🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Tar Free Epoxy Paint Market

Tar Free Epoxy Paint Market Global Industry Analysis and Forecast (2024-2032) By Product Type (Water-Based Epoxy Paint, Solvent-Based Epoxy Paint) By Application (Industrial Applications, Commercial Applications) By End User (Aerospace, Automotive) By Chemistry (Bisphenol A (BPA) Based, Bisphenol F (BPF) Based) By Distribution Channel (Online Retailers, Direct Sales) and Region

Mar 2025

Chemicals and Materials

Pages: 138

ID: IMR1883

Tar Free Epoxy Paint Market Synopsis

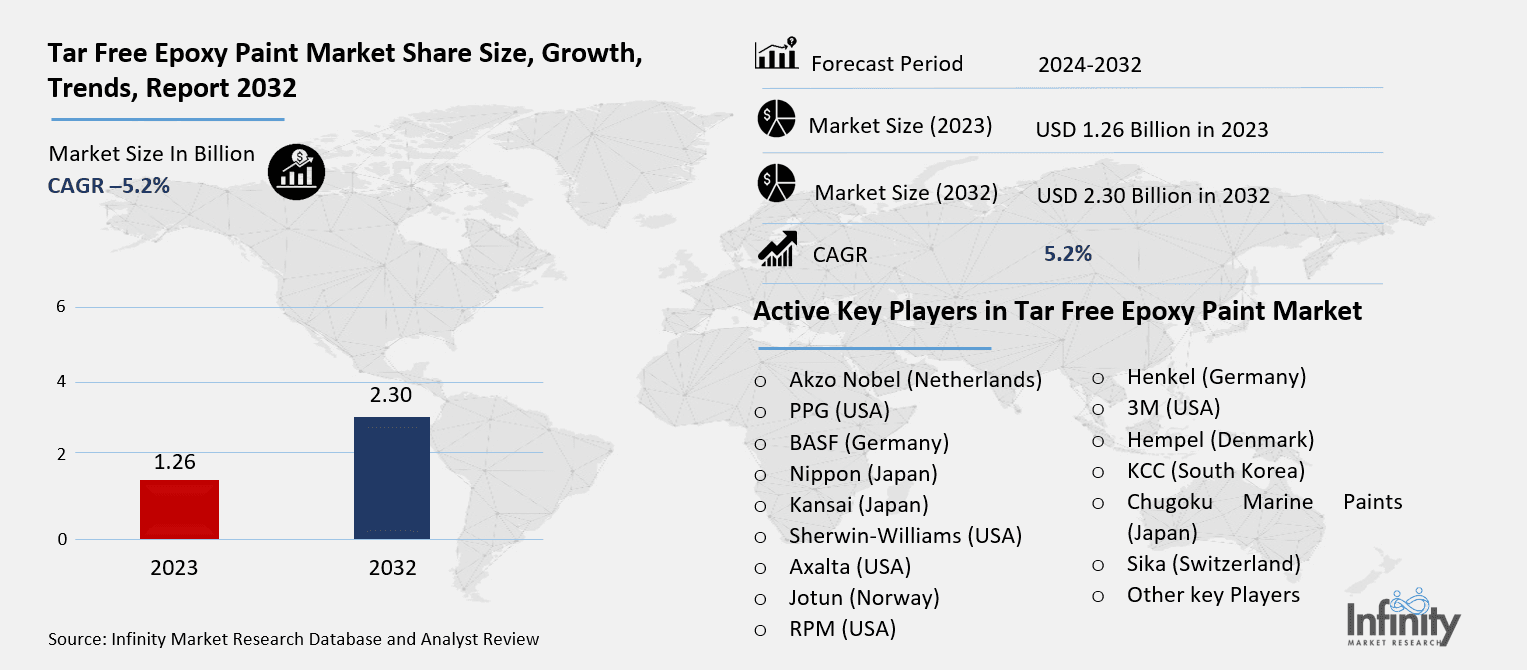

Tar Free Epoxy Paint Market Size Was Valued at USD 1.26 Billion in 2023, and is Projected to Reach USD 2.30 Billion by 2032, Growing at a CAGR of 5.2% From 2024-2032.

