🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Small Satellite Market

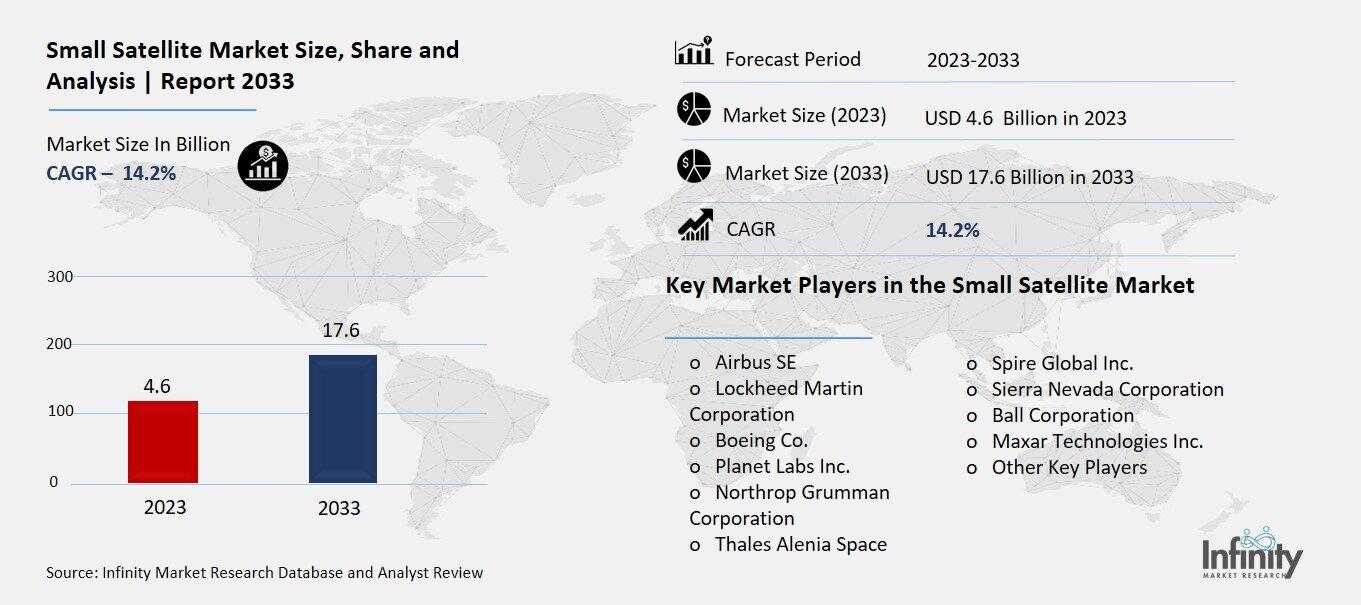

Global Small Satellite Market (By Payload (LEO, MEO, GEO, Beyond GEO), By Launch Platform (Land, Air, Sea), By Application (Communication, Earth Observation & Remote Sensing, Scientific Research, Education, Technology, Others), By End-Use (Commercial, Government & Defense, Dual Use), By Region and Companies)

Sep 2024

Information and Communication Technology

Pages: 138

ID: IMR1239

Small Satellite Market Overview

Global Small Satellite Market size is expected to be worth around USD 17.6 Billion by 2033 from USD 4.6 Billion in 2023, growing at a CAGR of 14.2% during the forecast period from 2023 to 2033.

The Small Satellite Market refers to the industry that designs, builds, and launches small spacecraft weighing less than 500 kilograms. These satellites serve a variety of tasks, including communication, earth observation, scientific study, and technology testing. Technology improvements have made it cheaper and easier to develop and launch tiny satellites, resulting in significant industry growth.

To Get An Overview , Request For Sample

They are commonly utilized by startups, governments, and institutions to collect data, provide internet services, and track environmental changes. Satellite constellations, which are groups of small satellites that work together, have also contributed to this increase because they can give global coverage for services such as internet access and weather forecasting. Overall, the tiny satellite market is gaining importance in the space industry and offers.

Drivers for the Small Satellite Market

Increasing Demand for Data and Communication

One of the primary drivers of the small satellite market is the rising demand for data and communication services. Businesses and governments require timely and accurate information for decision-making, which small satellites can provide. They are often used for earth observation, weather monitoring, and agricultural assessments. With advancements in technology, small satellites can capture high-resolution images and collect valuable data more efficiently than larger satellites. This growing need for data is encouraging more companies to invest in small satellite technology.

