🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Silicon Carbide Market

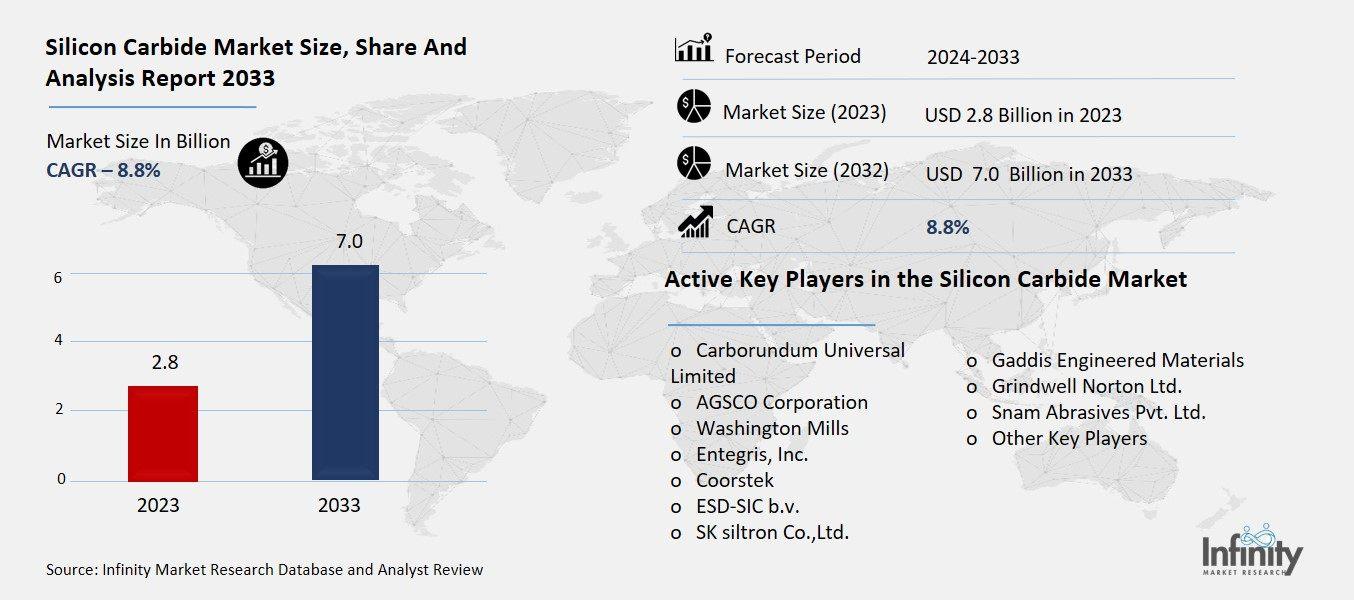

Silicon Carbide Market Global Industry Analysis and Forecast (2024-2033) by Type (Black Silicon Carbide and Green Silicon Carbide), Application (Steel & Energy, Medical & Healthcare, Automotive, Electronics & Semiconductors, Aerospace & Aviation, Military & Defense, and Other Applications) and Region

May 2025

Chemicals and Materials

Pages: 138

ID: IMR1948

Silicon Carbide Market Synopsis

The global Silicon Carbide Market was valued at USD 2.8 billion in 2023 and is expected to grow from USD 3.0 billion in 2024 to USD 7.0 billion by 2033, reflecting a CAGR of 8.8% over the forecast period.

The silicon carbide (SiC) market shows significant financial expansion because it serves crucial applications across many industries. Wide-bandgap silicon carbide functions as a semiconductor material that exhibits both exceptional thermal conduction power while maintaining highly efficient breakdown fields under elevated temperature and voltage conditions. Many power electronics systems together with electric vehicles (EVs) and renewable energy systems (including solar inverters and wind turbines) and industrial motor drives benefit from the exceptional properties of SiC. Compared to silicon-based components SiC devices revolutionize the EV and charging infrastructure sector through their ability to charge vehicles speedily and extend driving distances across the market. SiC materials assist the aerospace defense industry and other sectors by enabling the development of light-weight high-temperature resistant systems.

