🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Semiconductor Market

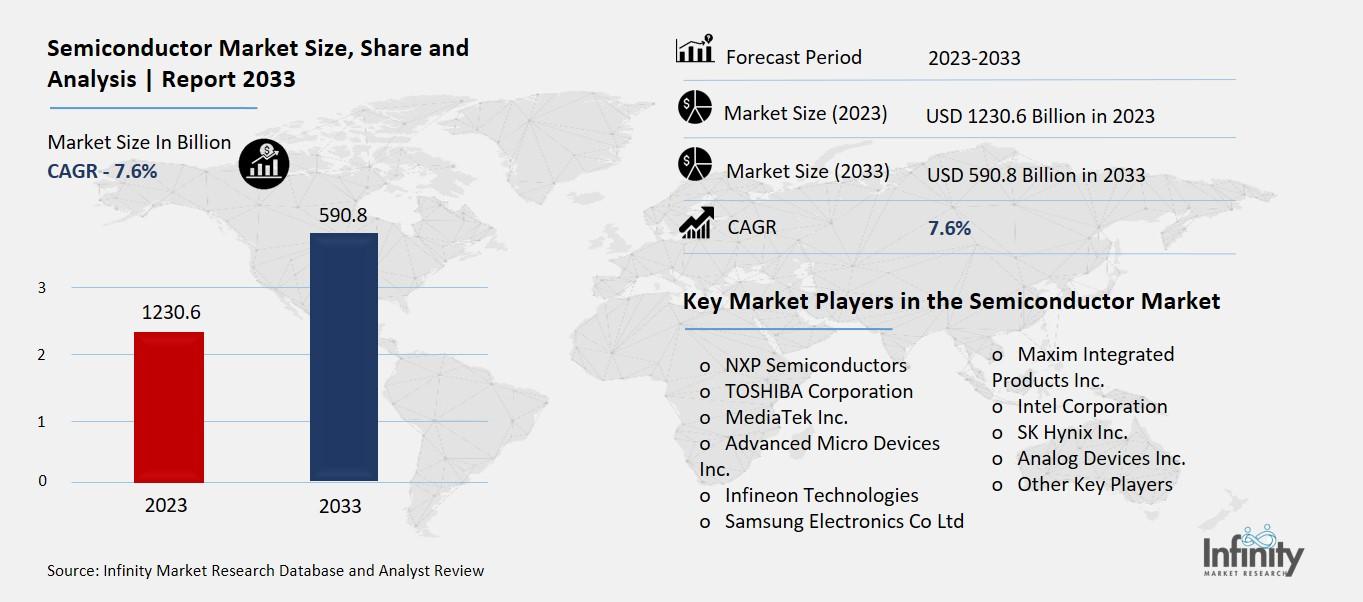

Semiconductor Market (By Component (Memory Devices, Logic Devices, Analog IC, MPU, MCU, and Other Components), By Source (Silicon, Germanium, Gallium Arsenide, and Other Sources), By Node Size (32/28nm, 16/14nm, 10/7nm, 7/5nm, 5nm, Other Node Sizes), By Application (Telecommunication, Data Processing, Industrial, Consumer Electronics, Automotive, and Other Applications), By Region and Companies)

Jul 2024

Semiconductor and Electronics

Pages: 160

ID: IMR1119

Semiconductor Market Overview

Global Semiconductor Market size is expected to be worth around USD 1,230.6 Billion by 2033 from USD 590.8 Billion in 2023, growing at a CAGR of 7.6% during the forecast period from 2023 to 2033.

A semiconductor is a special material that can conduct electricity under certain conditions but not always. Consider it a middle ground between a conductor (like copper, which always conducts electricity) and an insulator (like rubber, which never conducts electricity). Semiconductors are made from materials like silicon, which are treated with tiny amounts of other elements to control their electrical properties. This makes them incredibly useful for making electronic devices, such as computer chips, solar cells, and transistors.