The Tar-Free Epoxy Paint Market focuses on protective coatings formulated without coal tar, offering an environmentally friendly alternative for corrosion resistance in marine, industrial, and infrastructure applications. These epoxy-based coatings provide excellent adhesion, chemical resistance, and durability, making them ideal for use in pipelines, bridges, water tanks, and offshore structures. Growing environmental regulations restricting coal tar-based coatings, increasing infrastructure development, and rising demand for sustainable protective coatings drive market growth. Key players in this market include Akzo Nobel, PPG, Sherwin-Williams, Jotun, and Hempel, among others.

Rising demand for environmentally friendly and high-performance coatings is driving constant expansion in the Tar-Free Epoxy Paint Market. Sectors such as marine, infrastructure, and oil & gas have extensively applied conventional coal tar-based epoxy paints for corrosion protection. But worries about environmental rules and toxicity have driven a change toward tar-free epoxy substitutes, which provide comparable protection free of dangerous chemicals. The growing focus on sustainable and regulatory-compliant coatings in many different fields helps the industry.

The internationally expanding development of infrastructure is one of the main forces influencing the industry. Bridges, pipelines, water treatment facilities, and other buildings needing long-lasting protective coatings are among the projects governments and commercial investors are most heavily funding. Ideal for infrastructure uses, tar-free epoxy paints offer outstanding resistance to chemicals, water, and corrosion. Furthermore, driving market expansion is the growing use of these coatings in the marine sector, where protection against harsh conditions and seawater is very vital.

Significant customers of tar-free epoxy coatings also include the industrial and oil & gas sectors. Companies are moving to non-toxic, high-performance coatings to guard pipelines, tanks, and processing equipment under strict safety and environmental standards. Adoption of these coatings has been hastened by increasing consciousness of worker safety and environmental impact. Furthermore, increasing market penetration are developments in epoxy resin technology resulting in more robust and effective tar-free compositions.

Higher production costs and technical complexity in developing tar-free alternatives that match the performance of coal tar-based coatings provide obstacles to the industry even with the hopeful future. Furthermore, as tar-free epoxy paints have a higher starting cost than conventional alternatives, market penetration in underdeveloped areas is still in process. Still, more awareness and tougher environmental rules should open manufacturers fresh chances to grow their influence.

Driven by laws, environmental trends, and technical developments, the Tar-Free Epoxy Paint Market is expected to grow rather significantly overall. Important market players are concentrating on R&D initiatives to improve product performance while keeping the economy of cost. Tar-free epoxy coatings are predicted to become more in demand as sectors give safety and environmental responsibility first priority. This makes them a profitable part of the protective coatings market.

Tar Free Epoxy Paint Market Outlook, 2023 and 2032: Future Outlook

Tar Free Epoxy Paint Market Trend Analysis

Trend

Rising adoption of eco-friendly and sustainable coatings

Growing acceptance of environmentally safe and sustainable coatings is driving major expansion in the Tar-Free Epoxy Paint Market. Traditional coal tar-based coatings, widely used for corrosion protection, are facing phase-out due to their detrimental effects on the environment and human health. Tar-free epoxy coatings are a high-performance alternative that can meet needs because they don't harm the environment and last a long time, don't react with chemicals, and stick well. More and more, industries like maritime, oil and gas, infrastructure, and water treatment are using these environmentally friendly coatings to meet their sustainability goals and government rules.

Furthermore, developments in low-VOC and bio-based epoxy formulas are driving the industry, offering safer alternatives without compromising performance. Governments all around are enforcing more stringent environmental rules and pushing businesses toward better coatings. This change is particularly noticeable in regions like North America and Europe, where the enforcement of sustainability programs is prevalent. As infrastructure projects expand in emerging economies, the demand for high-performance, environmentally safe coatings is expected to grow, creating lucrative opportunities for manufacturers in the tar-free epoxy paint market.

