🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Surgical Stitching Products Market

Surgical Stitching Products Market Global Industry Analysis and Forecast (2024-2032) By Product Type(Absorbable Sutures, Non-Absorbable Sutures, Automated Suturing Devices, Suture Assist Devices),By Material(Natural Sutures (e.g., Silk, Catgut),Synthetic Sutures (e.g., Polyglycolic Acid (PGA), Polylactic Acid (PLA), Polyglactin, Nylon, Polypropylene, Polyester),By Application(General Surgery, Cardiovascular Surgery, Orthopedic Surgery, Gynecological Surgery, Ophthalmic Surgery, Plastic Surgery, Veterinary Surgery, Others),By End-User(Hospitals, Ambulatory Surgical Centers (ASCs),Specialty Clinics, Veterinary Clinics) and Region

Mar 2025

Healthcare

Pages: 138

ID: IMR1881

Surgical Stitching Products Market Synopsis

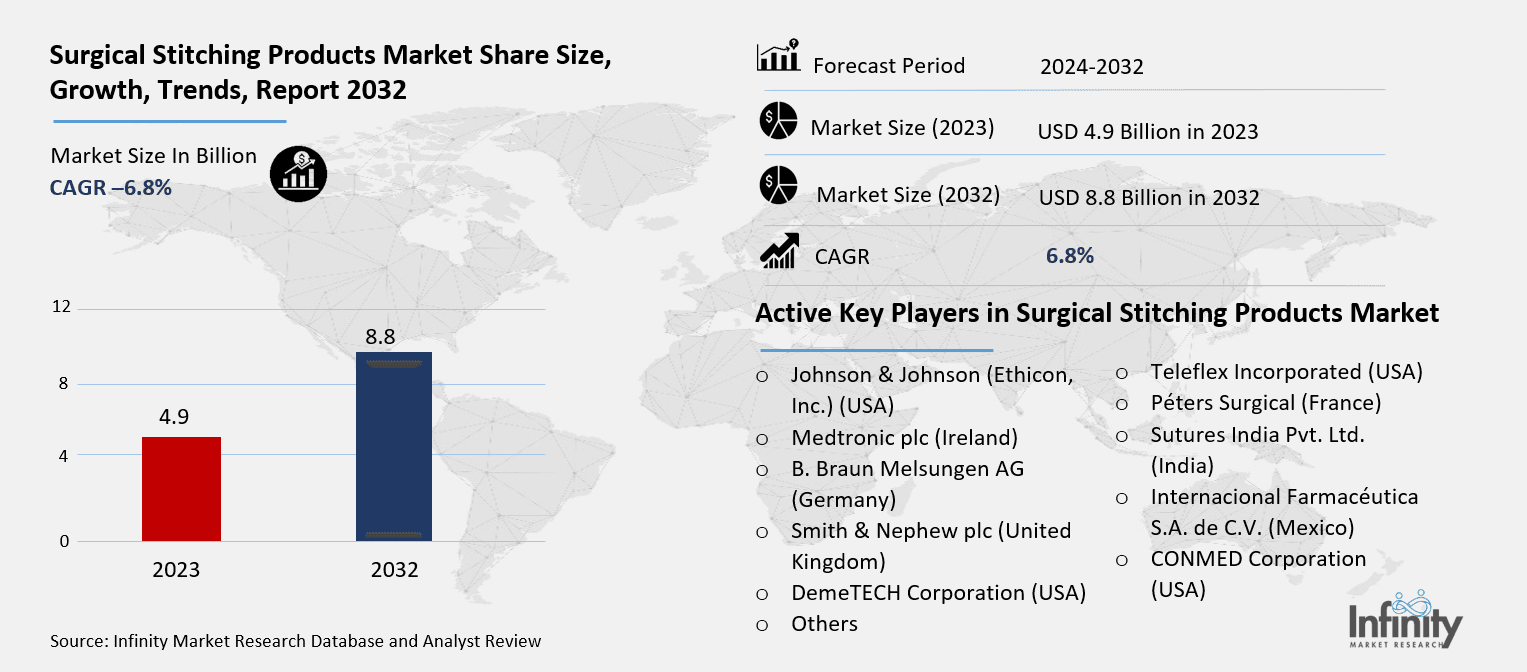

Surgical Stitching Products Market Size Was Valued at USD 4.9 Billion in 2023, and is Projected to Reach USD 8.8 Billion by 2032, Growing at a CAGR of 6.8% From 2024-2032.

