🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Shale Oil Market

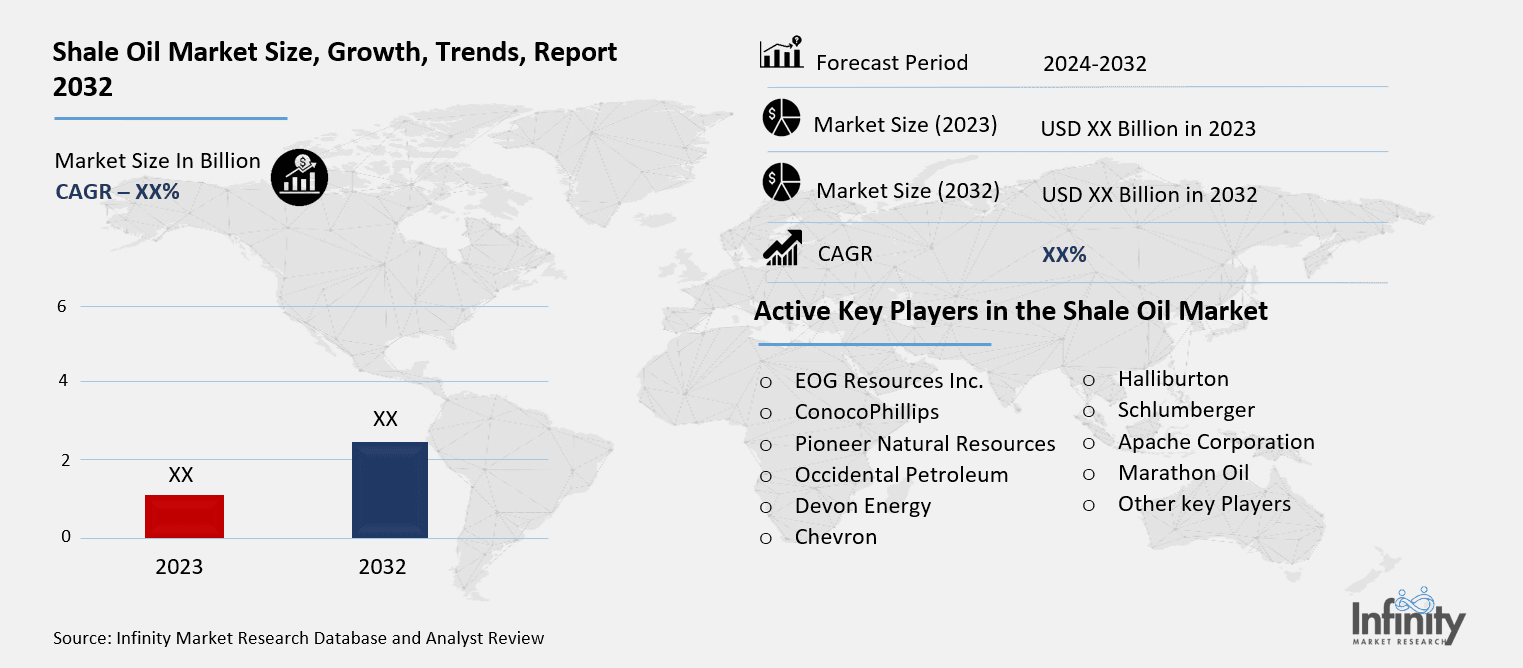

Shale Oil Market Global Industry Analysis and Forecast (2024-2032) By Type (Tight Oil, Shale Gas) By Application (Energy Production, Transportation, Industrial Uses, Residential & Commercial Heating) By Technology (Horizontal Drilling, Hydraulic Fracturing (Fracking), Enhanced Oil Recovery (EOR)) By Resource Type (Proved Reserves, Unproved Reserves) and Region

Mar 2025

Energy and Power

Pages: 138

ID: IMR1873

Shale Oil Market Synopsis

Shale Oil Market research report acquired the significant revenue of XX Billion in 2023 and expected to be worth around USD XX Billion by 2032 with the CAGR of XX% during the forecast period of 2024 to 2032.

The shale oil market includes all activities from shale rock formation exploration through extraction and production by means of hydraulic fracturing (fracking) and horizontal drilling methods. Shale oil exists as an unconventional petroleum trapped inside tightly compacted rocks therefore demanding sophisticated extraction methods. In recent years the market acquired strong importance because North America and especially the United States transformed into major global oil producers. Shale oil market growth stems from technological innovations together with affordable prices and security needs yet confronts obstacles from environmental effects and regulatory restrictions and volatile pricing mechanisms.