Opportunity

Innovations in bio-based and low-VOC epoxy coatings

Driven by growing attention toward environmentally friendly coatings, the tar-free epoxy paint market is seeing enormous expansion possibilities. As tough rules limit coal tar-based coatings due to their negative environmental and health effects, industries are actively searching for substitutes that provide better protection without hazardous emissions. Rising infrastructure development in emerging economies—bridges, pipelines, and marine constructions, among other things—is driving considerable demand for high-performance protective coatings. As businesses move toward coatings with low volatile organic compound (VOC) content, the growing acceptance of sustainable building techniques and green building certifications is also helping to drive the market's rise.

By offering environmentally responsible solutions with increased performance, innovations in low-VOC and bio-based epoxy coatings are transforming the market. By creating bio-based resins from renewable fuels, including plant-derived oils, manufacturers are less dependent on petrochemical feedstocks. These coatings are fit for demanding conditions since advanced formulations are also enhancing durability, adhesion, and chemical resistance. Adding nanotechnology to hybrid epoxy systems makes the products work better and gives them self-healing and anti-fouling properties that can be used in both industrial and marine settings. Companies funding R&D to create high-performance, environmentally friendly coatings will have a competitive edge in the changing market as sustainability becomes a major differentiator.

Tar Free Epoxy Paint Market Segment Analysis

Tar Free Epoxy Paint Market Segmented on the basis of type, application and end user.

By Type

o Water-Based Epoxy Paint

o Solvent-Based Epoxy Paint

By Application

o Industrial Applications

o Commercial Applications

By End User

o Aerospace

o Automotive

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Product Type, Water-Based Epoxy Paint segment is expected to dominate the market during the forecast period

Water-based epoxy paint is an environmentally friendly coating solution that emits low levels of volatile organic compounds (VOCs), making it a safer alternative for indoor applications. Unlike solvent-based counterparts, it produces minimal odor, ensuring better air quality and a more comfortable application process, especially in enclosed spaces. This makes it an ideal choice for commercial and residential environments, such as offices, hospitals, schools, and homes, where air quality and health concerns are paramount. Additionally, water-based epoxy paints are easier to clean up with water, reducing the need for harsh solvents and making them a more sustainable option.

Beyond its eco-friendly nature, water-based epoxy paint is highly regarded for its superior adhesion, durability, and resistance to chemicals. It effectively bonds to various surfaces, including concrete, wood, and metal, ensuring a long-lasting protective layer against moisture, stains, and daily wear. This makes it a preferred choice for high-traffic areas such as garages, warehouses, and commercial spaces. Furthermore, its resistance to chemicals and easy maintenance make it suitable for environments where cleanliness and surface protection are crucial, such as laboratories, food processing facilities, and healthcare settings.

By Distribution Channel, Online Retailers segment expected to held the largest share

Online retailers offer a convenient platform for customers to browse and compare multiple brands of epoxy paints, read product reviews, and make informed purchasing decisions from the comfort of their homes. The ability to access detailed specifications, customer feedback, and expert recommendations helps buyers choose the most suitable product for their specific needs. Additionally, online platforms often provide competitive pricing, discounts, and bulk purchase options, making them an attractive choice for cost-conscious consumers. The ease of doorstep delivery further enhances convenience, eliminating the need to visit physical stores and transport heavy paint containers.

This distribution channel is gaining significant traction, particularly among small-scale businesses and individual buyers who may not have access to direct suppliers or large-scale distributors. DIY enthusiasts, contractors, and small business owners benefit from the wide availability of epoxy paints through e-commerce platforms, which often stock a diverse range of formulations and colors. Moreover, online retailers frequently offer customer support services, such as live chat assistance and video tutorials, guiding users through the selection and application process. As digital shopping continues to expand, the accessibility and efficiency of purchasing epoxy paints online make it an increasingly preferred option.

