🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Residential Real Estate Market

Residential Real Estate Market (By Budget (Less Than USD 300,000, USD 300,001 to USD 700,000, USD 700,001 to USD 1,000,000, USD 1,000,001 to USD 2,000,000, More Than USD 2,000,000), By Size (Less Than 50 Square Meters, 51 To 80 Square Meters, 81 To 110 Square Meters, 111 To 200 Square Meters, More Than 200 Square Meters), By Region and Companies)

Jul 2024

Building and Construction

Pages: 149

ID: IMR1154

Residential Real Estate Market Overview

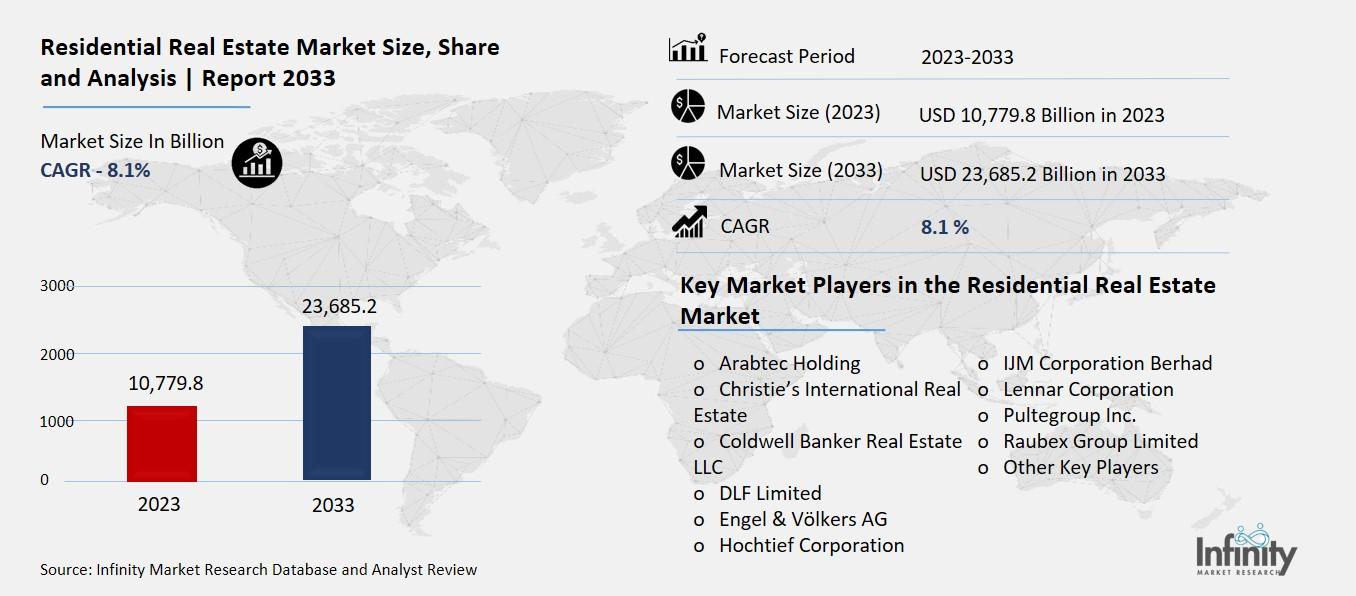

Global Residential Real Estate Market size is expected to be worth around USD 23,685.2 Billion by 2033 from USD 10,779.8 Billion in 2023, growing at a CAGR of 8.1% during the forecast period from 2023 to 2033.

The residential real estate market is all about buying, selling, and renting homes and apartments where people live. It includes everything from single-family houses to big apartment buildings. This market is influenced by things like how many homes are available, how much money people have, and what interest rates are like. When more people want to buy homes than there are homes available, prices go up. On the other hand, if there are more homes than buyers, prices tend to drop.

People look at the residential real estate market to understand trends, like whether home prices are rising or falling. This can help them decide if it's a good time to buy or sell a house. For example, if home prices are rising quickly, it might be a good time to sell. But if prices are low, it might be a good time to buy. This market also affects other parts of the economy, like construction jobs and the demand for home improvement products. Overall, the residential real estate market plays a big role in our daily lives and the economy.