During the past decade shale oil production worldwide experienced exponential advancement because of improved drilling technologies including hydraulic fracturing and horizontal drilling practices. New drilling methods including hydraulic fracturing and horizontal drilling unlocked considerable oil reserves from shale rock throughout the United States alongside Canada and selected areas across South America. Shale oil functions as an essential part of worldwide petroleum production by offering lower-cost and readily available alternatives to conventional petroleum reserves. Shale oil production growth has reshaped global energy systems while granting nations previously reliant on imports the chance to create domestic energy supply and redirect global petroleum market behaviors.

The United States leads shale oil operations by controlling immense shale reserves located in the Permian Basin along with Eagle Ford and Bakken Shale regions. The extraction focus shifted to these regional areas where shale oil production rates showed dramatic increases during the past ten years. The rise of U.S. shale oil production created significant geopolitical and economic impacts which reduced worldwide petroleum prices together with diminishing its traditional OPEC-related countries' ability to set prices and maintain market share. The U.S. shale oil industry bred a bustling marketplace for service providers while supporting technological advancement which made its market position more dominant.

The shale oil market confronts multiple issues because of unstable petroleum price dynamics and regulatory complexities alongside ecological concerns. The extraction of shale oil requires large initial capital resources while its operational viability depends heavily on world oil market pricing fluctuations. When oil prices fall beneath sustainable levels some shale oil production entities lose profitability which forces them to reduce their output levels. The industry growth faces active threats because of environmental repercussions from hydraulic fracturing processes that affect water consumption and groundwater pollution risks. Shale oil resource development faces complexity because numerous nations and regions operate under different regulations that introduce more stringent monitoring on drilling operations.

The shale oil industry displays promising expansion prospects since upcoming developments in drilling methods and exploration methods track to enhance productivity while lowering operational costs. Somewhat counteracting the forceful call for emerging market energy needs stands shale oil as a native fuel source for these market needs. The drive to achieve cleaner energy has propelled the market toward the adoption of environmental friendly strategies for shale oil production including carbon capture systems and methane emission reduction measures. Shale oil consumption will continue as a significant element of future global energy systems while global markets beyond the U.S. begin developing their own shale resources.

Shale Oil Market Trend Analysis

Trend

Technological Innovations Driving Shale Oil Production

The techniques of Hydraulic fracturing (fracking) with horizontal drilling represent major breakthroughs in shale oil production because they revolutionize how energy extraction happens in shale formations. Producers now access underground reserves through these innovative techniques as the U.S. emerged as the leading shale oil producer in worldwide markets. Fundership from hydraulic fracturing methods and horizontal drilling techniques has allowed the U.S. to transform its position in worldwide oil production while creating previously unavailable petroleum reserves which were previously viewed as uneconomical. The intense surge in domestic oil production transformed global energy trade patterns so America expanded its exports to confront OPEC and petroleum-producing Middle Eastern countries. The fundamental structure of global oil supply markets has shifted due to U.S. shale oil production which now shapes both international oil market prices and global energy trading patterns.

Due to environmental challenges and requirements for sustainability energy companies invest heavily into new technology solutions to improve shale oil operations and decrease their environmental impacts. The energy industry focuses its efforts on building technologies which decrease water requirements and improve fracking operations and cut down methane emissions. The surge of regulatory oversight along with growing environmental opposition to fracking has made these advanced technologies essential. The shale oil market enters a phase of sustained growth while encountering obstacles to reconcile its fiscal development with ecological protection measures. Industry development will depend on finding sustainable practices that integrate with current competitive capabilities within the global energy market.

Opportunity

Expanding Shale Oil Reserves in North America

Shale oil presents extensive market opportunities because of increased global energy needs combined with substantial North American shale oil reservoirs particularly those found within United States soil. Production of shale oil has experienced essential efficiency improvements through two key technological developments: hydraulic fracturing and horizontal drilling. Modern extraction technologies help industry professionals reach depleted resources found in areas previously unextractable thereby making millions of inaccessible resources available. A rise in exploration and production operations will drive supply growth ensuring both national and worldwide economic advancement. The advances in shale oil extraction methods improve both operational cost-efficiency and scalability which drives sector growth potential.

The shale oil market develops strong potential momentum because of global energy changes along with heightened energy security demands. The rising geopolitical instabilities in traditional oil-producing territories have led nations worldwide to choose domestic shale oil exploration in order to decrease their dependence on distant foreign oil providers. Strong financial performance and increased capital inflow support shale oil industry development as oil prices establish stable levels or increase. The market offers sustainable business prospects through environmentally friendly extraction procedures which enable businesses to succeed as societies shift toward clean energy yet maintain their oil consumption needs.

Shale Oil Market Segment Analysis

Shale Oil Market Segmented on the basis of By Type, By Application, By Technology, By Resource Type.