In simple terms, semiconductors are the building blocks of modern electronics. They are found in almost every electronic device you use, from smartphones and laptops to televisions and cars. These materials are key to creating circuits that can process information, store data, and perform various functions in electronic gadgets. Without semiconductors, we wouldn’t have the advanced technology we rely on every day.

Drivers for the Semiconductor Market

Increasing Demand in the Automotive Industry

One of the primary drivers is the growing demand for semiconductors in the automotive industry, particularly with the rise of electric vehicles (EVs). As EVs become more popular, the need for advanced semiconductor components for battery management, power electronics, and autonomous driving systems is escalating. This trend is expected to continue as car manufacturers invest more in EV technology and strive to meet regulatory requirements for emissions and fuel efficiency.

Expansion in Data Storage and Computing

The explosion of data and the need for robust data storage solutions are also propelling the semiconductor market. With the growth of cloud computing, big data analytics, and the Internet of Things (IoT), there is an increasing demand for semiconductors that can handle vast amounts of data efficiently. Data centers and storage solutions require advanced chips to ensure fast processing speeds and reliable storage capabilities, driving significant investments in semiconductor technologies.

Wireless Communication Advancements

The evolution of wireless communication, particularly the deployment of 5G networks, is another major driver. 5G technology requires sophisticated semiconductors to manage high-speed data transmission, low latency, and increased connectivity. This advancement is fostering innovations in mobile devices, telecommunications infrastructure, and IoT applications, thereby boosting the semiconductor market as manufacturers seek to develop and supply the necessary components for these technologies.

Growing Role of Artificial Intelligence

Artificial Intelligence (AI) and machine learning are becoming increasingly integral to various industries, from healthcare to finance. The need for high-performance computing (HPC) and AI-specific processors is driving demand for advanced semiconductors. These chips enable efficient processing of complex AI algorithms and large datasets, which are crucial for applications such as autonomous systems, predictive analytics, and personalized medicine.

Consumer Electronics and Smart Devices

The consumer electronics sector continues to be a significant contributor to the semiconductor market. The proliferation of smart devices, including smartphones, tablets, wearables, and home automation systems, requires a continuous supply of advanced semiconductors. Innovations in this sector, such as enhanced graphics processing, augmented reality (AR), and virtual reality (VR), further stimulate the demand for cutting-edge semiconductor technologies.

Industrial Automation and IoT

Lastly, the growth of industrial automation and the widespread adoption of IoT are driving the semiconductor market. Industries increasingly use connected devices and automation to improve efficiency, reduce costs, and enhance productivity. This trend necessitates the integration of semiconductors in sensors, actuators, and control systems, which are essential components for smart manufacturing and industrial IoT applications.

Restraints for the Semiconductor Market

High Production Costs

One of the main restraints in the semiconductor market is the high cost of production. Manufacturing semiconductors involves complex and precise processes that require expensive materials and advanced equipment. The need for cleanroom environments and the integration of cutting-edge technologies like photolithography significantly drive up costs. These high expenses are a barrier, especially for smaller companies or new entrants in the market, as they need substantial capital investment to set up and maintain production facilities.

Supply Chain Vulnerabilities

The semiconductor market is highly dependent on a global supply chain, which makes it vulnerable to disruptions. Events like natural disasters, political instability, or pandemics can lead to significant delays and shortages. For instance, the COVID-19 pandemic caused major disruptions in semiconductor supply chains, leading to shortages that affected various industries, from automotive to consumer electronics. This vulnerability necessitates robust risk management and contingency planning, which can add to operational costs.

Technological Complexity

As technology advances, the complexity of semiconductor manufacturing increases. Developing smaller, faster, and more efficient chips requires continuous innovation and adaptation to new technologies. This complexity can slow down production and increase the risk of defects, which in turn can lead to higher costs and longer times to market. Keeping up with the rapid pace of technological change also requires ongoing investment in research and development, which can be a significant financial burden.

