🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Specialty Water Treatment Chemical Market

Specialty Water Treatment Chemical Market Global Industry Analysis and Forecast (2024-2032) By Type( Coagulants & Flocculants, Corrosion Inhibitors, Biocides & Disinfectants, Chelating Agents, Anti-Foaming Agents, pH Adjusters & Stabilizers, Scale Inhibitors, Others),By End-Use Industry( Municipal Water Treatment, Industrial Water Treatment),By Application( Boiler Water Treatment, Cooling Water Treatment, Membrane Water Treatment, Wastewater Treatment, Process Water Treatment) and Region

Mar 2025

Environmental and Sustainability Waste Management

Pages: 138

ID: IMR1863

Specialty Water Treatment Chemical Market Synopsis

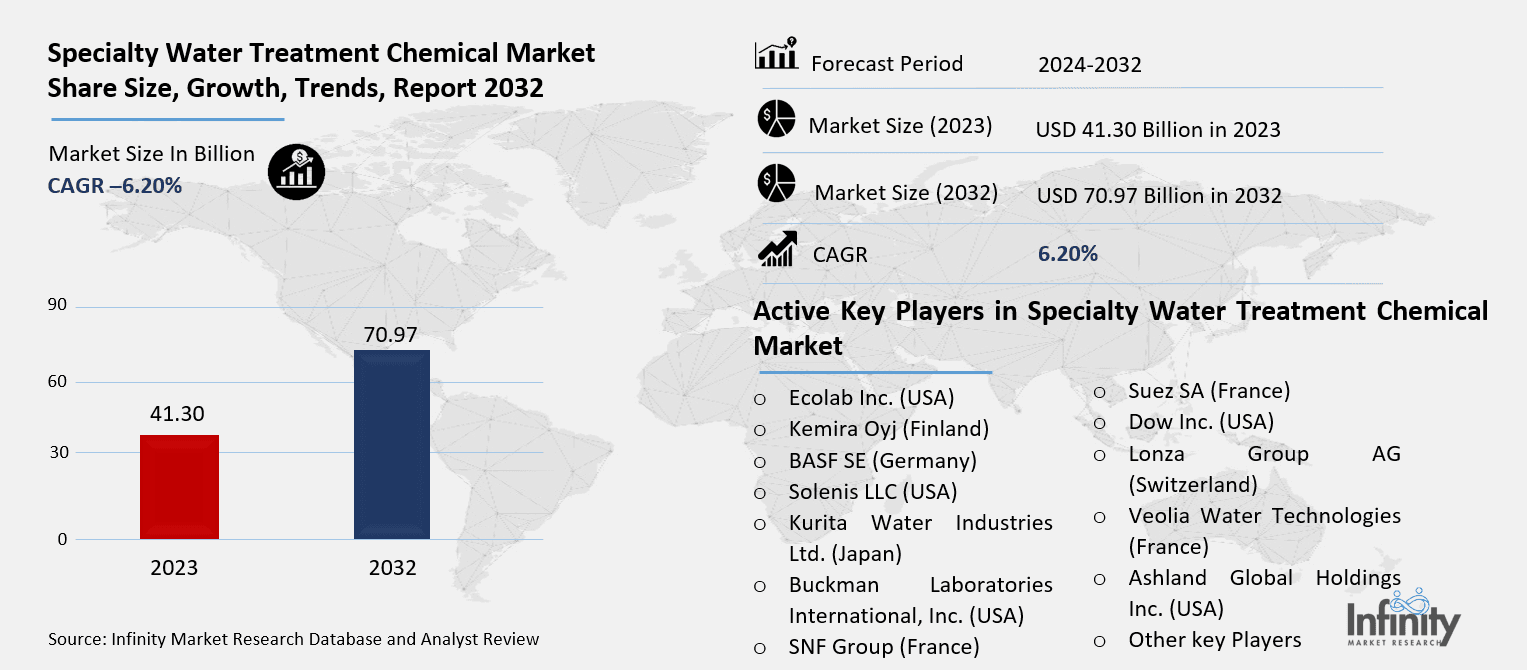

Specialty Water Treatment Chemical Market Size Was Valued at USD 41.30 Billion in 2023, and is Projected to Reach USD 70.97 Billion by 2032, Growing at a CAGR of 6.20% From 2024-2032.

