🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Tabular Alumina Market

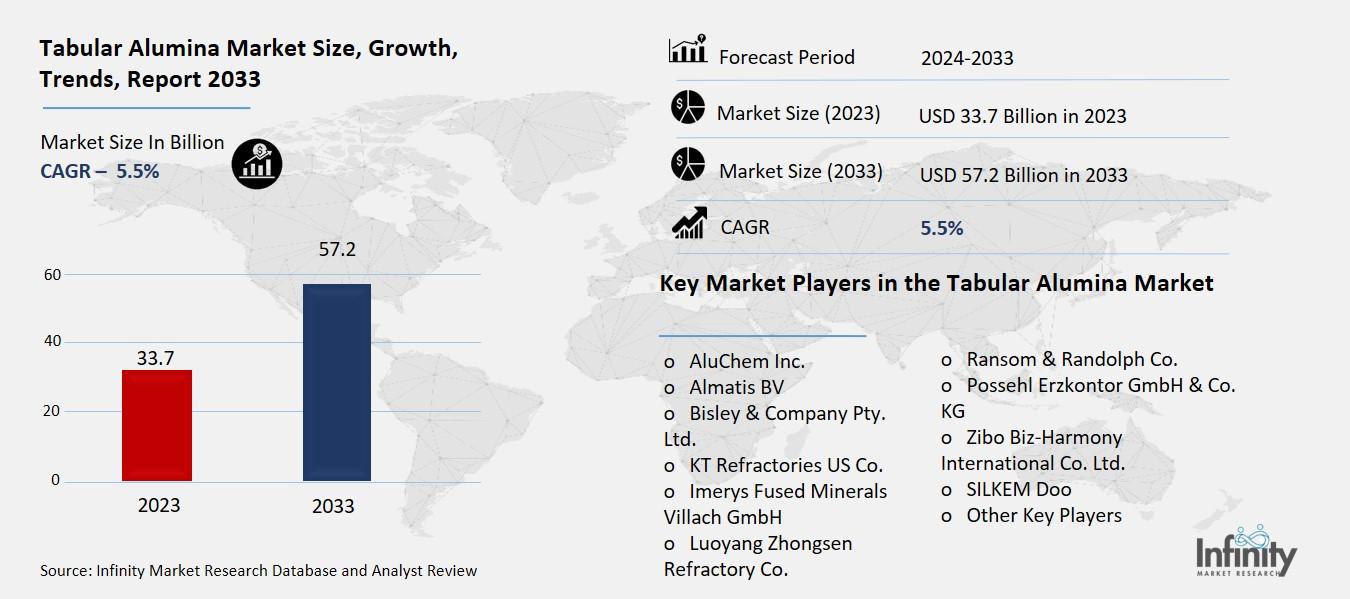

Global Tabular Alumina Market (By Product, Anodized Aluminum Plate and Chemical Alumina Board; By Type, Coarse Tabular Alumina and Fine Tabular Alumina; By Application, Refractory, Abrasives, and Oil and Gas, By Region and Companies), 2024-2033

Dec 2024

Chemicals and Materials

Pages: 138

ID: IMR1337

Tabular Alumina Market Overview

Global Tabular Alumina Market acquired the significant revenue of 33.7 Billion in 2023 and expected to be worth around USD 57.2 Billion by 2033 with the CAGR of 5.5% during the forecast period of 2024 to 2033. The tabular alumina market around the globe has been growing steadily as the product finds its diverse use in various sectors like refractories, ceramics, abrasives, and oil & gas. Tabular alumina is highly thermally shock resistant, hard wearing, and chemically stable and widely used in manufacture of refractory products suitable for high temperature uses in steel and cement industries. Such trends include: Increasing industrialization especially in the global emergent markets and the need for new and improved refractory products that improve energy efficiency and product life.

Further, increased demand in renewable energy especially in wind and solar energy tabular alumina in advanced ceramics is being used. However, threats include high volatility of raw material costs and issues of sustainability of the bauxite mining business. Organizations in this industry are hence dedicating their efforts on ways to make production sustainable besides working on product designs to meet the evolving consumer needs.

Drivers for the Tabular Alumina Market

Growing Demand for Refractories

The growing application of tabular alumina is due to the properties such as high thermal conductivity, high wear and corrosion resistance and capability to work in high temperature environment in steel, cement, glass industries and electronics. In steel-making, it is a vital factor in the preparation of refractory lining for furnaces, ladles, and kilns so that they should not easily wear out and there will be less time for repair. Likewise, in cement industry, tabular alumina consumes in kiln lining and pre heater cement’s backs for higher efficacy and durability in energy performing. The glass industry is user of this material where it is applied in regenerator chambers and crown areas of the furnaces where thermal shock is essential.

This demand is further fueled by accelerating industrial growth in such a country as India and china with their increasing infrastructural and urbanization development. The construction and automotive industries have registered tremendous growth in these regions pulling high performance materials such as steel and cement along, both of which require complex refractory solutions.