The increasing number of surgical operations globally is driving notable expansion in the Surgical Stitching Products Market. Advanced suturing solutions are more sought for as chronic diseases, traumatic injuries, and surgical operations become more common. The demand for exact, robust, and biocompatible stitching materials has exploded as minimally invasive surgeries and robotic-assisted procedures become more widely accepted. Furthermore, developments in synthetic and absorbable sutures lower infection risks and encourage faster healing, hence improving patient outcomes.

Another major driver of the market is the aging global population since senior people sometimes need surgical operations for ailments including cancer, orthopedic problems, and heart issues. Healthcare professionals are then making investments in premium surgical suturing materials to guarantee improved tissue healing and wound closure. Innovations in biodegradable and antibacterial sutures have improved surgical results even more, hence improving the efficiency of treatments and lowering postoperative problems.

Driven by modern healthcare infrastructure, high surgical volumes, and constant R&D investments by major players including Johnson & Johnson (Ethicon), Medtronic, and B. Braun, North America leads regionally in the market. Rising healthcare expenditure, growing medical tourism, and expanding hospital networks in nations including India, China, and Japan are driving the fastest development in the Asia-Pacific area as well. These governments are also emphasizing on enhancing access to high-quality surgical treatment, so accelerating the growth of the market.

Surgical Stitching Products Market Outlook, 2023 and 2032: Future Outlook

Surgical Stitching Products Market Trend Analysis

Trend: Rising Adoption of Absorbable and Antimicrobial Sutures

The surgical stitching products market is witnessing a notable shift toward absorbable and antimicrobial sutures, driven by the increasing emphasis on infection control, improved patient outcomes, and enhanced wound healing. Absorbable sutures, made from materials such as polyglycolic acid (PGA), polylactic acid (PLA), and catgut, dissolve naturally in the body over time, eliminating the need for suture removal and reducing the risk of post-surgical complications. These sutures are particularly preferred in internal and soft tissue surgeries, where traditional non-absorbable sutures may cause irritation or require secondary removal procedures. Additionally, antimicrobial-coated sutures, infused with agents like triclosan, help combat bacterial infections at the surgical site, significantly lowering the incidence of surgical site infections (SSIs).

Drivers: Rising Global Surgical Procedure Volume

The growing number of surgical operations worldwide significantly drives the market for surgical stitching products. Rising chronic diseases, traumatic traumas, and age-related problems have increased demand for efficient wound closure techniques. High-quality sutures and automated stitching machines are becoming more necessary for common surgeries for cardiovascular diseases, orthopedic problems, gastrointestinal conditions, and cancer therapies. Furthermore, helping to drive market expansion is the rise in cosmetic and reconstructive procedures as people search for better suturing methods, guaranteeing little scarring and faster recovery.

Restraints: High Cost of Advanced Suturing Products

The high cost of advanced suturing products remains a significant barrier to market growth, particularly in developing regions with limited healthcare budgets. Innovations such as antimicrobial-coated sutures, biodegradable materials, and robotic-assisted suturing devices offer superior wound closure efficiency and reduced infection risks, but they come at a premium price. Hospitals and healthcare facilities, especially in low- and middle-income countries, often struggle to justify the increased expenditure on these advanced products. Additionally, reimbursement policies in some regions may not fully cover the costs of high-performance sutures, further limiting their adoption and forcing healthcare providers to opt for more affordable but less advanced alternatives.

Opportunities: Expansion of Automated and Robotic Suturing Devices

In the market for surgical stitching products, the increasing acceptance of automated and robotic suturing tools offers a major potential. Especially in minimally invasive and laparoscopic procedures, these sophisticated devices improve accuracy, efficiency, and consistency in surgical operations. Robotic-assisted suturing helps doctors do complex operations with better control, reducing hand tremors and human mistakes. In complicated operations like cardiac, gastrointestinal, and neurosurgery ones, where high accuracy is absolutely vital, this technique is especially helpful. Automated suturing tools also aid in saving running times, therefore boosting surgical throughput and saving costs for hospitals.

