🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Silica Sand Market

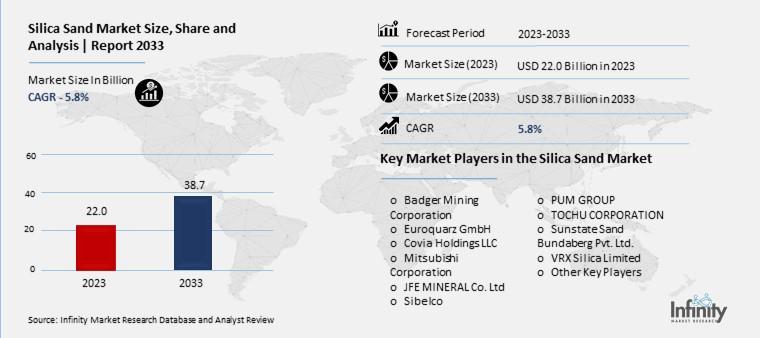

Silica Sand Market (By Purity (94% to 95.9%, 96% to 97.9%, 98% to 98.9%), By Silica Sand Type (Wet Sand, Dry Sand, Frac Sand, Filter Sand, Coated Sand, Others), By End-Use Industry (Glass Manufacturing, Foundry, Chemical Production, Construction, Paints and Coatings, Ceramics and Refractories, Filtration, Oil and Gas, Other), By Region and Companies)

Jul 2024

Chemicals and Materials

Pages: 180

ID: IMR1167

Silica Sand Market Overview

Global Silica Sand Market size is expected to be worth around USD 38.7 Billion by 2033 from USD 22.0 Billion in 2023, growing at a CAGR of 5.8% during the forecast period from 2023 to 2033.

The Silica Sand Market refers to the industry that deals with the extraction, processing, and sale of silica sand. Silica sand is a type of sand made up mostly of tiny quartz grains. It's a very pure and fine type of sand, often used in various industrial processes. Think of it as a special kind of sand that has many important uses in different fields, from making glass to helping with construction projects.

In the construction industry, silica sand is used to make things like concrete and cement stronger. In the glass-making industry, it's a key ingredient for creating clear and durable glass products like windows and bottles. Additionally, silica sand is used in the production of ceramics, electronics, and even in water filtration systems to keep water clean. The demand for silica sand keeps growing because it's essential for so many different industries.

Drivers for the Silica Sand Market

Growing Demand in the Construction Industry

One of the primary drivers of the silica sand market is the booming construction industry. Silica sand is a key ingredient in the production of concrete, glass, and mortar, essential materials for building infrastructure. The surge in construction projects worldwide, especially in emerging economies undergoing rapid urbanization and industrialization, has significantly increased the demand for silica sand. This sand is preferred for its strength, chemical purity, and resistance to heat and chemical attack, making it ideal for producing high-quality construction materials. Furthermore, the shift towards sustainable and energy-efficient buildings has increased the use of silica sand in architectural glass and other eco-friendly construction applications.

Expansion of the Glass Manufacturing Sector

Silica sand is a critical raw material in the glass manufacturing industry. The demand for glass products, including windows, containers, and fiberglass, is rising globally due to its applications in the construction, automotive, packaging, and renewable energy sectors. High-purity silica sand is essential for producing transparent, strong, and durable glass. As industries like automotive and solar energy continue to expand, the need for high-quality glass is driving the growth of the silica sand market. This trend is especially pronounced in regions with advanced glass manufacturing sectors, such as Europe and North America.

Advancements in Hydraulic Fracturing Technology

The rapid adoption of hydraulic fracturing (fracking) technology in the oil and gas industry is another significant driver for the silica sand market. Silica sand is used as a proppant in fracking to keep fractures in the rock open, facilitating the extraction of oil and natural gas. The unique properties of silica sand, such as its high purity, grain size, and spherical shape, make it highly effective for this purpose. As the global energy sector continues to invest in and adopt fracking technology, particularly in North America, the demand for high-quality silica sand is expected to rise steadily.

Technological Innovations in Mining and Processing

Technological advancements in the mining and processing of silica sand have enhanced the efficiency and quality of the product. Innovations such as improved extraction techniques, better sorting and washing processes, and the development of environmentally sustainable practices are driving the market forward. These advancements not only increase the supply of high-quality silica sand but also address environmental concerns, making the industry more sustainable. Companies are increasingly adopting practices like reducing water usage and implementing land reclamation projects to minimize their environmental footprint.

