🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Stainless Steel Market

Stainless Steel Market (By Grade (200 Series, 300 Series, 400 Series, Duplex Series, Other Grade), By Product (Austenitic Stainless Steels, Martensitic Stainless Steels, Ferritic Stainless Steels, Precipitation Hard Stainless Steel, Other Products), By Application (Building & Construction, Automotive & Transportation, Consumer Goods, Mechanical Engineering & Heavy Industries, Electronic Appliances, Food Manufacturing, Other Applications), By Region and Companies)

Jul 2024

Chemicals and Materials

Pages:

ID: IMR1158

Stainless Steel Market Overview

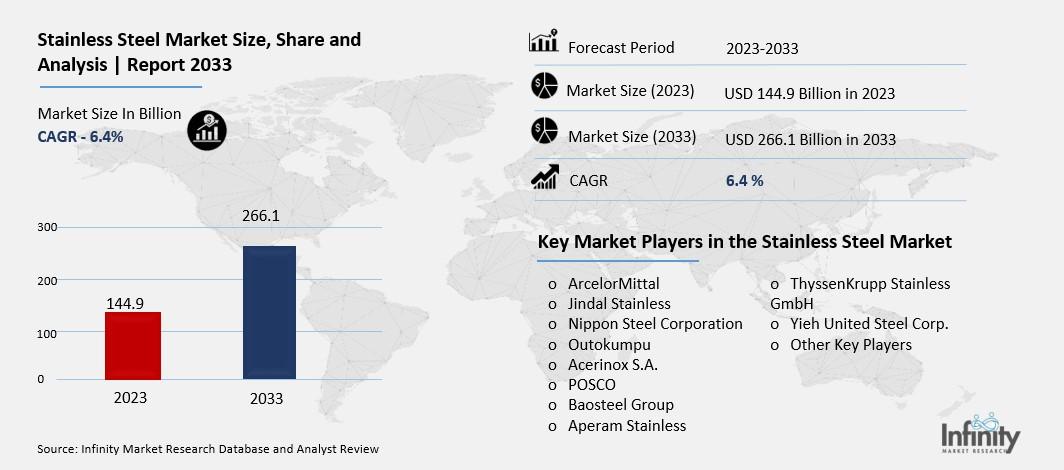

Global Stainless Steel Market size is expected to be worth around USD 266.1 Billion by 2033 from USD 144.9 Billion in 2023, growing at a CAGR of 6.4% during the forecast period from 2023 to 2033.

The Stainless-Steel Market is a global industry focused on the production and sale of stainless steel, a durable and versatile metal known for its resistance to rust and corrosion. Stainless steel is used in a wide range of applications, from kitchen appliances and cutlery to construction materials and medical devices. The market is driven by demand from various sectors such as construction, automotive, food and beverage, and healthcare, all of which benefit from stainless steel's properties like strength, durability, and ease of maintenance.

Growth in the stainless-steel market is largely attributed to increasing urbanization, industrialization, and infrastructure development around the world. As more cities expand and modernize, the need for materials that are both strong and aesthetically pleasing grows. Additionally, innovations in manufacturing processes and the development of more sustainable and recyclable stainless-steel products are also contributing to the market's expansion. With rising demand from developing countries and ongoing technological advancements, the stainless-steel market is expected to continue its robust growth trajectory.

Drivers for the Stainless Steel Market

Growing Demand in Construction and Infrastructure

The construction and infrastructure sectors are key drivers for the stainless steel market. The durability, corrosion resistance, and aesthetic appeal of stainless steel make it an ideal material for building facades, roofing, cladding, and structural components. Government initiatives and investments in infrastructure, such as the $2 trillion plan in the United States and significant projects in China and India, are propelling demand. These projects include bridges, highways, airports, and smart city developments, which all require extensive use of stainless steel for both structural integrity and long-term sustainability.

Expanding Automotive Industry

The automotive industry is another significant driver of stainless steel demand. Stainless steel is extensively used in vehicle manufacturing for components such as exhaust systems, decorative trims, and body panels due to its strength, lightweight properties, and resistance to extreme temperatures and corrosion. The shift towards electric vehicles (EVs) is further boosting demand as manufacturers seek materials that improve efficiency and longevity. Countries like Germany and Japan, which have robust automotive sectors, are seeing increased adoption of stainless steel in their production lines.

Industrial and Manufacturing Growth

Stainless steel plays a crucial role in the industrial and manufacturing sectors. It is used in the production of machinery, equipment, and tools due to its durability and resistance to wear and tear. The adoption of Industry 4.0 technologies, which include automation and smart manufacturing, has increased the demand for stainless steel components like robotic arms, conveyor systems, and sensors. This trend is particularly strong in regions with advanced industrial bases such as Germany and Japan, driving the market forward.

