🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Tile Adhesive Market

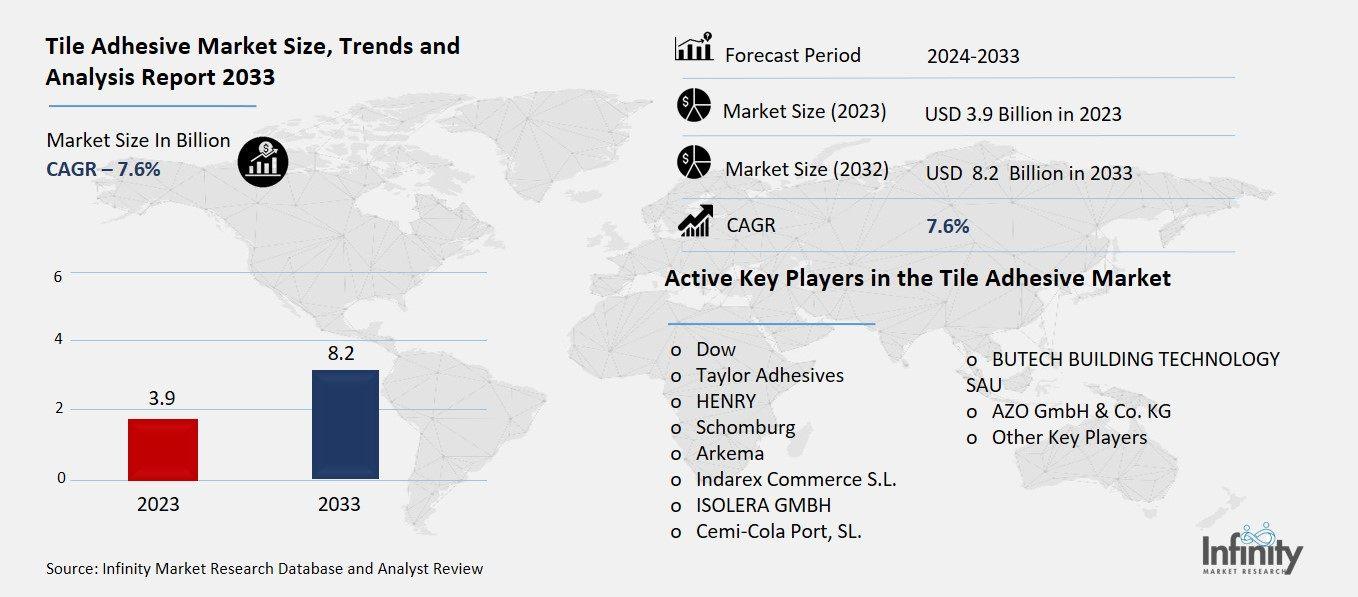

Tile Adhesive Market Global Industry Analysis and Forecast (2024-2033) by Product (Dispersion, Reaction Resin, Cementitious, and Other Products), End-Use (Commercial, Residential, and Industrial & Institutional) and Region

May 2025

Chemicals and Materials

Pages: 138

ID: IMR1980

Tile Adhesive Market Synopsis

The global tile adhesive market was valued at USD 3.9 billion in 2023 and is expected to grow from USD 4.2 billion in 2024 to USD 8.2 billion by 2033, reflecting a CAGR of 7.6% over the forecast period.

Tile adhesive market growth is increasing regularly with increased urban growth rates, construction of infrastructures and changing needs of consumers in various materials for building. Increased demand for appealing and strong floors such as large tiles has resulted in impressive growth of the market for reliable tile adhesives. Because of the reduced prices and versatility of use with various tiles, cementitious adhesives are still widely used; however, polymer-modified and epoxy adhesives are gaining popularity because of the outstanding performance in humid or busy areas. Most of the market is done by residential projects (new buildings and renovation); however, sales in the commercial and industrial sectors are also growing. Government push to enhance and develop housing opportunities results in the increase in demand.