Comprising a spectrum of chemical formulations meant to improve water quality by tackling pollutants, scaling, corrosion, and microbiological development in industrial, municipal, and commercial water systems, the Specialty Water Treatment Chemical Market consists of From power generation to pharmaceuticals, oil and gas, and food and beverage processing, these compounds—including coagulants, biocides, corrosion inhibitors, and scale inhibitors—play a vital role in ensuring water safety, extending equipment lifetime, and optimizing operational efficiency across diverse businesses. Demand for these specialist treatment systems stems from growing environmental issues, strict laws, and water shortage.

A vital part of world water management, the Specialty Water Treatment Chemical Market guarantees the safe and effective use of water resources over several sectors. Effective water treatment technologies are more important than ever given growing urbanization, industrialization, and strict environmental rules. Chemicals that stop corrosion, scaling, and microbiological contamination in many water treatment uses—including cooling towers, boilers, membrane filtration, and wastewater treatment plants—make up the market. By allowing water reuse and recycling, these compounds improve water quality, save running expenses, and support sustainable industry practices.

Rising need for clean water in sectors such power generation, oil and gas, pharmaceuticals, and food processing is one of the main causes of market growth. Industries investing in advanced water treatment technology and specialty chemicals have been driven by growing need to follow environmental rules such the European Union Water Framework Directive and the Clean Water Act in the United States. As businesses search for sustainable solutions, developments in water treatment chemistry—including biodegradable and green chemicals—are also gathering momentum. Raw material price volatility, environmental issues about chemical disposal, and the necessity of thorough research and development to create highly efficient, non-toxic substitutes challenge market expansion, nevertheless.

Thanks to fast industrialization and urbanization, which call for better water treatment facilities, developing economies—especially in Asia-Pacific—are becoming increasingly important agents of market expansion. Furthermore influencing the development of the market is the growing acceptance of smart water management systems and digital monitoring solutions coupled with specialized chemicals. The demand for sophisticated specialty water treatment chemicals is predicted to keep increasing given the current worldwide water problem and growing awareness of the need of water conservation.

Specialty Water Treatment Chemical Market Outlook, 2023 and 2032: Future Outlook

Specialty Water Treatment Chemical Market Trend Analysis

Trend: Growth of Sustainable and Eco-Friendly Water Treatment Chemicals

Sustainable and environmentally friendly water treatment chemicals are clearly becoming more important as environmental rules tighten all around. Concerning their environmental effect, particularly aquatic toxicity and bioaccumulation, traditional water treatment chemicals include phosphate-based corrosion inhibitors and chlorine-based disinfectants have generated questions. Green chemistry solutions—such as biodegradable coagulants, plant-based chelating agents, and non-toxic corrosion inhibitors—which efficiently treat water without damaging ecosystems—are thus being embraced by businesses even more. This tendency fits with international sustainability objectives and legal systems pushing chemical producers to create ecologically friendly formulations.

Businesses in the market are funding research and development to produce bio-based water treatment compounds with little environmental effect that either match or exceed performance of traditional chemicals. For water treatment uses, for instance, polymeric coagulants made from natural sources like starch and chitosan are becoming popular because of their lower toxicity and biodegradable character. Furthermore driving the usage of sustainable water treatment solutions is the demand for specialized chemicals that allow effective water recycling resulting from the development of zero-liquid discharge (ZLD) technology.

Opportunity: Expansion of Water Treatment in Developing Economies

Driven by industrial development, urbanization, and rising water infrastructure investment, developing economies in Asia-Pacific, Africa, and Latin America offer a major potential prospect for the Specialty Water Treatment Chemical Market. Many of these areas suffer with water shortage issues, which calls for innovative water treatment techniques to guarantee a continuous supply for businesses and cities. Large-scale water treatment initiatives are being funded by governments and international organizations, hence increasing demand for specialty chemicals that improve efficiency in industrial operations, wastewater treatment, and water purification.