Rising Demand in Consumer Goods and Appliances

The consumer goods sector, including appliances and kitchenware, is driving the stainless steel market. Stainless steel's aesthetic appeal, ease of cleaning, and resistance to rust and staining make it a preferred material for household items like refrigerators, ovens, and cutlery. The growing middle-class population and rising disposable incomes, especially in emerging economies, are boosting the demand for high-quality consumer goods, thereby increasing the use of stainless steel.

Increasing Applications in Renewable Energy

The renewable energy sector is another growing market for stainless steel. Wind turbines, solar panels, and other renewable energy infrastructures require materials that can withstand harsh environmental conditions and have a long lifespan. Stainless steel fits these requirements, making it an essential component in the construction and maintenance of renewable energy facilities. The global push towards clean energy and sustainability is thus driving the demand for stainless steel in this sector.

Technological Advancements and Innovation

Technological advancements in stainless steel production and processing are also driving market growth. Innovations in manufacturing techniques, such as the development of new alloys and improved recycling methods, are making stainless steel more cost-effective and versatile. These advancements are enabling its use in a broader range of applications, from advanced industrial equipment to high-performance automotive parts, further boosting market demand.

Restraints for the Stainless Steel Market

Volatile Raw Material Prices

One of the major restraints for the stainless steel market is the fluctuation in the prices of raw materials, especially nickel and chromium. These materials are essential for producing stainless steel, and their prices can be highly volatile. This unpredictability makes it difficult for manufacturers to maintain consistent production costs and pricing strategies, leading to uncertainties in profitability. For instance, the global nickel surplus and varying costs of iron ore have significantly impacted production expenses and market stability.

Environmental Regulations

Environmental regulations are becoming increasingly stringent worldwide, posing another significant challenge for the stainless steel industry. These regulations often require companies to invest in cleaner technologies and processes, which can be costly. Compliance with such regulations can lead to increased operational expenses and may also result in production slowdowns as companies adjust to new standards. The EU Carbon Border Tax is one example of a regulatory measure that has influenced market dynamics by affecting the availability and cost of raw materials.

Competition from Alternative Materials

Stainless steel faces competition from alternative materials such as aluminum and composites, which are gaining popularity in various applications due to their lightweight and corrosion-resistant properties. These materials often offer similar benefits to stainless steel but can be more cost effective or easier to work with in certain applications. The growing adoption of these alternatives in industries like automotive and construction is a significant restraint on the demand for stainless steel.

Overcapacity and Price Wars

The stainless steel market is also affected by overcapacity, especially in regions like Asia. Excess production capacity can lead to intense price competition among manufacturers, resulting in reduced profit margins. This overcapacity often stems from the expansion of production facilities in anticipation of future demand that does not materialize as expected, leading to a surplus of supply over demand. Consequently, manufacturers may be forced to sell at lower prices to maintain market share, further squeezing profitability.

Economic Uncertainties

Global economic uncertainties, such as recessions or trade tensions, can negatively impact the stainless steel market. Economic downturns reduce overall industrial activity, leading to decreased demand for stainless steel in key sectors like construction, automotive, and consumer goods. Additionally, trade tensions and tariffs can disrupt supply chains and affect the availability and cost of raw materials, making it more challenging for manufacturers to operate efficiently.

Technological Advancements in Recycling

While recycling stainless steel is beneficial for sustainability, technological advancements in recycling processes can sometimes act as a restraint. Improved recycling techniques reduce the need for new stainless steel production, as recycled steel can be reused in various applications. This reduces the overall demand for newly produced stainless steel, impacting the market growth. Additionally, the use of scrap metal in production can influence market dynamics and pricing.

Opportunity in the Stainless Steel Market

Growing Demand in the Construction Sector

Stainless steel is increasingly becoming the material of choice in the construction industry. Its durability, resistance to corrosion, and aesthetic appeal make it ideal for various applications such as roofing, cladding, and structural components. The rising construction activities, especially in developing economies, are driving significant demand growth. Architects and engineers prefer stainless steel for its sustainability and long-term cost-effectiveness, creating a robust opportunity landscape for market expansion.

Expanding Automotive Applications

The automotive sector is witnessing a surge in the use of stainless steel for components such as exhaust systems, automotive trim, and structural parts. This shift is primarily due to stainless steel's ability to withstand extreme temperatures and corrosive environments, thereby enhancing vehicle longevity and reducing maintenance costs. As automakers strive to meet stringent emission standards and improve vehicle efficiency, the demand for stainless steel in this sector is expected to continue growing, presenting lucrative opportunities for market players.

