🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Residential Solar Photovoltaic System Market

Global Residential Solar Photovoltaic System Market (By Connectivity, On-grid and Off-grid; By Mounting, Ground mounted and Roof-top; By Region and Companies), 2024-2033

Oct 2024

Energy and Power

Pages: 138

ID: IMR1252

Residential Solar Photovoltaic System Market Overview

Global Residential Solar Photovoltaic System Market acquired the significant revenue of 6.8 Billion in 2023 and expected to be worth around USD 10.2 Billion by 2033 with the CAGR of 4.6% during the forecast period of 2024 to 2033. The market involves the deployment of solar panels in residential settings to generate electricity from sunlight. This market has experienced significant growth owing to the increasing awareness of renewable energy and rising electricity prices.

Moreover, advances in solar technology led to cost reductions and improved efficiency. This makes solar power more accessible to homeowners. Moreover, the market is characterized by regional variations such as strong adoption in areas with abundant sunlight, favorable policies, and a push towards reducing carbon emissions. Key players in the residential solar photovoltaic system includes solar panel manufacturers, installers, and energy service providers.

Drivers for the Residential Solar Photovoltaic System Market

Growing Awareness of Climate Change

Increased need for renewable energy to combat climate change has significantly driven the demand for residential solar photovoltaic systems. Majority of people are recognizing the need to reduce carbon emissions and transition towards cleaner energy sources as scientific evidence on the impacts of climate change becomes more prevalent. Moreover, the traditional fossil fuels contributes to greenhouse gas emissions which accelerates global warming and environmental degradation. Thus individuals are increasingly motivated to adopt renewable energy solutions. The residential solar PV systems allow homeowners to directly contribute to climate change mitigation by generating their electricity without harmful emissions.

Restraints for the Residential Solar Photovoltaic System Market

Regulatory and Policy Uncertainties

Changes in government incentives or regulations can create uncertainty, which has a significant impact on the adoption rates of residential solar photovoltaic (PV) systems. Incentives such as tax credits, rebates, and subsidies are often critical factors in reducing the upfront cost of solar installations, making them more attractive to homeowners. However, when governments modify or eliminate these incentives, it can disrupt financial planning and discourage potential buyers from moving forward with installations. For example, if a popular subsidy program is suddenly reduced or terminated, the increased cost burden on consumers may lead to a drop in new solar installations.

Opportunity in the Residential Solar Photovoltaic System Market

Integration with Smart Home Technologies and Microgrids

Integration with smart home technologies and microgrids offers significant opportunities for better energy management and optimization in residential solar photovoltaic (PV) systems. Smart home technologies allow homeowners to monitor and control energy usage in real-time, optimizing the use of solar power generated from their panels. By connecting solar PV systems with smart appliances, energy consumption can be automatically adjusted based on solar availability, ensuring that power-hungry devices run when solar energy production is highest. Additionally, microgrids, which are localized grids that can operate independently of the main power grid, further enhance the value of residential solar systems. When integrated with a microgrid, homeowners can store excess solar energy in batteries and distribute it as needed, increasing energy reliability and reducing dependence on the utility grid.

Trends for the Residential Solar Photovoltaic System Market

Battery Storage Integration

The increased use of residential solar photovoltaic (PV) systems paired with battery storage is becoming an essential trend to ensure energy availability during non-sunny periods, such as at night or during cloudy days. While solar panels generate electricity only when there is sunlight, battery storage systems allow homeowners to store excess energy produced during the day for later use. This capability ensures a continuous supply of power, reducing reliance on the utility grid and enhancing energy independence. By integrating batteries with solar PV systems, homeowners can make the most of their solar energy production, minimizing wastage and using stored power when solar output is low or during peak demand hours when electricity rates are high. Additionally, solar-plus-storage systems provide backup power during grid outages, offering greater resilience and reliability, which is increasingly valuable as extreme weather events and grid instability become more common.