Cost-Effectiveness of Small Satellites

Another significant factor contributing to the growth of the small satellite market is the cost-effectiveness of building and launching these satellites. Traditional satellite programs can be extremely expensive, often costing hundreds of millions of dollars. In contrast, small satellites can be developed and launched for a fraction of that price, making space technology accessible to smaller companies and even universities. This lower cost encourages innovation and allows more players to enter the market, fueling growth.

Technological Advancements

Advancements in technology are also driving the small satellite market. Improvements in miniaturization, communication systems, and propulsion technology have made it possible to create small satellites that are more powerful and efficient. For example, advancements in electronics allow for more functions to be packed into smaller devices. These technological improvements enhance the capabilities of small satellites, making them more attractive to potential users.

Growing Interest in Space Exploration

The increasing interest in space exploration is another important factor driving the small satellite market. Many space agencies, including NASA and private companies like SpaceX, are investing in missions that utilize small satellites. These missions often aim to explore new frontiers, conduct scientific research, and even support manned missions to Mars and beyond. As more exploration missions are planned, the demand for small satellites to support these initiatives is expected to grow.

Development of Satellite Constellations

The trend of creating satellite constellations groups of small satellites working together to provide global coverage has also contributed to the market's growth. Companies like SpaceX with its Starlink project and One Web are deploying large numbers of small satellites to provide internet access worldwide. This approach not only improves connectivity but also reduces latency, making services faster and more reliable. The success of these constellations has demonstrated the potential of small satellites, encouraging further investment in this area.

Regulatory Support and Partnerships

Finally, regulatory support and partnerships between governments and private companies are helping to boost the small satellite market. Many governments are creating favorable policies and incentives to encourage the development of satellite technologies. Public-private partnerships are also becoming more common, allowing for shared resources and expertise. These collaborations can accelerate the development and deployment of small satellites, contributing to market growth.

Restraints for the Small Satellite Market

High Competition

One of the main restraints in the small satellite market is the intense competition among various companies. With many players entering the field, especially startups, there is a risk of oversaturation. This can lead to price wars, reducing profit margins and making it difficult for companies to sustain their operations. Established companies might struggle to maintain their market share, while new entrants may find it challenging to differentiate their products in a crowded market.

Regulatory Challenges

Regulatory issues present another significant restraint. The launch and operation of satellites are subject to strict regulations by governments and international organizations. These regulations can vary widely between countries, creating complexities for companies looking to operate in multiple regions. Delays in obtaining necessary permits or approvals can slow down project timelines and increase costs. Additionally, changes in regulatory policies can create uncertainty, making it difficult for companies to plan for the future.

Limited Lifespan of Small Satellites

Small satellites generally have a shorter operational lifespan compared to larger satellites. This limitation can hinder long-term investments in small satellite technology. Many small satellites are designed for specific missions and may not be suitable for long-term use. As they reach the end of their operational life, companies must invest in new satellites to replace them, leading to ongoing costs and resource allocation challenges.

Technical Limitations

Despite advancements in technology, small satellites still face technical limitations that can affect their performance. For example, smaller satellites may have reduced payload capacities, limiting the amount of equipment or data they can carry. Additionally, they may not be able to operate in extreme conditions or provide the same level of service as larger, more robust satellites. These technical constraints can restrict the types of missions small satellites can undertake, affecting their market appeal.

Launch Costs and Availability

Although launching small satellites is generally less expensive than launching larger ones, costs can still be significant. The availability of launch vehicles that can accommodate small satellites can also be a challenge. As demand for launches increases, the competition for available launch slots can drive up prices. This situation can limit the number of small satellites that can be launched within a specific timeframe, slowing down project timelines and market growth.

Data Security and Privacy Concerns

As the use of small satellites grows, so do concerns about data security and privacy. Satellites collect vast amounts of data, and ensuring this data is protected from unauthorized access is crucial. Companies must invest in robust security measures to safeguard sensitive information. Additionally, the collection of data from specific regions may raise privacy concerns among governments and individuals, potentially leading to regulatory scrutiny and limitations on data usage.

Opportunity in the Small Satellite Market

Expanding Applications Across Industries

One of the most significant growth opportunities in the small satellite market is the expanding range of applications across different industries. Small satellites are increasingly being used in agriculture, environmental monitoring, disaster management, and even transportation. For example, farmers use small satellites to monitor crop health and optimize irrigation. Environmental agencies utilize them for tracking climate change and natural disasters. As more industries recognize the benefits of small satellites, the demand for tailored solutions is expected to grow, leading to new business prospects.

