🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Solution Styrene Butadiene Rubbers (Ssbr) Market

Solution Styrene Butadiene Rubbers (Ssbr) Market Global Industry Analysis and Forecast (2024-2032) By Type(Solution SSBR, Emulsion SSBR), By Application(Automotive Tires, Industrial Products, Footwear, Adhesives, Sealants, Others), By End-User Industry(Automotive, Footwear, Construction, Consumer Goods, Others) and Region

Jan 2025

Chemicals and Materials

Pages: 138

ID: IMR1653

Solution Styrene Butadiene Rubbers (Ssbr) Market Synopsis

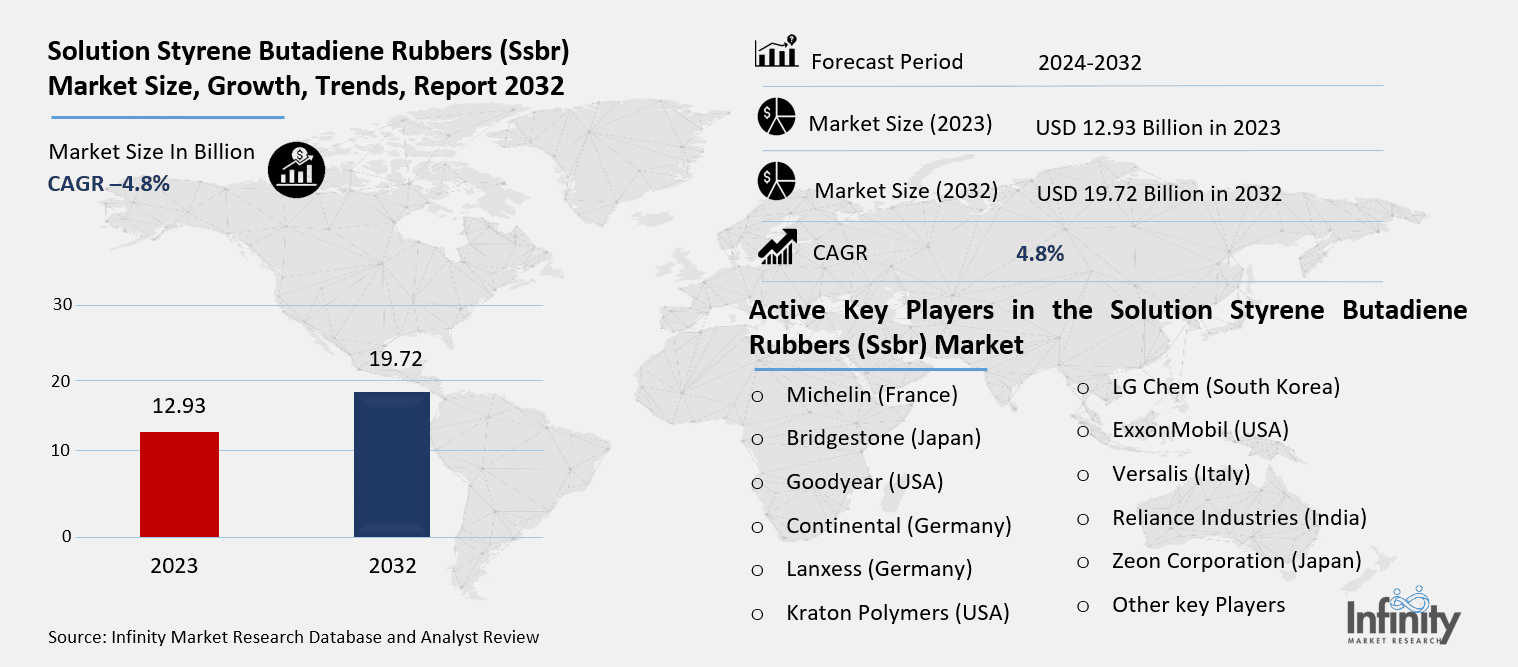

Solution Styrene Butadiene Rubbers (Ssbr) Market Size Was Valued at USD 12.93 Billion in 2023, and is Projected to Reach USD 19.72 Billion by 2032, Growing at a CAGR of 4.8% From 2024-2032.

