🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Steel Fiber Market

Steel Fiber Market (By Type (Hooked, Straight, Deformed, Others), By Application (Slabs & Flooring, Precast, Pavements & Tunneling, Other Applications), By End-Use (Buildings & Construction, Transportation), By Region and Companies)

Jul 2024

Chemicals and Materials

Pages: 145

ID: IMR1137

Steel Fiber Market Overview

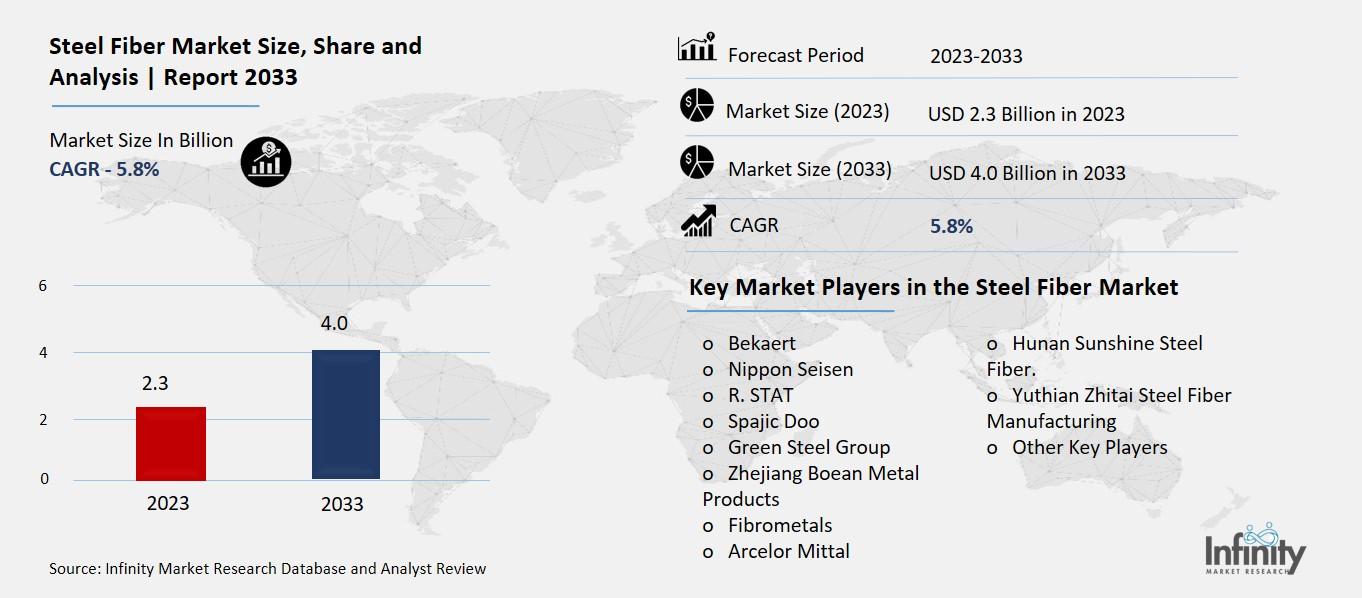

Global Steel Fiber Market size is expected to be worth around USD 4.0 Billion by 2033 from USD 2.3 Billion in 2023, growing at a CAGR of 5.8% during the forecast period from 2023 to 2033.

The Steel Fiber Market refers to the industry that deals with steel fibers used in construction materials like concrete. These fibers are small, thin strands made of steel, typically added to concrete mixes to enhance their strength and durability. They come in various shapes and sizes, such as hooked, straight, or crimped, and are mixed into the concrete to reinforce it against cracking and improve its resistance to impacts and stresses. Steel fibers work by distributing loads more evenly throughout the concrete structure, reducing the likelihood of cracks and improving its overall performance in tough conditions.

In construction, steel fibers are commonly used in flooring, tunnel linings, and precast elements like panels and pipes. Their integration into concrete mixes helps in making structures more resilient, especially in environments where heavy loads or dynamic stresses are frequent. This market is driven by the demand for stronger and more durable construction materials that can withstand harsh conditions and provide long-lasting performance. As technology advances, new types of steel fibers are being developed to meet specific construction challenges, further expanding the applications and potential of the steel fiber market in the building and infrastructure sectors.