Environmental Concerns

Semiconductor manufacturing is resource-intensive and has significant environmental impacts. The process consumes large amounts of water and energy and involves hazardous chemicals. As environmental regulations become stricter globally, companies face increasing pressure to adopt more sustainable practices. Complying with these regulations can lead to higher operational costs and require investments in cleaner technologies and waste management systems.

Skilled Labor Shortage

The semiconductor industry requires a highly skilled workforce to operate and maintain its sophisticated manufacturing equipment. However, there is a global shortage of skilled professionals in this field. Attracting and retaining talent is becoming increasingly difficult, and companies often have to invest heavily in training and development programs to build a competent workforce. This shortage of skilled labor can limit production capacity and slow down innovation efforts, posing a significant challenge to the industry's growth.

Opportunity in the Semiconductor Market

Technological Advancements

One of the primary opportunities in the semiconductor market is the continuous evolution of technology. The integration of artificial intelligence (AI) and machine learning (ML) into semiconductor applications is accelerating, offering enhanced capabilities in data processing and automation. This technological progression is not only making devices smarter but also optimizing manufacturing processes, leading to increased efficiency and reduced costs. For example, companies are developing energy-efficient chips that cater to the growing demand for low-power devices in various applications, including AI and the Internet of Things (IoT).

Expansion into New Markets

Semiconductors are increasingly finding applications in new and diverse markets. The automotive sector, particularly with the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), is becoming a major consumer of semiconductor components. This sector demands high-performance chips for vehicle automation and infotainment systems, driving substantial growth in the semiconductor industry. Additionally, the healthcare industry is leveraging semiconductors for medical devices and diagnostic equipment, further broadening the market's scope.

Sustainability Initiatives

Sustainability is emerging as a critical focus for semiconductor manufacturers. Companies are investing in environmentally friendly practices, such as using renewable energy sources and improving electronic waste management. These initiatives are not only beneficial for the environment but also enhance the corporate image and compliance with global regulations. For instance, manufacturers are adopting sustainable manufacturing processes to reduce their carbon footprint, which is increasingly becoming a selling point in the global market.

Government Support and Funding

Government support through funding and favorable regulations is another significant opportunity for the semiconductor market. Many countries are recognizing the strategic importance of semiconductor technology and are investing in its development. This includes financial incentives for research and development, as well as policies that support domestic production to reduce dependency on imports. Such government initiatives are expected to bolster the growth of the semiconductor industry by fostering innovation and ensuring a stable supply chain.

Collaboration and Partnerships

Collaboration between semiconductor companies and other industry players is fostering innovation and market expansion. Strategic partnerships, such as those between semiconductor manufacturers and technology firms, are leading to the development of advanced semiconductor solutions tailored to specific industry needs. These collaborations are also critical in addressing the challenges of high production costs and accelerating the time-to-market for new products. By working together, companies can leverage each other's strengths to drive growth and competitiveness in the market.

Trends for the Semiconductor Market

Growth Driven by AI and IoT

The semiconductor market is seeing significant growth due to the increasing adoption of artificial intelligence (AI) and the Internet of Things (IoT). AI applications, such as machine learning and neural networks, require advanced semiconductor technologies to process large amounts of data quickly and efficiently. This demand is pushing the development of more sophisticated AI chips and integrated circuits (ICs). Similarly, IoT devices, which connect various systems and devices to the internet, rely heavily on semiconductors to function. This surge in demand for AI and IoT technologies is driving substantial investment and innovation in the semiconductor industry.

Expansion of 5G Technology

The rollout of 5G technology is another major trend impacting the semiconductor market. 5G networks promise faster internet speeds and more reliable connections, which require advanced semiconductors for network infrastructure and mobile devices. The implementation of 5G is boosting the demand for high-performance chips that can handle increased data transfer rates and lower latency. This trend is expected to continue as more countries and companies invest in 5G technology, driving the need for innovative semiconductor solutions.