Segments Covered in the Report

By Connectivity

o On-grid

o Off-grid

By Mounting

o Ground mounted

o Roof-top

Segment Analysis

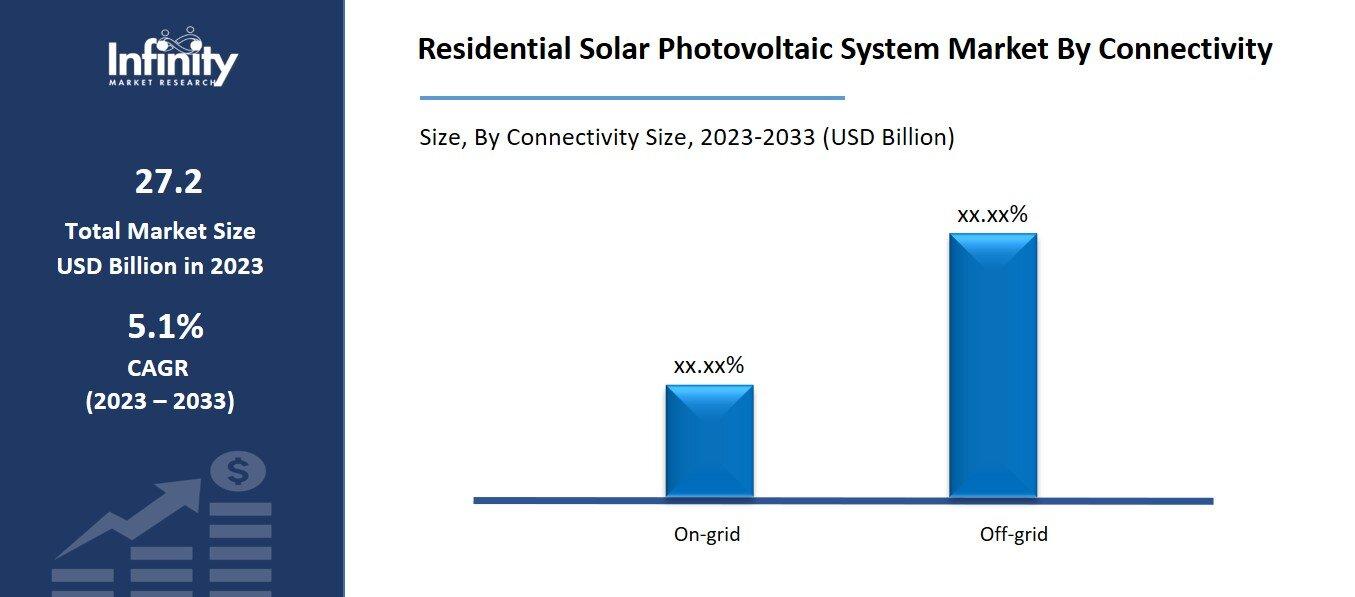

By Connectivity Analysis

On the basis of connectivity, the market is divided into on-grid and off-grid. Among these, on-grid segment acquired the significant share around 54.1% in the market owing to the cost-effectiveness and convenience it offers to homeowners. On-grid systems are directly connected to the utility grid, allowing users to draw electricity from the grid when their solar generation is insufficient and export excess energy back to the grid, often receiving compensation through net metering programs. This setup reduces the need for expensive battery storage solutions, making on-grid systems more affordable and attractive to homeowners. Additionally, government incentives and favorable net metering policies have further driven the adoption of on-grid solar systems, contributing to their dominant market share.

By Mounting Analysis

On the basis of mounting, the market is divided into ground mounted and roof-top. Among these, ground mounted held the prominent share of the market due to the flexibility in positioning and optimal orientation for maximum sunlight exposure. Ground-mounted solar systems allow for larger installations, which can generate more electricity compared to limited rooftop space. They can be installed at an ideal angle and location, ensuring that shading is minimized and energy production is maximized. Additionally, ground-mounted systems often have easier access for maintenance and cleaning, which helps improve overall system efficiency and longevity. These advantages make ground-mounted solar systems a preferred choice for properties with sufficient land availability, contributing to their significant market share.

Regional Analysis

Asia Pacific Dominated the Market with the Highest Revenue Share

Asia Pacific held the most of the share of 34.1% the market owing to the region's high levels of solar radiation, government support for renewable energy initiatives, and increasing energy demands driven by rapid urbanization and economic growth. Countries like China, India, and Japan are leading the way in solar adoption, with robust policies, incentives, and investments in solar infrastructure. Additionally, the declining costs of solar technology and growing awareness of climate change are further propelling the adoption of residential solar systems in this region. The combination of favorable natural conditions, supportive regulatory frameworks, and a growing middle class with rising electricity consumption makes Asia Pacific a key player in the global residential solar PV market.

Competitive Analysis

The competitive analysis of the residential solar photovoltaic (PV) system market reveals a dynamic landscape characterized by both established players and emerging companies striving to capture market share. Key industry participants include major manufacturers of solar panels, inverters, and energy storage solutions, alongside installation firms that offer integrated services to homeowners. Competition is primarily driven by technological advancements, with companies focusing on improving the efficiency and performance of their solar products. Price competitiveness is another crucial factor, as firms aim to offer affordable solutions while maintaining quality.

Recent Developments

In March 2023, Tersling & Wilson Renewable Energy Ltd has secured the contract for a solar PV project with NTPC Renewable Energy Ltd at the Khavda RE Power Park in Gujarat. This 1200 MW project is expected to provide electricity to numerous households and industries across Gujarat, India. The initiative is poised to significantly boost the outlook for the residential solar PV market in the region.