Drivers for the Residential Real Estate Market

Economic Growth and Stability

Economic growth and stability are major drivers for the residential real estate market. When the economy is strong, people have more disposable income and job security, which boosts their confidence in buying homes. In many regions, robust economic performance translates to higher employment rates and wage growth, making homeownership more accessible. Countries experiencing economic expansion, such as the United States and emerging markets in Asia, see significant increases in real estate demand. In these areas, more people can afford to buy homes, and investors are more likely to invest in residential properties, driving the market forward.

Urbanization and Population Growth

Urbanization and population growth also play a critical role in driving the residential real estate market. As more people move to cities in search of better job opportunities and improved living standards, the demand for housing in urban areas increases. This is especially evident in rapidly urbanizing regions like Asia-Pacific, where countries such as China and India are seeing large-scale migrations to urban centers. The creation of new urban areas and the expansion of existing ones drive the need for residential properties, thus propelling market growth.

Low-Interest Rates and Mortgage Availability

Low interest rates and the availability of mortgages significantly boost the residential real estate market. When interest rates are low, borrowing costs decrease, making it cheaper for people to take out loans to buy homes. This stimulates demand as more individuals and families can afford to enter the housing market. Governments and financial institutions often implement policies to keep interest rates low to encourage home buying, which in turn stimulates the real estate sector. For instance, post-pandemic economic policies in many countries have included measures to keep mortgage rates low, spurring a surge in residential real estate transactions.

Technological Advancements

Technological advancements are transforming the residential real estate market by making property transactions more efficient and accessible. Online platforms and digital tools facilitate virtual property tours, remote transactions, and better communication between buyers, sellers, and real estate agents. Technologies like artificial intelligence and blockchain are also being used to streamline processes and provide more transparency in transactions. The shift towards digitalization allows a broader audience to participate in the real estate market, thereby driving demand. For example, the adoption of digital currencies for property transactions in places like Dubai highlights how technology is making the market more accessible and efficient.

Government Policies and Incentives

Government policies and incentives play a pivotal role in driving the residential real estate market. Many governments implement policies to encourage homeownership, such as tax breaks, subsidies, and affordable housing schemes. These measures make it easier for individuals to buy homes, thereby increasing demand. Additionally, policies aimed at developing smart cities and sustainable living spaces also boost the real estate market. For instance, initiatives in the Middle East and North Africa to build smart cities are attracting significant investments in residential properties, further driving market growth.

Investment from Foreign Buyers

Investment from foreign buyers is another important driver of the residential real estate market. Many investors look to buy properties in stable and lucrative markets outside their home countries. This trend is particularly strong in global cities like New York, London, and Dubai, where foreign investments significantly contribute to the local real estate market. These investors often seek to diversify their portfolios and capitalize on growth in other regions, which brings additional capital into the residential market, driving up demand and property values

Restraints for the Residential Real Estate Market

High Interest Rates

One of the major restraints for the residential real estate market is the high interest rates. When the Federal Reserve increases interest rates, it becomes more expensive to borrow money for a mortgage. This discourages potential buyers, leading to a slowdown in home sales. Higher interest rates also increase the cost of financing for real estate developers, which can slow down new construction projects. As a result, fewer homes are built, and the supply of housing can become tight, driving up prices and making it harder for people to afford homes.

Economic Uncertainty

Economic uncertainty can also hold back the residential real estate market. When people are unsure about their financial future, they are less likely to make big investments like buying a home. Economic factors such as job security, inflation, and general economic performance can affect consumer confidence. If the economy is unstable, people might prefer to rent rather than buy, impacting home sales and property values. This uncertainty can be heightened by political instability or global economic issues.

Strict Lending Practices

Another significant restraint is the strict lending practices imposed by banks and financial institutions. After the housing crisis of 2008, lending standards became much stricter to prevent another bubble. While this is good for preventing risky lending, it also means that fewer people qualify for mortgages. Potential buyers with lower credit scores or unstable income might find it difficult to get approved for a loan, thus reducing the number of people who can enter the housing market.

Rising Construction Costs

The rising cost of construction materials and labor is another factor that restrains the residential real estate market. Increased costs for materials such as lumber, steel, and concrete make building new homes more expensive. Labor shortages and higher wages for construction workers also contribute to higher overall costs. These increased costs are often passed on to buyers in the form of higher home prices, making it more difficult for people to afford new homes. This can limit the number of new homes being built, affecting the overall supply in the market.