Silicon Carbide Market Driver Analysis

Increasing Demand for High-Performance Power Electronics

Silicon carbide (SiC) has become the material of choice in high-performance power electronics because it can function at reduced energy loss rates while operating at higher temperatures. SiC outperforms silicon through its increased bandgap and superior thermal conductance and voltage resistance which results in devices that achieve higher energy conversion efficiency with reduced heat production. Applications that need efficient energy conversion and reduced heat generation while working with bounded space dimensions benefit from SiC as the material choice. Solar inverters based on SiC technology transform solar power into energy with superior efficiency to result in better system performance. SiC material helps manufacturers create industrial equipment with better speed capabilities while achieving lower power losses while requiring minimal structure size and cooling system capacity.

Silicon Carbide Market Restraint Analysis

Limited Availability of High-Quality SiC Substrates

Silicon carbide (SiC) technology adoption faces major challenges because of restricted supply of premium-quality SiC wafers and substrates throughout the supply chain. High-temperature crystal growth procedures and specialized manufacturing equipment construct barriers to large-scale SiC production thus restricting the available number of suppliers. The rapid market expansion particularly in electric vehicles and renewable energy and power electronics sectors exceeds current SiC manufacturing capability. The unbalanced market produces both extended production timeframes and elevated costs while blocking numerous device producers from obtaining dependable supply continuity. Many industry players currently invest heavily in raw material processing together with wafer fabrication and component production for downstream deployment to overcome these bottlenecks.

Silicon Carbide Market Opportunity Analysis

Development of Next-Gen Semiconductor Devices

Scientists continue to develop silicon carbide (SiC) MOSFETs and Schottky diodes which enables effective application of SiC technology across high-power and high-efficiency environments. Silicon carbide MOSFETs surpass traditional silicon transistors by delivering faster operation together with reduced resistance and elevated operating capacity at high temperatures. The technology finds its perfect use for electric vehicle powertrain applications as well as onboard chargers and industrial power supplies. The combination of SiC Schottky diodes enables high efficiency through short reverse recovery times and reduces power losses in switch-mode power supplies, solar inverters and battery systems. Advanced transistor technologies enable engineers to design compact power-efficient durable electronic systems that support increased acceptance within aerospace data centers and telecommunications applications requiring superior power density thermal management.

Silicon Carbide Market Trend Analysis

Shift from Silicon to Wide-Bandgap Materials

High-performance power devices are transitioning to use Silicon carbide (SiC) and gallium nitride (GaN) materials instead of silicon in numerous state-of-the-art applications. These semiconductors belong to the wide-bandgap category which enables operations across elevated voltage levels and temperatures with minimal energy waste. SiC excels for electric vehicle inverters and industrial motor drives and renewable energy systems since it demonstrates high thermal conductivity and mechanical durability at high voltages. GaN has proven its superiority in fast charger development and RF systems as well as data center power supplies that require high frequencies while using lower operating voltages. The implementation of SiC and GaN establishes production of smaller high-efficiency and dependable electronic devices to meet market requirements across multiple industries including automotive and aerospace. The decrease in manufacturing costs combined with material technology maturation positions these materials as the new standard for power electronics advancement.

Silicon Carbide Market Segment Analysis

The Silicon Carbide Market is segmented on the basis of Type, Processing Method, and Application.