Furthermore, the fast expansion of industrial sectors including manufacturing, mining, and energy generation in these areas raises the necessity of efficient water management. Strong wastewater treatment rules imposed by nations like China and India are meant to reduce pollution, thereby increasing acceptance of specific water treatment chemicals. Through alliances and joint ventures with local water treatment service providers, international businesses are also joining these markets in order to increase their presence and meet the growing demand for modern water treatment solutions.

Driver: Stringent Environmental Regulations and Compliance Standards

Strict environmental rules imposed by governments all over have helped to reduce water pollution and guarantee sustainable water use, therefore greatly increasing the need for particular water treatment chemicals. High-performance water treatment solutions are therefore driven by regulations including the European Water Framework Directive, the Safe Drinking Water Act (SDWA) in the United States, and China's Water Pollution Prevention and Control Action Plan requiring industries to treat wastewater before discharge.

Under pressure to satisfy water quality criteria, industrial sectors including oil & gas, chemicals, and power generation are investing in advanced water treatment technologies and specialty chemicals. Market-active companies are creating creative formulas that satisfy environmental criteria while preserving great efficiency. Furthermore, the emergence of corporate sustainability projects motivates companies to apply water-saving techniques, hence increasing demand for specialized chemicals improving water recycling and reuse.

Restraints: High Cost of Specialty Water Treatment Chemicals

The main obstacles restricting industry expansion. Specialty chemicals include complicated formulations, innovative manufacturing techniques, and thorough research and development—qualities not found in standard water treatment solutions—which drive higher production costs. Further adding to the total cost burden for manufacturers and end users are changing raw material costs including those of specialized polymers, metals, and bio-based chemicals.

Particularly in underdeveloped areas, small and medium-sized businesses may find it difficult to purchase premium water treatment systems and choose less expensive options with just reasonable efficacy instead. This cost-sensitive character of some sectors can impede general acceptance, particularly in nations whose regulatory enforcement is still growing. Specialty chemicals should, however, become more affordable as technology develops and economies of scale are attained, therefore opening a wider spectrum of businesses access to them.

Specialty Water Treatment Chemical Market Segment Analysis

Specialty Water Treatment Chemical Market Segmented on the basis of type, application and end user.

By Type

o Coagulants & Flocculants

o Corrosion Inhibitors

o Biocides & Disinfectants

o Chelating Agents

o Anti-Foaming Agents

o pH Adjusters & Stabilizers

o Scale Inhibitors

o Others

By Application

o Boiler Water Treatment

o Cooling Water Treatment

o Membrane Water Treatment

o Wastewater Treatment

o Process Water Treatment

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Type, Coagulants & Flocculants segment is expected to dominate the market during the forecast period

Coagulants and flocculants, corrosion inhibitors, biocides and disinfectants, chelating agents, anti-foaming agents, pH adjusters and stabilizers, and scale inhibitors define the several forms of the Specialty Water Treatment Chemical Market. Among these, flocculants and coagulants have a sizable market share since they are so extensively used in applications including municipal and industrial wastewater treatment. These compounds help to remove organic debris, suspended particles, and heavy metals, therefore improving the water quality generally.

Particularly in sectors including power generation, oil and gas, and chemical processing where equipment lifetime and efficiency are vital, corrosion inhibitors and scale inhibitors are also seeing great demand. Essential for sectors like pharmaceuticals and food and beverage that depend on high-purity water, biocides and disinfectants are crucial in microbial control. Research on natural-based flocculants and biodegradable corrosion inhibitors is motivated by increasing inclination for environmentally acceptable formulations.

By Application, Boiler Water Treatment segment expected to held the largest share

Boiler water treatment, cooling water treatment, membrane water treatment, wastewater treatment, and process water treatment find usage for the market. Among these, wastewater treatment has the biggest market share since water conservation and growing regulatory pressure on industrial effluent release demand it.