Tile Adhesive Market Driver Analysis

Rising Use of Large-format and Vitrified Tiles

Specialized tile adhesives are critical to adhere large format and vitrified tiles that are heavier and are less porous for long term durability. Traditional ceramic tiles, while being lighter and more absorbent, are different as newer ones are heavier with least absorbency, hence incompatible with ordinary sand-cement mortars. Elasticity and persistence of epoxy-base or polymer enhanced adhesives are greatly increased providing reliable anchorage of tiles on diverse backgrounds, like concrete, drywall, tiles, etc. These sorts of adhesives help to increase the slip resistance, reduce installation time, and provide protection against moisture and thermal expansion, properties that are highly relevant in assuring longevity on busy surfaces or in humid surroundings such as bathrooms and kitchens. Proper usage of adhesive will certainly prevent tile detachment, cracks or unevenness of tiled surface, which will contribute to the longevity and visual quality of the tiled surface.

Tile Adhesive Market Restraint Analysis

Shortage of Skilled Labor

Correct application methods greatly improve the performance and life of tile adhesives. The efficacy of high-end adhesives relies quite heavily on precise also applying mistakes such as under-spread, a wrong mixing ratio, or careless troweling can cause an unstable bond, hollow spots, corners or tiles loosening or even detaching all together over time. Veteran tilers know how to proactively prepare surfaces, control curing intervals when tiling, and choose adhesives that are appropriate for both tiles and capabilities of the supporting material. In developing countries, an absence of qualified workers leads to outdated practices, i.e., using a sand-cement mixture, being used rather often, which causes a weaker connection of modern types of tiles, i.e., large-format or vitrified ones. Lack of adequate skills translates into inferior installations and reduced faith in adhesive products by the customers emphasizing the concern for sustained education and training.

Tile Adhesive Market Opportunity Analysis

Expansion into Tier 2 and Tier 3 Cities

The progression of the tile adhesive industry is strongly linked with skyrocketing profits and more people settling in cities of the emerging economies. Boom in urbanization that is sparked by people’s desire to acquire improved opportunities results in the need for modern and well-constructed housing and city systems. Along with that, increased financial resources allow customers to buy premium, durable home improvements that include state of the art tiles and adhesives. This pattern becomes most conspicuous in tier 2 and tier 3 cities, where the rapid urban growth is on par with the growth being experienced in big cities. This growth story is opening new entry opportunities for tile adhesive manufacturers that are actively customizing the distribution network, pricing and product lines to cater to the growing market.

Tile Adhesive Market Trend Analysis

Increased Use in Industrial and Commercial Applications

The high strength tile adhesives are increasingly being used in warehouses, showrooms, and healthcare facilities because of the difficult operational requirement as well as the need for lasting flooring systems. With the high foot travel, regular cleaning and sporadic ways of being exposed to chemicals or moisture, these are imposing needs for their floor material. Up till now conventional adhesives seldom offer the strength and durability required in such hostile environments. Epoxy as well as the polymer modified high strength adhesives are capable of showing outstanding performance due to their capacity to form strong bond, abrasion resistance and bonding to a variety of surfaces. Because hygiene and efficient cleaning are critical in healthcare spaces, these adhesives are ideal for ensuring sanitary but persistent tile installations in healthcare spaces that will not be defeated by standard sanitization. Likewise, for warehouses and showrooms where aesthetics and structure are important, the selection of reliable adhesives reduces tile movement while reducing future maintenance costs.

Tile Adhesive Market Segment Analysis

The Tile Adhesive Market is segmented on the basis of Product, Processing Method, and End-Use.