Solution Styrene Butadiene Rubbers abbreviated as SSBR are synthetic elastomers based on a copolymer of styrene and butadiene. These rubbers are made through solution polymerization, which offer better opportunity to control molecular weight, structure and properties. SSBR is mainly applied in automotive tire production because of its outstanding abrasion, wet adhesion and fuel burn up. They also have an excellent performance history; thus, ideal for several industrial uses such as shoe soles, industrial adhesives, and sealants as well as other functions.

Solution styrene butadiene rubbers market is discussed in details as it represents one of the most significant segments of the synthetic rubber market. SSBR is generated through Solution Polymerization process, which is effective in providing distinct desired qualities such as low hysteresis, low rolling resistance and high abrasion resistance that make the product particularly ideal for automotive tires. These rubbers are used in production of high performance tires because of their qualities such as improved fuel economy and better grip. Due to the rising need for fuel economy especially in the developing markets SSBR has recorded a higher demand among automakers. This trend is defined by the existing regulations on the reduction of emissions as well as by the automotive industry’s goal to increase the tires’ total efficiency.

It is also noteworthy that industrial uses also dictate demand for SSBR. This versatile product of SSBR finds application in the production of shoes, adhesive and sealants, as well as industrial applications. Further, it is used to synthesise rubber products that require high elasticity, strength and abrasion resistance. With the global emphasis placed on technology and improvement of manufacturing techniques, the growth of the SSBR market is expected to remain steady in those applications where service life and performance matter most. Thanks to the growth in demand for EVs, even the SSBR market is also growing as these vehicles need more specific types of polymers to satisfy their performance and energy density characteristics.

The consumption of SSBR is quite high in the Asia-Pacific region due to the sound automotive industry in China, Japan, and India. A primary application area for SSBR is the production of fuel-efficient automobiles being manufactured and simplified supply chains of the rapidly industrialising emerging markets also supports the high demand of SSBR. In addition, constant investments in infrastructure development across these countries ascertain that SSBR will continue to fill the demand in industrial utilities. The North American and European markets also contribute substantial shares in the consumption of automobile tire due to improved automotive sector and increased production of environmentally friendly tires. Major participants in the market remain committed to the development of new forms of SSBR that would have less negative impact on the environment while delivering superior performance.

Solution Styrene Butadiene Rubbers (Ssbr) Market Outlook, 2023 and 2032: Future Outlook

Solution Styrene Butadiene Rubbers (Ssbr) Market Trend Analysis

Trend: Rising Demand for Fuel-Efficient Tires

Growing prominence of fuel economy has been one of the key drivers that have contributed to the growth of the SSBR market. Car manufacturers are now paying much attention on efficiency, and part of efficiency is all about the performance of tires. Reducing rolling resistance is one of the hallmarks of SSBR and this translates to fuel use or consumption. In view of mounting regulations on fuel economy and CO2 emissions, SSBR has become a strategic material for tyre makers wishing to conform. The new developments were aimed at enhancing the SSBR performance parameters in order to meet the market requirement of fuel efficient tires.

This is Meadows somehow supported by the electric vehicles inclination which are more centred round energy efficiency. Manufacturers of EVs remain particularly interested in minimized energy utilization by tires that provide better performance as well as energy efficiency. As a result, the application of SSBR in tire manufacturing is on the rise because it reduces tearing, improves adhesion, and reduces rolling resistance that are vital in EVs. With the ever growing concern by the automotive industry worldwide to go green over the uses of their products the use of SSBR in manufacture of tires is expected to increase.

Opportunity: Expanding Automotive and Industrial Applications

An appreciation of automotive industry demand for SSBR indicates strong growth prospects. SSBR plays a crucial role of arriving at highly performance tire that not only offers durability to the tire but also safety to users and efficiency in fuel usage. The sharp rise in the use of electric vehicles is a favorable ground for SSBR manufacturers because EVs require tires that provide the best energy efficiency. Over the long-term, the market for SSBR is expected to further drive higher by the advancement of the global automobile industry especially for EandV (Electric and hybrid vehicles), and emerging regions, namely China and India.

