🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Thermal Interface Materials (Tim) Market

Thermal Interface Materials (Tim) Market Global Industry Analysis and Forecast (2024-2032) By Type(Tapes and Films, Elastomeric Pads, Greases and Adhesives, Phase Change Materials, Metal Based, Others),By Applications(Telecom, Computer, Medical Devices, Industrial Machinery, Consumer Durables, Automotive Electronics, Others) and Region

Mar 2025

Chemicals and Materials

Pages: 138

ID: IMR1885

Thermal Interface Materials (Tim) Market Synopsis

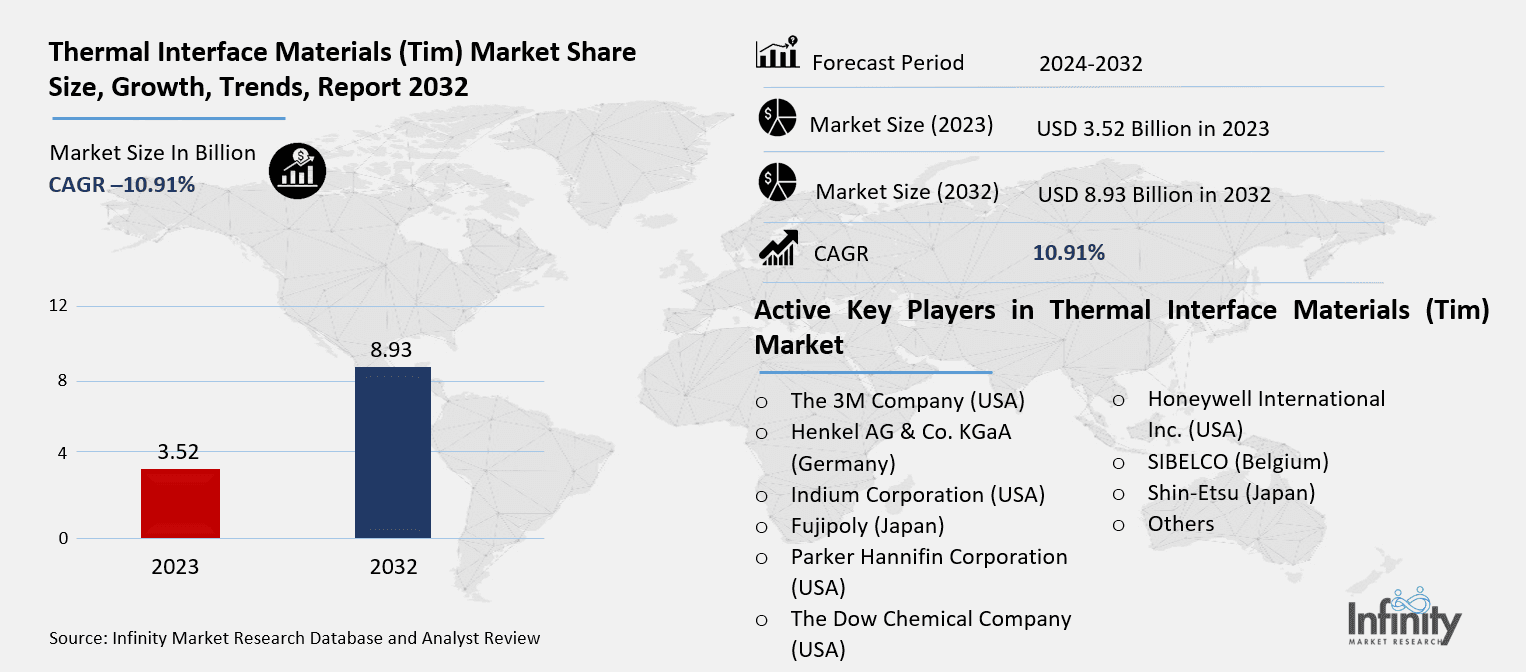

Thermal Interface Materials (Tim) Market Size Was Valued at USD 3.52 Billion in 2023, and is Projected to Reach USD 8.93 Billion by 2032, Growing at a CAGR of 10.91% From 2024-2032.

Driven by the need for effective heat management solutions in several sectors, including electronics, automotive, telecommunications, and healthcare, the Thermal Interface Materials (TIM) market is seeing notable expansion. As the need for better thermal conductivity grows due to downsizing and high-performance computing, TIMs become more important for making sure that electronic systems work reliably and dissipate heat better. Further driving market expansion includes growing acceptance of high-powered LED lighting systems, electric vehicles (EVs), and new semiconductor technologies.