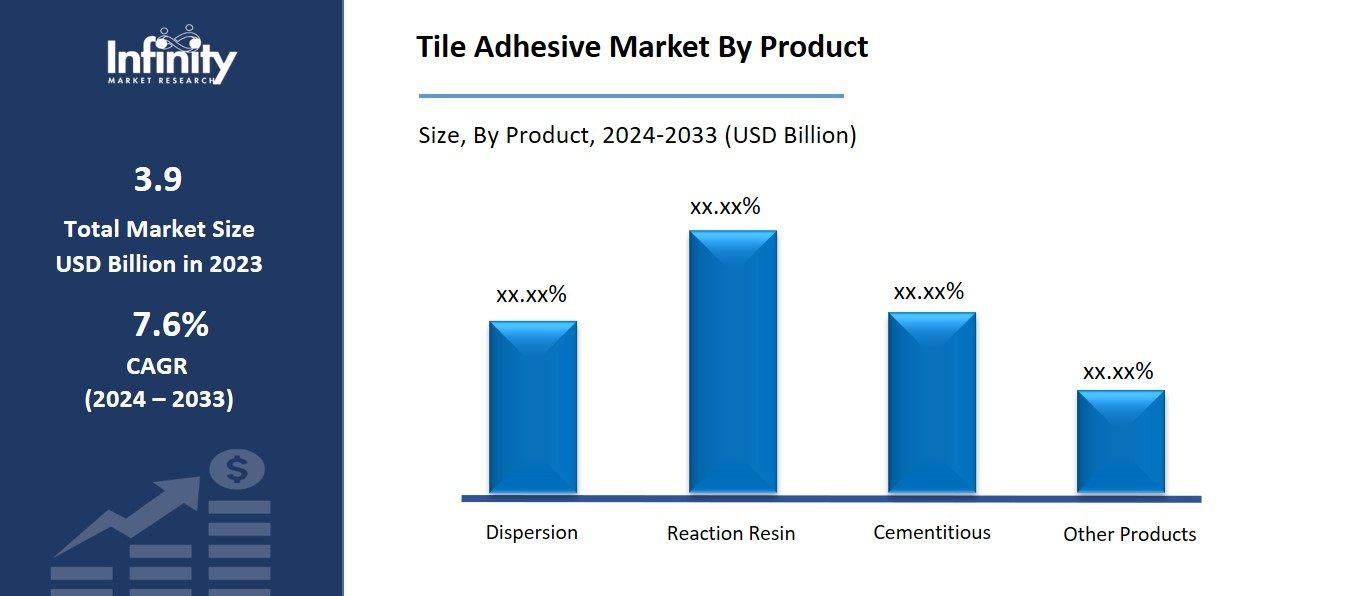

By Product

o Dispersion

o Reaction Resin

o Cementitious

o Other Products

By End-Use

o Commercial

o Residential

o Industrial & Institutional

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Product, Cementitious Segment is Expected to Dominate the Market During the Forecast Period

The products discussed in this research study, the cementitious segment is expected to account for the largest market share of tile adhesive market in the forecast period. Cementitious adhesives are produced mainly from cement, sand, and distinctive additives and have high bonding strength and fit most standard tile installation, i.e., on residential and commercial buildings. Their adaptability allows use on a number of substrates from concrete and plaster to cement boards. Successive adjustments to the formulation, starting with polymers, have led to improved performance, offering greater flexibility and water resistance. This means, cementitious adhesives can now be used in damp areas like bathrooms and kitchens. Low cost and established user-acceptance leads to cementitious adhesives being the more preferred option for many contractors and builders in areas where cost is a major factor.

By End-Use, the Residential Segment is Expected to Held the Largest Share

The residential segment is expected to hold the largest share of the tile adhesive market during the forecast period, driven by the increasing demand for home construction, renovations, and improvements. The synergism between urban increase and income advances has fueled an increasing trend of adoption of modern, flashy and robust flooring products with tiles being one of the most common options. Increased enthusiasm by homeowners for home renovation projects has meant increased demand for tile-adhesive solutions in residential areas. Also, development of the middle class in developing areas, as well as increased sophistication regarding specialized tiles are also contributing to the increase in adhesive-based tile setups. Cementitious adhesives remain popular due to their cost efficiency and proven reliability, while other more advanced adhesives are now being adopted more in top grade residential renovations to highlight greater performance and duration.

