🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Stannous Methanesulfonate Solution Market

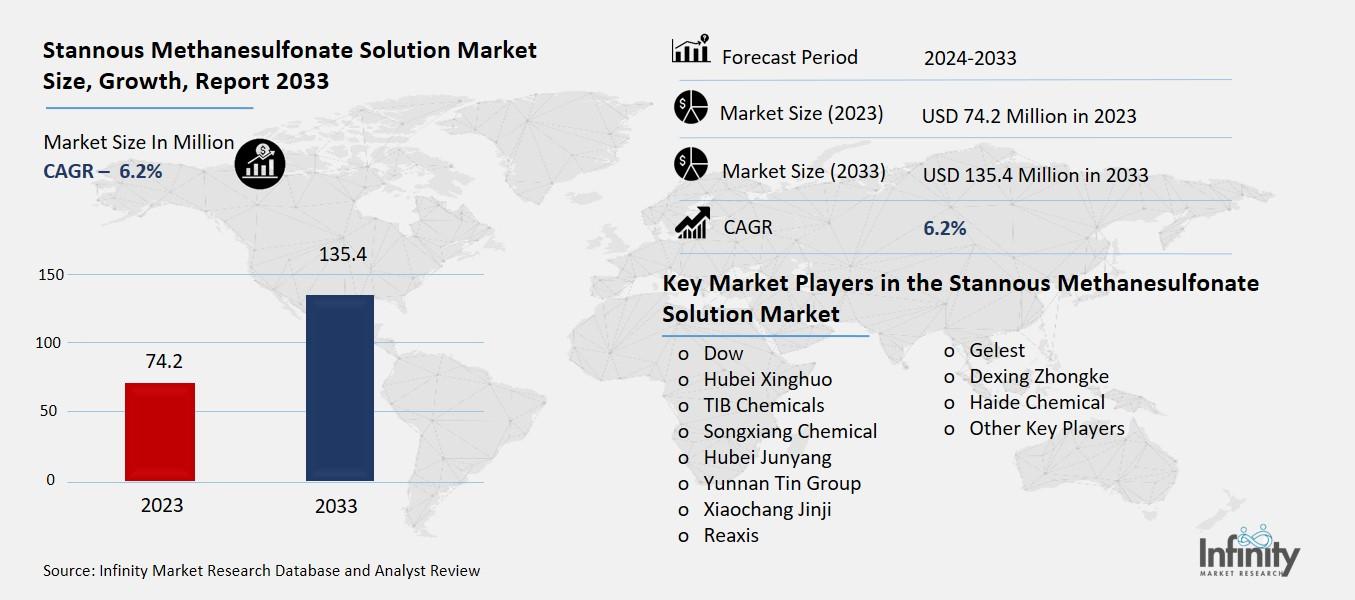

Global Stannous Methanesulfonate Solution Market (By Type, Content 50% and Other Types; By Application, Electroplate and Other Applications; By Region and Companies), 2024-2033

Dec 2024

Information and Communication Technology

Pages: 138

ID: IMR1339

Stannous Methanesulfonate Solution Market Overview

Global Stannous Methanesulfonate Solution Market acquired the significant revenue of 74.2 Million in 2023 and expected to be worth around USD 135.4 Million by 2033 with the CAGR of 6.2% during the forecast period of 2024 to 2033. The global market for stannous methanesulfonate solution is fast growing, especially due to vast application in industries such as electroplating and electronics. Stannous methanesulfonate is regarded as an optimal reagent, as it is stable and highly soluble for use in plating solutions with tin, especially where protective coatings of printed circuit boards (PCBs) and other electronics are being developed. It has been used in large quantities due increase in demand for miniaturization and high performance in electronic related products.

Further, its usages in aesthetics as decorative plating and coating and in industrial as protective coating enhances the markets size of derivatives. The market is driven by growths in electroplating technologies, high standards in environmental conservation because of preserving environmental quality, and by developments in renewable energy gadgets where tin coatings are vital.

Drivers for the Stannous Methanesulfonate Solution Market

Advancements in Electroplating Technologies

Stannous methanesulfonate is preferred in the electroplating industry due to high efficiency and relatively low costs. Feature of being chemically stable and highly soluble allow it to be a good source of tin that guarantees homogenous plating. Unlike other tin plating solutions, stannous methanesulfonate makes it easier to avoid common flaws that may encompass haphazard plating or formation of pits, which in the long run means that less material is used, time is not spent redoing the plates, and overall costs are kept relatively low.

