🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Spine Surgery Robots Market

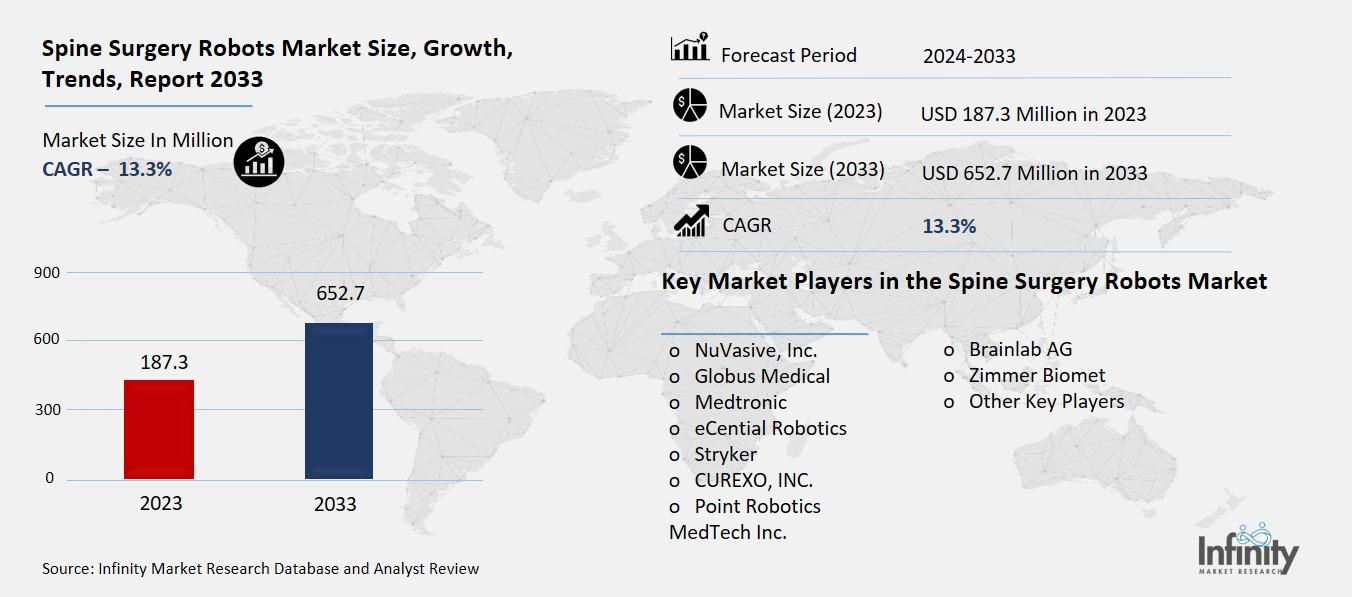

Global Spine Surgery Robots Market (By Component, Instruments and Software; By Surgery Type, Spinal Fusion, Vertebroplasty, Discectomy, Kyphoplasty, and Other Surgery Types; By End-User, Hospitals & ASCs, Specialty Clinics, and Other End-Users, By Region and Companies), 2024-2033

Jan 2025

Healthcare

Pages: 138

ID: IMR1403

Spine Surgery Robots Market Overview

Global Spine Surgery Robots Market acquired the significant revenue of 187.3 Million in 2023 and expected to be worth around USD 652.7 Million by 2033 with the CAGR of 13.3% during the forecast period of 2024 to 2033. The spine surgery robots market size is growing across the globe due to developing engineering application in the medical field along with patient’s preference for minimally invasive procedures and the growing incidence of spinal disorders. Spine surgery robots are surgical technology designed to help surgeons accurately and ensure that they perform detailed surgeries on the spinal area hence faster recovery for the patients. It uses features like real time image and internal/external navigation systems as well as enhanced robotic arms to enhance the conduct of surgeries to eliminate human mistakes and future health complications. The need for these robots is propelled by the following aspects; increasing population of the elderly, increased cases of spinal abnormalities and more outpatient surgical procedures.

Drivers for the Spine Surgery Robots Market

Minimally Invasive Surgery Demand

A major driving force in the spine surgery robots market is the ever-rising trend towards minimally invasive procedures because of their numerous advantages for both clients and health care facilities. It is well established that most minimally invasive surgical procedures require minor incisions and, therefore, would cause less damage to the tissues, less blood loss, and ideal conditions for no infections. For patients, this applies to less time to recover, need less pain relief after the surgery, and less days in the hospital. These advantages are quite relevant especially for the spine surgery because traditional open surgery of this area is traumatic and requires more time for rehabilitation. Robotic systems employed in minimally invasive surgery increase accuracy, although the level of technical dexterity is important when it comes to spine surgery, this reduces on the risk of the patients developing complications.

