🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Silver Market

Silver Market Global Industry Analysis and Forecast (2024-2032) by Sector (German Silver, Britannia Silver, Fine Silver, Russian Silver, Mexican Silver, Oxidized Silver, and Other Types), Application (Food and Beverage, Electrical and Electronics, Silverware, Personal Care and Cosmetics, Photographic Films, Pharmaceuticals, and Other Applications), and Region

Mar 2025

Chemicals and Materials

Pages: 138

ID: IMR1903

Silver Market Synopsis

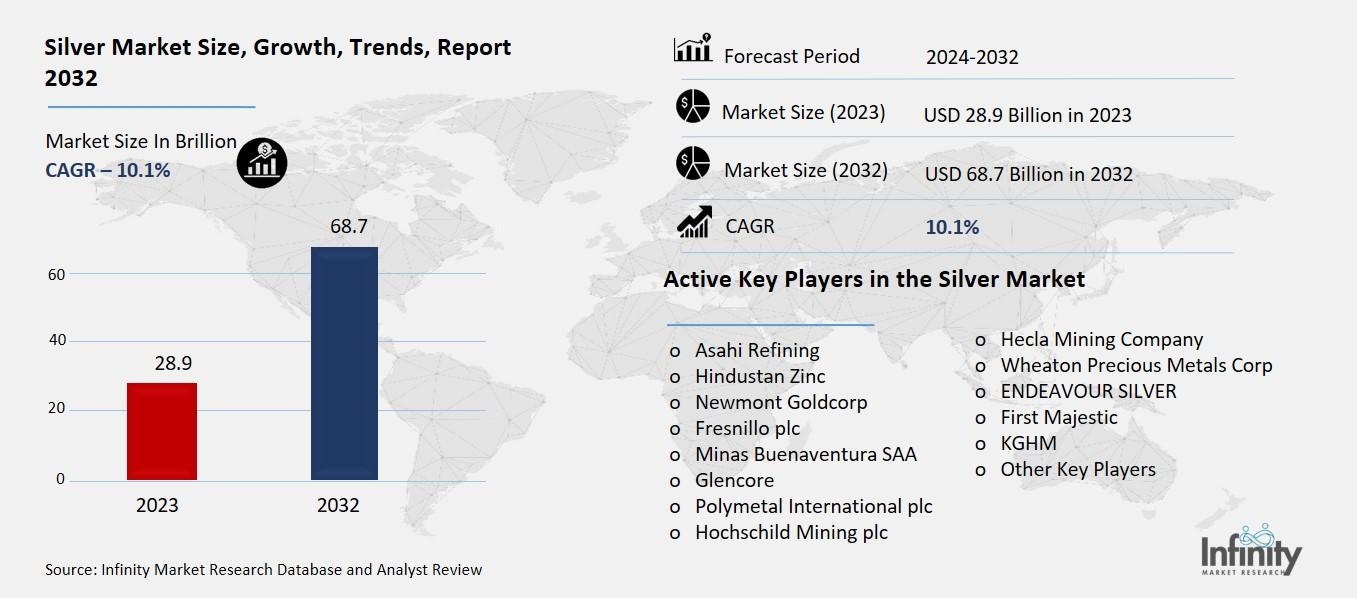

Silver Market Size Was Valued at USD 28.9 Billion in 2023, and is Projected to Reach USD 68.7 Billion by 2032, Growing at a CAGR of 10.1% From 2024-2032.

A dynamic silver market is influenced by industry demand, investment trends, macroeconomic factors and business cycles. Silver is used in electronics, solar panels, medical applications and jewelry industry. This makes it both an industrial as well a precious metal. Prices are affected by global economic conditions, the situation with mining output, and international politics. Investment in silver takes the forms of physical bullion and exchange-traded funds (ETFs). It also involves futures contracts. Markets are also influenced by central bank policies, inflation and the strength of currencies, particularly that of the U.S. dollar. Together with the new emphasis on renewable energy and technology, the role of silver in global markets continuing to change.