Regulatory and Zoning Restrictions

Finally, regulatory and zoning restrictions can limit the growth of the residential real estate market. Local governments often have strict zoning laws that determine what can be built and where. These regulations can slow down the approval process for new construction projects, making it more difficult and expensive for developers to build new homes. Additionally, environmental regulations and building codes can add to the cost and complexity of construction, further restraining the market. These restrictions can prevent the market from quickly responding to changes in demand, leading to imbalances between supply and demand

Opportunity in the Residential Real Estate Market

Demand for Affordable Housing

One of the most significant opportunities lies in the demand for affordable housing. With rising home prices and economic uncertainties, many buyers, especially first-time homeowners, are seeking more affordable options. This has created a market for developers and investors to focus on building and offering cost-effective housing solutions that cater to this growing demand. By addressing the affordability crisis, stakeholders can tap into a substantial market segment that is currently underserved.

Growth in Suburban and Rural Areas

The COVID-19 pandemic has accelerated the trend of people moving away from densely populated urban areas to suburban and rural locations. This shift is driven by the desire for more space, remote work flexibility, and a better quality of life. Consequently, there is an increasing demand for residential properties in these less crowded areas. Real estate developers and investors can capitalize on this trend by focusing on building and marketing properties in suburban and rural regions, which are becoming increasingly attractive to buyers.

Technological Innovations

Technological advancements are also creating new opportunities in the residential real estate market. The adoption of smart home technologies, virtual tours, and online property management tools has transformed how properties are bought, sold, and managed. Real estate companies that leverage these technologies can provide better services to clients, enhance the buying experience, and streamline operations. By integrating technology into their business models, real estate professionals can stay competitive and meet the evolving needs of modern consumers.

Sustainable and Green Housing

There is a growing demand for sustainable and eco-friendly housing options. Homebuyers are increasingly conscious of their environmental impact and are looking for energy-efficient homes with green features. This trend presents an opportunity for developers to design and construct environmentally friendly homes that not only appeal to eco-conscious buyers but also offer long-term cost savings through reduced energy consumption. Emphasizing sustainability in residential projects can attract a niche market and contribute to broader environmental goals.

Investment in Rental Properties

The rental market continues to offer substantial opportunities, particularly in areas with high demand for rental housing. With many individuals unable or unwilling to purchase homes, the rental sector remains robust. Investors can benefit from acquiring and managing rental properties, especially in regions with strong rental demand. Additionally, the trend of flexible living arrangements and the popularity of rental properties among younger generations further boost the potential for growth in this segment

Trends for the Residential Real Estate Market

Shift to Suburban and Rural Areas

One major trend is the continued movement from urban centers to suburban and rural areas. Many people, especially those who can work remotely, are seeking larger homes with more outdoor space, which are often more affordable outside of city centers. This trend started during the COVID-19 pandemic and has continued as remote work remains prevalent.

Technological Integration in Real Estate Transactions

Technology is playing an increasingly significant role in the real estate market. Virtual tours, digital transactions, and online real estate platforms are making it easier for buyers to view and purchase homes without needing to visit in person. This has broadened the market, allowing buyers from different regions or even countries to participate more easily.

Fluctuating Home Prices

Home prices are showing varying trends depending on the region. In some areas, especially those that saw rapid price increases during the pandemic, prices are beginning to stabilize or decrease slightly. In contrast, more affordable areas are experiencing price hikes due to increased demand from buyers relocating from pricier regions.

Increasing Interest Rates

Rising interest rates are another key trend affecting the residential real estate market. Higher mortgage rates can make home-buying more expensive, which might slow down the market in some areas. However, in regions where housing demand remains strong, the impact of rising rates may be less pronounced.

Sustainable and Energy-Efficient Homes

There is a growing demand for sustainable and energy-efficient homes. Buyers are increasingly looking for properties with features like solar panels, energy-efficient appliances, and sustainable building materials. Both environmental concerns and the potential for long-term savings on energy costs drive this trend.