Drivers for the Steel Fiber Market

Increasing Demand for High-Strength Construction Materials Drives Growth

The Steel Fiber Market is experiencing robust growth driven by several key factors that highlight its importance in the construction industry. One significant driver is the increasing demand for high-strength construction materials. As urbanization continues to expand globally, there is a growing need for infrastructure that can withstand heavier loads and harsh environmental conditions. Steel fibers are integral to meeting this demand, as they enhance the structural integrity of concrete, making it more resistant to cracking and improving its overall durability.

Infrastructure Development and Urbanization Fuel Market Expansion

Infrastructure development projects, particularly in emerging economies, are propelling the demand for steel fibers. Countries are investing heavily in building and upgrading their infrastructure to support growing populations and economic activities. Steel fibers offer a cost-effective solution compared to traditional reinforcement methods like rebar, as they can be easily mixed into concrete without the need for additional labor-intensive processes. This efficiency makes them attractive for large-scale projects such as bridges, highways, and residential buildings, where construction speed and cost-effectiveness are crucial factors.

Advantages of Steel Fibers Over Conventional Reinforcement Methods

Steel fibers provide several advantages over conventional reinforcement methods, which contribute to their growing adoption in the market. Unlike rebar, which requires precise placement and tying, steel fibers are simply mixed into the concrete mix, saving time and labor costs during construction. Moreover, they improve the toughness and impact resistance of concrete, reducing maintenance costs over the lifespan of the structure. This versatility makes steel fibers suitable for a wide range of applications, including industrial flooring, airport pavements, and seismic-resistant structures.

Technological Advancements Enhance Product Performance

Technological advancements in manufacturing processes have led to the development of steel fibers with enhanced performance characteristics. Modern fibers are engineered to provide specific benefits such as improved crack control, better bonding with concrete matrix, and higher tensile strength. These advancements have expanded the applications of steel fibers into new markets and enabled designers and engineers to create innovative solutions for challenging construction environments.

Environmental Regulations and Sustainability Drive Market Adoption

Increasing environmental regulations and a growing focus on sustainability are also driving the adoption of steel fibers. Concrete reinforced with steel fibers typically requires less material and generates lower carbon emissions compared to traditional reinforced concrete structures. This reduction in material usage and environmental impact aligns with global sustainability goals, making steel fibers an attractive choice for environmentally conscious construction projects and government initiatives promoting green building practices.

Growing Awareness and Education Among Architects and Engineers

There is a growing awareness and education among architects, engineers, and construction professionals about the benefits of steel fibers. As the knowledge about their performance advantages spreads, more projects are incorporating steel fiber-reinforced concrete to achieve superior structural performance and longevity. This trend is expected to continue as stakeholders seek durable and sustainable construction solutions that can withstand the challenges of modern urban environments.

Restraints for the Steel Fiber Market

Restraints and Obstacles

The Steel Fiber Market faces several restraints that pose challenges to its growth trajectory in the construction industry. One significant restraint is the higher initial cost compared to traditional reinforcement materials like rebar. While steel fibers offer long-term cost savings through reduced maintenance and improved durability, their upfront procurement and installation costs can deter initial adoption, especially in cost-sensitive construction projects and regions where budget constraints are significant. This cost factor remains a critical consideration for builders and developers weighing the benefits of using steel fibers in their construction projects.

Limited Awareness and Education Among Construction Professionals

A notable restraint for the Steel Fiber Market is the limited awareness and education among construction professionals about the benefits and applications of steel fibers. Many architects, engineers, and contractors may not fully understand how steel fibers can enhance concrete performance or may have concerns about integrating them into existing construction practices. This lack of knowledge can lead to hesitation or resistance towards adopting steel fibers, particularly in markets where traditional reinforcement methods are well-established and familiar.

Compatibility Issues and Technical Challenges in Mixing and Placement

Steel fibers require specific mixing and placement techniques to achieve optimal performance in concrete. Ensuring uniform distribution of fibers throughout the concrete mix and proper orientation during casting is crucial for achieving the desired strength and durability enhancements. However, improper handling or inadequate mixing practices can result in uneven dispersion of fibers or compromised bonding with the concrete matrix, potentially affecting the structural integrity of the finished construction. These technical challenges can pose restraints for the widespread adoption of steel fibers, especially in projects where precise concrete quality and performance standards are critical.

Regulatory and Certification Requirements

Regulatory requirements and certification standards also present restraints for the Steel Fiber Market. Different regions and countries may have varying regulations governing the use of construction materials, including steel fibers. Compliance with these standards often requires additional testing, documentation, and approvals, which can increase project timelines and costs. Moreover, the lack of universally accepted standards for steel fiber-reinforced concrete across all applications and environments can create uncertainty and complexity for stakeholders navigating regulatory landscapes.