Restraints for the Tabular Alumina Market

Raw Material Price Volatility

Fluctuations in bauxite and energy costs significantly impact the production expenses of tabular alumina, as these are key inputs in its manufacturing process. Bauxite, the primary raw material for alumina production, is subject to price volatility due to factors such as geopolitical tensions, export restrictions, and supply-demand imbalances. For example, disruptions in major bauxite-producing regions can lead to supply shortages, driving up costs for manufacturers.

Opportunity in the Tabular Alumina Market

Sustainable Production Processes

The growing emphasis on eco-friendly production techniques to minimize carbon emissions is reshaping the tabular alumina market. Manufacturers are increasingly adopting sustainable practices to address environmental concerns and comply with stringent regulations aimed at reducing industrial carbon footprints. Innovations include the use of renewable energy sources, such as solar and wind power, to meet the energy-intensive requirements of the calcination process.

Additionally, efforts are being made to optimize production processes by integrating advanced technologies that enhance energy efficiency and reduce waste. For instance, waste heat recovery systems are being implemented to reuse heat energy, significantly cutting down overall emissions. Some companies are also exploring low-carbon alternatives in bauxite sourcing and refining processes.

Trends for the Tabular Alumina Market

Shift Toward Renewable Energy Applications

The integration of tabular alumina in the production of high-performance components for wind turbines and solar panels is an emerging trend, driven by the rapid expansion of the renewable energy sector. In wind energy, tabular alumina is used in advanced ceramic components such as bearings and insulators that ensure durability, thermal stability, and resistance to wear under high-stress conditions. These properties are critical in enhancing the operational efficiency and lifespan of wind turbines, which often face harsh environmental conditions.

In solar energy, tabular alumina is incorporated into materials used in photovoltaic (PV) panel manufacturing and thermal energy storage systems. Its excellent heat resistance and chemical stability make it ideal for applications where high-temperature processes are involved, such as in the production of solar concentrators and heat-resistant coatings.

Segments Covered in the Report

By Product

o Anodized Aluminum Plate

o Chemical Alumina Board

By Type

o Coarse Tabular Alumina

o Fine Tabular Alumina

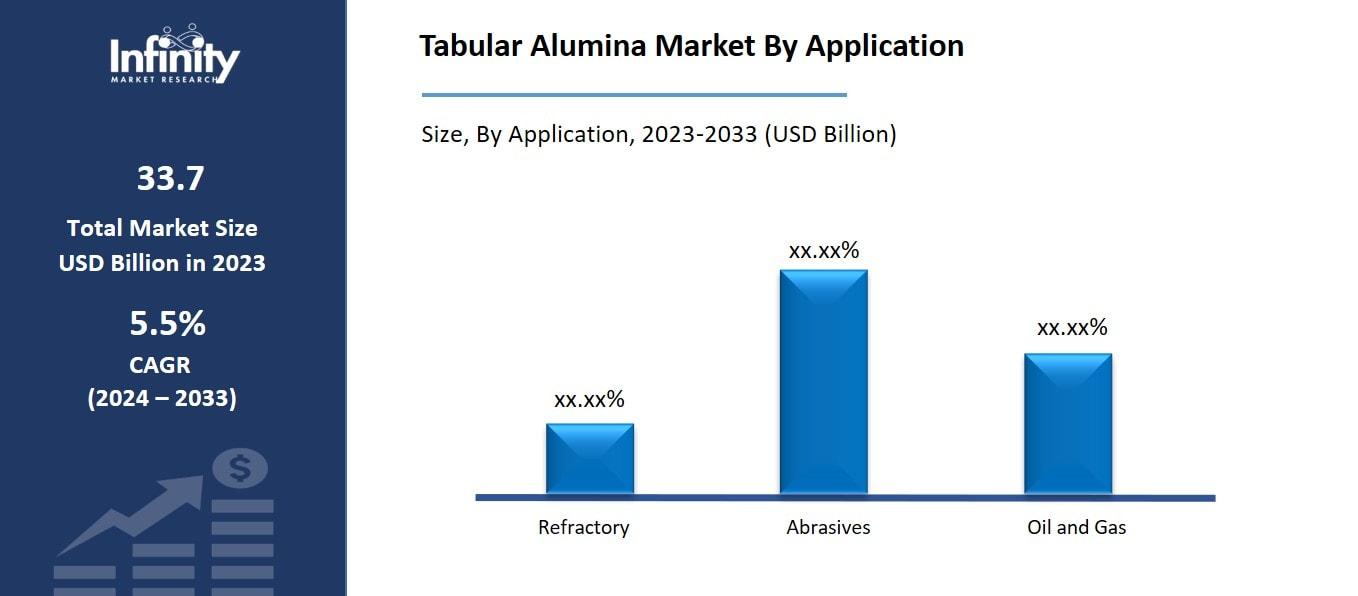

By Application

o Refractory

o Abrasives

o Oil and Gas

Segment Analysis

By Product Analysis

On the basis of product, the market is divided into anodized aluminum plate and chemical alumina board. Among these, anodized aluminum plate segment acquired the significant share in the market owing to their superior corrosion resistance, enhanced surface hardness, and aesthetic appeal, making them highly desirable in industries such as construction, automotive, and electronics. The growing demand for durable and lightweight materials in these sectors further bolsters the market position of anodized aluminum plates.