Aside from automotive, SSBR is also gradually finding its way into other industrial uses especially in the making of shoes, construction of adhesives as well as sealants. As the advance of environmentally friendly and multifunctional material continues, SSBR presents new opportunities to a variety of applications that require high-performance rubber. The diversification into improved durability, resistance, and better performance of products under difficult operating conditions also augur well for SSBR. The versatility of this material creates new growth opportunities in connection with several sectors, which creates great opportunities to increase the market share of SSBR manufacturers.

Driver: Technological Advancements in Rubber Manufacturing

The advancement of innovative solution polymerization to develop SSBR is one of the main forces acting on SSBR. The development of polymerization methods enables better control of process and structure of SSBR for the application the high-performance tires and other. New ways of improving the Performance Characteristic of SSBR for example, lower rolling resistance, better abrasive properties, and higher fuel economy; makes the material even more attractive to industries where precision moulded rubber products are ideal. All these dynamics are of paramount importance to address market needs and local, state and federal laws concerning environmental impacts and fuel consumption.

Furthermore, research for enhancing the environmental performance of生产, SSBRs has also cultivated the demand for this material. The producers in the industry currently aim towards coming up with more environmentally compliant SSBR formulations due to tight environmental standards. Because of the increasing demand in using substitutes to the conventional rubber materials, SSBR has become a key material on automotive manufacturers, especially in the green economy. These development combined to the customers’ rising need for performance based products place SSBR as an indispensable element in various uses.

Restraints: High Production Costs

A limitation to the growth of the market is the fact that the SSBR produced has a high cost since it is expensive to manufacture. The solution polymerization process that has been used to synthesize SSBR is more elaborate and costly compared to the emulsion polymerization hence the relatively high cost of production. This translates into higher prices for SSBR-based products, particularly those used in production of automotive industries, which are major consumers and who consider cost an important factor. Price sensitivity in some markets; particularly the developing countries is a challenge as it affects SSBR producer’s ability to compete hard while still delivering high quality product.

Furthermore, the basic materials for SSBR production namely styrene and butadiene happen to be a volatile lot by virtue of market supply and chain saw political volatility. These fluctuating prices can affect production plans and put pressures on the costs of more expenses, significantly affecting the SSBR manufactures’ profitability. Therefore, the high production costs of SSBR may hinder its usage in the cost-sensitive markets and thus its growth in some particular applications.

Solution Styrene Butadiene Rubbers (Ssbr) Market Segment Analysis

Solution Styrene Butadiene Rubbers (Ssbr) Market Segmented on the basis of type, application and end user.

By Type

o Solution SSBR

o Emulsion SSBR

By Application

o Automotive Tires

o Industrial Products

o Footwear

o Adhesives

o Sealants

o Others

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Type, Solution SSBR segment is expected to dominate the market during the forecast period

As the name implies Solution SSBR is made through solution polymerization, and this makes it possible to achieve some improved features than the conventional CRSBR, such as low rolling resistance, high abrasion and good fuel economy. Features of solution SSBR described makes it especially suitable for use in high-performance tires as where certain performance attributes are important. The higher cost of production, however, offsets the argument of using this material in more cost sensitive applications. The characteristics in performance that Solution SSBR has over the conventional SM make it more suitable for use in production of automotive tires.

On the other hand, emulsion SSBR is synthesized through an emulsion polymerization process, which costs much less than the solution polymerization method. Even if emulsion SSBR do not achieve the same performance as solution SSBR, it resembles close to acceptable properties for lesser use purposes. Because emulsion SSBR is cheaper to produce than solution SSBR, this product is best utilized in industrial products and shoes. However, due to increased use of high quality materials for higher performances, there is increased use of solution SSBR especially in tyre manufacturing industries.

By Application, Automotive Tires segment expected to held the largest share

About 90% of SSBR is used in the manufacturing of automobiles tires. High competition for energy-saving tires due to new standards and growing concern for environmentally friendly technologies has driven the demand for SSBR in the automotive industry. It is good news for tyre makers that SSBR can cut rolling resistance while at the same time offering superior wear and grip. This is due to the increasing preference for more fuel-efficient as well as electric cars, all of which require tires manufactured from SSBR. It is projected that automakers’ trends toward sustainability and performance shall boost SSBR’s part in the tyre manufacturing.