Focus on Affordability

Affordability remains a critical issue in the residential real estate market. High home prices and interest rates have made it challenging for many, especially first-time buyers, to enter the market. To address this, some local governments are implementing policies to increase housing supply and make homes more affordable. For instance, there are efforts to reduce zoning restrictions and provide subsidies for first-time homebuyers.

Segments Covered in the Report

By Budget

o Less Than USD 300,000

o USD 300,001 to USD 700,000

o USD 700,001 to USD 1,000,000

o USD 1,000,001 to USD 2,000,000

o More Than USD 2,000,000

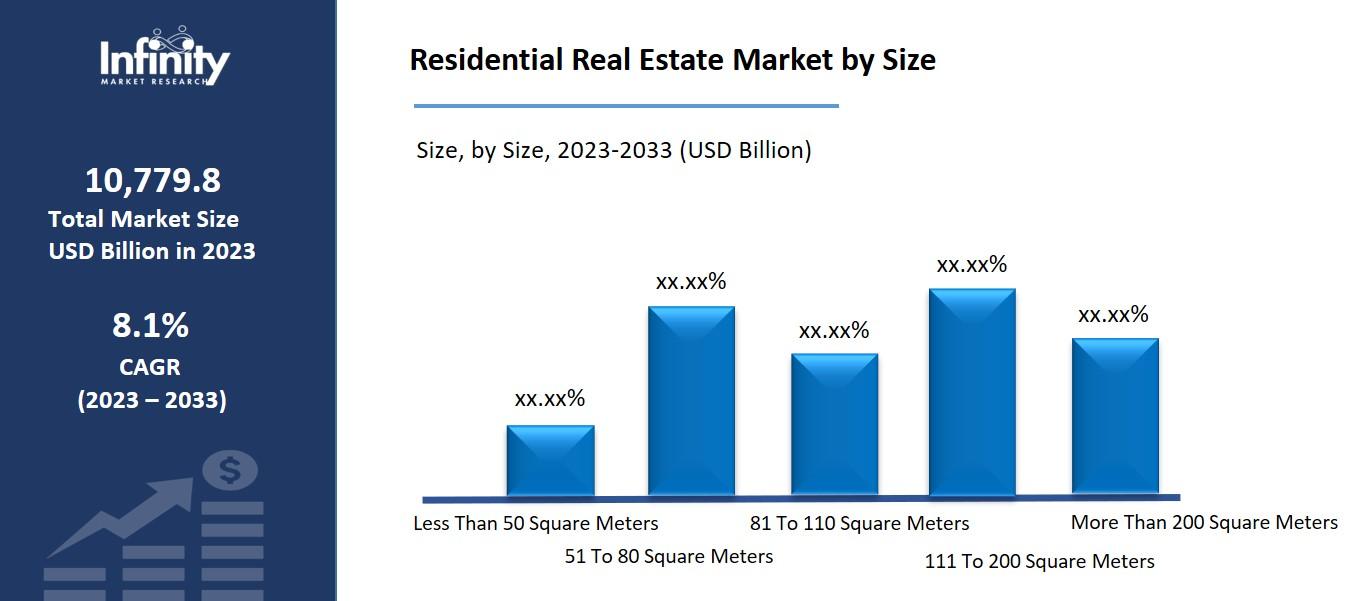

By Size

o Less Than 50 Square Meters

o 51 To 80 Square Meters

o 81 To 110 Square Meters

o 111 To 200 Square Meters

o More Than 200 Square Meters

Segment Analysis

By Budget Analysis

The market's largest contributor, the less than USD 300,000 category, is predicted to grow at a compound annual growth rate (CAGR) of 8.2% throughout the forecast period. The very high rental prices of larger properties in major cities such as New York, Berlin, and Madrid have led to an increase in the sales of studio apartments and small flats. Because they are metropolitan neighborhoods with high rent, people usually live in smaller spaces there. Due to rising tourism and urbanization, it is also estimated that the market for residential properties priced under USD 300,000 will expand throughout the projected period.

Individuals who require more space have opted to live in apartments in densely populated cities like Mumbai, Boston, and London. To cut down on commute time, almost two-thirds of individuals in large cities across the globe live in apartments that are usually closer to their places of employment. The market for residential properties priced between USD 300,001 and USD 700,000 is expected to be driven by government programs for affordable housing and the growth of these cities over the projected period.