Restraints for the Spine Surgery Robots Market

Lack of Skilled Personnel

The shortage of trained surgeons capable of operating advanced robotic systems presents a significant challenge for the growth of the spine surgery robots market, particularly in regions with limited access to specialized training programs or healthcare infrastructure. Robotic-assisted surgeries require surgeons to acquire new skills and proficiency in using advanced technologies such as real-time imaging, navigation systems, and robotic arms. The learning curve associated with these systems can be steep, and without adequate training and education, surgeons may be hesitant to adopt these technologies or may not be fully capable of maximizing their potential. This shortage of skilled professionals can lead to slower adoption rates in some regions, especially in emerging markets where medical training and access to cutting-edge technology may be limited.

Opportunity in the Spine Surgery Robots Market

Research and Development in AI and Robotics

Expanding the use of robotic systems beyond spine surgery to other orthopedic and complex surgeries presents a significant growth opportunity for the market. Robotics technology, which has already proven successful in spine surgeries, can be adapted to a wide range of orthopedic procedures, such as joint replacements, trauma surgeries, and deformity corrections. By leveraging the precision, accuracy, and minimally invasive capabilities of robotic systems, surgeons can perform these procedures with improved outcomes, reduced complications, and faster recovery times for patients.

Additionally, robotic systems can be employed in complex surgeries like tumor removal, reconstructive surgeries, and other areas where high levels of precision are crucial. The potential to apply robotics across various specialties not only broadens the scope of surgical procedures but also increases the overall demand for robotic systems, further driving market growth. This diversification could also lead to innovations in robotic designs and functionalities, making them more versatile and accessible to a larger pool of healthcare providers.

Trends for the Spine Surgery Robots Market

Integration of Artificial Intelligence (AI)

The integration of AI and machine learning algorithms into spine surgery robots is significantly enhancing the precision, outcomes, and decision-making capabilities during surgeries. AI and machine learning technologies can analyze vast amounts of data, including patient imaging, surgical history, and real-time feedback from the robot during the procedure. This allows for more accurate planning and execution of surgeries, as the system can continuously adapt to the specific conditions of the surgery. For instance, AI can assist in preoperative planning by creating personalized surgical plans based on a patient's unique anatomy, enabling surgeons to make more informed decisions.

During surgery, AI algorithms can help refine movements and optimize the robotic system’s actions in real-time, reducing human error and improving the overall accuracy of complex procedures. Additionally, machine learning allows the system to learn from previous surgeries and continually improve its performance, which can lead to better long-term outcomes.