Particularly in sectors like industry and power plants where effective heat transmission and corrosion prevention are vital, cooling water and boiler water treatment uses are also growing. Reverse osmosis (RO) and ultrafiltration technologies for desalination and high-purity water generation are helping the segment on membrane water treatment gather steam.

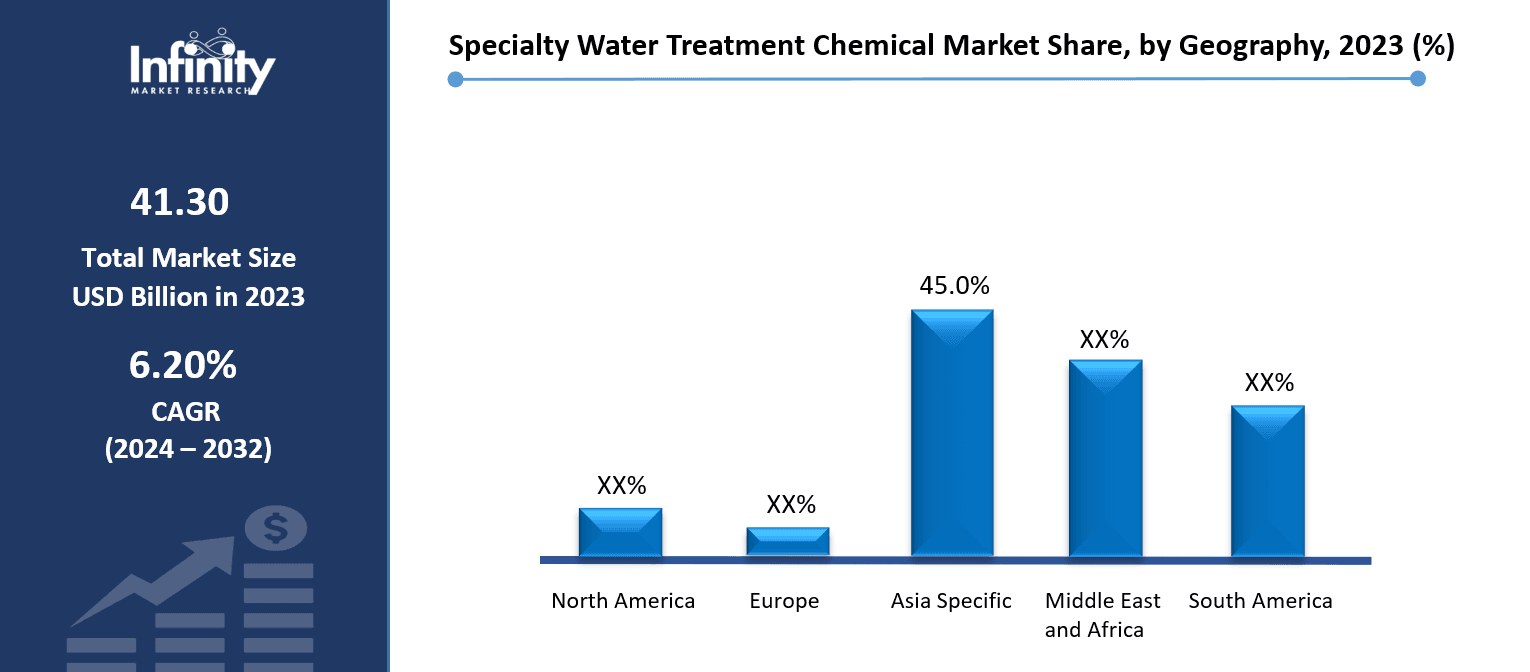

Specialty Water Treatment Chemical Market Regional Insights

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Driven by fast industrialization, urbanization, and growing environmental rules, the Asia-Pacific region rules the Specialty Water Treatment Chemical Market. Investing considerably in water infrastructure projects, nations including China, India, and Japan are increasing demand for sophisticated water treatment technologies.

Particularly China has put strict wastewater treatment rules in place to address industrial pollution, which has helped specialty chemicals be adopted in both municipal and industrial water treatment plants. Further driving market growth are the region's increasing electricity, chemical, and manufacturing industries.

