🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Silicon Steel Grade Magnesium Oxide Market

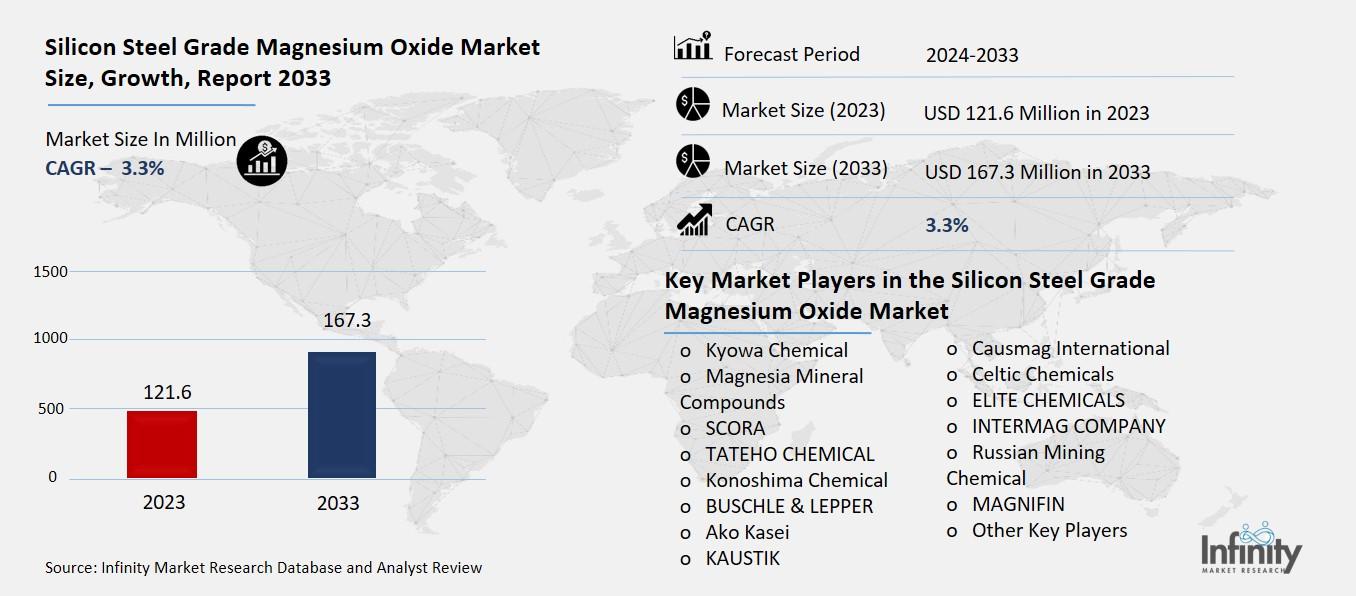

Global Silicon Steel Grade Magnesium Oxide Market (By Purity Level, 98% Purity and 99% Purity; By Application, Conventional, Electrical Steel, High Magnetic Strength Electrical Steel, Domain Refinement Electrical Steel, and Other Applications; By Region and Companies), 2024-2033

Dec 2024

Chemicals and Materials

Pages: 138

ID: IMR1369

Silicon Steel Grade Magnesium Oxide Market Overview

Global Silicon Steel Grade Magnesium Oxide Market acquired the significant revenue of 127.3 Million in 2023 and expected to be worth around USD 167.3 Million by 2033 with the CAGR of 3.3% during the forecast period of 2024 to 2033. Silicon steel grade magnesium oxide mainly refers to high-purity magnesium oxide, mainly used for making grain-oriented electrical steel (GOES) and non-grain-oriented electrical steel (NGOES). Some of the hot rolled products include these specialized steels in which are used for the manufacture of transformers, electric motors, and generators because of high magnetic permeability and low energy loss. It acts as an insulating layer thus improves the magnetic properties of the silicon steel as well as improving on the thermal stability as de-lonized through the process of annealing. Market growth potential depends on rising consumption of energy efficient electrical equipment and structures, many of which are renewable energy and include wind and electric vehicles.

Drivers for the Silicon Steel Grade Magnesium Oxide Market

Growing Demand for Energy-Efficient Equipment

The use of energy efficient transformers and motors is also growing fast in the industries as well as domestic standards due to the rising consciousness of energy saving schemes. These advanced devices are deliberately developed to reduce energy loss, enhance operation, and meet global energy standards such as the EU EcoDesign Directive and the U.S. Department of Energy's efficiency guidelines. Energy efficient motors are very important in industrial applications in motor driven applications in machinery, HVAC and manufacturing processes; this leads to much reduction in energy use and the costs.

Likewise, energy-efficient, profit-oriented transformers popularly used in global power distribution networks assist the utilities in transmitting power with minimal loss of energy while increasing the stability of power networks. When applied in households, such motors powering customized energy-efficient appliances are already in high demand to provide energy solutions that are sustainable and environmentally friendly by consumers and encouraged further by subsidies in government programs.