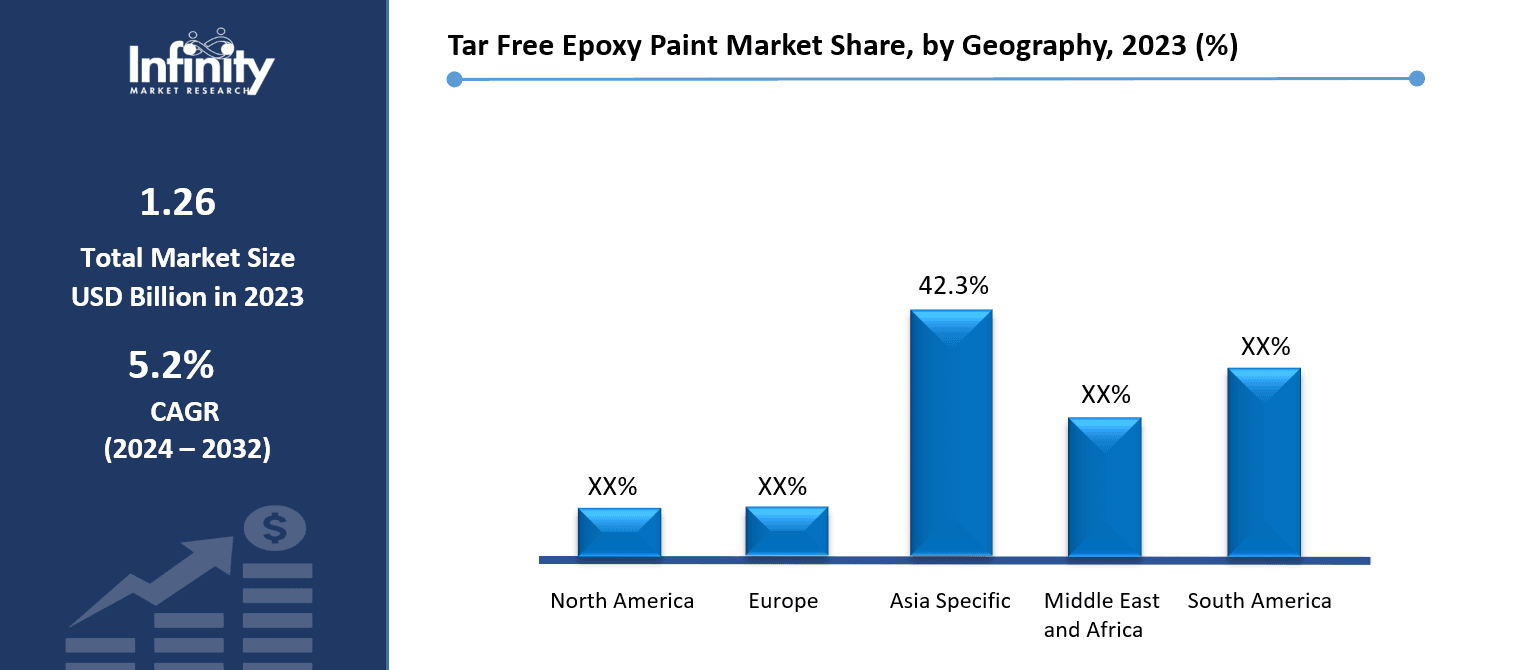

Tar Free Epoxy Paint Market Regional Insights

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Over the projected period, with Asia-Pacific leading as the major regional player, we expect a notable increase in the tar-free epoxy paint market. Demand for environmentally friendly protective coatings is being driven by rapid industrialization, growing infrastructure development, and strict environmental rules in nations including China, Japan, India, and South Korea. Along with increasing building activity, the region's burgeoning offshore and marine sectors help to drive market growth. Many sectors are adopting tar-free epoxy paints due to government programs supporting sustainable coatings and the growing preference for robust, corrosion-resistant solutions.

Major manufacturers and rising R&D investments in high-performance coatings help Asia-Pacific be dominant as well. Growing demand for solvent-free epoxy coatings in line with environmental objectives helps to increase market penetration even more. Higher costs relative to conventional coal tar coatings and raw material price swings, however, may somewhat impede progress. Notwithstanding these obstacles, Asia Pacific is positioned as the main growth center for the Tar-Free Epoxy Paint Market in the coming years thanks to rising infrastructure projects, more attention on marine protection, and continuous technical developments.