Specialty Water Treatment Chemical Market Share, by Geography, 2023 (%)

Active Key Players in the Specialty Water Treatment Chemical Market

o Ecolab Inc. (USA)

o Kemira Oyj (Finland)

o BASF SE (Germany)

o Solenis LLC (USA)

o Kurita Water Industries Ltd. (Japan)

o Buckman Laboratories International, Inc. (USA)

o SNF Group (France)

o Suez SA (France)

o Dow Inc. (USA)

o Lonza Group AG (Switzerland)

o Veolia Water Technologies (France)

o Ashland Global Holdings Inc. (USA)

o Other key Players

Global Specialty Water Treatment Chemical Market Scope

|

Global Specialty Water Treatment Chemical Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 41.30 Billion |

|

Forecast Period 2024-32 CAGR: |

6.20% |

Market Size in 2032: |

USD 70.97 Billion |

|

Segments Covered: |

By Type |

· Coagulants & Flocculants · Corrosion Inhibitors · Biocides & Disinfectants · Chelating Agents · Anti-Foaming Agents · pH Adjusters & Stabilizers · Scale Inhibitors · Others | |

|

By Application |

· Boiler Water Treatment · Cooling Water Treatment · Membrane Water Treatment · Wastewater Treatment · Process Water Treatment | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Stringent Environmental Regulations and Compliance Standards | ||

|

Key Market Restraints: |

· High Cost of Specialty Water Treatment Chemicals | ||

|

Key Opportunities: |

· Expansion of Water Treatment in Developing Economies | ||

|

Companies Covered in the report: |

· Ecolab Inc. (USA), Kemira Oyj (Finland), BASF SE (Germany), Solenis LLC (USA), Kurita Water Industries Ltd. (Japan), Buckman Laboratories International, Inc. (USA), SNF Group (France), Suez SA (France), Dow Inc. (USA) and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Specialty Water Treatment Chemical Market research report?

Answer: The forecast period in the Specialty Water Treatment Chemical Market research report is 2024-2032.

2. Who are the key players in the Specialty Water Treatment Chemical Market?

Answer: Ecolab Inc. (USA), Kemira Oyj (Finland), BASF SE (Germany), Solenis LLC (USA), Kurita Water Industries Ltd. (Japan), Buckman Laboratories International, Inc. (USA), SNF Group (France), Suez SA (France), Dow Inc. (USA) and Other Major Players.

3. What are the segments of the Specialty Water Treatment Chemical Market?

Answer: The Specialty Water Treatment Chemical Market is segmented into Type, Application, End User and region. By Type, the market is categorized into Coagulants & Flocculants, Corrosion Inhibitors, Biocides & Disinfectants, Chelating Agents, Anti-Foaming Agents, pH Adjusters & Stabilizers, Scale Inhibitors, Others. By End-Use Industry, the market is categorized into Municipal Water Treatment, Industrial Water Treatment. By Application, the market is categorized into Boiler Water Treatment, Cooling Water Treatment, Membrane Water Treatment, Wastewater Treatment, Process Water Treatment. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Specialty Water Treatment Chemical Market?

Answer: Comprising a spectrum of chemical formulations meant to improve water quality by tackling pollutants, scaling, corrosion, and microbiological development in industrial, municipal, and commercial water systems, the Specialty Water Treatment Chemical Market consists of From power generation to pharmaceuticals, oil and gas, and food and beverage processing, these compounds—including coagulants, biocides, corrosion inhibitors, and scale inhibitors—play a vital role in ensuring water safety, extending equipment lifetime, and optimizing operational efficiency across diverse businesses. Demand for these specialist treatment systems stems from growing environmental issues, strict laws, and water shortage.

5. How big is the Specialty Water Treatment Chemical Market?

Answer: Specialty Water Treatment Chemical Market Size Was Valued at USD 41.30 Billion in 2023, and is Projected to Reach USD 70.97 Billion by 2032, Growing at a CAGR of 6.20% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.