Additionally, because of the compatibility of hard chrome plating with sophisticated high definition plating technologies popular with today’s high precision plating technologies selectively plating and micro plating it especially applicable to industries that call for miniaturization such as electronic and semiconductor industries. These characteristics enable manufacturers to lay the layers to the required thickness and provide for the high quality of the surface even in the case of complex forms. At the same time, its compatibility with automated plating systems guarantees greater line productivity and at the same time adheres to the strict quality requirements necessary for use in high-tech production lines, which strengthens its status as a cost-effective solution for modern precision plating processes.

Restraints for the Stannous Methanesulfonate Solution Market

Limited Awareness in Emerging Markets

The adoption of stannous methanesulfonate in less-industrialized regions remains limited due to several factors, primarily stemming from knowledge gaps and accessibility challenges. In these regions, industries often rely on traditional or locally available plating solutions that may not match the efficiency or environmental benefits of stannous methanesulfonate. Limited awareness about its advantages, such as superior plating performance and cost-effectiveness, hinders its integration into local manufacturing processes. Additionally, logistical challenges, including the lack of a robust supply chain and higher import costs, restrict its availability to smaller businesses or emerging industries.

Opportunity in the Stannous Methanesulfonate Solution Market

Expanding Use in Automotive Electronics

The rising adoption of electric vehicles (EVs) and autonomous vehicles is significantly boosting the demand for stannous methanesulfonate due to its critical role in the production of high-performance, corrosion-resistant coatings. In EVs, components such as battery connectors, circuit boards, and charging interfaces require durable, conductive coatings to ensure efficiency and longevity. Stannous methanesulfonate provides a stable tin source for electroplating, delivering uniform coatings that protect against oxidation and wear, even in harsh operating environments.

Autonomous vehicles further drive this demand as they rely on sophisticated electronic systems and sensors, which are highly sensitive to corrosion and electrical interference. The superior properties of stannous methanesulfonate-based coatings, including excellent adhesion and resistance to environmental degradation, make it indispensable for such applications.

Trends for the Stannous Methanesulfonate Solution Market

Integration of Automation in Electroplating

The integration of AI and robotics into plating processes is transforming the electroplating industry by enhancing precision, scalability, and operational efficiency. AI-driven systems enable real-time monitoring and control of plating parameters, such as temperature, pH, and current density, ensuring optimal deposition quality and reducing the risk of defects. Advanced algorithms can predict equipment maintenance needs, streamline production schedules, and minimize downtime, resulting in cost savings and increased productivity.

obotics further augment this process by executing repetitive and intricate tasks with unparalleled accuracy, such as handling small or complex components in high-precision applications like electronics or medical devices. Automated robotic arms can maintain consistent immersion times, coating thicknesses, and surface finishes, which are critical for meeting stringent industry standards.