Restraints for the Silicon Steel Grade Magnesium Oxide Market

Volatility in Raw Material Supply

The growing emphasis on reducing energy consumption and improving operational efficiency has significantly increased the adoption of energy-efficient transformers and motors across industrial and residential sectors. Governments worldwide are introducing regulations and incentives to encourage the use of energy-efficient equipment to meet sustainability goals and combat climate change. For instance, energy labeling programs and minimum energy performance standards (MEPS) are driving the replacement of older, less efficient systems with advanced technologies. In industrial settings, where energy-intensive operations dominate, upgrading to high-performance motors and transformers can result in substantial cost savings and reduced environmental impact.

Opportunity in the Silicon Steel Grade Magnesium Oxide Market

Expansion in Emerging Markets

Emerging economies such as India, China, and Brazil are experiencing rapid industrialization, driving significant demand for materials essential to energy-efficient technologies, including silicon steel and magnesium oxide (MgO). In these countries, robust growth in sectors like manufacturing, automotive, construction, and renewable energy is fueling the need for advanced electrical infrastructure. Silicon steel, known for its superior magnetic properties, plays a critical role in producing transformers, motors, and generators essential to these industries. The increasing focus on localization, energy efficiency, and environmental sustainability further accelerates investments in high-purity MgO, making these regions pivotal in shaping global market trends.

Trends for the Silicon Steel Grade Magnesium Oxide Market

Adoption of AI and Automation

The magnesium oxide (MgO) manufacturing industry is embracing advanced technologies to ensure enhanced quality control and optimize production processes. Precision is crucial in producing silicon steel-grade MgO, as even minor impurities can adversely affect the performance of electrical steel in critical applications such as transformers and motors. Advanced tools like artificial intelligence (AI), machine learning (ML), and automation are increasingly being utilized to monitor and control manufacturing parameters in real time.

For example, AI-powered systems can predict and adjust process conditions to achieve optimal calcination and ensure uniform particle size distribution, which is vital for achieving the desired insulating properties in MgO coatings.

Segments Covered in the Report

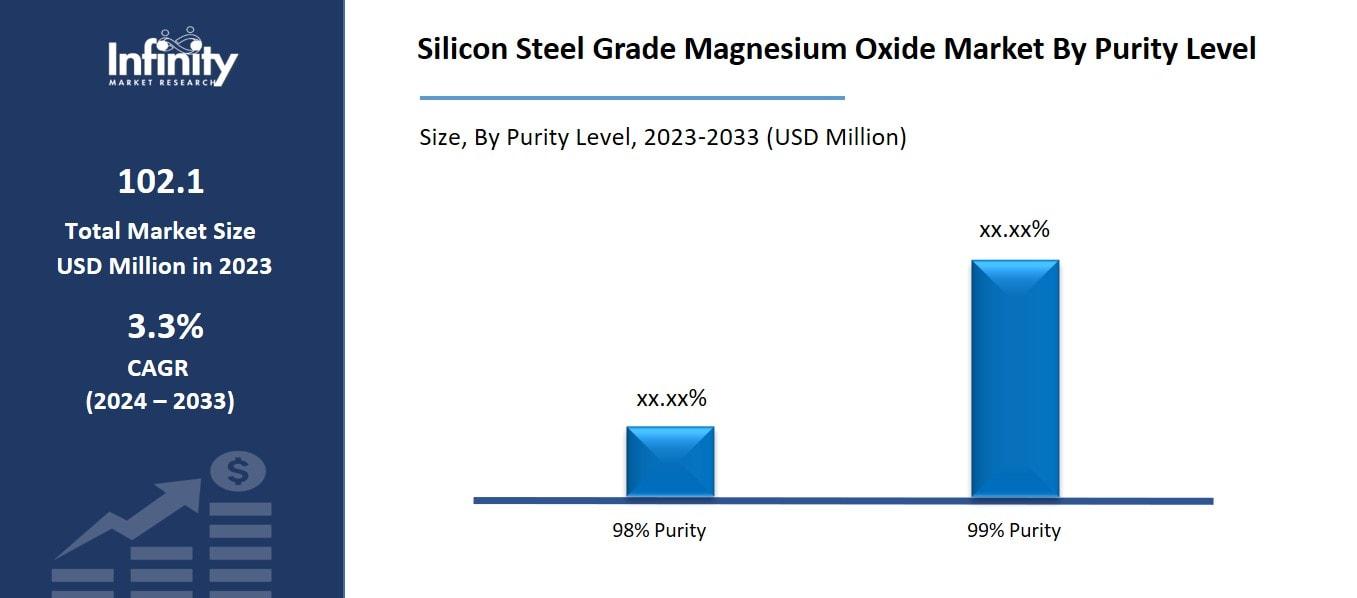

By Purity Level

o 98% Purity

o 99% Purity

By Application

o Conventional Electrical Steel

o High Magnetic Strength Electrical Steel

o Domain Refinement Electrical Steel

o Other Applications

Segment Analysis

By Purity Level Analysis

On the basis of purity level, the market is divided into 98% purity and 99% purity. Among these, buttercream frosting segment acquired the significant share in the market owing to its widespread application in producing conventional electrical steel, where ultra-high purity levels are not as critical. The 98% purity MgO offers a cost-effective solution, balancing performance and affordability, making it the preferred choice for many manufacturers. In contrast, the 99% purity MgO, while essential for high magnetic strength electrical steel requiring superior insulation and magnetic properties, caters to more specialized applications and thus occupies a smaller market share.