Segments Covered in the Report

By Component

o Instruments

o Software

By Surgery Type

o Spinal Fusion

o Vertebroplasty

o Discectomy

o Kyphoplasty

o Other Surgery Types

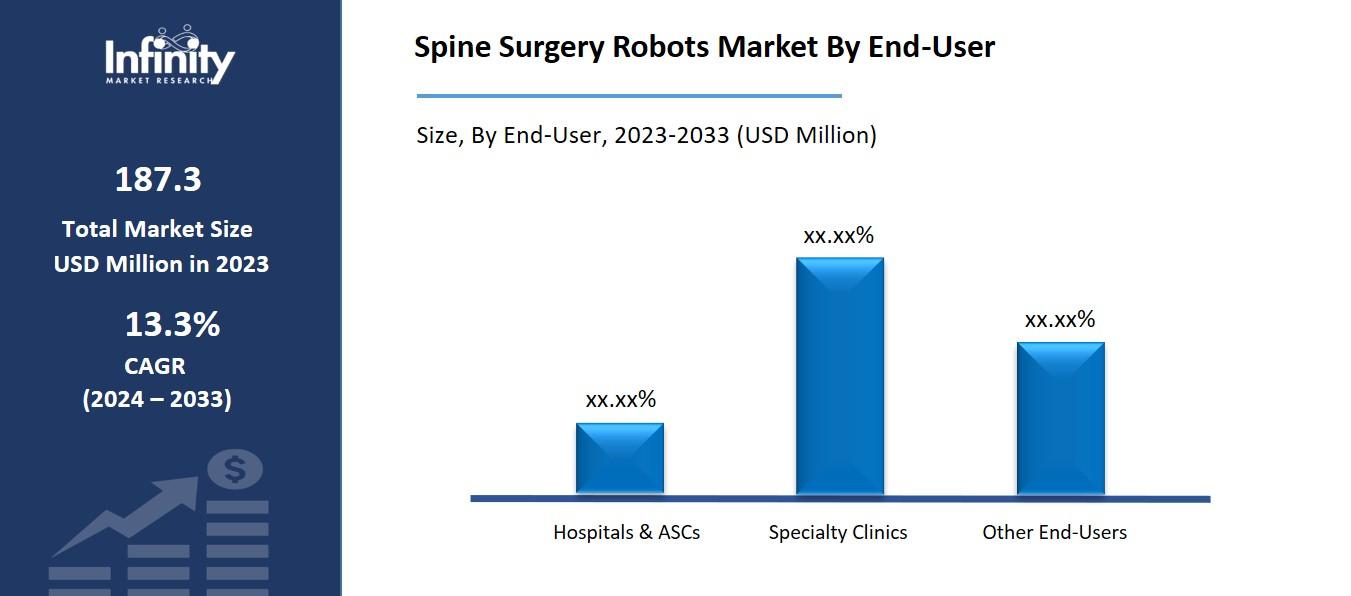

By End-User

o Hospitals & ASCs

o Specialty Clinics

o Other End-Users

Segment Analysis

By Component Analysis

On the basis of component, the market is divided into instruments and software. Among these, instruments segment acquired the significant share in the market owing to the crucial role that physical robotic instruments, such as robotic arms, surgical tools, and imaging devices, play in enabling the success of spine surgeries. These instruments are integral to the actual execution of the procedure, providing the precision and control necessary for performing complex spinal surgeries. The demand for advanced robotic instruments continues to rise as healthcare providers increasingly adopt robotic systems for their ability to perform minimally invasive surgeries with greater accuracy, reduced recovery times, and fewer complications.

By Surgery Type Analysis

On the basis of surgery type, the market is divided into spinal fusion, vertebroplasty, discectomy, kyphoplasty, and other surgery types. Among these, spinal fusion segment held the prominent share of the market due to the spinal fusion being one of the most common and widely performed procedures for treating degenerative spine conditions, spinal deformities, and trauma-related spinal injuries. The growing prevalence of conditions like degenerative disc disease, scoliosis, and other spinal disorders that require stabilization of the spine through fusion procedures has contributed to the high demand for robotic-assisted spinal fusion surgeries.

By End-User Analysis

On the basis of end-user, the market is divided into hospitals & ASCs, specialty clinics, and other end-users. Among these, hospitals & ASCs segment held the prominent share of the market due to the advanced infrastructure, resources, and capabilities that hospitals and ASCs offer, making them the primary settings for robotic spine surgeries. These institutions typically have access to the latest medical technologies, including robotic-assisted surgical systems, and are better equipped to perform complex and high-risk spine surgeries.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 32.1% of the market owing to the advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and a strong presence of key market players. The region, particularly the United States, is known for its world-class healthcare facilities, which are equipped with the latest robotic systems for spine surgeries. The high demand for minimally invasive surgeries, coupled with the growing prevalence of spinal disorders due to an aging population, further contributes to the market’s expansion in North America.

Additionally, North America benefits from significant investments in research and development, leading to continuous innovations in robotic technology and AI integration, which further enhance the precision and outcomes of spine surgeries. The regulatory environment in the region, which supports the approval and commercialization of advanced medical devices, also plays a crucial role in the widespread adoption of spine surgery robots.

Competitive Analysis

The competitive landscape of the spine surgery robots market is highly dynamic, with several key players vying for market share by offering advanced technologies, innovative solutions, and differentiated products. Major companies in this space include Medtronic, Johnson & Johnson, Zimmer Biomet, Stryker, and Globus Medical, among others. These companies are focusing on strategic initiatives such as product innovations, mergers and acquisitions, partnerships, and collaborations with healthcare institutions to enhance their market position. Medtronic, for example, offers the Mazor X Stealth Edition, a popular robotic system for spine surgery, while Stryker’s robotic platform, MAKO, has gained traction in the orthopedic segment, extending into spinal procedures.

Recent Developments

In March 2023, Accelus, a manufacturer of robotic navigation platforms for spinal surgery, announced that it had received FDA 510(k) clearance to utilize its technology with GE Healthcare’s fluoroscopic imaging systems.

In December 2022, BLK-Max Super Speciality Hospital introduced India's most advanced integrated robotic system for spine surgery, combining surgical navigation and robotic guidance to enhance precision and efficiency during procedures.

Key Market Players in the Spine Surgery Robots Market

o Globus Medical

o eCential Robotics

o Stryker

o CUREXO, INC.

o Point Robotics MedTech Inc.

o Brainlab AG

o Zimmer Biomet

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 187.3 Million |

|

Market Size 2033 |

USD 652.7 Million |

|

Compound Annual Growth Rate (CAGR) |

13.3% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Million) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Component, Surgery Type, End-User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

NuVasive, Inc., Globus Medical, Medtronic, eCential Robotics, Stryker, CUREXO, INC., Point Robotics MedTech Inc., Brainlab AG, Zimmer Biomet, and Other Key Players. |

|

Key Market Opportunities |

Research and Development in AI and Robotics |

|

Key Market Dynamics |

Minimally Invasive Surgery Demand |

📘 Frequently Asked Questions

1. Who are the key players in the Spine Surgery Robots Market?

Answer: NuVasive, Inc., Globus Medical, Medtronic, eCential Robotics, Stryker, CUREXO, INC., Point Robotics MedTech Inc., Brainlab AG, Zimmer Biomet, and Other Key Players.

2. How much is the Spine Surgery Robots Market in 2023?

Answer: The Spine Surgery Robots Market size was valued at USD 187.3 Million in 2023.

3. What would be the forecast period in the Spine Surgery Robots Market?

Answer: The forecast period in the Spine Surgery Robots Market report is 2024-2033.

4. What is the growth rate of the Spine Surgery Robots Market?

Answer: Spine Surgery Robots Market is growing at a CAGR of 13.3% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.