Segments Covered in the Report

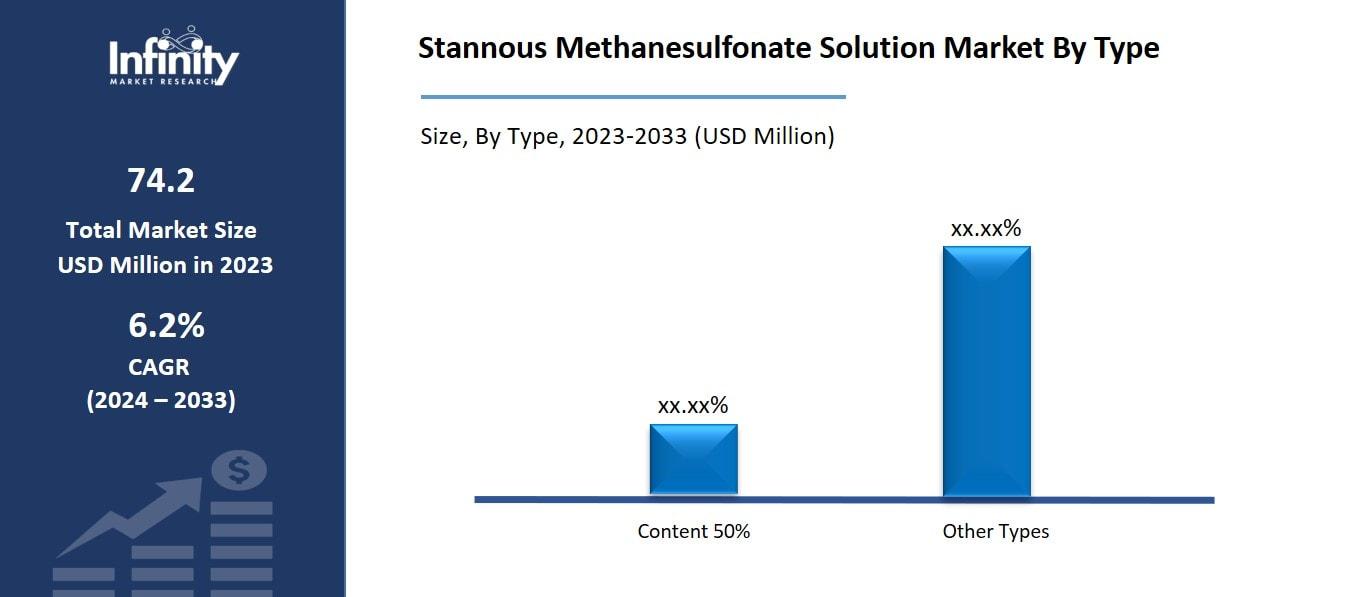

By Type

o Content 50%

o Other Types

By Application

o Electroplate

o Other Applications

Segment Analysis

By Type Analysis

On the basis of type, the market is divided into content 50% and other types. Among these, products with a 50% concentration have captured a significant share owing to their optimal balance between tin content and solution stability, making them highly effective for various electroplating applications. The 50% concentration ensures efficient deposition rates and consistent coating quality, which are essential for industries such as electronics and automotive manufacturing. Additionally, this concentration level offers a favorable cost-performance ratio, appealing to manufacturers seeking both quality and economic efficiency in their plating processes.

By Application Analysis

On the basis of application, the market is divided into electroplate and other applications. Among these, commercial held the prominent share of the market due to the compound's extensive use in the electronics industry, particularly for plating printed circuit boards (PCBs) and other electronic components. Its ability to provide uniform and reliable tin coatings is crucial for ensuring the performance and longevity of electronic devices. The growing demand for miniaturized and high-performance electronics has further amplified the need for advanced electroplating solutions, solidifying the electroplating segment's leading position in the market.

Regional Analysis

Asia Pacific Dominated the Market with the Highest Revenue Share

Asia Pacific held the most of the share of 34.1% of the market due to its robust industrial base and growing demand from key sectors such as electronics, automotive, and renewable energy. Countries like China, Japan, and South Korea lead the region in the manufacturing of semiconductors, printed circuit boards (PCBs), and consumer electronics, all of which require high-quality tin plating. The presence of large-scale production facilities and extensive supply chains further bolsters market growth in the region.

Additionally, the rapid adoption of electric vehicles (EVs) and renewable energy systems, particularly solar panels, has increased the demand for corrosion-resistant coatings, driving the use of stannous methanesulfonate. Favorable government policies supporting industrial development and technological advancements in electroplating techniques also contribute to the region’s market dominance.

Competitive Analysis

The competitive landscape of the global stannous methanesulfonate solution market is characterized by a mix of established players and emerging companies striving for market share through innovation, product differentiation, and strategic partnerships. Leading companies in the market focus on enhancing the performance characteristics of their products, such as improving coating uniformity, reducing environmental impact, and increasing the efficiency of electroplating processes. Key players invest heavily in research and development (R&D) to meet the evolving demands of industries like electronics, automotive, and renewable energy, where high-quality plating solutions are crucial.

Key Market Players in the Stannous Methanesulfonate Solution Market

o Dow

o Hubei Xinghuo

o TIB Chemicals

o Songxiang Chemical

o Hubei Junyang

o Yunnan Tin Group

o Xiaochang Jinji

o Reaxis

o Gelest

o Dexing Zhongke

o Haide Chemical

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 74.2 Million |

|

Market Size 2033 |

USD 135.4 Million |

|

Compound Annual Growth Rate (CAGR) |

6.2% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Million) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Dow, Hubei Xinghuo, TIB Chemicals, Songxiang Chemical, Hubei Junyang, Yunnan Tin Group, Xiaochang Jinji, Reaxis, Gelest, Dexing Zhongke, Haide Chemical, and Other Key Players. |

|

Key Market Opportunities |

Expanding Use in Automotive Electronics |

|

Key Market Dynamics |

Advancements in Electroplating Technologies |

📘 Frequently Asked Questions

1. Who are the key players in the Stannous Methanesulfonate Solution Market?

Answer: Dow, Hubei Xinghuo, TIB Chemicals, Songxiang Chemical, Hubei Junyang, Yunnan Tin Group, Xiaochang Jinji, Reaxis, Gelest, Dexing Zhongke, Haide Chemical, and Other Key Players.

2. How much is the Stannous Methanesulfonate Solution Market in 2023?

Answer: The Stannous Methanesulfonate Solution Market size was valued at USD 74.2 Million in 2023.

3. What would be the forecast period in the Stannous Methanesulfonate Solution Market?

Answer: The forecast period in the Stannous Methanesulfonate Solution Market report is 2024-2033.

4. What is the growth rate of the Stannous Methanesulfonate Solution Market?

Answer: Stannous Methanesulfonate Solution Market is growing at a CAGR of 6.2% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.