By Application Analysis

On the basis of application, the market is divided into conventional, electrical steel, high magnetic strength electrical steel, domain refinement electrical steel, and other applications. Among these, commercial held the prominent share of the market due to its extensive use in manufacturing electrical components such as transformers, motors, and generators, which are fundamental to both industrial and residential applications. The widespread demand for these components drives the need for conventional electrical steel, thereby increasing the consumption of MgO used in its production. Additionally, the cost-effectiveness and adequate performance characteristics of conventional electrical steel make it a preferred choice for many manufacturers, further solidifying its significant market share.

Regional Analysis

Asia Pacific Dominated the Market with the Highest Revenue Share

Asia Pacific held the most of the share of 35.2% of the market driven by its robust industrial base, expanding energy infrastructure, and significant investments in manufacturing. Countries like China, India, Japan, and South Korea are at the forefront of this dominance due to their well-established steel production capabilities and the rising demand for energy-efficient technologies. China, in particular, holds a substantial share due to its position as the world's largest producer and consumer of silicon steel, coupled with its extensive renewable energy projects and industrialization.

The growing automotive and electronics industries in Japan and South Korea contribute to the region's dominance. The Asia Pacific market benefits from cost-effective raw material sourcing, advanced manufacturing technologies, and the presence of key market players. The rising adoption of electric vehicles, coupled with government policies promoting renewable energy and energy efficiency, continues to fuel growth in this region, solidifying its position as the highest revenue-generating market for silicon steel grade MgO.

Competitive Analysis

The competitive landscape of the silicon steel grade magnesium oxide (MgO) market is marked by a dynamic mix of established players and emerging companies vying for market share. The market is characterized by intense competition among key players who focus on enhancing product quality, expanding production capacities, and achieving cost efficiency. Leading manufacturers, such as Ube Industries, RHI Magnesita, and Lanxess, have significant market presence due to their extensive research and development capabilities, which enable them to deliver high-purity MgO products that meet the stringent requirements of the silicon steel industry.

Key Market Players in the Silicon Steel Grade Magnesium Oxide Market

o Kyowa Chemical

o Magnesia Mineral Compounds

o SCORA

o TATEHO CHEMICAL

o Konoshima Chemical

o BUSCHLE & LEPPER

o Ako Kasei

o KAUSTIK

o Causmag International

o Celtic Chemicals

o ELITE CHEMICALS

o INTERMAG COMPANY

o Russian Mining Chemical

o MAGNIFIN

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 121.6 Million |

|

Market Size 2033 |

USD 167.3 Million |

|

Compound Annual Growth Rate (CAGR) |

3.3% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Million) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Purity Level, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Kyowa Chemical, Magnesia Mineral Compounds, SCORA, TATEHO CHEMICAL, Konoshima Chemical, BUSCHLE & LEPPER, Ako Kasei, KAUSTIK, Causmag International, Celtic Chemicals, ELITE CHEMICALS, INTERMAG COMPANY, Russian Mining Chemical, MAGNIFIN, and Other Key Players. |

|

Key Market Opportunities |

Expansion in Emerging Markets |

|

Key Market Dynamics |

Growing Demand for Energy-Efficient Equipment |

📘 Frequently Asked Questions

1. Who are the key players in the Silicon Steel Grade Magnesium Oxide Market?

Answer: Kyowa Chemical, Magnesia Mineral Compounds, SCORA, TATEHO CHEMICAL, Konoshima Chemical, BUSCHLE & LEPPER, Ako Kasei, KAUSTIK, Causmag International, Celtic Chemicals, ELITE CHEMICALS, INTERMAG COMPANY, Russian Mining Chemical, MAGNIFIN, and Other Key Players.

2. How much is the Silicon Steel Grade Magnesium Oxide Market in 2023?

Answer: The Silicon Steel Grade Magnesium Oxide Market size was valued at USD 121.6 Billion in 2023.

3. What would be the forecast period in the Silicon Steel Grade Magnesium Oxide Market?

Answer: The forecast period in the Silicon Steel Grade Magnesium Oxide Market report is 2024-2033.

4. What is the growth rate of the Silicon Steel Grade Magnesium Oxide Market?

Answer: Silicon Steel Grade Magnesium Oxide Market is growing at a CAGR of 3.3% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.