Rising Demand in the Healthcare Industry

In the healthcare sector, stainless steel plays a critical role in the manufacturing of medical equipment, surgical instruments, and hospital infrastructure. The material's hygienic properties, ease of sterilization, and corrosion resistance are essential factors driving its adoption. With increasing investments in healthcare infrastructure globally and growing healthcare expenditures, the demand for stainless steel is poised to escalate. This trend opens doors for market expansion, particularly in supplying specialized stainless steel grades tailored for medical applications.

Growing Popularity in Consumer Goods

Stainless steel's aesthetic appeal, durability, and ease of maintenance make it a preferred choice in the production of consumer goods such as kitchenware, appliances, and furniture. Consumers increasingly value products that offer longevity and sustainable attributes, driving manufacturers to integrate stainless steel into their product lines. As consumer awareness regarding environmental impact grows, the market for stainless steel in consumer goods is anticipated to flourish, providing ample opportunities for innovation and market growth.

Increasing Adoption in Energy and Heavy Industries

Industries such as energy generation (including renewable energy projects) and heavy machinery rely on stainless steel for its strength, corrosion resistance, and reliability in harsh operating conditions. From power plants to oil and gas installations, stainless steel is integral to infrastructure that demands long-term performance and minimal maintenance. As global energy demands rise and industrial activities expand, the stainless steel market is set to benefit from increased adoption across these sectors, presenting substantial growth prospects.

Expanding Geographic Markets

Geographically, Asia Pacific is emerging as a dominant region for stainless steel consumption, driven by rapid urbanization, infrastructure development, and industrialization. Countries like China, India, and Southeast Asian nations are pivotal in the market's expansion due to their burgeoning construction activities and manufacturing sectors. North America and Europe also contribute significantly, particularly in advanced applications requiring high-performance stainless steel grades.

Trends for the Stainless Steel Market

Increasing Demand for Sustainable Materials

The stainless steel market is experiencing a growing trend towards sustainability. Consumers and industries alike are prioritizing materials that offer environmental benefits, such as recyclability and durability. Stainless steel's ability to be recycled indefinitely without losing its properties makes it highly attractive in a circular economy context. This trend is driving manufacturers to innovate sustainable production practices and develop stainless steel grades that further minimize environmental impact, thereby shaping the market's future trajectory.

Technological Advancements in Manufacturing Processes

Advancements in manufacturing technologies are revolutionizing the stainless steel industry. Processes such as additive manufacturing (3D printing) and advanced welding techniques are enhancing efficiency, reducing production costs, and expanding design possibilities. These technological innovations allow for the customization of stainless steel components across various applications, from automotive to aerospace, fostering greater market flexibility and responsiveness to customer demands.

Shift Towards High-Performance Stainless Steel Alloys

There is a notable shift towards high-performance stainless steel alloys capable of withstanding extreme conditions such as high temperatures, corrosive environments, and mechanical stress. Industries such as oil and gas, chemical processing, and power generation are increasingly demanding stainless steel grades with superior mechanical properties and enhanced corrosion resistance. This trend is driven by the need for reliability, safety, and longevity in critical infrastructure and industrial applications, stimulating research and development efforts in advanced alloy formulations.

Rising Adoption in Emerging Economies

Emerging economies, particularly in Asia Pacific and Latin America, are witnessing a rapid increase in the adoption of stainless steel. This growth is fueled by urbanization, infrastructure development, and expanding industrial sectors. Countries like China, India, and Brazil are pivotal in driving market demand, with significant investments in construction, automotive manufacturing, and consumer goods production. As these economies continue to grow, so does their consumption of stainless steel, creating new opportunities for market expansion and investment.

Growing Application Diversity Across Industries

Stainless steel's versatility is leading to its expanding application diversity across various industries. Beyond traditional sectors like construction and manufacturing, stainless steel is gaining traction in emerging fields such as renewable energy, healthcare, and telecommunications. Its inherent strength, corrosion resistance, and aesthetic appeal make it suitable for a wide range of applications, from solar panel frames to surgical instruments and telecommunications infrastructure. This trend underscores stainless steel's role as a material of choice for modern, technology-driven industries seeking reliability and performance.

Impact of Global Supply Chain Dynamics

The stainless steel market is influenced by global supply chain dynamics, including raw material availability, geopolitical factors, and trade policies. Fluctuations in nickel and chromium prices, essential elements in stainless steel production, can impact market dynamics and pricing trends. Moreover, shifts in global manufacturing hubs and trade agreements can alter supply chain logistics and sourcing strategies for stainless steel manufacturers and end-users alike.