Competition from Alternative Reinforcement Materials

The Steel Fiber Market faces competition from alternative reinforcement materials, such as polymer fibers and carbon fibers, which offer unique advantages in specific applications. Polymer fibers, for instance, are lightweight and corrosion-resistant, making them suitable for projects requiring high chemical resistance or where weight reduction is critical. Carbon fibers, on the other hand, offer exceptional strength-to-weight ratios and are preferred in applications demanding superior tensile strength and stiffness. The availability and evolving performance characteristics of these alternative materials provide builders and engineers with viable alternatives to steel fibers, influencing market dynamics and adoption decisions.

Opportunity in the Steel Fiber Market

Promising Growth Opportunities in the Steel Fiber Market

The Steel Fiber Market presents significant opportunities for growth and expansion in the construction industry, driven by several key factors that highlight its potential in enhancing infrastructure and building resilience. One major opportunity lies in the increasing adoption of steel fibers for improving the durability and lifespan of concrete structures. As urbanization intensifies globally, there is a growing need for infrastructure that can withstand heavier loads, seismic activity, and environmental pressures. Steel fibers offer a reliable solution by reinforcing concrete, reducing cracking, and enhancing structural integrity, thereby extending the lifespan of buildings and infrastructure.

Rising Demand for Sustainable Construction Materials

A notable opportunity in the Steel Fiber Market is the rising demand for sustainable construction materials. With increasing awareness of environmental issues and regulatory pressures to reduce carbon footprints, there is a shift towards sustainable building practices. Steel fibers contribute to sustainability goals by optimizing material usage, improving energy efficiency during construction, and enhancing the longevity of structures, which minimizes the need for replacements and repairs. This aligns with global initiatives promoting green building technologies and sustainable infrastructure development, presenting a lucrative opportunity for steel fiber manufacturers and suppliers.

Expansion in Infrastructure Development Projects

Infrastructure development projects, particularly in emerging economies, offer substantial opportunities for the Steel Fiber Market. Governments and private investors are investing in upgrading transportation networks, building smart cities, and enhancing public utilities to support economic growth and urbanization. Steel fibers play a crucial role in these projects by reinforcing bridges, tunnels, pavements, and high-rise buildings, where durability and safety are paramount. The scalability of steel fibers and their ability to withstand varying environmental conditions make them ideal for large-scale infrastructure projects, driving demand and market growth.

Technological Advancements and Product Innovation

Technological advancements in manufacturing processes and product innovation present opportunities for enhancing the performance and versatility of steel fibers. Manufacturers are continuously developing new types of fibers with enhanced characteristics such as improved bonding with concrete, better crack resistance, and higher tensile strength. These advancements enable engineers and architects to design innovative structures that meet stringent performance requirements while optimizing construction costs and timelines. The evolution of steel fiber technology opens doors to new applications and markets, fostering growth opportunities in diverse construction sectors globally.

Growing Preference for High-Performance Construction Materials

There is a growing preference among builders, developers, and infrastructure planners for high-performance construction materials that offer superior strength, durability, and resilience. Steel fibers meet these criteria by enhancing the mechanical properties of concrete, reducing maintenance costs, and improving overall structural performance. As stakeholders prioritize long-term value and operational efficiency in construction projects, the demand for steel fibers is expected to rise, creating opportunities for market expansion and penetration into new geographical regions and industrial applications.

Education and Awareness Initiatives Among Stakeholders

Education and awareness initiatives aimed at informing architects, engineers, and construction professionals about the benefits and applications of steel fibers represent a significant opportunity for market growth. Training programs, seminars, and industry collaborations can help dispel misconceptions, promote best practices in fiber reinforcement, and encourage the adoption of steel fibers in construction projects. Enhanced knowledge and expertise among stakeholders can drive confidence in the use of steel fibers, accelerate market acceptance, and stimulate demand for advanced fiber-reinforced concrete solutions.

Trends for the Steel Fiber Market

Current Trends Shaping the Steel Fiber Market

The Steel Fiber Market is experiencing dynamic trends that are reshaping its landscape in the construction sector. One prominent trend is the increasing adoption of macro synthetic fibers in addition to traditional steel fibers. These synthetic fibers, often made from materials like polypropylene or polyethylene, offer different properties such as corrosion resistance and lightweight characteristics, complementing the strengths of steel fibers. This trend reflects a growing demand for tailored solutions in concrete reinforcement that address specific project requirements and environmental considerations, driving innovation and diversity in fiber-reinforced concrete applications.