Surgical Stitching Products Market Segment Analysis:

Surgical Stitching Products Market Segmented on the basis of By Product Type, By Material, By Application and End user.

By Product Type

o Absorbable Sutures

o Non-Absorbable Sutures

o Automated Suturing Devices

o Suture Assist Devices

By Material

o Natural Sutures (e.g., Silk, Catgut)

o Synthetic Sutures (e.g., Polyglycolic Acid (PGA)

o Polylactic Acid (PLA)

o Polyglactin

o Nylon

o Polypropylene

o Polyester

By End User

o Hospitals

o Ambulatory Surgical Centers (ASCs)

o Specialty Clinics

o Veterinary Clinics

By Application

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Product Type, Absorbable Sutures segment is expected to dominate the market during the forecast period

The Surgical Stitching Products Market is segmented into absorbable sutures, non-absorbable sutures, automated suturing devices, and suture assist devices, each catering to specific surgical needs. Absorbable sutures, made from materials like polyglycolic acid (PGA) and polylactic acid (PLA), naturally degrade within the body, eliminating the need for removal and reducing infection risks. These sutures are widely used in internal and soft tissue surgeries. In contrast, non-absorbable sutures, made from materials such as nylon, silk, and polypropylene, offer high tensile strength and durability, making them ideal for long-term wound closure, cardiovascular surgeries, and orthopedic procedures. The demand for these sutures remains high in procedures where prolonged support is required.

Automated suturing devices are revolutionizing wound closure by enhancing precision, speed, and efficiency, particularly in laparoscopic and robotic surgeries. These devices reduce manual effort, minimize tissue damage, and improve surgical outcomes. Meanwhile, suture assist devices, including needle holders, forceps, and knot pushers, aid surgeons in achieving optimal wound closure, especially in complex and minimally invasive surgeries. The increasing adoption of robotic-assisted surgical suturing and advancements in biodegradable, antimicrobial, and smart sutures are driving market expansion. As healthcare providers seek more efficient and cost-effective solutions, the demand for advanced surgical stitching products is expected to grow significantly in the coming years.

By End-User, Hospitals segment expected to held the largest share

End users—including hospitals, ambulatory surgical centers (ASCs), specialty clinics, veterinary clinics, and research & academic institutes—have helped to segment the Surgical Stitching Products Market. Because of their daily high frequency of surgical operations as well as the availability of sophisticated surgical tools and qualified medical personnel, hospitals hold the biggest market share. Hospitals remain the main users of premium suturing materials as trauma cases, chronic conditions, and elective surgeries become more common. Furthermore, driving demand for precision suturing tools is the growth of robotic-assisted procedures in hospitals.

Ambulatory Surgical Centers (ASCs) and specialized clinics are growing because more people want minimally invasive outpatient surgeries that use sutures that work very well and heal quickly. Driven by the growing need for animal healthcare and surgical treatments in pets and cattle, veterinary clinics are also becoming increasingly important. Focusing on biodegradable, antimicrobial, and smart suturing technologies, research and academic institutions are also significant in product development and innovation. Advanced surgical stitching devices are likely to become more in demand across all end-user segments as healthcare professionals give cost-effective, infection-resistant, and patient-friendly solutions top priority.

Surgical Stitching Products Market Regional Insights

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Driven by fast improvements in healthcare infrastructure, growing surgical procedures, and mounting medical tourism, the Asia-Pacific region is expected to lead the surgical stitching product market over the forecast period. Rising healthcare expenditure and government efforts to enhance surgical treatment are driving notable expansion in hospital networks in nations including China, India, and Japan. Furthermore, driving demand for premium suturing materials is the region's growing population, together with the rising incidence of chronic ailments, trauma cases, and cosmetic operations. The expansion of medical device manufacturing centers and the presence of significant global and regional players are further propelling the market's development.