By Type Analysis

On the basis of type, the market is divided into coarse tabular alumina and fine tabular alumina. Among these, coarse tabular alumina segment held the prominent share of the market due to its extensive use in high-temperature refractory applications. Its larger particle size provides enhanced mechanical strength and thermal shock resistance, making it ideal for linings in furnaces, kilns, and reactors within the steel, cement, and glass industries. The demand for durable refractory materials in these sectors significantly contributes to the dominance of coarse tabular alumina in the market.

By Application Analysis

On the basis of application, the market is divided into refractory, abrasives, and oil and gas. Among these, refractory segment held the prominent share of the market due to the material's exceptional thermal stability, mechanical strength, and resistance to chemical corrosion. These properties make tabular alumina ideal for high-temperature applications in industries such as steel, cement, and glass manufacturing, where durable and reliable refractory materials are essential. The increasing demand for efficient and long-lasting refractory solutions in these sectors significantly contributes to the dominance of the refractory application segment in the market.

Regional Analysis

Asia Pacific Dominated the Market with the Highest Revenue Share

Asia Pacific held the most of the share of 34.1% of the market. The region is home to some of the world’s fastest-growing economies, including China, India, and Southeast Asian nations, where industrialization and infrastructure development are rapidly advancing. This growth fuels the demand for steel, cement, and other high-temperature materials, directly driving the need for advanced refractory products like tabular alumina.

China, as the largest producer and consumer of tabular alumina, plays a pivotal role in the market, with its extensive industrial base spanning steel manufacturing, construction, and energy production. Similarly, India’s growing industrial activities, especially in steel and cement sectors, contribute significantly to the region's demand for high-performance refractory materials.

Competitive Analysis

The competitive landscape of the global tabular alumina market is characterized by the presence of several key players striving to maintain their market share through innovation, strategic partnerships, and geographical expansion. Major companies focus on enhancing production capabilities, improving product quality, and optimizing cost-efficiency to meet the growing demand for advanced materials in high-temperature applications. Leading players often engage in mergers and acquisitions, joint ventures, and collaborations with other industries, particularly in sectors like steel, cement, and energy, to strengthen their market position.

Recent Developments

In January 2024, Almatis launched a reduced carbon tabular alumina, which is approximately 15% lighter and aligns with sustainability goals. This innovation reduces the carbon footprint from 1.1 to 0.9 Mt CO2e per metric ton of alumina, achieving an impressive 13% decrease in CO2e emissions.

Key Market Players in the Tabular Alumina Market

o AluChem Inc.

o Almatis BV

o Bisley & Company Pty. Ltd.

o KT Refractories US Co.

o Imerys Fused Minerals Villach GmbH

o Luoyang Zhongsen Refractory Co.

o Ransom & Randolph Co.

o Possehl Erzkontor GmbH & Co. KG

o Zibo Biz-Harmony International Co. Ltd.

o SILKEM Doo

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 33.7 Billion |

|

Market Size 2033 |

USD 57.2 Billion |

|

Compound Annual Growth Rate (CAGR) |

5.5% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Product, Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

AluChem Inc., Almatis BV, Bisley & Company Pty. Ltd., KT Refractories US Co., Imerys Fused Minerals Villach GmbH, Luoyang Zhongsen Refractory Co., Ransom & Randolph Co., Possehl Erzkontor GmbH & Co. KG, Zibo Biz-Harmony International Co. Ltd., SILKEM Doo, and Other Key Players. |

|

Key Market Opportunities |

Sustainable Production Processes |

|

Key Market Dynamics |

Growing Demand for Refractories |

📘 Frequently Asked Questions

1. Who are the key players in the Tabular Alumina Market?

Answer: AluChem Inc., Almatis BV, Bisley & Company Pty. Ltd., KT Refractories US Co., Imerys Fused Minerals Villach GmbH, Luoyang Zhongsen Refractory Co., Ransom & Randolph Co., Possehl Erzkontor GmbH & Co. KG, Zibo Biz-Harmony International Co. Ltd., SILKEM Doo, and Other Key Players.

2. How much is the Tabular Alumina Market in 2023?

Answer: The Tabular Alumina Market size was valued at USD 33.7 Billion in 2023.

3. What would be the forecast period in the Tabular Alumina Market?

Answer: The forecast period in the Tabular Alumina Market report is 2024-2033.

4. What is the growth rate of the Tabular Alumina Market?

Answer: Tabular Alumina Market is growing at a CAGR of 5.5% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.