Tile Adhesive Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

North America is expected to dominate the tile adhesive market over the forecast period, driven by strong construction activities, a robust real estate sector, and the growing demand for high-quality flooring solutions in both residential and commercial sectors. Significant benefits in the area include advanced building techniques and deep experience with the use of custom adhesives for various tile varieties, especially for high-demand large-form and upscale floor applications. The modern design trends augmented by ever-tightening home upgrades and the push for sustainable buildings require more demand for the tile adhesives that can provide greater performance, such as its resistance to moisture and more friendly environmental attributes.

Furthermore, industries like hospitality, health care and retail in North America are booming and this is increasing the demand for strong and reliable adhesives. Considering its high level of advanced infrastructure advancements and increased interest in attractive and functional flooring design, North America is in a good position to maintain its leading position in this industry.

Recent Development

In July 2024, Magicrete launched a new advertising campaign featuring actor Sumeet Vyas, promoting its tile adhesive as a superior alternative to traditional cement-based methods. The campaign emphasizes the adhesive's enhanced strength, durability, and ease of use, while addressing common problems associated with sand and cement, such as cracking and debonding.

In January 2024, Omnicol introduced a new range of powdered tile adhesives, including the PL200 Omnicem, a highly flexible S2 adhesive designed for a variety of applications. Suitable for use on both walls and floors, indoors and outdoors, it is perfect for recent cement screeds and reduces curing time from 90 to 28 days.

Active Key Players in the Tile Adhesive Market

o Dow

o Taylor Adhesives

o HENRY

o Schomburg

o Arkema

o Indarex Commerce S.L.

o ISOLERA GMBH

o Cemi-Cola Port, SL.

o BUTECH BUILDING TECHNOLOGY SAU

o AZO GmbH & Co. KG

o Other Key Players

Global Tile Adhesive Market Scope

|

Global Tile Adhesive Market | |||

|

Base Year: |

2024 |

Forecast Period: |

2024-2033 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.9 Billion |

|

Market Size in 2024: |

USD 4.2 Billion | ||

|

Forecast Period 2024-33 CAGR: |

7.6% |

Market Size in 2033: |

USD 8.2 Billion |

|

Segments Covered: |

By Product |

· Dispersion · Reaction Resin · Cementitious · Other Products | |

|

By End-Use |

· Commercial · Residential · Industrial & Institutional | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Rising Use of Large-format and Vitrified Tiles | ||

|

Key Market Restraints: |

· Shortage of Skilled Labor | ||

|

Key Opportunities: |

· Expansion into Tier 2 and Tier 3 Cities | ||

|

Companies Covered in the report: |

· Dow, Taylor Adhesives, HENRY, Schomburg and Other Key Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Tile Adhesive Market Research report?

Answer: The forecast period in the Tile Adhesive Market Research report is 2024-2033.

2. Who are the key players in the Tile Adhesive Market?

Answer: Dow, Taylor Adhesives, HENRY, Schomburg, and Other Key Players.

3. What are the segments of the Tile Adhesive Market?

Answer: The Tile Adhesive Market is segmented into Product, End-Use, and Regions. By Product, the market is categorized into Dispersion, Reaction Resin, Cementitious, and Other Products. By End-Use, the market is categorized into Commercial, Residential, and Industrial & Institutional. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Tile Adhesive Market?

Answer: The tile adhesive industry is experiencing rapid increase, accelerated by the swift urban developments, infrastructure works combined with the increasing desire by consumers to use modern and durable floorings. Increasing interest in large format tiles in both residential and commercial settings has resulted in a substantial demand for advanced adhesives to support the large format tiles. Affordability and application ease makes cement based adhesives market standard but derivatives such as polymer-modified and epoxy-based adhesives are gaining interest for their strength and durability to high moisture content within busy or damp locations. Government-orchestrated affordable housing and smart city infrastructure projects are boosting construction output which will drive up the market for tile adhesives.

5. How big is the Tile Adhesive Market?

Answer: The global tile adhesive market was valued at USD 3.9 billion in 2023 and is expected to grow from USD 4.2 billion in 2024 to USD 8.2 billion by 2033, reflecting a CAGR of 7.6% over the forecast period.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.