By Type

o Tight Oil

o Shale Gas

By Application

o Energy Production

o Transportation

o Industrial Uses

o Residential & Commercial Heating

By Technology

o Horizontal Drilling

o Hydraulic Fracturing (Fracking)

o Enhanced Oil Recovery (EOR)

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Type, Tight Oil segment is expected to dominate the market during the forecast period

Tight oil, also known as shale oil, refers to crude oil that is trapped in rock formations with low permeability, such as shale. These formations require advanced extraction techniques like horizontal drilling and hydraulic fracturing (fracking) to unlock the oil. Unlike traditional oil reserves that flow freely to the surface, tight oil requires more complex methods to extract it. The development of fracking technology has been pivotal in making tight oil production economically viable, especially in regions with significant shale deposits. This technique involves injecting high-pressure fluids into the rock to create fractures, allowing the oil to flow more freely to the wellbore.

The global tight oil market has witnessed remarkable growth, particularly in the United States, where the shale boom has transformed the energy landscape. The ability to tap into vast unconventional reserves has boosted domestic production and significantly reduced reliance on imported oil. This shift has not only contributed to energy security but also helped stabilize oil prices, as new production has added to global supply levels. The success of tight oil production has driven innovation in extraction technologies and encouraged investment in shale plays worldwide, with other countries beginning to explore their own unconventional oil resources. As technology continues to evolve, tight oil could become an even more integral part of the global energy mix.

By Resource Type, Proved Reserves segment expected to held the largest share

Proved reserves are those quantities of oil and gas that have been thoroughly confirmed through geological and engineering analysis to be recoverable with a high degree of certainty, under existing economic conditions and operating practices. These reserves are considered the most reliable when projecting future production, as they are backed by actual drilling data and analysis of the reservoir’s properties. Typically, proved reserves represent resources that are already in production or are easily accessible using current technology. They provide a foundation for future production estimates and serve as a critical measure of a country or company’s energy potential.

In the context of tight oil and shale gas, a significant portion of these unconventional resources has been categorized as proved reserves due to advancements in extraction technologies, such as horizontal drilling and hydraulic fracturing. These technologies have made previously inaccessible reserves economically viable to extract, thus increasing the reliability and volume of proved reserves. Tight oil and shale gas have become key contributors to the global energy supply, with these proved reserves being central to meeting rising demand. As technology continues to improve, the classification of more resources as proved reserves is expected to increase, further solidifying their role in the future energy mix.