Increasing Use in Water Filtration and Abrasives

Silica sand is also extensively used in water filtration systems and as an abrasive material. Its high silica content and uniform grain size make it ideal for removing impurities from water, contributing to the growing demand in the water treatment industry. Additionally, silica sand's hardness and sharp edges make it an effective abrasive for sandblasting and other surface treatment applications. The increasing need for clean water and the widespread use of abrasives in various industries are further propelling the growth of the silica sand market.

Geographical Trends and Market Opportunities

Geographically, regions like China and the United States dominate the silica sand market due to their massive construction and manufacturing industries and significant investments in hydraulic fracturing, respectively. Other regions, such as Europe, are also major consumers of silica sand due to their advanced glass manufacturing sectors. The consistent demand across these diverse applications and regions offers substantial growth opportunities for the silica sand market. However, companies must navigate environmental regulations and sustainability challenges to capitalize on these opportunities effectively

Restraints for the Silica Sand Market

Environmental Regulations and Sustainability Issues

One of the primary restraints facing the silica sand market is the increasing stringency of environmental regulations. Mining and processing silica sand can have significant environmental impacts, including habitat destruction, water pollution, and air quality issues. Governments worldwide are imposing stricter regulations to mitigate these effects, which can increase operational costs for companies involved in the extraction and processing of silica sand. For example, managing dust emissions and water usage efficiently to comply with these regulations can be both technically challenging and financially demanding.

Health and Safety Concerns

The health risks associated with silica dust are another major constraint. Prolonged exposure to respirable crystalline silica can lead to serious health issues such as silicosis, lung cancer, and other respiratory diseases. These health concerns necessitate stringent workplace safety regulations and significant investment in protective measures and equipment. Ensuring compliance with health and safety standards increases operational costs and can also lead to production delays or shutdowns if violations occur.

Supply Chain Disruptions

The silica sand market also faces challenges related to supply chain disruptions. Factors such as geopolitical tensions, trade restrictions, and natural disasters can impact the consistent supply of raw materials. For instance, disruptions in transport logistics due to geopolitical conflicts or pandemics can delay deliveries and increase costs. These interruptions can have a ripple effect on industries dependent on silica sand, such as glass manufacturing and construction, thereby affecting overall market stability.

Market Competition and Pricing Pressures

Intense competition within the silica sand market can lead to pricing pressures. Numerous local and international players compete for market share, which often results in price wars. Smaller companies, in particular, may struggle to maintain profitability when larger players can afford to reduce prices due to economies of scale. This competitive landscape can stifle investment in innovation and sustainability initiatives, further hindering market growth.

Resource Depletion Concerns

Finally, the finite nature of high-purity silica sand reserves poses a long-term constraint. As high-quality deposits become increasingly scarce, companies may need to explore and develop lower-grade deposits, which can be more costly and environmentally taxing to process. This scarcity can drive up the cost of silica sand and limit the availability of this critical resource for industries that rely on it, such as electronics and construction.

Opportunity in the Silica Sand Market

Growing Demand in Construction and Glass Manufacturing

The silica sand market is experiencing significant growth due to its extensive use in the construction and glass manufacturing industries. Silica sand is a critical raw material in producing high-quality glass, which is in high demand due to increasing construction projects and urbanization worldwide. The need for sustainable and energy-efficient buildings also drives the demand for silica sand in producing architectural glass and other construction materials. The rise in infrastructure projects, especially in emerging economies, contributes to the market's expansion.

Technological Advancements in Hydraulic Fracturing

Technological advancements in hydraulic fracturing (fracking) are creating new opportunities in the silica sand market. Fracking, a method used to extract oil and gas, relies on silica sand as a proppant to keep fractures open in the rock, facilitating the extraction process. Innovations in this technology enhance the efficiency and effectiveness of fracking operations, thereby increasing the demand for high-purity silica sand. The growth of the oil and gas industry, particularly in regions like the United States, is a significant driver of this market segment.