Besides automotive tyres, SSBR finds application in other industries such as in the production of footwear, adhesives and sealants. Due to the versatility and specific features of SSBR it is widely used for materializing products where high durability, flexibility and wearing resistance are expected. SSBR has seen interest from the industrial side due to the improving efficacy and durability of its products and hence is likely to see added application.

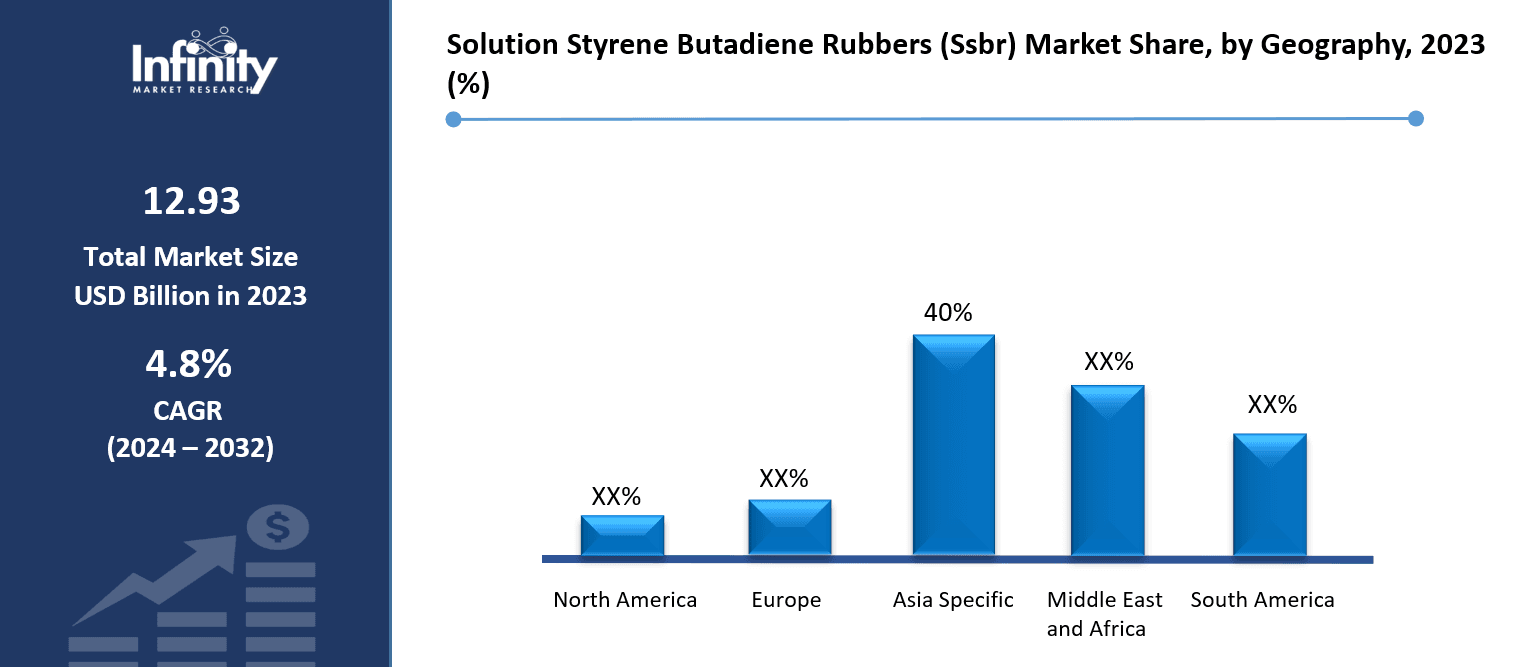

Solution Styrene Butadiene Rubbers (Ssbr) Market Regional Insights

Asia Pacific is Expected to Dominate the Market Over the Forecast period

The Asia-Pacific is the largest region for the SSBR market mainly because of a vast car industry and growing industrialization. It is used by countries such as China, Japan and India owning to their growing automobile industry and renewed interest developed the world over in fuel efficiency. Due to a robust manufacturing sector and areas of focus on low-cost yet high-performance materials SSBR is in high demand. Also, the rising production of electric vehicles (EVs) in Asia-Pacific continues to propel demand for tires derived from SSBR for efficiency and performance.