Silver Market Driver Analysis

Expanding Jewellery & Silverware Market

Silver jewelry is in great demand especially in the emerging markets, largely for its affordability, cultural implication, and mutable fashion cycles Silver, unlike gold, is a cheaper precious metal. This makes it more appealing to those in places such as India, China, and Southeast Asia where jewelry plays an important part as a carrier of tradition and celebration. Thus the growing middle class in these areas has more disposable income, resulting in further growth in silver jewelry sales. But modern consumers also admire the diversity of silver, which fits not only traditional fashions but those of today. What is more, e-commerce and social media have extended the silhouettes of silver jewelry brands and made it easier for people to get hold various design types.

Silver Market Restraint Analysis

Substitution & Recycling

The growing use of alternative materials and recycling is beginning to affect the demand for newly mined silver, especially in industrial uses. Shifts in technology will make materials like aluminum, copper and even graphene usable alternatives to silver in electronics and industrial processes. Dies and cost of manufacturing new variety silver products can sometimes be significantly lower if they are made from these replacements. Moreover, by further improving the processing of used electronics, that old silver can be bought back from solar plants plus other industrial trash. The pressure for companies to upcycle in order to save our environment less and gain already scarce resources is growing. While these broad industrial trends conserve resources, they also put a challenge to silver markets by slackening primary silver demand.

Silver Market Opportunity Analysis

Green Energy Transition

The rise of silver consumption in the solar power sector stems from clean energy measures adopted by government agencies. The growing adoption of renewable energy depends on various incentives and regulations which enable solar energy to lead these initiatives in multiple countries. The photovoltaic (PV) cells utilize silver as an essential component because this material improves solar panel electrical conductivity while boosting their efficiency. The implementation of tax credits together with feed-in tariffs and net metering programs fuels substantial solar projects which drives up silver demand. Industrial requirements for sustainable energy solutions combined with worldwide carbon-neutral plans and enhanced emission standards have increased the importance of silver in renewable energy transitions. The renewable energy sector expansion will boost the silver market because improved solar panel technology combined with cheaper production methods.

Silver Market Trend Analysis

Rising Silver ETF Investments

The growing popularity of silver ETFs is having a big impact on the silver market, by offering investors an accessible and liquid vehicle for playing the market, which they can do without taking possession of any actual metal. Silver ETFs mirror silver's price while being physically silos and vaulted storage provides a hedge against inflation, currency risk and uncertainty in the economy, so investors both large retail have good reason to buy it. Digital trading platforms bring added impetus to silver ETFs, in that they offer convenience reduced transaction costs and diversification benefits. The greater volatility in the world's markets and rising geopolitical tension has forced an intensified demand for silver from those interested in it as a safe haven. As a result, ETF inflows have been pushed even higher.

Silver Market Segment Analysis

The Silver Market is segmented on the basis of Type and application.

By Type

o German Silver

o Britannia Silver

o Fine Silver

o Russian Silver

o Mexican Silver

o Oxidized Silver

o Other Types

By Application

o Food and Beverage

o Electrical and Electronics

o Silverware

o Personal Care and Cosmetics

o Photographic Films

o Pharmaceuticals

o Other Applications

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Type, Fine Silver Segment is Expected to Dominate the Market during the Forecast Period

The type discussed in this research study, the fine silver is projected to be the major segment of Silver Market during forecast period mainly due to its high purity combined with broad industrial usage. The market expects Fine silver to lead the market because its 99.9% purity makes it ideal for use in investment products and industrial components which include bullion bars and coins and electronics as well as medical devices and solar panels. The market demand rises because of advanced technologies that rely on its high conductivity and its exceptional corrosion resistance properties. The silver-backed exchange-traded funds (ETFs) rising popularity combined with an increasing interest in using high-purity silver for jewelry and collectibles fuels its overall market leadership position. Fine Silver will keep its leading market position because industries persist in requiring high-quality silver for their precision applications.