Growing Preference for Specialty Steel Fibers

There is a noticeable trend towards the use of specialty steel fibers with enhanced properties tailored for specific applications. Manufacturers are developing fibers with optimized geometries and surface treatments to improve bonding with concrete, increase durability, and enhance crack resistance. Specialty steel fibers are increasingly favored in high-performance applications such as industrial flooring, seismic-resistant structures, and military installations, where stringent performance standards and reliability are critical. This trend underscores the market's evolution towards offering customized solutions that meet the diverse needs of modern construction projects.

Integration of Steel Fibers in Prefabricated Construction

Prefabricated construction methods are gaining traction globally due to their efficiency, cost-effectiveness, and reduced construction timelines. Steel fibers are being integrated into prefabricated elements such as panels, beams, and modular units to enhance their structural integrity and durability. This trend is driven by the advantages of steel fibers in simplifying reinforcement processes during manufacturing, ensuring consistent quality, and reducing on-site construction time. As the demand for prefabricated building solutions grows, the use of steel fibers is expected to expand, influencing market dynamics and adoption patterns.

Emphasis on Sustainable and Green Building Practices

The Steel Fiber Market is witnessing a trend toward sustainable and green building practices, driven by regulatory mandates and increasing environmental awareness. Steel fibers contribute to sustainability goals by improving the longevity of concrete structures, reducing material usage, and minimizing lifecycle environmental impacts. Builders and developers are increasingly choosing steel fibers as a sustainable reinforcement option that aligns with green building certifications and initiatives promoting energy-efficient construction methods. This trend highlights the market's role in supporting environmentally responsible building practices and meeting stringent sustainability criteria.

Adoption of Advanced Manufacturing Technologies

Advancements in manufacturing technologies are influencing the Steel Fiber Market by enhancing production efficiency, product quality, and customization capabilities. Automated manufacturing processes allow for precise control over fiber dimensions, shapes, and surface treatments, enabling manufacturers to meet specific project requirements and industry standards. The adoption of advanced technologies such as laser cutting, robotics, and digital modeling is facilitating the development of next-generation steel fibers with superior mechanical properties and performance characteristics. This trend is driving innovation in the market and expanding the range of applications for steel fiber-reinforced concrete in diverse construction environments.

Shift Towards Performance-Based Specifications

There is a noticeable shift towards performance-based specifications in construction projects, where the emphasis is placed on achieving desired performance outcomes rather than adhering to prescriptive material requirements. This trend favors the use of steel fibers due to their proven ability to enhance concrete's mechanical properties, durability, and resilience under various loading conditions. Performance-based specifications allow engineers and designers to optimize concrete mixes with the right combination of materials, including steel fibers, to achieve specific performance criteria such as crack control, impact resistance, and durability over time. As project stakeholders prioritize performance-driven solutions, the demand for steel fibers is expected to grow, driving market expansion and innovation.

Segments Covered in the Report

By Type

o Hooked

o Straight

o Deformed

o Others

By Application

o Slabs & Flooring

o Precast

o Pavements & Tunneling

o Other Applications

By End-Use

o Buildings & Construction

o Transportation

Segment Analysis

By Type Analysis

The steel fiber market is divided into hooked, straight, deformed, and other categories based on the type of steel fiber. With a 63.8% market share in terms of volume in 2023, the hooked type is expected to continue to hold this position throughout the forecast period. The market's demand for hooked-type items is being aided by attributes including the capacity to increase bonding strength and resistance. Additionally, these chemicals can build strong connections, requiring less structure upkeep.

The need for concrete applications to guard against water damage and cracking is anticipated to drive the market's expansion in the upcoming years. These materials also exhibit superior post-crack strength and excellent resistance to impact and abrasion.

Steel fiber lowers slab thickness, enhances installation, and lowers the cost of concrete. By using these products, cloth placement errors can be minimized. Construction proceeds more quickly, saving money and time in the process. Growing government and private infrastructure investment will probably drive demand for various steel fiber goods.

By Application Analysis

The market has been divided into slabs and floors, precast, pavements and tunnels, and other categories based on application. The applications for concrete reinforcement that are most likely to see demand are slabs and flooring, precast, pavements, and tunneling. Slabs and flooring were the greatest revenue-generating segments in 2023, accounting for 47.1% of total sales. Throughout the projection period, the precast segment is expected to develop as a result of the building and construction market's constant demand for non-structural and architectural building components.