Infrastructural development is also increasing pace in the region especially in China and India where demand for SSBR is high in industrial products. With these countries urbanizing and industrializing this requirement of SSBR for construction, shoes and adhesives continue to rise. Higher economic growth rate, fast-growing automotive industry, and continuing industrialization in the Asia-Pacific region will most likely sustain the market’s leadership in the SSBR market in the future.

Solution Styrene Butadiene Rubbers (Ssbr) Market Share, by Geography, 2023 (%)

Active Key Players in the Solution Styrene Butadiene Rubbers (Ssbr) Market

o Michelin (France)

o Bridgestone (Japan)

o Goodyear (USA)

o Continental (Germany)

o Lanxess (Germany)

o Kraton Polymers (USA)

o SABIC (Saudi Arabia)

o LG Chem (South Korea)

o ExxonMobil (USA)

o Versalis (Italy)

o Reliance Industries (India)

o Zeon Corporation (Japan)

o Other key Players

Global Solution Styrene Butadiene Rubbers (Ssbr) Market Scope

|

Global Solution Styrene Butadiene Rubbers (Ssbr) Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.93 Billion |

|

Forecast Period 2024-32 CAGR: |

4.8% |

Market Size in 2032: |

USD 19.72 Billion |

|

Segments Covered: |

By Type |

· Solution SSBR · Emulsion SSBR | |

|

By Application |

· Automotive Tires · Industrial Products · Footwear · Adhesives · Sealants · Others | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Technological Advancements in Rubber Manufacturing | ||

|

Key Market Restraints: |

· High Production Costs | ||

|

Key Opportunities: |

· Expanding Automotive and Industrial Applications | ||

|

Companies Covered in the report: |

· Michelin (France), Bridgestone (Japan), Goodyear (USA), Continental (Germany), Lanxess (Germany) Kraton Polymers (USA), SABIC (Saudi Arabia), LG Chem (South Korea) and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Solution Styrene Butadiene Rubbers (Ssbr) Market research report?

Answer: The forecast period in the Solution Styrene Butadiene Rubbers (Ssbr) Market research report is 2024-2032.

2. Who are the key players in the Solution Styrene Butadiene Rubbers (Ssbr) Market?

Answer: Michelin (France), Bridgestone (Japan), Goodyear (USA), Continental (Germany), Lanxess (Germany) Kraton Polymers (USA), SABIC (Saudi Arabia), LG Chem (South Korea) and Other Major Players.

3. What are the segments of the Solution Styrene Butadiene Rubbers (Ssbr) Market?

Answer: The Solution Styrene Butadiene Rubbers (Ssbr) Market is segmented into Type, Application, End User and region. By Type, the market is categorized into Solution SSBR, Emulsion SSBR), By Application, the market is categorized into Automotive Tires, Industrial Products, Footwear, Adhesives, Sealants, Others. By End-User Industry, the market is categorized into Automotive, Footwear, Construction, Consumer Goods, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Solution Styrene Butadiene Rubbers (Ssbr) Market?

Answer: Solution Styrene Butadiene Rubbers abbreviated as SSBR are synthetic elastomers based on a copolymer of styrene and butadiene. These rubbers are made through solution polymerization, which offer better opportunity to control molecular weight, structure and properties. SSBR is mainly applied in automotive tire production because of its outstanding abrasion, wet adhesion and fuel burn up. They also have an excellent performance history; thus, ideal for several industrial uses such as shoe soles, industrial adhesives, and sealants as well as other functions.

5. How big is the Solution Styrene Butadiene Rubbers (Ssbr) Market?

Answer: Solution Styrene Butadiene Rubbers (Ssbr) Market Size Was Valued at USD 12.93 Billion in 2023, and is Projected to Reach USD 19.72 Billion by 2032, Growing at a CAGR of 4.8% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.