Segments Covered in the Report

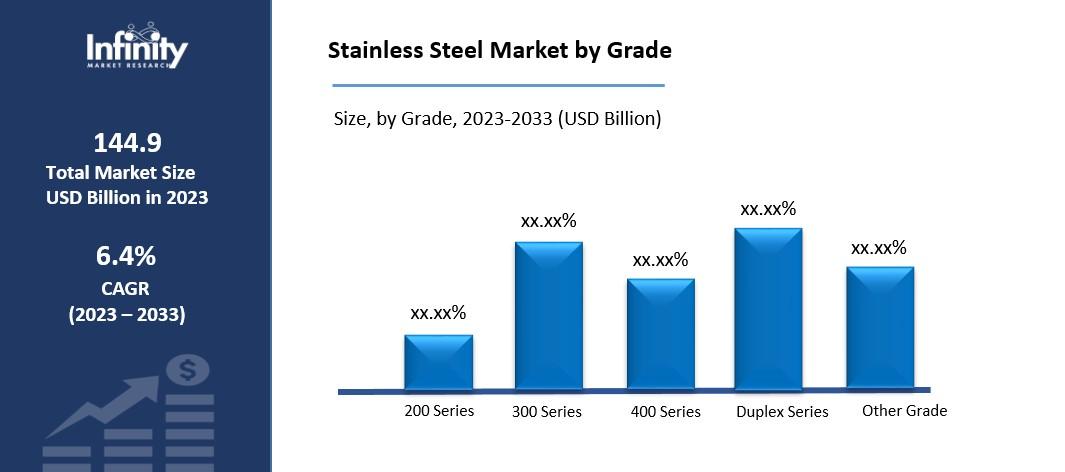

By Grade

o 200 Series

o 300 Series

o 400 Series

o Duplex Series

o Other Grade

By Product

o Austenitic Stainless Steel

o Martensitic Stainless Steel

o Ferritic Stainless Steel

o Precipitation Hard Stainless Steel

o Other Products

By Application

o Building & Construction

o Automotive & Transportation

o Consumer Goods

o Mechanical Engineering & Heavy Industries

o Electronic Appliances

o Food Manufacturing

o Other Applications

Segment Analysis

By Grade Analysis

In 2023, the 300 series sector accounted for the biggest share, with almost 58.7%. For any part in the series that needs to be polished, ground, or machined and where strong corrosion resistance is also required, grade 303 is almost exclusively utilized. It is perfect for moving parts because it doesn't seize or gallop. Since minimal magnetic permeability is desired, this austenitic steel is quite helpful. It is utilized for airplane components, gears, valve trim, shafts, valves, and all kinds of screw machine goods because of its reasonably good forming capabilities. It's also necessary from an architectural standpoint. All types of dairy equipment, such as railroad wagons, milk trucks, valves, homogenizers, milking machines, and storage and transportation tanks, are especially well-suited for Grade 304 in the 300 series.

Similar applications for this 18-8 alloy may be found in the brewing industry, where it is utilized in pipelines, fermentation vats, storage & railroad trains, and yeast pans. Throughout the forecast period, it is expected that superior product properties—such as high strength, low weight, and high corrosion resistance, particularly stress corrosion cracking—will boost product demand. The chemical and petrochemical, water desalination, oil and gas, and pharmaceutical industries are among the businesses that use this product.

By Product Analysis

Approximately the course of the forecast period, flat goods are expected to dominate the market, accounting for a revenue share of approximately 72.8% in 2023. Plates and sheets/coils make up the majority of flat items. SS flat materials find extensive usage in structural and construction applications, as well as in mechanical parts and industrial tools. These items come in both hot and cold rolls, and they feature qualities including excellent thickness, high strength, and corrosion resistance. The expansion of the transportation and automotive industries is probably what will boost demand for stainless steel products. One significant area where SS is replacing corten steel in coaches is the railway industry.

Its high strength-to-weight ratio and ability to absorb energy were the primary causes of the coach's increased crash efficacy. In industries like textile, automotive, defense, shipbuilding, cement, fabrication, paper & pulp, and earthmoving machines, long items are broadly utilized. Within this category, round bars are a vital product that can easily machined and bent to fit specific needs. Not only are these goods utilized in the production of automotive and machinery & equipment parts, but they are also employed in the machining applications, grills, and fasteners.

