🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Renal Anemia Market

Global Renal Anemia Market (By Type, Sickle Cell Anemia, Iron Deficiency Anemia, Hemolytic Anemia, Vitamin B12 Deficiency Anemia, Aplastic Anemia, and Other Types; By Treatment Type, Bone Marrow Transplant, Erythropoiesis-Stimulating Agents (ESAs), Vitamin B12 Supplementation, Iron Supplementation, Transfusion Therapy, and Other Treatment Types; By Route of Administration, Oral, Intravenous, and Subcutaneous; By End-User, Hospitals & Clinics, Dialysis Centers, and Home Healthcare; By Region and Companies), 2024-2033

Jan 2025

Healthcare

Pages: 138

ID: IMR1410

Renal Anemia Market Overview

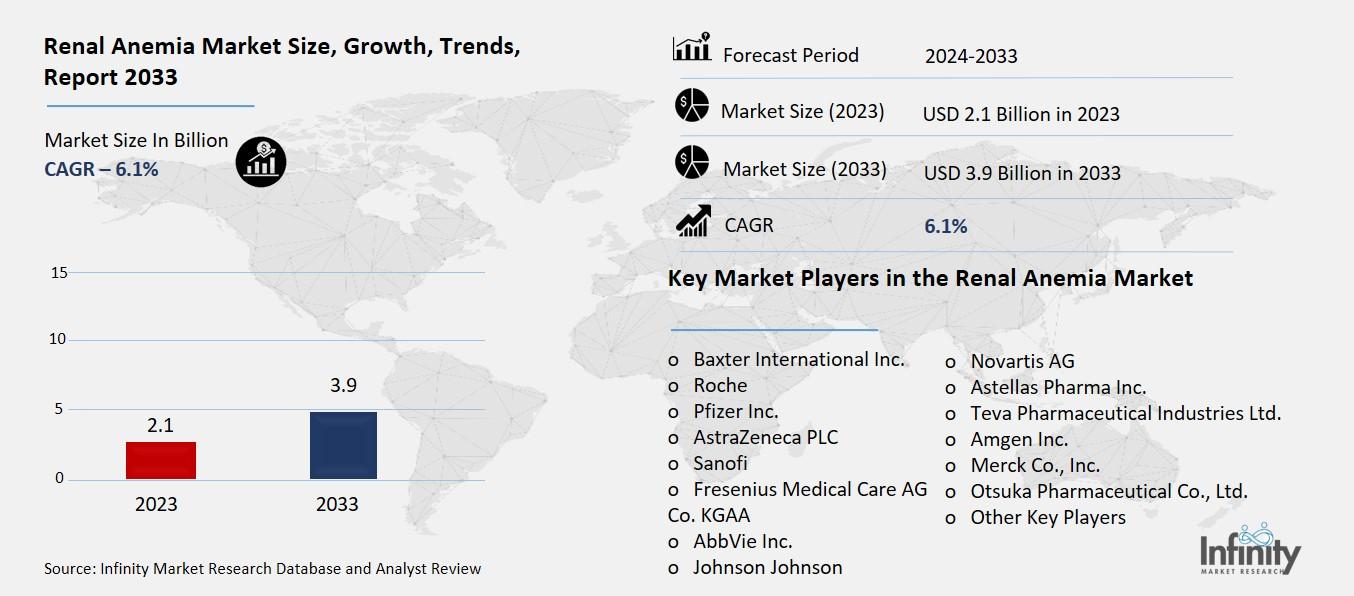

Global Renal Anemia Market acquired the significant revenue of 2.1 Billion in 2023 and expected to be worth around USD 3.9 Billion by 2033 with the CAGR of 6.1% during the forecast period of 2024 to 2033. The growth of the global renal anemia market is attributed to the rise in the incidence of chronic kidney diseases (CKD), which result in renal anemia, a situation where the kidneys are incapable of synthesizing erythropoietin a hormone crucial for red blood cell production. Global KA rat continues steadily and especially in kale with aging populations the need for management modalities including ESA, iron though, and conversion to blood transfusion also increases. The market is also impacted by developments in diagnostics, therapies and treatments, and an increased focus on diseases affecting the kidneys. Due to growing concerns over renal complications, governments as well as healthcare are funding in renal care infrastructure more, thus fueling the market growth.