Increasing Demand for Internet Connectivity

Another major opportunity lies in the growing need for global internet connectivity. Many regions around the world still lack reliable internet access, particularly in remote or underserved areas. Small satellite constellations can provide affordable and efficient internet services to these regions. Companies like SpaceX with their Starlink project are already working on this, and as more companies enter the market, the demand for small satellites dedicated to internet services is likely to rise. This growth can help bridge the digital divide and open up new markets for satellite providers.

Technological Advancements and Innovations

Advancements in technology also present growth opportunities for the small satellite market. Innovations in miniaturization, communication systems, and propulsion technologies are making it possible to develop smaller, more efficient satellites. Additionally, improvements in satellite design and manufacturing processes can reduce costs and increase the speed of production. Companies that invest in research and development can create more advanced small satellites that meet specific needs, enhancing their market competitiveness.

Collaboration with Government and Research Institutions

Collaboration with government agencies and research institutions can drive growth in the small satellite market. Governments are increasingly funding space-related projects and initiatives, creating opportunities for private companies to partner in research and development. These collaborations can lead to innovative projects that push the boundaries of satellite technology and expand applications. Furthermore, public-private partnerships can provide additional funding and resources, helping to accelerate development timelines and improve market access.

Emerging Markets and Global Expansion

The small satellite market also has significant growth potential in emerging markets. Many developing countries are investing in space technology to improve their infrastructure, communications, and disaster response capabilities. As these nations recognize the benefits of small satellites, demand for satellite services and solutions is likely to increase. Companies that strategically position themselves in these markets can benefit from the growing interest and investment in satellite technology.

Enhanced Data Analytics Capabilities

The rise of data analytics and artificial intelligence (AI) also opens up new opportunities for the small satellite market. Small satellites generate vast amounts of data, and with the right analytics tools, this data can be transformed into valuable insights. Companies that offer integrated solutions combining satellite data with advanced analytics can provide clients with actionable information for decision-making. This trend will likely enhance the value proposition of small satellite services and create additional revenue streams.

Trends for the Small Satellite Market

Rise of Mega Constellations

One of the most notable trends is the rise of mega-constellations large groups of small satellites working together to provide global coverage. Companies like SpaceX with Starlink and OneWeb are leading this trend, deploying hundreds or even thousands of satellites to offer internet services worldwide. These constellations aim to deliver high-speed internet to underserved areas, driving significant investment in small satellite technology. As more companies join this space, we can expect to see increased competition and innovation in satellite communications.

Miniaturization and Advanced Technology

Another significant trend is the ongoing miniaturization of satellite technology. Small satellites are becoming increasingly compact and efficient, thanks to advancements in materials and design. This miniaturization allows for more functions to be packed into smaller devices, making them lighter and cheaper to launch. Additionally, improvements in propulsion systems, power generation, and communication technologies enhance the capabilities of small satellites, enabling them to perform complex tasks and operate in various environments.

Increased Focus on Earth Observation

There is a growing emphasis on Earth observation applications among small satellites. These satellites can provide valuable data for monitoring climate change, urban development, and natural disasters. Companies and governments are investing in small satellites to collect high-resolution images and real-time data for better decision-making. The demand for data-driven insights in sectors like agriculture, forestry, and environmental protection is fueling the growth of this trend, leading to the development of specialized small satellites for specific Earth observation tasks.

Collaborative Efforts and Partnerships

Collaboration is becoming a key trend in the small satellite market. Private companies are increasingly partnering with governments, universities, and research institutions to share resources, expertise, and funding. These collaborations can lead to innovative projects and faster development times. For instance, partnerships between private satellite companies and government agencies can facilitate data sharing for disaster response and environmental monitoring, making small satellites more effective in addressing real-world challenges.

Focus on Sustainability

Sustainability is also emerging as a crucial trend in the small satellite market. With the increasing number of satellites in orbit, concerns about space debris and its impact on the environment are rising. Companies are developing strategies to mitigate these issues, such as designing satellites that can deorbit themselves at the end of their operational life. The focus on sustainability extends to the entire lifecycle of satellites, from production to disposal, ensuring that the growing industry operates in an environmentally responsible manner.