Rise of Autonomous Vehicles

Autonomous vehicles are becoming a significant area of interest within the semiconductor market. These vehicles rely on a variety of sensors, cameras, and other technologies to operate safely and efficiently, all of which require advanced semiconductor components. The development and deployment of self-driving cars are increasing the demand for semiconductors that can process large amounts of data in real-time. As the automotive industry continues to move towards greater automation, the need for high-performance semiconductors will grow, driving further market expansion.

Growth in Consumer Electronics

The consumer electronics sector remains a vital driver of the semiconductor market. Devices such as smartphones, tablets, and wearables are continuously evolving, requiring more advanced and efficient semiconductor technologies. Innovations in consumer electronics, such as foldable screens and augmented reality features, are pushing the boundaries of what semiconductors can do. This constant evolution in consumer preferences and technology advancements ensures a steady demand for cutting-edge semiconductor solutions.

Increasing Focus on Sustainability

Sustainability is becoming an essential trend in the semiconductor market. Companies are investing in eco-friendly manufacturing processes and developing semiconductors that consume less power and have a longer lifespan. This focus on sustainability is not only driven by regulatory requirements but also by consumer demand for greener products. By adopting more sustainable practices, semiconductor companies can reduce their environmental impact and appeal to a growing segment of environmentally conscious consumers.

Government Support and Investment

Government initiatives and investments are playing a crucial role in shaping the semiconductor market. Programs like the CHIPS Act in the United States aim to bolster domestic semiconductor manufacturing and innovation. These initiatives provide funding and incentives for research and development, helping to drive advancements in semiconductor technology. Government support is crucial for maintaining a competitive edge in the global semiconductor market and ensuring a stable supply chain.

Segments Covered in the Report

By Component

-

Memory devices

-

Logic devices

-

Analog IC

-

MPUs

-

MCUs

-

Other Components

By Source

-

Silicon

-

Germanium

-

Gallium arsenide

-

Other Sources

By Node Size

-

32/28nm

-

16/14nm

-

10/7/5nm

-

65nm

-

5nm

-

Other Node Sizes

By Application

-

Telecommunication

-

Data Processing

-

Industrial

-

Consumer Electronics

-

Automotive

-

Other Applications

Segment Analysis

By Component Analysis

There are several ways to categorize the semiconductor market: by components, source, node size, application, and region. Memory devices, analog integrated circuits (ICs), logic devices, MPUs, MCUs, and other related components are all included in the component segment. In this market, the MPU and MCU sectors are leading the way with a significant share of 33.8% in 2023.

This market's dominance is mainly due to the widespread use of MCUs and MPUs in the production of various devices, including notebooks, desktops, laptops, and personal computers. The MPU & MCU category has grown dramatically as a result of this huge employment. Strong processors and controllers are becoming more and more necessary as a result of the current Internet of Things (IoT) trends and the growing demand for these devices.

This increase in demand is thereby supporting the market's MPUs and MCUs segments. The National Cable and Telecommunications Association has reported that the number of connected devices worldwide reached about 50 billion in 2020, up from approximately 34 billion in 2018. The forecast for the upcoming years predicts that the number of IoT devices will proliferate quickly.

In addition, it is expected that the memory device segment will grow at the fastest rate over the estimated period. This is a result of both the growing number of businesses operating in the digital space and the increasing penetration of digitalization. The rapid use of virtual reality (VR) technology and the increasing need for cloud computing services are anticipated to act as catalysts for the growth of this market shortly.

