling cutting-edge products.

Recent Developments

January 2022: For their outstanding remote patient monitoring initiatives in the US and the UK, OMRON Healthcare, Inc. received recognition. The company's goal of attaining zero incidences of stroke and heart attack is expected to be advanced by this recognition, which is also expected to encourage more proactive healthcare management, behavioral changes to lower health risks, and stronger patient-physician relationships.

September 2022: Stasis Health and Medtronic have partnered to launch Stasis' innovative bedside patient monitoring system in India. It is anticipated that this partnership will help Medtronic solidify its leadership in the remote patient monitoring sector and help Stasis increase its medical footprint in the nation.

Key Market Players in the Remote Patient Monitoring Software And Services Market

-

Teladoc Health Inc.

-

GE Healthcare

-

Medtronic Plc.

-

Philips Healthcare

-

Siemens Healthineers AG

-

OMRON Healthcare

-

Caretaker Medical

-

BioIntelliSense

-

Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 8.4 Billion |

|

Market Size 2033 |

USD 130.6 Billion |

|

Compound Annual Growth Rate (CAGR) |

31.1% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Application, End-User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Teladoc Health Inc., GE Healthcare, Medtronic Plc., Philips Healthcare, Siemens Healthineers AG, OMRON Healthcare, Caretaker Medical, BioIntelliSense, Other Key Players |

|

Key Market Opportunities |

Rising Prevalence of Chronic Diseases |

|

Key Market Dynamics |

Increased Adoption of Telehealth |

📘 Frequently Asked Questions

1. How much is the Cyber Insurance Market in 2023?

Answer: The Cyber Insurance Market size was valued at USD 8.4 Billion in 2023.

2. What would be the forecast period in the Cyber Insurance Market report?

Answer: The forecast period in the Cyber Insurance Market report is 2023-2033.

3. Who are the key players in the Cyber Insurance Market?

Answer: Teladoc Health Inc., GE Healthcare, Medtronic Plc., Philips Healthcare, Siemens Healthineers AG, OMRON Healthcare, Caretaker Medical, BioIntelliSense, Other Key Players

4. What is the growth rate of the Cyber Insurance Market?

Answer: Cyber Insurance Market is growing at a CAGR of 31.1% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.