Emerging Markets and Global Expansion

Lastly, the small satellite market is witnessing growth in emerging markets. Countries in Africa, Asia, and Latin America are investing in satellite technology to enhance their communication infrastructure, agricultural monitoring, and disaster management capabilities. This expansion presents significant opportunities for satellite manufacturers and service providers, as these regions look to leverage space technology for development and economic growth.

Segments Covered in the Report

By Payload

o LEO

o MEO

o GEO

o Beyond GEO

By Launch Platform

o Land

o Air

o Sea

By Application

o Communication

o Earth Observation & Remote Sensing

o Scientific Research

o Education

o Technology

o Others

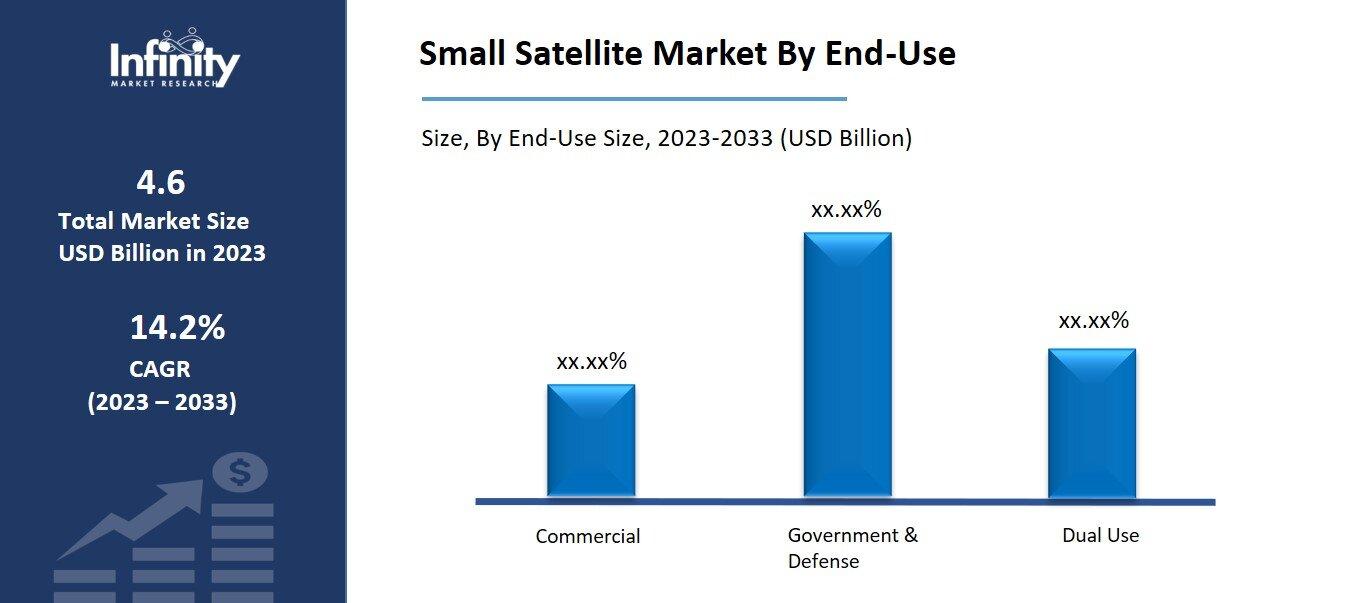

By End-Use

o Commercial

o Government & Defense

o Dual Use

Segment Analysis

By Payload Analysis

The small satellite market is divided into four payload segments: LEO, MEO, GEO, and Beyond GEO. The GEO category, commonly known as geostationary satellites, is expected to exhibit the most rapid expansion during the projected period. Geostationary satellites appear fixed because they orbit the Earth in a path parallel to its rotation and move at the same angular velocity as the Earth. Weather forecasting, satellite radio, and satellite television are just a few of the applications for geostationary satellites.

By Launch Platform Analysis

Small satellite market segmentation by launch platform comprises land, air, and sea. Because of its ability to launch from a variety of locations, including remote locations, which can reduce launch costs and increase flexibility, the air segment has the largest market share in the business for space launch services. Furthermore, air launch technologies provide the user with more control over the launch trajectory, which is advantageous for certain payloads.

By Application Analysis

In 2023, the communication segment is expected to have the highest compound annual growth rate. This development can be ascribed to the increased use of communication antennas in both the government and commercial sectors. Satellites play an important role in providing a variety of communication services, including data transmission, broadcasting, and telephony. They enable programs for laptops, mobile phones, and personal digital assistants, thereby broadening the scope of communication services.