Expanding Applications in Various Industries

Beyond construction and oil and gas, silica sand finds applications in several other industries, including foundries, water filtration, and abrasives. Its versatility and unique properties, such as high chemical purity and resistance to heat, make it valuable across different sectors. The diverse applications of silica sand ensure a steady demand, providing numerous growth opportunities for market players. As industries continue to discover new uses for silica sand, its market potential expands further.

Increasing Environmental Regulations

While environmental regulations present challenges, they also offer opportunities for innovation in sustainable mining and processing practices. Companies are investing in technologies that reduce water usage and minimize environmental impact, aligning with stricter regulations and public demand for environmentally friendly products. These advancements not only help companies comply with regulations but also position them as leaders in sustainable practices, potentially attracting more customers and partners.

Market Expansion in Emerging Economies

Emerging economies, particularly in Asia-Pacific, are witnessing rapid industrialization and urbanization, driving the demand for silica sand. Countries like China and India are investing heavily in infrastructure and construction projects, creating substantial opportunities for silica sand suppliers. Additionally, these regions are becoming significant players in the global glass manufacturing industry, further boosting the demand for high-quality silica sand.

Strategic Partnerships and Investments

Companies in the silica sand market are increasingly forming strategic partnerships and making significant investments to enhance their production capacities and market presence. Mergers and acquisitions, along with investments in research and development, are common strategies employed to stay competitive. These initiatives not only help companies meet the growing demand but also drive innovation and improve product quality, opening up new avenues for market growth.

Trends for the Silica Sand Market

Rising Demand in Construction and Glass Industries

The construction and glass industries are major consumers of silica sand, driving its market growth. In construction, silica sand is a key component in concrete and cement, essential for building structures. The glass industry uses high-purity silica sand to manufacture windows, bottles, and other glass products. The booming construction activities, especially in emerging economies, and the expanding glass industry are significantly boosting the demand for silica sand.

Growth in Hydraulic Fracturing

Hydraulic fracturing, or fracking, is another significant driver for the silica sand market. In this process, silica sand is used as a proppant to keep fractures in the rock open, allowing oil and gas to flow out. The increase in shale gas extraction activities, particularly in North America, has led to a surge in demand for silica sand. As the energy sector continues to seek alternative sources of fuel, the use of silica sand in hydraulic fracturing is expected to grow.

Advancements in Water Filtration

The use of silica sand in water filtration systems is on the rise due to its effective filtering capabilities. Silica sand helps remove contaminants from water, ensuring safe drinking water. With increasing awareness about water quality and the establishment of new water filtration plants worldwide, the demand for silica sand is growing. Its ability to maintain pH balance and neutralize acidic substances makes it a preferred choice in water treatment processes.

Technological Innovations in Foundry Applications

Silica sand is widely used in foundry applications for making molds and cores. Technological advancements in foundry processes are enhancing the quality and efficiency of casting, increasing the demand for high-purity silica sand. Innovations such as 3D printing of molds and cores are creating new opportunities for silica sand in the foundry industry, driving market growth.

Regional Market Dynamics

The Asia-Pacific region dominates the silica sand market, driven by rapid industrialization and urbanization in countries like China and India. The region's construction boom and the growing glass manufacturing industry are key factors. North America also shows significant market growth due to the rise in hydraulic fracturing activities. In Europe, the increasing use of silica sand in water filtration and the glass industry is propelling market expansion. Each region has unique factors contributing to the overall growth of the silica sand market.

Environmental and Regulatory Considerations

Environmental regulations and sustainability concerns are shaping the silica sand market trends. Regulations to reduce dust emissions during mining and transportation of silica sand are being implemented. Additionally, the industry is focusing on sustainable mining practices and efficient resource utilization to minimize environmental impact. These considerations are leading to innovations and adaptations within the industry, influencing market trends positively.