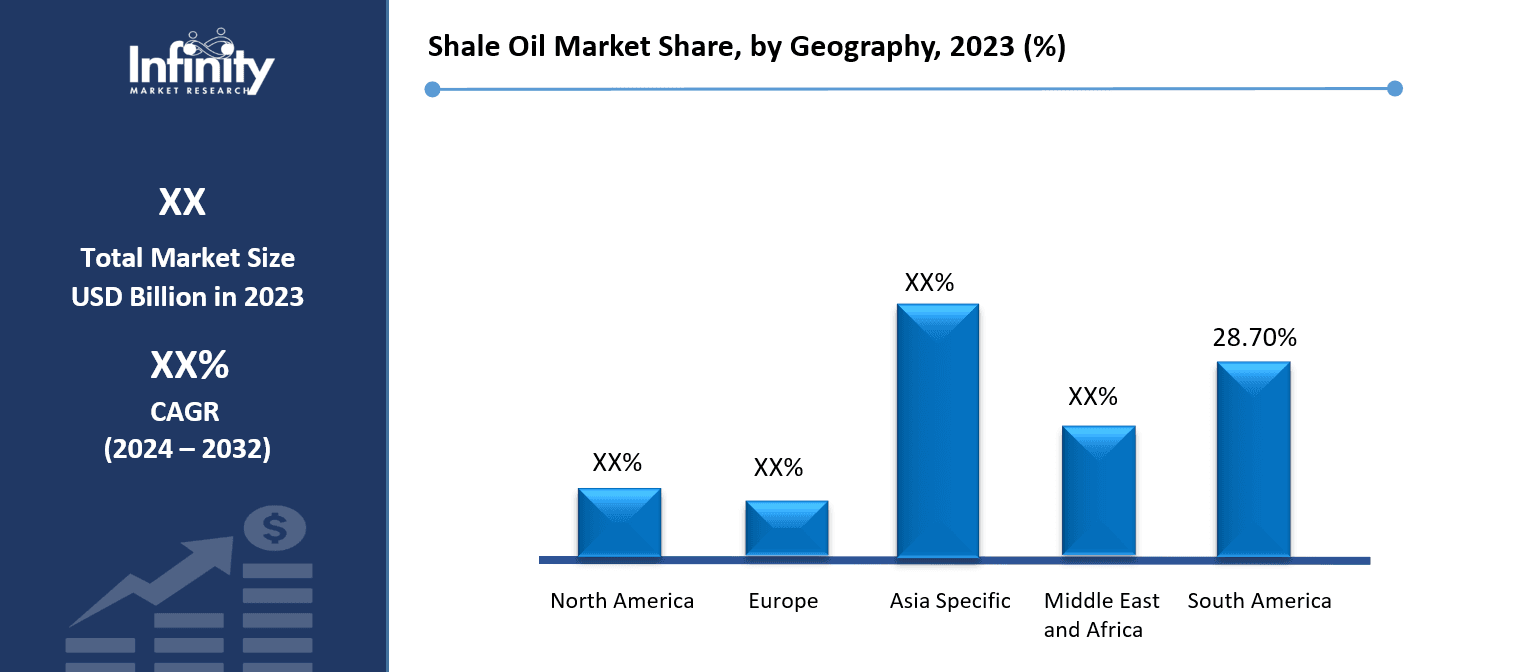

Shale Oil Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

Shale oil presents extensive market opportunities because of increased global energy needs combined with substantial North American shale oil reservoirs particularly those found within United States soil. Production of shale oil has experienced essential efficiency improvements through two key technological developments: hydraulic fracturing and horizontal drilling. Modern extraction technologies help industry professionals reach depleted resources found in areas previously unextractable thereby making millions of inaccessible resources available. A rise in exploration and production operations will drive supply growth ensuring both national and worldwide economic advancement. The advances in shale oil extraction methods improve both operational cost-efficiency and scalability which drives sector growth potential.

The shale oil market develops strong potential momentum because of global energy changes along with heightened energy security demands. The rising geopolitical instabilities in traditional oil-producing territories have led nations worldwide to choose domestic shale oil exploration in order to decrease their dependence on distant foreign oil providers. Strong financial performance and increased capital inflow support shale oil industry development as oil prices establish stable levels or increase. The market offers sustainable business prospects through environmentally friendly extraction procedures which enable businesses to succeed as societies shift toward clean energy yet maintain their oil consumption needs.

Shale Oil Market Share, by Geography, 2023 (%)

Active Key Players in the Shale Oil Market

o EOG Resources Inc.

o ConocoPhillips

o Pioneer Natural Resources

o Occidental Petroleum

o Devon Energy

o Chevron

o Halliburton

o Schlumberger

o Apache Corporation

o Marathon Oil

o Other key Players

Global Shale Oil Market Scope

|

Global Shale Oil Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD XX Billion |

|

Forecast Period 2024-32 CAGR: |

XX% |

Market Size in 2032: |

USD XX Billion |

|

|

By Type |

· Tight Oil · Shale Gas | |

|

By Application |

· Energy Production · Transportation · Industrial Uses · Residential & Commercial Heating | ||

|

By Technology |

· Horizontal Drilling · Hydraulic Fracturing (Fracking) · Enhanced Oil Recovery (EOR) | ||

|

By Resource Type |

· Proved Reserves · Unproved Reserves | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Technological Advancements in Hydraulic Fracturing and Horizontal Drilling | ||

|

Key Market Restraints: |

· Environmental Impact of Shale Oil Extraction | ||

|

Key Opportunities: |

· Expanding Shale Oil Reserves in North America | ||

|

Companies Covered in the report: |

· EOG Resources Inc., ConocoPhillips, Pioneer Natural Resources, Occidental Petroleum, Devon Energy, Chevron, Halliburton, Schlumberger, Apache Corporation, Marathon Oil, and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Shale Oil Market research report?

Answer: The forecast period in the Market research report is 2024-2032.

2. Who are the key players in the Shale Oil Market?

Answer: EOG Resources Inc., ConocoPhillips, Pioneer Natural Resources, Occidental Petroleum, Devon Energy, Chevron, Halliburton, Schlumberger, Apache Corporation, Marathon Oil and Other Major Players.

3. What are the segments of the Shale Oil Market?

Answer: The Shale Oil Market is segmented into By Type, By Application, By Technology, By Resource Type and region. By Type, the market is categorized into Tight Oil, Shale Gas. By Application, the market is categorized into Energy Production, Transportation, Industrial Uses, Residential & Commercial Heating. By Technology, the market is categorized into Horizontal Drilling, Hydraulic Fracturing (Fracking), Enhanced Oil Recovery (EOR). By Resource Type, the market is categorized into Proved Reserves, Unproved Reserves. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Shale Oil Market?

Answer: The shale oil market includes all activities from shale rock formation exploration through extraction and production by means of hydraulic fracturing (fracking) and horizontal drilling methods. Shale oil exists as an unconventional petroleum trapped inside tightly compacted rocks therefore demanding sophisticated extraction methods. In recent years the market acquired strong importance because North America and especially the United States transformed into major global oil producers. Shale oil market growth stems from technological innovations together with affordable prices and security needs yet confronts obstacles from environmental effects and regulatory restrictions and volatile pricing mechanisms.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.