The earth observation segment is also likely to experience significant expansion. Small satellites monitor climatic patterns, environmental changes, and water resources. This application has gained popularity in fields such as agriculture, disaster management, and environmental research.

By End-Use Analysis

In 2023, the commercial category will have the biggest market share in the worldwide small satellite market. The commercial segment is predicted to dominate the market due to the growing number of internet users and mobile devices. The demand for tiny satellites for commercial uses, such as navigation, telecommunications, weather forecasting, and other applications, is propelling the industry forward.

To Learn More About This Report , Request For Sample

The military industry is also seeing substantial growth in the small satellite market. Small satellites are increasingly being used for surveillance operations, resulting in the expansion of the military component. These satellites play an important role in adversary monitoring and intelligence collection. The government market is expected to grow significantly as government space agencies become more actively involved in small satellite development programs. Governments around the world are recognizing the benefits and capabilities of tiny satellites, resulting in greater investment and participation in this market.

Regional Analysis

North America dominated the worldwide small satellite market in 2023. This is due to the strong presence of key firms in the region, combined with technological improvements and a robust infrastructure to support satellite manufacture and operations. The United States has been at the forefront of tiny satellite development and deployment. The presence of major aerospace and defense businesses, combined with strong government assistance, has led to the region's dominance. North America has a robust commercial space industry, advanced R&D capabilities, and a favorable regulatory environment, making it an important hub for small satellite activities.

Europe is expected to have the fastest growth rate in the small satellite market over the forecast period. This expansion is being driven by technological breakthroughs in the small satellite ecosystem and an increase in satellite deployments. Over the next five years, the number of space exploration initiatives in Europe is likely to increase, driving up demand for tiny satellites. The improved geospatial imaging given by tiny satellites has raised demand, as businesses seek geospatial data for critical insights into supply chain management and corporate growth.

Competitive Analysis

The global small satellite industry is extremely competitive, with multiple competitors striving for a large market share. The competitive landscape includes traditional aerospace corporations, startups specializing in small satellite technology, and a variety of service providers. These companies compete on technological capabilities, product offerings, strategic alliances, and customer relationships.

Recent Developments

April 2024: SAIC, a US defense contractor, has secured its first contract with the Pentagon to integrate a tiny satellite, leveraging a cooperation with spacecraft maker GomSpace. SAIC is tasked with designing and deploying a satellite to demonstrate cutting-edge space technologies such as artificial intelligence and machine learning, edge computing, and software-defined radio communications, all with a "zero-trust" cybersecurity architecture.

February 2024: OneWeb resumed its satellite deployment operation by launching 36 tiny satellites on a SpaceX Falcon 9 rocket. This deployment is part of OneWeb's goal to deliver global broadband internet access via a network of tiny satellites in low Earth orbit (LEO).

Key Market Players in the Small Satellite Market

o Airbus SE

o Lockheed Martin Corporation

o Boeing Co.

o Planet Labs Inc.

o Northrop Grumman Corporation

o Thales Alenia Space

o Spire Global Inc.

o Sierra Nevada Corporation

o Ball Corporation

o Maxar Technologies Inc.

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 4.6 Billion |

|

Market Size 2033 |

USD 17.6 Billion |

|

Compound Annual Growth Rate (CAGR) |

14.2% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Payload, Launch Platform, Application, End-Use, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Airbus SE, Lockheed Martin Corporation, Boeing Co., Planet Labs Inc., Northrop Grumman Corporation, Thales Alenia Space, Spire Global Inc., Sierra Nevada Corporation, Ball Corporation, Maxar Technologies Inc., Other Key Players |

|

Key Market Opportunities |

Expanding Applications Across Industries |

|

Key Market Dynamics |

Increasing Demand for Data and Communication |

📘 Frequently Asked Questions

1. Who are the key players in the Small Satellite Market?

Answer: Airbus SE, Lockheed Martin Corporation, Boeing Co., Planet Labs Inc., Northrop Grumman Corporation, Thales Alenia Space, Spire Global Inc., Sierra Nevada Corporation, Ball Corporation, Maxar Technologies Inc., Other Key Players

2. How much is the Small Satellite Market in 2023?

Answer: The Small Satellite Market size was valued at USD 4.6 Billion in 2023.

3. What would be the forecast period in the Small Satellite Market?

Answer: The forecast period in the Small Satellite Market report is 2023-2033.

4. What is the growth rate of the Small Satellite Market?

Answer: Small Satellite Market is growing at a CAGR of 14.2% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.