Drivers for the Renal Anemia Market

Rising Prevalence of Chronic Kidney Disease (CKD)

Chronic Kidney Disease or CKD is an ailment that is fast becoming a major health concern across the globe, especially due to increasing life expectancy and aging population, and therefore the therapies of renal anemia is an area of focus. It is established that with aging, probability of CKD development increases as a result of declining inherent renal mass, incidence of comorbidities including diabetes and hypertension, and inherited factors. CKD is often accompanied by renal anemia because the kidneys no longer produce enough erythropoietin – a hormone that promotes red blood cell production. This condition results in fatigue, weakness and other pathological symptoms which tend to produce a major nuisance on the quality of life.

Since the population of the elderly is constantly increasing globally, the prevalence of CKD and renal anemia will also increase in parallel and expand the market for treatment solutions. This shift in demographics increases demands on healthcare organizations to deliver additional, innovative therapies like erythropoiesis-stimulating agents (ESAs), iron, and other newer biologic agents, to treat and mitigate the manifestations of renal anemia.

Restraints for the Renal Anemia Market

Adverse Effects of Current Therapies

The potential side effects and complications associated with treatments such as erythropoiesis-stimulating agents (ESAs) are a significant barrier to their widespread adoption in the renal anemia market. While ESAs are effective in stimulating red blood cell production and treating anemia, they are not without risks. One of the primary concerns is their association with cardiovascular complications, including hypertension, stroke, and heart failure. These risks arise because ESAs can increase red blood cell count rapidly, leading to thicker blood and heightened pressure within the cardiovascular system. As a result, patients undergoing ESA treatment may face an elevated risk of adverse events, especially those with pre-existing heart conditions or CKD-related cardiovascular problems.

Opportunity in the Renal Anemia Market

Home Dialysis and Self-Administered Therapies

The increasing demand for home dialysis and therapies that can be self-administered presents significant growth opportunities for companies offering innovative solutions in the renal anemia market. As patients with chronic kidney disease (CKD) and renal anemia seek more convenient, flexible, and cost-effective treatment options, the shift towards home-based care is becoming more pronounced. Home dialysis allows patients to undergo treatment in the comfort of their own homes, reducing the need for frequent hospital visits, minimizing disruption to daily life, and lowering overall healthcare costs. Self-administered therapies, including at-home injections of erythropoiesis-stimulating agents (ESAs) or iron supplements, are increasingly preferred by patients who want greater autonomy and control over their treatment regimen. This trend is especially strong among younger, more tech-savvy patients who are comfortable using remote monitoring tools and devices to track their health status.

Trends for the Renal Anemia Market

Increased Focus on Early Detection

A growing emphasis on early detection and prevention of renal anemia through routine screenings and biomarkers is significantly shaping the market landscape. As awareness of chronic kidney disease (CKD) and its complications, including renal anemia, increases, healthcare systems are placing more focus on early identification and management. Early detection of renal anemia, often a consequence of CKD, can prevent the progression of symptoms and reduce the need for more aggressive treatments later on. Routine screenings, particularly in high-risk populations such as the elderly, diabetics, and hypertensive individuals, help identify kidney dysfunction and anemia at earlier stages, facilitating timely intervention.

The use of biomarkers, such as serum creatinine levels, hemoglobin, and erythropoietin, plays a crucial role in detecting renal anemia before it becomes severe. Advancements in biomarker technology are making it easier to diagnose and monitor renal anemia, allowing for personalized treatment strategies. These early interventions can lead to better patient outcomes and reduced healthcare costs, which in turn drives the adoption of early detection strategies.

Segments Covered in the Report

By Type

o Sickle Cell Anemia

o Iron Deficiency Anemia

o Hemolytic Anemia

o Vitamin B12 Deficiency Anemia

o Aplastic Anemia

o Other Types

By Treatment Type

o Bone Marrow Transplant

o Erythropoiesis-Stimulating Agents (ESAs)

o Vitamin B12 Supplementation

o Iron Supplementation

o Transfusion Therapy

o Other Treatment Types

By Route of Administration

o Oral

o Intravenous

o Subcutaneous

By End-User

o Hospitals & Clinics

o Dialysis Centers

o Home Healthcare

Segment Analysis

By Type Analysis

On the basis of type, the market is divided into sickle cell anemia, iron deficiency anemia, hemolytic anemia, vitamin b12 deficiency anemia, aplastic anemia, and other types. Among these, iron deficiency anemia segment acquired the significant share in the market owing to the strong connection between iron deficiency and chronic kidney disease (CKD). Iron deficiency is a common comorbidity in CKD patients, particularly those undergoing dialysis, as kidney dysfunction can impair iron absorption and utilization in the body. Additionally, treatments for renal anemia, such as erythropoiesis-stimulating agents (ESAs), often require iron supplementation to enhance their efficacy, further increasing the demand for iron supplementation therapies.