Segments Covered in the Report

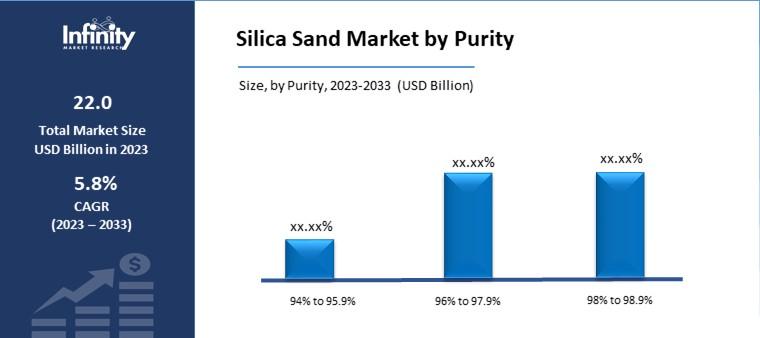

By Purity

o 94% to 95.9%

o 96% to 97.9%

o 98% to 98.9%

By Silica Sand Type

o Wet Sand

o Dry Sand

o Frac Sand

o Filter Sand

o Coated Sand

o Others

By End-Use Industry

o Glass Manufacturing

o Foundry

o Chemical Production

o Construction

o Paints and Coatings

o Ceramics and Refractories

o Filtration

o Oil and Gas

o Other

Segment Analysis

By Purity Analysis

Throughout the projection period, the Above 99% segment is anticipated to develop at the highest CAGR of 5.2%. Pure silica sand with 99.5% content is used in the glass industry. Commercial glass is made by fusing silica sand (Si02), limestone (CaC03), and soda ash (NC03) at 1,100°C. Usually composed of 15% soda ash, 10% lime, and 75% silica. The sand needs to be uniformly sized with a minimum silica content of 99.53%. the process of using photothermal treatment to reduce silica sand's impurities to a level that makes silicon of the necessary solar grade for photovoltaic applications possible.

By drawing impurities to the surface of silica grains, this approach makes it easier to remove them by dissolving them partially in an acidic solution. The inductively coupled plasma atomic emission spectrometry (ICP-AES) method was used to analyze the obtained silica. The most common contaminants found in silica sand were Al, K, Fe, Na, Ca, Mg, and B. Almost all significant pollutants were successfully removed from the new products. ICP-AES characterization shows that the purity level ranges from 99.76 to 99.98%, with an average impurity removal effectiveness of 83.34%.

By Silica Sand Type Analysis

It is anticipated that during the forecast period, the Wet Sand segment will increase at the highest CAGR of 5.6%. Wet silica sand is utilized by the glass industry as a premium sand source because of its high silica concentration (SiO2). Its principal applications are in construction, the glass industry, golf courses, and other fields. Because the building industry is always in need of wet silica sand, it makes sense to choose destination markets that have specific grain sizes and composition characteristics. The characteristics listed above are also present in wet silica sand, which is used to create and maintain golf courses. Such wet silica sand has long been a mainstay on and on the finest golf courses of the Portuguese and Spanish peninsulas. It's used on the tee, access paths, bunkers, and green, among other places.

By End-Use Industry Analysis

The category with the highest predicted compound annual growth rate (CAGR) for the forecast period is glass manufacturing. Silica sand is the primary component of all glassware types, both regular and specialty. The essential silicon dioxide (SiO2) component required to manufacture glass is supplied by it, and the strength, color, and clarity of the glass are mostly determined by the chemical purity of this component.

It is anticipated that the growing need for flat glass and fiberglass from the electronics and construction sectors in Asia's emerging countries, especially in China and India, will greatly benefit the market for silica sand in this application area. According to the Glass Manufacturing section, the use of specialty glass in the reputable electronics industries of developed countries such as South Korea and Japan is anticipated to support the expansion of the glass manufacturing industry and possibly increase the need for silica sand. Furthermore, glasses are widely utilized in the construction industry in a range of building components, including shopfronts, windows, doors, interior partitions, balustrades, and railings for balconies and staircases. This presents prospective applications for glasses and may also increase the need for silica sand.

Regional Analysis

The silica sand market was dominated by APAC in 2023, with a market share of about 47.2%. about the course of the forecast period, growth in the sector is anticipated to average 6.3% CAGR. Sand has been classified by the Indian Ministry of Mines along with marble, clay, and other minor minerals. Minor minerals make up about 12.2% of India's total mining production. In India, silica sand is used in many different operations, such as the production of glass in foundries, the synthesis of chemicals, construction, painting, etc. India is one of the major countries in the global construction business in terms of revenue and potential future growth. India's economy is the tenth largest in the world and ranks third in terms of purchasing power parity.