Key players in the industry, such as 3M, Henkel AG & Co. KGaA, Indium Corporation, Fujipoly, Parker Hannifin Corporation, The Dow Chemical Company, Honeywell International Inc., SIBELCO, and Shin-Etsu, are putting a lot of money into research and development to come up with new materials that are better at transferring heat, having less resistance, and lasting longer. Among the generally utilized TIMs that meet various application requirements are thermal greases, phase change materials, thermal pads, and sticky tapes. Better thermal performance and longer lifespan of nanotechnology-based TIMs and graphene-enhanced materials should transform the market.

The electronics and semiconductor industry still uses the most TIMs, even though more and more high-performance computers, data centers, and AI-driven technologies need effective ways to get rid of heat. TIM usage is also rising in the automobile sector, especially in relation to hybrid and electric cars depending on effective battery heat management. Furthermore, driving TIM demand is the expanding use of 5G networks and new technology equipment, which guarantees consistent performance in high-speed data transfer systems.

Thermal Interface Materials (Tim) Market Outlook, 2023 and 2032: Future Outlook

Thermal Interface Materials (Tim) Market Trend Analysis

Trend: Growing adoption of high-performance computing and AI-driven technologies.

Artificial intelligence (AI)-driven technologies and high-performance computing (HPC) are significantly shaping the Thermal Interface Materials (TIM) market. The demand for effective thermal management systems has grown as businesses implement sophisticated computing technologies, including artificial intelligence workloads, cloud computing, and data centers. High-performance CPUs, GPUs, and artificial intelligence accelerators produce significant heat that calls for sophisticated TIMs to keep ideal running temperatures and avoid thermal throttling. The increasing dependence on edge computing, deep learning techniques, and large-scale data processing highlights even more the need for better TIM solutions that enhance heat dissipation and raise general system dependability.

Drivers: Rising need for efficient thermal management in electronics and semiconductors.

Rising necessity for effective thermal management in electronics and semiconductor applications is driving notable expansion in the Thermal Interface Materials (TIM) Market. Effective heat dissipation has become crucial to preserve system dependability and lifetime as electronic gadgets keep getting increasingly small, powerful, and performance-oriented. TIMs assist in closing the thermal gap between heat-generating devices like CPUs, GPUs, power modules, and data center servers and their respective cooling solutions. As the need for edge computing, artificial intelligence (AI), and high-performance computing (HPC) grows, so does the need for advanced TIMs that have great thermal conductivity, low thermal resistance, and long-term stability.

Restraints: High costs associated with advanced TIM formulations.

The considerable expense of modern Thermal Interface Material (TIM) formulations limits market expansion greatly. Though more expensive, cutting-edge TIMs include phase change materials, metal-based pastes, and graphene-enhanced composites that have exceptional thermal conductivity and efficiency. These higher expenses stem from the costly raw ingredients, complex manufacturing techniques, and strict quality control policies. Small and medium-sized businesses (SMEs) and cost-sensitive sectors, such as consumer electronics and automotive, often struggle to adopt these high-performance solutions, thereby hindering the industry's growth.

Opportunities: Development of eco-friendly and recyclable TIM solutions.

Driven by growing environmental issues and strict sustainability rules, the development of recyclable and eco-friendly Thermal Interface Materials (TIMs) offers enormous market possibilities. Many times, when containing difficult-to-recycle or dispose of elements, traditional TIMs add to electrical trash. But developments in biodegradable and recyclable TIM formulations—such as those based on recyclable metal oxides and bio-derived polymers—are finding favor. For sectors including consumer electronics, automobiles, and renewable energy systems, these environmentally friendly substitutes not only lower environmental impact but also improve thermal conductivity and durability, so appealing.

Thermal Interface Materials (Tim) Market Segment Analysis

Thermal Interface Materials (Tim) Market Segmented on the basis of By Type and By Applications

By Type

o Tapes and Films

o Elastomeric Pads

o Greases and Adhesives

o Phase Change Materials

o Metal Based

o Others

By Application

o Telecom

o Computer

o Medical Devices,

o Industrial Machinery

o Consumer Durables

o Automotive Electronics

o Others

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Type, Tapes and Films segment is expected to dominate the market during the forecast period

Rising demand for effective heat dissipation solutions across many sectors, including electronics, automotive, and telecommunications, is driving a notable increase in the Thermal Interface Materials (TIM) market. Type-wise, the market is divided into tapes and films, elastomeric pads, greases and adhesives, phase-change materials, metal-based materials, and others. Because they are easy to apply and help lower thermal resistance, tapes and films find extensive employment. Power electronics would find elastomeric pads perfect since they have excellent thermal conductivity and endurance. The perfect conformability of grease and adhesives guarantees great heat transfer between surfaces. Phase change materials (PCMs) meanwhile offer effective thermal management by collecting and releasing heat during phase transitions; metal-based TIMs such as liquid metals and metal-infused pastes have great conductivity for high-performance uses.