By Treatment Type Analysis

On the basis of treatment type, the market is divided into bone marrow transplant, erythropoiesis-stimulating agents (ESAS), vitamin b12 supplementation, iron supplementation, transfusion therapy, and other treatment types. Among these, erythropoiesis-stimulating agents (ESAS) segment held the prominent share of the market due to their proven efficacy in stimulating red blood cell production, which is essential for managing renal anemia, particularly in patients with chronic kidney disease (CKD). ESAs, such as epoetin alfa and darbepoetin alfa, have been widely used for several years to treat anemia in CKD patients, especially those undergoing dialysis. These agents work by mimicking erythropoietin, a hormone that the kidneys normally produce to stimulate the production of red blood cells, which is often insufficient in CKD patients.

By Route of Administration Analysis

On the basis of route of administration, the market is divided into oral, intravenous, and subcutaneous. Among these, intravenous segment held the significant share of the market due to effectiveness and rapid absorption, especially in patients with chronic kidney disease (CKD) and those undergoing dialysis. Intravenous administration is preferred for several treatments, such as iron supplementation and erythropoiesis-stimulating agents (ESAs), as it allows for more direct and immediate delivery of these therapies into the bloodstream. For dialysis patients, IV administration is often the most practical and efficient option, as these patients are typically in healthcare settings where IV access is readily available.