Surgical Stitching Products Market Share, by Geography, 2023 (%)

Active Key Players in the Surgical Stitching Products Market

o Johnson & Johnson (Ethicon, Inc.) (USA)

o Medtronic plc (Ireland)

o B. Braun Melsungen AG (Germany)

o Smith & Nephew plc (United Kingdom)

o DemeTECH Corporation (USA)

o Teleflex Incorporated (USA)

o Péters Surgical (France)

o Sutures India Pvt. Ltd. (India)

o Internacional Farmacéutica S.A. de C.V. (Mexico)

o CONMED Corporation (USA)

o Others

Global Surgical Stitching Products Market Scope

|

Global Surgical Stitching Products Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.9 Billion |

|

Forecast Period 2024-32 CAGR: |

6.8% |

Market Size in 2032: |

USD 8.8 Billion |

|

Segments Covered: |

By Product Type |

· Absorbable Sutures · Non-Absorbable Sutures · Automated Suturing Devices · Suture Assist Devices | |

|

By Material |

· Natural Sutures (e.g., Silk, Catgut) · Synthetic Sutures (e.g., Polyglycolic Acid (PGA) · Polylactic Acid (PLA) · Polyglactin · Nylon · Polypropylene · Polyester | ||

|

By Application |

· General Surgery · Cardiovascular Surgery · Orthopedic Surgery · Gynecological Surgery · Ophthalmic Surgery · Plastic Surgery · Veterinary Surgery · Others | ||

|

By End-User |

· Hospitals · Ambulatory Surgical Centers (ASCs) · Specialty Clinics · Veterinary Clinics | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Rising Global Surgical Procedure Volume | ||

|

Key Market Restraints: |

· High Cost of Advanced Suturing Products | ||

|

Key Opportunities: |

· Expansion of Automated and Robotic Suturing Devices. | ||

|

Companies Covered in the report: |

· Johnson & Johnson (Ethicon, Inc.) (USA), Medtronic plc (Ireland), B. Braun Melsungen AG (Germany), Smith & Nephew plc (United Kingdom), DemeTECH Corporation (USA), Teleflex Incorporated (USA), Péters Surgical (France), Sutures India Pvt. Ltd. (India), Internacional Farmacéutica S.A. de C.V. (Mexico), CONMED Corporation (USA), Others. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Surgical Stitching Products Market research report?

Answer: The forecast period in the Surgical Stitching Products Market research report is 2024-2032.

2. Who are the key players in the Surgical Stitching Products Market?

Answer: Johnson & Johnson (Ethicon, Inc.) (USA), Medtronic plc (Ireland), B. Braun Melsungen AG (Germany), Smith & Nephew plc (United Kingdom), DemeTECH Corporation (USA), Teleflex Incorporated (USA), Péters Surgical (France), Sutures India Pvt. Ltd. (India), Internacional Farmacéutica S.A. de C.V. (Mexico), CONMED Corporation (USA), Others.

3. What are the segments of the Surgical Stitching Products Market?

Answer: The Surgical Stitching Products Market is segmented into By Product Type, By Material, By Application, By End-User and region. By Product Type(Absorbable Sutures, Non-Absorbable Sutures, Automated Suturing Devices, Suture Assist Devices),By Material(Natural Sutures (e.g., Silk, Catgut),Synthetic Sutures (e.g., Polyglycolic Acid (PGA), Polylactic Acid (PLA), Polyglactin, Nylon, Polypropylene, Polyester),By Application(General Surgery, Cardiovascular Surgery, Orthopedic Surgery, Gynecological Surgery, Ophthalmic Surgery, Plastic Surgery, Veterinary Surgery, Others),By End-User(Hospitals, Ambulatory Surgical Centers (ASCs),Specialty Clinics, Veterinary Clinics). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Surgical Stitching Products Market?

Answer: Surgical stitching products refer to a range of medical tools and materials used for wound closure during surgical procedures. These products include absorbable and non-absorbable sutures, surgical needles, automated suturing devices, and suture assist devices, all designed to securely hold tissues together, promote healing, and minimize infection risks. Made from materials like silk, nylon, polypropylene, polyglycolic acid (PGA), and catgut, these sutures vary in strength, flexibility, and biodegradability based on the specific surgical application. With advancements in biodegradable, antimicrobial, and smart suturing technologies, surgical stitching products continue to evolve, ensuring improved patient outcomes and efficiency in modern surgical practices.

5. How big is the Surgical Stitching Products Market?

Answer: Surgical Stitching Products Market Size Was Valued at USD 4.9 Billion in 2023, and is Projected to Reach USD 8.8 Billion by 2032, Growing at a CAGR of 6.8% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.