Tar Free Epoxy Paint Market Share, by Geography, 2023 (%)

Active Key Players in the Tar Free Epoxy Paint Market

o Akzo Nobel (Netherlands)

o PPG (USA)

o BASF (Germany)

o Nippon (Japan)

o Kansai (Japan)

o Sherwin-Williams (USA)

o Axalta (USA)

o Jotun (Norway)

o RPM (USA)

o Henkel (Germany)

o 3M (USA)

o Hempel (Denmark)

o KCC (South Korea)

o Chugoku Marine Paints (Japan)

o Sika (Switzerland)

o Other key Players

Global Tar Free Epoxy Paint Market Scope

|

Global Tar Free Epoxy Paint Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.26 Billion |

|

Forecast Period 2024-32 CAGR: |

5.2% |

Market Size in 2032: |

USD 2.30 Billion |

|

Segments Covered: |

By Product Type |

· Water-Based Epoxy Paint · Solvent-Based Epoxy Paint | |

|

By Application |

· Industrial Applications · Commercial Applications | ||

|

By End-User |

· Aerospace · Automotive | ||

|

By Chemistry |

· Bisphenol A (BPA) Based · Bisphenol F (BPF) Based | ||

|

By Distribution Channel |

· Online Retailers · Direct Sales | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Stringent environmental regulations against coal tar-based coatings | ||

|

Key Market Restraints: |

· High cost compared to traditional coal tar-based coatings | ||

|

Key Opportunities: |

· Innovations in bio-based and low-VOC epoxy coatings | ||

|

Companies Covered in the report: |

· Akzo Nobel (Netherlands) , PPG (USA), BASF (Germany), Nippon (Japan), Kansai (Japan), Sherwin-Williams (USA), Axalta (USA), Jotun (Norway), RPM (USA), Henkel (Germany), 3M (USA), Hempel (Denmark), KCC (South Korea), Chugoku Marine Paints (Japan), Sika (Switzerland) and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Tar Free Epoxy Paint Market research report?

Answer: The forecast period in the Tar Free Epoxy Paint Market research report is 2024-2032.

2. Who are the key players in the Tar Free Epoxy Paint Market?

Answer: Akzo Nobel (Netherlands) , PPG (USA), BASF (Germany), Nippon (Japan), Kansai (Japan), Sherwin-Williams (USA), Axalta (USA), Jotun (Norway), RPM (USA), Henkel (Germany), 3M (USA), Hempel (Denmark), KCC (South Korea), Chugoku Marine Paints (Japan), Sika (Switzerland) and Other Major Players.

3. What are the segments of the Tar Free Epoxy Paint Market?

Answer: The Tar Free Epoxy Paint Market is segmented into By Product Type, By Application, By End-User, By Chemistry, By Distribution Channel and region. By Product Type, the market is categorized into Water-Based Epoxy Paint, Solvent-Based Epoxy Paint. By Application, the market is categorized into Industrial Applications, Commercial Applications. By End User, the market is categorized into Aerospace, Automotive. By Chemistry, the market is categorized into Bisphenol A (BPA) Based, Bisphenol F (BPF) Based. By Distribution Channel, the market is categorized into Online Retailers, Direct Sales. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Tar Free Epoxy Paint Market?

Answer: The Tar-Free Epoxy Paint Market focuses on protective coatings formulated without coal tar, offering an environmentally friendly alternative for corrosion resistance in marine, industrial, and infrastructure applications. These epoxy-based coatings provide excellent adhesion, chemical resistance, and durability, making them ideal for use in pipelines, bridges, water tanks, and offshore structures. Growing environmental regulations restricting coal tar-based coatings, increasing infrastructure development, and rising demand for sustainable protective coatings drive market growth. Key players in this market include Akzo Nobel, PPG, Sherwin-Williams, Jotun, and Hempel, among others.

5. How big is the Tar Free Epoxy Paint Market?

Answer: Tar Free Epoxy Paint Market Size Was Valued at USD 1.26 Billion in 2023, and is Projected to Reach USD 2.30 Billion by 2032, Growing at a CAGR of 5.2% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.