In the upcoming years, tunnels and pavements should see the highest demand. The steel fiber reinforced concrete in tunnel linings has led to low bending moments and high compressive forces, which has recently resulted in increased demand for the product.

Because of the advantages, including lower costs and faster construction, installing concrete segments is anticipated to be facilitated by the use of tunnel boring machines in mechanized tunneling. One of the major companies in the industry, Bekaert has provided steel fiber products to many tunnel projects, such as the Kakegawa Twin Tunnel, Citybanan, Bottnia Banan, Crossrail Bond Street Station, and Shieldhall Tunnel.

By End-Use Analysis

The end-user segmentation of the steel fiber market comprises the transportation buildings and construction segments. Buildings and construction held a 47.9% market share and generated USD 3.2 billion in sales in 2023, making it the dominant segment of the market. Throughout the anticipated period, the building and construction sectors' ongoing requirement for non-structural slabs and architectural features is anticipated to support overall market growth.

Regional Analysis

In 2023, Europe held the second-largest market share in terms of volume, with a percentage of 29.7%. Significant tunneling initiatives and modest growth in the construction industry should have a favorable effect on regional expansion. The market is expected to profit in the long run from the rapid penetration of steel fiber reinforcing that is occurring in Europe.

North America is expected to see substantial demand; however, it is likely to lose market share to Asia Pacific. It is expected that government investment in public infrastructure together with the replacement of aging buildings, bridges, and highways would continue to be the primary drivers of growth.

Asia Pacific is anticipated to have the fastest CAGR during the projection period, at 8.2%. The primary engine of regional growth is the expansion of the building and construction industry along with a heightened emphasis on public infrastructure. Rapid development in infrastructure spending is anticipated in China and India, where the building of highways, airports, and railroads is anticipated to create a significant demand for steel fiber goods. Throughout the projection period, this is anticipated to have a beneficial effect on the regional market's growth.

Competitive Analysis

Details per competitor are provided by the competitive landscape of the steel fiber market. The company's overview, financials, revenue, market potential, R&D investment, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance are all included in the details. The data points mentioned above only pertain to the companies' attention to the steel fiber market.

Recent Developments

In January 2022: For a total of $763 million, Nippon Steel Corporation successfully acquired G.J. Steel and G. Steel. This strategic acquisition is intended to help them launch a variety of steel fiber goods and services onto the market by utilizing their combined resources and expertise. The manufacturing and retailing of hot-rolled steel plates is the primary focus of GJ Steel Public Corporation Limited, a Thai company.

In October 2021: Bekaert's Dramix steel fibers, an innovative product, have helped the construction industry significantly reduce its carbon footprint. Bekaert's steadfast attempts to reduce their environmental effect and their high sustainability goals demonstrate their dedication to sustainability.

Key Market Players in the Steel Fiber Market

o Bekaert

o Nippon Seisen

o R. STAT

o Spajic Doo

o Green Steel Group

o Zhejiang Boean Metal Products

o Fibrometals

o Arcelor Mittal

o Hunan Sunshine Steel Fiber.

o Yuthian Zhitai Steel Fiber Manufacturing

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 2.3 Billion |

|

Market Size 2033 |

USD 4.0 Billion |

|

Compound Annual Growth Rate (CAGR) |

5.8% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Application, End-Use, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Bekaert, Nippon Seisen, R. STAT, Spajic Doo, Green Steel Group, Zhejiang Boean Metal Products, Fibrometals, Arcelor Mittal, Hunan Sunshine Steel Fiber., Yuthian Zhitai Steel Fiber Manufacturing, Other Key Players |

|

Key Market Opportunities |

Rising Demand for Sustainable Construction Materials |

|

Key Market Dynamics |

Infrastructure Development and Urbanization Fuel Market Expansion |

📘 Frequently Asked Questions

1. How much is the Steel Fiber Market in 2023?

Answer: The Steel Fiber Market size was valued at USD 2.3 Billion in 2023.

2. What would be the forecast period in the Steel Fiber Market?

Answer: The forecast period in the Steel Fiber Market report is 2023-2033.

3. Who are the key players in the Steel Fiber Market?

Answer: Bekaert, Nippon Seisen, R. STAT, Spajic Doo, Green Steel Group, Zhejiang Boean Metal Products, Fibrometals, Arcelor Mittal, Hunan Sunshine Steel Fiber., Yuthian Zhitai Steel Fiber Manufacturing, Other Key Players

4. What is the growth rate of the Steel Fiber Market?

Answer: Steel Fiber Market is growing at a CAGR of 5.8% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.