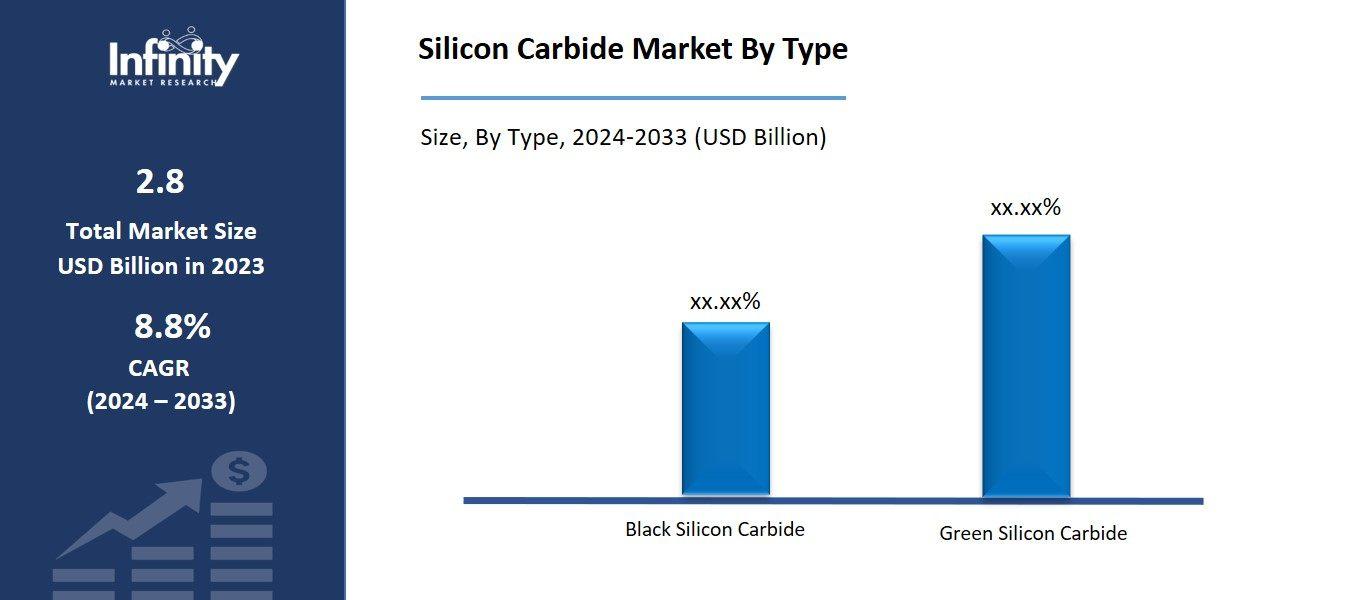

By Type

o Black Silicon Carbide

o Green Silicon Carbide

By Application

o Steel & Energy

o Medical & Healthcare

o Automotive

o Electronics & Semiconductors

o Aerospace & Aviation

o Military & Defense

o Other Applications

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Type, Black Silicon Carbide Segment is Expected to Dominate the Market During the Forecast Period

The types discussed in this research study, the black silicon carbide segment is expected to account for the largest market share of silicon carbide market in the forecast period. Black SiC forms from electric resistance furnace processing of quartz sand together with petroleum coke which produces a hard brittle material with excellent thermal conductance and chemical protective capabilities. Black silicon carbide serves numerous industrial functions because it finds applications in grinding wheels, sandpapers, cutting tools, and furnaces and kilns. Because it offers lower production costs than green SiC the material is better suited for large-scale industrial usage. The market dominance of Silicon Carbide material increases because of its applications in steel production as deoxidizers and its role in ceramics manufacturing.

By Application, the Electronics & Semiconductors Segment is Expected to Held the Largest Share

By application, the electronics and semiconductors segment is expected to hold the largest share of the silicon carbide (SiC) market during the forecast period. The high-efficiency power devices requirement across electric vehicles and renewable energy infrastructure and data centers and industrial automation drives the dominant position of this sector. The combination of MOSFETs and Schottky diodes built from SiC provides electronics applications with exceptional superiority across switching velocity and power friction in addition to superior heat endurance than conventional silicon semiconductors. Manufacturers are joining the worldwide drive toward efficient miniaturized power systems by adding SiC elements to products demanding dense compact systems. Fast advancements in 5G networks power management systems and automotive electronics strengthen the market demand for SiC components making semiconductors and electronics the driving force behind market growth.