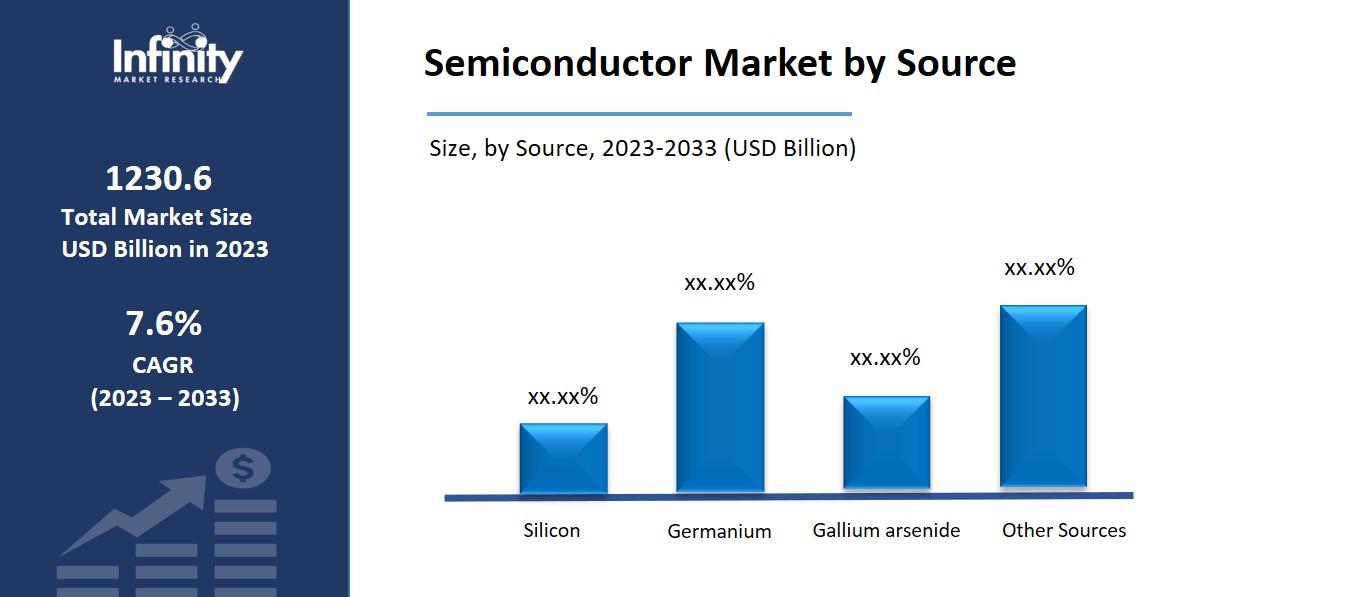

By Source Analysis

Semiconductors play a critical role in electronic gadgets and center on three major elements: silicon, germanium, and gallium arsenide. Among them, silicon shines as the most vital element, expected to commandeer a large 46.9% share of the market. The reason silicon is used so often to make semiconductors is that it is very stable. Its versatility in forming switches, circuits, and gates is impressive.

Electronics makers can replace bulky and impractical traditional thermoelectric parts with integrated silicon (Si), germanium (Ge), and gallium arsenide (GaAs). With the introduction of these semiconductor elements, there has been a noticeable shift towards smaller products, which has made electronic gadgets more portable and compact. Of all the readily available semiconductor components on the market, silicon is the most superior.

By Node Size Analysis

With a noteworthy share of 27.8%, the 16/14nm category is the leading segment in the market as of 2023. The unit of measurement for semiconductor size, also known as node size, is nanometers, which is equivalent to one billionth of a meter (0.00000001 m). Chips measuring 14 and 10 nanometers are currently made on a significant basis. The industry is, nevertheless, gradually heading toward progressively smaller node sizes. The problem, though, is that the actual dimensions might be deceiving despite this trend.

Even though 7-nanometer chips are currently on the market, the way companies like Samsung and Taiwan Semiconductor Manufacturing Company (TSMC) characterize them is comparable to how Intel defines its 10-nanometer node. A 5-nanometer product with a high transistor density of 171.3 million transistors per square millimeter is presently under development by TSMC. Furthermore, it has been stated that TSMC and Samsung intend to produce semiconductors using 3-nanometer nodes. During the projection period, these advancements are probably going to drive segment growth.