This class of residential real estate includes large flats and bungalows and ranges in price from USD 700,001 to USD 1,000,000. In smaller cities and towns, construction of large-scale dwellings is allowed. Because of this, properties built in these types of towns are usually sparser than in metro areas with higher population concentrations. The more room in residential homes results in a price increase. The number of properties valued between USD 700,001 and USD 1,000,000 is therefore expected to rise during the projection period.

The pricing range for residential properties with greater room and high facilities is between USD 1,000,000 and USD 2,000,000. The tendency to upgrade homes by buying larger ones has also been aided by the high per capita income of individuals in industrialized nations. It is anticipated that the market for residential properties valued between USD 1,000,000 and USD 2,000,000 will grow, supporting the market for the duration of the projection.

By Size Analysis

The market's largest segment, those under 50 square meters, is expected to grow at a compound annual growth rate (CAGR) of 9.4% throughout the forecast period. People who live in premium neighborhoods of cities like Beijing, Shanghai, Madrid, Seattle, and Paris choose to live in smaller rooms because residential properties there are so expensive. For example, sales of micro apartments apartments smaller than 20 square meters rose in the Hong Kong metropolitan neighborhoods of Wan Chai and Sham Shui Po in 2016 and 2017. Furthermore, about one-third of people live in tiny apartments in the most elite cities in the world. As a result, sales of smaller apartments and studio apartments have surged, and it is expected that this trend will continue for the duration of the projected time.

Large-sized flats are affordable for the middle class and upper middle class. Furthermore, as cities expand, there is an increasing demand for residences in this category. Furthermore, the need for these apartments has grown along with the urbanization and expansion of cities. For example, the population of Mumbai, India increased from over 185 million in 2011 to over 204 million in 2020. As a result, the market for residential real estate will grow.

There are opulent residences and apartments nearby. Since the number of families and population growth has increased along with per capita income, people have opted to buy larger living spaces rather than small flats. Furthermore, many who can afford it opt to buy bungalows. Sales of houses ranging in size from 81 to 110 square meters have surged as a result. Furthermore, it is projected that the market share of residences between 81 and 110 square meters will increase as individual standards of living rise.

Larger houses and smaller villas are usually constructed on lots between 111 and 200 square meters. Bigger villas and bungalows are typically owned by the upper class. Larger homes and villas have therefore become more popular all around the world in recent years. It was also revealed that Canadians preferred homes with an average size of about 160 square meters. Europeans like homes that are 120 to 130 square meters in size, much like Americans do. Furthermore, increased per capita earnings in both established and emerging countries are expected to contribute to an increase in sales of residences between 111 and 200 square meters during the projection period.

Typically, members of the ultra-elite class and hotels that rent out the villas to tourists later own large villas built in this category that measure more than 200 square meters. Moreover, buying weekend retreats and vacation homes has been done. Developers are therefore building lavish projects in the smaller, more rural towns and areas that encircle larger cities. Furthermore, patterns indicate that in recent years, there has been a rise in demand in locations such as Saudi Arabia and the United Arab Emirates for large, luxurious bungalows and villas.

Regional Analysis

The region that contributes the most to revenue, Asia-Pacific, is anticipated to grow at a CAGR of 9.5% over the projected year. This study examines the four largest countries in Asia-Pacific: South Korea, Japan, China, India, and the rest of the region. The market is dominated by Asia-Pacific. Countries like China, India, Singapore, and South Korea are now acknowledged as important markets because of factors like urbanization, which promotes growth in the construction of residential infrastructure. Three important players in the Asia-Pacific industry are Sun Hung Kai Properties, DLF Limited, and IJM Corporation Berhad. Rapid urbanization has benefited the residential real estate market in the Asia-Pacific area, which includes China, Japan, India, and South Korea. Investment in the Asia-Pacific residential real estate market is also fueled by high returns on sales and rentals.

Throughout the projection period, North America is anticipated to show a CAGR of 8.1%. This study on the residential real estate market in North America focuses on three countries: the United States, Canada, and Mexico. Mexico is expected to develop rapidly over the next few years, leaving the United States with a major piece of the sector in 2019. Due to the high per capita income rates in the US and Canada, more and more people are opting to buy rather than rent their homes. Furthermore, because homes can yield larger returns in the future due to higher rents in developed and developing locations, many people prefer to invest in real estate. These components drive the market in North America.