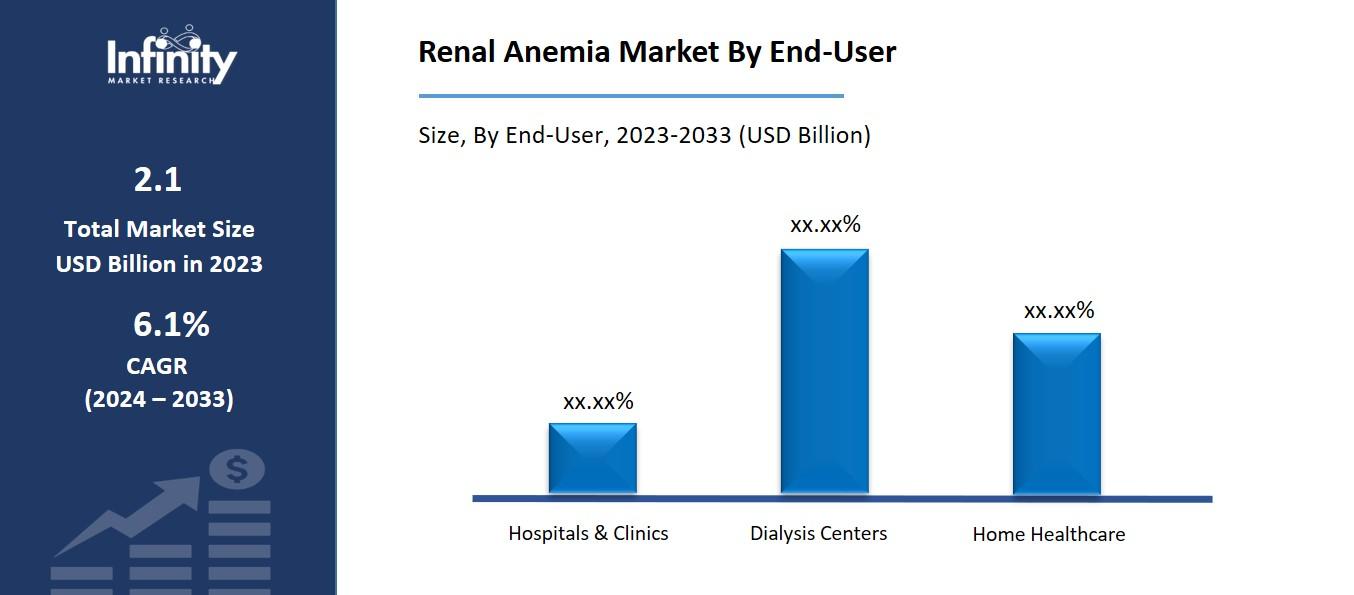

By End-User Analysis

On the basis of end-user, the market is divided into hospitals & clinics, dialysis centers, and home healthcare. Among these, hospitals & clinics segment held the most of the share of the market owing to the central role that hospitals and clinics play in the treatment and management of chronic kidney disease (CKD) and renal anemia. These healthcare facilities are equipped with the necessary infrastructure, medical professionals, and diagnostic tools required to provide comprehensive care for patients with CKD, including the administration of erythropoiesis-stimulating agents (ESAs), iron supplements, blood transfusions, and other therapies for renal anemia.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 32.5% of the market. The region benefits from advanced healthcare infrastructure, high levels of healthcare spending, and a robust system for diagnosing and treating chronic kidney disease (CKD) and its complications, such as renal anemia. The United States, in particular, has a large patient population suffering from CKD, largely due to the high prevalence of risk factors such as diabetes, hypertension, and an aging population. As a result, there is significant demand for effective therapies, including erythropoiesis-stimulating agents (ESAs), iron supplementation, and dialysis treatments.

Additionally, North America has seen significant investments in the development and adoption of new treatment options, such as biologics and home-based therapies, which have further expanded the market. The presence of leading pharmaceutical companies and a favorable regulatory environment also contribute to the region's dominance, with new therapies and innovations reaching the market more quickly.

Competitive Analysis

The competitive landscape of the renal anemia market is characterized by the presence of several key players offering a wide range of therapies to manage chronic kidney disease (CKD)-associated anemia. Major pharmaceutical companies, including Amgen, Roche, Bayer, and Hospira (now part of Pfizer), dominate the market with their established products like erythropoiesis-stimulating agents (ESAs) and iron supplements. These companies have a strong market presence due to their extensive product portfolios, significant investments in research and development, and strong distribution networks.

Recent Developments

In October 2024, Akebia Therapeutics®, Inc., a biopharmaceutical company dedicated to improving the lives of individuals affected by kidney disease, and U.S. Renal Care (USRC), the fastest-growing dialysis provider in the U.S., announced a multi-year commercial supply agreement covering all USRC dialysis centers.

Key Market Players in the Renal Anemia Market

o Baxter International Inc.

o Roche

o Pfizer Inc.

o AstraZeneca PLC

o Sanofi

o Fresenius Medical Care AG Co. KGAA

o AbbVie Inc.

o Johnson Johnson

o Novartis AG

o Astellas Pharma Inc.

o Teva Pharmaceutical Industries Ltd.

o Amgen Inc.

o Merck Co., Inc.

o Otsuka Pharmaceutical Co., Ltd.

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 2.1 Billion |

|

Market Size 2033 |

USD 3.9 Billion |

|

Compound Annual Growth Rate (CAGR) |

6.1% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Treatment Type, Route of Administration, End-User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Baxter International Inc., Roche, Pfizer Inc., AstraZeneca PLC, Sanofi, Fresenius Medical Care AG Co. KGAA, AbbVie Inc., Johnson Johnson, Novartis AG, Astellas Pharma Inc., Teva Pharmaceutical Industries Ltd., Amgen Inc., Merck Co., Inc., Otsuka Pharmaceutical Co., Ltd., and Other Key Players. |

|

Key Market Opportunities |

Home Dialysis and Self-Administered Therapies |

|

Key Market Dynamics |

Rising Prevalence of Chronic Kidney Disease (CKD) |

📘 Frequently Asked Questions

1. Who are the key players in the Renal Anemia Market?

Answer: Baxter International Inc., Roche, Pfizer Inc., AstraZeneca PLC, Sanofi, Fresenius Medical Care AG Co. KGAA, AbbVie Inc., Johnson Johnson, Novartis AG, Astellas Pharma Inc., Teva Pharmaceutical Industries Ltd., Amgen Inc., Merck Co., Inc., Otsuka Pharmaceutical Co., Ltd., and Other Key Players.

2. How much is the Renal Anemia Market in 2023?

Answer: The Renal Anemia Market size was valued at USD 2.1 Billion in 2023.

3. What would be the forecast period in the Renal Anemia Market?

Answer: The forecast period in the Renal Anemia Market report is 2024-2033.

4. What is the growth rate of the Renal Anemia Market?

Answer: Renal Anemia Market is growing at a CAGR of 6.1% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.