By Application Analysis

The semiconductor market is separated into sectors related to telecommunication, data processing, consumer electronics, industrial, automotive, and other areas based on application. The leading industry is telecommunications, which will hold a 36.8% share in 2023. The need for these semiconductors in the telecommunications industry is significantly increased by the rising requirement for remote work in both developed and developing countries.

This market sector currently includes a large percentage of the semiconductor industry in data processing. This is explained by the significant increase in sales and demand for smartphones and other connected devices, which has increased the need for memory and storage components.

Consumer electronics, which includes wearable technology, gaming consoles, and other electronic devices, is a big industry. This is a result of the widespread acceptance of electronic gaming in many nations. Furthermore, because industrial machinery manufacturing still has opportunities for improvement, the industrial application category is expected to grow steadily.

Regional Analysis

Asia Pacific is currently the dominating player, with the largest market share of 52.1%, and is expected to exhibit the greatest growth potential globally. One of the main factors propelling the overall market rise is the region's growing semiconductor market.

The market in North America is expected to grow at a rapid pace, primarily due to increased investments in research and development (R&D) projects. Notably, between 1999 and 2019, US industry R&D investments grew at a Compound Annual Growth Rate (CAGR) of approximately 6.6%, according to figures from the Semiconductor Industry Association (SIA). This tendency is a result of the US's persistently high corporate spending levels on operational R&D. Notable developments are anticipated to be enabled by the telecom and automotive industries in Europe, indicating their potential for significant growth.

Competitive Analysis

Leading players in this space use a variety of tactics, including joint ventures, smart investments for portfolio growth, mergers and acquisitions, and other relevant actions. These businesses are also spending a significant amount of money to improve the products they sell. Furthermore, they are unwavering in their resolve to uphold competitive price structures.

Recent Developments

May 2023: The leadership of the India Semiconductor Mission and Purdue University signed a critical agreement, the second significant international partnership announced in the same month.

February 2023: The India Electronics and Semiconductor Association (IESA) and the US Semiconductor Industry Association (SIA) both stated their desire to improve public-private collaboration in the semiconductor ecosystem.

Key Market Players in the Semiconductor Market

-

NXP Semiconductors

-

TOSHIBA Corporation

-

MediaTek Inc.

-

Advanced Micro Devices Inc.

-

Infineon Technologies

-

Samsung Electronics Co Ltd

-

Maxim Integrated Products Inc.

-

Intel Corporation

-

SK Hynix Inc.

-

Analog Devices Inc.

-

Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 590.8 Billion |

|

Market Size 2033 |

USD 1,230.6 Billion |

|

Compound Annual Growth Rate (CAGR) |

7.6% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Component, Source, Node Size, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

NXP Semiconductors, TOSHIBA Corporation, MediaTek Inc., Advanced Micro Devices Inc., Infineon Technologies, Samsung Electronics Co Ltd, Maxim Integrated Products Inc., Intel Corporation, SK Hynix Inc., Analog Devices Inc., Other Key Players |

|

Key Market Opportunities |

Technological Advancements |

|

Key Market Dynamics |

Increasing Demand in the Automotive Industry |

📘 Frequently Asked Questions

1. How much is the Semiconductor Market in 2023?

Answer: The Semiconductor Market size was valued at USD 590.8 Billion in 2023.

2. What would be the forecast period in the Semiconductor Market report?

Answer: The forecast period in the Semiconductor Market report is 2023-2033.

3. Who are the key players in the Semiconductor Market?

Answer: NXP Semiconductors, TOSHIBA Corporation, MediaTek Inc., Advanced Micro Devices Inc., Infineon Technologies, Samsung Electronics Co Ltd, Maxim Integrated Products Inc., Intel Corporation, SK Hynix Inc., Analog Devices Inc., Other Key Players

4. What is the growth rate of the Semiconductor Market?

Answer: Semiconductor Market is growing at a CAGR of 7.6% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.