Silicon Carbide Market Regional Insights

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Asia-Pacific is expected to dominate the silicon carbide (SiC) market over the forecast period, primarily due to the region's strong manufacturing base, rapid industrialization, and increasing demand for high-performance power devices. The automotive electronics and renewable energy sectors in the Asian countries of China and Japan and South Korea and India contribute to the growth while driving significant advancements in the field. China serves as one of the largest global SiC material producers and consumers since it leads electronics manufacturing and expands its electric vehicle industry. Multiple semiconductor companies operating in the Asia-Pacific region increase their SiC production levels while serving growing demands from automotive along with industrial and telecommunications markets for power electronics. The region demonstrates strong support for green energy through its expansion of solar and wind projects while using SiC materials to create a sustaining environment for its implementation.

Recent Development

In September 2022, SK Siltron CSS opened a new manufacturing facility in Bay City, marking a $300 million investment that reinforces the company's commitment to Michigan and enhances the state's position as a leader in the national semiconductor supply chain.

In January 2022, Fuji Electric Tsugaru Semiconductor Co., Ltd. secured a capital investment from Fuji Electric Co., Ltd. to ramp up the production of SiC power semiconductors. Mass production is anticipated to begin in fiscal 2024.

Active Key Players in the Silicon Carbide Market

o Carborundum Universal Limited

o AGSCO Corporation

o Washington Mills

o Entegris, Inc.

o Coorstek

o ESD-SIC b.v.

o SK siltron Co.,Ltd.

o Gaddis Engineered Materials

o Grindwell Norton Ltd.

o Snam Abrasives Pvt. Ltd.

o Other Key Players

Global Silicon Carbide Market Scope

|

Global Silicon Carbide Market | |||

|

Base Year: |

2024 |

Forecast Period: |

2024-2033 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.8 Billion |

|

Market Size in 2024: |

USD 3.0 Billion | ||

|

Forecast Period 2024-33 CAGR: |

8.8% |

Market Size in 2033: |

USD 7.0 Billion |

|

Segments Covered: |

By Type |

· Black Silicon Carbide · Green Silicon Carbide | |

|

By Application |

· Steel & Energy · Medical & Healthcare · Automotive · Electronics & Semiconductors · Aerospace & Aviation · Military & Defense · Other Applications | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Increasing Demand for High-Performance Power Electronics | ||

|

Key Market Restraints: |

· Limited Availability of High-Quality SiC Substrates | ||

|

Key Opportunities: |

· Technological Advancements in Smelting & Recycling | ||

|

Companies Covered in the report: |

· Carborundum Universal Limited, AGSCO Corporation, Washington Mills, Entegris, Inc. and Other Key Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Silicon Carbide Market Research report?

Answer: The forecast period in the Silicon Carbide Market Research report is 2024-2033.

2. Who are the key players in the Silicon Carbide Market?

Answer: Carborundum Universal Limited, AGSCO Corporation, Washington Mills, Entegris, Inc. and Other Key Players.

3. What are the segments of the Silicon Carbide Market?

Answer: The Silicon Carbide Market is segmented into Type, Application, and Regions. By Type, the market is categorized into Black Silicon Carbide and Green Silicon Carbide. By Application, the market is categorized into Steel & Energy, Medical & Healthcare, Automotive, Electronics & Semiconductors, Aerospace & Aviation, Military & Defense, and Other Applications. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Silicon Carbide Market?

Answer: The global industry dedicated to producing and distributing silicon carbide materials operates as the silicon carbide (SiC) market. The silicon-carbon composite that embodies silicon carbide demonstrates exceptional toughness alongside powerful thermal heat transfer capabilities and corrosion resistance and capability to handle high heat and high voltage parameters. SiC materials excel in many critical properties that enable their applications across automotive and electronics sectors as well as energy use and manufacturing industries and aerospace applications. The powertrains and charging systems for electric vehicles from automotive industries use silicon carbide for enhancing both efficiency and performance attributes.

5. How big is the Silicon Carbide Market?

Answer: The global Silicon Carbide Market was valued at USD 2.8 billion in 2023 and is expected to grow from USD 3.0 billion in 2024 to USD 7.0 billion by 2033, reflecting a CAGR of 8.8% over the forecast period.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.