By Application Analysis

With a market share of more than 38.2% in 2023, the consumer goods segment led the industry. The market is expected to expand as a result of rising demand for sinks, cookware, washing machines, and refrigerator parts, among other items. Features including ease of production, resistance to corrosion, and visual attractiveness are probably going to increase demand for consumer goods, which will drive market expansion. The COVID-19 epidemic had a significant impact on the building and construction (B&C) market in 2020. The B&C sector's market dynamics have recently been impacted by several factors, including the global financial crisis, disruptions in supply, and changes in demand worldwide.

For example, data from EUROCONSTRUCT shows that in 2020, the building production in European countries decreased by 5.1% compared to the year before. In terms of automobile production and sales, the automotive and transportation market likewise had a notable downturn in 2020. For instance, the International Organization of Motor Vehicle Manufacturers (OICA) reports that worldwide auto manufacturing fell by 16% in 2020. Since 2023, the industry has been growing and bouncing back from a production gap brought on by shortages of semiconductors and the demand created by passenger car sales. Demand is anticipated in the observable future for automotive stainless steel tubes, forged parts, gaskets, and other structural parts.

Regional Analysis

With a revenue share of over 67.8% in 2023, Asia Pacific dominated the market, driven by the rapidly growing defense, industrial, automotive, and shipbuilding sectors in nations including South Korea, Japan, China, India, and South Africa. Infrastructure and energy-related foreign direct investment (FDI) are projected to open doors for market suppliers. The Asia Pacific stainless steel market is projected to grow as a result of rising demand for SS from ASEAN and Indian nations. India, Vietnam, Thailand, and Indonesia are seeing a steady rise in per capita consumption, which is probably going to continue to be a major driver of market expansion. The market for stainless steel in China has historically been fueled by rising demand in infrastructure applications and rising use in the manufacture of consumer goods, electronics, and car parts.

Furthermore, it is anticipated that the development of cold-rolled facilities will continue to be essential to the market's progress. From 2024 to 2030, Europe's revenue is projected to expand at a compound annual growth rate (CAGR) of more than 6.0%. The European market has recovered since the post-pandemic operations began in 2021. For example, the International Stainless Steel Forum (ISSF) reports that through the first quarter of 2021, y-o-y growth in SS melt shop production was approximately 11%. The market is anticipated to rise in the upcoming years due to an increase in pre-engineered construction applications.

Competitive Analysis

Major corporations are implementing various inorganic and organic growth tactics, including joint ventures, capacity expansion, and mergers & acquisitions, to sustain and enhance their market share.

Recent Developments

July 2023: Following the acquisition of a 74% share in Jindal United Steel Limited (JUSL), JUSL became a fully owned subsidiary of Jindal Stainless (JSL). The corporation once held a 26% ownership stake in JUSL, which has an annual capacity of 0.2 million tons for cold rolling and 1.6 million tons for hot strip milling.

April 2023: ArcelorMittal purchased a majority 80 percent stake in Voestalpine's Texas Hot Briquetted Iron (HBI) plant. With this acquisition, ArcelorMittal's reliance on conventional scrap-based processes is reduced as it gains access to a crucial raw material for the production of steel.

Key Market Players in the Stainless Steel Market

o Acerinox S.A.

o POSCO

o Baosteel Group

o ThyssenKrupp Stainless GmbH

o Yieh United Steel Corp.

o Other Key Players

Reports Scope:

|

Report Features |

Description |

|

Market Size 2023 |

USD 144.9 Billion |

|

Market Size 2033 |

USD 266.1 Billion |

|

Compound Annual Growth Rate (CAGR) |

6.4% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2023-2033 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Grade, Product, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

ArcelorMittal, Jindal Stainless, Nippon Steel Corporation, Outokumpu, Acerinox S.A., POSCO, Baosteel Group, Aperam Stainless, ThyssenKrupp Stainless GmbH, Yieh United Steel Corp, Other Key Players |

|

Key Market Opportunities |

Growing Demand in the Construction Sector |

|

Key Market Dynamics |

Growing Demand in Construction and Infrastructure |

📘 Frequently Asked Questions

1. Who are the key players in the Stainless Steel Market?

Answer: ArcelorMittal, Jindal Stainless, Nippon Steel Corporation, Outokumpu, Acerinox S.A., POSCO, Baosteel Group, Aperam Stainless, ThyssenKrupp Stainless GmbH, Yieh United Steel Corp, Other Key Players

2. How much is the Stainless Steel Market in 2023?

Answer: The Stainless Steel Market size was valued at USD 144.9 Billion in 2023.

3. What would be the forecast period in the Stainless Steel Market?

Answer: The forecast period in the Stainless Steel Market report is 2023-2033.

4. What is the growth rate of the Stainless Steel Market?

Answer: Stainless Steel Market is growing at a CAGR of 6.4% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.