Two main forces driving the TIM market growth are the growing acceptance of electric vehicles (EVs) and the shrinking of electronic devices. TIMs are quite important in the electronics industry for increasing the thermal performance of semiconductors, CPUs, and LEDs; therefore, they prevent overheating and extend device lifetime. Furthermore, driving demand for efficient thermal management solutions are growing investments in 5G infrastructure and developments in artificial intelligence (AI) and high-performance computing (HPC). With nanotechnology improving material performance, sustainability trends are also driving producers to create environmentally friendly and extremely efficient TIMs. The TIM market is likely to increase steadily in the next years as businesses keep needing better thermal conductivity and dependability.

By Applications, Telecom segment expected to held the largest share

Driven by growing demand across many uses, including telecom, computers, medical devices, industrial machinery, consumer durables, and automotive electronics, the Thermal Interface Materials (TIM) Market is seeing notable expansion. Effective thermal management solutions are critical to guarantee best performance and lifetime as electronic devices becoming more small and powerful. Heat dissipation is improved and overheating is avoided in high-performance computing systems, data centers, and 5G telecom infrastructure via TIMs including thermal greases, adhesives, phase change materials, and thermal pads. Growing acceptance of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) is also driving demand for TIMs in the automotive electronics industry, where effective thermal management is essential for battery performance and electronic control units (ECUs).

Furthermore depending more and more on TIMs for enhanced thermal control in wearable healthcare devices and diagnostic imaging systems is the medical equipment market. TIMs are absolutely essential in the industrial machinery sector for preserving the efficiency of power electronics and automation tools. As manufacturers search for sophisticated thermal solutions for increased product longevity, the consumer durables segment—which includes smart home appliances, gaming consoles, and cell phones—is also helping to drive market expansion. As materials research advances, the creation of environmentally friendly and high-performance TIMs is gathering steam, therefore driving market growth even more.