The domestic construction industry experienced a slowdown during the fiscal year 2021–2022, but since the lockdown was lifted, the majority of projects in the commercial sector have driven construction activities because they were either public-private partnerships (like smart cities) or already budgeted public projects. During the predicted years, the government is promoting significant measures in the residential sector. The government's "Housing for All" plan aims to build approximately 20 million affordable homes for the urban poor by 2022. As a result, residential construction will rise significantly and account for one-third of the industry's total value by 2023.

In December 2020, Sterlite Technologies said that it would invest USD 40.4 million in India to expand its fiber optic production facilities to meet demand. Furthermore, in November 2019, the Asian Infrastructure Investment Bank (AIIB) declared that it would invest up to USD 2.5 billion in urban transportation projects, such as the construction of New Delhi's commuter train networks and radial highways. This will support the industry's expansion in silica sand.

In deep well applications, industrial sand is frequently injected downhole to prop open rock fissures and increase the flow rate of natural gas or oil. It is projected that USD 206 billion will be invested in the Indian oil and natural gas sector during the next eight to 10 years. In December 2020, the Indian Oil Corporation (IOCL) announced plans to invest USD 228.81 million in new projects in Andhra Pradesh. This involves investing USD 22,62,000,000 in LPG storage facilities and USD 206,19,000,000 in petroleum product infrastructure. This will help the market for silica sand to grow even further.

Competitive Analysis

To improve the quality of their products, major companies in the market are concentrating on increasing their production capacity, increasing the efficiency of their mining and processing operations, and funding research and development. They are also aggressively pursuing mergers, acquisitions, and strategic alliances to fortify their position in the market and broaden their reach internationally. To comply with strict environmental requirements, these enterprises are progressively employing environmentally sustainable methods, such as lowering water usage in processing and undertaking reclamation projects. Furthermore, they are utilizing cutting-edge technology to enhance resource management and fulfill the varied demands of different sectors, such as hydraulic fracturing, glass making, and foundries.

Recent Developments

February 2024: A project to mine silica sand in Hollow Water First Nation has received approval from Manitoba. It is anticipated to produce USD 200 million in provincial taxes annually and almost 300 employees, the majority of which will be in Selkirk.

August 2023: After going through several steps, Chongqing Changjiang River Moulding Material Group Co. Ltd. (CCRMM) was able to turn waste sand that was previously thrown away into useful "new sand". The new sand has a lower expansion coefficient, less gas generation, and less scorch, all of which lower foundry production costs.

Key Market Players in the Silica Sand Market

o Euroquarz GmbH

o Sibelco

o Sunstate Sand Bundaberg Pvt. Ltd.

o VRX Silica Limited

o Other Key Players

Reports Scope:

|

Report Features |

Description |

|

Market Size 2023 |

USD 22.0 Billion |

|

Market Size 2033 |

USD 38.7 Billion |

|

Compound Annual Growth Rate (CAGR) |

5.8% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Purity, Silica Sand Type, End-Use Industry, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Badger Mining Corporation, Euroquarz GmbH, Covia Holdings LLC, Mitsubishi Corporation, JFE MINERAL Co. Ltd, Sibelco, PUM GROUP, TOCHU CORPORATION, Sunstate Sand Bundaberg Pvt. Ltd., VRX Silica Limited, Other Key Players |

|

Key Market Opportunities |

Growing Demand in Construction and Glass Manufacturing |

|

Key Market Dynamics |

Growing Demand in the Construction Industry |

📘 Frequently Asked Questions

1. Who are the key players in the Silica Sand Market?

Answer: Badger Mining Corporation, Euroquarz GmbH, Covia Holdings LLC, Mitsubishi Corporation, JFE MINERAL Co. Ltd, Sibelco, PUM GROUP, TOCHU CORPORATION, Sunstate Sand Bundaberg Pvt. Ltd., VRX Silica Limited, Other Key Players

2. How much is the Silica Sand Market in 2023?

Answer: The Silica Sand Market size was valued at USD 22.0 Billion in 2023.

3. What would be the forecast period in the Silica Sand Market?

Answer: The forecast period in the Silica Sand Market report is 2023-2033.

4. What is the growth rate of the Silica Sand Market?

Answer: Silica Sand Market is growing at a CAGR of 5.8% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.