Major European countries such as Spain, Germany, Portugal, France, Greece, the United Kingdom, Italy, and the rest of Europe are all examined in the European market report. Countries like Germany, France, and the United Kingdom have become well-known for having sizable residential real estate markets as a result of their economies growing. The leading companies in the market are Vinci, Savills, Engel and Volkers AG, and Christie's International Real Estate. Furthermore, the increasing population, historically low borrowing costs, better job security, and foreign tourism in many European countries are all contributing factors to the rising demand for real estate.

LAMEA stands for Latin American, Middle Eastern, and African countries. This market was dominated by LAMEA, and throughout the forecast period, the UAE is expected to grow rapidly. In the region, countries like Peru, Chile, Argentina, Brazil, and Chile are growing quickly. Nigeria, Ghana, and Uganda are also contributing to the area's urbanization. Meanwhile, over the past ten years, there has been a discernible increase in the rate of urbanization in other Middle Eastern nations, such as Kuwait, Egypt, and others. Housing projects and residential infrastructure are being built as a result of the urbanization of developing countries in Latin America and Africa. Furthermore, it is envisaged that the LAMEA market would be strengthened by government aid in the form of tax reductions.

Competitive Analysis

Large players in the industry have implemented tactics such as product launches, business development, joint ventures, acquisitions, and partnerships to provide clients in the residential real estate market with improved services. For example, to renovate hangar J1 and the adjacent region in Marseille, France, Adim Provence, a subsidiary of Vinci Construction France, and Caisse des Dépôts inked a joint venture agreement in March 2019. The project involves the port area. Similarly, to oversee Savills' real estate services provided in the United States, Savills purchased Macro Consultants LLC, a project management company in North America, in March 2020.

Recent Developments

May 2024: The launch of Mintos' newest product, passive rental real estate investments, was announced. The platform provides a special fusion of traditional and non-traditional investment options. With this innovative offering, investors can enter the real estate market in a simple, affordable, and accessible manner. With expected earnings of 6 to 8% annually and a minimal investment of €50, Mintos makes investing in residential real estate more accessible.

February 2024: Real estate behemoth DLF declared its aim to offer new projects totaling approximately 32 million square feet, with a sales potential of nearly ₹80,000 crores, over the next three to four years, citing its "plans of scaling up the business." For the next twelve to fifteen months, Gurugram, Chennai, Goa, and Mumbai are expected to host the main launches.

Key Market Players in the Residential Real Estate Market

o Arabtec Holding

o Christie’s International Real Estate

o Coldwell Banker Real Estate LLC

o Hochtief Corporation

o Other Key Players

Report Scope:

|

Report Features |

Description |

|

Market Size 2023 |

USD 10,779.8 Billion |

|

Market Size 2033 |

USD 23,685.2 Billion |

|

Compound Annual Growth Rate (CAGR) |

8.1% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2033 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Budget, Size, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Arabtec Holding, Christie’s International Real Estate, Coldwell Banker Real Estate LLC, DLF Limited, Engel & Völkers AG, Hochtief Corporation, IJM Corporation Berhad, Lennar Corporation, Pultegroup, Inc., Raubex Group Limited, Other Key Players |

|

Key Market Opportunities |

Demand for Affordable Housing |

|

Key Market Dynamics |

Economic Growth and Stability |

📘 Frequently Asked Questions

1. Who are the key players in the Residential Real Estate Market?

Answer: Arabtec Holding, Christie’s International Real Estate, Coldwell Banker Real Estate LLC, DLF Limited, Engel & Völkers AG, Hochtief Corporation, IJM Corporation Berhad, Lennar Corporation, Pultegroup, Inc., Raubex Group Limited, Other Key Players

2. How much is the Residential Real Estate Market in 2023?

Answer: The Residential Real Estate Market size was valued at USD 10,779.8 Billion in 2023.

3. What would be the forecast period in the Residential Real Estate Market?

Answer: The forecast period in the Residential Real Estate Market report is 2023-2033.

4. What is the growth rate of the Residential Real Estate Market?

Answer: Residential Real Estate Market is growing at a CAGR of 8.1% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.