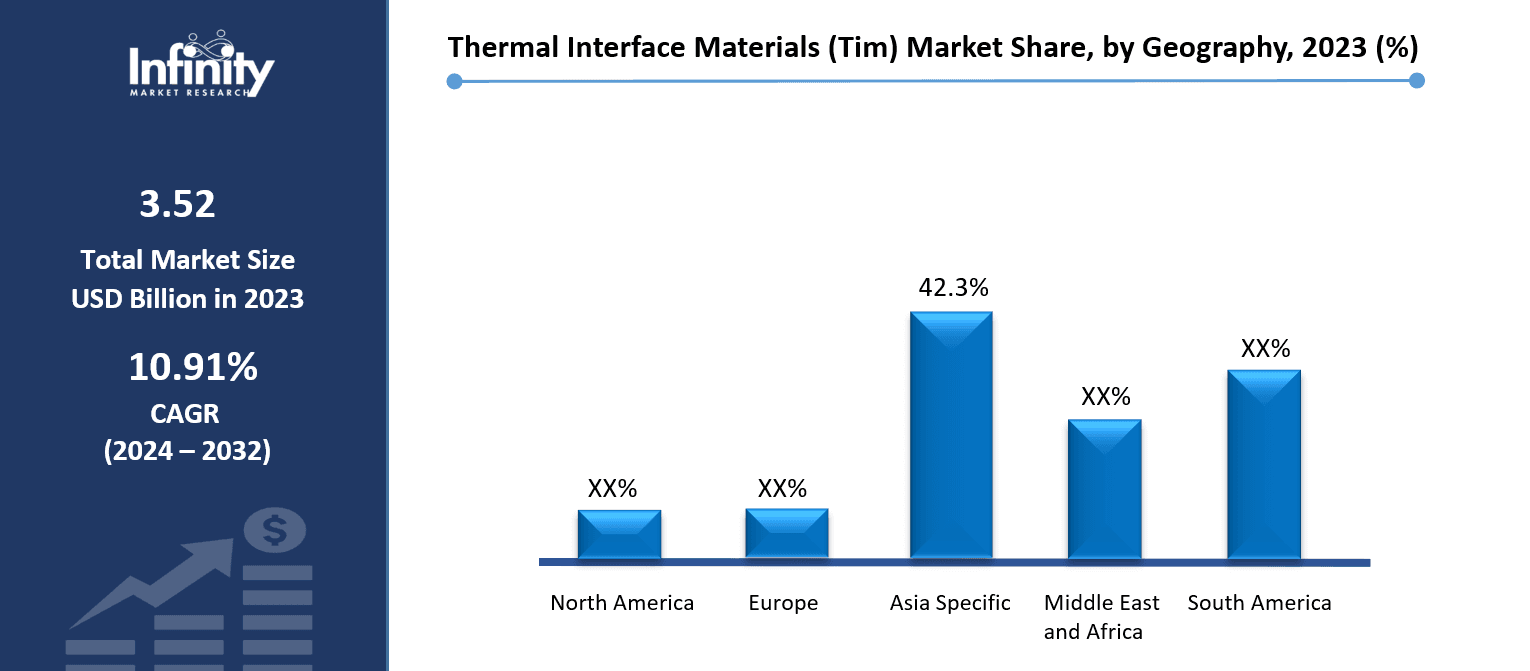

Thermal Interface Materials (Tim) Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Driven by fast industrialization, increasing electronics production, and growing demand for effective thermal management solutions, the Asia-Pacific region is predicted to rule the thermal interface materials (TIM) market over the forecast period. Strong semiconductor and consumer electronics sectors in nations such as China, Japan, South Korea, and India help them be major contributors. Demand for TIMs—which are absolutely vital in boosting heat dissipation and device performance—is being driven by growing acceptance of 5G technology, electric vehicles (EVs), and advanced computer systems. Government projects promoting renewable energy and smart infrastructure also help the industry expand since TIMs are fundamental in solar panels, power electronics, and battery technologies.

Thermal Interface Materials (Tim) Market Share, by Geography, 2023 (%)

Active Key Players in the Thermal Interface Materials (Tim) Market

o The 3M Company (USA)

o Henkel AG & Co. KGaA (Germany)

o Indium Corporation (USA)

o Fujipoly (Japan)

o Parker Hannifin Corporation (USA)

o The Dow Chemical Company (USA)

o Honeywell International Inc. (USA)

o SIBELCO (Belgium)

o Shin-Etsu (Japan)

o Others

Global Thermal Interface Materials (Tim) Market Scope

|

Global Thermal Interface Materials (Tim) Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.52 Billion |

|

Forecast Period 2024-32 CAGR: |

10.91% |

Market Size in 2032: |

USD 8.93 Billion |

|

Segments Covered: |

By Type |

· Tapes and Films · Elastomeric Pads · Greases and Adhesives · Phase Change Materials · Metal Based · Others | |

|

By Applications |

· Telecom · Computer · Medical Devices, · Industrial Machinery · Consumer Durables · Automotive Electronics · Others | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Rising need for efficient thermal management in electronics and semiconductors. | ||

|

Key Market Restraints: |

· High costs associated with advanced TIM formulations. | ||

|

Key Opportunities: |

· Development of eco-friendly and recyclable TIM solutions. | ||

|

Companies Covered in the report: |

· The 3M Company (USA), Henkel AG & Co. KGaA (Germany), Indium Corporation (USA), Fujipoly (Japan), Parker Hannifin Corporation (USA), The Dow Chemical Company (USA), Honeywell International Inc. (USA), SIBELCO (Belgium), Shin-Etsu (Japan), Others. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Thermal Interface Materials (Tim) Market research report?

Answer: The forecast period in the Thermal Interface Materials (Tim) Market research report is 2024-2032.

2. Who are the key players in the Thermal Interface Materials (Tim) Market?

Answer: The 3M Company (USA), Henkel AG & Co. KGaA (Germany), Indium Corporation (USA), Fujipoly (Japan), Parker Hannifin Corporation (USA), The Dow Chemical Company (USA), Honeywell International Inc. (USA), SIBELCO (Belgium), Shin-Etsu (Japan), Others.

3. What are the segments of the Thermal Interface Materials (Tim) Market?

Answer: The Thermal Interface Materials (Tim) Market is segmented into By Type, By Applications and region. By Type(Tapes and Films, Elastomeric Pads, Greases and Adhesives, Phase Change Materials, Metal Based, Others),By Applications(Telecom, Computer, Medical Devices, Industrial Machinery, Consumer Durables, Automotive Electronics, Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What are the Thermal Interface Materials (Tim) Market?

Answer: Thermal Interface Material (TIM) refers to a substance used to enhance heat transfer between two surfaces, typically between a heat-generating component (such as a semiconductor, processor, or battery) and a heat sink or cooling device. TIMs fill microscopic air gaps and irregularities between surfaces, reducing thermal resistance and improving overall heat dissipation efficiency. Common types of TIMs include thermal greases, adhesive tapes, phase change materials, thermal pads, and metal-based compounds. These materials are widely used in electronics, automotive, aerospace, and telecommunications industries to ensure optimal thermal management and prevent overheating, thereby enhancing device performance and longevity.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.