By Application, the Electrical and Electronics Segment is Expected to Held the Largest Share

Electrical and automation is expected to have a high market share of silver during the forecast period. Silver's outstanding conductive and thermal properties, resistance to corrosion, make it to be critical materials in many electronic applications such as semiconductors, printed circuit boards (PCBs), connectors, switches. As 5G technology advances more people migrate to electric cars or are connected by the Internet of Things, demand for silver has surged further in electronics manufacturing too. Furthermore, the growing number of renewable energy installations-in solar panels, particularly-helps maintain this segment's leading role. With the worldwide push for digital transformation, as well as governments efforts in smart cities and home equipment to spur growth. Applications figure to continue driving demand higher yet sustain its commanding position in the market as first among second largest category segment at present time is electronics.

Silver Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

North America is expected to lead the silver market in the forecast period due to strong industrial demand, many years of investment in futures, and as it begins to make strides toward clean energy technology. Metal resources and industrial production of silver and electronic components along with automotive components and renewable energy systems belong to the United States and Canada. Some of the world's biggest trading funds based on silver exist in this region as it functions as one of the prime centers for silver investment. The push for clean energy by national governments stimulates silver market demand by providing benefits for solar panel development and EV manufacturing and PV cells and battery technology implementation. The silver market position of North America receives additional strength from expanding medical applications alongside rising adoption of advanced manufacturing.

Recent Development

In October 2024, Coeur Mining announced the acquisition of SilverCrest Metals for approximately $1.7 billion, driven by rising silver prices. This strategic decision enhances Coeur’s production capacity by integrating SilverCrest's Las Chispas mine, located in Sonora, Mexico, into its operations.

Active Key Players in the Silver Market

o Asahi Refining

o Hindustan Zinc

o Newmont Goldcorp

o Fresnillo plc

o Minas Buenaventura SAA

o Glencore

o Polymetal International plc

o Hochschild Mining plc

o Hecla Mining Company

o Wheaton Precious Metals Corp

o ENDEAVOUR SILVER

o First Majestic

o KGHM

o Other Key Players

Global Silver Market Scope

|

Global Silver Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 28.9 Billion |

|

Forecast Period 2024-32 CAGR: |

10.1% |

Market Size in 2032: |

USD 68.7 Billion |

|

Segments Covered: |

By Type |

· German Silver · Britannia Silver · Fine Silver · Russian Silver · Mexican Silver · Oxidized Silver · Other Types | |

|

By Application |

· Food and Beverage · Electrical and Electronics · Silverware · Personal Care and Cosmetics · Photographic Films · Pharmaceuticals · Other Applications | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Expanding Jewellery & Silverware Market | ||

|

Key Market Restraints: |

· Substitution & Recycling | ||

|

Key Opportunities: |

· Green Energy Transition | ||

|

Companies Covered in the report: |

· Asahi Refining, Hindustan Zinc, Newmont Goldcorp, Fresnillo plc and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Silver Market Research report?

Answer: The forecast period in the Silver Market Research report is 2024-2032.

2. Who are the key players in the Silver Market?

Answer: Asahi Refining, Hindustan Zinc, Newmont Goldcorp, Fresnillo plc and Other Major Players.

3. What are the segments of the Silver Market?

Answer: The Silver Market is segmented into Type, Applications, and Regions. By Type, the market is categorized into German Silver, Britannia Silver, Fine Silver, Russian Silver, Mexican Silver, Oxidized Silver, and Other Types. By Application, the market is categorized into Food and Beverage, Electrical and Electronics, Silverware, Personal Care and Cosmetics, Photographic Films, Pharmaceuticals, and Other Applications. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Silver Market?

Answer: The silver market refers to the worldwide trade of silver. This encompasses extraction, refining, circulation and consumption across a wide variety of sectors. Silver is both a precious metal and an industrial shopping bag type item. It has uses in electronics, solar power and medicine. Silver is traded through the physis with futures contracts, exchange-traded funds, and derivatives. Global economic situations, politics or war, and inflation all swing prices. Investors view silver as a hedge against inflation or economic instability. Providential sectors drive up demand due in part to its excellent conducting and bactericidal properties.

5. How big is the Silver Market?

Answer: Silver Market Size Was Valued at USD 28.9 Billion in 2023, and is Projected to Reach USD 68.7 Billion by 2032, Growing at a CAGR of 10.1% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.