In April 2023, Qcells and Summit Ridge Energy have entered into a partnership to develop solar panels for solar projects in the United States. These projects are designed to produce enough clean electricity to power approximately 140,000 residences and businesses. This collaboration is set to contribute to the creation of a more sustainable environment across the U.S.

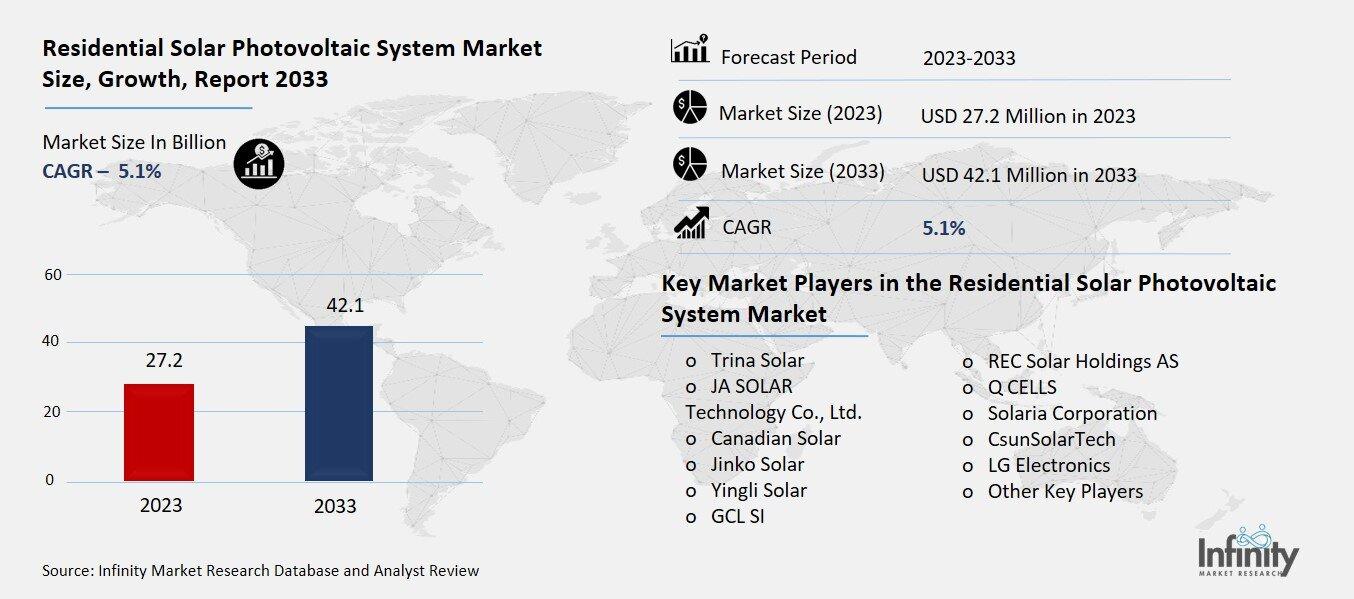

Key Market Players in the Residential Solar Photovoltaic System Market

o Trina Solar

o JA SOLAR Technology Co., Ltd.

o Canadian Solar

o Jinko Solar

o Yingli Solar

o GCL SI

o REC Solar Holdings AS

o Q CELLS

o Solaria Corporation

o CsunSolarTech

o LG Electronics

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 27.2 Billion |

|

Market Size 2033 |

USD 42.1 Billion |

|

Compound Annual Growth Rate (CAGR) |

5.1% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Connectivity, Mounting, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Trina Solar, JA SOLAR Technology Co., Ltd., Canadian Solar, Jinko Solar, Yingli Solar, GCL SI, REC Solar Holdings AS, Q CELLS, Solaria Corporation, CsunSolarTech, LG Electronics, and Other Key Players. |

|

Key Market Opportunities |

Integration with Smart Home Technologies and Microgrids |

|

Key Market Dynamics |

Growing Awareness of Climate Change |

📘 Frequently Asked Questions

1. How much is the Residential Solar Photovoltaic System Market in 2023?

Answer: The Residential Solar Photovoltaic System Market size was valued at USD 27.2 Billion in 2023.

2. What would be the forecast period in the Residential Solar Photovoltaic System Market?

Answer: The forecast period in the Residential Solar Photovoltaic System Market report is 2024-2033.

3. Who are the key players in the Residential Solar Photovoltaic System Market?

Answer: Trina Solar, JA SOLAR Technology Co., Ltd., Canadian Solar, Jinko Solar, Yingli Solar, GCL SI, REC Solar Holdings AS, Q CELLS, Solaria Corporation, CsunSolarTech, LG Electronics, and Other Key Players.

4. What is the growth rate of the Residential Solar Photovoltaic System Market?

Answer: Residential Solar Photovoltaic System Market is growing at a CAGR of 5.1% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.